Professional Documents

Culture Documents

IFF Q211EarningsPresentation

Uploaded by

SwamiCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

IFF Q211EarningsPresentation

Uploaded by

SwamiCopyright:

Available Formats

Second Quarter 2011 Results

Doug Tough Chairman & CEO August 9, 2011 Hernan Vaisman President, Flavors Nicolas Mirzayantz President, Fragrances Kevin Berryman EVP & CFO

Cautionary Statement

Statements made in this presentation that relate to our future performance or future financial results or other future events (identified by such terms as expect, anticipate, believe, outlook, guidance, may or similar terms and variations thereof are forward-looking statements, which involve uncertainties that could cause actual performance or results to materially differ. We undertake no obligation to update any of these statements. Listeners are cautioned not to place undue reliance on these forward-looking statements. These statements should be taken in conjunction with our cautionary statement, the additional information about risk factors and other uncertainties set forth in the companys annual report on Form 10-K for the year ended December 31, 2010 and in our other periodic reports filed with the SEC, all of which are available on our website under Investor Relations, at www.iff.com. We have disclosed certain non-GAAP measures within this presentation. Please see reconciliations to their respective measures prescribed by accounting principles generally accepted in the U.S. included on our website at www.iff.com under Investor Relations.

First Quarter 2011 Results

Doug Tough Chairman & Chief Executive Officer

Second Quarter 2011 Results

Q2 2011 Overview

LC Sales Growth +3% Adjusted Operating Margin* 17.0% Adjusted EPS Growth* +14%

Top-line Performance Driven by Portfolio & Geographic Diversification Margins Pressured by Significant Increases in Input Costs Strong Flavors Performance, Continued Cost Discipline & Foreign Exchange Benefits Drove Double-Digit Operating Profit & EPS Growth

* Excludes Non-Recurring Items Please See NonGAAP to GAAP Reconciliation in Q2 11 Press Release

Second Quarter 2011 Results

First Half 2011 Results In Context

H1 2011 Local Currency Sales Growth: Flavors Fragrances Adjusted Operating Profit Growth*: Adjusted Operating Margin* : Adjusted EPS Growth*: 6% 10% 2% 16% +130 bps 18% 2-Year Avg. 10% 10% 11% 24% +150 bps 27% 3-Year Avg. 6% 7% 6% 10% +40 bps 12%

* Excludes Non-Recurring Items Please See NonGAAP to GAAP Reconciliation at IFF.com

Second Quarter 2011 Results

Hernan Vaisman Group President, Flavors

Second Quarter 2011 Results

Flavor Segment Performance

Q2 Local Currency Sales Performance

North America:

H&W solutions drove high single-digit growth

EAME:

E. Europe, Africa & the Middle East provided greatest upside

Latin America:

Strong trends in Confectionery, Savory & Dairy continued

Greater Asia:

Confectionery & Savory grew double-digits

Second Quarter 2011 Results

7

Flavor Business Performance

Q2 Reported Sales

In Millions

$345 $304 Operating Margin 21.2% 20.6%

Local Currency Sales +8% Strong performance led by doubledigit growth in the emerging markets Operating Margin (60) bps Profit +$6M Sales growth (pricing & volume) as well as cost discipline offset significant raw material pressure Strong Momentum Continuing in Q3 11

Q2 10

Q2 11

Second Quarter 2011 Results

Nicolas Mirzayantz Group President, Fragrances

Second Quarter 2011 Results

Fragrance Segment Performance

Q2 Local Currency Sales Performance

Fine & Beauty Care:

Results challenged by strongest year-ago comparison

Functional:

New wins & pricing across all categories offset volume erosion

Fragrance Ingredients:

Against difficult comparison, pricing was offset by lower volumes

Second Quarter 2011 Results

10

Fragrance Business Performance

Q2 Reported Sales

In Millions

$370 $361 Operating Margin* 18.6% 16.8%

Local Currency Sales (2)% Emerging markets growth mitigated developed markets softness Adjusted Operating Margin* (180) bps & Adjusted Operating Profit $(5)M Double-digit raw material increases more than offset pricing, restructuring benefits & cost discipline Challenging Comparables Expected to Pressure Q3 Results

Q2 10

Q2 11

* Excludes Non-Recurring Items Please See NonGAAP to GAAP Reconciliation in Q2 11 Press Release

Second Quarter 2011 Results

11

Kevin Berryman EVP & Chief Financial Officer

Second Quarter 2011 Results

12

Q2 2011 Financial Results

Reported Sales Increased 7%

Adjusted Operating Profit Up 11%*

Adjusted EPS Grew 14%*

* Excludes Non-Recurring Items Please See NonGAAP to GAAP Reconciliation in Q2 11 Press Release

Second Quarter 2011 Results

13

Input Costs

Raw Material Costs

Year-over-year change

12%

Significant Increases in Input Costs Across Both Businesses Pricing Benefits Expected to Build Throughout Q3 Discussions Underway With Customers Regarding Additional Pricing Actions

4%

Q1 11

Q2 11

Second Quarter 2011 Results

14

Research, Selling & Administrative

Adjusted RSA Cost*

In Millions

$175 $162

Lower Incentive Comp & Continued Cost Discipline Drove 360 Bps Decrease YoY Continued Business Reinvestment Throughout Q2

Percentage of Sales 26.3% 22.7%

Q2 10

Q2 11

* Excludes Non-Recurring Items Please See NonGAAP to GAAP Reconciliation in Q2 11 Press Release

Second Quarter 2011 Results

15

Currency

U.S. Dollars Per Euro

Q1A 2010 2011 Q2A Q3E Q4E

$1.39 $1.29 $1.27 $1.37 $1.34 $1.43 $1.42 $1.42 11% 12% 4%

Foreign Exchange Beneficial to Q2 Results At Current Rates, Forex Should Be Favorable in H2 11 Expect Hedges to Reduce Volatility Going Forward

Change (4)%

* Euro Spot Rate As of August 8, 2011

Second Quarter 2011 Results

16

Cash Flow Review

1H 10 Net Income Working Capital D&A Other Operating Cash Flow Capital Expenditures Dividends $ 131 (26) 40 (17) 128 (37) (40) 1H 11 $ 160 (225) 37 30 2 (46) (43)

Operational Results Drove 22% Improvement in Net Income Working Capital Pressured by Payables & Inventories Capex On-Track to be 5% of Sales in FY 11 Announced 15% Dividend Increase Payable Q4 11 Reduced Outstanding Debt by $100M

Second Quarter 2011 Results

17

Doug Tough Chairman & CEO

Second Quarter 2011 Results

18

Balance of Year Perspective

H2 2011 Context

1) Comparing to 11% LC Sales Growth Reported in H2 2010 2) Significant Raw Material Pressure Expected to Continue 3) Strengthening of Euro vs. U.S. $ 4) Continued Cost Discipline

H2 2011 Implication

LC Sales Growth In line With Long-Term Targets Greater Pricing Benefits Cost Controls & Forex Driving Operating Profit Growth Below-the-line Leverage Should Provide Double-Digit EPS Growth

Expect FY 2011 Results to be In Line With Long-Term Targets

Second Quarter 2011 Results

19

Conclusion

Pleased With Our Performance Through H1 2011, In light of the Challenging Environment

Cautiously Optimistic In Our Outlook

Continue to Make Progress Against Strategic Plan

Second Quarter 2011 Results

20

10

Questions

11

You might also like

- Offices of Bank Holding Company Revenues World Summary: Market Values & Financials by CountryFrom EverandOffices of Bank Holding Company Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- IFF International Flavors and Fragrances Sept 2013 Investor Slide Deck Powerpoint PDFDocument9 pagesIFF International Flavors and Fragrances Sept 2013 Investor Slide Deck Powerpoint PDFAla BasterNo ratings yet

- PepsiCo Reports Third Quarter 2014 Results and RaisesDocument25 pagesPepsiCo Reports Third Quarter 2014 Results and RaisesEvan Buxbaum, CircaNo ratings yet

- Q4 2011 Press Release-Feb 9 2012Document10 pagesQ4 2011 Press Release-Feb 9 2012macheg98No ratings yet

- 2011 5 Results eDocument58 pages2011 5 Results eDennis HoNo ratings yet

- BUMA - project-WPS OfficeDocument13 pagesBUMA - project-WPS OfficeJanet LorestoNo ratings yet

- JLL Reports Record Fourth Quarter and Full-Year 2015 ResultsDocument24 pagesJLL Reports Record Fourth Quarter and Full-Year 2015 ResultsAnonymous Feglbx5No ratings yet

- 2014 Annual Report enDocument232 pages2014 Annual Report enNikhil GoyalNo ratings yet

- Starbucks - MS Conference Nov 2015 - FINALDocument24 pagesStarbucks - MS Conference Nov 2015 - FINALPedro Canales PradoNo ratings yet

- BM&FBOVESPA S.A. Announces Results For The First Quarter 2012Document9 pagesBM&FBOVESPA S.A. Announces Results For The First Quarter 2012BVMF_RINo ratings yet

- Emerson 2012 PresentationDocument128 pagesEmerson 2012 PresentationCapgoods1No ratings yet

- Fiscal 2010 Second Quarter Earnings Call: March 17, 2010Document25 pagesFiscal 2010 Second Quarter Earnings Call: March 17, 2010claudiogut123No ratings yet

- 3Q11 HON Earnings ReleaseDocument20 pages3Q11 HON Earnings Releaseambuj_srivastavNo ratings yet

- Rio Tinto 2014 Annual ReportDocument232 pagesRio Tinto 2014 Annual ReportTarekNo ratings yet

- Annual Report Lassonde 2011Document74 pagesAnnual Report Lassonde 2011chrisjames20036No ratings yet

- Shree Renuka Sugars LTD: Quarter Ended 31 Dec 2011 Earnings PresentationDocument22 pagesShree Renuka Sugars LTD: Quarter Ended 31 Dec 2011 Earnings PresentationAtul VoraNo ratings yet

- First Quarter 2012 Earnings Conference Call: 15 February 2012Document38 pagesFirst Quarter 2012 Earnings Conference Call: 15 February 2012Travis VedderNo ratings yet

- Qbe 10-KDocument183 pagesQbe 10-Kftsmall0% (1)

- Q2 2011 Investor Call PresentationDocument17 pagesQ2 2011 Investor Call PresentationphyscdispNo ratings yet

- Earnings ReleaseDocument8 pagesEarnings ReleaseBVMF_RINo ratings yet

- Platinum 2004 ASX Release FFH Short PositionDocument36 pagesPlatinum 2004 ASX Release FFH Short PositionGeronimo BobNo ratings yet

- ADIB Investor Presentation FY 2011Document38 pagesADIB Investor Presentation FY 2011sunilkpareekNo ratings yet

- Q4 2014 Results PresentationDocument42 pagesQ4 2014 Results Presentationnad13eNo ratings yet

- Investor Update: Key HighlightsDocument24 pagesInvestor Update: Key Highlightsmanoj.samtani5571No ratings yet

- Accenture ReportDocument14 pagesAccenture Reportc_crackyNo ratings yet

- Q4 2014 PFE Earnings Press Release AlksdjindflsDocument37 pagesQ4 2014 PFE Earnings Press Release AlksdjindflsSimona NechiforNo ratings yet

- Rio Tinto Delivers First Half Underlying Earnings of 2.9 BillionDocument58 pagesRio Tinto Delivers First Half Underlying Earnings of 2.9 BillionBisto MasiloNo ratings yet

- Ausenco 2012 Preliminary Final ReportDocument101 pagesAusenco 2012 Preliminary Final ReportMuhammad SalmanNo ratings yet

- Fourth Quarter 2012 Financial Results Conference Call: February 5, 2013Document22 pagesFourth Quarter 2012 Financial Results Conference Call: February 5, 2013Nicholas AngNo ratings yet

- Moody's Investor DayDocument44 pagesMoody's Investor Daymaxbg91No ratings yet

- McGraw Hill Earnings ReportDocument20 pagesMcGraw Hill Earnings Reportmtpo6No ratings yet

- Pure Circle H1FY11 Interim SLIDESDocument28 pagesPure Circle H1FY11 Interim SLIDESuva_uvaNo ratings yet

- Axiata Presentation 1Q2015Document39 pagesAxiata Presentation 1Q2015Jeck Hong TanNo ratings yet

- KeellsFoods Annual Report 2010 2011Document72 pagesKeellsFoods Annual Report 2010 2011Tharindu Madhawa PadmabanduNo ratings yet

- TJX Investor Handout June2013Document11 pagesTJX Investor Handout June2013Thaloengsak KucharoenpaisanNo ratings yet

- BM&FBOVESPA Announces Results For The First Quarter 2011Document9 pagesBM&FBOVESPA Announces Results For The First Quarter 2011BVMF_RINo ratings yet

- LG HH - Ir Presentation 2012 - 1Q - EngDocument8 pagesLG HH - Ir Presentation 2012 - 1Q - EngSam_Ha_No ratings yet

- Q1 2012 Supplemental InformationDocument6 pagesQ1 2012 Supplemental InformationMihir BhatiaNo ratings yet

- Coca-Cola Reports Fourth Quarter and Full-Year 2021 ResultsDocument32 pagesCoca-Cola Reports Fourth Quarter and Full-Year 2021 ResultsMatheus AlexandreNo ratings yet

- D2RIL Q1resultsDocument62 pagesD2RIL Q1resultsnons57No ratings yet

- Tools and Techniques of Financial Statement AnalysisDocument10 pagesTools and Techniques of Financial Statement AnalysisVignesh VijayanNo ratings yet

- Ogilbi & MatherDocument47 pagesOgilbi & MatherRaveen DagarNo ratings yet

- KeppelT&T - 2010 Annual ReportDocument144 pagesKeppelT&T - 2010 Annual ReportDaxx83No ratings yet

- Colgate 2011 AR Web ReadyDocument57 pagesColgate 2011 AR Web Readysaurabh_sethiya9558No ratings yet

- Presentation - Nine Months 2011Document12 pagesPresentation - Nine Months 2011PiaggiogroupNo ratings yet

- Butterfield Reports 2011 Net Income of $40.5 Million: For Immediate ReleaseDocument10 pagesButterfield Reports 2011 Net Income of $40.5 Million: For Immediate Releasepatburchall6278No ratings yet

- Investor Presentation November 2011 FINALDocument26 pagesInvestor Presentation November 2011 FINALErika AxelssonNo ratings yet

- Hyundai Motor - Ir Presentation 2012 - 1Q - EngDocument20 pagesHyundai Motor - Ir Presentation 2012 - 1Q - EngSam_Ha_No ratings yet

- Sept 2011 Investor PresentationDocument28 pagesSept 2011 Investor PresentationAbhiram NayanNo ratings yet

- Weekly Market Commentary 07-11-2011Document2 pagesWeekly Market Commentary 07-11-2011Jeremy A. MillerNo ratings yet

- Earnings ReleaseDocument8 pagesEarnings ReleaseBVMF_RINo ratings yet

- FICCI Economic Outlook Survey May 2011Document20 pagesFICCI Economic Outlook Survey May 2011nishantp_22No ratings yet

- 09 FinanceDocument19 pages09 FinancecherianjayNo ratings yet

- June Quarter 2012 Results - tcm114-297529Document29 pagesJune Quarter 2012 Results - tcm114-297529Harsh DeshmukhNo ratings yet

- 2016 Agm - Ceo PresentationDocument13 pages2016 Agm - Ceo PresentationNandar KhaingNo ratings yet

- BHP Billiton Results For The Half Year Ended 31 December 2013Document40 pagesBHP Billiton Results For The Half Year Ended 31 December 2013digifi100% (1)

- Indian Economic Survey 2012Document10 pagesIndian Economic Survey 2012Krunal KeniaNo ratings yet

- HP Q1 Fy12 Earnings Announcement: February 22, 2012Document43 pagesHP Q1 Fy12 Earnings Announcement: February 22, 2012Revive RevivalNo ratings yet

- Q2 2011 - FinancialResultsDocument7 pagesQ2 2011 - FinancialResultspatburchall6278No ratings yet

- Accenture Reports Strong Second-Quarter Fiscal 2011 ResultsDocument12 pagesAccenture Reports Strong Second-Quarter Fiscal 2011 ResultsPriya NairNo ratings yet

- India Business Market TV Journal September 2022Document32 pagesIndia Business Market TV Journal September 2022Devaraj DharamshiNo ratings yet

- Hikal Investor Presentation August 2020Document43 pagesHikal Investor Presentation August 2020SwamiNo ratings yet

- Consumer Protection ActDocument8 pagesConsumer Protection ActSwamiNo ratings yet

- Freight Reforms in Indian RailwaysDocument9 pagesFreight Reforms in Indian RailwaysSwamiNo ratings yet

- Aarti Surfactants Annual ReportDocument120 pagesAarti Surfactants Annual ReportSwamiNo ratings yet

- ET Wealth 19-25 Sep 22Document25 pagesET Wealth 19-25 Sep 22SwamiNo ratings yet

- Kiri Q4FY20 EarmingsDocument28 pagesKiri Q4FY20 EarmingsSwamiNo ratings yet

- Kilpest InvestorDocument11 pagesKilpest InvestorSwamiNo ratings yet

- Aarti Surfactants Annual ReportDocument120 pagesAarti Surfactants Annual ReportSwamiNo ratings yet

- The Brewing Storm of EB-5 Defaults: PR Esented byDocument32 pagesThe Brewing Storm of EB-5 Defaults: PR Esented bySwamiNo ratings yet

- Chinese Corporates High LeverageDocument1 pageChinese Corporates High LeverageSwamiNo ratings yet

- Fy13 Investor PresentationDocument36 pagesFy13 Investor PresentationSwamiNo ratings yet

- Driving Spend Management Through Advanced AnalyticsDocument2 pagesDriving Spend Management Through Advanced AnalyticsSwamiNo ratings yet

- IncomeStocks - FatpDocument5 pagesIncomeStocks - FatpSwamiNo ratings yet

- Guide TurkeyDocument49 pagesGuide TurkeySwamiNo ratings yet

- Aarti Drugs Investor-Presentation-June-2020 PDFDocument41 pagesAarti Drugs Investor-Presentation-June-2020 PDFSwamiNo ratings yet

- Singapore Property Weekly Issue 269Document14 pagesSingapore Property Weekly Issue 269Propwise.sgNo ratings yet

- Graphite Electrodes Dec 2013Document19 pagesGraphite Electrodes Dec 2013SwamiNo ratings yet

- 3M India Ltd. (3MI) (CMP: Rs. 1735.5)Document10 pages3M India Ltd. (3MI) (CMP: Rs. 1735.5)SwamiNo ratings yet

- The Punch LineDocument17 pagesThe Punch LineSwamiNo ratings yet

- Shalimar Paints LTD 120813Document1 pageShalimar Paints LTD 120813SwamiNo ratings yet

- Paper Product - Q4,2014 Result UpdateDocument3 pagesPaper Product - Q4,2014 Result UpdateSwamiNo ratings yet

- Hold Hold Hold Hold: VST Industries LimitedDocument10 pagesHold Hold Hold Hold: VST Industries LimitedSwamiNo ratings yet

- Wyeth - Q4FY12 Result Update - Centrum 22052012Document4 pagesWyeth - Q4FY12 Result Update - Centrum 22052012SwamiNo ratings yet

- Escorts LTD 030613Document1 pageEscorts LTD 030613SwamiNo ratings yet

- Prestige Estates Q4FY13 Result UpdateDocument4 pagesPrestige Estates Q4FY13 Result UpdateSwamiNo ratings yet

- V-Guard Industries LTD 150513 RSTDocument4 pagesV-Guard Industries LTD 150513 RSTSwamiNo ratings yet

- Camlin Fine Sciences LTD 300113 RSTDocument3 pagesCamlin Fine Sciences LTD 300113 RSTSwamiNo ratings yet

- Bayer CropScience Ltd2 200513 RSTDocument2 pagesBayer CropScience Ltd2 200513 RSTSwamiNo ratings yet

- Brand Report CardDocument4 pagesBrand Report CardjagadishprasadNo ratings yet

- Trend AnalysisDocument28 pagesTrend Analysisdiwakar0000000No ratings yet

- Swot Pest NavneetDocument8 pagesSwot Pest Navneetfriend_foru2121No ratings yet

- Answer and CounterclaimDocument9 pagesAnswer and CounterclaimleeiglodyNo ratings yet

- Real Estate Capital Markets - ReadingsDocument3 pagesReal Estate Capital Markets - ReadingsCoursePin100% (1)

- NK SurabayaDocument84 pagesNK SurabayaZamroni BonangNo ratings yet

- Capital StructureDocument11 pagesCapital StructureSathya Bharathi100% (1)

- Aro Granite LTD - Impetus Advisors - Nov-04Document8 pagesAro Granite LTD - Impetus Advisors - Nov-04Arpit JainNo ratings yet

- Investment Banking & Private EquityDocument73 pagesInvestment Banking & Private Equitymakarandr_1100% (1)

- CASHFLOW TemplateDocument6 pagesCASHFLOW Templatemilabol100% (1)

- Issuing International Bonds A Guidance NoteDocument51 pagesIssuing International Bonds A Guidance NoteAnupama BalajiNo ratings yet

- APSE Guide v1.0Document30 pagesAPSE Guide v1.0wilmat9No ratings yet

- MGT401 Midterm Paperz by YushaDocument27 pagesMGT401 Midterm Paperz by Yushamoni763No ratings yet

- ACC 401 Homework CH 4Document4 pagesACC 401 Homework CH 4leelee03020% (1)

- On January 1 2013 Stamford Reacquires 8 000 of The OutstandingDocument1 pageOn January 1 2013 Stamford Reacquires 8 000 of The OutstandingMiroslav GegoskiNo ratings yet

- Cpa ReviewDocument17 pagesCpa ReviewJericho PedragosaNo ratings yet

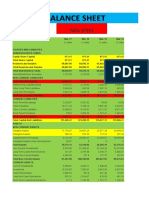

- Balance Sheet: Tata SteelDocument4 pagesBalance Sheet: Tata SteelMithilesh ShamkuwarNo ratings yet

- Hostile Takeover in Respect To IndiaDocument39 pagesHostile Takeover in Respect To IndiadebankaNo ratings yet

- Sunlife InsuranceDocument37 pagesSunlife InsuranceRica SolanoNo ratings yet

- The Business Times September 12 2017Document29 pagesThe Business Times September 12 2017Mahtab ChondonNo ratings yet

- Chapter 10 Measuring Outcomes of Brand Equity Capturing Market PerformanceDocument13 pagesChapter 10 Measuring Outcomes of Brand Equity Capturing Market PerformanceprosmaticNo ratings yet

- Limited Business Opportunities.: 2) Failed in MarketingDocument3 pagesLimited Business Opportunities.: 2) Failed in MarketingSyakirin.azmiNo ratings yet

- Acct 3101 Chapter 05Document13 pagesAcct 3101 Chapter 05Arief RachmanNo ratings yet

- BCIP Application: Mode of Investment Ocbc Deposit Account Ocbc Online Banking Ocbc SRS AccountDocument6 pagesBCIP Application: Mode of Investment Ocbc Deposit Account Ocbc Online Banking Ocbc SRS Accountmugger123456No ratings yet

- Aspeon Sparkling Water, Inc. Capital Structure Policy: Case 10Document16 pagesAspeon Sparkling Water, Inc. Capital Structure Policy: Case 10Alla LiNo ratings yet

- Leader of The M: One Step AheadDocument6 pagesLeader of The M: One Step AheadshreyasNo ratings yet

- Corporation Law: JGA Medina Bus. Org II, Philippine Law SchoolDocument27 pagesCorporation Law: JGA Medina Bus. Org II, Philippine Law SchoolLien PatrickNo ratings yet

- The Ichimoku TraderDocument11 pagesThe Ichimoku TraderPui SanNo ratings yet

- Case 5 - OptitechDocument1 pageCase 5 - Optitechthrust_xone100% (1)

- FIN 448 Midterm ProblemsDocument6 pagesFIN 448 Midterm Problemsgilli1trNo ratings yet