Professional Documents

Culture Documents

Bond Valuation

Uploaded by

Gokil AjeOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Bond Valuation

Uploaded by

Gokil AjeCopyright:

Available Formats

BOND VALUATION

A. Terminology and Characteristics of Bonds

- Bond is long-term contract under which a borrower

(business or goverment) agrees to make payments of

interest and principal, on specific dates, to the holders of

the bond .

- Corporate Bond is a long-term debt instrument

indicating that a corporation has borrowed a certain

amount of money and promises to repay it in the future

under clearly defined terms.

- Key Characteristics of Bonds

1. Par (Face) Value is the stated face value of the bond. Its generally

represents the amount of money the firm borrows and promises to repay

on the maturity date.

2. Coupon Interest Rate is the stated annual interest rate on a bond.

3. Maturity date is a specified date on which the par value of a bond must be

repaid.

4. In the case of a firm's insolvency, a bondholder has a priority of claim to

the firm's assets before the preferred and common stockholders. Also,

bondholders must be paid interest due them before dividends can be

distributed to the stockholders

B. Bond Valuation

The process of determining the fair price of bond by calculating its expected

present value of the future interest payments and maturity value discounted at

the bondholder's required rate of return.

C. Formula

B

0

=

=

+

+

+

N

1 t

N

b

t

b

) k (1

PAR

) k (1

COUPON

) ( ) ( , , 0 n rd n rd PVIF Mx PVIFA Ix B + =

For semmi annual coupon payments

B

0

=

=

|

.

|

\

|

+

+

|

.

|

\

|

+

2N

1 t

2N

b

t

b

2

k

1

PAR

2

k

1

2

COUPON

) ( ) (

2

2 ,

2

2 ,

2

0 n

rd

n

rd

PVIF Mx PVIFA x

I

B + =

Where

Bo = value of the bond at the time zero

COUPON = the dollar interest to be received in each

payment

PAR VALUE = the par value of the bond at maturity

k

b

= the required rate of return for the bondholder

N = the number of periods to maturity

D. Yield to Maturity (YTM)

The rate of return that an investor would earn if he bought the bond at its

current market price and held it until maturity.

(

)

(

2

)

E. Yield to Call (YTC)

The rate of return that an investor would earn if he bought a callable bond at its

current market price and held it until the call date given that the bond was called

on the call date.

(

)

(

2

)

F. Current Yield

The current yield measures the annual return to an investor based on the

current price

Criteria :

If Then Bonds sells at a :

Current yield < YTM Market < Face Discount

Current yield = YTM Market = Face Par/Face Value

Current yield > YTM Market > Face Premium

PROBLEMS

1. FT hv 12

years remaining to maturity.

Interest is paid annually, the

bonds have a 1,000 par value,

and the coupon interest rate is 8%.

The bonds have a required rate of

return of 9%. What is the current

market price of these bonds?

2. Sumaryati Company has outstanding a $1,000 par-value bond with an 8%

coupon interest rate. The bond has 12 years remaining to its maturity date. If

interest is paid annually, find the value of the bond when the required return is

(1) 7%, (2) 8%, and (3) 10%

3. You just purchased a bond that matures in 5 years. The bond has a face value of

1,000 h 8% . Th h y 8.21%.

Wh h y y?

4. Andreli Industries has issued bonds that have a 10% coupon rate, payable

semiannually.The bonds mature in 8 years, have a face value of 1,000, and a

yield to maturity of 8.5%. What is the price of the bonds?

5. You own a bond that pays $100 in annual interest, with a $1,000 par value. It

matures in 15 years. Your required rate of return is 12 percent. Calculate the

value of the bond ! How does the value change if your required rate of return

increases to 15 percent or decreases to 8 percent? Explain the implications of

your answers as they relate to interest rate risk, premium bonds, and discount

bonds !

6. Calculate the yield to call on a 16 % coupon rate bond that has 10 years

remaining to maturity and its currently trading in the market at 1500 . assume

that bond can be called in 5 years from now at a call price of 1200 (par value =

1000)

You might also like

- Reputatio and Risk Management by PWC PDFDocument184 pagesReputatio and Risk Management by PWC PDFGokil AjeNo ratings yet

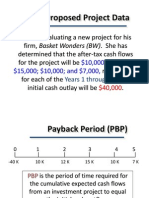

- Chapt 8 Capital Budgeting Cash FlowsDocument39 pagesChapt 8 Capital Budgeting Cash FlowsTom EricksonNo ratings yet

- Graph and Pie Chart For 12-25 AgeDocument14 pagesGraph and Pie Chart For 12-25 AgeGokil AjeNo ratings yet

- Capital BudgetingDocument24 pagesCapital BudgetingGokil AjeNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Market Segmentation Strategies in the Digital AgeDocument23 pagesMarket Segmentation Strategies in the Digital AgeIzabela MugosaNo ratings yet

- Diversification StrategyDocument20 pagesDiversification StrategyHo NaNo ratings yet

- Indonesia Digital Startup Landscape 2018Document41 pagesIndonesia Digital Startup Landscape 2018Sugianto HaramonoNo ratings yet

- Forex Courses ListDocument9 pagesForex Courses ListTaKo TaKoNo ratings yet

- PCCW CaseDocument2 pagesPCCW CaseamarNo ratings yet

- BOISE INC. 8-K (Events or Changes Between Quarterly Reports) 2009-02-24Document26 pagesBOISE INC. 8-K (Events or Changes Between Quarterly Reports) 2009-02-24http://secwatch.comNo ratings yet

- Investment Universe, Process & Strategy: What Is Abakkus Smart Flexi Cap Portfolio?Document2 pagesInvestment Universe, Process & Strategy: What Is Abakkus Smart Flexi Cap Portfolio?Bina ShahNo ratings yet

- Sustainable Development Is Feasible: Time for ActionDocument2 pagesSustainable Development Is Feasible: Time for Actionjaylen gardnerNo ratings yet

- Alterations to Listed Breakwater and Viaduct on Portland HarbourDocument18 pagesAlterations to Listed Breakwater and Viaduct on Portland HarbourAnonymous Lx3jPjHAVLNo ratings yet

- World Tax ReformDocument333 pagesWorld Tax ReformncariwibowoNo ratings yet

- Fera and Fema: Submitted To: Prof. Anant AmdekarDocument40 pagesFera and Fema: Submitted To: Prof. Anant AmdekarhasbicNo ratings yet

- HSBC Holdings PLC Annual Report and Accounts 2015Document502 pagesHSBC Holdings PLC Annual Report and Accounts 2015lucindaNo ratings yet

- Organisation Study On SHREE CEMENT BEAWARDocument89 pagesOrganisation Study On SHREE CEMENT BEAWARRajesh YadavNo ratings yet

- Equity Pick-Up Module & Customized Intercompany Matching: Fusion 11.1.1.2, HFM & ReportsDocument20 pagesEquity Pick-Up Module & Customized Intercompany Matching: Fusion 11.1.1.2, HFM & Reportssagiinfo1No ratings yet

- Intermediate Accounting 1Document8 pagesIntermediate Accounting 1Margielyn SuniNo ratings yet

- Statement of Cash Flows - StudentsDocument14 pagesStatement of Cash Flows - StudentsAyushi ThakkarNo ratings yet

- Financial Detective Case AnalysisDocument11 pagesFinancial Detective Case AnalysisBrian AlmeidaNo ratings yet

- Jul 2022 Performance ReportDocument3 pagesJul 2022 Performance ReportMyles PiniliNo ratings yet

- LCM Accounting in P2PDocument4 pagesLCM Accounting in P2Pramthilak2007gmailcomNo ratings yet

- Trade AgreementDocument6 pagesTrade AgreementSoumyajit KaramNo ratings yet

- Problem 12-2 Cash Flow (LO2) : 1.00 PointsDocument37 pagesProblem 12-2 Cash Flow (LO2) : 1.00 PointsSheep ersNo ratings yet

- Stated Objective: Dow Jones Stoxx Global 1800 IndexDocument2 pagesStated Objective: Dow Jones Stoxx Global 1800 IndexMutimbaNo ratings yet

- Portfolio Returns and Standard DeviationsDocument2 pagesPortfolio Returns and Standard DeviationsNguyễn Hồng HạnhNo ratings yet

- Quiz Money and BankingDocument10 pagesQuiz Money and Bankingibrahim gendiiNo ratings yet

- SFM Nov 20Document20 pagesSFM Nov 20ritz meshNo ratings yet

- Confidence You Can Carry Girls in Crisis and The Market For Girls Empowerment OrganizationsDocument13 pagesConfidence You Can Carry Girls in Crisis and The Market For Girls Empowerment OrganizationsAnonymous WpqyzJ6No ratings yet

- Billionaires Secrets PDFDocument30 pagesBillionaires Secrets PDFAbel Quintos67% (3)

- Amla 2016 Revised Implementing Rules and RegulationsDocument41 pagesAmla 2016 Revised Implementing Rules and RegulationsRechelleNo ratings yet

- Bonds Payable Multiple Choice QuestionsDocument9 pagesBonds Payable Multiple Choice QuestionsAl-Sinbad Bercasio100% (2)

- USAID GDA - Indonesia Ecotourism Concept Paper Submission - GWA-idGuides-Daemeter-TNC (17feb2015) PDFDocument12 pagesUSAID GDA - Indonesia Ecotourism Concept Paper Submission - GWA-idGuides-Daemeter-TNC (17feb2015) PDFPeter Skøtt PedersenNo ratings yet