Professional Documents

Culture Documents

Joint Return 5. Residency

Uploaded by

Jon LeinsOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Joint Return 5. Residency

Uploaded by

Jon LeinsCopyright:

Available Formats

Individual Taxation

Qualifying Child Tests

1. Age (<19, <24 if student, no limit if disabled)

2. Adobe (live with >1/2 year)

3. Support (child provides < ½ of own support)

4. Residency (US, Canada, Mexico)

5. Joint Return (can’t file a joint return if owing taxes on it)

Qualifying Relative Tests

1. Relationship (parents, grandparents, stepsiblings, stepparents,

nephew, immediate in-laws, bum if living w/you for ENTIRE YEAR,

NO COUSINS/FOSTER PARENTS)

2. Support (person claiming the dependent provide over ½ for the

relative)

3. Gross Income (<$3,500- the standard exemption. No GI test if

under age limit)

4. Joint Return

5. Residency

Qualifying Widow(er)

• Provide >50% cost of maintaining house

• Dependent child lives with for entire year

• May file as widower for 2 years after death of spouse

• Allows for only 1 personal exemption (can’t claim dead

person)

Elderly/Disabled Credit = Must be very poor to claim (AGI of 15K+

disqualifies in most cases)

AMT Credit = can offset regular tax liability in future years (but

not offset AMT)

Farm Line of Credit (Sole proprietor) = Form 1040, NOT Schedule F

Employer provided Death Benefit = Included in Gross Income

Series EE Bonds- If used for tuition of dependent, then tax-exempt!

If not, then the interest is taxable

IRA Early Withdraw Penalties

• Pay regular income tax + 10% penalty

• Must be over 59 ½ years old to avoid penalty

• REQUIRED TO W/D @ age 70 ½

• Exceptions: HIMDEAD

○ Homebuyer (1st time); $10,000 max

○ Insurance (medical) if unemployed or self-employed

○ Medical expenses >7.5% of AGI

○ Disabled permanently

○ Educational Expenses (College)

○ and

○ Death

Individual Taxation

IRA Rules

– $5K per spouse allowed, can deduct for AGI

– If AGI exceeds a threshold (~100K) and covered by employee

pension plan, then no deduction is allowed

– $6K limit if 50 or older

– Limited to compensation received (includes alimony!)

Section 179- Not allowed if NOL occurs

• May carry forward forever and use in future years, once

operating @ a profit

• Report on form 4562- Depreciation & Amortization, & fully

deductible on Schedule C

Foreign Taxes = deduction OR credit, at option of taxpayer

Deductions

• Roth IRA = NOT Deductible

• Penalties on late payment = NOT Deductible

• Health Insurance Premiums paid = Itemize (7.5% AGI floor)

• Life Insurance Premiums = NOT Deductible

• Vehicle Repairs, insurance, gasoline, maintenance = Line

9 of Schedule C- “Car and Truck Expenses”

○ (Depreciate car with other biz equipment and lump

together w/Section 179 expense)

• M&E: 50% deductible on Schedule C

• Professional Journals used for biz = FULLY deductible on

Schedule C

• Ad Volerem/Property Taxes = fully deductible as Itemized

deduct

• Home Equity Interest = fully deductible as Itemized deduct

○ Limit = $100K indebtedness (secured by principal home)

○ Limited to FMV of residence reduced by acquisition

indebtedness related to that residence

• Homeowner’s Insurance = NOT deductible

• Qualifying contributions to simplified EE pension plan =

Fully deductible ‘for’ AGI

• Real Property tax = Fully deductible as itemized (even if

not principal residence)

• Estate Tax attributable to income of decedent = Itemize

(2% AGI)

• Loss on sale of residence = NOT deductible (considered

personal loss)

Schedule E = Rental real estate, royalties, partnerships, S Corps,

Estates, Trusts

Individual Taxation

• “Supplemental Income or Loss”

Retainer Fees for Attorney = Include in Schedule C

Selling stocks – recognize gain/loss on trade date (whether cash or

accrual basis)

Dividends from mutual funds investing in tax-free govt obligations =

not taxable

Interest Income on State/Local Govt Bonds = not taxable

Interest on Federal Tax Refund = taxable, report on Schedule B

(interest & divs)

Uniform Capitalization Rules = capitalize costs associated w/preparing

INV

• Effect: 1st year- increase inventory value, reduce operating exp’s

= higher NI

• Exception for ‘goods acquired for resale’: Only need to

apply if taxpayer’s average annual gross receipts for previous 3

years exceeds $10m

• INCLUDE: Direct materials/labor, indirect costs, utilities, repairs,

maintenance, engineering, design, spoilage, indirect labor,

warehousing, insurance, repacking, pensions, admin supplies

• DON’T INCLUDE: Advertising, marketing, selling exp’s, officer

compensation, administrative, research

Taxpayer withholds, but owes no tax & doesn’t file = must file for

refund w/in 2 years from date TAX WAS PAID

Merchandise Inventory = Accrual method required!

Net Passive Activity Losses (PAL’s)

• Can only be used to offset passive income

• Applies to Individuals, estates, trusts, PSC’s, closely held C

Corps

• Can carryforward indefinitely until used up

• If taxpayer becomes active (materially participates) -> may

be used to offset active income

• Unused PAL’s = fully tax deductible in the year of equipment

disposal

• EXCEPTIONS: (for real estate, allowed to offset active income)

○ Mom & Pop: Deduct up to $25K in rental income if actively

participate

Phase-out: $25K reduced by 50% of amt exceeding

AGI of $100K. Completely phased out at AGI of $150K

○ Real Estate Professional (may fully deduct against regular

income)

Individual Taxation

Social Security Income

1. Poor: No S.S. benefits are taxable (income below: $25K single,

$32K MFJ)

2. Lower-Middle: Less than 50% of benefits are taxable

3. Middle: 50% benefits are taxed (income up to: $25K single)

4. Upper-Middle: 50-65% are taxable

5. Upper: 85% (maximum) of benefits are taxable (MAGI > $34K-

S; $44K MFJ)

Accrual Basis Income Formula

Beg A/R

+ Sales

– Cash collections

– Ending A/R

AMT

• Medical expenses: >10% AGI

• No exemptions allowed? May be different

You might also like

- Read This First: Estimated Taxes PaidDocument7 pagesRead This First: Estimated Taxes PaidDan HuntingtonNo ratings yet

- Next Level Tax Course: The only book a newbie needs for a foundation of the tax industryFrom EverandNext Level Tax Course: The only book a newbie needs for a foundation of the tax industryNo ratings yet

- REG NotesDocument41 pagesREG NotesNick Huynh75% (4)

- Sixteen Thirty Fund's 2022 Tax FormsDocument101 pagesSixteen Thirty Fund's 2022 Tax FormsJoeSchoffstallNo ratings yet

- EA LectureNotesDocument84 pagesEA LectureNotesKim Nguyen100% (1)

- Quick Notes on “The Trump Tax Cut: Your Personal Guide to the New Tax Law by Eva Rosenberg”From EverandQuick Notes on “The Trump Tax Cut: Your Personal Guide to the New Tax Law by Eva Rosenberg”No ratings yet

- Deminimis BenefitsDocument24 pagesDeminimis Benefitsdaryl canoza100% (1)

- T-Bills in India: Treasury Bills, 2. 182 Days Treasury Bills, and 3. 364 Days Treasury BillsDocument5 pagesT-Bills in India: Treasury Bills, 2. 182 Days Treasury Bills, and 3. 364 Days Treasury Billsbb2No ratings yet

- Notes Chapter 1 REGDocument7 pagesNotes Chapter 1 REGcpacfa100% (20)

- Tax Accounting Study GuideDocument4 pagesTax Accounting Study Guides511939No ratings yet

- Notes Chapter 2 REGDocument7 pagesNotes Chapter 2 REGcpacfa100% (10)

- F 1040 EsDocument12 pagesF 1040 EsEndu EnduroNo ratings yet

- Economies of ScaleDocument16 pagesEconomies of Scalebhakti_kumariNo ratings yet

- Hours and ProceduresDocument4 pagesHours and ProceduresttawniaNo ratings yet

- Annotated BibliographyDocument9 pagesAnnotated Bibliographyapi-309971310100% (2)

- Tax Cheat Sheet - Exam 1Document2 pagesTax Cheat Sheet - Exam 1tyg1992No ratings yet

- 22 - Intangible Assets - TheoryDocument3 pages22 - Intangible Assets - TheoryralphalonzoNo ratings yet

- Papers On The Philippine Financial Crisis and Its Roots - A.Lichauco, J. Sison & Edberto Malvar VillegasDocument28 pagesPapers On The Philippine Financial Crisis and Its Roots - A.Lichauco, J. Sison & Edberto Malvar VillegasBert M Drona100% (1)

- 1Document7 pages1wbell1No ratings yet

- CPA Regulation Notes Chapter 2 20101001Document11 pagesCPA Regulation Notes Chapter 2 20101001Regulation2010No ratings yet

- Tax SavingDocument24 pagesTax SavingcrazysidzNo ratings yet

- REG NotesDocument119 pagesREG NotesYash MhatreNo ratings yet

- Individual Income Tax Formula ExplainedDocument2 pagesIndividual Income Tax Formula ExplainedHenry ZhuNo ratings yet

- Tax Notes Chapter 3-6Document9 pagesTax Notes Chapter 3-6Jack BrownNo ratings yet

- Temporary Differences (Result in Deferred Taxes)Document45 pagesTemporary Differences (Result in Deferred Taxes)chuynh18No ratings yet

- Notes Chapter 1 REGDocument7 pagesNotes Chapter 1 REGelmotakeover1No ratings yet

- Income TaxationDocument12 pagesIncome TaxationMonica Jarabelo RamintasNo ratings yet

- Temporary Differences (Result in Deferred Taxes) :: Royalties Received in AdvanceDocument41 pagesTemporary Differences (Result in Deferred Taxes) :: Royalties Received in AdvanceIrfanali Jusab100% (1)

- Adjustments For Agi - "Above The Line" Deductions - Deductions To Arrive at AgiDocument47 pagesAdjustments For Agi - "Above The Line" Deductions - Deductions To Arrive at Agiesoniat51No ratings yet

- Adjustments and Itemized Deductions: REG - Notes Chapter 2Document7 pagesAdjustments and Itemized Deductions: REG - Notes Chapter 2Reeder DonaldsonNo ratings yet

- RG146 Pocket GuideDocument30 pagesRG146 Pocket GuideMentor RG146No ratings yet

- Tax Law Snapshot 2014Document4 pagesTax Law Snapshot 2014HosameldeenSalehNo ratings yet

- US Individual RegulationDocument3 pagesUS Individual RegulationDarab AkhtarNo ratings yet

- Chap017 2016Document23 pagesChap017 2016Puneet GoelNo ratings yet

- Regulation 1: Individual TaxationDocument14 pagesRegulation 1: Individual TaxationFaten AlraiiNo ratings yet

- Taxes: Tax StructureDocument14 pagesTaxes: Tax StructurePradeep NairNo ratings yet

- Filling For Claim For RefundDocument8 pagesFilling For Claim For RefundsheldonNo ratings yet

- Module 11 - Business MathematicsDocument31 pagesModule 11 - Business MathematicsMaam AprilNo ratings yet

- Itemized Deductions & Other Incentives: Income Tax Fundamentals 2014Document44 pagesItemized Deductions & Other Incentives: Income Tax Fundamentals 2014tyg1992No ratings yet

- AttachmentDocument95 pagesAttachmentSyed InamNo ratings yet

- Becker Regulation CHPT 1Document3 pagesBecker Regulation CHPT 1kishkiss25No ratings yet

- Tax Rules for Salary Income and DeductionsDocument15 pagesTax Rules for Salary Income and DeductionsmagusamNo ratings yet

- Tax On The Citizens of The PhilippinesDocument21 pagesTax On The Citizens of The PhilippinesPercival CelestinoNo ratings yet

- Exam 2Document2 pagesExam 2Gabe RodriguezNo ratings yet

- USAA PresentationDocument43 pagesUSAA Presentationarkan1976No ratings yet

- Real Property (Realty) Exemption 1-7: Head of Household 3-24Document3 pagesReal Property (Realty) Exemption 1-7: Head of Household 3-24ChloeNo ratings yet

- LEGT2751 Lecture 1Document14 pagesLEGT2751 Lecture 1reflecti0nNo ratings yet

- Income Tax ReturnDocument57 pagesIncome Tax ReturnMalik WasimNo ratings yet

- Taxation LawDocument20 pagesTaxation LawAnjana P NairNo ratings yet

- A. The Constitution and The Income Tax: Federal Income Tax Professor Morrison Fall 2003 CHAPTER 1: IntroductionDocument67 pagesA. The Constitution and The Income Tax: Federal Income Tax Professor Morrison Fall 2003 CHAPTER 1: IntroductioncjleopNo ratings yet

- CWC Tax PresentationDocument61 pagesCWC Tax PresentationRajani AthanimathNo ratings yet

- Full Tax OutlineDocument35 pagesFull Tax OutlinedellamatNo ratings yet

- ACCT226 Final ReviewDocument41 pagesACCT226 Final ReviewMahesh YadavNo ratings yet

- Nature and Concept: OF IncomeDocument193 pagesNature and Concept: OF IncomeFranchise AlienNo ratings yet

- TAX NotesDocument45 pagesTAX NotesAlhaji Umaru JallohNo ratings yet

- Taxation Notes 4.1.23 MidtermDocument11 pagesTaxation Notes 4.1.23 MidtermRaissa Anjela Carman-JardenicoNo ratings yet

- Chapter 4. Personal Income TaxDocument51 pagesChapter 4. Personal Income TaxVu Thi ThuongNo ratings yet

- Understanding Income Tax in IndiaDocument38 pagesUnderstanding Income Tax in IndiaKrishanKantNo ratings yet

- Tax Implication For Abc Company and Its Thailand SubsidiaryDocument11 pagesTax Implication For Abc Company and Its Thailand SubsidiaryNirvana ShresthaNo ratings yet

- An Assignment of Tax Planning On "Tax System in United States of America"Document23 pagesAn Assignment of Tax Planning On "Tax System in United States of America"Akash NathwaniNo ratings yet

- Philippines Taxation GuideDocument8 pagesPhilippines Taxation GuideCindy-chan DelfinNo ratings yet

- Deductions 3Document35 pagesDeductions 3sanjeev kumar vsNo ratings yet

- Surviving the New Tax Landscape: Smart Savings, Investment and Estate Planning StrategiesFrom EverandSurviving the New Tax Landscape: Smart Savings, Investment and Estate Planning StrategiesNo ratings yet

- Reporting Results of OperationsDocument5 pagesReporting Results of OperationsJon LeinsNo ratings yet

- Stockholders' EquityDocument6 pagesStockholders' EquityJon Leins100% (1)

- R&D IntangiblesDocument2 pagesR&D IntangiblesJon LeinsNo ratings yet

- Corporate TaxesDocument1 pageCorporate TaxesJon LeinsNo ratings yet

- Preparing SCF EquationsDocument1 pagePreparing SCF EquationsJon LeinsNo ratings yet

- LT ContractsDocument4 pagesLT ContractsJon LeinsNo ratings yet

- Post Employment BenefitsDocument3 pagesPost Employment BenefitsJon LeinsNo ratings yet

- PP&EDocument3 pagesPP&EJon LeinsNo ratings yet

- LiabilitiesDocument4 pagesLiabilitiesJon LeinsNo ratings yet

- Profitability RatiosDocument3 pagesProfitability RatiosJon LeinsNo ratings yet

- Misc FAR Notes 1, DiscountingDocument6 pagesMisc FAR Notes 1, DiscountingJon LeinsNo ratings yet

- NFPDocument4 pagesNFPJon LeinsNo ratings yet

- Ex: Payments of $10K Due For 10 Years, First 2 Years Free Yearly Expense Is ($80K/10 Yrs) $8k/year Rent Expense Lessor JEDocument4 pagesEx: Payments of $10K Due For 10 Years, First 2 Years Free Yearly Expense Is ($80K/10 Yrs) $8k/year Rent Expense Lessor JEJon LeinsNo ratings yet

- Fixed Asset ExchangesDocument1 pageFixed Asset ExchangesJon LeinsNo ratings yet

- GovernmentalDocument7 pagesGovernmentalJon LeinsNo ratings yet

- Foreign OperationsDocument1 pageForeign OperationsJon LeinsNo ratings yet

- PartnershipsDocument1 pagePartnershipsJon LeinsNo ratings yet

- InventoryDocument3 pagesInventoryJon LeinsNo ratings yet

- ConsolidationDocument3 pagesConsolidationJon LeinsNo ratings yet

- Final Review NotesDocument3 pagesFinal Review NotesJon LeinsNo ratings yet

- Financial Statements - ForMATDocument2 pagesFinancial Statements - ForMATJon LeinsNo ratings yet

- PartnershipsDocument1 pagePartnershipsJon LeinsNo ratings yet

- ITDocument4 pagesITJon LeinsNo ratings yet

- Cost and Equity MethodsDocument2 pagesCost and Equity MethodsJon LeinsNo ratings yet

- BondsDocument3 pagesBondsJon LeinsNo ratings yet

- Planning and ControlDocument2 pagesPlanning and ControlJon LeinsNo ratings yet

- Standard CostingDocument2 pagesStandard CostingJon LeinsNo ratings yet

- Finance BECDocument8 pagesFinance BECJon LeinsNo ratings yet

- Cost and Decision Making OverviewDocument4 pagesCost and Decision Making OverviewJon LeinsNo ratings yet

- Increase in Demand and SupplyDocument9 pagesIncrease in Demand and SupplyJon LeinsNo ratings yet

- Case 03 - Walmart Case NoteDocument3 pagesCase 03 - Walmart Case Notemarcole198440% (5)

- Bridge Over Bhagirathi AllotmentDocument6 pagesBridge Over Bhagirathi AllotmentKyle CruzNo ratings yet

- Mishkin Econ13e PPT 17Document25 pagesMishkin Econ13e PPT 17Huyền Nhi QuảnNo ratings yet

- Audi Power To Gas News (Media)Document3 pagesAudi Power To Gas News (Media)asmecsiNo ratings yet

- Ratan TataDocument7 pagesRatan TatadrankurshahNo ratings yet

- SoEasy Roof Mounting Solution.Document8 pagesSoEasy Roof Mounting Solution.Irfan FatahilahNo ratings yet

- PUGEL 'Scale Economies Imperfect Competition and Trade' INTERNATIONAL ECONOMICS 6ED - Thomas Pugel - 001 PDFDocument29 pagesPUGEL 'Scale Economies Imperfect Competition and Trade' INTERNATIONAL ECONOMICS 6ED - Thomas Pugel - 001 PDFPraba Vettrivelu100% (1)

- Survey highlights deficits facing India's minority districtsDocument75 pagesSurvey highlights deficits facing India's minority districtsAnonymous yCpjZF1rFNo ratings yet

- Low Fouling, High Temperature Air Preheaters For The Carbon Black IndustryDocument3 pagesLow Fouling, High Temperature Air Preheaters For The Carbon Black IndustryffownNo ratings yet

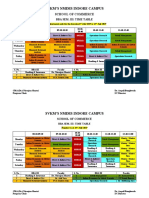

- Time-Table - BBA 3rd SemesterDocument2 pagesTime-Table - BBA 3rd SemesterSunny GoyalNo ratings yet

- Financial Accounting 1 by HaroldDocument392 pagesFinancial Accounting 1 by HaroldRobertKimtaiNo ratings yet

- PDFDocument16 pagesPDFAnil KhadkaNo ratings yet

- Most Important Terms & ConditionsDocument6 pagesMost Important Terms & ConditionsshanmarsNo ratings yet

- Group A Hyderabad Settlement StudyDocument12 pagesGroup A Hyderabad Settlement StudyRIYA AhujaNo ratings yet

- Iskandar Malaysia's Vision, Growth and Promotional PoliciesDocument29 pagesIskandar Malaysia's Vision, Growth and Promotional PoliciesJiaChyi PungNo ratings yet

- Energia Solar en EspañaDocument1 pageEnergia Solar en EspañaCatalin LeusteanNo ratings yet

- Monopolistic CompetitionDocument14 pagesMonopolistic CompetitionRajesh GangulyNo ratings yet

- October 16, 2023 Philippine Stock ExchangeDocument5 pagesOctober 16, 2023 Philippine Stock ExchangePaul De CastroNo ratings yet

- Design and ArchitectureDocument26 pagesDesign and ArchitecturesaifazamNo ratings yet

- Econ 601 f14 Workshop 3 Answer Key PDFDocument3 pagesEcon 601 f14 Workshop 3 Answer Key PDFюрий локтионовNo ratings yet

- Topic 6 Stances On Economic Global IntegrationDocument43 pagesTopic 6 Stances On Economic Global IntegrationLady Edzelle Aliado100% (1)

- Your Account Summary: Airtel Number MR Bucha Reddy ADocument8 pagesYour Account Summary: Airtel Number MR Bucha Reddy AKothamasu PrasadNo ratings yet

- America Turning Japanese? Global Debt Deflation & Manipulated Asset MarketsDocument20 pagesAmerica Turning Japanese? Global Debt Deflation & Manipulated Asset Marketsaao5269No ratings yet

- Measuring Elasticity of SupplyDocument16 pagesMeasuring Elasticity of SupplyPetronilo De Leon Jr.No ratings yet