Professional Documents

Culture Documents

Strategic Risks 2013 - 1215 - Internet at The Age of Empires 03

Uploaded by

zeronomicsOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Strategic Risks 2013 - 1215 - Internet at The Age of Empires 03

Uploaded by

zeronomicsCopyright:

Available Formats

Internet took off there nearly 20 years ago with the wide dissemination of Netscape, the first web

browser. Among the founding myths of this new economy was the belief that it would do away with intermediaries placing buyers and sellers face to face. Far from disappearing, new overpowerful intermediaries have actually emerged. The likes of Google, Apple, Amazon, and Facebook are causing a real creative destruction, in the way articulated by the economist Joseph Schumpeter. A process which redefines trade, modes of distribution, balance of power, and the way value is distributed. This is a puzzle for policy makers and traditional incumbent businesses all around the world. Barbarians at the gates For two decades the Internet has been profoundly changing the economy. And this is only a beginning. In the G20 countries, the heart of the digital economy, operated by Information and Communications Technology (ICT) organisations, is about 5 % of GDP. But the digitisation of the economy now affects a much larger number of sectors: for instance the French have calculated that of their national production is affected. This penetration is accomplished in two ways. Firstly by realising large productivity gains through the inherent efficiency of ICTs: across sectors, businesses have become more efficient thanks to electronic orders and billing, by monitoring their production. Secondly by a significant dematerialisation of most of the value chain: entire parts become redundant because of digital processes. Just think that today you can book a flight and check-in from your mobile phone, making the role of travel agents totally redundant. In turn, advertising, tourism and the cultural industries have seen their business model deeply challenged by this digitisation. For each sector that the digital world "cannibalises, the modus operandi is similar: barbarians from the Internet enter the value chain at a strategic point in direct contact with the consumers, and use the data they collect from regular and systematic monitoring of peoples activities to gain market share and cause a gradual transfer of the margin in their favour. This is exactly what Amazon did through the power of its recommendation system built from a detailed analysis of the behaviour of its users, and a very aggressive pricing policy. This distributor shipping books from warehouses has become hegemonic in the sale of cultural products. With the spectacular consequence of putting out of business a plethora of brick and mortar players, from the small bookshop at the corner of the street, to the giant Border's that filed for bankruptcy in the US in 2011 after its 500 stores and 20,000 employees lost the battle against online distribution. The same happened with Apple. The couple formed by the iPod music player and the iTunes software has created a direct relationship with customers (and their bank details!). The company now dominates the online music market (2 thirds in the US), to the point of having succeeded in imposing to record labels the prices at which they sell their songs. With the success of the iPhone and iPad, Apple is on the way to extend this rule to other producers of content, whether video or the press.

So, far from having materialised the ideal of a pure market allowing perfect competition - as its pioneers believed the Internet has instead given birth to a juxtaposition of giant monopolies in separate market segments, which are often not in competition or only indirectly. A winner takes all world If the digital world tolerates so little of the competition, it is because of a specific law of its own: the network effect. The value of a good or service increases with the number of its users, even at the expense of short term profitability: the product is adopted by a critical mass of users, allowing a company to acquire a dominant position on a given market. This delivers a winner takes all outcome. This is how Google has ended up dominating search, Facebook social network, YouTube video streaming, Apple online music, and Amazon e-retail. Amazon is a fascinating case because it provides insights on how organisations achieve this. To establish its domination, the e-retailer has spent nearly 3 billion dollars between 1995 and 2003, mostly funded from its own cash-flow, before becoming profitable. Therefore, if the Internet is dominated by U.S. giants, it is not only because of the innovative spirit of the Silicon Valley they often come from, but also through unique financing facilities they benefit from. Since 1998, U.S. venture-capital firms have funded on average one digital start-up every 3 months which value has subsequently exceeded one billion dollars. Faced with the consolidation of these monopolies, authorities responsible for enforcing competition often remained impotent. The weapon normally used by government are taxes, but they prove difficult to collect in the face of cross-border optimisation techniques deployed by those businesses. The problem also goes beyond the issue of tax evasion. It is illustrative of a disconnect between a traditional regulation applied to business models it was not designed for. Those Tech giants have established their domination though services that are often free for users: Googles search engine is free, so is Apple iTunes or the Facebook social networking software. They dont generate direct revenues. Instead, those companies derive value in other ways, thanks to the data they collect, which allows them to sell advertising like Google and Facebook, or to become exclusive sellers of content on a locked proprietary system like Apple. This complexity of supply underpinned by constantly evolving business models, which combine software, online services and new hardware, and which is always changing due to innovation, condemns the regulator to always be several steps behind. For example, it is only 12 years after the browser has killed its rival Netscape that the European Commission has obtained that Microsoft Internet Explorer is no longer installed by default on all computers running the operating system! The insight is that in the last decade, the Internet has shifted from the free innovative market people still imagine, towards a juxtaposition of private empires. A situation that represents a systemic risk at a time where the number and scale of services we use from the online world has created critical dependencies. The geo-strategic stakes of the cyber age are often compared to nuclear during the cold war. Nations and businesses that find themselves relegated at the periphery of those new empires now need to operates all the levers they have - competition regulation , taxation, @zeronomics industrial policy, investment strategies - to preserve their chances to benefit from the next digital wave that will come with the Internet of Things, Big Data and Artificial Intelligence.

You might also like

- Evolution of e CommerceDocument4 pagesEvolution of e Commercepratyush0501No ratings yet

- The Impact of E-Commerce On International TradeDocument11 pagesThe Impact of E-Commerce On International TradeGerelchuluun TamirNo ratings yet

- Different Types of Steering Systems + ExamplesDocument0 pagesDifferent Types of Steering Systems + ExamplesAbhilash NagavarapuNo ratings yet

- Cii Sohrabji Godrej Green Business Center - SUSTAINABLE ARCHITECTUREDocument23 pagesCii Sohrabji Godrej Green Business Center - SUSTAINABLE ARCHITECTUREBryson Solomon50% (2)

- 18 Jan 18 Competition in The Digital Age - How To Tame The Tech TitansDocument4 pages18 Jan 18 Competition in The Digital Age - How To Tame The Tech Titanslockleong93No ratings yet

- The Platform Paradox: How Digital Businesses Succeed in an Ever-Changing Global MarketplaceFrom EverandThe Platform Paradox: How Digital Businesses Succeed in an Ever-Changing Global MarketplaceRating: 4 out of 5 stars4/5 (1)

- The World's Most Valuable Resource Is No Longer Oil - But DataDocument3 pagesThe World's Most Valuable Resource Is No Longer Oil - But DataLvs KiranNo ratings yet

- Software Is Eating The WorldDocument6 pagesSoftware Is Eating The WorldWilfredo Baños CruzNo ratings yet

- Impact of Internet On RetailingDocument17 pagesImpact of Internet On RetailingGautam MahantiNo ratings yet

- The Effect of E-Commerce On Employment in Retail Sector: January 2018Document10 pagesThe Effect of E-Commerce On Employment in Retail Sector: January 2018LêTrọngQuangNo ratings yet

- Marc Andreessen On Why Software Is Eating The World PDFDocument7 pagesMarc Andreessen On Why Software Is Eating The World PDFbrain64bitNo ratings yet

- Marc Andreessen On Why Software Is Eating The World - WSJDocument10 pagesMarc Andreessen On Why Software Is Eating The World - WSJCliff CoutinhoNo ratings yet

- Collusion and Collisions TechnDocument4 pagesCollusion and Collisions TechnhannahNo ratings yet

- Hyperconnected Economy - Informilo Swift Sibos Magazine October 2012Document11 pagesHyperconnected Economy - Informilo Swift Sibos Magazine October 2012anthemisgroupNo ratings yet

- Andreeson - Software Eating The World 2011-08-20Document7 pagesAndreeson - Software Eating The World 2011-08-20Chris TsaiNo ratings yet

- Online BehaviourDocument13 pagesOnline BehaviourBinda KularNo ratings yet

- DIANE COYLE - Tech Titans at BayDocument3 pagesDIANE COYLE - Tech Titans at BayLauti ProsperiNo ratings yet

- Antitrust Congress SummaryDocument4 pagesAntitrust Congress SummaryJoshua WithrowNo ratings yet

- The End of The Capitalist Era, and What Comes Next: Jeremy RifkinDocument3 pagesThe End of The Capitalist Era, and What Comes Next: Jeremy RifkinLeia LopesNo ratings yet

- Open Banking: What You Need To Know: Fintech FuturesDocument8 pagesOpen Banking: What You Need To Know: Fintech Futuresdarma bonarNo ratings yet

- SSRN Id3744192Document86 pagesSSRN Id3744192SULAGNA DUTTANo ratings yet

- Digital Transformation IBMDocument20 pagesDigital Transformation IBMNina RungNo ratings yet

- Analysis of Mercadolibre and Its International PresenceDocument12 pagesAnalysis of Mercadolibre and Its International PresenceLauraLindarteCastroNo ratings yet

- Stewart 2000Document10 pagesStewart 2000lpa20020220No ratings yet

- Competition Law in Digital Markets in THDocument19 pagesCompetition Law in Digital Markets in THexams_sbsNo ratings yet

- Implications of Globalization For Today'S Manager: Advantages of Globalization in A Highly Connected Digital WorldDocument6 pagesImplications of Globalization For Today'S Manager: Advantages of Globalization in A Highly Connected Digital WorldSriman VorugantiNo ratings yet

- 0911 Tmfuk-HowtoprofitfromtheiphonerevolutionDocument6 pages0911 Tmfuk-HowtoprofitfromtheiphonerevolutionjarodzeeNo ratings yet

- Geopolitics CommentsDocument7 pagesGeopolitics CommentsAndrea IvanneNo ratings yet

- What Went Wrong With SnapDocument2 pagesWhat Went Wrong With SnapPARANGAT KAPURNo ratings yet

- DigitizationofExploitation - Initial Study On Platform Workers in The Gig EconomyDocument21 pagesDigitizationofExploitation - Initial Study On Platform Workers in The Gig EconomyJenny NoodleNo ratings yet

- Wto and E Commerce: by Obtaining Within The WTODocument4 pagesWto and E Commerce: by Obtaining Within The WTOone extraNo ratings yet

- Introduction To E-Commerce: 1 A Perfect MarketDocument20 pagesIntroduction To E-Commerce: 1 A Perfect MarketTudorNo ratings yet

- Aviv, Basu 2020 Big DataDocument66 pagesAviv, Basu 2020 Big DataVanlalsawmiNo ratings yet

- Colles AppleDocument1 pageColles AppleNATSU01 FFNo ratings yet

- Instant Download Ebook PDF e Commerce Essentials 1st Edition by Kenneth C Laudon PDF ScribdDocument41 pagesInstant Download Ebook PDF e Commerce Essentials 1st Edition by Kenneth C Laudon PDF Scribdedith.abe485100% (43)

- PestDocument2 pagesPestXi ZhengNo ratings yet

- The Frightful Monopoly of Google, Amazon, Apple, Facebook and MicrosoftDocument4 pagesThe Frightful Monopoly of Google, Amazon, Apple, Facebook and MicrosoftThanh Lịch NguyễnNo ratings yet

- E-Commerce: A Global PerspectiveDocument18 pagesE-Commerce: A Global PerspectiveAkash BhowmikNo ratings yet

- The European DSM StrategyDocument4 pagesThe European DSM StrategyAPCO WorldwideNo ratings yet

- Constantini Des Social MediaDocument28 pagesConstantini Des Social MediaAnca PatrauNo ratings yet

- E-Business: A Strategic Glimpse: What'S in A Name?Document8 pagesE-Business: A Strategic Glimpse: What'S in A Name?awinash012No ratings yet

- Why Every Aspect of Your Business Is About To Change - FortuneDocument11 pagesWhy Every Aspect of Your Business Is About To Change - FortunePrithvi RajNo ratings yet

- Modified Amazon Strategic ManagementDocument30 pagesModified Amazon Strategic ManagementusmjiamancunyinNo ratings yet

- Transcript 7 Digital Business ModelDocument4 pagesTranscript 7 Digital Business ModelRidhima GoyalNo ratings yet

- Online Advertising Techniques For Counterfeit Goods and Illicit SalesDocument16 pagesOnline Advertising Techniques For Counterfeit Goods and Illicit SalesAndrewNo ratings yet

- Effects of Digital Economy Around The WorldDocument12 pagesEffects of Digital Economy Around The WorldK59 DINH THAO VINo ratings yet

- Tax Law, SubhamDocument9 pagesTax Law, SubhamSugam AgrawalNo ratings yet

- Politica MonetariaDocument11 pagesPolitica MonetariaLetty Fiorella Reto EncaladaNo ratings yet

- App ValuationDocument2 pagesApp ValuationmarkanapierNo ratings yet

- Why Tech Will Bloom AgainDocument5 pagesWhy Tech Will Bloom AgainerejotaNo ratings yet

- Electronic Markets: Impact and ImplicationsDocument21 pagesElectronic Markets: Impact and ImplicationsArnab MukherjeeNo ratings yet

- SSRN Id3900137Document36 pagesSSRN Id3900137historiadeorienteNo ratings yet

- What If Gafa Replaced Traditional Banks?: Translation: Wency-Wenceslas MOUNDOUNGADocument10 pagesWhat If Gafa Replaced Traditional Banks?: Translation: Wency-Wenceslas MOUNDOUNGAMike BurdickNo ratings yet

- An Antitrust For Big TechDocument9 pagesAn Antitrust For Big Techapi-460187464No ratings yet

- Consumer Protection in Electronic Commerce: Nicoleta Andreea NEACŞUDocument8 pagesConsumer Protection in Electronic Commerce: Nicoleta Andreea NEACŞUnoorNo ratings yet

- Unleashing the Killer App (Review and Analysis of Downes and Mui's Book)From EverandUnleashing the Killer App (Review and Analysis of Downes and Mui's Book)No ratings yet

- IT and Digital MarketingDocument11 pagesIT and Digital MarketingMoritz SchmidtNo ratings yet

- Challenges of Digitisation and Way ForwardDocument3 pagesChallenges of Digitisation and Way ForwardNitish KumarNo ratings yet

- MIT Technology Review Business Report The Internet of ThingsDocument11 pagesMIT Technology Review Business Report The Internet of Thingsraviei426No ratings yet

- Digital Risk Governance: Security Strategies for the Public and Private SectorsFrom EverandDigital Risk Governance: Security Strategies for the Public and Private SectorsNo ratings yet

- The Economic Impact of E-CommerceDocument8 pagesThe Economic Impact of E-CommerceSumit SahaNo ratings yet

- Norma para Tuercas Hexagonales y Cuadradas (Inch Series) ASME-ANSI B18.2.2-1987Document42 pagesNorma para Tuercas Hexagonales y Cuadradas (Inch Series) ASME-ANSI B18.2.2-1987Jorge Roman SantosNo ratings yet

- Research DesignDocument6 pagesResearch DesignOsama Fayyaz100% (3)

- Brochure A35g A40g t4f en 22 20050840 DDocument20 pagesBrochure A35g A40g t4f en 22 20050840 DRengga PratamaNo ratings yet

- E85005-0126 - FireShield Plus Conventional Fire Alarm Systems PDFDocument8 pagesE85005-0126 - FireShield Plus Conventional Fire Alarm Systems PDFLuis TovarNo ratings yet

- K60-HSS Install GuideDocument2 pagesK60-HSS Install GuidedakidofdaboomNo ratings yet

- W L 1176Document1 pageW L 1176shama093No ratings yet

- Rotation Gearbox Component Fig 1Document2 pagesRotation Gearbox Component Fig 1Mohamed RashedNo ratings yet

- Heat Loss and Gain CalculationDocument84 pagesHeat Loss and Gain Calculationafraz_xecNo ratings yet

- Mmro C 053 MD 0357 Interior PL DrawingsDocument82 pagesMmro C 053 MD 0357 Interior PL DrawingsAnonymous 4Ts8UBFwzNo ratings yet

- A Neural Network Model For Electric PDFDocument6 pagesA Neural Network Model For Electric PDFR Adhitya ArNo ratings yet

- Last - kmsg-2016-11-17 10 29 34Document588 pagesLast - kmsg-2016-11-17 10 29 34Anonymous HpW3UcqNo ratings yet

- ITS Quick Ref GuideDocument6 pagesITS Quick Ref GuidedhanahbalNo ratings yet

- Infile StatementDocument21 pagesInfile StatementNagarjuna Parvatala100% (1)

- Ric RG90 y RG60Document1 pageRic RG90 y RG60GabrielConsentidoNo ratings yet

- Alexandria University Faculty of Engineering: Electromechanical Engineering Sheet 1 (Synchronous Machine)Document5 pagesAlexandria University Faculty of Engineering: Electromechanical Engineering Sheet 1 (Synchronous Machine)Mahmoud EltawabNo ratings yet

- Rishabh SharmaDocument72 pagesRishabh SharmaAmitt MalhotraNo ratings yet

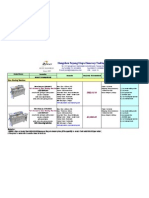

- Quotation For Blue Star Printek From Boway2010 (1) .09.04Document1 pageQuotation For Blue Star Printek From Boway2010 (1) .09.04Arvin Kumar GargNo ratings yet

- The Miser'S T/R Loop Antenna: MiserlyDocument3 pagesThe Miser'S T/R Loop Antenna: MiserlyTariq ZuhlufNo ratings yet

- Analyzing and Securing Social Media: Cloud-Based Assured Information SharingDocument36 pagesAnalyzing and Securing Social Media: Cloud-Based Assured Information SharingakrmbaNo ratings yet

- Abbbaileyinfi 90Document17 pagesAbbbaileyinfi 90Vipper80No ratings yet

- Gudenaaparken (Randers) - All You Need To Know BEFORE You GoDocument8 pagesGudenaaparken (Randers) - All You Need To Know BEFORE You GoElaine Zarb GiorgioNo ratings yet

- 3D - Quick Start - OptitexHelpEnDocument26 pages3D - Quick Start - OptitexHelpEnpanzon_villaNo ratings yet

- XJ3 PDFDocument2 pagesXJ3 PDFEvert Chavez TapiaNo ratings yet

- Module 1 Microtunneling NoteDocument2 pagesModule 1 Microtunneling Notematrixworld20No ratings yet

- 晴天木塑目录册Document18 pages晴天木塑目录册contaeduNo ratings yet

- Is 803Document98 pagesIs 803Gaurav BedseNo ratings yet

- V1 001 PDFDocument20 pagesV1 001 PDFG100% (2)

- JKM410 430N 54HL4 (V) F3 enDocument2 pagesJKM410 430N 54HL4 (V) F3 enAmer CajdricNo ratings yet