Professional Documents

Culture Documents

Compatibility of Camels As Measurements Instruments of Sharia Bank Performance On Justice in Islamic Perspectives

Uploaded by

Tri Arini TitisingtyasOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Compatibility of Camels As Measurements Instruments of Sharia Bank Performance On Justice in Islamic Perspectives

Uploaded by

Tri Arini TitisingtyasCopyright:

Available Formats

COMPATIBILITY OF CAMELS AS MEASUREMENTS INSTRUMENTS OF SHARIA BANK PERFORMANCE ON JUSTICE IN ISLAMIC PERSPECTIVES By Siti Asiam International Undergraduate Program

in Accounting - University of Brawijaya Jl. Mayjend Haryono 169 Malang; Telp. 0341-551396; Faks. 0341-553834 siti_asiam90@yahoo.com

Abstract This research has the purpose to analyze the compatibility of CAMELS as measurement instruments of sharia banks performance on justice that is based on Islamic perspectives based on the theory of paired epistemology and through analysis of the materialistic aspect with the spiritualistic aspect by using a qualitative method and document studies. The result of this research concluded that the assessment components of CAMELS that is stated in Peraturan Bank Indonesia Nomor: 9/1/PBI/2007 and Surat Edaran Bank Indonesia No.9/24/DPbS do not fulfill the justice based on justice in paired epistemology theory. This is because there is not yet a formulated standard that is suitable for sharia banks. Key Words: CAMELS, Justice, Material, Spiritual, Paired Epistemology

1. INTRODUCTION In current day, sharia financial institutions are have been significantly growing. Sharia Banking as part of the national banking system has an important function in the economy. The function of Sharia Banking is not much different from Conventional Banking. The fundamental differences of that Banks are in the principles of financial transactions or operations, Sharia Banking used profit and loss sharing and Conventional Banking applying interest. The reports of financial and non-financial condition of Sharia Banks are needed by all stakeholders such as owners, bank management, community that use

Bank services, Bank Indonesia that has an authority as banks supervision, and other parties. That reports can be used by the users to evaluate the performance of banks such as in implementing the prudential principle, compliance to Sharia principles, compliance to regulations and management risk (PBI 2007). Based on Peraturan Bank Indonesia Nomor: 9/1/PBI/2007, we can see that the CAMELS which is used to measure performance of Sharia Banks is also used by Conventional Banks. This is not suitable because the basic principles and operational systems of Sharia Banks are different from Conventional Banks. Because the basic principles and operational systems are different, Sharia Bank needs assessment tolls that are suitable with that. Sharia Banks are financial institutions that based on Islamic values and ensure that all activities in accordance with sharia. Islamic values are highly concerned about justice. In Al-Quran Allah SWT stated that justice is on a level with righteousness and taqwa. Islam value order to the human to maintain the justice and prohibit discrimination to another people (Qs. Al Maidah (5):8). Islamic values rejected the capitalism philosophy because the capitalism values are not suitable with Islamic perspectives in many aspects. One of most important example of this is the separation between live activity and religion in a capitalism perspective. This separation is not allowed in Islam because Islam is Syumul or a comprehensive religion that regulates all of human life activities. Islam value cannot be separated also from an accounting practice. Based on that, Sharia Banks needs the measurement instruments that are suitable with the basic principles and operational systems. The measurement instruments must be based on Islamic perspective in term of responsibility to Allah SWT.

2. JUSTICE IN ISLAMIC PERSPECTIVE Justice is important because justice is expected to be realized by most people. Justice is closely related to the welfare of the society as a whole. Justice has meaning and an important role in the activities of life. Discussion of justice has a

wide scope, ranging from economic, political, ethical, philosophical, legal, and social justice. However, this research only focuses on the theory justice in the economic perspective. Economic justice is including in social justice. The word "adil" in the Indonesian come from Arabic "al 'adl" which means something good, a dispassionate attitude, the guarding of a person's rights and the right way to make decisions. To illustrate fairness other words or synonyms are also used such as qisth, hukm, and so on. (safaat:2002). Based on Justice paired epistemology theory that is formulated by Triyuwono (2003); this theory mentions that justice is the balancing of the egoistic with the altruistic, the materialistic with the spiritualistic, internality with externality, quantitative with qualitative, and so on (Triyuwono:2003).

3. JUSTICE BASED ON PAIRED EPISTEMOLOGY THEORY One aspect that is considered in sharia accounting is the value of justice mentioned in the Al-Quran (2:282), which is epistemologically expressed in the paired formula as mentioned in the Al-Quran (36:36). This form of justice can be seen in the balancing of the egoistic with the altruistic, the materialistic with the spiritualistic, internality with externality, quantitative with qualitative, and so on (Triyuwono:2003). Paired Epistemology is the approach that is used to establish sharia accounting. This approach has always adhered to the principle of justice. In this context, sharia accounting balances the material and the spiritual. Thus the purpose of sharia accounting is to represent the material world and the spiritual world. This approach synergizes the rational mental instrument that is rational intellect and intuitive conscience (Triyuwono:2006). In the concept of paired epistemology justice, the materialistic aspect must be balanced with the spiritualistic aspect. The materialistic aspect is a human nature that only pays attention to the material world. When associated with accounting, accounting that has been penetrated by materialistic values only pays attention to the material and as a result is reduced to money. So the modern accounting that is materialistic only captures and reports transactions that involve money

(Triyuwono:2006). In the concept of paired epistemology justice, the materialistic aspect must be balanced with the spiritualistic aspect.

4. CEMELS CAMELS is assessment system of Sharia Banks Soundness level that regulated by Peraturan Bank Indonesia Nomor: 9/1/PBI/2007 and Surat Edaran Bank Indonesia No.9/24/DPbS. Based on Peraturan Bank Indonesia Nomor: 9/1/PBI/2007 and Surat Edaran Bank Indonesia No.9/24/DPbS, Sharia Banks Soundness level valuations include the some factors. The factors are Capital, Asset Quality, Management, Earnings, Liquidity, and Sensitivity to Market Risk. The ratios that are used to calculate the factor ratings of capital, asset quality, earnings, liquidity and sensitivity to market risks can be divided into main ratios, supporting ratios and the observed ratio. The main ratio is a ratio that has a high impact to the Bank Soundness, while the supporting ratio is the ratio that directly affects the main ratio and the observed ratio is an additional ratio that is used in analysis and judgment. Assessment of management factor is done by using qualitative assessment on every aspect of general management, risk management and compliance management.

5. RESEARCH METHOD This research used a qualitative method by using document studies. Qualitative research is research that aims to understand the phenomenon of what subjects such as behavior, perception, motivation, action, etc experience, holistically, and description by using words and language, in particular natural context that natural and by using natural methods (Moleong, 2010:6). The type of research that is used in this study is a qualitative research based on document studies. Based on Raharjo (2010) document studies is a study that focuses on the analysis or interpretation of written material in context. This research uses secondary data. The researcher uses the Peraturan Bank Indonesia Nomor: 9/1/PBI/2007 and Surat Edaran Bank Indonesia No.9/24/DPbS about performance assessment system of a general bank based on Sharia

Principles to know whether the assessment component of this standard has been compatible with the justice in paired epistemology. The data collecting technique that was used in this research was conducted by literature exploration study, which the researcher enrich the library reading, either in the form of articles, journals, papers, references, newspapers, and books related to the research literature. In this research, the activities in the data analysis are conducted by describing and assessing of each component assessment of CAMELS stated in Surat Edaran Bank Indonesia No.9/24/DPbS to identify whether each assessment component in CAMELS consists of material and spiritual aspects.

6. COMPATIBILITY OF CAMELS TOWARD JUSTICE IN ISLAMIC PERSPECTIVES This research describe and assess each component of CAMELS to know whether each assessment component in CAMELS consists of the material and spiritual aspects. Thus it will be known whether the CAMELS assessment components are just or not based on justice in paired epistemology theory. 6.1 Capital Based on sharia, all of things essentially belong to Allah and human is only gets the right to use and manage it. Islam regulates how the humans could get and used the resources as capital. Islamic values give a freedom to conduct economic by utilize the capital that has been provide as long as it does not violating Islamic roles. From the explanation above, so the assessment components of capital can be categorized as material and spiritual aspects. The categories are as follows:

Table 1 Compatibilities of Capital assessment components on material and spiritual aspects Point a Assessment Components Adequacy compliance of Minimum Capital supplying; Ability of main capital and Allowance for Productive Assets write-off in securing the risk of a book (write-off); Ability of main capital to cover losses when liquidation; Trend or growth of Minimum Capital supplying; Internal ability of banks to increase the capital; The intensity of Sharia Banks agency functions; Main capital compared with mudharabah funds; Dividend Pay Out Ratio; Access to sources of capital (external support); Shareholder's financial performance to improve bank capital; Aspects considered Material Spiritual -

c d e f g h i j

From table 1 above it can be concluded that the assessment components of Capital only includes the material assessment component. Therefore, generally the Capital assessments are unbalanced between material and spiritual aspect. So the assessment of Capital is unjust.

6.2

Asset Quality In Islamic perspective, the assets that have been provided by Allah must be

utilized in the right way. Humans are required to be tactful in using them and as optimally as possible because we have to think about the sustainability of existing resources for the future of their children and grandchildren. This means not more or less, because Allah does not like things in excess as quoted from the Al Quran: " In truth, Allah dislikes those who are extravagant (Surah

6: 31). In the Islamic perspective, assets are valued by how they can give benefits to the company and society. From the explanation above, so the assessment components of asset quality can be categorized as material and spiritual aspects. The categories are as follows: Table 2 Compatibilities of Asset Quality assessment components on material and spiritual aspects Point a b Assessment Components Quality of Bank productive asset, is the main ratio; Concentration of funds distribution to the main debtor, is the supporting ratio; The quality of funds distribution to the main debtor, is the supporting ratio; The ability of banks in handling / return the assets that has been write-off, is the supporting ratio; The amount of non-performing financing, is the supporting ratio; The levels of collateral sufficiency, is the Observed ratio; Projection / growth of productive assets quality, is the Observed ratio; Growth / trends of in problem productive assets that restructured, is the Observed ratio; Aspects considered Material Spiritual -

d e f

From the table 2 above it can be concluded that the assessment components of assets quality only includes the material assessment component. Therefore, generally the asset quality assessments are unbalanced between the material and spiritual aspect. So the assessment of asset quality is unjust.

6.3

Management The essence of management that contains in the Al-Quran is

contemplating an affair or looking forward (issue), so the problem commendable and good result. To get to the essence, it is necessary to setup a prudent manner. In Islamic perspective, manager must consider the all parties interest. The manager should has good ability in managing and also to give role model to the subordinates. From the explanation above, so the assessment components of management can be categorized as material and spiritual aspects. The categories are as follows: Table 3 Compatibilities of Management assessment components on material and spiritual aspect Point Assessment Components The Quality of General Management related to the implementation of good corporate governance. The quality of risk management implementation. The compliance with the provisions that relate to the prudential principles, compliance with Islamic principles, and commitment to Bank Indonesia. Aspects considered Material Spiritual

From the table 3 above it can be concluded that the assessment components of management have been includes the material and spiritual assessment component. Therefore, generally the management assessments are balance between the material and spiritual aspect. So the assessment of management is just.

6.4

Earning Islamic value determines the basic principles in the transaction

mechanism, based on Islamic value the profits must be free from the elements of usury and fraud. Islam prohibits the wealth exploitation and takes advantage from other parties losses. Based on Islamic perspective the concept of profit is not only based on logic, but also based on moral values and ethics and must based on Allah SWT guided (Fachrudin and Beik:2012). Profit is intended in order to fulfillment and maintenance of the human primary needs that includes the religion (ad Dien), life (an Nafs), sense (al-'Aql), generation (an Nasl), and wealth (al-mal) Islamic rule in the form of prohibitions are aimed to reach maslahat. From the explanation above, so the assessment components of earning can be categorized as material and spiritual aspects. The categories are as follows: Table 4 Compatibilities of earning assessment components on material and spiritual aspects Point a b c d e f g h i j Assessment Components Net operating margin (NOM), is the main ratio; Return on assets (ROA), is the supporting ratio; Operational efficiency ratio (REO), is the supporting ratio; Assets that can generate revenue Ratio, is the supporting ratio; Revenue diversification , is the supporting ratio; Main Net Operating Income Projections (PPBO), is the supporting ratio; Net structural operating margin, is the Observed ratio; Return on equity (ROE), is the Observed ratio; funds placement Composition in securities / financial market, is the Observed ratio; Disparities between highest fee

9

orders and

Aspects considered Material Spiritual

k l

n o

with the lowest fee, is the Observed ratio; Implementation of the educational function, is the Observed ratio; Implementation of social function, is the Observed ratio; The correlation between the interest rate on the market with a return / profit sharing that provided by Sharia Banks, is the Observed ratio; Profit sharing investment fund ratio, is the Observed ratio; Distribution of write-off funds compared to the operational cost, is the Observed ratio;

From the table 4 above it can be concluded that the assessment components of earning have been including the material and spiritual assessment components. Therefore, generally the earning assessments are balance between the material and spiritual aspect. So the assessment of earning is just.

6.5

Liquidity In Islamic economics do not exist the term of interest. Because debt

interest is the same as usury or riba that is unlawful or haram. Based on AlHadits, surely the best people is the people who most good in restoring debt (Bukhari and Muslim). The People who owe should he try to pay off the debt as soon as possible when he has the ability to recover the debt. For those who delaying repayment of debts when he was able, he considered those who do injustice. Based on Hadits "Delaying the payments is zhalim (Bukhari). From the explanation above, so the assessment components of liquidity can be categorized as material and spiritual aspects. The categories are as follows:

10

Table 5 Compatibilities of liquidity assessment components on material and spiritual aspects

Point a

Assessment Components The amount of current assets compared to current liabilities, is the main ratio; Current Assets Ability, Cash and Secondary Reserve in current liabilies, is the supporting ratio; Dependency to main depositors' funds, is the supporting ratio; The growth of main depositors' funds to total third parties funds, is the supporting ratio; The ability of banks to obtain funds from other parties in mismatch case, is the Observed ratio; Dependency on interbank funding, is the Observed ratio;

Aspects considered Material Spiritual -

c d

From the table 5 above it can be concluded that the assessment component of liquidity only includes the material assessment components. Therefore, generally the liquidity assessments are unbalanced between material and spiritual aspect. So the assessment of liquidity is unjust.

6.6

Sensitivity to Market Risk In Islamic economic perspective, the risk is seen as a positive thing.

Business risks are related to concept of justice, every profit that is generated should be involved in the business risk. The profits that are not related to the business risk are considered does not reflect justice. Although Islamic Economics view risks as positive thing, but the Islamic economics does not yet have a comprehensive risk concept. Risk concepts in Islam are about the gharar (uncertainty) and maysir (gambling). Islam forbids

11

both types of this uncertainty because this indicates the concept of Asymetric information phenomenon. Gharar is the condition that one person who knows about the information and the risk harm to other people who do not know about the information and the risk. While maysir is a condition of the exchange, where all parties that are involved in the transaction or the business could not estimate the risk profile of the business. This infers that Islam forbids business transactions that involved unexpected risks. The assessment of sensitivity to Market Risk (MR) risks is has purposes to measure bank capital capability to cover risk caused by exchange rate fluctuation. From that can be concluded that the assessment components of sensitivity to market risk only includes the material assessment component. Therefore, generally the sensitivity to market risk assessments are unbalanced between material and spiritual aspect. So the assessment of sensitivity to market risk is unjust. From the discussion and analysis that has been presented above it can be seen that the assessment of capital, asset quality, liquidity, and sensitivity to market risk only consist of measurement instruments that consider the material aspect and does not consist of measurement instruments that consider spiritual aspects. This is because there is no specific regulation to measure the performance of a sharia bank, and there is actually no difference in the measurement of performance of sharia banks and conventional banks in assessing capital, asset quality, liquidity, and sensitivity to market risk. The standard for measuring sharia bank performance only recognizes things that appear and can be calculated. Measurement of a sharia bank should be different from a conventional bank because the sharia bank consider human values as well as divine values, whereas a conventional organization only focuses on achieving material aspects such as efficiency, cost orientation, and even profit orientation (Hines in Widati Triyuwono, and Sukoharsono: 2012). The sharia bank assessment component must balance material elements that can be seen and spiritual elements that cannot be seen. This is to have the purpose to spread

12

awareness of God consciousness value and creating a civilization that is Rahmatan lilalamin (Triyuwono, Sukoharsono, and Widati: 2012). On the other hand, management and earnings are just because the assessment of this has included the material and spiritual aspects. Because the assessment of earning has include the element of zakah, the assessment of management has considered about the principle of sharia. This is because the principle of zakah in earning is stated clearly in the Al-Quran. Also, the role of management is stated clearly also in the Al Quran. 7. CONCLUSION Based on the research that done on the CAMELS model that is stated in Peraturan Bank Indonesia Nomor: 9/1/PBI/2007 and Surat Edaran Bank Indonesia No.9/24/DPbS and analyses using justice based on paired epistemology theory, it can be concluded that the assessments components of capital, asset quality, liquidity and sensitivity to market risk only include the material aspects without including spiritual aspects. So, the assessment components of capital, asset quality, liquidity and sensitivity to market risk are unjust based on paired epistemology theory. however, the some assessment components of management and earning has included material and spiritual aspects. So, the assessment components of management and earning are just, based on paired epistemology theory. Generally it can be concluded that the assessment components of the CAMELS that are stated in Peraturan Bank Indonesia Nomor: 9/1/PBI/2007 and Surat Edaran Bank Indonesia No.9/24/DPbS do not fulfill the principle of in paired epistemology theory because the assessment components focus more on material aspects. This is because there is not yet a formulated standard that is suitable for sharia banks.

13

REFERENCES

.Peraturan Bank Indonesia Nomor:9/1/PBI/2007 tentang Sistem Penilaian Tingkat Kesehatan Bank Umum Berdasarkan Prinsip Syariah.(Online: http://www.bi.go.id/NR/rdonlyres/4C7F39F8-FE8F-45C79918-2F559F231298/11874/pbi_90107.pdf, accessed on March 10, 2012). .Surat Edaran Kepada Semua Bank Umum Yang Melaksanakan Kegiatan UsahaBerdasarkan Prinsip Syariah di Indonesia. (Online: http://www.bi.go.id/NR/rdonlyres/6ED5E7B8-1F8A-4467-983286B727E0A036/12159/se_092407.pdf, accessed on March 10, 2012). Fachrudin, Fachri and Irfan Syauqi Beik. 2012. Filosofi Laba Dalam Perspektif Syariah. (Online: http://irfansb.blogdetik.com/2012/05/09/filosofilaba-dalam-perspektif-syariah/, accessed on July 16, 2012). Indriantoro, dan Supomo, 2002.Metodologi Penelitian Bisnis untuk Akuntansi dan Manajemen. Yogyakarta: BPFE-Yogyakarta. Mawardi. 2007. Konsep Al-Adalah Dalam Perspektif Ekonomi Islam. Hukum Islam. Vol. VII No. 5. Juli 2007. Mawardi. 2007. Konsep Al-Adalah dalam Perspektif Ekonomi Islam. Hukum Islam. Vol. VII No. 5. Juli 2007; 546-566). Moleong, Lexy J. (2004). Metodologi Penelitian Kualitatif. Bandung: PT Remaja Rossdakarya. Moleong, Lexy J. 2010. Metode Penelitian Kualitatif. Bandung: PT Remaja Rossdakarya. Muhamad. 2002. Manajemen Bank Syariah. Yogyakarta: Unit Penerbit dan Percetakan (UPP) AMP YKPN. Triyuwono, Iwan. 2003. Konsekuensi Penggunakan Entity Theory Sebagai Konsep Dasar Standar Akuntansi Perbankan Syariah. JAAI VOLUME 7 NO. 1; 37-51). Triyuwono, Iwan. 2006. Akuntansi Syariah, Menuju Puncak Kesadaran Ketuhanan Manunggaling Kawulo-Gusti. Pidato Pengukuhan Guru Besar Akuntansi Syariah di Gedung PPI Universitas Brawijaya 2 Septerber 2006. Triyuwono, Iwan. 2007. Mengangkat Sing Liyan untuk Formulasi Nilai Tambah Syariah. Simposium Nasional Akuntansi X. Makassar (Online: https://info.perbanasinstitute.ac.id/pdf/AS/AS01.pdf, accessed on July 17, 2012).

14

Widati, Suryan, and Iwan Triyuwono and Eko Ganis Sukoharsono. 2012. Kajian Kritis Feminist Posmodernis dalam Formulasi Aset Mental Organisasi Feminis Religius. Jurnal Reviu Akuntansi dan Keuangan ISSN: 2088-0685 Vol.2 No. 1, April 2012 (Online: http://ejournal.umm.ac.id/index.php/jrak/article/viewFile/700/721_umm_scient ific_journal.pdf, accessed on January 16, 2012).

15

You might also like

- Article Review ofDocument2 pagesArticle Review ofPutri anjjarwati100% (1)

- Original Article Organizational Justice and Employee's Service Behavior in The Healthcare Organizations in Bangladesh: An Agenda For ResearchDocument15 pagesOriginal Article Organizational Justice and Employee's Service Behavior in The Healthcare Organizations in Bangladesh: An Agenda For Researchsimranarora2007No ratings yet

- 1 PBDocument23 pages1 PBHakim FadliNo ratings yet

- The Relationship of Spiritual Well-Being and Accountant'S Ethical SensitivityDocument11 pagesThe Relationship of Spiritual Well-Being and Accountant'S Ethical SensitivityAfifah Nurul HidayahNo ratings yet

- 626 1200 1 SMDocument38 pages626 1200 1 SMLia AfizaNo ratings yet

- Good Governance & IntegrityDocument12 pagesGood Governance & IntegrityAbang KapalNo ratings yet

- Conventional Accounting Versus Sharia Accounting: Reconciliation of Perception To Achieve Spiritual MeaningDocument6 pagesConventional Accounting Versus Sharia Accounting: Reconciliation of Perception To Achieve Spiritual Meaninggrizzly hereNo ratings yet

- The Cognitive Basis of Institutions: A Synthesis of Behavioral and Institutional EconomicsFrom EverandThe Cognitive Basis of Institutions: A Synthesis of Behavioral and Institutional EconomicsNo ratings yet

- Special Issue 1 February 2016: Organizational CommitmentDocument18 pagesSpecial Issue 1 February 2016: Organizational CommitmentChristian Dell GentallanNo ratings yet

- 28888-Article Text-87193-1-10-20220630Document14 pages28888-Article Text-87193-1-10-20220630Rezky EndriyaniNo ratings yet

- 1029 2016 1 SMDocument11 pages1029 2016 1 SMAtut Tri LegowatiNo ratings yet

- Fitriani Saragih Artikel ScopusDocument13 pagesFitriani Saragih Artikel Scopusirma.chairani0905No ratings yet

- The Effect of Emotional Professional Ethics and Intelligence On Auditor Decision Making (Case Study at Public Accounting Firm in South Jakarta)Document7 pagesThe Effect of Emotional Professional Ethics and Intelligence On Auditor Decision Making (Case Study at Public Accounting Firm in South Jakarta)Wuri HandayaniNo ratings yet

- 1 PB PDFDocument7 pages1 PB PDFWuri HandayaniNo ratings yet

- 29 Iajps29112017 PDFDocument7 pages29 Iajps29112017 PDFBaru Chandrasekhar RaoNo ratings yet

- Perilaku KonsumenDocument89 pagesPerilaku KonsumenArif SualdiNo ratings yet

- Artikel Lindawati-138 EditanDocument21 pagesArtikel Lindawati-138 EditanSugeng HidayatNo ratings yet

- Islamic Work Ethics and Organizational Justice Implementation in Reaching Accountants' Job SatisfactionDocument11 pagesIslamic Work Ethics and Organizational Justice Implementation in Reaching Accountants' Job SatisfactionreskinoNo ratings yet

- Jurnal - MAQASID SHARIA AS A PERFORMANCE FRAMEWORK FOR ISLAMIC FINANCIALDocument17 pagesJurnal - MAQASID SHARIA AS A PERFORMANCE FRAMEWORK FOR ISLAMIC FINANCIALHernia UlfatinNo ratings yet

- An Interactive Model of Clinical-Ethical Decision MakingDocument14 pagesAn Interactive Model of Clinical-Ethical Decision MakingMuhammad Na'im100% (7)

- Research PaperDocument8 pagesResearch PaperSumit AcharyaNo ratings yet

- Tafriq Al Halal 'An Al Haram TheoryDocument17 pagesTafriq Al Halal 'An Al Haram TheoryhasnasafarinaNo ratings yet

- I J C R B: Nterdisciplinary Ournal F Ontemporary Esearch N Usiness Anuary 2013 V 4, N 9Document16 pagesI J C R B: Nterdisciplinary Ournal F Ontemporary Esearch N Usiness Anuary 2013 V 4, N 9Amit ModaniNo ratings yet

- Article On Ss and Perform eDocument10 pagesArticle On Ss and Perform eAnnisa SophiaNo ratings yet

- Pandangan Pemilik Badan Usaha Islam Terhadap Akuntabilitas Dan MoralitasDocument10 pagesPandangan Pemilik Badan Usaha Islam Terhadap Akuntabilitas Dan MoralitasIndah SaputriNo ratings yet

- 64-Article Text-243-1-4-20210411Document7 pages64-Article Text-243-1-4-20210411Restoi HapsariNo ratings yet

- Does Ethical Context Affect The Ethically Related Judgement by The Observers of Earnings Management?Document10 pagesDoes Ethical Context Affect The Ethically Related Judgement by The Observers of Earnings Management?Devy RahmawatiNo ratings yet

- ArticleReview SRC WannaDocument6 pagesArticleReview SRC Wannawendesen belayNo ratings yet

- Post Implementation of Shariah Governance Framework PDFDocument5 pagesPost Implementation of Shariah Governance Framework PDFmasumiiumNo ratings yet

- The Relationship Between Human Resource Management and Islamic Microfinance Providers' Performance: The Mediatıng Role of Human CapitalDocument6 pagesThe Relationship Between Human Resource Management and Islamic Microfinance Providers' Performance: The Mediatıng Role of Human CapitalamjadNo ratings yet

- The Role of Islamic Ethics in Accounting Environment: Dr. Farooq Salman Alani, Dr. Haris Kareem AlaniDocument5 pagesThe Role of Islamic Ethics in Accounting Environment: Dr. Farooq Salman Alani, Dr. Haris Kareem Alanipenilai kpknlyogyaNo ratings yet

- Ajibm 2015052515161486 PDFDocument9 pagesAjibm 2015052515161486 PDFEnescu RalucaNo ratings yet

- Spiritual Assessment in Social Work and Mental Health PracticeFrom EverandSpiritual Assessment in Social Work and Mental Health PracticeNo ratings yet

- ArticleReview SRC Wanna PDFDocument6 pagesArticleReview SRC Wanna PDFHaile HailuNo ratings yet

- 29 54 1 SMDocument17 pages29 54 1 SMSherly AuliaNo ratings yet

- Awakening The Conscience Inside: The Spirituality of Code of Ethics For Professional AccountantsDocument8 pagesAwakening The Conscience Inside: The Spirituality of Code of Ethics For Professional Accountantsshoaib samNo ratings yet

- The Ethical Dimension of Human Resource Management: Dr. Radhika KapurDocument15 pagesThe Ethical Dimension of Human Resource Management: Dr. Radhika KapurFatimahNo ratings yet

- Organizational Spirituality and Its Impact On Consumption Model of Employees in Governmental Organizations in Iran (Case Study)Document8 pagesOrganizational Spirituality and Its Impact On Consumption Model of Employees in Governmental Organizations in Iran (Case Study)Julaiha JamaldinNo ratings yet

- Direction For Article Review in AccountingDocument3 pagesDirection For Article Review in Accountingkooruu22No ratings yet

- Evaluating Investments in Health Care Systems: Health Technology AssessmentFrom EverandEvaluating Investments in Health Care Systems: Health Technology AssessmentNo ratings yet

- New Approach To Teaching of Ethics in Accounting "Introducing Islamic Ethics Into Accounting Education"Document5 pagesNew Approach To Teaching of Ethics in Accounting "Introducing Islamic Ethics Into Accounting Education"Faten FatihahNo ratings yet

- An Analysis of The Spiritual Intelligence Self Report Inventory (Sisri)Document12 pagesAn Analysis of The Spiritual Intelligence Self Report Inventory (Sisri)Keerthika KNo ratings yet

- Fraud Prevention: Relevance To Religiosity and Spirituality in The WorkplaceDocument9 pagesFraud Prevention: Relevance To Religiosity and Spirituality in The WorkplaceJannah ZahraNo ratings yet

- Organizational Skills For A Corporate Citizen Policy AnalysisDocument3 pagesOrganizational Skills For A Corporate Citizen Policy AnalysislorainnellamadoNo ratings yet

- Article Review of Financial Management ADocument5 pagesArticle Review of Financial Management AAliyi HassenNo ratings yet

- A Review of PsychologicalDocument35 pagesA Review of PsychologicalPrincess Diane Ferrer NuvalNo ratings yet

- AccountingDocument5 pagesAccountingsemonNo ratings yet

- Assignment 1 ERM - SP23-MSEF-0002 - Sabahat AhmedDocument7 pagesAssignment 1 ERM - SP23-MSEF-0002 - Sabahat AhmedSabahat AhmedNo ratings yet

- Behaviour Accounting ResearchDocument9 pagesBehaviour Accounting ResearchAnonymous yMOMM9bsNo ratings yet

- Critical Analysis On Accounting Information Based On Pancasila ValueDocument7 pagesCritical Analysis On Accounting Information Based On Pancasila ValueHariKusumaDharmawanNo ratings yet

- The Surveying The Impact of Organizational Justice On Quality of Work Life of Administrative Units in Azad University of MashhadDocument6 pagesThe Surveying The Impact of Organizational Justice On Quality of Work Life of Administrative Units in Azad University of MashhadTI Journals PublishingNo ratings yet

- The Role of Professional Accounting Bodies in Public Fund Accountability in NigeriaDocument7 pagesThe Role of Professional Accounting Bodies in Public Fund Accountability in Nigeriaelvisapiafi72No ratings yet

- The Nature of Accounting Theory and The Development of TheoryDocument6 pagesThe Nature of Accounting Theory and The Development of TheoryEngrAbeer Arif100% (1)

- International Journal of Economy, Management and Social SciencesDocument6 pagesInternational Journal of Economy, Management and Social SciencesTI Journals PublishingNo ratings yet

- The Influence of External Locus of Control, Machiavellian-Nature, Representative of The Audit Board of The Republic of IndonesiaDocument5 pagesThe Influence of External Locus of Control, Machiavellian-Nature, Representative of The Audit Board of The Republic of IndonesiaAJHSSR JournalNo ratings yet

- Background of The Study: Swarbrick, 2011)Document29 pagesBackground of The Study: Swarbrick, 2011)meryll daphneNo ratings yet

- The Relationship Between Organizational Justice and Job SatisfactionDocument14 pagesThe Relationship Between Organizational Justice and Job Satisfactionctg.shein.and.youNo ratings yet

- Industrial Economics: Monopoly in Islamic PerspectiveFrom EverandIndustrial Economics: Monopoly in Islamic PerspectiveNo ratings yet

- Assignment 1 HRMDocument4 pagesAssignment 1 HRMAb BasNo ratings yet

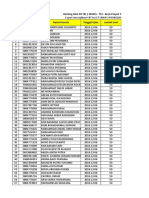

- Ranking Nilai XII TKJ - MAPEL: TKJ - Kerja Proyek Teknik Komputer Dan Jaringan No NIS Nama Peserta Tanggal Ujian Jumlah SoalDocument13 pagesRanking Nilai XII TKJ - MAPEL: TKJ - Kerja Proyek Teknik Komputer Dan Jaringan No NIS Nama Peserta Tanggal Ujian Jumlah SoalTri Arini TitisingtyasNo ratings yet

- Soal OracleDocument11 pagesSoal OracleTri Arini TitisingtyasNo ratings yet

- TestDocument21 pagesTestTri Arini TitisingtyasNo ratings yet

- Commented (RA1)Document1 pageCommented (RA1)Tri Arini TitisingtyasNo ratings yet

- Adelia Putri Rahmadani: NO Nama SiswaDocument1 pageAdelia Putri Rahmadani: NO Nama SiswaTri Arini TitisingtyasNo ratings yet

- Topics: Introduction To Robotics CS 491/691 (X) : Instructor: Monica NicolescuDocument32 pagesTopics: Introduction To Robotics CS 491/691 (X) : Instructor: Monica NicolescuTri Arini TitisingtyasNo ratings yet

- Study Manual of Tax-I (Certificate Level) 12-10-2019-1 PDFDocument402 pagesStudy Manual of Tax-I (Certificate Level) 12-10-2019-1 PDFToaha0% (1)

- Kpi Dashboard TemplateDocument15 pagesKpi Dashboard TemplateADINo ratings yet

- Surya NepalDocument13 pagesSurya NepalanishabatajuNo ratings yet

- Fs - Part 2 CH 02 - s23Document43 pagesFs - Part 2 CH 02 - s23Fady AhmedNo ratings yet

- Entrepreneurship The Art Science and Process For Success 2nd Edition Bamford Solutions Manual Full Chapter PDFDocument66 pagesEntrepreneurship The Art Science and Process For Success 2nd Edition Bamford Solutions Manual Full Chapter PDFmelrosecontrastbtjv1w100% (13)

- Sample Business Plan - Car HireDocument16 pagesSample Business Plan - Car HireBuali Yahya100% (5)

- JOSB SummaryDocument1 pageJOSB SummaryOld School ValueNo ratings yet

- Financial Reporting Conceptual Framework of Financial Accounting KeyDocument13 pagesFinancial Reporting Conceptual Framework of Financial Accounting KeySteffNo ratings yet

- How To Handle Letter of Authority To Examine Cooperatives: Rhodora Garcia-IcaranomDocument42 pagesHow To Handle Letter of Authority To Examine Cooperatives: Rhodora Garcia-IcaranomJeanette LampitocNo ratings yet

- Advanced Financial Accounting & Reporting JULY 21, 2019 Problem 1Document9 pagesAdvanced Financial Accounting & Reporting JULY 21, 2019 Problem 1FelixNo ratings yet

- CHAPTER 3 Corrent LiabilityDocument25 pagesCHAPTER 3 Corrent LiabilityTesfaye Megiso BegajoNo ratings yet

- Comman Size Analysis of Income StatementDocument11 pagesComman Size Analysis of Income Statement4 7No ratings yet

- Second Division: Republic of The Philippines Court of Tax Appeals Quezon CityDocument8 pagesSecond Division: Republic of The Philippines Court of Tax Appeals Quezon CityCamille CastilloNo ratings yet

- Dhaka City Corporation BudgetDocument9 pagesDhaka City Corporation BudgetAshraf AtiqueNo ratings yet

- Chapter 2Document90 pagesChapter 2Sky walkingNo ratings yet

- Upfl Annual Report 2015 - tcm1267 503874 - en PDFDocument84 pagesUpfl Annual Report 2015 - tcm1267 503874 - en PDFZaib HassanNo ratings yet

- Mus Bhai Munda ComputitationDocument3 pagesMus Bhai Munda Computitationsatish devdaNo ratings yet

- David Sm15 Case Im 28 PearsonDocument19 pagesDavid Sm15 Case Im 28 PearsonAyaz KhanNo ratings yet

- Retail MGMT Handouts PDFDocument22 pagesRetail MGMT Handouts PDFdudeNo ratings yet

- Mock Exam 2023 #2 - First Session (Ethical and Professional Standards, Quantitative Methods, Economics Financial Statement Analysis) - QuestionDocument30 pagesMock Exam 2023 #2 - First Session (Ethical and Professional Standards, Quantitative Methods, Economics Financial Statement Analysis) - QuestionCyrine JemaaNo ratings yet

- Uadc Financial Statements 2019. 123119.10PM - JonaDocument263 pagesUadc Financial Statements 2019. 123119.10PM - JonaYameteKudasaiNo ratings yet

- Accounting Standard 5-8Document36 pagesAccounting Standard 5-8Aseem1No ratings yet

- Cash Flows 500Document41 pagesCash Flows 500MUNAWAR ALI100% (2)

- AC405 Lecture 3Document9 pagesAC405 Lecture 3TINASHENo ratings yet

- Theory of Accounts - Multiple Choices: Cash Flows?Document20 pagesTheory of Accounts - Multiple Choices: Cash Flows?Babylyn Navarro0% (1)

- Progress Report of Nepal Electricity Authority 2013Document120 pagesProgress Report of Nepal Electricity Authority 2013Vijay TamrakarNo ratings yet

- Fashion Channel SpreadsheetDocument14 pagesFashion Channel SpreadsheetRohan SmithNo ratings yet

- INSABA BW Fresh Fruit Juice Business - 20070809Document9 pagesINSABA BW Fresh Fruit Juice Business - 20070809Ngọc TrânNo ratings yet

- Non Trading OrganizationDocument2 pagesNon Trading OrganizationPBGYB60% (5)

- DoceboDocument24 pagesDoceboArianeNo ratings yet