Professional Documents

Culture Documents

Product Cost Analysis

Uploaded by

MaryCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Product Cost Analysis

Uploaded by

MaryCopyright:

Available Formats

Product Cost Analysis

Introduction

Product costs are all the costs included to manufacture a product. These costs include direct materials, direct labor, and manufacturing overhead. Product costs are only those costs that can be directly related to the manufacturing process. The term used for costs that are not directly related to the manufacture of a product is Period Costs Period costs are those costs incurred to sell the finished product and the costs incurred to have management run the company. Period costs are referred to as non-value added cost because they do not increase the sales value of the end product. This document is designed to show the process from start to finish in assigning product costs to jobs.

Types of Product Costs:

Direct Materials (material used during manufacturing of a product) Direct Labor (Labor of individuals working on the product) Manufacturing Overhead (factory depreciation, factory supervisors salary, Indirect materials, Indirect labor, accounts payable)

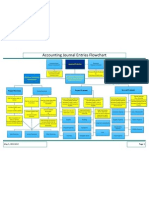

Types of Journal Entries

There are three types of journal entries dealing with the manufacture of a product. Actual Cost The actual price paid during the process. Applied Cost The estimated cost applied to the job cost sheets during the process of manufacturing. Product cost which are the cost of the finished product that is transferred to the finished goods inventory at the end of the process.

Here is the web-link to the presentation for this Product Cost Analysis:

http://prezi.com/0afjqlk4ilhy/product-cost-analysis/

MJC

Product Cost Analysis

Transaction Description

To record actual purchases of Raw Materials To record actual factory labor

Account Titles

Raw Materials Inventory Accounts Payable Factory Labor Factory Wages Payable Employee Payroll Tax Payable Manufacturing Overhead Accounts Payable (other on account) Accumulated Depreciation (depreciation) Prepaid Factory Rent Raw Materials (indirect materials) Factory Labor (indirect labor) Work in Process Inventory Raw Material Inventory Work in Process Inventory Factory Labor Work in Process Inventory Manufacturing Overhead Finished Goods Inventory Work in Process Inventory Accounts Receivable

Debit

XXX

Credit

XXX

XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX

Actual Costs Applied Costs Goods Transferred and Sold

To record actual factory manufacturing overhead (List credits from highest to lowest) Do not copy what is in the brackets it is listed only as supportive information. To record direct materials place into work in process. Add Manufacturing Overhead if you are given indirect materials. To record direct labor placed into work in process. Add Manufacturing Overhead if you are given indirect labor To record estimated factory manufacturing overhead To record transfer of good out of work in process to finished goods inventory

To record sale of goods to customer and to remove those goods from finished goods inventory

Sales Revenue Cost of Goods Sold Finished Goods Inventory

MJC

Product Cost Analysis

Example Problem

Introduction

Blackburn Manufacturing uses a job order cost system and applies overhead to production on the bases of direct labor cost. At the beginning of the fiscal year on February 1, 2014, Job 2897 was the only job in process.

Beginning Work in Process

Job 2897 Job Cost Sheet Quantity 1 Date Requested: February 2013 Date Completed: Manufacturing Direct Labor Overhead 900

Job No: 2897 Item: Equipment For: Lawrence Company Date Jan 31, 2013 Direct Material 1,500

1,260

Cost of completed job Direct Materials Direct Labor Manufacturing Overhead Total Cost Unit cost

Other Beginning Balances:

Finished Goods balance of $ 5,300 consisting of Job 2896 Raw Materials balance of 5,000

MJC

Product Cost Analysis

2014 Manufacturing Activities:

During 2014, Blackburn Manufacturing began Jobs 2898 and 2899, and they completed Jobs 2897 and 2898. Jobs 2896 and 2897 were also sold on account during the year for $8,000 and 9,000 respectively.

2014 Actual Costs Incurred

1. Purchased additional raw materials of 4,500 on Account. 2. Incurred factory labor costs of $2,900. Of this amount $900 related to employer payroll taxes. 3. Incurred manufacturing overhead costs as follows: indirect materials $1,200; indirect labor $500; depreciation expense $2,000; and various other manufacturing overhead cost on account of $1,000.

Assigned Cost to Jobs:

Job No. 2897 2898 2899 Totals

Direct Materials 900 2,500 1,000

Direct Labor 600 1,350 900

Overhead

MJC

Product Cost Analysis

Instructions:

1. Calculate the predetermined overhead rate for 2014, assuming Blackburn Manufacturing estimates total manufacturing overhead costs of $4,500, direct labor costs of $3,000, and direct labor hours of 1,500 for the year. 2. Open job cost sheets for Jobs 2898 and 2899. Enter the beginning balance on the job cost sheet for Job 2897. 3. Prepare the journal entries to record 2014 actual cost incurred. 4. Prepare the journal entries to record 2014 applied cost. 5. Total the job cost sheets for any job(s) completed during the year. 6. Prepare the journal entries to record the completion of any job(s) during the year. 7. Prepare the journal entries for the sale of any job(s) during the year. 8. What is the balance in the Finished Goods Inventory account at the end of the year? What does the balance represent? 9. What is the amount of over or under applied overhead?

MJC

Product Cost Analysis

Answers:

(1) Formula: Estimated Overhead divided estimated labor cost equals Predetermined Overhead rate. 4,500 3,000 = 1.50 X 100 = 150%

(2 & 5)

Job No: 2897 Item: Equipment For: Lawrence Company Date Jan 31, 2013 Feb 1, 2014 Direct Material 1,500 900

Job Cost Sheet Quantity 1 Date Requested: February 2013 Date Completed: Manufacturing Direct Labor Overhead 900 600

1,260 900

2,400 Cost of completed job Direct Materials Direct Labor Manufacturing Overhead Total Cost Unit cost (6060 1)

1,500

2,160

2,400 1,500 2,160 6,060 6,060

MJC

Product Cost Analysis

Job No: 2898 Item: Equipment For: Lawrence Company Date Feb 1, 2014 Direct Material 2,500

Job Cost Sheet Quantity 1 Date Requested: February 2013 Date Completed: Manufacturing Direct Labor Overhead 1,350

2,025

2,500 Cost of completed job Direct Materials Direct Labor Manufacturing Overhead Total Cost Unit cost (5,875 1)

1,350

2,025

2,500 1,350 2,025 5,875 5,875

Job No: 2899 Item: Equipment For: Lawrence Company Date Feb 1, 2014 Direct Material 1,000

Job Cost Sheet Quantity 1 Date Requested: February 2013 Date Completed: Manufacturing Direct Labor Overhead 900

1,350

Cost of completed job Direct Materials Direct Labor Manufacturing Overhead Total Cost Unit cost

MJC

Product Cost Analysis

(3) Journal Entries to record actual product cost during the year:

Date Description & Account Titles Debit Credit 1 Raw Materials Inventory 4,500 Accounts Payable 4,500 (Purchases of Raw Materials on Account) 2 Factory Labor Factory Wages Payable Employee Payroll Taxes Payable (To record Factory Labor incurred) Manufacturing Overhead Accumulated depreciation Raw Materials Inventory Accounts Payable Factory Labor (To record actual overhead incurred) 2,900 2,000 900

4,700 2,000 1,200 1,000 500

(4) Journal Entries to record applied product cost during the year:

Date 1

Description & Account Titles Work in Process Raw Materials (To record materials used) Work in Process Factory Labor (To record labor incurred) Work in Process Manufacturing Overhead (To record applied overhead)

Debit 4,400

Credit 4,400

2,850 2,850

4,275 4,275

MJC

Product Cost Analysis

(4) Calculations for journal entries: Job No. 2897 2898 2899 Totals Direct Materials 900 2,500 1,000 4,400 Direct Labor 600 1,350 900 2,850 Overhead 900 2,025 1,350 4,275

Manufacturing Overhead Calculation (Direct Labor cost X Predetermined Overhead rate)

(6 & 7) Transfer of jobs to finish goods and the sale of jobs 2896 & 2897.

Date 1

Description & Account Titles Finished Goods Inventory Work in Process (To record transfer) Accounts Receivable Sales Revenue (To record sale of goods) Cost of Goods Sold Finished Goods Inventory (To record removal of goods)

Debit 11,935

Credit 11,935

17,000 17,000

11,360 11,360

MJC

Product Cost Analysis

(6 & 7) Calculations

1 Finished Goods Inventory and Work in Process Job 2897 Job 2898 Total (From Job Sheets Totals) 2 Accounts Receivable and Sales Revenues Job 2896 Job 2897 Total (From Stated Sales Price) 3 Cost of Goods Sold and Finished Goods Inventory Job 2896 Job 2897 Total (From Job Sheets Totals)

6,060

5,875 11,935

8,000

9,000 17,000

5,300 6,060

11,360

(8) Balance in Finished Goods Inventory

Finished Goods Inventory Beginning Balance 5,300 11,360 Goods Sold Goods transferred 11,935 Ending Balance 5,875 Beginning Balance represents Job 2896. Ending Balance Represents the cost of Job 2898, which was transferred to finished goods but has not yet been sold. (9) Manufacturing Overhead Account Manufacturing Overhead Actual 4,700 4,275 Applied Ending Balance 425 Under-applied Overhead of $425 Debit Balance results from Under-applied balance Credit Balance results from Over-applied balance

MJC

10

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Diagram of Accounting EquationDocument1 pageDiagram of Accounting EquationMary100% (3)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Kirkpatrick + ModelDocument1 pageKirkpatrick + ModelMaryNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Basic Everyday Journal Entries Retained Earnings and Stockholders EquityDocument2 pagesBasic Everyday Journal Entries Retained Earnings and Stockholders EquityMary100% (2)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Basic Impact of Everyday Journal Entries On The Income StatementDocument2 pagesBasic Impact of Everyday Journal Entries On The Income StatementMary100% (1)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Cash Flows Statement Indirect MethodDocument2 pagesCash Flows Statement Indirect MethodMary100% (1)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- End of The Year Adjustment For Allowance For Doubtful AccountsDocument1 pageEnd of The Year Adjustment For Allowance For Doubtful AccountsMary100% (1)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Adjusting Entries For Bank ReconciliationDocument1 pageAdjusting Entries For Bank ReconciliationMaryNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Analysis of Financial Statements RatiosDocument2 pagesAnalysis of Financial Statements RatiosMaryNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Special Order AnalysisDocument2 pagesSpecial Order AnalysisMaryNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Continue or Eliminate AnalysisDocument3 pagesContinue or Eliminate AnalysisMaryNo ratings yet

- Make or Buy AnalysisDocument4 pagesMake or Buy AnalysisMaryNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Horizontal Analysis of A Balance SheetDocument3 pagesHorizontal Analysis of A Balance SheetMary100% (6)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Circle of LifeDocument1 pageCircle of LifeMaryNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Scaffolding MethodDocument1 pageScaffolding MethodMaryNo ratings yet

- Journal Entry Format PDFDocument1 pageJournal Entry Format PDFMaryNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Partial Income Statement For Manufacturing CompanyDocument1 pagePartial Income Statement For Manufacturing CompanyMary50% (2)

- Current Assets, Liabilities, and Stockholders' Equity Normal BalancesDocument1 pageCurrent Assets, Liabilities, and Stockholders' Equity Normal BalancesMaryNo ratings yet

- ARCS Method of MotivationDocument1 pageARCS Method of MotivationMaryNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Chunking Method DiagramDocument1 pageChunking Method DiagramMaryNo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Accounting Journal Entries Flowchart PDFDocument1 pageAccounting Journal Entries Flowchart PDFMary75% (4)

- Table Factors For Present and Future Value of One DollarDocument6 pagesTable Factors For Present and Future Value of One DollarMaryNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Labor Variance FormulasDocument2 pagesLabor Variance FormulasMaryNo ratings yet

- Materials Variance FormulasDocument2 pagesMaterials Variance FormulasMary100% (1)

- Transaction Analyzes For A CorporationDocument2 pagesTransaction Analyzes For A CorporationMaryNo ratings yet

- Simplified Charts-Percentage Method Income Tax Withholding 2008Document4 pagesSimplified Charts-Percentage Method Income Tax Withholding 2008MaryNo ratings yet

- Calendars For Sales TermsDocument2 pagesCalendars For Sales TermsMaryNo ratings yet

- Simplified Charts - Percentage Method Income Tax Withholding 2012Document4 pagesSimplified Charts - Percentage Method Income Tax Withholding 2012MaryNo ratings yet

- Gross Profit Section of Income Statement-Periodic SystemDocument3 pagesGross Profit Section of Income Statement-Periodic SystemMary67% (3)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Financial StatementsDocument1 pageFinancial StatementsMary100% (4)

- BM2 Chapter 1Document23 pagesBM2 Chapter 1Lowela KasandraNo ratings yet

- Analyzing The Caterpillar Production SystemDocument6 pagesAnalyzing The Caterpillar Production Systemmanasmhatre007100% (2)

- Cost Accounting Part 1 (University of Cebu) Cost Accounting Part 1 (University of Cebu)Document6 pagesCost Accounting Part 1 (University of Cebu) Cost Accounting Part 1 (University of Cebu)Shane TorrieNo ratings yet

- Article On Staff TrainingDocument19 pagesArticle On Staff TrainingAamir SaeedNo ratings yet

- HBL Goes Digital To Grow Its Corporate Banking BusinessDocument4 pagesHBL Goes Digital To Grow Its Corporate Banking Businesssameed iqbalNo ratings yet

- International Strategic ManagementDocument17 pagesInternational Strategic ManagementVadher Amit100% (1)

- Analytics & Data Mastery: and Certification ClassDocument26 pagesAnalytics & Data Mastery: and Certification ClassZeib Shelby100% (1)

- Resume Book of Pmbok Bab 1Document10 pagesResume Book of Pmbok Bab 1Muhamad SyafiiNo ratings yet

- SMUDocument10 pagesSMUAbhisek Sarkar0% (1)

- Vaibhav Bandekar - PROCESS ANALYSIS AND IMPROVEMENTDocument9 pagesVaibhav Bandekar - PROCESS ANALYSIS AND IMPROVEMENTVaibhav BandekarNo ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Student Dossier 2011-2012 SOILDocument60 pagesStudent Dossier 2011-2012 SOILSaket SaurabhNo ratings yet

- Manual of Works AuditDocument566 pagesManual of Works Auditsaurabh singh100% (1)

- Topic 1: Supply Chain ManagementDocument17 pagesTopic 1: Supply Chain ManagementRoyce DenolanNo ratings yet

- Managing Brands Over Geographic Boundaries and Market SegmentsDocument10 pagesManaging Brands Over Geographic Boundaries and Market SegmentsShenali AndreaNo ratings yet

- International Business: AssignmentDocument7 pagesInternational Business: AssignmentariaNo ratings yet

- Parker Quality ManualDocument33 pagesParker Quality ManualRaul AquinoNo ratings yet

- Enterprise Resource Planning SystemsDocument15 pagesEnterprise Resource Planning SystemsabuNo ratings yet

- Dipali Bundheliya: Sr. Executive HR & Admin at Rex-Tone Industries LTDDocument5 pagesDipali Bundheliya: Sr. Executive HR & Admin at Rex-Tone Industries LTDNILESHNo ratings yet

- Lloyd's Register GroupDocument6 pagesLloyd's Register GroupRhegina Mariztelle ForteNo ratings yet

- Project ReportDocument7 pagesProject ReportShahrooz JuttNo ratings yet

- Incorrect Material Movements PDFDocument55 pagesIncorrect Material Movements PDFsksk1911No ratings yet

- Human Resource Information System (Hris) PlanningDocument26 pagesHuman Resource Information System (Hris) PlanningAde MuseNo ratings yet

- M4T1 - Retail Life CycleDocument2 pagesM4T1 - Retail Life CycleShalu KumariNo ratings yet

- Al-Ko Katalog Paderborn 10 2018-En Lowres PDFDocument146 pagesAl-Ko Katalog Paderborn 10 2018-En Lowres PDFGround ViewNo ratings yet

- Gap Fin SaaS Solv1.2Document6 pagesGap Fin SaaS Solv1.2shanmugaNo ratings yet

- Conventional Views of BA Are Concerned in Some Way With Operating On DataDocument2 pagesConventional Views of BA Are Concerned in Some Way With Operating On DataMaChAnZzz OFFICIALNo ratings yet

- Audit Internal ISO 19011 2018 - 9001Document47 pagesAudit Internal ISO 19011 2018 - 9001Yohannes SinagaNo ratings yet

- Leadership and Influence ProcessesDocument62 pagesLeadership and Influence ProcessesNenad Krstevski75% (4)

- Chapter 2Document2 pagesChapter 2TrangNo ratings yet

- Design and Facilities Management in A Time of Change: Francis DuffyDocument2 pagesDesign and Facilities Management in A Time of Change: Francis DuffyEtnad Oric OreducseNo ratings yet

- The Anatomy of Ethical Leadership: To Lead Our Organizations in a Conscientious and Authentic MannerFrom EverandThe Anatomy of Ethical Leadership: To Lead Our Organizations in a Conscientious and Authentic MannerNo ratings yet

- Lean Maintenance: Reduce Costs, Improve Quality, and Increase Market ShareFrom EverandLean Maintenance: Reduce Costs, Improve Quality, and Increase Market ShareRating: 5 out of 5 stars5/5 (2)

- Inventory Management System A Complete Guide - 2019 EditionFrom EverandInventory Management System A Complete Guide - 2019 EditionNo ratings yet

- Securing Prosperity: The American Labor Market: How It Has Changed and What to Do about ItFrom EverandSecuring Prosperity: The American Labor Market: How It Has Changed and What to Do about ItNo ratings yet

- Do What You Love: And Other Lies About Success & HappinessFrom EverandDo What You Love: And Other Lies About Success & HappinessRating: 4 out of 5 stars4/5 (2)