Professional Documents

Culture Documents

Solow

Uploaded by

Kim BarriosOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Solow

Uploaded by

Kim BarriosCopyright:

Available Formats

macro in a nutshell The Solow model The Solow model (for which the American economist Robert Solow

was awarded the Nobel prize in economics in 1987) i nores the temporar! ups and downs of the business c!cle and e"plains potential income (output) as it obtains in the lon run#

$

The main buildin bloc% is the production function# &hile the '( production function shows output to depend on the capital stoc% and the labour force) the basic *ersion of the Solow model %eeps the labour force fi"ed at its normal le*el# &e ma! then operate with the partial production function that %eeps + fi"ed#

$

To identif! the le*el of (potential) income (or output) this econom! enerates in lon $run e,uilibrium) we need to find out the capital stoc% maintained in lon $run e,uilibrium$

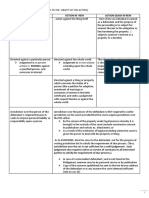

.apital is added when firms in*est# .apital is lost due to depreciation# So when in*estment e"ceeds depreciation the capital stoc% rows/ when in*estment falls short of depreciation the capital stoc% shrin%s# The capital stoc% remains unchan ed) or stead!) if in*estment e,uals (offsets) depreciation# This situation is called a steady state#

$

&hen does in*estment e"ceed depreciation) and when does it fall short of it0 This can onl! be answered if we %now what determines in*estment and depreciationAs re ards depreciation) we ma! safel! assume that a constant fraction of the capital stoc%) sa! 1 percent) is lost e*er! !ear because it is used up or became obsolete# Then depreciation e,uals 1 percent of the current capital stoc%# 2n a 345 dia ram the depreciation line (or) in a more eneral settin ) the re,uirement line) is a strai ht line with slope 6#61#

$

To determine in*estment) suppose there is no o*ernment and no trade with other countries# Then accordin to the circular flow dia ram in*estment e,uals sa*in # Sa*in is a fi"ed share of income# Then the amount people sa*e and in*est at different capital stoc%s ma! be read off the red sa*in s cur*e in the accompan!in dia ram#

$

&hether the capital stoc% rows or shrin%s depends on where it currentl! is# 2f it is at 56) firms in*est and bu! more capital oods than the! loose due to depreciation# Net in*estment is positi*e# The capital stoc% will be hi her ne"t !ear# 2f the capital stoc% is at 51) in*estment fails to replace all capital that wears out# Net in*estment is ne ati*e# The capital stoc% will be lower ne"t !ear#

$

The cru" of this is that if current capital is smaller than 57) the capital stoc% rows/ if it e"ceeds 57) the capital stoc% falls# So the capital stoc% alwa!s mo*es towards 57) where it will sta!) since onl! there depreciation is e"actl! replaced b! new in*estment# 57 is the stead!$state capital stoc%) and 37 is stead!$state income#

8an%iw sa!s a oal of macroeconomic anal!sis is 9to e"plain wh! our national income

rows) and wh! some economies row faster than others###9 (18:)# ;e identifies 9the factors of production<capital and labor<and the production technolo ! as the sources of the econom!=s output and) thus) of its total income# (ifferences in income) then) must come from differences in capital) labor) and technolo !9 (18:)# The model that forms the centerpiece of 8an%iw=s anal!sis) and the one de*eloped below) is the Solow rowth model# 8an%iw sa!s of this model) 9The Solow rowth model shows how sa*in ) population rowth) and technolo ical pro ress affect the le*el of an econom!=s output and its rowth o*er time9 (18: $ 187)# The model also identifies some of the reasons that countries *ar! so widel! in their standards of li*in # The second claim for the model) that the model identifies reasons for income differences across countries) is stated in a more reser*ed fashion than the first) that it e"plains rowth o*er time# This is as it should be# 2ndeed) some anal!sts hold that the Solow model de*eloped below should be applied onl! to modern industrial economies# ;ansen and >rescott sa!?ntil *er! recentl!) the literature on economic rowth focused on e"plainin features of modern industrial economies while bein inconsistent with the rowth facts describin preindustrial economies# This includes both models based on e"o enous technical pro ress@and more recent models with endo enous rowth@# Aut sustained rowth has e"isted for at most the past two centuries) while the millennia prior ha*e been characterized b! sta nation with no si nificant permanent rowth in li*in standards# &ith this ca*eat in mind) we turn to the de*elopment of the Solow rowth model# This de*elopment follows 8an%iwBs intermediate$le*el te"tboo%) Macroeconomics) but it can be used as a stand alone module# Cach step of the de*elopment below is accompanied b! a fi ure or a table from an Excel wor%boo%# The wor%boo% contains e"ercises that enable the manipulation of *ariables and show how chan es impact other *ariables# The abilit! to manipulate the *ariables and animate dia rams facilitates the understandin of the model# Dor a similar de*elopment and for some other macroeconomic topics) see Aarreto# Click here to download the workbook. The Production Function The most basic fact of economic life is scarcit!# Ene wa! of statin this fact of life is *ia a production function li%e this one-

3 F D(5) +)# This function specifies that) for a i*en technolo !<defined b! D(###)) onl! so much output (3) can be produced for i*en emplo!ment le*els of the inputs capital (5) and labor (+)# To turn this obser*ation into a model of economic rowth re,uires some further assumptions# The assumptions re ardin production that underlie the Solow rowth models are these-

A sin le output is produced# ?nits of this output can be consumed or added to the capital stoc%# A sin le t!pe of capital and a sin le t!pe of labor are emplo!ed in the production process# The production function e"hibits constant returns to scale# That is) chan in the emplo!ment of both + and 5 b! a proportional factor 9z9 would cause an e,ui$ proportional chan e in 3# The wor%boo% upon which the illustrations below are based uses a particular constant$returns$to$scale production function) the .obb$(ou las function) 3 F 5a+1$a# (All graphs are from the workbook. Sheet names appear in the figures.)

A useful characteristic of the constant$returns$to scale production function is that it can be 9scaled9 b! the size of the labor force (assumed to e,ual) or at least be proportional to) the population)# So the per$capita production function is of the form! F 34+ F f(54+) F f(%)) where the lower$case letters indicate per$capita *alues# 2n the .obb$(ou las case) 34+ F 5a+1$a4+ F 5a+$a F 5a4+a# F %a# The fi ure abo*e shows the relationship between ! and %#

Two features of the production function stand out- The relationship is positi*e (more capital per wor%er implies more output per wor%er)) and the slope decreases as % increases (the mar inal product of capital decreases)# The mar inal product of capital is defined as8>5 F ( f(% G H%) $ f(%))4H%) or e,ui*alentl! 8>5 F f(%I) $ f(%1)4(%I $ %1)# 2n the raph abo*e) %1 F I1 and %I F '6) so H% F G1# 2n response) ! increases from I#:I7 units to I#77J units) so H! F 6#1J8 units# This implies that 8>5) o*er the ran e considered here is 6#1J841 F 6#6I9:) rounded to 6#6'6# Dor the .obb$(ou las production function) 8>+ F a%a$1# Aecause a K 1) (1 $ a) is positi*e) which implies that a%a$1 F a4%1$a decreases as % increases# This fact is reflected in the e*er$decreasin slope of the production function in the raph abo*e# See notes on the mar inal product# utput! "ncome! Consumption! Sa#ing! and "n#estment An important lesson of the simple circular flow model is that an econom!=s output is simultaneousl! its income/ i. e.) the means to purchase that output# The ne"t step in de*elopin the Solow model is to trace the implications of this relationship to the allocation of output between consumption and in*estment# The model=s consumption is a simple onec F (1 $ s)!)

where c is per$capita consumption and s is the sa*in rate) the fraction of income not spent for

consumption# This simple model is consistent with obser*ed lon $run beha*ior# Driedman cites earlier empirical wor% b! 5uznets that pro*ides e*idence of this proportional relationship and de*elops some of its macroeconomic implications# The model assumes that sa*in s are con*erted) *ia the capital mar%et) into in*estment demand# Thus the le*el of in*estment demand isi F s!# This completes the demand for oods and ser*ices# The e,uilibrium condition is that the two are e,ual!FcGi# The fi ure abo*e illustrates these relationships# At an! specified *alue of % (capital per wor%er)) the cur*e ! F 34+ is the total demand for that output# The lower cur*e (2n*estment) is the in*estment demand# And the *ertical distance between the two cur*es is the consumption le*el# $epreciation

(epreciation is an unfortunate fact of life/ capital wears out# The simple model of depreciation used here is that a constant percenta e of the total capital stoc% wears out each !ear# The e"ample to the ri ht uses a relati*el! hi h rate) I6L) so that if the *alue of % is 16) then I units of capital per wor%er must be replaced each !ear in order to maintain the capital stoc% at its be innin $of$ the$!ear le*el# An! additional in*estment would result in an increased *alue of %#

Steady State! "ntroduction

Sa*in is proportional to output (F income)) so it increases at a decreasin rate as % increases# Dor small *alues of %) sa*in e"ceeds depreciation# Since sa*in e,uals in*estment) sa*in e"ceedin depreciation implies that the capital stoc% is rowin # At hi her *alues of %) depreciation e"ceeds sa*in (which) to repeat) e,uals in*estment)# This is so because output rises less than proportionatel! when % increases while depreciation rises proportionatel!# Therefore) at hi her *alues of %) depreciation e"ceeds in*estment) so the capital stoc% cannot be maintained# The illustration at the ri ht shows a case where the initial *alue of % (16) is below %=s stead!$ state *alue (1I#6:1)# Accordin l!) in*estment e,uals 6#798 units (J6 percent of the income le*el) which is not shown)# 8eanwhile) depreciation is 6#67 times % or 6#766# Thus % increases b! 6#698 units durin this period#

Approaching the Steady State

The raph abo*e shows the adMustment to the stead!$state *alue of % as a function of % itself# An! such adMustment) howe*er) must occur throu h time# The table at the ri ht pro*ides a *iew of how the chan e occurs# The table ta%es as i*en the followin - the production function (! F %6#')) the sa*in rate (sa*in F in*estment F 6#J!)) the depreciation function (depreciation F 6#1%)) and an initial *alue of %# Ni*en these *alues) durin the base !ear) the followin are true- ! F 1#9'') so sa*in F 6#77') which is less than the 6#966 units of depreciation) so the capital stoc% falls from its initial *alue of 9 to 8#87') the *alue obser*ed at the be innin of !ear 1# This process continues) with the decrements to the capital stoc% decreasin as % approaches its stead!$ state *alue of 7#IJ:# (urin the16th !ear) the capital stoc% falls b! 6#6J1 units) and durin the I1th !ear b! onl! 6#6I6 units<the per$wor%er capital stoc% is ,uite near its stead!$state *alue# (To see what happens durin inter*enin !ears) see the full table in the wor%boo%#)

The raph shows how this process pla!s out o*er the first 7: !ears) after which the chan e in % is less than 6#661# The chan e in % be ins at the relati*el! low le*el of $6#1I7 and ,uic%l! approaches zero# This reflects the facts that i is below depreciation (the two middle cur*es) but that the difference is rapidl! *anishin # These e*er$decreasin decrements to the capital stoc% impl! that % is decreasin o*er the period (top cur*e) which refers to the left a"is)) but an an e*er$ decreasin rate# Comparing Steady States

The anal!sis to this point has been positi*e) definin how a s!stem wor%s# 2n that s!stem) the technolo ! and depreciation are i*en b! 9nature9<some combination of technolo ical facts of life) institutions) and historical accidents# The one *ariable that mi ht be subMect to control b! polic!ma%ers is the sa*in rate# To some e"tent that rate is determined b! people=s preferences re ardin future and present consumption) but not entirel!# >olicies matter# Dor e"ample) Social Securit! is a pa!$as$ !ou$ o transfer pro ram that loo%s much li%e a pension plan# Accordin l!) its current desi n can reduce the sa*in rate# See the note# +i%ewise) policies li%e interest deductions for mort a e interest pa!ments can affect both the le*el of in*estment and the sort of capital in which people in*est# (The latter) of course) is not addressed in this simple one$ ood model# See the note#) 2f the *alues of s can be affected b! polic! and if different *alues of s lead to different outcomes) then we are faced with a normati*e issue) to determine a criterion for determinin the 9best9 *alue of s) and accordin l! the 9best9 stead!$state outcome for %) i) and c# &e e"plore a sin le normati*e criterion) the ma"imization of per$capita consumption# That such should be the criterion is not self$e*ident# Dor e"ample) one mi ht ar ue for more %) especiall! if part of % is armament and if one=s bod! politic fears other political entities#

The %olden &ule Steady State

Ta%in the ma"imization of per$capita consumption as our oal) we e"amine the criterion that must be met if the best of the man! possible stead!$state *alues of % is to be identified# The raph at the ri ht shows the *alue of % for which c is ma"imized# The *alue of c does not appear on the raph) but is the difference between ! and s! (or) at stead!$state) the difference between ! and O!)# The condition that must be met is that the slope of the ! function must e,ual O#

To see wh!) suppose that % is less than this *alue (which happens to be J#86 in this case)) which would happen if s K 6#'# Then the slope of the ! function e"ceeds that of the depreciation function# so increasin % would cause ! to increase b! more than depreciation) lea*in more for consumption Alternati*el!) suppose that % P J#8# Then ! increases b! less than depreciation) so

what is left for consumption decreases# C"amination of the raph and of the accompan!in tables re*eals the optimizin condition <the condition that must be met if the normati*e criterion is to be satisfied# That condition is that the mar inal product of capital (the slope of the ! function) must e,ual the depreciation rate O# So) if polic! is to result in ma"imum stead!$state consumption) then a sa*in rate must be established such that8>5 F O# As 8an%iw points out (p# I1I)) public polic! influences national sa*in in two wa!s- 9The most direct wa! in which the o*ernment affects national sa*in is throu h public sa*in <the difference between what the o*ernment recei*es in ta" re*enue and what it spends# @ The o*ernment also affects national sa*in b! influencin pri*ate sa*in <the sa*in done b! households and firms#9 Comparing Steady States' Steady(State Consumption as a Function of the Sa#ing &ate

The reasonin abo*e implies that the stead!$state e,uilibrium matters# Ene ,uestion is Must how sensiti*e the outcome) in our case per$capita consumption) is to the stead! state# The fi ure at the ri ht su ests that if the underl!in .obb$(ou las production is a reasonable first appro"imation to an econom!=s technolo !) then the e"act *alue mi ht not be a critical concern# The optimal sa*in rate is s F 6#') which results in per$capita consumption of c F 1#::6

(see the chart below the raph)# 2f the sa*in rate falls to Must o*er one$half this le*el) s F 6#181) the resultin stead!$state per$capita consumption falls onl! to c F 1#171) a decrease of about 1 percent# +i%ewise) if the sa*in rate were s F 6#J17) more than one$third abo*e the optimal le*el) c falls onl! to 1#19I) a decrease of about J percent#

The table shows the Nolden Rule stead!$state *alues for all *ariables# Dor the current model) one without population chan e or technolo ical chan e) the Nolden rule outcome re,uires that the mar inal product of capital e,ual the depreciation rate) as stated abo*e# &ith the .obb$(ou las production function) 8>5 F a%a$1# Sol*in for the Nolden Rule *alue of % is strai htforward- %NR F (O4a)14(a$1)# Ni*en the model=s parameters) this implies that the *alue is %NR F (6#6J46#')$146#7 F 17#78:# The rest of the *alues follow from this one as follows ! F %6#' F 17#78:6#' F I#'7I) O% F 6#6J(17#78:) F 6#711)

s! F O% from the nature of stead! state) s F (s!)4! F 6#7114I#'7I F 6#'66) c F ! $ s(!) F I#'7I $ 6#711 F 1#::1 (difference from table *alue due to roundin errors))

8>5 F 6#'(%$6#7) F 6#'4(17#78:6#7) F 6#6J6# Approaching the %olden &ule Steady State

Suppose that an econom! has achie*ed its stead!$state in*estment rate) but not the one prescribed b! the Nolden Rule# Then suppose that polic! chan es occur such that the new sa*in (F in*estment) rate results in mo*ement to the Nolden Rule le*els of %) s) and c# ;ow does this chan e pla! out throu h time0 ;ere we address that case of an econom! that has been sa*in too much) so that its capital stoc% is too lar e to enerate the ma"imum flow of consumption# &e lea*e the e"amination of the other case as an e"ercise# The fi ure at the ri ht shows that) if the econom! were at the Nolden Rule stead!$state e,uilibrium) its sustained consumption le*el would be 1#::6# Aecause the capital stoc% is abo*e the Nolden Rule *alue) sustainin that capital stoc% eats into consumption) so the stead!$state consumption le*el is onl! 1#:I7 (*alue read from the spreadsheet)) while output is I#:I7# This implies that s F (I#:I7 $ 1#:I7)4I#:I7 F 6#'81# The table abo*e shows that the Nolden Rule s is lower) 6#'66# Reducin s to its Nolden Rule *alue) startin in !ear '1) allows a Mump in consumption in that !ear (from 1#:I7 to 1#8'9 (F 6#7 7 I#:I7)# As the capital stoc% decreases (%=s *alues are on the ri ht a"is)) so do ! and i (F s7! F depreciation) at stead! state<*alues shown on

the left a"is)# .onsumers in each !ear after '6 ha*e increased consumption) but the model shows a basis for inter$ enerational tension# The chan e for s P sNR to s F sNR pro*ides the reatest boon to those in the !ears immediatel! after the chan e# Accordin l!) those who institute the polic! chan e in !ear '6 are appropriatin the 9free lunch9 that those in later !ears would ha*e enMo!ed had s remained at its historicall! hi h le*el of 6#'81# The inter$ enerational tension is) perhaps) more pronounced when the initial s is less than sNR# A ain) wor%in throu h that case is left as an e"ercise# Population Change and the Steady State

?ntil now) the population has been held at a constant le*el) so that % rows whene*er 5 rows (% F 54+) where + is the amount of labor)# 2f + is rowin ) howe*er) a constant le*el of 5 would impl! a decreasin le*el of %# 2n this re ard) population rowth is much li%e depreciation- both reduce %<depreciation *ia its effect on the numerator in 54+) and population rowth *ia its effect on the denominator# 8an%iw pro*ides the reasonin behind the followin e,uation-

Q% F i $ O% $ n% or Q% F i $ (O G n)%# The term (O G n)% is the amount b! which % would decrease in a !ear=s time if no in*estment were made# This e,uation is onl! appro"imatel! correct) but the appro"imation is ,uite close# See the note# The strai ht line in the raph shows the amount b! which the per$wor%er capital stoc% would decrease if no in*estment were made# 2n*estment is made) howe*er- s! is in*ested each time period# Stead!$state is attained when s! F (O G n)%# 2n the e"ample at the ri ht) a positi*e population rowth rate has been added to the model de*eloped immediatel! abo*e# &hen n F 6) a F 6#' O F 6#6J) and s F 6#'6) the resultin stead!$state % was 17#78: units of capital per wor%er# &hen the population is rowin at I#1 percent per !ear) howe*er) the same sa*in function) production function) and depreciation ratio result in a stead!$state % of Must 8#889 units of capital per unit of labor# Accordin l!) per$capita output is 1#9I: units) down from I#'7I when n F 6# Population Change ""

The raph at the ri ht recreates the one abo*e) with two e"ceptions# Dirst) the depreciation$onl! (n F 6) case is included for comparison# Also) the population rowth rate is a bit hi her) 'L rather than I#1L# The result of this increase is that the stead!$state % falls from 8#889 to 7#99:# >er$ capita output and consumption fall as a result of the decreased %# 2s this particular stead!$state outcome the 9Nolden Rule9 outcome) the one that ma"imizes sustained per$capita consumption0 As we shall see) !es# That outcome re,uires that 8>5 F O G n# See note# Ni*en the production function emplo!ed here) the table below reports the Nolden Rule *alues when the population rowth rate is I#1 percent per !ear# %olden &ule #alues when population grows at ).*+ per year n , -.-)* k%& , ..../ y%& , 0./)1 c%& , 0.23. i%& , -.*4.

, -.2--

Dor the .obb$(ou las production function) the *alue of s that corresponds to Nolden Rule consumption is still the the e"ponent of % in the production function ! F %a# The anal!sis abo*e treats n as e"o enous# Aoth n and s) howe*er) mi ht be sensiti*e to polic! actions# Now polic!ma%ers ha*e two potential tools for affectin the stead!$state le*el of c# The! can implement policies to chan e s) or the! can implement policies to affect n# 8an! modern industrial countries are acti*el! pursuin pro$natalist policies (for reasons unrelated to ma"imization of c)) and some de*elopin countries ha*e implemented policies desi ned to reduce n) the most notorious bein that of .hina# See Cberstadt# See inde" Technological Change and the Steady State

The Solow rowth model treats technolo ! as if more wor%ers were bein added# That is) the effecti*e labor force now becomes + times C) where C is a measure of producti*it!# &ith this new source of chan e) the capital per effecti*e unit of labor) the new capital$per$unit$of$labor *ariable becomes % F 54(+ " C)# Now) absent in*estment) % chan es o*er time for three separate reasons- depreciation of

the capital stoc%) population rowth) and producti*it! rowth# &ith this new source of chan e in %) the chan e in % becomes the followin H% F i $ (O G n G )%) where the first two terms inside the parentheses are as de*eloped earlier) and is the annual rate at which labor producti*it! chan es# See the note for the deri*ation of the term (O G n G )%# To see wh! per$capita consumption rows at the rate ) consider the raph at the ri ht# Stead!$state e,uilibrium now re,uires that both the amount of capital and the amount of in*estment per efficienc! unit of labor be constant# A! the same to%en !) the output per efficienc! unit of labor must be constant# Eutput must) therefore) row at a rate (n G )# The number of wor%ers rows at a rate of n) so the difference) ) is the annual rate of increase of per$wor%er output# Since consumption rows e"actl! in proportion with output) consumption per wor%er also rows at a rate e,ual to # The anal!sis abo*e treats as e"o enous# Aoth n and s) howe*er) mi ht be sensiti*e to polic! actions# Now polic!ma%ers ha*e three potential tools for affectin the stead!$state le*el of c# The! can implement policies to chan e s) the! can implement policies to affect n) and the! can implement policies to affect # Such policies include those related to cop!ri ht and patents) as well as ta" brea%s for research and de*elopment or subsidies for basic research## Technological Change ""

The raph at the ri ht shows some of the same information as abo*e) but from a different perspecti*e# The wor%sheet from which this raph is copied focuses on the implications of s) n) and for per$capita output and consumption# The raph at the ri ht is based on the assumption that the econom! is on its Nolden Rule stead!$state path# The followin e"ercise is instructi*e- Set the sa*in rate *er! low (what happens if s F 60) and raise it toward the Nolden Rule *alue and then abo*e that *alue# Ebser*e that) as s increases so does the 34+ trend for all *alues of s# 2n contrast) howe*er) the .4+ trend shifts upward onl! until s F a (the Nolden Rule *alue) and then shifts downward) with the e*er$increasin difference between 34+ and .4+ bein the depreciation of the e*er$lar er capital stoc%#

This wor%sheet is normalized so that + F 1 and 3 F 1 in the first !ear# Thus) the initial *alue of C is determined in a wa! that ma%es this normalization 9wor%#9 As a result) the sheet does not not directl! show the ne ati*e impact of population rowth on per$capita consumption) but the ne ati*e effect can be can be deduced# The two inserts at the ri ht show part of the table that i*es rise to

the raph abo*e# 2n one case) the population rowth rate is n F 1#1L and in the other it is n F I#1L# 2n both cases) the rowth of per$capita consumption is the same$$it rows at a rate e,ual to ) the rate of technolo ical chan e# &hat differs) howe*er) is the initial le*el of efficienc! necessar! to sustain these identical paths# &hen the population is rowin at 1#1 percent per !ear (+ F 1) 1#611) 1#6J:) ###)) an initial efficienc! inde" of 6#11I is sufficient to enerate obser*ed income stream# &hen population is rowin at I#1 percent per !ear (+ F 1) 1#6I1) 1#677) ###) the necessar! efficienc! inde" is 6#18I in the initial period# This means that a i*en roup of laborers with a i*en le*el of efficienc! must ha*e lower consumption if the population is rowin faster#

An 5mpirical 6ote &hile reser*ations about the ade,uac! of the simple Solow model for e"plainin differences in economic rowth are warranted) the model=s predictions are consistent with obser*ed outcomes# The estimated e,uation below is based on a data set de*eloped b! 8an%iw) Romer) and &eil# Aased on cross$section data from 1I1 countries) the followin estimates are deri*eddpR rowthRrate F I#IJ: $ 1#'JJ7EC.( G 6#1117in*estmentRrate# (I#9'J) (1#6':) The coefficient of determination is RI F 6#181# The dependent *ariable is the a*era e annual rowth rate between 19:6 and 1981# EC.( is a binar! *ariable that e,uals 1 if the countr! is a member of the Er anization for Cconomic .ooperation and (e*elopment/ the point estimate indicates that the rowth rates a*era ed about 1#' percenta e points less for these countries than for others# The rowth rate increased b! an estimated 6#111 percenta e points per one$percenta e$point increase in the fraction of a countr!=s income that was in*ested# The associated t$statistic is ,uite lar e) indicatin stron e*idence that in*estment affects output# &hile in*estment is an important part of the stor!) it is far from bein the whole stor!- The RI of 6#181 indicates that either *ariables other than the two included abo*e or random effects account for 81#1 percent of the *ariation amon rowth rates#

6otes

The decreasing importance of land ;ansen and >rescott ar ue that in a pre$industrial econom!) the fact that land is a fi"ed factor has serious implications for the rele*ance of the Solow model) in which no factor is in fi"ed suppl!# The! point out that the implication of land=s bein a fi"ed factor becomes increasin l! unimportant as economies pro ress toward the industrial (and post$industrial) sta e# Their Table I (pa e 1I69) shows this pro ression for the ?nited States# TA785 )9:.S. FA&;8A6$ <A8:5 &58AT"<5 T =ear Percentage 0.4.. 0/-4. 0/)/ 24 0/*)0/// Return to te"t %6P

$eri#ing the marginal product function from the production function At an! point on the production function the mar inal product is the deri*ati*e of the function with respect to the independent *ariable# Dor the .obb$ (ou las production function) ! F %a) 8>+ F a%a$1# (efinin the 8>+ in terms of per$capita *alues mi ht

appear inappropriate# After all) 8>+ is t!picall! defined as the chan e in total output per one$unit chan e in the *ariable input (capital here) i*en the emplo!ment le*el of the fi"ed input (labor here)# Are the two definitions compatible0 To see that the! are return to the ori inal production function3 F 5a+1$a# The mar inal product of capital is 8>5 F a5a$1+1$a F a5a$14+$(1$a) F a5a$14+a$1 F (54+)a$1 F %a$1# This raph shows how the 8>+ as deri*ati*e compares to 8>+ in terms of discrete chan es# 2n this case) H% F 1# The true 8>+ for this size chan e is 6#6'6) the *alue deri*ed in the te"t# The deri*ati*e is a short$hand wa! of definin the 8>+ for the entire function# At the initial *alue of %) the 8>+ is 6#6'I) which o*erstates the chan e when H% F 1 rather than an arbitraril! small *alue) but the o*erstatement is sli ht# Aac% to te"t $ownloading the workbook &e recommend sa*in the wor%boo% file to a dis% and then openin it# The wor%boo% contains macros# Acti*atin the macros re,uires that Excel=s securit! le*el be set at medium or lower before the wor%boo% is opened# The default is hi h) and will not allow the openin of macros# ?nder 9Tools4 8acro## 4 Securit!9 set the securit! le*el to medium# To repeat- Dailin to set the securit! le*el below its default le*el will cause C"cel to load the wor%boo% but to strip it of all macros#

To download the wor%boo%) clic% here or on the icon at the ri ht#

Aac% to te"t

Social Security and sa#ings 8ost obser*ers see the potential of Social Securit! for reducin sa*in as a wea%ness# 2t was not alwa!s so# Accordin to Deldstein (pa e 16)) 95e!nesian economists in the 19J6s @ praised the unfunded character of the new Social Securit! pro ram for its abilit! to depress national sa*in and stimulate a re ate demand#9 Aac% to te"t $iffering production functions Ene reason that the 9a re ate production function9 that represents an econom! mi ht differ from one econom! to another is the de ree to which funds are allocated to those in*estments with the hi hest rates of return# 2f capital mar%ets were perfect and if propert! ri hts were perfectl! defined and enforced) then a s!stem of mar%ets would ensure e,ual mar inal rates of return for all in*estments# As noted abo*e) howe*er) subsidies mi ht fa*or one t!pe of in*estment (in residential real estate in this case) o*er others# 8an%iw (II7) points out that three maMor t!pes of in*estment can be identified- infrastructure (roads) brid es) sewer s!stems) etc#)) human capital) and in*estments in non$infrastructure ph!sical capital# Si nificant barriers to e,ualizin rates of returns across these broad cate ories can be identified# Durthermore) e,ualization within the cate ories is unli%el!# Such is e*en more so in man! pre$industrial economies# (eSoto ar ues that an important reason for failure of man! third$world countries to de*elop is insecure propert! ri hts# ;e obser*es that s,uatters build up a considerable stoc% of capital) in the form of housin ) without an! clear title# The! cannot) howe*er) use an! e,uit! in this housin to underwrite small businesses) no matter how hi h the rates of returns from such in*estments mi ht be# Aac% to te"t

&e are e"aminin the rate at which % would decrease if it were not replaced# Now) two factors lead to reduced %- depreciation of the capital stoc% and dispersion of the capital stoc% amon increasin l! more wor%ers# .onsider two adMoinin periods) 6 and 151 F 56(1 $ O) ((epreciation) +1 F +6(1 G n) (>opulation rowth) so %1 F %6(1 $ O)4(1 G n) Some al ebra shows that %6 $ %1 F %6(O G n)4(1 G n) ;ere is the al ebra# %6 $ %1 is the amount b! which the capital stoc% declines) absent

offsettin in*estment# %6 F 564+6 and %1 F 514+1 F (564+6)(1 G O)4(1 G n)) so %6 $ %1 F %6 $ %6(1 $ O)4(1 G n) %6 $ %1 F S%6(1 G n) $ %6(1 $ O)T4(1 G n) %6 $ %1 F %6(O G n)4(1 G n) This is the amount that the per$capita stoc% of capital decreases if no in*estment is made# This e,uation differs sli htl! from the e,uation in 8an%iw and the e,uation used in the wor%boo%# Dor simplicit!) the denominator (1 G n) is i nored# +ea*in out this term simplifies the e"position at the cost of introducin an error of 14(1 G n)# Dor reasonable *alues of n) this error is about I or ' percent# To repeat) the simpler e,uation that *er! closel! appro"imates the actual decrease in % in the absence of an! in*estment is thisQ% F %(O G n) To illustrate) suppose that % F 16 and that depreciation and population rowth are as indicated abo*e# Dor concreteness) suppose that 5 F 16)666 and + F 1666 in the base !ear# Then a !ear later) 5 F 16)666(6#9:) F 9:66 and + F 1666(1#6I1) F 16I1# Therefore) in the ne"t !ear % F 9:66416I1 F 9#'::# C"cept for roundin ) this *alues e,uals 16)666(1 $ 6#6J)41#6I1) which is 9':1#81J# The decrease in % from 16 to 9#':: implies that 16 $ 9#':: or 6#:'J units of output per wor%er must be set aside for maintenance of the per$wor%er capital stoc%) rou hl! 6#J to maintain the necessar! 16)666 units of capital and 6#I'J to pro*ide the I1 additional wor%ers with as much capital as the initial 1666 wor%ers had# The numbers shown are e"act# .ompare them to the results of the simpler e,uation16(6#6J G 6#6I1) F 6#:16# The discrepanc! is (6#:16 $ 6#:'J)46#:'J or about I#1 percent# Aac% to te"t Consumption! sa#ing! and in#estment .onsumption is c F ! $ i because i F s# Dor an! stead!$state to occur i F (O G n)%# Therefore) we see% the *alue of % that ma"imizes ! $ (O G n)%# Aut ! is f(%)# To find the ma"imum *alue of c) find the % for which the slope of the ! F f(%) function e,uals (O G n)# That is) find the % for which 8>5 F (O G n)# Aac% to te"t See inde" Factors changing the #alue of k &hen technolo ! is ta%en into account % is defined as follows- % F 54(+ 7 C)# + chan es at a rate of n) and C chan es at a rate of # The capital stoc% depreciates at a rate O# .onsider the implication for Q% for two adMoinin !ears# 3ear 1 *alues are as follows+1 F +6(1 G n) and C1 F C6(1 G )# Accordin l! %1 F 514(+1 " C1) F U(56 $ O56)4S+6(1 G n)C6(1 G )TVF %6(1 $ O)4S(1 G n)(1 G )T# Absent in*estment) %1 K %6 for three reasons- depreciation) increase in the population) and increase in the number of efficienc! units of labor per wor%er#

&e now use this information to determine the e"act relationship between %6 and the decrease in %) absent in*estment# %6 $ %6(1 $ O)4S(1 G n)(1 G )T F S%6(1 G n G G n )T $ %6(1 $ O)T4(1 G n G G n ) F S%6(O G n G G n )T4(1 G n G G n ) This differs sli htl! from the appro"imation used in the te"t abo*e) and used b! 8an%iw# There the decrease in % per time period) absent in*estment) is %(O G n G )# To see how much the two differ) suppose that n F I#1 percent and F I#6 percent) both fairl! lar e *alues# +et O F J percent# 8an%iw=s appro"imation is that % falls b! (6#6J G 6#6I G 6#6I1)% or b! 6#681%# 2n fact) o*er a !ear=s time) the e"act decrease is S(6#6J G 6#6I G 6#6I1 G #6661)4(1#6I71#6I1)T% F 6#681779%) for an error of less than J percent# Aac% to te"t

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- Cost Accounting 7 & 8Document26 pagesCost Accounting 7 & 8Kyrara79% (19)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- SandiganbayanDocument3 pagesSandiganbayanKim BarriosNo ratings yet

- Supreme CourtDocument2 pagesSupreme CourtKim BarriosNo ratings yet

- Special Complex CrimeDocument2 pagesSpecial Complex CrimeKim BarriosNo ratings yet

- DoctrinesDocument2 pagesDoctrinesKim BarriosNo ratings yet

- Majority VoteDocument2 pagesMajority VoteKim BarriosNo ratings yet

- DoctrinesDocument2 pagesDoctrinesKim BarriosNo ratings yet

- Zebulun Tribe Historical Background LocationDocument2 pagesZebulun Tribe Historical Background LocationKim BarriosNo ratings yet

- Aggravating CircumstancesDocument2 pagesAggravating CircumstancesKim BarriosNo ratings yet

- PointsDocument1 pagePointsKim BarriosNo ratings yet

- Cert Proh MandDocument2 pagesCert Proh MandKim BarriosNo ratings yet

- TableDocument21 pagesTableKim Barrios100% (1)

- Special Complex CrimeDocument2 pagesSpecial Complex CrimeKim BarriosNo ratings yet

- SuccessionDocument7 pagesSuccessionKim BarriosNo ratings yet

- DoctrinesDocument2 pagesDoctrinesKim BarriosNo ratings yet

- Bautista vs. UnangstDocument21 pagesBautista vs. UnangstKim BarriosNo ratings yet

- Orquiola vs. CADocument13 pagesOrquiola vs. CAKim BarriosNo ratings yet

- Alday vs. FGU InsuranceDocument15 pagesAlday vs. FGU InsuranceKim BarriosNo ratings yet

- Fruit Coloring PageDocument1 pageFruit Coloring PageKim BarriosNo ratings yet

- Dendrimers For Theranostic ApplicationsDocument17 pagesDendrimers For Theranostic ApplicationsKim BarriosNo ratings yet

- Donor Cases Doctrines ContDocument3 pagesDonor Cases Doctrines ContKim BarriosNo ratings yet

- LegitimesDocument3 pagesLegitimesnarockavNo ratings yet

- Investments Fiscal IncentivesDocument4 pagesInvestments Fiscal IncentivesKim BarriosNo ratings yet

- Com N Plain TTT TTTTTDocument5 pagesCom N Plain TTT TTTTTKim BarriosNo ratings yet

- New York 1958 Convention - Convenzione Di New York 1958 - United Nations - Nazioni UniteDocument7 pagesNew York 1958 Convention - Convenzione Di New York 1958 - United Nations - Nazioni UniteGiordana SalamiNo ratings yet

- CorpoDocument81 pagesCorpoKim BarriosNo ratings yet

- Karl Marx's Life and WorkDocument5 pagesKarl Marx's Life and WorkKim BarriosNo ratings yet

- Corpo CasesDocument8 pagesCorpo CasesKim BarriosNo ratings yet

- Fringe BenefitDocument9 pagesFringe BenefitKim BarriosNo ratings yet

- The Principal Commerce in Every Civilized Society Is That Between The Towns People and The Country Folk. The Raw MaterialsDocument2 pagesThe Principal Commerce in Every Civilized Society Is That Between The Towns People and The Country Folk. The Raw MaterialsKim BarriosNo ratings yet

- Chapter Four: 2. Audit of Inventory, Cost of Sales and Related AccountsDocument8 pagesChapter Four: 2. Audit of Inventory, Cost of Sales and Related AccountsZelalem HassenNo ratings yet

- Computer Aided Production Planning & Control Systems ExplainedDocument32 pagesComputer Aided Production Planning & Control Systems ExplainedJo100% (2)

- 673 Quirino Highway, San Bartolome, Novaliches, Quezon CityDocument4 pages673 Quirino Highway, San Bartolome, Novaliches, Quezon CityRodolfo ManalacNo ratings yet

- Financial Planning Process: Lesson 3.1Document20 pagesFinancial Planning Process: Lesson 3.1Tin CabosNo ratings yet

- Network Externalities and Their EffectsDocument14 pagesNetwork Externalities and Their EffectsTan Huey YinNo ratings yet

- Get Asset Depreciation to GL LinkDocument2 pagesGet Asset Depreciation to GL Linksrains123No ratings yet

- Class Activity 01Document5 pagesClass Activity 01Nisrine HafidNo ratings yet

- SyllabusDocument68 pagesSyllabusHarshal Borgaon100% (1)

- Non Banking Finance Companies and Notified Entities Regulations 2008 Updated Till May 17 2023Document216 pagesNon Banking Finance Companies and Notified Entities Regulations 2008 Updated Till May 17 2023haseeb ahmedNo ratings yet

- Sphinx Embedded & It SolutionsDocument8 pagesSphinx Embedded & It SolutionsJANANI COMPUTERSNo ratings yet

- Solved Use The September Transaction Data For Taylor Moffat Veterinarian GivenDocument1 pageSolved Use The September Transaction Data For Taylor Moffat Veterinarian GivenAnbu jaromiaNo ratings yet

- FinalDocument22 pagesFinalgaurav PrajapatiNo ratings yet

- CRO Unlocked Facts SheetDocument6 pagesCRO Unlocked Facts SheetboscoNo ratings yet

- Marketing plan for coffee shop workshopDocument3 pagesMarketing plan for coffee shop workshopAnish DalmiaNo ratings yet

- The Production ProcessDocument84 pagesThe Production ProcessRafi UllahNo ratings yet

- Day 1 Schedule of 6th Research ForumDocument9 pagesDay 1 Schedule of 6th Research ForumTrisha Ann BarteNo ratings yet

- Audit and Assurance June 2009 Past Paper Answers (ACCA)Document15 pagesAudit and Assurance June 2009 Past Paper Answers (ACCA)Serena JainarainNo ratings yet

- Chapter 3 - Organizational EthicsDocument17 pagesChapter 3 - Organizational EthicsNguyễn Quốc HưngNo ratings yet

- Assignment of Rural Marketing To Launch A Eveready Torch in Meghalaya StateDocument18 pagesAssignment of Rural Marketing To Launch A Eveready Torch in Meghalaya StateAsad Gour0% (1)

- EMB 833 Assignment 1Document11 pagesEMB 833 Assignment 1Aliyu GafaarNo ratings yet

- MM Lectures CompleteDocument518 pagesMM Lectures CompleteVarunNo ratings yet

- Chapter 3 Marketing Mix of Life InsuranceDocument19 pagesChapter 3 Marketing Mix of Life Insurancerahulhaldankar0% (1)

- Analysing Effectiveness of Point of Purchase Display On Consumer Purchases in Bigbazaar, HebbalDocument8 pagesAnalysing Effectiveness of Point of Purchase Display On Consumer Purchases in Bigbazaar, HebbalShiv HanchinamaniNo ratings yet

- Preparation of Monthly Transcripts of A SelfDocument4 pagesPreparation of Monthly Transcripts of A SelfEsther Akpan100% (2)

- Far1 Chapter 4Document61 pagesFar1 Chapter 4Erik NavarroNo ratings yet

- Form CCL Dian PertiwiDocument1 pageForm CCL Dian Pertiwipertiwidhyan1No ratings yet

- Strategic Management: Porter's Five Forces Model and The Competitive Profile Matrix (CPM) - of Competitive AdvantageDocument62 pagesStrategic Management: Porter's Five Forces Model and The Competitive Profile Matrix (CPM) - of Competitive AdvantageMURALI PNo ratings yet

- Annual Report 2075 76 EnglishDocument200 pagesAnnual Report 2075 76 Englishram krishnaNo ratings yet

- IAS 8 Accounting Policies - Changes in Accounting Estimates and Errors PDFDocument20 pagesIAS 8 Accounting Policies - Changes in Accounting Estimates and Errors PDFMichelle TanNo ratings yet