Professional Documents

Culture Documents

1 - 0 - 09062012fullerton GPI LTD 08th June 2012

Uploaded by

didwaniasOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

1 - 0 - 09062012fullerton GPI LTD 08th June 2012

Uploaded by

didwaniasCopyright:

Available Formats

June 08, 2012 GODAWARI POWER AND ISPAT LTD BUY

Recommendations Strong Buy Buy Hold Reduce Sell <= 1 year 1 - 2 yrs 2 - 5 yrs

Godawari Power and Ispat Ltd (GPIL), the flagship company of the Hira Group of Industries based in Chhattisgarh, is a mid size steel manufacturer. The company has a wide range of products from sponge iron, billets, wire rods and ferro alloys. Besides this, GPIL has presence in power sector with consolidated power generation capacity of 103MW. GPIL is in process of becoming fully integrated steel player. In iron ore mining space, it has got mining lease of iron ore mines at Ari Dongri and Boria Tibu in Chhattisgarh with total capacity of 1.2mn tonnes. Of these, Ari Dongri mine is operational whereas for Boria Tibu, the company has received all regulatory clearance and is awaiting surface right from forest department. It is expected that the mine will be operational in FY14 and the total output from both the mines would reach around 1.2mn tonnes and would meet 100% captive requirement. The company has pellet production capacity of 1.2mn tonnes (including 0.6mn tonnes capacity of its 75% subsidiary Ardent Steel). For both the plants the operational issues has been cleared and is expected to operate at higher capacity utilization leading to higher pellet production. The company is expected to register pellet production growth of 79% over FY12-14. The company is expected to improve its operating margin from the fall in key raw material prices like iron ore and coal. Currently the company meets its iron ore short-fall from spot market. Post commencement of operation at Boria Tibu mine, it will meet its iron ore requirement captively and will be insulated from the fluctuation of iron ore prices in the spot market. GPIL is implementing 50MW solar power plant under Jawaharlal Nehru National Solar Mission and the project is expected to be completed by Q1FY14. Power generated will be sold at Rs. 12.2 per unit or 25 years to NTPC Vidyut Vyapar Nigam Limited (NVVN). Moreover, the company is planning to set up a 1.3GW of thermal power plant in Chhattisgarh through its 100% subsidiary, Godawari Energy Ltd (GEL).

Strong Buy Expected Returns > 20% p.a. Buy Expected Returns from 10 to 20% p.a. Hold Expected Returns from 0 % to 10% p.a. Reduce Expected Returns from 0 % to 10% p.a. with possible downside risk Sell Returns < 0 %

STOCK DATA

BSE / NSE Code Bloomberg Code No. of Shares (Mn) Sensex / Nifty 532734/GPIL GODPI IB EQUITY 32 16,454/ 4,997 113 0.77 3,573 174/ 70 14,195 30D -1% -2% -2% 3M 10% -4% -4% 6M 1% -2% -1% 1Y -33% -11% -10% 64 7 29 100

PRICE DATA

CMP Rs (06th June' 12) Beta Market Cap (Rs mn) 52 Week High-low Average Daily Volume

STOCK RETURN (%)

Godawari Power and Ispat Ltd Sensex Nifty

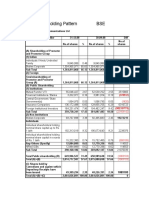

SHARE HOLDING PATTERN (%)

Promoter Institutional Non Institutional Total

Based on a consolidated FY14 P/E multiple of 4, the fair value for the company works out to Rs. 142

Financial Snapshot Projections (Rs Mn) Net Sales Y-o-Y Growth % EBIDTA Y-o-Y Growth % Adjusted PAT Y-o-Y Growth % EPS Rs BVPS Rs EBIDTA % NPM % ROE % PER x P/B Ratio FY10A 8,266 -24% 1,305 6% 572 -8% 18 160 16% 7% 11% FY11A 11,274 36% 2,323 78% 859 50% 27 215 21% 8% 13% FY12A 20,604 83% 2,818 21% 843 -2% 27 243 14% 4% 11% FY13E 20,145 -2% 3,099 10% 1,032 22% 33 276 15% 5% 12% 3.5 0.4 FY14E 21,898 9% 3,458 12% 1,129 9% 36 311 16% 5% 11% 3.2 0.4

1 Year Price Performance (Rel. to Sensex)

Sensex

110 100 90 80 70 60 50 40 30

GPIL

www.fullertonsecurities.co.in

Page | 1

June 08, 2012 BUSINESS PROFILE

Godawari Power & Ispat Ltd (GPIL), formally Ispat Godawari Ltd (IGL), belonging to HIRA Group of Industries, Raipur, was incorporated in 1999 to set up an integrated steel plant with captive power generation. Today GPIL is an integrated steel manufacturer and has dominant presence in the long product segment of the steel industry, mainly into mild steel wire. GPIL is an end-to-end manufacturer of mild steel wires. In the process, the company manufactures sponge iron, billets, ferro alloys, captive power, wires rods, steel wires, oxygen gas, fly ash brick and pellets. GPIL is also awarded rights for coal and iron ore mining for captive consumption, as a result of which, the company has managed to traverse the entire value chain (raw material to final product) in steel wires and is now a fully integrated manufacturer. In 2007, the company was allotted a coal mine in Chhattisgarh in JV with four other companies. The total coal reserve is around 243mn tonnes, of that GPILs share is 26% (i.e. 63mn tonne). On iron ore mining front, GPIL was awarded mining lease in two iron ore mine with total reserves of 15mn tonnes. For both, GPIL has a mining license of 0.6MT having Fe content of 62-64% and Lump to Fine ratio of 50:50. Ari Dongri captive coal mine with reserve of 7mn tonnes is operational since Q1FY10. Another mine at Boria Tibu with reserve of 8mn tonnes is expected to be operational in FY13. Post commencement of operation at the Boria Tibu, the company will meet its iron ore captively and will be insulated from the fluctuation of iron ore price in spot market. Moreover, due to mines located in the vicinity of the plant there will be substantial reduction in the cost of procurement. These mines have lump concentration of 50%, which will be used in the manufacturing of sponge iron. Before converting it into sponge iron, lump mine is converted into pellet with the help of two plants of 0.6mn tonnes each. As a result of this process, the landed cost of the ore for sponge production will be lower, which will increase the operating margin in the upcoming years.

Current Production Capacity as on FY12

GPIL is the first company to utilize lump iron ore to manufacture sponge iron

GPIL has pellet manufacturing capacity of 1.2mn tonnes

GPIL has power generation capacity of 73MW and is expected to add 50MW in FY14

Electricity Capacity Portolio as on FY12

0.60 0.60 0.50 0.40 0.12 0.02 0.60 103.00

GPIL Pellets (mn Tonnes) Ardent Steel Pellets (mn Tonnes) Sponge Iron (mn Tonnes) Steel Billets (mn Tonnes) H.B. Wire (mn Tonnes) Ferro Alloys (mn Tonnes) Iron ore Mine (mn Tonnes)

Power Capacity (MW)

Hira Ferro Alloys Ltd (51% Subsidiary) Thermal Wind Mill Bio Mass GPIL Thermal Waste Heat recovery Bio Mass Consolidated Total

30 20 1.5 8.5 73 11 42 20 103

From its subsidiary, Hira Alloys Ltd, it has power generation capacity of 30MW

Mining Portfolio as on FY12 Resource Iron Ore Iron Ore Iron Ore Coal Location Ari Dongri, Chhattisgarh Boria Tibu, Chhattisgarh Reserves (mn Tonnes) 7 8 100 243 Capacity (mn Tonnes) 0.6 0.6 --Status Operational Awaiting Surface Clearence from Forest Ministry Received Prospecting License Waiting for Environment and Forest Clearence

The company has started focusing on steel business from power business due to volatility in merchant power rates

Chhattisgarh

Nakia (GPI&L's 26% stake)

Iron ore mine at Boria Tibu is expected to be operational by FY13

www.fullertonsecurities.co.in

Page | 2

June 08, 2012 BUSINESS PROFILE

Expansions in steel business: GPIL signed MoUs with the Government of Chhattisgarh to undertake:

Setting up of a sponge iron plant of 0.6mn tonnes per annum (mtpa), pig iron of 0.2mtpa, steel billets of 0.6mtpa, steel

rolled product of 0.5mtpa, ferro alloys of 20ktpa, calcinations plant of 0.1mtpa and iron ore pellet plant of 3mtpa.

Setting up an iron ore pellet plant, with an installed capacity of 1.2mtpa at the organizations existing plant location at

Siltara in Raipur. Expansions in power business:

The company is planning to increase its pellet production capacity from 0.6mn tonnes to 1.2mn tonnes at its existing plant at Raipur

GPIL is foraying into the renewable energy space by setting up 50MW Solar Thermal Power Project under the Jawaharlal

Nehru National Solar Mission (JNNSM) Scheme through its 100% subsidiary, Godawari Green Energy Limited (GGEL).

The company is also planning a 1.3GW thermal power plant through its 100% subsidiary, Godawari Energy Limited (GEL)

at Raigarh, Chhattisgarh.

GPIL is also planning a 1.3GW of power capacity in Chhattisgarh

RISK & CONCERNS

Fluctuation in prices of raw material & fuel: GPILs major raw material is iron ore and coal. On the iron ore front, one of two own captive mines commenced production. The other mine i.e. Boria Tibu also received all regulatory clearances and should start production soon. Hence, GPIL will be insulated from the fluctuation of iron ore prices in the spot market. However, until both the mines start production, GPILs operations will continue to be affected by fluctuation in the prices of iron ore, to the extent of dependence on market purchases. On the coal front, GPIL is currently meeting its coal requirement through long-term linkages with Coal India Limited and imports. The prices of imported coal depend upon the global market demand and supply and linkage prices as determined by the Ministry of Coal. The company shall be insulated from price fluctuations once captive mines start production. GPIL awaits regulatory approvals from various departments for the coal blocks it has been allotted. Changes in selling prices: A specific feature of steel and mining industries is their liability to cyclical changes in steel prices. In critical conditions, where the selling prices were almost equal to the average cost of production of sponge iron, profitability margins gets impacted. So if prices of finished products fall to such a level, margins cannot be maintained. Credit, interest and exchange fluctuation risk: Financial crisis of the economy in 2008 has led to an interbank crisis of trust, reducing the levels of interbank credits and liquidity of the financial system. Simultaneously, increased volatility and uncertainties led to increased premium in the cost of external financing. The increased cost of financing may negatively affect GPILs financial results and lead to lower profitability. Fluctuation of interest rates may cause variation in the value of existing foreign currency. The level of existing rupee debt as on March 31, 2011 is Rs.3bn and foreign currency term loans of USD 12mn, out of which 10mn is un-hedged. Hence, change in interest rates may have significant impact on the financial results. The company is expected to gain from the falling iron ore and coal prices GPIL is exposed to the volatility in the spot iron ore and coal prices until its captive mine are operational

GPIL is expected to get affected due to volatility in currency rates as it has exposure from foreign currency term loans

www.fullertonsecurities.co.in

Page | 3

June 08, 2012 FINANCIAL PERFORMANCE

In Q4FY12, the company reported 53% Y-o-Y jump in consolidated top-line and a decline of 1% Y-o-Y in bottomline. Operating revenue and net profit for the quarter stood at Rs. 7bn and Rs. 0.3bn respectively. Growth in top-line was aided by higher saleable volume and realization across the product portfolio. Steel billets, ferro alloys and pellets sales increased by 45%, 19% and 18% Y-o-Y respectively. However, sales of sponge iron and power units declined by 11% and 39% respectively. On realization front, there was double digit growth on Y-o-Y basis for all products expect ferro alloys. On sequential basis, top-line and bottom-line increased by 37% and 210%. Operating margin (EBITDA) declined by 520bps Y-o-Y due to 63% Y-o-Y increase in operating expenditure. Operating expenditure was higher due to 66%, 31% and 36% increase in raw material, employee expenses and other expense. Other expense includes exchange loss of Rs. 0.2bn on account of foreign currency transaction. Thus leading to EBITDA of Rs. 1bn with EBITDA margin of 15% as against 20% in the same quarter last year. Other income declined by 97% and stood at Rs. 3mn. Bottom-line reported profit of Rs. 0.3bn due to 11% and 8% increase in interest and tax expenses respectively. Tax expenses increased by 200bps, leading to an increase in effective tax rate to 22%. During the quarter, the company has decided to issue and allot 5mn equity warrants convertible into 5mn equity shares of Rs. 10/- each on preferential basis to the promoters and/or promoters' group at a price of Rs. 130 per equity warrants. The holders of the said equity warrants shall have an option to convert the same into equity of the company on or before the expiry of 18 months from the date of allotment. The fund raised would be used for funding the CAPEX of the company.

25,000 20,000 16% 15,000 11,274 10,000 5,000 FY10A FY11A FY12A FY13E FY14E PAT Margin 8,266 7% 8% 4% 5% 5% 10% 5% 0% 0 Q4FY11 Q1FY12 Q2FY12 Q3FY12 Q4FY12 PAT Margins Revenue (Rs mn) EBITDA Margins 8% 14%

In Q4FY12, top-line increased by 53% and bottom-line declined 1% Y-o-Y

Top-line growth was aided by growth in sales volume and higher realization across the product profile

Bottom-line was affected due to higher interest and effective tax rate

Yearly Operating Margins

21% 20,604 21,898 20,145 16%

25% 20%

Quarterly Operating Margins

7,000 20% 4,940 4,298 3,500 15% 12% 12% 4,287 15% 15% 10% 5% 2% 5% 0% 4,810 6,568 25% 20%

15%

15%

On sequential basis, operating margin increased 272bps due to correction in key raw material prices

6%

2%

Revenue (Rs Mn)

EBIDTA Margin

Yearly Operating Performance

40,000 30,000 20,000 18,281 10,000 0 FY10A FY11A FY12A FY13E FY14E Pellets Realization (Rs per Tonne) HB Wire Realization (Rs per Tonne) 14,248 6,107 8,383 8,412 5.0 30,837 3.5 2.9 21,046 16,637 7,814 16,592 7,529 0.0 Sponge Iron Realization (Rs per Tonne) Power Realization (Rs per Unit) 0 3.5 3.5 3.0 2.0 1.0 5.0 34,437 37,403 33,761 34,112 4.0 30,000 20,000 10,000 40,000

Quarterly Operating Performance

35,855 34,811 2.9 36,415 2.9 2.8 19,445 2.5 7,924 Q4FY11 19,404 19,873 21,464 23,441 2.6 7,956 Q1FY12 7,930 Q2FY12 8,571 Q3FY12 9,190 2.4 Q4FY12 Sponge Iron Realization (Rs per Tonne) Power Realization (Rs per Unit) 2.6 3.0 37,818 39,525 3.0

On Y-o-Y basis, power realization increased by 4% and declined by 13% on sequential basis

Pellets Realization (Rs per Tonne) HB Wire Realization (Rs per Tonne)

Pellet production during Q4FY12 increased due to improvement in plant capacity utilization

www.fullertonsecurities.co.in

Page | 4

June 08, 2012 PEER COMPARISION

Peer Group Comparison

Companies

GODAWARI POWER & ISPAT LTD ADHUNIK METALIKS LTD INDIAN METALS & FERRO ALLOYS LTD FY12 Consolidated Figures

Revenue (Rs. mn)

20,604 19,674 11,927

EBIDTA PAT Margin (%) Margin (%)

14% 22% 19% 4.1% 0.2% 5.2%

ROE %

10.9% 0.8% 7.6%

P/E (x)

4 39 12

P/B (x)

0.5 0.3 0.9

CMP (Rs.)

113 34 280

FV (Rs.)

10 10 10

Peer Comparison: Adhunik Metaliks Ltd (AML) is a diversified player having presence across steel, mining and power

sectors. Moreover it has presence in merchant mining business. It is trading at higher multiple due to highly integrated business and exposure to merchant mining business. However, the current valuation cannot be sustained due to falling manganese ore prices. Indian Metals and Ferro Alloys Ltd (IMFL) is one of the low cost producers of ferro alloys globally due to captive mines and power units. It is trading at higher P/E multiple due to stable business model (earning stability as majority of the output is tied up for long term contracts). Major concern with IMFL is that it drives around 80% of the revenue from export business and is subjected to risk related to subdued global demand and volatility in currency exchange rates. GPIL is better placed as compared to its peers because of the benefits arising from the integration process and improving capacity utilization of its plants. GPIL is expected to benefit from the ongoing integration process and improving plant capacity utilization

VALUATION

Based on the conservative estimated given below, we estimate that GPILs operating revenue to grow at a CAGR of 3% over FY2012-14E to Rs. 22bn. Furthermore, due to benefits arising from the backward integration process and increased capacity utilization, we further estimate that net profit would grow at a CAGR of 16% to Rs. 1bn over the same period. Based on a GPILs top-line and bottom-line is expected to grow at CAGR of 3% and 16% respectively over FY12-14

consolidated FY14 P/E multiple of 4, the fair value for the company works out to Rs. 142

Key Financial Assumptions FY13E Total Pellet Production (mn Tonnes) Pellet realization (Rs per Tonne) Sponge Iron Production (mn Tonnes) Sponge Iron Realization (Rs per Tonne) HB Wire Production (mn Tonnes) HB Wire Realization (Rs per Tonne) Steel Billet Production (mn Tonnes) Steel Billet Realization (Rs per Tonne) Ferro Alloy Production (mn Tonnes) Ferro Alloy Realization (Rs per Tonne) Power Generation Capacity (MW) Merchant Power Realization (Rs per Unit) Tax Rate (%) 0.79 7,814 0.37 16,637 0.10 33,761 0.24 29,060 0.02 61,861 103 3.50 20% FY14E 1.16 7,529 0.40 16,592 0.10 34,112 0.26 29,612 0.02 63,525 153 3.50 20%

www.fullertonsecurities.co.in

Page | 5

June 08, 2012 FINANCIAL STATEMENTS AND RATIOS

Consolidated Profit & Loss Statement Particulars (Rs Mn) Net Sales Operating Expenditure Depreciation EBIT EBIT Margin (%) Interest Expenses Profit Before Tax Less: Tax Adjusted PAT PAT Margin (%) EPS (Rs) BVPS (Rs) ROE % FY10A 8,266 6,960 342 964 12% 337 666 106 572 7% 18 160 11% FY11A 11,274 8,950 554 1,769 16% 731 1,193 198 859 8% 27 215 13% FY12A 20,604 17,787 677 2,141 10% 1,158 1,096 220 843 4% 27 243 11% FY13E 20,145 17,046 731 2,368 12% 1,099 1,417 283 1,032 5% 33 276 12% FY14E 21,898 18,440 813 2,645 12% 1,321 1,507 301 1,129 5% 36 311 11%

Valuation Ratios (x) PER x P/B Ratio

Consolidated Cash Flow Statement Particulars (Rs Mn) Profit Before Tax Depreciation Other Adjustments Direct Tax Paid Change in Working Capital Cash Flow from Operations FY10A 666 342 328 (103) (226) 1,008 FY11A 1,193 554 624 (189) (1,738) 445 FY12E 1,096 677 1,158 (220) 1,338 4,049

FY13E 3.5 0.4

FY14E 3.2 0.4

FY13E 1,417 731 1,099 (283) (1,979) 984

FY14E 1,507 813 1,321 (301) (219) 3,121

Change in Fixed Assets Other Adjustments Cash Flow from Investment

(2,499) 2 (2,497)

(2,458) 56 (2,402)

(1,637) 126 (1,511)

(1,878) 86 (1,792)

(2,131) (5) (2,137)

Proceeds from Debt Debt Repayment Interest Paid Dividends Paid Others Cash Flow from Financing

1,632 0 (337) (82) 35 1,248

3,429 0 (731) (96) 522 3,124

940 (2,613) (1,158) (79) 0 (2,911)

4,662 (2,848) (1,099) (82) 0 633

5,158 (4,785) (1,321) (76) 0 (1,024)

Net Cash Flows Op bal of cash Transferred to B/S

(242) 438 196

1,166 196 1,363

(373) 1,363 990

(175) 990 815

(40) 815 775

www.fullertonsecurities.co.in

Page | 6

June 08, 2012 FINANCIAL STATEMENTS AND RATIOS

Consolidated Balance Sheet Particulars (Rs Mn) Application of Funds Fixed Asset (Net) CWIP Investments Other Non Current Assets Inventories Sundry Debtors Cash & Bank Balance Loans & Advances Other Current Assets Total 6,341 1,938 117 0 1,728 372 196 587 1 11,279 9,709 936 220 0 2,872 674 1,363 1,097 1 16,872 13,355 0 177 89 3,461 959 990 981 7 20,019 14,503 0 162 17 4,135 947 815 1,247 2 21,828 15,821 0 162 23 4,433 993 775 1,405 3 23,615 FY10A FY11A FY12A FY13E FY14E

Sources of Funds Share Capital Reserves and Surplus Minority Interest Total Debts Net Deferred Tax Sundry Creditors Other Current Liabilities Provisions Total 269 4,713 101 5,181 9 354 464 187 11,279 318 5,732 764 8,845 (55) 727 321 221 16,872 318 6,463 925 8,998 (67) 1,527 1,588 269 20,019 318 7,413 1,026 10,812 (67) 1,131 796 400 21,828 318 8,466 1,102 11,186 (67) 1,274 933 404 23,615

Ratio Analysis Particulars (Rs Mn) FY10A FY11A FY12A FY13E FY14E

Current Ratio Cash Ratio Interest Coverage Ratio Debt Equity Ratio ROCE

2.8 0.2 0.3 1.0 7%

4.9 1.1 0.4 1.3 9%

1.9 0.3 0.5 1.2 9%

3.2 0.4 0.5 1.2 9%

3.0 0.3 0.5 1.1 9%

www.fullertonsecurities.co.in

Page | 7

June 08, 2012 BOARD OF DIRECTORS

Board Of Directors Director Name Current Position Description

Biswajit Choudhuri

Shri. Biswajit Choudhuri has been appointed as Non-Executive Independent Chairman of the Board of Godawari Power And Ispat Ltd., effective November 09, 2011. He is a Mechanical Engineer from the Indian Institute of Technology, Kharagpur and is a Fellow Member of the Institute of the Cost and Works Accountants of India. He is an honorary fellow member ot the Indian Institute of Banking and Finance. He has over forty four years ot experience in the fields of engineering, management, banking and finance, He was the Chairman and Managing Director of the United Bank of India Non-Executive Independent Chairman of the Board from 1996 to 2001. He was associated with UCO Bank as an Executive Director on its board from 1992 to 1993. He has also been associated with the British Oxygen Company from 1963 to 1972 as part of their management cadre. He is currently on the boards of Bihar Caustic and Chemicals Limited, Orind Exports Limited, Aekta Limited, DIC India Limited, Bengal Sunny Rock Estate Housing Development Company Limited, Hindusthan Engineering and Industries Limited, Shalzip Industries Limited and A. V. Investments and Dealers Limited. He is not holding any shares in the Company.

Dinesh Gandhi

Shri. Dinesh Kumar Gandhi is Non-Independent Whole Time Director - Finance, Director of Godawari Power And Ispat Ltd. He is a qualified Chartered Accountant and Company secretary. Mr. Gandhi has more than 18 years of post qualification experience in different Industries particularly the steel Non-Independent Whole Time Director - Finance, industry in areas like Accounts, Finance, Project Planning and Financing. He started his career at Mepco Metal Powders Ltd. as Manager, Finance and Director worked there for 4 years. He then worked as an independent financial consultant to various industrial houses in Madhya Pradesh. Subsequently, he worked at Indore Steel & Iron Mills Ltd. and Shri Ishar Alloy Steels Ltd. for a period of 7 years as Vice President (Finance ). He then joined Reliance Info comm as Commercial Head, Raipur cluster and worked there for 3 years before joining the Company.

Bajrang Agrawal

Shri. Bajrang Lal Agrawal is Managing Director and Non-Independent Whole Time Director of Godawari Power And Ispat Ltd. He is an Electronic Managing Director, Non-Independent Whole Time Engineer from Pandit Ravi Shakar Shukla University, Raipur. While his family concentrated on setting up a tyre trading business, he sought out the Director more challenging vocation of industrial entrepreneurship. He is Chairman of All India Sponge Iron Manufacturers Association (SIMA). He is Former Chairman of Confederation of Indian Industries, Chhattisgarh Chapter.

Abhishek Agrawal

Additional Non-Independent Executive Director

Shri. Abhishek Agrawal is serving as Additional Non-Independent Executive Director in the Board

Vinod Pillai

Non-Independent Whole Time Director

Shri. Vinod Pillai is Non-Independent Whole Time Director of Godawari Power And Ispat Ltd., since June 1, 2011. He is a Commerce Graduate from Pt. Ravi Shankar Shukla University, Raipur. He serves on the Board of M/s Hira Cement Limited. He has experience in purchase, sales, liasioning, administration and logistics management. He joined M/s Hira Cement Limited as Marketing Executive in the year 1989 to look after sales, administration and liasioning activities. In the year 1997 he joined M/s Hira Steels Limited as Deputy General Manager (Marketing & Liasioning) and was looking after the purchase of various steel items required for setting up of the project and after commissioning of the project, he was looking after purchase of raw materials, sale of finished goods, liasioning with suppliers, government agencies, local authorities etc. He was also looking after the logistics. In the year 2000, he joined M/s R. R. Ispat Limited as General Manager (Marketing & Liasioning) and subsequently promoted to Vice President (Marketing & Liasioning) and has been looking after similar activities like purchase of steel items required for the project, sale of finished goods, logistics management and liasioning with various outside authorities. M/s R. R. Ispat Limited has now been merged with the Company.

Dinesh Agrawal

Non-Independent Non-Executive Director

Shri. Dinesh Kumar Agrawal has been appointed as Non-Independent Non-Executive Director of Godawari Power And Ispat Ltd., effective November 09, 2011. He is an Electronic Engineer from Pune University. He is a promoter of the Company and has been associated with the technical aspects of Ferro Alloys Unit and the Steel Rolling Mills in the past. He was the Managing Director of the Companys 100% subsidiary M/s R. R. Ispat Limited which has been merged with the Company. He is currently involved with the day to day administration of the technical aspects of the various projects of the company. He has been associated with the Company since incorporation.

Shashi Kumar

Non-Executive Independent Director

Shri. Shashi Kumar is Non-Executive Independent Director of Godawari Power And Ispat Ltd. He is a graduate from the Indian School of Mines, Dhanbad and also holds an AISM Diploma in Mining. He is a member of the Mining, Geological and metallurgical Institute of India and the Indian Institute of Engineers. He has around three decades of experience in the mining industry. He was appointed as the technical director of Coal India Limited (CIL) in 2001 and from 2005 to 2006, he was appointed as CILs the Chairman and Managing Director. He is currently on the boards of Neyveli Lignite Corporation Limited, Shyam DRI Power Limited, Jessop and Company Limited and Rashmi Metahks Limited. He is not holding any shares in the Company.

Bhrigu Ojha

Non-Executive Independent Director

Shri. Bhrigu Nath Ojha is Non-Executive Independent Director of Godawari Power And Ispat Ltd. He is Bachelor of Electrical Engineering from B. I. T., Sindri and also holds a diploma in Senior Management Program from Cranford School of Management, U.K. He has over 40 years of experience in Power sector in building, developing, managing and directing Power sector organizations to success, He is fully capable of and representing organizations and undertaking high level roles and in matters related to power industry, government issues, commerce and media. He was the Chairman of CIGRE India High Voltage Equipment Technical Committee and a member of CIGRE International Council on Electric System, France. He was also associated with National Thermal Power Corporation from 1996-2003.

www.fullertonsecurities.co.in

Page | 8

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Stermon Mills - Group ADocument16 pagesStermon Mills - Group AAniruddha MajumderNo ratings yet

- KFC CompleteDocument18 pagesKFC CompleteMuhammad Asif AyazNo ratings yet

- Lesson 1 Revisiting Economics As A Social ScienceDocument2 pagesLesson 1 Revisiting Economics As A Social ScienceJay92% (26)

- Industry Report Card April 2018Document16 pagesIndustry Report Card April 2018didwaniasNo ratings yet

- Rbi Allowed Banks To Increase Limit From 10 To 15 PercentDocument10 pagesRbi Allowed Banks To Increase Limit From 10 To 15 PercentdidwaniasNo ratings yet

- 0hsie F PDFDocument416 pages0hsie F PDFchemkumar16No ratings yet

- Rain Industries: CMP: INR381 TP: INR480 (+26%) Carbon Prices and Margins Continue To ImproveDocument8 pagesRain Industries: CMP: INR381 TP: INR480 (+26%) Carbon Prices and Margins Continue To ImprovedidwaniasNo ratings yet

- Information Technology: Covid-19, Oil Price Dip To Pose Near Term HeadwindsDocument8 pagesInformation Technology: Covid-19, Oil Price Dip To Pose Near Term HeadwindsdidwaniasNo ratings yet

- Idfc QTR FinancialsDocument2 pagesIdfc QTR FinancialsdidwaniasNo ratings yet

- BandhanBank 15 3 18 PLDocument1 pageBandhanBank 15 3 18 PLdidwaniasNo ratings yet

- Weekly Technical PicksDocument4 pagesWeekly Technical PicksMaruthee SharmaNo ratings yet

- Financials 7-11-08Document6 pagesFinancials 7-11-08didwaniasNo ratings yet

- APL Apollo Antique Stock Broking Coverage Aprl 17Document17 pagesAPL Apollo Antique Stock Broking Coverage Aprl 17didwaniasNo ratings yet

- Sensex AnalysisDocument2 pagesSensex AnalysisdidwaniasNo ratings yet

- Bandhan Bank Building Strong Franchise Through Retail FocusDocument13 pagesBandhan Bank Building Strong Franchise Through Retail FocusdidwaniasNo ratings yet

- MARKET ESTIMATES FOR Sep, 2008 Results To Be Announced TodayDocument2 pagesMARKET ESTIMATES FOR Sep, 2008 Results To Be Announced TodaydidwaniasNo ratings yet

- Sponge Iron Industry B K Oct 06 PDFDocument30 pagesSponge Iron Industry B K Oct 06 PDFdidwaniasNo ratings yet

- Shareholding Pattern BSEDocument3 pagesShareholding Pattern BSEdidwaniasNo ratings yet

- Mawana FinancialsDocument8 pagesMawana FinancialsdidwaniasNo ratings yet

- Income & Growth One Pager 06302008Document2 pagesIncome & Growth One Pager 06302008didwaniasNo ratings yet

- IDEA One PagerDocument6 pagesIDEA One PagerdidwaniasNo ratings yet

- 'A' Grade Turnaround: Associated Cement CompaniesDocument3 pages'A' Grade Turnaround: Associated Cement CompaniesdidwaniasNo ratings yet

- BHEL One PagerDocument1 pageBHEL One PagerdidwaniasNo ratings yet

- IFLEX One PagerDocument1 pageIFLEX One PagerdidwaniasNo ratings yet

- IAG+ +India+Strategy+ (June+08)Document17 pagesIAG+ +India+Strategy+ (June+08)api-3862995No ratings yet

- Citizens Guide 2008Document12 pagesCitizens Guide 2008DeliajrsNo ratings yet

- 24 Jun 08 - BHELDocument4 pages24 Jun 08 - BHELdidwaniasNo ratings yet

- The Subprime Meltdown: Understanding Accounting-Related AllegationsDocument7 pagesThe Subprime Meltdown: Understanding Accounting-Related AllegationsdidwaniasNo ratings yet

- HSBC Private Bank Strategy MattersDocument4 pagesHSBC Private Bank Strategy MattersdidwaniasNo ratings yet

- IAG+ +India+Strategy+ (June+08)Document17 pagesIAG+ +India+Strategy+ (June+08)api-3862995No ratings yet

- CKP PresentationDocument39 pagesCKP PresentationdidwaniasNo ratings yet

- Sanjiv KaulDocument18 pagesSanjiv KaulsdNo ratings yet

- Kpo VsbpoDocument3 pagesKpo VsbposdNo ratings yet

- Compare Honda City, Ford Fiesta and Mitsubishi AttrageDocument4 pagesCompare Honda City, Ford Fiesta and Mitsubishi AttrageDHANASEKAR NATARAJANNo ratings yet

- COST ACCOUNTING 1-6 FinalDocument22 pagesCOST ACCOUNTING 1-6 FinalChristian Blanza Lleva0% (1)

- IOIPROPDocument40 pagesIOIPROPSaifuliza Omar83% (6)

- MTF of Wheat - 5Document18 pagesMTF of Wheat - 5chengadNo ratings yet

- Chapter 7 - Decision Making With Risk and UncertaintyDocument10 pagesChapter 7 - Decision Making With Risk and UncertaintyJeremiah NcubeNo ratings yet

- CIMA p1 March 2011 Post Exam GuideDocument18 pagesCIMA p1 March 2011 Post Exam GuidearkadiiNo ratings yet

- CASE STUDY - Rural Buyer BehaviourDocument6 pagesCASE STUDY - Rural Buyer Behaviourrakeshgopinath499957% (14)

- Session 2 CBA Valuing Benefit and Cost Primary MarketsDocument21 pagesSession 2 CBA Valuing Benefit and Cost Primary MarketsShabahul ArafiNo ratings yet

- FM Crash Course Material 111Document65 pagesFM Crash Course Material 111Safwan Abdul GafoorNo ratings yet

- Test Paper 1Document15 pagesTest Paper 1NancyLavye50% (6)

- Tender Documentation GuideDocument34 pagesTender Documentation GuidemusthaqhassanNo ratings yet

- Brokers' Perceptions of Derivative Trading in Indian Stock MarketsDocument14 pagesBrokers' Perceptions of Derivative Trading in Indian Stock MarketsJagannath G EswaranNo ratings yet

- WK5 - S1 - Intro To Supply Chain Management - 2223 - Tri 1Document55 pagesWK5 - S1 - Intro To Supply Chain Management - 2223 - Tri 1patricia njokiNo ratings yet

- New Heritage Doll Company Write-Up Essay Example For FreeDocument5 pagesNew Heritage Doll Company Write-Up Essay Example For FreeCarlosNo ratings yet

- The Effects of Protectionist Policies On International TradeDocument23 pagesThe Effects of Protectionist Policies On International TradeGlobal Research and Development ServicesNo ratings yet

- Advantages and disadvantages of holding companiesDocument2 pagesAdvantages and disadvantages of holding companiestheekshanaNo ratings yet

- 7 Iskandar Investment Tips - StarpropertyDocument5 pages7 Iskandar Investment Tips - StarpropertyFong KhNo ratings yet

- MaterialDocument5 pagesMaterialQuestionscastle FriendNo ratings yet

- BMW 3 Series 325i Saloon ReviewDocument10 pagesBMW 3 Series 325i Saloon ReviewHaroldNo ratings yet

- Dissertation: Analysis, Impact and The Future of CryptocurrenciesDocument41 pagesDissertation: Analysis, Impact and The Future of Cryptocurrenciesjoseph mainaNo ratings yet

- Separation of Ownership and ControlDocument4 pagesSeparation of Ownership and ControldishaNo ratings yet

- Name: E-Mail: Cell Phone Number:: Balance Sheet Initial 1st MonthDocument3 pagesName: E-Mail: Cell Phone Number:: Balance Sheet Initial 1st MonthEmiliano Mancilla SilvaNo ratings yet

- Marketing StrategyDocument7 pagesMarketing StrategyAnonymous oklXbtc8No ratings yet

- Gashub - 2018Document23 pagesGashub - 2018Ricky PrasetyaNo ratings yet

- Mark Scheme Q4 MicroeconomicsDocument5 pagesMark Scheme Q4 MicroeconomicsVittoria RussoNo ratings yet

- Marginal AbsorptionDocument4 pagesMarginal Absorptionbalachmalik100% (1)

- Leverage ActivityDocument2 pagesLeverage ActivitySamNo ratings yet