Professional Documents

Culture Documents

Quiz

Uploaded by

Juan Rafael FernandezCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Quiz

Uploaded by

Juan Rafael FernandezCopyright:

Available Formats

Question 1 Complete Mark 1 out of 1 Question text A company that is in the process of liquidation had the following liabilities:

Income Taxes P10,000 Notes Payable secured by land 100,000 Accounts Payable 51,050 Salaries Payable (P10,950 to a contractual employee and P2,000 to a regular employee) 12,950 Administrative Expenses for liquidation20,000 The company had the following assets: Book Value Fair Value Current Assets P100,000 P95,000 Land 50,000 75,000 Building 150,000 200,000 Determine total free assets before deducting preferred creditors Select one: a. P75,000 b. P270,000 c. P295,000 d. P275,000 Question 2 Complete Mark 1 out of 1Question text A company that is in the process of liquidation had the following liabilities: Income Taxes P10,000 Notes Payable secured by land 100,000 Accounts Payable 51,050 Salaries Payable (P10,950 to a contractual employee and P2,000 to a regular employee) 12,950

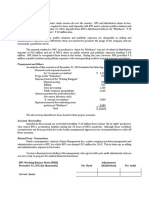

Administrative Expenses for liquidation 20,000 The company had the following assets: Book Value Fair Value Current Assets P100,000P95,000 Land 50,000 75,000 Building 150,000 200,000 Determine the net free assets before deducting preferred creditors: Select one: a. P251,000 b. P226,000 c. P252,050 d. P247,050 Question 3 Complete Mark 1 out of 1 Question text The BSA CORP is in the process of liquidation and has the following accounts and balances as of December 31, 2020 prior to its application for liquidation: Accounts Payable 189,875-105000=84875 Accounts Receivable 596,400 Bank Loan Payable 385,000 Bonds Payable 700,000-630000=70000 Building, net 603,750 Cash 199,850 Goodwill 96,250 Merchandise Inventory 140,000-92750= Note Payable 140,000 Ordinary Share 210,000

Prepaid Insurance 4,375 Retained Earnings (71,750)Salaries Payable 87,500 The bonds payable is secured by the building with a net realizable value of P630,000. Of the total accounts payable, P105,000 is secured by twenty-five percent of the accounts receivable which is estimated to be eighty percent collectible. Seventy-five percent of the accounts receivable has a realizable value of P411,250 was used to secure the bank loan payable. The inventory has a realizable value of P92,750. In addition to the recorded liabilities are accrued interest on bonds payable of P7,000, liquidation expenses of P4,375, and taxes of P5,250. Compute for the settlement to UNSECURED creditors: Select one: a. P236,007 b. P490,000 c. P175,807 d. P690,199 Question 4 Complete Mark 0 out of 1 Question text A company that is in the process of liquidation had the following liabilities: Income Taxes P10,000 Notes Payable secured by land 100,000 Accounts Payable 51,050 Salaries Payable (P10,950 to a contractual employee and P2,000 to a regular employee) 12,950Administrative Expenses for liquidation 20,000 The company had the following assets: Book Value Fair Value Current Assets P100,000 P95,000 Land 50,000 75,000 Building 150,000 200,000

Determine the total unsecured creditors: Select one: a. P51,050 b. P76,050 c. P85,000 d. P44,000 Question 5 Complete Mark 0 out of 1 Question text The unsecured creditors of INSOLVENT CORP filed a petition on July 1, 2008 to force the company into bankruptcy. The court order for relief was granted on July 10 at which time an interim trustee was appointed to supervise the liquidation procedure. A listing of assets and liabilities of the company as of July 10, 2008, along with estimated realizable values, is as follows: Accounts Book Value Realizable Value Cash 61,400 P61,400 Accounts Receivable 250,000 15% of the accounts receivable is estimated to be uncollectible Allowance for Bad Debts (20,000) Inventories 420,000 Estimated selling price, P340,000 which will require additional costs of P50,000 Prepayments 40,000 ? Investments 180,000 P110,000 Land 210,000 An offer of P500,000 has been received for land and building Building, net 260,000 Machinery and Equipment 220,000 P53,900 Goodwill 200,000 ? Accounts Payable 670,000 Wages Payable 3,400 Notes Payable 160,000 Accrued Interest on Notes 5,000 Mortgage Payable 400,000 Secured by land and building Ordinary Share 800,000 Additional Paid-in Capital 80,000 Deficit (297,000) Additional information: Patents completely written-off the books in past years but with a realizable value of P10,000. The books do not show the following accruals: taxes P16,400 and interest on mortgage P10,000 The investment have been pledged as security for holder of the notes payable The trustee fees and other costs of liquidating the estate are estimated to be P60,000

Compute the estimated amount to be paid to partially secured creditors: Select one: a. P165,000 b. P158,400 c. P60,000 d. P79,800 e. P110,000 Question 6 Complete Mark 1 out of 1 Question text The following information are related to BSBA CORP that is undergoing liquidation:A bank loan amounting to P227,500 is secured by inventories with carrying value of P262,500 and net realizable value of P175,000. Of the P560,000 accounts payable, P171,500 is secured by accounts receivable amounting to P206,500 which is ninety percent collectible. Property and equipment costing P437,500 and which is depreciated by twenty percent has a net realizable value of P294,000. Other unrecorded liabilities are accrued interest payable on bank loan, P22,750; salaries payable, P56,000; taxes payable, P31,500; liquidation expenses, P26,250. Cash available before liquidation amounts to P43,750. Compute for the estimated deficiency to unsecured creditors: Select one: a. P463,750 b. P490,000 c. P441,000 d. P225,000 Question 7 Complete Mark 0 out of 1 Question text The unsecured creditors of INSOLVENT CORP filed a petition on July 1, 2008 to force the company into bankruptcy. The court order for relief was granted on July 10 at which time an interim trustee was appointed to supervise the liquidation procedure. A listing of assets and liabilities of the company as of July 10, 2008, along with estimated realizable values, is as follows: Accounts Book Value Realizable Value Cash 61,400 P61,400 Accounts Receivable250,000 15% of the accounts receivable is estimated to be uncollectible

Allowance for Bad Debts (20,000) Inventories 420,000 Estimated selling price, P340,000 which will require additional costs of P50,000 Prepayments 40,000 ? Investments 180,000 P110,000 Land 210,000 An offer of P500,000 has been received for land and building Building, net260,000 Machinery and Equipment, net 220,000 P53,900 Goodwill 200,000 ? Accounts Payable 670,000 Wages Payable 3,400 Notes Payable 160,000 Accrued Interest on Notes5,000 Mortgage Payable 400,000 Secured by land and building Ordinary Share 800,000 Additional Paid-in Capital 80,000 Deficit (297,000) Additional information: Patents completely written-off the books in past years but with a realizable value of P10,000. The books do not show the following accruals: taxes P16,400 and interest on mortgage P10,000 The investment have been pledged as security for holder of the notes payable The trustee fees and other costs of liquidating the estate are estimated to be P60,000Compute the estimated amount to be paid to preferred creditors: Select one:

a. P79,800 b. P60,000 c. P110,000 d. P165,000 e. P158,400 Question 8 Complete Mark 1 out of 1 Question text The unsecured creditors of INSOLVENT CORP filed a petition on July 1, 20... PM Question 8 Complete Mark 1 out of 1 Question text The unsecured creditors of INSOLVENT CORP filed a petition on July 1, 2008 to force the company into bankruptcy. The court order for relief was granted on July 10 at which time an interim trustee was appointed to supervise the liquidation procedure. A listing of assets and liabilities of the company as of July 10, 2008, along with estimated realizable values, is as follows: Accounts Book Value Realizable Value Cash 61,400 P61,400 Accounts Receivable 250,000 15% of the accounts receivable is estimated to be uncollectible Allowance for Bad Debts(20,000) Inventories 420,000 Estimated selling price, P340,000 which will require additional costs of P50,000 Prepayments 40,000 ? Investments 180,000 P110,000 Land 210,000 An offer of P500,000 has been received for land and building Building, net 260,000 Machinery and Equipment, net

220,000P53,900 Goodwill 200,000 ? Accounts Payable 670,000 Wages Payable 3,400 Notes Payable 160,000 Accrued Interest on Notes 5,000 Mortgage Payable400,000 Secured by land and building Ordinary Share 800,000 Additional Paid-in Capital 80,000 Deficit (297,000) Additional information: Patents completely written-off the books in past years but with a realizable value of P10,000. The books do not show the following accruals: taxes P16,400 and interest on mortgage P10,000 The investment have been pledged as security for holder of the notes payable The trustee fees and other costs of liquidating the estate are estimated to be P60,000 Compute total free assets Select one: a. P1,831,400 b. P1,821,400 c. P638,000 d. P717,800 Question 9 Complete Mark 1 out of 1 Question text The unsecured creditors of INSOLVENT CORP filed a petition on July 1, 2008 to force the company into bankruptcy. The court order for relief was granted on July 10 at which time an interim trustee was appointed to supervise the liquidation procedure. A listing of assets and liabilities of the company as of July 10, 2008, along with estimated realizable values, is as follows: Accounts Book Value Realizable Value

Cash 61,400 P61,400 Accounts Receivable 250,000 15% of the accounts receivable is estimated to be uncollectible Allowance for Bad Debts (20,000) Inventories 420,000Estimated selling price, P340,000 which will require additional costs of P50,000 Prepayments 40,000 ? Investments 180,000 P110,000 Land 210,000 An offer of P500,000 has been received for land and building Building, net 260,000 Machinery and Equipment, net 220,000 P53,900 Goodwill 200,000? Accounts Payable 670,000 Wages Payable 3,400 Notes Payable 160,000 Accrued Interest on Notes 5,000 Mortgage Payable 400,000 Secured by land and building Ordinary Share800,000 Additional Paid-in Capital 80,000 Deficit (297,000) Additional information: Patents completely written-off the books in past years but with a realizable value of P10,000. The books do not show the following accruals: taxes P16,400 and interest on

mortgage P10,000 The investment have been pledged as security for holder of the notes payable The trustee fees and other costs of liquidating the estate are estimated to be P60,000 Compute estimated deficiency to unsecured creditors Select one: a. P27,000 b. P7,200 c. 87,000 d. P47,800

Question 10 Complete Mark 0 out of 1 Question text The unsecured creditors of INSOLVENT CORP filed a petition on July 1, 2008 to force the company into bankruptcy. The court order for relief was granted on July 10 at which time an interim trustee was appointed to supervise the liquidation procedure. A listing of assets and liabilities of the company as of July 10, 2008, along with estimated realizable values, is as follows:Accounts Book Value Realizable Value Cash 61,400 P61,400 Accounts Receivable 250,000 15% of the accounts receivable is estimated to be uncollectible Allowance for Bad Debts (20,000) Inventories 420,000 Estimated selling price, P340,000 which will require additional costs of P50,000 Prepayments 40,000? Investments 180,000 P110,000 Land 210,000 An offer of P500,000 has been received for land and building Building, net 260,000 Machinery and Equipment, net 220,000 P53,900

Goodwill 200,000 ? Accounts Payable 670,000Wages Payable 3,400 Notes Payable 160,000 Accrued Interest on Notes 5,000 Mortgage Payable 400,000 Secured by land and building Ordinary Share 800,000 Additional Paid-in Capital 80,000Deficit (297,000) Additional information: Patents completely written-off the books in past years but with a realizable value of P10,000. The books do not show the following accruals: taxes P16,400 and interest on mortgage P10,000 The investment have been pledged as security for holder of the notes payable The trustee fees and other costs of liquidating the estate are estimated to be P60,000 Compute the expected recovery percentage of unsecured creditors: Select one: a. 96.00% b. 88.00% c. 86.62% d. 95.00%

You might also like

- 11.11.2017 Audit of PPEDocument9 pages11.11.2017 Audit of PPEPatOcampoNo ratings yet

- Activity 1 Home Office and Branch Accounting - General ProceduresDocument4 pagesActivity 1 Home Office and Branch Accounting - General ProceduresDaenielle EspinozaNo ratings yet

- Instruction: Show Your Solution. No Solution Incorrect AnswerDocument1 pageInstruction: Show Your Solution. No Solution Incorrect AnswerRian ChiseiNo ratings yet

- CMO No.03 s2007Document225 pagesCMO No.03 s2007Pao AuxteroNo ratings yet

- CMPC312 QuizDocument19 pagesCMPC312 QuizNicole ViernesNo ratings yet

- AFAR Review Net Asset AcquisitionDocument12 pagesAFAR Review Net Asset AcquisitionThom Santos Crebillo100% (1)

- RewDocument69 pagesRewMargenete Casiano100% (2)

- Practical Accounting 2 Review Prelim Exam SolutionsDocument5 pagesPractical Accounting 2 Review Prelim Exam SolutionsRen EyNo ratings yet

- Activity Task Business CombinationDocument7 pagesActivity Task Business CombinationCasper John Nanas MuñozNo ratings yet

- Rmyc SGV Cup Final Round QM Copy v1Document15 pagesRmyc SGV Cup Final Round QM Copy v1Darelle Hannah MarquezNo ratings yet

- PRTC 1st Preboard Solution GuideDocument48 pagesPRTC 1st Preboard Solution GuideAnonymous Lih1laax100% (2)

- Afar 02 P'ship Operation QuizDocument4 pagesAfar 02 P'ship Operation QuizJohn Laurence LoplopNo ratings yet

- Quiz 2 - Corp Liqui and Installment SalesDocument8 pagesQuiz 2 - Corp Liqui and Installment SalesKenneth Christian WilburNo ratings yet

- Business Combination Comprehensive ExamDocument4 pagesBusiness Combination Comprehensive ExamRose VeeNo ratings yet

- PDF Advanced Accounting Solman CompressDocument91 pagesPDF Advanced Accounting Solman CompressLeah Mae NolascoNo ratings yet

- Psa 220 Focus NotesDocument2 pagesPsa 220 Focus NotesCathryn Alcantara100% (1)

- Practical Accounting 2 4Document13 pagesPractical Accounting 2 4AB CloydNo ratings yet

- PSA 230 (RED) "Audit Documentation": (Effectivity Date: December 15, 2009)Document20 pagesPSA 230 (RED) "Audit Documentation": (Effectivity Date: December 15, 2009)Christine NicoleNo ratings yet

- AP.2906 InvestmentsDocument6 pagesAP.2906 InvestmentsmoNo ratings yet

- Palmones, Jayhan Grace M. QuizDocument6 pagesPalmones, Jayhan Grace M. QuizjayhandarwinNo ratings yet

- 1PB - Ar6Document12 pages1PB - Ar6KimNo ratings yet

- Auditing Theory - Internal Control ConsiderationDocument11 pagesAuditing Theory - Internal Control ConsiderationNeil BacaniNo ratings yet

- Prac 2Document10 pagesPrac 2Fery AnnNo ratings yet

- This Is RealDocument17 pagesThis Is RealCheemee LiuNo ratings yet

- G.M4 HW GWDocument3 pagesG.M4 HW GWClint Agustin M. RoblesNo ratings yet

- Auditing fraud risk factors and responsibilitiesDocument2 pagesAuditing fraud risk factors and responsibilitiesnhbNo ratings yet

- Chapter 11-Investments in Noncurrent Operating Assets-Utilization and RetirementDocument33 pagesChapter 11-Investments in Noncurrent Operating Assets-Utilization and RetirementYukiNo ratings yet

- Business Combinations ExplainedDocument8 pagesBusiness Combinations ExplainedLabLab ChattoNo ratings yet

- Auditing Cup - 19 Rmyc Answer Key Final Round House StarkDocument13 pagesAuditing Cup - 19 Rmyc Answer Key Final Round House StarkCarl John PlacidoNo ratings yet

- An SME Prepared The Following Post Closing Trial Balance at YearDocument1 pageAn SME Prepared The Following Post Closing Trial Balance at YearRaca DesuNo ratings yet

- Practical Accounting 1: I ExamcoverageDocument12 pagesPractical Accounting 1: I ExamcoverageCharry Ramos0% (2)

- Seatwork Income MaDocument3 pagesSeatwork Income MaJoyce Ann Agdippa Barcelona0% (1)

- Consolidated Statement of Financial Position - Date of Acquisition AnalysisDocument2 pagesConsolidated Statement of Financial Position - Date of Acquisition AnalysisKharen Valdez0% (1)

- Test-Bank-Advanced-Accounting-3 By-Jeter-10-ChapterDocument20 pagesTest-Bank-Advanced-Accounting-3 By-Jeter-10-Chapterjhean dabatosNo ratings yet

- Sol Man - MC PTXDocument5 pagesSol Man - MC PTXiamjan_101No ratings yet

- Not-for-Profit Organization Revenue and Asset ClassificationsDocument3 pagesNot-for-Profit Organization Revenue and Asset ClassificationsSid TuazonNo ratings yet

- Advanced Accounting - Volume 1Document4 pagesAdvanced Accounting - Volume 1Erica CaliuagNo ratings yet

- Cpareviewschoolofthephilippines ChanchanDocument8 pagesCpareviewschoolofthephilippines ChanchanDavid David100% (1)

- CHAPTER 8 - Audit of Liabilities: Problem 1Document27 pagesCHAPTER 8 - Audit of Liabilities: Problem 1Mikaela Gale CatabayNo ratings yet

- TX 1102 Deductions from Gross Income Itemized and Special DeductionsDocument10 pagesTX 1102 Deductions from Gross Income Itemized and Special DeductionsJulz0% (1)

- A Government Employee May Claim The Tax InformerDocument3 pagesA Government Employee May Claim The Tax InformerYuno NanaseNo ratings yet

- Chapter 1 - An Introduction To Audit and Other Assurance ServicesDocument10 pagesChapter 1 - An Introduction To Audit and Other Assurance ServicesCharry May DelaCruz GalvanFaustinoNo ratings yet

- STANDARD COSTING AND VARIANCE ANALYSIS (Repaired)Document24 pagesSTANDARD COSTING AND VARIANCE ANALYSIS (Repaired)Arlyn Alonzo100% (1)

- Auditing Problems Final Preboard Examination Batch 87 SET: Cpa Review School of The Philippines ManilaDocument12 pagesAuditing Problems Final Preboard Examination Batch 87 SET: Cpa Review School of The Philippines ManilaMarwin AceNo ratings yet

- Chapter 2 discussion questions and problemsDocument3 pagesChapter 2 discussion questions and problemsMuhammad Ullah0% (1)

- What A ProblemDocument4 pagesWhat A ProblemEleazar SalazarNo ratings yet

- Chapter 1: IntroductionDocument143 pagesChapter 1: IntroductionmarieieiemNo ratings yet

- Sample Midterm PDFDocument9 pagesSample Midterm PDFErrell D. GomezNo ratings yet

- Consolidation at Acquisition DateDocument29 pagesConsolidation at Acquisition DateLee DokyeomNo ratings yet

- CPALEDocument1 pageCPALERalph Clarence NicodemusNo ratings yet

- ATDocument15 pagesATSamanthaNo ratings yet

- Bus Com 7Document5 pagesBus Com 7Chabelita MijaresNo ratings yet

- LTCC Quiz W AnsDocument4 pagesLTCC Quiz W AnsalyNo ratings yet

- AFARDocument12 pagesAFARsino akoNo ratings yet

- Corporate LiquidationDocument2 pagesCorporate LiquidationKristienalyn De Asis33% (3)

- Pa2 M-1415Document4 pagesPa2 M-1415Ronnelson PascualNo ratings yet

- Quiz - Corporate LiquidationDocument3 pagesQuiz - Corporate LiquidationJoyce Ann CortezNo ratings yet

- Module 2 - Business Combinations (Hand-Outs 2)Document3 pagesModule 2 - Business Combinations (Hand-Outs 2)Darryl AgustinNo ratings yet

- Lesson 6 Corporate LiquidationDocument11 pagesLesson 6 Corporate Liquidationheyhey100% (2)

- APCAS Advanced Financial Accounting I ExamDocument12 pagesAPCAS Advanced Financial Accounting I ExamGemine Ailna Panganiban NuevoNo ratings yet

- Milk and Honey PresentationDocument22 pagesMilk and Honey PresentationJuan Rafael FernandezNo ratings yet

- Improving Expenditure Cycle EfficiencyDocument21 pagesImproving Expenditure Cycle EfficiencyJuan Rafael FernandezNo ratings yet

- NotesDocument6 pagesNotesJuan Rafael FernandezNo ratings yet

- Case Study - NextCard Inc.Document3 pagesCase Study - NextCard Inc.Juan Rafael Fernandez0% (1)

- Journal EntriesDocument1 pageJournal EntriesJuan Rafael FernandezNo ratings yet

- Chapter 1 PWTDocument40 pagesChapter 1 PWTJuan Rafael FernandezNo ratings yet

- Perry Drug Stores SynopsisDocument2 pagesPerry Drug Stores SynopsisJuan Rafael FernandezNo ratings yet

- Synopsis LiventDocument1 pageSynopsis LiventJuan Rafael Fernandez100% (1)

- Chapter 17Document3 pagesChapter 17Juan Rafael FernandezNo ratings yet

- Outline of EnviDocument2 pagesOutline of EnviJuan Rafael FernandezNo ratings yet

- Advacc Environmenta AcctglDocument37 pagesAdvacc Environmenta AcctglJuan Rafael FernandezNo ratings yet

- Decision Trees Guide for Business DecisionsDocument17 pagesDecision Trees Guide for Business DecisionsJuan Rafael FernandezNo ratings yet

- Philex Corp ProfDocument5 pagesPhilex Corp ProfJuan Rafael FernandezNo ratings yet

- Quamet2 Lesson 5.3Document6 pagesQuamet2 Lesson 5.3Juan Rafael FernandezNo ratings yet

- Philippine Standards On Auditing: Review QuestionsDocument2 pagesPhilippine Standards On Auditing: Review QuestionsDave ManaloNo ratings yet

- INTFINA Lecture 1 Introduction To MoneyDocument13 pagesINTFINA Lecture 1 Introduction To MoneyJuan Rafael FernandezNo ratings yet

- Chapter 01 AnsDocument3 pagesChapter 01 AnsDave ManaloNo ratings yet

- Reflective Essay Assignment #8 - Managing Emotions and Coping With StressDocument2 pagesReflective Essay Assignment #8 - Managing Emotions and Coping With StressRej GarbosaNo ratings yet

- Restaurant Supervisor Job Description Job SummaryDocument3 pagesRestaurant Supervisor Job Description Job SummaryKumarSvNo ratings yet

- CWK-IDD-009-CC-2020: Reference Checking Consent and Authorization Form Candidate's Full NameDocument1 pageCWK-IDD-009-CC-2020: Reference Checking Consent and Authorization Form Candidate's Full NamePopa Alina-ManuelaNo ratings yet

- Impact of Dairy Subsidies in NepalDocument123 pagesImpact of Dairy Subsidies in NepalGaurav PradhanNo ratings yet

- Seguridad Boltec Cable PDFDocument36 pagesSeguridad Boltec Cable PDFCesar QuintanillaNo ratings yet

- Concept PaperDocument6 pagesConcept Paperapple amanteNo ratings yet

- CASR Part 830 Amdt. 2 - Notification & Reporting of Aircraft Accidents, Incidents, or Overdue Acft & Investigation OCRDocument17 pagesCASR Part 830 Amdt. 2 - Notification & Reporting of Aircraft Accidents, Incidents, or Overdue Acft & Investigation OCRHarry NuryantoNo ratings yet

- Hospital & Clinical Pharmacy Q&ADocument22 pagesHospital & Clinical Pharmacy Q&AKrishan KumarNo ratings yet

- Deadline Anchors BrochureDocument3 pagesDeadline Anchors Brochurejlmunozv100% (2)

- Platinum Gazette 29 November 2013Document12 pagesPlatinum Gazette 29 November 2013Anonymous w8NEyXNo ratings yet

- Sampling & Data AssayDocument22 pagesSampling & Data AssayFerdinand SiahaanNo ratings yet

- Build Size and Aesthetics with the 6-Week Hype Gains Hypertrophy ProgramDocument21 pagesBuild Size and Aesthetics with the 6-Week Hype Gains Hypertrophy ProgramDanCurtis100% (1)

- 5 S Principles ExplainedDocument30 pages5 S Principles Explainedamaresh nkNo ratings yet

- Assessing Inclusive Ed-PhilDocument18 pagesAssessing Inclusive Ed-PhilElla MaglunobNo ratings yet

- 6V Plush Ride-On: Owner'S ManualDocument26 pages6V Plush Ride-On: Owner'S ManualVisas LaredoNo ratings yet

- 01 Slug CatchersDocument23 pages01 Slug CatchersMohamed Sahnoun100% (2)

- Vietnam Snack Market Grade BDocument3 pagesVietnam Snack Market Grade BHuỳnh Điệp TrầnNo ratings yet

- EDSP Quantitative and Qualitative FormDocument2 pagesEDSP Quantitative and Qualitative FormTalal SultanNo ratings yet

- Pakistan List of Approved Panel PhysicianssDocument5 pagesPakistan List of Approved Panel PhysicianssGulzar Ahmad RawnNo ratings yet

- Rice Research: Open Access: Black Rice Cultivation and Forming Practices: Success Story of Indian FarmersDocument2 pagesRice Research: Open Access: Black Rice Cultivation and Forming Practices: Success Story of Indian Farmersapi-420356823No ratings yet

- Asme NM.2-2018Document126 pagesAsme NM.2-2018aneeshjokay75% (4)

- Fiitjee JEE Adv p1 Phase II SolDocument10 pagesFiitjee JEE Adv p1 Phase II SolPadamNo ratings yet

- Therminol 55Document5 pagesTherminol 55Dinesh KumarNo ratings yet

- 220/132 KV Sub-Station Bhilai-3: Training Report ONDocument24 pages220/132 KV Sub-Station Bhilai-3: Training Report ONKalyani ShuklaNo ratings yet

- The Pentester BlueprintDocument27 pagesThe Pentester Blueprintjames smith100% (1)

- Temporomandibular Joint SyndromeDocument11 pagesTemporomandibular Joint SyndromeRahma RahmaNo ratings yet

- Fischer FBN II BoltDocument5 pagesFischer FBN II BoltJaga NathNo ratings yet

- Density of Aggregates: ObjectivesDocument4 pagesDensity of Aggregates: ObjectivesKit Gerald EliasNo ratings yet

- Jeffrey Ansloos - Indigenous Peoples and Professional Training in Psychology in CanadaDocument17 pagesJeffrey Ansloos - Indigenous Peoples and Professional Training in Psychology in CanadaleoNo ratings yet

- DNV Rules For Electrical Instal at IonsDocument80 pagesDNV Rules For Electrical Instal at Ionsnzjohn100% (3)