Professional Documents

Culture Documents

Calculations of Payback Period, Arr, NPV and Irr For Lighting Project

Uploaded by

Mushtaq Hussain KhanOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Calculations of Payback Period, Arr, NPV and Irr For Lighting Project

Uploaded by

Mushtaq Hussain KhanCopyright:

Available Formats

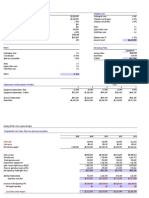

Calculations of PayBack Period, ARR, NPV and IRR for l

Total Investment

Less Woking Capital requirements

Total

Less short term investment

Long term debt requirements

95

15

80

40

40

WACC

Equity

Debt

Total Cost

WACC

Paybank Period

ARR (Average Cashflows/ Initial

Investment)

Financing

40

40

Interest Rate

20%

12%

Cost

8

4.8

12.8

16%

Year Net cash Flow Accumulated CF

1

17.3

17.3

2

24

41.3

3

29.5

70.8

4

32.5

103.3

5

38

141.3

6

41

182.3

7

46.1

228.4

8

49.5

277.9

9

55.4

333.3

10

60

393.3

3.69

49.16

Net Present Value:

Years

1

2

3

4

5

6

7

8

9

10

Present Value

Less: Initial Investment

Net Present Value

Internal Rate of Return

35%

Cash Inflows

17.3

24

29.5

32.5

38

41

46.1

49.5

55.4

60

PVIF

0.862

0.743

0.641

0.552

0.476

0.41

0.354

0.305

0.263

0.227

riod, ARR, NPV and IRR for lighting project

PV

14.91

17.83

18.91

17.94

18.09

16.81

16.32

15.1

14.57

13.62

164.1

80

84.1

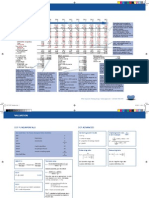

Calculations of PayBack Period, ARR, NPV and IRR for Switching

Total Investment

Less Woking Capital requirements

Total

Less Cash available

Long term debt requirements

110

25

85

40

45

WACC

Equity

Debt

Total Cost

WACC

Add: 2% risk

WACC

Financing

40

45

Interest Rate

0.20

11%

Cost

8

4.95

12.95

15.24%

2%

17.24%

Pay Back Period

Pay Back Period

Accounting Rate of Return

Years

1

2

3

4

5

6

7

8

9

10

3.72

Cashflows Accumulated CF

19.9

19.9

24.1

44

25.9

69.9

27.3

97.2

29.8

127

32

159

35.1

194.1

38.2

232.3

42

274.3

45.8

320

38%

Net Present Value

Years

1

2

3

4

5

6

7

8

9

10

Present Value

Initial Investment

Net Present Value

Internal Rate of Return

29%

Cashflows

19.9

24.1

25.9

27.3

29.8

32

35.1

38.2

42

45.8

PVIF

0.853

0.725

0.621

0.529

0.4513

0.385

0.3285

0.2802

0.2389

0.2038

PV

16.97

17.54

16.08

14.44

13.45

12.32

11.53

10.7

10.03

9.3

132.36

85

47.36

V and IRR for Switching project

Appendix 3

Calculations of PayBack Period, ARR, NPV and IRR for Both Projects

Total Investment required

205

Total

Less short term investment

Total financing required

Less cash available

Required long term

Debt by English Electronics

Debt from other sources

205

40

165

40

125

80

45

WACC Calculations

Equity

Debt from English Electronics

Debt from other Sources

Total Cost

Add: 2% risk

WACC

Financing Interest Rate

40

20%

80

11%

45

12%

13.45%

2%

Cost

8

8.8

5.4

15.45%

Payback Period

Payback Period

Accounting Rate of Return

Years

1

2

3

4

5

6

7

8

9

10

3.67

42%

Cashflows Accumulated CF

37.2

37.2

48.1

65.4

55.4

120.8

59.8

180.6

67.8

248.4

73

321.4

81.2

402.6

87.7

490.3

97.4

587.7

105.8

693.5

Net Present Value

Years

1

2

3

4

5

6

7

8

9

10

PV

Initial Investment

NPV

Internal Rate of Return

32%

Cashflows

37.2

48.1

55.4

59.8

67.8

73

81.2

87.7

97.4

105.8

PVIF

0.866

0.7502

0.6499

0.5629

0.4876

0.4223

0.3658

0.3168

0.2744

0.2377

PV

32.22

36.08

36

33.66

33.59

30.82

29.7

27.78

26.73

24.96

311.54

165

146.54

d IRR for Both Projects

You might also like

- W19196-PDF-EnG ChimpChange - How To Raise Capital To GrowDocument17 pagesW19196-PDF-EnG ChimpChange - How To Raise Capital To GrowbobbyNo ratings yet

- Calculate Lowest Acceptable Lease RateDocument4 pagesCalculate Lowest Acceptable Lease RateMuhammed Amjad IslamNo ratings yet

- 202E13Document24 pages202E13Sammy Ben MenahemNo ratings yet

- Capital Budgeting Practical Questions 1Document139 pagesCapital Budgeting Practical Questions 1Amita Bissa100% (1)

- Strauss Printing ServicesDocument5 pagesStrauss Printing ServicesYvonne BigayNo ratings yet

- ValuationDocument7 pagesValuationSumit Pol0% (1)

- Oper FrameworkDocument32 pagesOper Frameworkapi-313047789No ratings yet

- BDP Financial Final PartDocument14 pagesBDP Financial Final PartDeepak G.C.No ratings yet

- 1 2 3 4 5 6 7 8 9 File Name: C:/Courses/Course Materials/3 Templates and Exercises M&A Models/LBO Shell - Xls Colour CodesDocument46 pages1 2 3 4 5 6 7 8 9 File Name: C:/Courses/Course Materials/3 Templates and Exercises M&A Models/LBO Shell - Xls Colour CodesfdallacasaNo ratings yet

- NPV and IRRDocument7 pagesNPV and IRRWondim GenetNo ratings yet

- Capital Budgeting Techniques for Restaurant ExpansionDocument15 pagesCapital Budgeting Techniques for Restaurant ExpansionVinu DNo ratings yet

- Chapter 4Document5 pagesChapter 4Kamarulnizam ZainalNo ratings yet

- Financial Analysis and Planning Project 1Document43 pagesFinancial Analysis and Planning Project 1api-271895984No ratings yet

- Ie463 CHP5 (2010-2011)Document6 pagesIe463 CHP5 (2010-2011)Gözde ŞençimenNo ratings yet

- Financial EvaluationDocument27 pagesFinancial EvaluationRamani KNo ratings yet

- Simulasi CashflowDocument24 pagesSimulasi CashflowDeviSulistiaNo ratings yet

- Lecture ProfitabilityDocument42 pagesLecture ProfitabilityGLORIA GUINDOS BRETONESNo ratings yet

- Capital Budgeting NPV IrrDocument26 pagesCapital Budgeting NPV Irrkamarulz93_kzNo ratings yet

- SR No Particulars Amt (Rs in Lacs)Document20 pagesSR No Particulars Amt (Rs in Lacs)Payal PatelNo ratings yet

- Excel Solutions To CasesDocument38 pagesExcel Solutions To CaseselizabethanhdoNo ratings yet

- HorngrenIMA14eSM ch16Document53 pagesHorngrenIMA14eSM ch16Piyal HossainNo ratings yet

- FM 100 Cash Flow AnalysisDocument31 pagesFM 100 Cash Flow AnalysisChaiiNo ratings yet

- 05. LBO Model and Venture Capital Scenario AnalysisDocument73 pages05. LBO Model and Venture Capital Scenario Analysisharshit.dwivedi320No ratings yet

- Basic Leveraged Lease Example: NPV of Equity Cash FlowsDocument13 pagesBasic Leveraged Lease Example: NPV of Equity Cash FlowscatherinephilippouNo ratings yet

- Lost Rabbit Final Model 2.1.14Document459 pagesLost Rabbit Final Model 2.1.14the kingfishNo ratings yet

- Chapter 18: Financing and ValuationDocument35 pagesChapter 18: Financing and ValuationKoey TseNo ratings yet

- Value-Based ManagementDocument21 pagesValue-Based ManagementPrathamesh411No ratings yet

- Equity Chapter4Document12 pagesEquity Chapter4bingoNo ratings yet

- Eco Frame LTDDocument7 pagesEco Frame LTDewinzeNo ratings yet

- Equity ValuationDocument2,424 pagesEquity ValuationMuteeb Raina0% (1)

- Calculating Project NPV and Investment ConsiderationsDocument14 pagesCalculating Project NPV and Investment ConsiderationsMaster's FameNo ratings yet

- WACC of Project Wacc 12.5%Document2 pagesWACC of Project Wacc 12.5%nbemathNo ratings yet

- Chapter09 SMDocument14 pagesChapter09 SMkike-armendarizNo ratings yet

- FM HardDocument9 pagesFM HardKiran DalviNo ratings yet

- DCF TakeawaysDocument2 pagesDCF TakeawaysvrkasturiNo ratings yet

- Condensed Income Statement and Cash Flow Analysis for "BaseDocument15 pagesCondensed Income Statement and Cash Flow Analysis for "BaseJasonNo ratings yet

- Volcom Financial Analysis PresentationDocument27 pagesVolcom Financial Analysis PresentationKipley_Pereles_59490% (1)

- Chapter 3 Problems 1-30 Input and Output BoxesDocument24 pagesChapter 3 Problems 1-30 Input and Output BoxesSultan_Alali_9279No ratings yet

- 5 - Profitability AnalysisDocument42 pages5 - Profitability AnalysisGioacchinoNo ratings yet

- MBA FFM Exam Aug 08 SolsDocument9 pagesMBA FFM Exam Aug 08 SolsAnette ToobyNo ratings yet

- Capital Exp DecisionsDocument24 pagesCapital Exp DecisionsGourav PandeyNo ratings yet

- ACYFMG2 Quiz 2 QuestionsDocument41 pagesACYFMG2 Quiz 2 QuestionsArnold BernasNo ratings yet

- Sampa Video Inc Case StudyDocument26 pagesSampa Video Inc Case StudyMegha BepariNo ratings yet

- DCF ModelDocument14 pagesDCF ModelmfaisalidreisNo ratings yet

- S7 WEEK8 REI Corporate Finance 15 16Document6 pagesS7 WEEK8 REI Corporate Finance 15 16StefanAndreiNo ratings yet

- Exercise - Project Selection2Document3 pagesExercise - Project Selection2MAC CAYABANNo ratings yet

- Research and Development CostDocument6 pagesResearch and Development CostFahim AfzalNo ratings yet

- Use This Template To Complete The Problem 4-32 Based Upon The 3 Step Approach BelowDocument7 pagesUse This Template To Complete The Problem 4-32 Based Upon The 3 Step Approach BelowJoshua LenardsonNo ratings yet

- Financial Management Session 10Document20 pagesFinancial Management Session 10vaidehirajput03No ratings yet

- Capital Budgeting - Baldwin Inc (Solved)Document27 pagesCapital Budgeting - Baldwin Inc (Solved)Contact InfoNo ratings yet

- Readymade Garment Manufacturing.Document23 pagesReadymade Garment Manufacturing.Yasir Sheikh83% (6)

- Assignment 3 SolutionsDocument2 pagesAssignment 3 SolutionsHennrocksNo ratings yet

- Ashoka Buildcon: Performance HighlightsDocument14 pagesAshoka Buildcon: Performance HighlightsAngel BrokingNo ratings yet

- Chapter 20. CH 20-06 Build A ModelDocument4 pagesChapter 20. CH 20-06 Build A ModelCarol Lee0% (1)

- Construction Cost Breakdown and Project Financial AnalysisDocument2 pagesConstruction Cost Breakdown and Project Financial AnalysisNishanth M S HebbarNo ratings yet

- The Directors of Ayr Co. Effiong James NDocument36 pagesThe Directors of Ayr Co. Effiong James NRob Van Helden100% (3)

- Real Estate Investment AnalysisDocument1 pageReal Estate Investment AnalysisJoelleCabasaNo ratings yet

- Financial Feasibility of Business PlanDocument14 pagesFinancial Feasibility of Business PlanmuhammadnainNo ratings yet

- Principles of Cash Flow Valuation: An Integrated Market-Based ApproachFrom EverandPrinciples of Cash Flow Valuation: An Integrated Market-Based ApproachRating: 3 out of 5 stars3/5 (3)

- The Complete Direct Investing Handbook: A Guide for Family Offices, Qualified Purchasers, and Accredited InvestorsFrom EverandThe Complete Direct Investing Handbook: A Guide for Family Offices, Qualified Purchasers, and Accredited InvestorsNo ratings yet

- Sound Recording Studio Revenues World Summary: Market Values & Financials by CountryFrom EverandSound Recording Studio Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Guidance NoteDocument5 pagesGuidance NoteDawod AbdieNo ratings yet

- CV - Pejman AbedifarDocument2 pagesCV - Pejman AbedifarMushtaq Hussain KhanNo ratings yet

- Entrepreneurship & Small Business: Lecture No. 02Document20 pagesEntrepreneurship & Small Business: Lecture No. 02Mushtaq Hussain KhanNo ratings yet

- Hong Kong PHD Fellowship Scheme - Research Grants CouncilDocument5 pagesHong Kong PHD Fellowship Scheme - Research Grants CouncilMushtaq Hussain KhanNo ratings yet

- Q2Document4 pagesQ2Mushtaq Hussain KhanNo ratings yet

- Mushtaq Hussain Khan: Mushtaq - Hussain@ajku - Edu.pk Skype Sex - Date of Birth - NationalityDocument3 pagesMushtaq Hussain Khan: Mushtaq - Hussain@ajku - Edu.pk Skype Sex - Date of Birth - NationalityMushtaq Hussain KhanNo ratings yet

- Steckel2016 (Hamayun SB)Document8 pagesSteckel2016 (Hamayun SB)Mushtaq Hussain KhanNo ratings yet

- My Application For CouncilDocument2 pagesMy Application For CouncilMushtaq Hussain KhanNo ratings yet

- Ibrahim 2017Document32 pagesIbrahim 2017Mushtaq Hussain KhanNo ratings yet

- Literature NEWDocument1 pageLiterature NEWMushtaq Hussain KhanNo ratings yet

- 1 - Modelling COVID-19 As Black SwanDocument20 pages1 - Modelling COVID-19 As Black SwanMushtaq Hussain KhanNo ratings yet

- Q 1..Document4 pagesQ 1..Mushtaq Hussain KhanNo ratings yet

- Natural Disaster - Klomp2014Document36 pagesNatural Disaster - Klomp2014Mushtaq Hussain KhanNo ratings yet

- Financing Entrepreneurship in Times of Crisis: Exploring The Impact of COVID-19 On The Market For Entrepreneurial Finance in The United KingdomDocument11 pagesFinancing Entrepreneurship in Times of Crisis: Exploring The Impact of COVID-19 On The Market For Entrepreneurial Finance in The United KingdomGianmarco David Turpo MarónNo ratings yet

- Literature NEWDocument1 pageLiterature NEWMushtaq Hussain KhanNo ratings yet

- LaevenDocument1 pageLaevenMushtaq Hussain KhanNo ratings yet

- List of Courses New Sem 2020Document3 pagesList of Courses New Sem 2020Mushtaq Hussain KhanNo ratings yet

- Analysis 00Document325 pagesAnalysis 00Mushtaq Hussain KhanNo ratings yet

- Dear SirDocument3 pagesDear SirMushtaq Hussain KhanNo ratings yet

- Dear SirDocument3 pagesDear SirMushtaq Hussain KhanNo ratings yet

- Foreign Supervisor PerformaDocument2 pagesForeign Supervisor PerformaMushtaq Hussain Khan100% (3)

- Formula For Panel in ExcelDocument28 pagesFormula For Panel in ExcelMushtaq Hussain KhanNo ratings yet

- Dear SirDocument3 pagesDear SirMushtaq Hussain KhanNo ratings yet

- Tables ModifiedDocument10 pagesTables ModifiedMushtaq Hussain KhanNo ratings yet

- Table 4Document1 pageTable 4Mushtaq Hussain KhanNo ratings yet

- KhanDocument60 pagesKhanMushtaq Hussain KhanNo ratings yet

- SERIAL KeyDocument1 pageSERIAL KeyMushtaq Hussain KhanNo ratings yet

- ManDocument1 pageManMushtaq Hussain KhanNo ratings yet

- Gadzo 2019Document16 pagesGadzo 2019Mushtaq Hussain KhanNo ratings yet

- Request For Acceptance LetterDocument1 pageRequest For Acceptance LetterMushtaq Hussain KhanNo ratings yet

- Consti Cases Part 1Document173 pagesConsti Cases Part 1Michael Ang SauzaNo ratings yet

- Joseph L Tauro Financial Disclosure Report For 2009Document7 pagesJoseph L Tauro Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- MCS-Responsibility Centres & Profit CentresDocument24 pagesMCS-Responsibility Centres & Profit CentresAnand KansalNo ratings yet

- CH 02Document3 pagesCH 02Osama Zaidiah100% (1)

- Company Law 1 NewDocument62 pagesCompany Law 1 NewmuhumuzaNo ratings yet

- 10 HowToPredictForexBWDocument6 pages10 HowToPredictForexBWWihartono100% (1)

- Applying The CAMEL Model To Assess Performance ofDocument11 pagesApplying The CAMEL Model To Assess Performance ofMai Anh NguyễnNo ratings yet

- Preparing Financial StatementsDocument6 pagesPreparing Financial StatementsAUDITOR97No ratings yet

- Ringkasan Saham-20201120Document64 pagesRingkasan Saham-2020112012gogNo ratings yet

- Journal Home GridDocument1 pageJournal Home Grid03217925346No ratings yet

- PT Kalbe Farma TBK.: Summary of Financial StatementDocument2 pagesPT Kalbe Farma TBK.: Summary of Financial StatementIshidaUryuuNo ratings yet

- Income Recognition & Asset Classification CA Pankaj TiwariDocument42 pagesIncome Recognition & Asset Classification CA Pankaj TiwariRakesh RajpurohitNo ratings yet

- Purchases & PayablesDocument12 pagesPurchases & Payablesrsn_surya100% (2)

- McGahan Porter PDFDocument30 pagesMcGahan Porter PDFGerónimo SchlieperNo ratings yet

- CIR vs. Shinko Elec. Industries Co., LTDDocument5 pagesCIR vs. Shinko Elec. Industries Co., LTDPio Vincent BuencaminoNo ratings yet

- All 760953Document13 pagesAll 760953David CheishviliNo ratings yet

- Probate: What Is Probate? Probate (Or More Specifically 'Probate of The Will') Is An Official Form ThatDocument2 pagesProbate: What Is Probate? Probate (Or More Specifically 'Probate of The Will') Is An Official Form ThatRoy2013No ratings yet

- Excel Solutions - CasesDocument25 pagesExcel Solutions - CasesJerry Ramos CasanaNo ratings yet

- Katanga Mining Limited Annual Information Form For The Year Ended DECEMBER 31, 2017Document68 pagesKatanga Mining Limited Annual Information Form For The Year Ended DECEMBER 31, 2017badrNo ratings yet

- Claremont COURIER 7.14.10Document24 pagesClaremont COURIER 7.14.10Claremont CourierNo ratings yet

- Pujita B Gaddi (10skcma044)Document17 pagesPujita B Gaddi (10skcma044)Pramod ShekarNo ratings yet

- 45 Profit and Loss AccountDocument15 pages45 Profit and Loss AccountJitender Gupta100% (1)

- Corporate Strategy - Plan For A Diversified CompanyDocument49 pagesCorporate Strategy - Plan For A Diversified CompanyRavi GuptaNo ratings yet

- Executive Agencies Act, Cap 245Document10 pagesExecutive Agencies Act, Cap 245Jeremia MtobesyaNo ratings yet

- Communiques - DP - DP 668 Securities Admitted With CDSL 15112023Document10 pagesCommuniques - DP - DP 668 Securities Admitted With CDSL 15112023Mudit NawaniNo ratings yet

- Chapter 5 and 6 Financial SystemDocument7 pagesChapter 5 and 6 Financial SystemRemar22No ratings yet

- Sbi 8853 Dec 23 RecoDocument9 pagesSbi 8853 Dec 23 RecoShivam pandeyNo ratings yet