Professional Documents

Culture Documents

Financial Markets 0

Uploaded by

Ashmita NagpalOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Financial Markets 0

Uploaded by

Ashmita NagpalCopyright:

Available Formats

FINANCIAL MARKETS 1.What is a financial market ? Ans. It refers to the market which creates and exchanges financial assets.

2. What are financial assets? Ans. It refers to the financial instruments or securities. For e.g shares, debentures, treasury bills, commercial paper etc. 3. What is floatation cost? Ans. The expenditure incurred in issuing the securities is called floatation cost. For e.g underwriting commission, advertising etc. 4.What is a zero coupon bond ? Ans. It is a financial instrument for which no interest is paid but is issued at a discount redeemable at par. 5.State the components of capital market ? Ans. a) Primary market b) secondary market. 6. Name two buyers of Commercial paper . Ans. a) Banks b) Insurance companies. 7.What is meant by Near money Ans. All very short term securities are called near money For e.g marketable securities. 8.What type of trade-off function is performed by the money market? Ans. The money market establishes a balance between short term financial supply and short term financial demand. 9.State two promoters of NSEI. Ans. a) Industrial development bank of India (IDBI) b) Life insurance corporation of India (LIC) 10.How many stock exchanges are there in India . Ans. There are 24 stock exchanges in India. 12. Name two advisory committees set up by SEBI. Ans. a) Primary market Advisory committee. b)Secondary market advisory committee. 13. What is price rigging ? Ans. It refers to the manipulation of prices of the securities by agents/company for their own profits. 14.On what lines was OTCEI started ?

Ans. It was started on the lines of NASDAQ (National Association of securities Dealers Automated Quotation) 15.Name the system where there is electronic book entry form of holding and transferring the securities. Ans. Dematerialisation. 16.What is Demutualisation of securities Ans. It separates the ownership and control of stock exchanges from trading rights. 17. Name the Benchmark index of BSE. Ans. SENSEX. 18. When was SEBI established? Ans. It was established in 1988 but was given statutory status in 1992. 19. State the segments of NSEI. Ans. a) Wholesale debt market b) Capital market segment 20. State one development function of SEBI Ans. to carry out research work. 21. What is Sensex? Ans. The index showing the rise and fall in the market price of the shares on the basis of 30 companies of the Bombay stock exchange is called SENSEX. 22. Name the method of floatation of securities in the primary market where the share are initially offered to the existing shareholders. Ans. Rights issue 23. What is Bridge financing? Ans. The finance needed to meet the floatation cost is called Bridge financing. 24. Name the market where companies issue new securities. Ans. Primary market 25. Which money market security is also known as Zero Coupon Bond? Ans. Treasury bills 26. SEBI is the watchdog of the securities market Do you agree? Give two reasons to support your Ans.wer. Ans. Yes , SEBI is considered as watchdog as it performs the following protective functionsa) Prohibits insider trading b) Prohibits misleading prospectus. 27.Give two examples of floatation cost

Ans. Preliminary expenss, underwriting commission, brokerage etc. 28. Name the method of floatation of securities where the securities are traded on lone. Ans. e-IPO 29. Name the index of national stock exchange Ans. NIFTY 30. Why NSEI is known as Model exchange ? Ans. Because it is the first stock exchange of its kind 31. Name the market where companies issue new securities. Ans. Primary Market. 32. How many stock exchanges are there in India? Ans. There are 22 regional stock exchanges and 2 National level Stock Exchanges- NSEI and OTCEI. 33. Why secondary market is considered as market for second hand securities? Ans. Because in this market existing and second hand securities are sold between investors. 34. Which money market security is also known as Zero Coupon Bond? Ans.Treasury Bill is also known as Zero Coupon Bond. 35 Explain the term : Price Rigging Ans. Price Rigging refers to manipulating the prices of securities with the main objectives of inflating or depressing the market price of securities. 36 A wants to get his company listed in National Stock Exchange . His companys paid up capital is Rs. 20,00,000. Can he get it listed? Kindly advise him. Ans. No, he cannot get it listed in NSE because to get listed in NSE minimum paid up capital required is Rs. 3 crore. Name the kind of issue in which shares are offered to existing shareholder. Ans. Right Issue. Give example of any two financial intermediaries. Ans. a) Banks. b) Financial markets. give examples of any two money market instruments. Ans. a) Commercial Paper. B) Call Money. what was the traditional system of trading on a stock exchange? Ans. Outcry or auction system . What are the two basis on which transactions on a stock exchange may be carried out?

Ans. Cash basis or Carry over basis. Give names of any two places where regional offices of SEBI is located. Ans. a) Chennai b) Delhi What is the settlement cycle in NSE. T+2 the director of a newly established company having paid up equity share capital of 25 crores desire to get its shares traded at all India Level Stock exchange. As finance Manager of the company, Suggest the name of stock exchange for the purpose. Give any 3 reasons in support of your answer. Ans The company should get its share listed at OTCEI. The main features of OTCEL are the followingNation-wide listing, Listing on one exchange one can have transactions with all the counters in the whole country. Exclusive list of companies, on the OTCEL only those companies are listed whose issued capital is 30 Lakh or more. Investors registration- All the investor doing transactions on the OTCEL have got to register themselves compulsorily. Transparency in transactions- All the transactions are done in the presence of the investor. The rates of buying and selling can be seen on the computer screen. The director of a company want to modernize its plants and machinery by making a public issue of Shares. They wish to approach stock exchange, while the finance manager prefers to approach a consultant for the new public issue of shares. Advice the directors whether to approach stock exchange ro a consultant for new public issue of shares and why? Also advise about the different methods which the company may adopt for the new public issue of shares. Ans: the directors should approach the consultant for the new public issue of shares as the company wish to make new public issue of shares to modernize its plants and machinery. Following are the methods which the company may adopt for the new public issue of shares: Right Issue: Since it appears from the question that the company is an existing company as it wants to modernize its plant and machinery, the company by statute is required to offer these shares first to the existing shareholders in proportion to their holdings. If the existing shareholders do not take these shares then company can resort to other methods as given below. Public Offer through Prospectus: Under this method, the company can directly offer its shares to the public at large after issuing prospectus. Offer for sale: In this case, an intermediary buys all the shares from the company at agreed price and offers it to the investors at a higher rate. Private Placement: In this case also an intermediary buys the shares from the company but offers it to only a selected few for sale. the directors of a newly established company having a paid up equity share capital of Rs 25 crores, desire to get its shares traded at an all India level stock exchange. As finance

manager of the company, suggest the name of the stock exchange for the purpose. Give any 3 reasons in support of your answer. Ans: In the given situation, I would recommend the shares of the company to be listed at the outlet the counter exchange of India(OTCEI). The reasons are: In the OTCEI, there is an existence of compulsory market makers(banks/financial institutions) that buys/sells securities of the selected companies which improves the liquidity of the securities. The Company has a paid-up share capital of less than Rs3crores. Less stringent conditions are applicable for listing of the securities as compared to those applicable for listing in National Stock exchange of India.

37. State four objectives of SEBI. Ans. a) To regulate stock exchanges and the securities industry and to promote their orderly functioning. b) To protect the rights and interests of the Investors. c) To prevent unfair trade activities/ trading malpractices. d) To regulate and develop a code of conduct for intermediaries such as brokers, agents etc. 38. State three objectives of NSEI. Ans. a) To ensure equal access to investors all over the world. b) To provide fair, efficient and transparent trading of the securities electronically. c) To provide facilities of international standards. 39. State three advantages of OTCEI. Ans. a) To provide a trading platform to smaller and less liquid companies. b) It is economical in nature as it involves low cost of new issue. c) It is a transparent system of trading with no problems of bad deliveries. d) it is suitable for family concerns and closely held companies. 40. State four features of Commercial paper. Ans. a) Commercial paper is debt instrument issued for a period of 15 days to one year b) These are issued in the form of unsecured promissory note. c) These are transferable by mere endorsement and delivery. d) These are issued by large and creditworthy companies. 41. State three features of Treasury bills. Ans. a) Treasury bills are instruments of money market issued by the Government of India. They are freely transferable. b) They are issued in the multiples of 25000. c) These are in the form of Zero coupon bond , that is issued at a discount redeemable at par. No interest is given on such securities. 42. How is Private placement a cost effective method of raising finance. Ans. In case of Private placement, new securities are issued to selected groups or persons at fixed price. For e.g to Insurance companies, financial institutions etc. It does not involve expenses such as underwriting, brokerage, advertisement etc.

Besides it also saves time. Thus it is economical in nature. 43. What is e-IPO. ? Ans. It is in of the method of floating new issue of shares or debentures in the market. Under this method, a company enters an agreement with the stock exchange to issue the securities to the public through the on line system of the stock exchange. The issuer company has to appoint a Registrar having electronic connectivity with the exchange. The brokers registered under SEBI are appointed to accept application and place orders with the company. 45. Nature of Capital market can be well explained with the help of its features . State any three such features of Capital Market. Ans. (i) Link between saver and investment opportunities. (ii) Deals in long term investment. (iii) Utilises intermediaries. 46. Nature of Money Market can be well explained with the help of its features. State and three such features of money market. Ans. (i) Market for short term funds, (ii) Deals in monetary assets whose period of maturity is upto one year, (iii) Market where low risk, unsecured and short term debt instruments are issued and actively traded everyday. 47. State any three objectives of NSE. Ans. (i) Establishing a nationwide trading facility for all types of securities. (ii) Ensuring equal access to investors all ovet the country through an appropriate communication network. (iii) providing a fair, efficient and transparent securities market using electronic trading system. 48. Explain any three functions of a Stock Exchange. Ans. (i) A Stock Exchange is a reliable barometer to measure the economic condition of a country. (ii) It helps to value the securities on the basis of demand and supply factors. (iii) It provides ready market for sale and purchase of securities. 49. SEBI is the watchdog of security market. Comment. Ans. SEBI was setup in 1988 to regulate the functions of the securities market and to protect the interest of investors but SEBI was found ineffective in regulating the activities of stock market. It was able to observe and watch only but failed to take corrective measure that is why it is called as watchdog. 50. Stock market imparts liquidity to investment. Comment. Ans. The Stock market is a place where securities of companies are bought and sold. Generally the securities are long term and get matured only after a long period of time. These securities can be sold in stock market and can be easily converted into cash. The presence of market is an

assurance to investors that their investment can be converted into cash as and when required by them. 51. State any two methods of issuing securites in Primary Market. Ans. The Primary market is also known as the new issues market. It deals with new securities being issued for the first time. The securities may be issued in primary market by following two methods: public issue through prospectus Offer for sale. 52. Explain the terms: (i) Bulls (ii) Bears (iii) Stag Ans (i) Bulls- A bull is a speculator who expects rise in price. He buys securities with a view to sell them in future at a higher price and making profit out of it. (ii)Bears- A bear is a speculator who expects fall in the price. He sells securities which he does not possess. (iii)Stag- A stag is a speculator who applies for new securities in expectation that prices will rise by the time allotment and he can sell them at premium. 53. What function does financial market perform? Ans. The financial market performs the function of bringing together the deficit units ( corporate Sector) and surplus units (investors). It is through financial market that the lender meet the borrowers. 54. State four regulatory functions of SEBI. Ans. a) registration of Intermediaries such as Merchant agents, Brokers and sub brokers. b) Registration of Mutual fund agencies and collective Investment schemes. c) Regulation of the stock exchanges through conducting enquires, sudden Inspection, audit of the stock exchange and intermediaries. d) regulation of the Takeover bids of companies. 57. Discuss in brief the methods of floating new issues in the primary market. OR The Directors of a company want to modernize its plant and machinery by making a public issue of shares. They wish to approach the stock exchange, while the finance manager prefers to approach a consultant for the new public issue of shares. Advise the directors whether to approach the stock exchange or a consultant for new public issue of shares and why? Also advise about the different methods which the company may adopt for new public issue of shares. Ans.. The directors should approach to the consultant for new public issue of shares as this is the case of primary market. Primary market is the market where the securities are issued for the first time by the company. Following are the methods of floatationIssue through prospectus- Prospectus is an invitation made to the public for the subscription of the securities. It is an old and popular method of issue. It is the direct appeal to the public. It

requires proper Listing of the securities. Minimum subscription is to be collected before the allotment of shares. Offer for sale : As issue of prospectus is a time consuming method, public can be invited indirectly through intermediaries such as Issuing houses, brokers etc. The securities are sold to the intermediaries at a determined price who in turn reseel to the public. Private placement : Under this method, the company does not invite general public for subscription but offers and allots the shares to selected organizations and individuals such as Insurance companies, financial institutions etc. It is less expensive and saves time. Rights issue: Under this method the existing shareholders enjoy pre-emptive right. Thus the shares are initially offered to the existing shareholders at a price lower than the market price. E-IPOs: A company invites the public for the subscription of the securities through on-line system. The registered members of the SEBI are appointed to accept the applications of the investors and place to the company.

You might also like

- IntroductionDocument0 pagesIntroductionramanagpalNo ratings yet

- 12 Business Studies Notes CH01 Nature and Significance of ManagementDocument6 pages12 Business Studies Notes CH01 Nature and Significance of ManagementAshmita NagpalNo ratings yet

- AcknowledgementDocument13 pagesAcknowledgementAshmita Nagpal88% (8)

- 12 Economics Notes Micro Ch01 IntroductionDocument9 pages12 Economics Notes Micro Ch01 IntroductionRama NagpalNo ratings yet

- 12 Geography Human Geography Nature and Scope Impq 1Document2 pages12 Geography Human Geography Nature and Scope Impq 1Ashmita Nagpal100% (1)

- Understanding PartitionDocument18 pagesUnderstanding PartitionRamita Udayashankar100% (1)

- 12 English Core Impq WritingDocument55 pages12 English Core Impq WritingAshmita Nagpal33% (3)

- Bricks Beads and BonesDocument21 pagesBricks Beads and BonesAshmita Nagpal100% (1)

- 12 Geography Human Geography Nature and Scope Impq 1Document2 pages12 Geography Human Geography Nature and Scope Impq 1Ashmita Nagpal100% (1)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Ifrs Viewpoint 7 - When The Going Concern Basis Is Not AppropriateDocument8 pagesIfrs Viewpoint 7 - When The Going Concern Basis Is Not AppropriateMarjorie PalmaNo ratings yet

- Ratio Analysis (Buet)Document13 pagesRatio Analysis (Buet)Tahsinul Haque TasifNo ratings yet

- MBL Term PaperDocument15 pagesMBL Term PaperMehedi HasanNo ratings yet

- Deduction Allowed and Not Allowed Under The Head Income From Business PDFDocument6 pagesDeduction Allowed and Not Allowed Under The Head Income From Business PDFMuhammad sheran sattiNo ratings yet

- Business Studies Chapter 22 Statement of Financial PositionDocument8 pagesBusiness Studies Chapter 22 Statement of Financial Position牛仔danielNo ratings yet

- Soal Dan Jawaban Tugas Lab 1 - Home Office and Branch OfficeDocument6 pagesSoal Dan Jawaban Tugas Lab 1 - Home Office and Branch OfficePUTRI YANINo ratings yet

- Wac 1 (Final)Document12 pagesWac 1 (Final)lynloy24No ratings yet

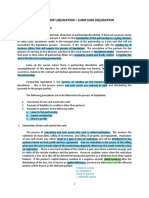

- IM-PARTNERSHIP LUMP SUM LIQUIDATION With ExercisesDocument16 pagesIM-PARTNERSHIP LUMP SUM LIQUIDATION With ExercisesAisea Juliana VillanuevaNo ratings yet

- Chapter - Strategy Implementation MCQDocument11 pagesChapter - Strategy Implementation MCQgamergeeeNo ratings yet

- Financial Grants Management Manual Version 1 0 54855hDocument103 pagesFinancial Grants Management Manual Version 1 0 54855hNano SamyurashviliNo ratings yet

- A. Calculate Watkins's Value of OperationsDocument20 pagesA. Calculate Watkins's Value of OperationsNarmeen Khan100% (1)

- PL Financial Accounting and Reporting Sample Paper 1Document11 pagesPL Financial Accounting and Reporting Sample Paper 1karlr9No ratings yet

- Notes of 3. Issue of SharesDocument21 pagesNotes of 3. Issue of SharesatuldipsNo ratings yet

- FAR1 - PPE - Subsequent MeasurementDocument11 pagesFAR1 - PPE - Subsequent MeasurementErika Mae LegaspiNo ratings yet

- Stock Index Futures GuideDocument13 pagesStock Index Futures GuideEric MarlowNo ratings yet

- Pir Ifrs 3 Report Feedback StatementDocument38 pagesPir Ifrs 3 Report Feedback StatementPIA MICHAELLA ILAGANo ratings yet

- Polo Company and Subsidiary Consolidated Statement of Financial Position As of December 31, 2020 AssetsDocument3 pagesPolo Company and Subsidiary Consolidated Statement of Financial Position As of December 31, 2020 AssetsJunzen Ralph YapNo ratings yet

- Cash Flow Online April 6 2024 For StudentsDocument5 pagesCash Flow Online April 6 2024 For Studentsraven.jumaoas.eNo ratings yet

- December 2021 Financial Acocunting and Reporting UK GAAPDocument11 pagesDecember 2021 Financial Acocunting and Reporting UK GAAPChoo LeeNo ratings yet

- The Ultimate Guide To Trading OptionsDocument68 pagesThe Ultimate Guide To Trading Optionsjose HernandezNo ratings yet

- Value-Based Working Capital Management Determining Liquid Asset Levels in Entrepreneurial EnvironmentsDocument200 pagesValue-Based Working Capital Management Determining Liquid Asset Levels in Entrepreneurial EnvironmentsDiky WidodoNo ratings yet

- STT FinancilaDocument22 pagesSTT FinancilaravNo ratings yet

- Affan Final Word PDFDocument100 pagesAffan Final Word PDFanas khanNo ratings yet

- Learn Value - Berry GlobalDocument28 pagesLearn Value - Berry Globalivan.bliminse1402No ratings yet

- Cash Conversion CycleDocument95 pagesCash Conversion CycleNeelabh100% (1)

- FIN341 Excel Demo - Chapter 11Document23 pagesFIN341 Excel Demo - Chapter 11mai tharatharnNo ratings yet

- Advanced Accounting Case Study PDFDocument7 pagesAdvanced Accounting Case Study PDFAnonymous IpBC61Z100% (1)

- Debit Card and Credit CardDocument5 pagesDebit Card and Credit Cardbeena antuNo ratings yet

- Trading Log v3Document60 pagesTrading Log v3Jose GuzmanNo ratings yet

- Auditing Cup - 19 Rmyc Answer Key Elimination Round EasyDocument14 pagesAuditing Cup - 19 Rmyc Answer Key Elimination Round EasyFarhana GuiandalNo ratings yet