Professional Documents

Culture Documents

World FTTX Market

Uploaded by

Hien NguyenOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

World FTTX Market

Uploaded by

Hien NguyenCopyright:

Available Formats

FTTx Market Report

July 2009

FTTx Market Report

Copyright IDATE 2009, BP 4167, 34092 Montpellier Cedex 5, France Tous droits rservs Toute reproduction, stockage ou diffusion, mme partiel et par tous moyens, y compris lectroniques, ne peut tre effectu sans accord crit pralable de l'IDATE. ISBN 978-2-84822-146-5 All rights reserved. None of the contents of this publication may be reproduced, stored in a retrieval system or transmitted in any form, including electronically, without the prior written permission of IDATE.

www.idate-research.com IDATE 2009

FTTx Market Report

Table of contents

1. FTTx Market panorama worldwide .................................................................................. 4 FTTx deployments still in progress........................................................................................................ 4 FTTH/B: the prevailing architecture....................................................................................................... 5 The alternative architectures still lagging behind .................................................................................. 7 FTTH/B Homes passed and Subscribers.............................................................................................. 9 Players involved ................................................................................................................................ 9

2. FTTH/B technologies ...................................................................................................... 12 EPON, the most widespread FTTH technology deployed................................................................... 12 The situation in Asia Pacific: hotbed for EPON ................................................................................... 13 Choice of operators............................................................................................................................. 14

3. FTTx Vendors' dynamics................................................................................................ 16 Vendors positioned.............................................................................................................................. 16 Local vendors selected in main FTTx markets.................................................................................... 17 Vendors positioning of main vendors .................................................................................................. 18 Active development of Chinese vendors............................................................................................. 18 Focus on the FTTx Chinese market.................................................................................................... 19

4. FTTH Market Forecasts 2014 ......................................................................................... 20 Worldwide............................................................................................................................................ 20 Forecasts by Region ........................................................................................................................... 21

www.idate-research.com IDATE 2009

FTTx Market Report

1.

FTTx Market panorama worldwide

This chapter is presenting the status of FTTx deployments on a worldwide basis with a breakdown by architecture type and by geographic zone. The FTTx market here includes FTTH/B, VDSL, FTTLA and FTTx+LAN and the geographical zones covered are Asia Pacific, Western and Eastern Europe, Middle East, North America and Latin America.

1

FTTx deployments still in progress

As end of 2008, the global FTTx market which includes FTTH/B, VDSL, FTTLA and FTTX+LAN architectures represented 48 million subscribers. FTTH and FTTB are still the most prevalent network architectures, accounting for more than 61% of the fibre-connected subscribers. Those architectures and in particular FTTB based, are the most economic and the most suitable solution for operators to increase their bandwidth in many countries especially in Asia (densely populated areas) and also now starting in emerging countries.

FTTx subscribers breakdown by architecture type end 2008

FTTx/LAN 35%

VDSL 4% FTTH/B 61% FTTLA 0%

Source: IDATE

VDSL includes Fiber To The Node + VDSL and VDSL2 technologies. FTTLA stands for Fiber To The Last Amplifier : depending on cablecos networks' architecture, the fiber optic is deployed until a point generally located before the building. FTTx/LAN is mainly used for Asian countries where Ethernet LAN can be the technology used for connecting the end users from a point located outside the building or SDU. More generally, when talking about FTTx, we include FTTH/B, FTTLA, FTTN+VDSL and FTTx+LAN.

www.idate-research.com IDATE 2009

FTTx Market Report

FTTH/B: the prevailing architecture

The global FTTH/B market continues to make strides. Growth in 2008 was significant, with more than 8 million additional subscribers (+39% over the past 12 months) bringing the number of FTTH/B subscribers around the world to just over 29 million at the end of 2008.

Global FTTH/B subscribers' growth per geographic zones, in million, 2007-2008

30 25 20 15 10 5 0 Dec 07 Asia Pacific June 08 Western Europe Dec 08 Rest of World North America 20,86

+17% +19%

29,02

24,39

Source: IDATE

Asia Pacific is still the FTTH/B market leader, and subscriber growth is accelerating thanks to China

It is not surprising that Asia Pacific continued to dominate the FTTH/B and was the major contributing region in terms of subscribers with near 5 million additional users in one year. The highest worldwide concentration of FTTH/B subscribers was in the Asia region: with close to four-fifth of the global FTTH/B subscribers at the end of 2008. The number of FTTH/B subscribers in the Asia Pacific region rose from 17.9 million to more than 22.7 million between December 2007 and December 2008. Thus, the Asian market accounted for the bulk of the global FTTH/B market, with Japan and South Korea still leading the way. With 14.5 and 6.8 million respectively, the two countries represented the largest number of ultra high-speed Internet users in the world. There was a sharp rise in FTTH/B subscribers in Japan (3 million new subscriptions) and in South Korea (1.6 million) in 2008.

www.idate-research.com IDATE 2009

FTTx Market Report

FTTH/B subscriber growth in Asia, 2007-2008

25 20,36 20 17,75

+15% +12%

22,72

15

10

0 Dec 07 June 08 Dec 08

Source: IDATE

If those last years the Asia Pacific FTTx market booming was mainly explained by large scale deployments in Japan and South Korea, now the dynamism is clearly evolving toward China. Indeed at end 2008, China is already counting 17 million subscribers, but the growth in China will continue and even explode if we take into account the last announcements th coming. Indeed on July 16 , China Unicom completed the world's largest EPON purchasing involving 11.3 million lines.

North America region marked by a substantial growth driven by United States

Reaching 5 million FTTx subscribers at the end of 2008, the United States market continued to progress, particularly in the FTTH/B market with 1.9 new subscribers in one year. The US is the global third largest fibre access market, behind Japan and South Korea, and accounts for 16% of the globes FTTx subscribers. Marking a 90% increase over the end of 2008, it makes the United States the globes fastest growing FTTH/B market.

FTTH/B subscriber growth in the United States, 2007-2008

45 39,96 40 35 30 25 20 15 10 5 0 Dec 07 June 08 Dec 08 21,00

+29% +48%

27,00

Source: IDATE

www.idate-research.com IDATE 2009

FTTx Market Report

European market gaining momentum

Still well behind the Asian and North American markets, the Western Europe market appears to gain momentum. As of December 2008, it accounted for 5% of the global FTTH/B market with more than 1.5 million subscribers, compared to just over a million at the end of 2007 (+60% growth in on year). High disparities characterize the European FTTH/B market as only six countries combined account for 81% of the subscriber base: Sweden, Italy, Norway, France, Denmark and the Netherlands.

FTTH/B subscriber growth in the Western Europe, 2007-2008

1,6 1,4 1,22 1,2 1 0,8 0,6 0,4 0,2 0 Dec 07 June 08 Dec 08 0,95

+29% +24%

1,51

Source: IDATE

FTTx market still in the embryonic stage in the rest of the World

Aside from a few small-scale rollouts in Mexico, Canada, Chile and Brazil, there are no major FTTx networks in other Americas countries. Brazil does, however, appear to have a bright future when it comes to fibre, in part thanks to Telefnica which has plans to deploy a vast FTTH network in and around Sao Paulo. In the Middle East and Africa, outside the United Arab Emirates, FTTx is still not very well developed. At the end of 2008, there were no more than 15 000 FTTx subscribers in the geographical zone, with the majority of networks being either new or still in the planning stage. But, given the number of homes that are currently under construction, especially in the UAE, it is entirely possible that this will be one of the most dynamic FTTx markets of the next five years. Two players in particular in the United Arab Emirates will likely contributed to this momentum in the region, namely du and Etisalat.

The alternative architectures still lagging behind

Alternative architectures including VDSL, FTTLA and FTTx/LAN were not largely adopted, but are however deployed in specific regions: FTTx/LAN being the architecture adopted largely until now in China; VDSL in Europe and North America and FTTLA in Eastern & Central Europe.

www.idate-research.com IDATE 2009

FTTx Market Report

VDSL, FTTLA and FTTx/LAN subscribers in the different geographical zones at the end of 2008 VDSL Western Europe Eastern & Central Europe North America Asia Pacific Middle East & Africa Total 776 550 32 000 1 045 000 1 500* 0 1 855 050 FTTLA 15 000 212 393 na na 0 227 393 FTTx/LAN 0 0 0 17 000 000 0 17 000 000

* In many countries in Asia, VDSL subscribers are included in FTTH/B figures as fibre stops at the basement of the MDUs. Source: IDATE and FTTH Council Europe.

FTTX/LAN driving the FTTx market in China

China is a special market where until now the majority of fiber-based connections are based on FTTx/LAN solutions which supply 2 to 10 Mbps of bandwidth on average (that could not enough high to be considered as a very high speed connections). We estimate the number of FTTx/LAN lines at 17 million as end of 2008. Starting in particular in 2009, FTTB architectures will gain momentum in china in the years to come, especially in large cities.

VDSL slightly increased in Europe and in USA

VDSL did appear to be making strides, and accounted for 4% of the FTTx market as end of 2008. This is due in part to the take-off occurred in Europe (42% of deployments) where growth has been particularly substantial, as VDSL is faster and cheaper to deploy than FTTH/B. This trend was particularly observable with the involvement of incumbent operators from Switzerland, Belgium and Germany. Meanwhile, in the United States (56% of deployments), AT&T's VDSL base continued to grow as well. VDSL subscribers are virtually non-existent in Asia as fibre is pulled to the basement of apartment buildings, so VDSL technologies are considered to be part of FTTB networks. Only 1 500 subscribers were accounted as VDSL ones in 2008 and came from Hong Kong.

Handful FTTLA roll outs in Central and Eastern Europe

FTTLA technology appears to enjoy a solid position in the Eastern and Central Europe region, serving 212 393 subscribers who are located in four countries in particular: Estonia, Lithuania, Rumania and the Czech Republic. There have also been a handful of FTTLA rollouts, chiefly in Eastern Europe (Romania, Lithuania and Estonia).

www.idate-research.com IDATE 2009

FTTx Market Report

FTTH/B Homes passed and Subscribers

Breakdown of homes passed and subscribers in Asia Pacific

FTTH/B figures in APAC, million

80 70 60 50 40 30 20 10 0 December 2007 June 2008 December 2008

Subscribers Homes passed

Source: IDATE

Breakdown of homes passed and subscribers in North America

FTTH/B figures in North America, million

20 15 10 5 0 December 2007 June 2008 December 2008 Subscribers Homes passed

Source: IDATE

Breakdown of homes passed and subscribers in Western Europe

FTTH/B figures in Western Europe, m illion 15 10 5 0 December 2007 June 2008 December 2008 Subscribers Homes passed

Source: IDATE

Players involved

in Asia Pacific

Incumbent carriers represented the major type of players involved in FTTH/B projects in Asia including emerging countries. In Japan, NTT and KDDI have invested massively in optical fibre chiefly focusing on the countrys most densely populated areas while local authorities and power utilities investing in the more sparsely populated areas.

www.idate-research.com IDATE 2009

FTTx Market Report

In South Korea, the incumbent KT and its main rivals SK Broadband and LG Powercom are the players the more involved in FTTH. In China, China Telecom and China Unicom but also very recently China Mobile, are clearly motivated in deploying large scale FTTH/B network.

FTTx operator market share in Japan 2008

Pow er utilities 10% Alternative 10% Others 7%

FTTx operator market share in South Korea - 2008

Other 4% KT 33%

NTT 73%

Alternative (SK, LG) 63%

Source: IDATE

Source: IDATE

FTTx operator market share in China - 2008

Others 5%

China Unicom 30% China Telecom 65%

Source: IDATE

in North America

The American broadband market is highly fragmented. RBOCs have 64% share of the FTTH market while ILECs (Incumbent Local Exchange Carriers) control 18% of this market; alternative operators, or CLECs (Competitive Local Exchange Carriers), control 6%; and local authorities about 8%. This means that local operators, excluding municipal projects, have a just under 25% share of the countrys FTTH market. By becoming involved in FTTH rollouts, local players are helping to compensate for the RBOCs lack of interest in the zones concerned, most of which are rural areas with little market potential despite which local actors appear to be having some success. Verizon (FTTH) and AT&T (VDSL) are particularly very aggressively deploying FTTx and have a substantial lead in this market.

www.idate-research.com IDATE 2009

10

FTTx Market Report

American FTTH market by type of player end 2008

M unicipalit ie s 8% CLEC 6%

M SO/Ot hers 4%

ILEC 18%

RBOC 64%

Source: IDATE, based on Broadband Properties

in Europe

Municipalities and power utilities continued to be the players the more involved in FTTH/B projects in 2008 in Europe, representing quite 60% of the market, by deploying very often the FTTH/B through an open network model. Alternative operators were also still dynamic but significant FTTH/B deployments are now launched or announced by European incumbent operators like France Telecom, Telefonica, Swisscom, Portugal Telecom, Telecom Italia or KPN in the Netherlands.

European FTTH market by type of player end 2008

Housing companies / Others 4% Alternative operators / ISP 25% Incumbents 9%

Municipalities / Pow er utilities 62%

Source: IDATE

www.idate-research.com IDATE 2009

11

FTTx Market Report

2.

FTTH/B technologies

This following section will focus on technologies used to deliver FTTH/B accesses that 2 3 include EPON , GPON , BPON and Ethernet P2P. Worth noting that for the first time, FTTx/LAN lines (installed ports) are included in the calculation when assessing the total FTTx access lines as we believe that this architecture will supply soon higher speed than the current 2 to 10 Mbps available in China.

EPON, the most widespread FTTH technology deployed

EPON (and now GEPON) is by far the most popular FTTH technology on a worldwide basis, representing 60% of the market in 2008 due to Asia Pacific's almost exclusive use of EPON with Japanese and South Korean carriers backing the technology. Moreover, its evolution is clear with the expected 10G EPON standard expected by September 2009. GPON deployment is still lagging behind EPON on a worldwide basis. Indeed until now GPON is gaining momentum mainly in Europe and North America but in currently Chinese dynamic market, EPON is clearly today the selected technology. Certainly that EPON technology will remain dominating until 2011 in China because of the first choices of Chinese operators. Nevertheless, we must notice that EPON is used also (China Mobile) for mobile backhauling especially for the current 3G deployments in the country. We must notice also the GPON recent announcement and trials conducted by China Telecom, China Unicom and China Mobile (more recently). The success of EPON in China with the current large scale deployments could rapidly influence the choice of other emerging markets as we already notice first deployments in Thailand or Ethiopia.. Indeed, Chinese huge EPON deployment will drive this technology costs down. Largely used by European carriers, Ethernet P2P deployment remained marginal like BPON technology which was only deployed in North America by Verizon (now replaced by GPON).

EPON (Ethernet Passive Optical Network - IEEE 802.3ah) is a point-to-multipoint connectivity technology based on Ethernet and supporting all FTTx architectures. EPON is now available on his GEPON version: Symmetrical bidirectional 1Gbps. 10GEPON version allowing symmetrical 10Gbps is expected for September 2009. 3 GPON (Giga Optical Passive Optical Network - ITU-T G.984) is a point-to-multipoint connectivity technology based on Ethernet + ATM and supporting all FTTx architectures. GPON is now available giving 2.5 Gbps Downstream and 1.25 Gbps Upstream. 10GPON version allowing 10Gbps is expected for 2011.

www.idate-research.com IDATE 2009

12

FTTx Market Report

Breakdown of the FTTx technologies worldwide end 2008

GPON 17%

BPON 9%

EPON 60% Ethernet P2P 14%

Source: IDATE

Breakdown of FTTx technologies per region (subscribers) end 2008 EPON Asia Pacific China North America Europe 91% 100% 5% 74% 19% 12% 9% 81% GPON BPON Ethernet P2P 9%

Source: IDATE and Broadband Properties for North America figures

The situation in Asia Pacific: hotbed for EPON

Service providers in Asia Pacific have invested heavily in PON, and mainly in EPON technology due to its lower cost driven by high volumes. Indeed large FTTH/B markets or FTTx/LAN markets have adopted mainly EPON chosen by incumbents: KT, NTT, China Telecom,

The situation in China "China is getting to deploy the world's largest FTTH deployment"

The optical fiber broadband access network was deployed on a considerable scale in China. In 2008, EPON has dominated China deployments (almost 100%) as Chinese carriers have adopted this technology for its lower cost. In the meantime, even being marginal, GPON gained moderate momentum in the recent months. China is still the market with the greatest growth potential. Thanks to the involvement of China Telecom, China Unicom as well as China Mobile, the country seems to have begun the largest FTTx market.

www.idate-research.com IDATE 2009

13

FTTx Market Report

Choice of operators

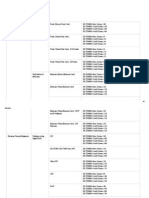

Technology adopters Technology Country China Type of Players Local authorities Players Beijing Unicom, Beijing Telecom, Shanghai Telecom, Wuhan Telecom, Hangzhou Telecom, Fuzhou Telecom, Shanxi Taiyuan Telecom, Guizhou Telecom and Hubei Telecom. China Telecom China Unicom NTT (for FTTH) KT KDDI SICOVAL: science park SIPPEREC: suburbs of Paris Malaysia Mexico Taiwan USA Incumbent Local authorities Incumbent Local authorities Telekom Malaysia El Tamarindo Resort and Spa Chunghwa Telecom US SONET Jackson Energy Authority City of Chattanooga Telecom Tennessee China Cyprus Denmark France France Hong Kong Italy Kuwait GPON Portugal Russia Singapore Sweden South Korea UK USA Incumbent Incumbent Utilities Incumbent CLEC CLEC Incumbent Local bodies CLEC CLEC Incumbent Utilities CLEC Incumbent Incumbents China Telecom (trials of 2 300 GPON lines) CYTA EnergiMidt, EnergiRanders, NRGi Fibrenet France Telecom / Orange SFR HKBN/city telecom Telecom Italia The Kuwaiti Ministry of Telecommunications Sonaecom COMCOR (in Moscow) Singtel Jnkping Energi SK Broadband BT Verizon AT&T USA Ethernet P2P Austria Cyprus France Local authorities Local authorities Incumbent CLEC Cities of Las Vegas, New Orleans, Baton Rouge, Lafayette (enterprises) City of Ried CYTA Free-Illiad

China China Japan South Korea Japan EPON France

Incumbent Incumbent Incumbent Incumbent CLEC Local authorities

www.idate-research.com IDATE 2009

14

FTTx Market Report

Germany Italy The Netherlands The Netherlands

Local authorities CLEC Incumbent Local authorities

City of Schwerte FastWeb KPN Amsterdam CityNet Nuenen

Norway Sweden Switzerland BPON USA

CLEC CLEC Incumbent Incumbent

Lyse B2 Swisscom Verizon

Source: IDATE

www.idate-research.com IDATE 2009

15

FTTx Market Report

3.

FTTx Vendors' dynamics

This section will treat about the leading FTTx equipment manufacturers.

Vendors positioned

The installed FTTx ports are estimated worldwide at 83.3 million as end of 2008. At end of July 2009, we can now present a first estimate of the vendors global market shares at 2009, Q2 (those figures will be confirmed later by IDATE). In a very fragmented FTTx market, the global top six vendors is composed of Asian equipment vendors, ZTE being the market leader with 19% of market share. Huawei came in second position with 13%, followed by the Japanese manufacturer Mitsubishi in the third position at 7%. These results confirm that ZTE is taking the FTTx market worldwide lead in 2009,Q2 because of the shipments realised by ZTE in 2009,Q1 and 2009,Q2 especially taking into account the last important contracts won in the domestic market (China Unicom for instance).

FTTx ports market share per vendor worldwide 2009, Q2

ZTE 19% Others 50%

Huaw ei 13%

Mitsubishi 7% Fiberhome 5%

Fujitsu 3%

Sumitomo 3%

Source: IDATE

www.idate-research.com IDATE 2009

16

FTTx Market Report

Local vendors selected in main FTTx markets

Given the high level of fragmentation of the market, the vendors distinguished each others by the technologies backed and their geographical presence. In the two main FTTx markets (Japan and China), the FTTx players' favourite suppliers are the local ones. Indeed, in Japan, Sumitomo, Mitsubishi and Fujitsu remained the market leaders, which ones benefit of the significant FTTH/B deployments there. In China, Chinese vendors are also preferred to deploy FTTx networks. ZTE, Huawei, FiberHome and Alcatel-Lucent (through Shanghai Bell) lead the market. At end of July 2009, we can now present a first estimate of the vendors market shares in China at 2009, Q2 (those figures will be confirmed later by IDATE). These results confirm that ZTE is consolidating is first place on the Chinese FTTx market with 45% FTTx market share.

FTTx ports market share per vendor in China- 2009, Q2

Others 25%

ZTE 45%

FiberHome 10% Huaw ei 20%

Source: IDATE

In Europe, the market is mainly shared between the two main Ethernet P2P providers which are Cisco and Packetfront then Alcatel Lucent GPON. In North America, the main equipment manufacturers involved in supplying local players include both international heavyweights (Alcatel-Lucent for GPON, and Motorola and Tellabs for BPON); other smaller players such as Calix are also focused on a niche market by supplying ILECs in the US.

www.idate-research.com IDATE 2009

17

FTTx Market Report

Vendors positioning of main vendors

As seen on the table below, each FTTx ports suppliers back one promising technology except from ZTE, Alcatel Lucent and Huawei.

Technologies mainly promoted by equipment vendors

Equipment vendors ZTE Huawei Mitsubishi Fiberhome Sumitomo Fujitsu Nokia Siemens Networks4 Hitachi Alcatel-Lucent Cisco Tellabs Ericsson Motorola Packetfront UTStarcom

EPON

GPON

BPON

P2P

Source: IDATE

Active development of Chinese vendors

ZTE

ZTE has the advantage to provide both EPON and GPON technologies. Really involved in the evolution of PON technology, ZTE push the development of PON standards and mainly on interoperability issue. The company also participated in the development of the next generation PON technologies - 10GEPON - and has launched the first prototype last October 2008. 10GEPON will be used to provide greater bandwidth to the final used but will be more and more used combined with VDSL2 in a FTTB architecture. The strategy of ZTE is therefore to continue their commitment in GPON and EPON (10GEPON) standards. As already mentioned, ZTE is today leading FTTx market. Furthermore the fact that ZTE won the largest share in China Unicom's group purchase in 2009 Q2, is confirming this leadership.

4 At mid 2008, NSN announced that he will stop his investments in GPON technology but will continue to support existing customers. NSN is until then focusing on next generation of optical access for when the market is ready.

www.idate-research.com IDATE 2009

18

FTTx Market Report

Huawei

Huawei also owns both EPON and GPON licenses. Comparatively with its competitors, Huawei is positioned in overseas countries and mainly in Europe and Middle East, deploying GPON. Huawei provides EPON in his domestic market. Huawei has some references in Europe like Deutsche Telekom, British Telecom, and Telecom Italia for GPON deployments and also in Middle East supplying Etisalat and STC. Nevertheless overseas shipments on GPON are still small and Huawei FTTx market rely still mainly on the domestic EPON market.

Fiberhome

Promoting the EPON, FiberHome is an incontestable player in China. Overseas, the company provides GEPON such as in Russia, Thailand and Malaysia.

Focus on the FTTx Chinese market

Two largest operators in China, China Telecom and China Unicom, have confirmed their EPON strategies. China Mobile is today the only major Chinese operator now involved in GPON (more for final access) as well as in EPON (more for 3G mobile backhauling). Furthermore for those Chinese operators already deeply involved in EPON, the temptation will be high to migrate to the new 10G EPON (as the standard is expected in September 2009). Indeed China Telecom is already testing 10G EPON equipments. So vendors who have already taken position on future 10G EPON will then have a strong advantage: this is the case of ZTE who launched world first symmetrical 10 G EPON equipment prototype in May 2009.

China will push the GPON industry ahead

Today GPON is still very confidential in China compared to the EPON massive deployments announced. At end 2008, we have noticed mainly trials concerning GPON: China Telecom is testing around 2 300 GPON lines, China Unicom is testing in the Shanxi Province around 170 000 GPON lines.

The very recent announcement of China Mobile concerning GPON could be the sign of a collaborative development of EPON and GPON in China. To summarize we can say that even if until now Chinese operators have developed an unshakable faith in EPON developments, they are now also paying attention on GPON.

Chinese carriers' GPON announcements Equipment manufacturers involved China Telecom China Unicom China Mobile Alcatel-Lucent, Ericsson , FiberHome, Huawei, ZTE Ericsson, Huawei, ZTE Alcatel-Lucent, Ericsson, ZTE GPON announcement FTTH trials in four Chinese cities of Beijing, Guangzhou, Wuhan and Shanghai Upgrade of fiber cable and FTTH deployment (especially in Shanxi Province concerning GPON) Deployment of FTTH GPON network in 10 cities in Guangdong and Anhui provinces

Source: IDATE

www.idate-research.com IDATE 2009

19

FTTx Market Report

4.

FTTH Market Forecasts 2014

The very high broadband access (FTTH/B and VDSL combined) is expected to experience steady growth in the coming years, to reach close to 140 million subscribers around the globe by 2014. Naturally the rate of progress will not be the same across the board, as each national market will be shaped by the countrys intrinsic features and its players.

5

Worldwide

Growth of the number of FTTH/B and VDSL subscribers around the world has increased significantly in recent months, with forecasts up to 2014 indicating a steady increase across the globe for all ultra-broadband systems. FTTH/B will continue to dominate VDSL in the medium term. According to IDATE, FTTH/B technologies will dominate the market in 2014, with some 114.4 million subscribers compared to around 25.6 million VDSL subscribers. This translates into a 21% to 33% annual increase over the next five years with a steady rate of growth expected between 2010 and 2012 when rollouts will be in their final stages, or properly underway in those zones where deployments are currently in the planning phase. Asia will remain the largest FTTH/B market, but the gap with Europe and the United States will shrink. The opposite is expected to be true for VDSL, however, with Asia in general, and China in particular, forecast to have more VDSL subscribers than Europe and North America by 2011.

Growth of FTTH/B and VDSL subscribers around the world between 2008 and 2014

140 000 000 120 000 000 100 000 000 80 000 000 60 000 000 40 000 000 20 000 000 0

FTTH/B subscribers VDSL subscribers

2008 29 652 400 1482 000

2009 35 1 41000 2 423 600

201 0 45 591600 4 423 000

201 1 57 792 400 71 49 700

201 2 73 91 4 500 1 1755 900

201 3 91970 500 1 7 821600

201 4 1 1 4 348 1 00 25 559 700

Source: IDATE.

In this chapter we mention VDSL but in fact the version now being adopted worldwide is clearly VDSL2.

www.idate-research.com IDATE 2009

20

FTTx Market Report

Forecasts by Region

Growth by zone of the very high-speed subscriber base between 2008 and 2014

N O R T H A M ER I C A ( 2 ) 100 000 000 100 000 000 W EST ER N EU R OPE ( 1)

80 000 000

80 000 000

60 000 000

60 000 000

40 000 000

40 000 000

20 000 000

20 000 000

0 2008 2009 2010 2011 2012 2013 2014

0 2008 2009 2010 2011 2012 2013 2014

EA ST ER N & C EN T R A L EU R O PE 100 000 000

80 000 000

60 000 000

40 000 000

20 000 000

0 2008 2009 2010 2011 2012 2013 2014

M I D D LE EA ST & A F R I C A 1 000 000 100 000 000 800 000

A SI A / PA C I F I C

80 000 000

600 000

60 000 000

400 000

40 000 000

200 000

20 000 000

0 2008 2009 2010 2011 2012 2013 2014

0 2008 2009 2010 2011 2012 2013 2014

1) EU 27 + Norway, Switzerland, Iceland and Andorra 2) Forecasts excluding the Canadian market for which data is irrelevant. Source: IDATE

www.idate-research.com IDATE 2009

21

You might also like

- Enodeb Kpi Reference (v100r002c00 - 02) (PDF) - enDocument57 pagesEnodeb Kpi Reference (v100r002c00 - 02) (PDF) - enHien NguyenNo ratings yet

- LTE Air InterfaceDocument179 pagesLTE Air Interfaceawan_s_n100% (5)

- Catalyst 4500 Series OverviewDocument8 pagesCatalyst 4500 Series OverviewHien NguyenNo ratings yet

- Driving Test & AnalysisDocument20 pagesDriving Test & AnalysisHien NguyenNo ratings yet

- 40-Channel Reconfigurable Optical Add/Drop Multiplexing Portfolio For The Cisco ONS 15454 Multiservice Transport PlatformDocument9 pages40-Channel Reconfigurable Optical Add/Drop Multiplexing Portfolio For The Cisco ONS 15454 Multiservice Transport PlatformHien NguyenNo ratings yet

- Reconfigurable Optical NetworksDocument15 pagesReconfigurable Optical NetworksHien NguyenNo ratings yet

- RADWin ProductOverview enDocument4 pagesRADWin ProductOverview enHien NguyenNo ratings yet

- RNP Rno ProcessDocument24 pagesRNP Rno ProcessHien NguyenNo ratings yet

- Getting Started With RANOPTDocument34 pagesGetting Started With RANOPTHien NguyenNo ratings yet

- 3G System Planing and OptimizationDocument11 pages3G System Planing and OptimizationKalpesh JesalpuraNo ratings yet

- Installation GuideDocument54 pagesInstallation GuideHien NguyenNo ratings yet

- Getting Started With RANOPTDocument34 pagesGetting Started With RANOPTHien NguyenNo ratings yet

- Cisco Ran IonDocument10 pagesCisco Ran IonHofman RadebeNo ratings yet

- Cisco GmplsDocument8 pagesCisco GmplsederdemattosNo ratings yet

- KX Tde600Document2 pagesKX Tde600Hien NguyenNo ratings yet

- Actix OverviewDocument15 pagesActix OverviewHien NguyenNo ratings yet

- Set Top Box Dct700Document7 pagesSet Top Box Dct700Hien NguyenNo ratings yet

- ALU B11 FeaturesDocument288 pagesALU B11 FeatureskirtibhatiaNo ratings yet

- Carrier Ethernet EssentialsDocument14 pagesCarrier Ethernet EssentialsHien NguyenNo ratings yet

- Dimensioning Rules B9Document22 pagesDimensioning Rules B9Hien NguyenNo ratings yet

- DCH3416 Cable ReceiverDocument72 pagesDCH3416 Cable ReceiverHien NguyenNo ratings yet

- Set Top Box Dct700Document7 pagesSet Top Box Dct700Hien NguyenNo ratings yet

- Cisco Explorer 8650HD DVR: FeaturesDocument6 pagesCisco Explorer 8650HD DVR: FeaturesHien NguyenNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5784)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- 10 KW TV TransmitterDocument58 pages10 KW TV TransmitterKirti Khandelwal80% (5)

- LM-0013-1 Generic GET Map PDFDocument1 pageLM-0013-1 Generic GET Map PDFmarco100% (1)

- nL400 Series - Transparent Mode - Operating Manual.1.1 PDFDocument54 pagesnL400 Series - Transparent Mode - Operating Manual.1.1 PDFcarloseduardo1984No ratings yet

- RG Coaxials GuideDocument16 pagesRG Coaxials Guidelijojose1No ratings yet

- SM-J510MN SS Tshoo 7 - (WWW - Stockrom.net) PDFDocument30 pagesSM-J510MN SS Tshoo 7 - (WWW - Stockrom.net) PDFAnonymous mMye6Vs1ONo ratings yet

- Aux InputDocument3 pagesAux Inputfoxast100% (1)

- IEEE c37-90-2-1995-Capability-Capability-of-Relay-Systems-to-Radi PDFDocument14 pagesIEEE c37-90-2-1995-Capability-Capability-of-Relay-Systems-to-Radi PDFCesar Machado0% (1)

- Acko All-Round Protection PlanDocument4 pagesAcko All-Round Protection PlanrahilkelaNo ratings yet

- Data TransmissionDocument2 pagesData TransmissionjakimlmNo ratings yet

- Wireless World 1948 06Document102 pagesWireless World 1948 06Jan Pran100% (1)

- Nokia 2112 Apac Ug NDN enDocument84 pagesNokia 2112 Apac Ug NDN enandrex900No ratings yet

- Ananda International Industrial Limited: Refurbished Samsung, HTC, Blackberry, LG, Google, Sony Price ListDocument4 pagesAnanda International Industrial Limited: Refurbished Samsung, HTC, Blackberry, LG, Google, Sony Price ListLOPEZ CASTANEDA HECTOR ALONSONo ratings yet

- Android App Crash Bug Investigation ReportDocument6 pagesAndroid App Crash Bug Investigation ReportTestingGarageNo ratings yet

- Learn musical notes Do Re Mi with The Sound of Music songDocument3 pagesLearn musical notes Do Re Mi with The Sound of Music songSweety_73No ratings yet

- Failure of NokiaDocument27 pagesFailure of NokiahondaNo ratings yet

- GSM Vs CDMA Vs TDMADocument3 pagesGSM Vs CDMA Vs TDMAMohak BhatiaNo ratings yet

- Sony Case StudyDocument6 pagesSony Case StudySahedul islamNo ratings yet

- Valere HSeriesRectifierFlyer 110105Document2 pagesValere HSeriesRectifierFlyer 110105Mariano Andres TorresNo ratings yet

- 01 Housekeeping LasleyDocument8 pages01 Housekeeping LasleyMani Rathinam RajamaniNo ratings yet

- Submittal ReviewDocument22 pagesSubmittal ReviewuddinnadeemNo ratings yet

- Tbos ManualDocument20 pagesTbos ManualNichole GoffNo ratings yet

- Service Manual Samsung Q1Document6 pagesService Manual Samsung Q1shakil4skNo ratings yet

- Toa 500 Series Mixer Power Amplifier: A-503A A-506A A-512ADocument12 pagesToa 500 Series Mixer Power Amplifier: A-503A A-506A A-512AJorge Alberto Castaño OrtegaNo ratings yet

- CSE4255: Telecommunication: Telephone NetworkDocument19 pagesCSE4255: Telecommunication: Telephone NetworkFif PlayerNo ratings yet

- KX-TDE600: PBX Ip-PbxDocument5 pagesKX-TDE600: PBX Ip-Pbxfiqur1No ratings yet

- Panasonic Kxtg7150ex Kxtg7170exDocument216 pagesPanasonic Kxtg7150ex Kxtg7170exTony AlonsoNo ratings yet

- Nokia Brand AuditDocument8 pagesNokia Brand AuditJust_denver100% (1)

- Samsung Galaxy Brand ImageDocument63 pagesSamsung Galaxy Brand ImageShams SNo ratings yet

- Globe PromoDocument14 pagesGlobe PromoCatherine Jane PaceNo ratings yet

- Samsung Galaxy Ace GT-S5830 User Manual (ENG)Document128 pagesSamsung Galaxy Ace GT-S5830 User Manual (ENG)Horváth Károly100% (1)