Professional Documents

Culture Documents

Pension Loan Otc Final 2012

Uploaded by

Claire RoxasCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Pension Loan Otc Final 2012

Uploaded by

Claire RoxasCopyright:

Available Formats

Form No.

PASEGURUHAN NG MGA NAGLILINGKOD SA PAMAHALAAN Government Service Insurance System

Financial Center, Roxas Blvd., Pasay City

PENSION LOAN OVER-THE-COUNTER APPLICATION

IMPORTANT: Proceeds of this loan will be credited to the eCard account of the pensioner/borrower. Prior to the filing of the accomplished application form, the pensioner/borrower must: (a) secure a tentative computation of the net loan proceeds; and, (b) read carefully the terms and conditions below.

TO BE FILLED OUT BY THE PENSIONER/APPLICANT

Name of Applicant: ____________________________________________________________

Last Name First Name Middle Name

Birth Date: ______________ Age: __________ Pensioner ID No. ____________________ Mailing/Residential Address: ____________________________________________________

No.

Street Brgy/District

Municipality/City

Zip Code

Contact No. _______________________

Cellphone No. ___________________________

1 Mo. 2 Mos. 3 Mos. 4 Mos. 5 Mos. 6 Mos.

NO. OF PENSION MONTHS: (Please encircle your choice or indicate preferred loan amount) TYPE OF LOAN:

(See table 1 for maximum loanable amount)

New Renewal

APPLICATION AGREEMENT

I hereby acknowledge as my indebtedness to GSIS whatever loan amount is approved as my Pension Loan. I also agree to pay such loan in twenty four (24) months. I further agree that the loan principal, interest and other charges due shall be payable in monthly amortization to be deducted from my monthly pension from GSIS. For this purpose, I hereby authorize the GSIS to deduct from my monthly pension the required monthly amortization. Moreover, in the event that the deduction as authorized is not effected for whatever reason, I shall personally pay directly to the GSIS the said amount, including penalties, surcharges and interest in order to update my account. Finally, I agree that this loan shall at all times be subject to the terms and conditions mentioned in this application.

Upon filing of this application, it is understood that I have previously secured a tentative computation of the net loan proceeds I will receive and that I fully conform to the terms and conditions stated below.

____________________________________________

_______________

SIGNATURE OF PENSIONER/BORROWER

TERMS AND CONDITIONS

1. 2.

DATE SIGNED

ELIGIBILITY REQUIREMENTS. Qualified loan borrowers shall be old-age GSIS pensioners who have no outstanding service loans being amortized under the Choice of Loan Amortization Schedule for Pensioners (CLASP) at the time of filing. APPLICATION. Application shall be online through the GW@PS Kiosk. The over-the-counter facility shall only be allowed if the Pensioner-Borrower is unable to complete the loan application transaction through the kiosk because of defects in the card, the kiosk, or the system. Over-the-counter application must be filed personally and accepted at any GSIS Office. AMOUNT OF LOAN. The loan amount that may be availed shall be based on the Basic Monthly Pension (BMP) and the pensioners age as of the date of the receipt of the application or the time the pensioner applied through the kiosk, as shown in Table 1. The pensioner shall have the option to choose a loan amount lower than his maximum loan amount. Failure to indicate the preferred loan amount shall be construed that the pensioner is applying for the maximum loan amount to which the borrower is entitled. TABLE 1. TABLE OF MAXIMUM LOAN AMOUNT Age of Pensioner Maximum Loanable Amount X BMP Limit Below 65 years old 6 100, 000.00 65 to 69 years old 4 60, 000.00 70 years old and above 2 20, 000.00

3.

4. 5.

TARGET PROCESSING TIME. The loan shall be processed within the day of the application if received by the processing units before 12:00 noon. For GW@PS kiosk transactions, it shall be electronically processed within the day of application. eCREDITING OF LOAN PROCEEDS. The proceeds of the GSIS Pension Loan shall be directly credited to the account of the Pensioner-Borrower within three (3) to five (5) working days from application. The pensioner shall be notified of the crediting of the proceeds of the loan to his account through short messaging service (SMS). TERMS OF PAYMENT. The loan principal, interest and other charges due shall be payable in monthly amortization within twenty four (24) months. The monthly amortization shall be deducted from the Pensioner-Borrower's monthly pension from GSIS. It is understood that the Pensioner-Borrower cannot authorize the stoppage of such pension deduction until the loan and other charges that have accrued thereon are fully paid. In the event that deduction as above authorized is not effected for whatever reason, the Pensioner-Borrower hereby undertakes to pay directly to the GSIS any and all amortization due.

6.

7. 8. 9.

DUE DATE OF FIRST MONTHLY INSTALLMENT. The first monthly amortization shall be due on the first day of the month following the granting of the loan and every month thereafter until the loan is paid. INTEREST RATE. The loan shall incur interest at the rate of ten percent (10%) per annum computed in advance. FEES. A service fee of 1% of the gross loan amount shall be charged and deducted from the proceeds of the loan

10. REDEMPTION INSURANCE. All pension loan borrowers shall be covered with a loan Redemption Insurance (RI) whereby, in the event of the death of the Pensioner-Borrower, the theoretical balance of the loan shall be considered paid. The RI rate shall depend on the age of the Pensioner-Borrower at the time of availment, as shown below: Age 52 53 54 55 56 57 58 59 60 61 62 63 , RI rate per P1,000.00 0.53 0.58 0.63 0.69 0.76 0.82 0.90 0.98 1.06 1.16 1.28 1.40 Age 64 65 66 67 68 69 70 71 72 73 74 75 RI rate per P1,000.00 1.54 1.69 1.85 2.02 2.20 2.41 2.64 2.90 3.21 3.55 3.92 4.31 Age 76 77 78 79 80 81 82 83 84 85 86 87 RI rate per P1,000.00 4.73 5.16 5.62 6.11 6.65 7.26 7.96 8.72 9.54 10.41 11.30 12.22 Age 88 89 90 91 92 93 94 95 96 97 98 RI rate per P1,000.00 13.17 14.16 15.20 16.32 17.59 19.16 21.36 24.79 30.67 41.31 60.73

Funeral and/or Survivorship benefits shall not be answerable for the balance of the pension loan. 11. LOAN CANCELLATION. Once the loan is approved and the loan proceeds have been eCredited to the pensioner's eCard account, the Borrower-Pensioner can no longer cancel the loan. 12. RENEWAL OF THE LOAN. Renewal of the loan will be allowed only after the Pensioner-Borrower has been deducted the required twenty four (24) monthly installments, subject to eligibility requirements in Section 1 above. Application for succeeding loan shall be processed starting on the month following the month of the last repayment. 13. ATTORNEYS FEES. Should the GSIS be compelled to refer the Loan or any portion thereof to an Attorney-at-Law for collection or to enforce any right hereunder against the Pensioner-Borrower or avail of any remedy under the law or this Agreement, the Borrower shall pay an amount equivalent to twenty five (25%) percent of all amounts outstanding and unpaid as and for attorney's fees and litigation expenses. 14. VENUE. Any legal action, suit, or proceeding arising out or relating to this Agreement, shall be brought or instituted in the appropriate courts in the City of Pasay or such other venue at the exclusive option of GSIS. In the event the PensionerBorrower initiates any legal action arising from or under this agreement, for whatever causes, the borrower agrees to initiate such action only in the City where the principal office of GSIS is located. . 15. NOTICES. All notices required under this Agreement or for its enforcement shall be sent through SMS or at the Postal/Mailing Address indicated in the Personal Data portion of this loan application or any other addresses as may be indicated hereafter by the Pensioner-Borrower to the GSIS. The notices sent to any of the duly indicated addresses shall be valid and shall serve as sufficient notice to the Pensioner-Borrower for all legal intents and purposes.

You might also like

- Regular Policy Loan Applicationnnb BBGHJN Form 3Document2 pagesRegular Policy Loan Applicationnnb BBGHJN Form 3Greg BeloroNo ratings yet

- Terms and Conditions Personal Loan 1687845092306Document7 pagesTerms and Conditions Personal Loan 1687845092306vishal kademaniNo ratings yet

- Terms and Conditions Personal Loan 1694167502237Document9 pagesTerms and Conditions Personal Loan 1694167502237LAXMIDHAR BEHERANo ratings yet

- SSS Webinar Short Term LoanDocument12 pagesSSS Webinar Short Term Loanmelvanne tamboboyNo ratings yet

- Axis Bank Credit Card Instant Loan T&CDocument3 pagesAxis Bank Credit Card Instant Loan T&CDabba SmashersNo ratings yet

- Terms and Conditions Personal Loan 1701499798644Document7 pagesTerms and Conditions Personal Loan 1701499798644SHIVAM GUPTANo ratings yet

- Optional Policy Loan Application-REV 120111Document2 pagesOptional Policy Loan Application-REV 120111Roel Caedo100% (1)

- Terms and Conditions1709557590073Document6 pagesTerms and Conditions1709557590073nalanda612No ratings yet

- Quick Loan - Terms and ConditionsDocument4 pagesQuick Loan - Terms and ConditionspeterNo ratings yet

- Rules DDDocument3 pagesRules DDsubrahmanyamNo ratings yet

- Terms and Conditions For Calamity Loan: A. Coverage of The ProgramDocument2 pagesTerms and Conditions For Calamity Loan: A. Coverage of The ProgramVilma MoralNo ratings yet

- SSS Member Loan ApplicationDocument2 pagesSSS Member Loan ApplicationRj Santos95% (20)

- terms_and_conditions_personal_loan_1710164964727Document7 pagesterms_and_conditions_personal_loan_1710164964727THENDRAL 05No ratings yet

- Terms and Conditions Personal Loan 1701319332651Document7 pagesTerms and Conditions Personal Loan 1701319332651Parthiban DevendiranNo ratings yet

- Revised PMSBYDocument3 pagesRevised PMSBYSagar SinghNo ratings yet

- FORMS Emergency - Loan PDFDocument3 pagesFORMS Emergency - Loan PDFUsep ObreroNo ratings yet

- Terms and ConditionDocument1 pageTerms and ConditionkrishithamaheshNo ratings yet

- Yusr Loan For Pensioners Eng PDFDocument10 pagesYusr Loan For Pensioners Eng PDFAbdulkadir Al-OthiamNo ratings yet

- Cir 56-I - Implementing Guidelines of The Pag-IBIG MPL Program For Non-IISP BranchesDocument7 pagesCir 56-I - Implementing Guidelines of The Pag-IBIG MPL Program For Non-IISP Branchesmaxx villaNo ratings yet

- HDFC Fixed Deposits Individual Application Form Contact Wealth Advisor Anandaraman at 944-529-6519Document5 pagesHDFC Fixed Deposits Individual Application Form Contact Wealth Advisor Anandaraman at 944-529-6519Mutual Funds Advisor ANANDARAMAN 944-529-6519No ratings yet

- Terms and ConditionsDocument4 pagesTerms and ConditionsThatukuru LakshmanNo ratings yet

- Social Security System: Terms and Conditions For Salary LoanDocument2 pagesSocial Security System: Terms and Conditions For Salary LoanMichael NavosNo ratings yet

- Terms and Condition Personal LoanDocument1 pageTerms and Condition Personal LoanSasmita PanigrahyNo ratings yet

- Lodging Claims Under Credit Guarantee SchemesDocument10 pagesLodging Claims Under Credit Guarantee SchemesAsma SaeedNo ratings yet

- Loan Agreement SampleDocument3 pagesLoan Agreement SampleJamie JovellanosNo ratings yet

- Revised Guidelines On The Pag-IBIG Multi-Purpose Loan (MPL) Program Under The STLMS - IISPDocument8 pagesRevised Guidelines On The Pag-IBIG Multi-Purpose Loan (MPL) Program Under The STLMS - IISPjohnarbhen23velardeNo ratings yet

- FLS011 Application For PenCon Special STLDocument2 pagesFLS011 Application For PenCon Special STLwillienorNo ratings yet

- 32 Claim Procedure Under PMBSBY PMJBY1Document21 pages32 Claim Procedure Under PMBSBY PMJBY1taniaNo ratings yet

- Calamity Loan Application Form (CLAF, HQP-SLF-066) (Applicable To Imus Branch Members Only)Document2 pagesCalamity Loan Application Form (CLAF, HQP-SLF-066) (Applicable To Imus Branch Members Only)egabad78% (9)

- ECS Direct Debit Mandate FormDocument3 pagesECS Direct Debit Mandate FormManish KumarNo ratings yet

- Fixed Deposit Schemes: Scheme (A) - Non Cumulative Scheme (B) - CumulativeDocument4 pagesFixed Deposit Schemes: Scheme (A) - Non Cumulative Scheme (B) - CumulativeoooohlalaNo ratings yet

- Special Pre-Approved Personal Loan TermsDocument1 pageSpecial Pre-Approved Personal Loan TermsRam Kannan PNo ratings yet

- Calamity HMDFDocument3 pagesCalamity HMDFchennieNo ratings yet

- Salary and Medal New Form2Document3 pagesSalary and Medal New Form2diamajolu gaygons100% (1)

- Sudheer Loan Letter PDFDocument7 pagesSudheer Loan Letter PDFmr copy xeroxNo ratings yet

- Nagoor SANCTION - LETTER - PSI - AVFSDocument16 pagesNagoor SANCTION - LETTER - PSI - AVFSgudavalli0088No ratings yet

- Convert Purchases to EMIs on LIC Credit CardDocument2 pagesConvert Purchases to EMIs on LIC Credit CardvijaykannamallaNo ratings yet

- Welcome Letter 33875975Document3 pagesWelcome Letter 33875975Raj KumarNo ratings yet

- Pag-lBIG Fund Updates Guidelines for Multi-Purpose LoansDocument8 pagesPag-lBIG Fund Updates Guidelines for Multi-Purpose LoansLandsNo ratings yet

- Indian Bank Global Credit Card Usage GuideDocument14 pagesIndian Bank Global Credit Card Usage GuideJijithpillaiNo ratings yet

- Name - Mahesh Tukaram Jagadale CIF No. - Date and Time of Request: 87097609648 10/07/2020 11:17:37 AM Loan Amount: Rs 60000Document1 pageName - Mahesh Tukaram Jagadale CIF No. - Date and Time of Request: 87097609648 10/07/2020 11:17:37 AM Loan Amount: Rs 60000mahesh jagadaleNo ratings yet

- 26 March 2024_Amendment to the Master Direction_Finance 360Document13 pages26 March 2024_Amendment to the Master Direction_Finance 360Aniket RathoreNo ratings yet

- Vamsi Krishna Loan Sanction Letter 456Document7 pagesVamsi Krishna Loan Sanction Letter 456Venkatesh DoodamNo ratings yet

- Future Pensions Plan - 0 PDFDocument10 pagesFuture Pensions Plan - 0 PDFManjula Nadeeth De SilvaNo ratings yet

- Fair Practices Code: ObjectiveDocument16 pagesFair Practices Code: ObjectiveBADRI VENKATESHNo ratings yet

- Loan Policy PDFDocument3 pagesLoan Policy PDFVeeru Mudiraj0% (1)

- RHB Bank Berhad CashXcess Program TermsDocument3 pagesRHB Bank Berhad CashXcess Program TermsAmy GarrettNo ratings yet

- Notice Consoloan Installment 3445640967Document7 pagesNotice Consoloan Installment 3445640967marianazarethagliamNo ratings yet

- MQL Info SheetDocument3 pagesMQL Info Sheetdesmarais jean francoisNo ratings yet

- Terms and ConditionsDocument14 pagesTerms and ConditionsKarthik SingamNo ratings yet

- PMJJBY RulesDocument3 pagesPMJJBY Rulesyogesh kumarNo ratings yet

- Loan Information Sheet Mutual Aid QuickDocument4 pagesLoan Information Sheet Mutual Aid Quickdesmarais jean francoisNo ratings yet

- Terms and ConditionsDocument14 pagesTerms and ConditionsPiyush ckNo ratings yet

- Opening of Term DepositDocument8 pagesOpening of Term DepositDeepak RoyNo ratings yet

- PNB CCDocument13 pagesPNB CCArim TorrNo ratings yet

- LIC NEFT mandate form for policy paymentsDocument3 pagesLIC NEFT mandate form for policy paymentshitesh_tilalaNo ratings yet

- SLF001 MultiPurposeLoanApplicationForm (MPLAF) V01Document2 pagesSLF001 MultiPurposeLoanApplicationForm (MPLAF) V01mitzi_0350% (2)

- Credit Secrets: Learn the concepts of Credit Scores, How to Boost them and Take Advantages from Your Credit CardsFrom EverandCredit Secrets: Learn the concepts of Credit Scores, How to Boost them and Take Advantages from Your Credit CardsNo ratings yet

- 27 People vs. RobeloDocument3 pages27 People vs. RobeloClaire RoxasNo ratings yet

- Rem 38Document115 pagesRem 38Claire RoxasNo ratings yet

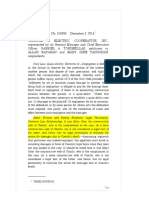

- Cagayan II Electric Cooperative, Inc. vs. Rapanan 743 SCRA 703, December 03, 2014Document15 pagesCagayan II Electric Cooperative, Inc. vs. Rapanan 743 SCRA 703, December 03, 2014Claire RoxasNo ratings yet

- Preliminary Attachment - AnnotationsDocument12 pagesPreliminary Attachment - AnnotationsClaire RoxasNo ratings yet

- MTJ 10 1770Document6 pagesMTJ 10 1770Anonymous oNB5QA0No ratings yet

- 10, 48, 86 - QuiambaoDocument4 pages10, 48, 86 - QuiambaoClaire RoxasNo ratings yet

- 65 PEOPLE vs. GODocument2 pages65 PEOPLE vs. GOClaire RoxasNo ratings yet

- !court: L/epnblic of Tbe F) BilippinesDocument20 pages!court: L/epnblic of Tbe F) BilippinesClaire RoxasNo ratings yet

- Irr Foreign Investment ActDocument17 pagesIrr Foreign Investment ActClaire RoxasNo ratings yet

- ISSUE: Whether or Not The Search and Seizure of The Alleged Subject Shabu Was Incident To A Lawful ArrestDocument5 pagesISSUE: Whether or Not The Search and Seizure of The Alleged Subject Shabu Was Incident To A Lawful ArrestClaire RoxasNo ratings yet

- 12Document2 pages12Claire Roxas100% (1)

- 89Document5 pages89Claire RoxasNo ratings yet

- 19 - Dabu v. KapunanDocument2 pages19 - Dabu v. KapunanClaire RoxasNo ratings yet

- (PART2) Case #53 People Vs SoriaDocument3 pages(PART2) Case #53 People Vs SoriaClaire RoxasNo ratings yet

- (PART 2) Case #91 Nollora, Jr. Vs PeopleDocument2 pages(PART 2) Case #91 Nollora, Jr. Vs PeopleClaire RoxasNo ratings yet

- (PART2) Case # 15 Borlongan Jr. Vs PeñaDocument2 pages(PART2) Case # 15 Borlongan Jr. Vs PeñaClaire RoxasNo ratings yet

- 117Document11 pages117Claire RoxasNo ratings yet

- Midterm Consolidated PrintableDocument65 pagesMidterm Consolidated PrintableClaire RoxasNo ratings yet

- Crimpro 116 117Document1 pageCrimpro 116 117Claire RoxasNo ratings yet

- People v. LayloDocument2 pagesPeople v. LayloClaire RoxasNo ratings yet

- Court rules on civil liability despite acquittalDocument15 pagesCourt rules on civil liability despite acquittalClaire RoxasNo ratings yet

- Rosa H. Fenequito, Corazon E. Hernandez, and Lauro H. Rodriguez, Petitioners, vs. Bernardo Vergara, JR G.R. No. 172829Document7 pagesRosa H. Fenequito, Corazon E. Hernandez, and Lauro H. Rodriguez, Petitioners, vs. Bernardo Vergara, JR G.R. No. 172829Claire RoxasNo ratings yet

- Midterm Consolidated Revised PrintableDocument80 pagesMidterm Consolidated Revised PrintableClaire RoxasNo ratings yet

- Rem1 Rules 23 32Document86 pagesRem1 Rules 23 32Claire RoxasNo ratings yet

- Rem1-Rules 6-9Document92 pagesRem1-Rules 6-9Claire RoxasNo ratings yet

- Criminal Law Review Case Pool For FinalsDocument1 pageCriminal Law Review Case Pool For FinalsClaire RoxasNo ratings yet

- Rem1 Rules 15 19Document78 pagesRem1 Rules 15 19Claire RoxasNo ratings yet

- Rem1 Case Pool Rule 23-39Document2 pagesRem1 Case Pool Rule 23-39Claire RoxasNo ratings yet

- Case No. 10 - Rules 1-5Document3 pagesCase No. 10 - Rules 1-5Claire RoxasNo ratings yet

- Crim Rev AssignmentDocument11 pagesCrim Rev AssignmentClaire RoxasNo ratings yet

- Preterite vs Imperfect in SpanishDocument16 pagesPreterite vs Imperfect in SpanishOsa NilefunNo ratings yet

- Service Manual Pioneer CDJ 2000-2 (RRV4163) (2010)Document28 pagesService Manual Pioneer CDJ 2000-2 (RRV4163) (2010)GiancaNo ratings yet

- Fact-Sheet Pupils With Asperger SyndromeDocument4 pagesFact-Sheet Pupils With Asperger SyndromeAnonymous Pj6OdjNo ratings yet

- Food Processing & ClassificationDocument3 pagesFood Processing & ClassificationAzrielle JaydeNo ratings yet

- Development Proposal ReportDocument37 pagesDevelopment Proposal ReportJean-Pierre RouxNo ratings yet

- International Waiver Attestation FormDocument1 pageInternational Waiver Attestation FormJiabao ZhengNo ratings yet

- Final Exam, Business EnglishDocument5 pagesFinal Exam, Business EnglishsubtleserpentNo ratings yet

- PDF To Sas DatasetsDocument6 pagesPDF To Sas DatasetsSiri KothaNo ratings yet

- Restructuring ScenariosDocument57 pagesRestructuring ScenariosEmir KarabegovićNo ratings yet

- PDFDocument2 pagesPDFJahi100% (3)

- Fiegel Kutter Idriss PDFDocument1 pageFiegel Kutter Idriss PDFAvaNo ratings yet

- 5.2.1 1539323575 2163Document30 pages5.2.1 1539323575 2163Brinda TNo ratings yet

- Hempel's Curing Agent 95040 PDFDocument12 pagesHempel's Curing Agent 95040 PDFeternalkhut0% (1)

- PSP, Modern Technologies and Large Scale PDFDocument11 pagesPSP, Modern Technologies and Large Scale PDFDeepak GehlotNo ratings yet

- Dy Keng vs. International LaborDocument9 pagesDy Keng vs. International LaborDani McstNo ratings yet

- Specification For Diesel Engines: AugustDocument19 pagesSpecification For Diesel Engines: AugustSerge RINAUDONo ratings yet

- Sawmill Safety 3-Trim SawsDocument51 pagesSawmill Safety 3-Trim SawsramptgdNo ratings yet

- Self Respect MovementDocument2 pagesSelf Respect MovementJananee RajagopalanNo ratings yet

- Ramesh Dargond Shine Commerce Classes NotesDocument11 pagesRamesh Dargond Shine Commerce Classes NotesRajath KumarNo ratings yet

- 2015 Masonry Codes and Specifications Compilation, MCAA StoreDocument1 page2015 Masonry Codes and Specifications Compilation, MCAA StoreMuhammad MurtazaNo ratings yet

- Sagnik CVDocument3 pagesSagnik CVSagnik GangulyNo ratings yet

- Mcquillin Murphy ResumeDocument1 pageMcquillin Murphy Resumeapi-253430225No ratings yet

- CH1 Ncert 11th BiologyDocument18 pagesCH1 Ncert 11th Biologysomnathsharma777No ratings yet

- Clique Pen's Marketing StrategyDocument10 pagesClique Pen's Marketing StrategySAMBIT HALDER PGP 2018-20 BatchNo ratings yet

- PSE Inc. V CA G.R. No. 125469, Oct 27, 1997Document7 pagesPSE Inc. V CA G.R. No. 125469, Oct 27, 1997mae ann rodolfoNo ratings yet

- ThumbDocument32 pagesThumbdhapraNo ratings yet

- The Experience of God Being Consciousness BlissDocument376 pagesThe Experience of God Being Consciousness BlissVivian Hyppolito100% (6)

- V-AMP3: User ManualDocument19 pagesV-AMP3: User Manualnutmeg_kickerNo ratings yet

- 5528 L1 L2 Business Admin Unit Pack v4Document199 pages5528 L1 L2 Business Admin Unit Pack v4Yousef OlabiNo ratings yet

- GUCR Elections Information 2017-2018Document10 pagesGUCR Elections Information 2017-2018Alexandra WilliamsNo ratings yet