Professional Documents

Culture Documents

Dutch Accounting Standards For Large and Medium-Sized Legal Entities 2011

Uploaded by

Nicoleta Mihai0 ratings0% found this document useful (0 votes)

332 views0 pagesIKJUJJ

Original Title

Dutch Accounting Standards for Large and Medium-sized Legal Entities 2011

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentIKJUJJ

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

332 views0 pagesDutch Accounting Standards For Large and Medium-Sized Legal Entities 2011

Uploaded by

Nicoleta MihaiIKJUJJ

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 0

SEPTEMBER 2011

Dutch Accounting Standards for large

and medium-sized legal entities

2011 edition

Related parties

Following a legal amendment (section

2:381.3 of the Netherlands Civil Code

(BW)), the DASB revised DAS 330

Related parties. Pursuant to the law,

the legal entity is required to disclose

the following information in the notes

to the nancial statements if the entity

concluded signicant transactions with

related parties and these transactions

did not take place under normal market

conditions:

information about the size of the

transactions;

the nature of the relationship with

the related parties; and

other information about the

transactions that is required for

providing insight into the nancial

position of the legal entity.

The DASB further recommends that

transactions with related parties that

did take place under normal market

conditions also be disclosed.

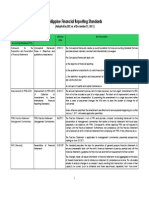

The Dutch Accounting Standards Board

(DASB) recently published the 2011

edition of the Dutch Accounting

Standards for large and medium-sized

legal entities. This edition contains a

small number of changes as compared

to the previous edition. The revised

Standards are effective for nancial

years starting on or after 1 January 2012,

unless specically stated otherwise.

This factsheet presents an overview of

the most important changes published

in the 2011 edition. It does not identify

changes with respect to the guidance

for specic industries. In order to

provide a complete overview, this

factsheet starts with a summary of

the main changes to the standards

that frst become effective in the 2011

nancial year.

Contents

Introduction 1

Major changes applicable from

1 January 2011 1

Important changes effective

from 1 January 2012 4

Other changes 6

Draft Standards 7

Finally 8

Major changes applicable

from 1 January 2011

Medium-sized legal entities, other than

listed and/or public limited liability

companies, are exempt from these

disclosure requirements. With respect

to medium-sized public limited liability

companies (not listed), disclosure of

this information may be limited to

transactions concluded directly or

Introduction

1 | Dutch Accounting Standards for large and medium-sized legal entities

indirectly between the company and its

principal shareholders and between the

company and members of its executive,

managerial and/or supervisory bodies.

Transactions between two or more

members of a group are also exempt

from the identied disclosure

requirements, provided that the

subsidiaries that are party to the

transaction are wholly owned by one or

more members of the group.

Segment reporting

In response to international

developments with respect to annual

reporting, the 2010 edition includes a

new DAS 350 Segment reporting. In

addition to the legal requirements for

segmentation of net turnover according

to business segment and geographic

area, this Standard discusses voluntary

additional segment information.

An entity may disclose additional

segmented information to provide

insight into the results, assets,

provisions and liabilities of its operating

segments. An operating segment is an

activity of the entity:

that is capable of generating

revenues and incurring expenses

(even if the revenues and expenses

arise from transactions with other

segments of the entity);

whose results are regularly reviewed

by management in order to come to

decisions regarding resources to be

allocated and to assess the nancial

performance; and

for which separate fnancial

information is available.

Similar operating segments that

satisfy certain qualitative criteria

may be aggregated. The Standard

then identies quantitative thresholds

for designating operating segments as

reportable segments.

There may be differences between

the accounting policies applied for

segment information and those for

the nancial statements.

The accounting policies applied to

transactions between reportable

segments, the nature of any differences

between accounting policies, and the

nature of any changes to those policies

should be disclosed.

Operating segments

Business segments

Geographical segments

X

X

Additional segment information

2 | Dutch Accounting Standards for large and medium-sized legal entities

2011 KPMG Accountants N.V.

Other information to be disclosed in

the notes

In response to a legal amendment

(section 2:381.2 BW), the DASB added

a new paragraph to DAS 390 Other

information to be disclosed in the notes.

Accordingly, the legal entity is required

to disclose information in the notes

to the fnancial statements about the

nature, the business objective and the

fnancial consequences of off-balance

sheet arrangements if the risks or

benefts fowing from these

arrangements are signicant and to

the extent that the disclosure of such

risks and benefts is necessary in order

to assess the entitys nancial position.

Examples include prot-sharing

schemes, debt factoring, pledged

assets and operating lease contracts.

Medium-sized legal entities are

exempt from the disclosure

requirements concerning the nancial

consequences: These entities can

sufce with disclosing the nature and

the business objective of off-balance

sheet arrangements.

Annual report

The 2010 edition contains a revised

DAS 400 Annual report. Subparagraph

110a of this Standard includes a listing

of risk categories (strategy, operational,

nancial, nancial reporting and

legislation and regulations) with

reference to which the entity can

provide the legally required description

of the main risks and uncertainties

facing it.

Furthermore, DAS 400.112 stipulates

that a legal entity (in the context of

corporate governance) discloses

information in the annual report

concerning codes of conduct that it

applies and whether these are applied

voluntarily or by law or regulation.

In addition, the subparagraphs dealing

with disclosures about corporate social

responsibility have been expanded.

The DASB recommends that the annual

report include information about the

main issues of relevant social aspects

of the entitys business operations,

including its domestic and/or

international supply chain management.

Further details on corporate social

responsibility reporting can be found in

the Recommendations for social

reporting (2009), which is included

separately in an appendix (chapter 920)

of the 2010 edition. Medium-sized legal

entities, in fact, are legally exempt

from the requirements to disclose

information in the annual report about

(similar) non-nancial performance

indicators.

Finally, a separate paragraph was added

to DAS 400 dealing with listed legal

entities. This paragraph discusses legal

requirements, codes of conduct and

management statement for listed

companies.

Annual report

Performance indicators

(including CSR*)

Additional information

on items in financial

statements

Outlook section

Financial analysis

Risks and

uncertainties

Use of financial

instruments

Corporate

governance*

Annual report

* = new

Dutch Accounting Standards for large and medium-sized legal entities | 3

2011 KPMG Accountants N.V.

Important changes effective from

1 January 2012

In the 2011 edition, a number of draft

requirements from the Standards and

draft Standards were made nal. In

addition, since the publication of the

previous edition of the Standards, the

DASB has published a number of DASB

statements that have been incorporated

in the 2011 edition. A list of the main

changes can be found below.

Impairment of xed assets

In DAS 121.514, the tests for the

allocation of goodwill to cash generating

units for determining a possible

impairment loss have been replaced by

a simplied method. Under this new

method, goodwill is allocated to all cash

generating units and groups of cash

generating units that are expected to

gain synergy benefts after an acquisition.

This allocation takes place at the lowest

level at which goodwill is reviewed for

internal management purposes, though

not higher than an operating segment

as dened in DAS 350.

Investment property under

development

Previously, the DASB made a distinction

between the accounting treatment of

investment property under development

(treatment in accordance with DAS 212

Tangible xed assets) and investment

property that is being redeveloped or

renovated (treatment in accordance

with DAS 213 Investment property).

Given the fact that there is no

fundamental difference between

development and redevelopment, the

relevant Standards now stipulate that

investment property under development

should also be treated in accordance

with the requirements of DAS 213

Investment property.

Loyalty programmes

Following international developments,

subparagraph 109a was added to DAS

270 The prot and loss account with

stipulations concerning loyalty

programmes. These are dened as

credits awarded by the entity to its

clients in the form of, for example,

loyalty points and/or bonus cards.

Credits in respect of loyalty

programmes are identied as a separate

component of a transaction if the

following conditions are met:

the credits can be exchanged for

goods or services that the entity

provides as part of its normal

operations; and

the value of the credits is not

insignicant to the value of the sales

on which these credits are awarded.

The revenue attributable to this separate

component is allocated to the period in

which the credit is cashed in.

If the relevant conditions are not

satised, the revenues from the entire

transaction are recognised at the time of

the sale when the credits are awarded.

In that case, the costs of the loyalty

programme are recognised in the same

period.

Financial instruments, accounting

principles for foreign currency and

securities

In DAS 290 Financial instruments and,

related to it, DAS 122 Accounting

principles for foreign currency and DAS

226 Securities, a number of paragraphs

have been included or changed in order

to eliminate ambiguities identifed in

practice.

DAS 290, paragraphs 513 and 541,

clarify that if at the balance sheet date

the fair value of derivatives measured

at cost, to which no cost price hedge

accounting is applied, is lower than the

historical cost price of the derivative, the

difference must always be recognised in

the prot and loss account. This lower

4 | Dutch Accounting Standards for large and medium-sized legal entities

2011 KPMG Accountants N.V.

fair value has to be established in a

manner that does not take account of

accrued interest.

In addition, the view contained in DAS

122 and DAS 290 that forward exchange

contracts are monetary items has

changed. Currency elements in

derivatives are now recognised at cost

or lower market value instead of at

period-end exchange rates as is the

case with monetary items. This can

have consequences for hedge

documentation. A mismatch can now

arise in the result of a forward exchange

contract entered into to hedge the

foreign currency risk on a balance sheet

position (for example, a receivable)

denominated in foreign currency.

The receivable is translated at balance

sheet date at the exchange rate

applicable at that date, and the

exchange rate gains or losses are taken

to the prot and loss account, whereas

this only applies to a forward exchange

contract if the market value is below

cost. To prevent such a mismatch,

application of cost price hedge

accounting, including the relevant hedge

documentation, is essential.

In addition, paragraphs 537a and 537b in

DAS 290 contain a simplied alternative

for the impairment of nancial assets

that is aligned with the principle of cost

or lower market value.

Further, the international environment,

partly under the infuence of the credit

crisis, offers the option to value listed

bonds at cost, provided they are

not held for trading. This option has

been incorporated in the Standards.

In connection with these changes,

paragraphs 207 and 304 in DAS 226

have been abolished and the reference

to unlisted bonds has been adjusted

in paragraph 208.

Finally, transitional provisions have been

added to DAS 290 in response to these

changes.

Forward exchange contract: exchange differences to

profit and loss

Receivable: exchange differences to profit and loss

Forward exchange contract: do not recognise

any value adjustments unless fair value < cost

Receivable: exchange differences to profit and loss

Mismatch

Cost price hedge

accounting

No hedge

accounting

Forward exchange contract at cost

hedge

documen-

tation

Example forward exchange contract and receivable

Dutch Accounting Standards for large and medium-sized legal entities | 5

2011 KPMG Accountants N.V.

Other changes

Paragraphs 211 of DAS 140 Changes

in accounting principles and 201 of

DAS 265 have been revised to

clarify that the effect of changes in

accounting principles is not part of

the Statement of total result.

Paragraph 206 of DAS 160 Events

after balance sheet date claries that

events occurring after balance sheet

date that do not provide any further

information as to the situation as

at balance sheet date are not

recognised in the nancial

statements, unless the going

concern assumption is no longer

effective and the nancial statements

are prepared on the basis of

liquidation of the operations of the

entity.

Paragraph 506 of DAS 212 Tangible

xed assets (and the related

paragraphs 201 in DAS 270 and 217 in

DAS 360) recommends that income

from the regular sale of tangible fxed

assets in the context of ordinary

activities be recognised as net

turnover.

The description of the items that

form part of the net investment in a

participating interest has been

brought in line in paragraph 340 of

DAS 214 Financial xed assets with

paragraph 112 of DAS 122 Accounting

principles for foreign currency.

For example, an item for which

settlement is not planned for the

near future and will probably not be

settled in the near future is

essentially an increase of the net

investment in the participating

interest. Trade receivables and trade

payables do not form part of the net

investment.

Paragraph 201 of DAS 273 Interest

expenses has been brought in line

with paragraph 201 of DAS 254

Liabilities.

It is recommended to recognise

the discount of liabilities not yet

recognised in the prot and loss

account as reduction of the liability

to which they relate. Pursuant to

section 2:375(5) BW, it is allowed to

capitalise the discount (the difference

between amount received and

redemption payable amounts)

allocated to successive periods

instead of deducting it from the

amount repayable.

6 | Dutch Accounting Standards for large and medium-sized legal entities

2011 KPMG Accountants N.V.

Draft Standards

Introduction, Financial xed assets

and Shareholders equity: application

of combination 3 (DAS 100, DAS 214

and DAS 240)

Various Standards of the 2011 edition

include a number of draft paragraphs

for legal entities that prepare their

consolidated nancial statements in

accordance with EU-IFRS in

combination with the company fnancial

statements in accordance with Part 9

Book 2 BW, with the entity applying the

same accounting principles as for the

consolidated nancial statements

(combination 3). The basic principle

here is to keep shareholders equity in

accordance with the company nancial

statements equal to shareholders

equity according to the consolidated

nancial statements.

Draft paragraph 107 of DAS 100

Introduction claries that it is permitted

to recognise participating interests

consolidated in the consolidated

nancial statements at net equity value

or in accordance with the equity method

in the company nancial statements.

When using each of the two options,

the entity applies the accounting

principles in accordance with EU-IFRS

that are applied in the consolidated

nancial statements. The difference

between the two options solely

concerns the presentation of goodwill.

Three draft paragraphs have been added

to DAS 214 Financial xed assets that

describe the recognition in the company

nancial statements of a phased

acquisition (214.312), the loss of control

with retention of a remaining interest

(214.312a) and transactions with

minority shareholders with retention

of actual control (214.312b) in the

application of combination 3. In all these

cases, recognition is in accordance with

EU-IFRS. Finally, draft paragraph 227c

has been added to DAS 240

Shareholders equity that stipulates

when the legal entity is required to

form a revaluation reserve with respect

to these transactions.

Impairment of xed assets (DAS 121)

Draft paragraph 515 of DAS 121

Impairment of xed assets stipulates

that, upon disposal of an activity of the

cash generating unit, goodwill has to be

allocated to the activity for determining

the result. Draft DAS 121.516

subsequently stipulates that, when a

change occurs in the composition of

cash generating units, goodwill has to

be allocated anew to the units.

Allocation takes place on the basis of

the relative value of the activities or the

units, unless the entity can demonstrate

that a different method is more suitable.

In addition, a stipulation was added to

paragraph 519 that, to the extent that

the general operating assets cannot be

allocated to the cash generating unit

fairly and consistently, the impairment

test for this unit will take place without

these general operating assets. A test is

also performed on the group of cash

generating units to which it is possible

to allocate these general operating

assets fairly and consistently.

Participating

interest in group

company 120

Equity method

Goodwill 20

Participating

interest in group

company 100

Net equity value

Equity method compared to net equity value:

difference in presentation of goodwill.

Dutch Accounting Standards for large and medium-sized legal entities | 7

2011 KPMG Accountants N.V.

KPMG

Laan van Langerhuize 1

1186 DS AMSTELVEEN

T +31 (0)20 656 78 90

Katja van der Kuij-Groenberg

Tel. +31 (0)20 656 7092

vanderkuij-groenberg.katja@kpmg.nl

www.kpmg.nl

Deadline for comments

The Dutch Accounting Standards Board

invites comments and reactions to the

draft Standards. The DASB would like to

receive these reactions and comments

no later than 1 December 2011.

No deadline applies to other reactions

and comments.

Finally

Acknowledgement of sources

The information contained in this

factsheet is primarily derived from

the introduction to the 2010 and 2011

editions of the Dutch Accounting

Standards.

Further information

Your KPMG contact person would

be pleased to expand further on

the information contained in this

publication and its consequences

for your company.

About KPMG

KPMG offers services in the feld of audit, tax and advisory. We work for a broad spectrum of clients:

major domestic and international companies, medium-sized entities, non-proft organisations and

government authorities. The complicated issues facing our clients demand a multi-disciplinary approach.

Our professionals stand out in their own specialities but, at the same time, work closely together to

create added value enabling our clients to excel in their own environment. To this end we rely on a

rich source of knowledge and experience gained worldwide in the widest range of organisations and

markets.

The information contained herein is of a general nature and is not intended to address the

circumstances of any particular individual or entity. Although we endeavor to provide accurate and

timely information, there can be no guarantee that such information is accurate as of the date it is

received or that it will continue to be accurate in the future. No one should act on such information

without appropriate professional advice after a thorough examination of the particular situation.

2011 KPMG Accountants N.V., a Dutch limited liability company, is a subsidiary of KPMG Europe

LLP and a member frm of the KPMG network of independent member frms affliated with KPMG

International Cooperative (KPMG International), a Swiss entity. All rights reserved. Printed in the

Netherlands. The KPMG name, logo and cutting through complexity are registered trademarks of

KPMG International Cooperative. 145_0811

You might also like

- The Handbook for Reading and Preparing Proxy Statements: A Guide to the SEC Disclosure Rules for Executive and Director Compensation, 6th EditionFrom EverandThe Handbook for Reading and Preparing Proxy Statements: A Guide to the SEC Disclosure Rules for Executive and Director Compensation, 6th EditionNo ratings yet

- Deloitte Model Half Year Report 31dec2013Document75 pagesDeloitte Model Half Year Report 31dec2013PhillipGaoNo ratings yet

- Retail & Consumer Retail & ConsumerDocument3 pagesRetail & Consumer Retail & ConsumerSo LokNo ratings yet

- From Dutch Gaap To Ifrs For Smes : AssuranceDocument119 pagesFrom Dutch Gaap To Ifrs For Smes : AssurancePrachi GroverNo ratings yet

- Ifrs Top20 Tracker 2013Document44 pagesIfrs Top20 Tracker 2013ingridbachNo ratings yet

- VALUE IFRS PLC Interim June 2022 Final 26 MarchDocument45 pagesVALUE IFRS PLC Interim June 2022 Final 26 MarchKatarina GojkovicNo ratings yet

- Segment and Interim ReportingDocument8 pagesSegment and Interim ReportingKECEBONG ALBINO50% (2)

- Key Current Issues: Accounting Policies (ED/2018/1) The ProblemDocument8 pagesKey Current Issues: Accounting Policies (ED/2018/1) The ProblemAMNA T.ZNo ratings yet

- Assignment 1: Accounting Policies For Reporting IncomeDocument9 pagesAssignment 1: Accounting Policies For Reporting IncomesrystalNo ratings yet

- Chapsum 14Document3 pagesChapsum 14sm8dreamsNo ratings yet

- Fair Valuing Assets and Liabilities .................................................................................. 13Document103 pagesFair Valuing Assets and Liabilities .................................................................................. 13Ileo AliNo ratings yet

- Advanced Accounting - APPLICABILITY OF ACCOUNTING STANDARDSDocument4 pagesAdvanced Accounting - APPLICABILITY OF ACCOUNTING STANDARDSGedie RocamoraNo ratings yet

- Ifrs 8 Segment InformationDocument6 pagesIfrs 8 Segment InformationMovies OnlyNo ratings yet

- Slas 03Document11 pagesSlas 03Dinushika MadhubhashiniNo ratings yet

- IFRS Illustrative Financial StatementsDocument306 pagesIFRS Illustrative Financial Statementsjohnthorrr100% (1)

- Ifrs 8 - Operating Segments: January 2009Document6 pagesIfrs 8 - Operating Segments: January 2009Joyce Anne MorenoNo ratings yet

- IAS Plus: Amendments To IFRS 2 - Vesting Conditions and CancellationsDocument3 pagesIAS Plus: Amendments To IFRS 2 - Vesting Conditions and CancellationsFarhat ParveenNo ratings yet

- Asu 2019-12Document49 pagesAsu 2019-12janineNo ratings yet

- 2012 Model Financial StatementsDocument140 pages2012 Model Financial StatementsBhava Nath Dahal100% (1)

- Mutual Recognition Means That National Financial Statements Are Accepted AbroadDocument7 pagesMutual Recognition Means That National Financial Statements Are Accepted Abroadইবনুল মাইজভাণ্ডারীNo ratings yet

- Updates in Financial Reporting StandardsDocument24 pagesUpdates in Financial Reporting Standardsloyd smithNo ratings yet

- No. 2019-06 May 2019Document46 pagesNo. 2019-06 May 2019JM LopezNo ratings yet

- Explanation Financial StatementsDocument3 pagesExplanation Financial StatementsitsmekuskusumaNo ratings yet

- Aim 1004Document28 pagesAim 1004Emily HoeNo ratings yet

- Value Ifrs PLC 2022 Final 30 JuneDocument230 pagesValue Ifrs PLC 2022 Final 30 Junetunlinoo.067433No ratings yet

- Deloitte NGAS&NPOsDocument16 pagesDeloitte NGAS&NPOsJayden GalingNo ratings yet

- Investment Decision - Edited (1) .EditedDocument2 pagesInvestment Decision - Edited (1) .EditedDavid JumaNo ratings yet

- CoverDocument284 pagesCoverstoreroom_02No ratings yet

- 25 Notes of Financial StatementsDocument35 pages25 Notes of Financial StatementsDustin ThompsonNo ratings yet

- Fourth Quarter 2012 Financial Results Conference Call: February 5, 2013Document22 pagesFourth Quarter 2012 Financial Results Conference Call: February 5, 2013Nicholas AngNo ratings yet

- Chapter 4Document53 pagesChapter 4tangliNo ratings yet

- Ifrs 8 Reserrch DocumentsDocument6 pagesIfrs 8 Reserrch Documentssandeep11116No ratings yet

- Requirements For Financial Statements Under The International Financial Reporting StandardsDocument4 pagesRequirements For Financial Statements Under The International Financial Reporting StandardsabdellaNo ratings yet

- Asu 2020-04Document86 pagesAsu 2020-04Tingulakkum LakkumNo ratings yet

- IFRS 8 Operating SegmentsDocument6 pagesIFRS 8 Operating SegmentsPratima SeedheeyanNo ratings yet

- IFRS SOE GuidelineDocument7 pagesIFRS SOE GuidelineFredericYudhistiraDharmawataNo ratings yet

- Workshop On The Revised Fifth Schedule: Facilitator: Tahmeen Ahmad, ACADocument47 pagesWorkshop On The Revised Fifth Schedule: Facilitator: Tahmeen Ahmad, ACAShahid AliNo ratings yet

- Legal Case StudyDocument12 pagesLegal Case Studytanmay agrawalNo ratings yet

- Significant Accounting Policies of IBMDocument19 pagesSignificant Accounting Policies of IBMvivek799No ratings yet

- Division of Corporation Finance: Financial Reporting ManualDocument358 pagesDivision of Corporation Finance: Financial Reporting ManualankushbindwalNo ratings yet

- CF FRM Nov2020Document370 pagesCF FRM Nov2020KHWAJA MOHAMMAD MASOODNo ratings yet

- IFRS For Small and Medium-Sized Entities: Pocket Guide 2009Document8 pagesIFRS For Small and Medium-Sized Entities: Pocket Guide 2009Robin SicatNo ratings yet

- Ifrs 8Document5 pagesIfrs 8Zahid HussainNo ratings yet

- Ifrs VS PsakDocument58 pagesIfrs VS PsakAnisyaCahyaningrumNo ratings yet

- Technicalline Cc0350 Ipo 14june2012Document17 pagesTechnicalline Cc0350 Ipo 14june2012conchday-replyNo ratings yet

- NPO StandardsDocument9 pagesNPO Standardsbngo01No ratings yet

- Fifth ScheduleDocument47 pagesFifth Schedulezulfi100% (1)

- Accounting StandardsDocument24 pagesAccounting Standardslakhan619No ratings yet

- PFRS Adopted by SEC As of December 31, 2011 PDFDocument27 pagesPFRS Adopted by SEC As of December 31, 2011 PDFJennybabe PetaNo ratings yet

- Philippine Financial Reporting Standards: (Adopted by SEC As of December 31, 2011)Document27 pagesPhilippine Financial Reporting Standards: (Adopted by SEC As of December 31, 2011)Ana Liza MendozaNo ratings yet

- Why We Need of Accounting StandardDocument5 pagesWhy We Need of Accounting StandardrashidgNo ratings yet

- Notes To Interim Finacial StatementsDocument7 pagesNotes To Interim Finacial StatementsJhoanna Marie Manuel-AbelNo ratings yet

- ACTIVITY 8 - Intermediate AccountingDocument2 pagesACTIVITY 8 - Intermediate AccountingMicky BernalNo ratings yet

- IFRS Illustrative Financial Statements (Dec 2019) FINALDocument290 pagesIFRS Illustrative Financial Statements (Dec 2019) FINALPaddireddySatyamNo ratings yet

- What is Financial Accounting and BookkeepingFrom EverandWhat is Financial Accounting and BookkeepingRating: 4 out of 5 stars4/5 (10)

- An Introduction To CandlestickDocument34 pagesAn Introduction To Candlesticksttbalan98% (47)

- The New Comprehensive Annual Financial Report Format ("GASB 34")Document8 pagesThe New Comprehensive Annual Financial Report Format ("GASB 34")Wachid CahyonoNo ratings yet

- Chapter Three How Financial Statements Are Used in ValuationDocument35 pagesChapter Three How Financial Statements Are Used in ValuationSilvia WongNo ratings yet

- B 11Document176 pagesB 11Nathan JonesNo ratings yet

- Argo - Icmd 2009 (B03)Document4 pagesArgo - Icmd 2009 (B03)IshidaUryuuNo ratings yet

- Updates On Outcome of Board Meeting - Reclassification of The Promoters of The Company (Board Meeting)Document1 pageUpdates On Outcome of Board Meeting - Reclassification of The Promoters of The Company (Board Meeting)Shyam SunderNo ratings yet

- Plantilla de Excel Con Dashboard FinancieroDocument36 pagesPlantilla de Excel Con Dashboard FinancieroSamuel FLoresNo ratings yet

- Indian Stock MarketDocument91 pagesIndian Stock Marketsukhwindersinghsukhi70% (10)

- Balance Sheet AccountsDocument7 pagesBalance Sheet AccountsroldanNo ratings yet

- PROMOTIONDocument4 pagesPROMOTIONHarryNo ratings yet

- Case 5 Tata Steel's Acquisition of CorusDocument28 pagesCase 5 Tata Steel's Acquisition of Corusashmit100% (1)

- Multiple Choice AssetDocument4 pagesMultiple Choice AssetRianntyD98No ratings yet

- Reyes Vs RTC of MakatiDocument13 pagesReyes Vs RTC of MakatiYvon BaguioNo ratings yet

- ISO0668 Overview Brand FinanceDocument16 pagesISO0668 Overview Brand FinanceDurban Chamber of Commerce and IndustryNo ratings yet

- TESLA AnalysisDocument19 pagesTESLA AnalysisMuhammad Rifki PutraNo ratings yet

- Presentation Fe670 Lecture01Document24 pagesPresentation Fe670 Lecture01desikudi9000No ratings yet

- Duke Plasto Ratio ReportDocument43 pagesDuke Plasto Ratio ReportMukesh Patel100% (2)

- Occidental Petrolium CorporationDocument10 pagesOccidental Petrolium CorporationblockeisuNo ratings yet

- ResultsDocument16 pagesResultsichikuro9No ratings yet

- DB Realty Limited: Another Mumbai-Based PlayerDocument8 pagesDB Realty Limited: Another Mumbai-Based PlayerVahni SinghNo ratings yet

- MarriottDocument16 pagesMarriotta.hasan670No ratings yet

- NUS Student Investment Society PDFDocument29 pagesNUS Student Investment Society PDFtacamp daNo ratings yet

- BBL 2019 IDocument4 pagesBBL 2019 Iapi-294141759No ratings yet

- Rainmaker: Building Strategic Relationships For A Pipeline of New Affluent ClientsDocument2 pagesRainmaker: Building Strategic Relationships For A Pipeline of New Affluent ClientsMahesh PatilNo ratings yet

- ch15 2e Kieso TBDocument46 pagesch15 2e Kieso TBMohammed Khouli100% (3)

- Rikkyo Syllabus (Undergrad Version)Document6 pagesRikkyo Syllabus (Undergrad Version)SteffenNo ratings yet

- Decoding DuPont AnalysisDocument3 pagesDecoding DuPont AnalysisShalu PurswaniNo ratings yet

- Optimal Risky Portfolios Chapter 7 PracticeDocument2 pagesOptimal Risky Portfolios Chapter 7 PracticeRehabUddinNo ratings yet

- Institute and Faculty of Actuaries: Subject CT1 - Financial Mathematics Core TechnicalDocument15 pagesInstitute and Faculty of Actuaries: Subject CT1 - Financial Mathematics Core TechnicalAlexander FriendNo ratings yet

- UTI ScamDocument21 pagesUTI ScamNamrta Agarwal100% (2)