Professional Documents

Culture Documents

Lect 12

Uploaded by

ssregens82Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Lect 12

Uploaded by

ssregens82Copyright:

Available Formats

SAIS 370.

760, 2008

380.760: Corporate Finance

Lecture 12: Issues in Corporate Governance

Professor Gordon M. Bodnar 2008

Gordon Bodnar, 2008

Corporate Governance

�

Corporate governance is the framework within which corporations exist

�

it focuses on the relationships among officers, directors, shareholders, stakeholders, and regulators

�

reflects both the decision rights within the firm and mechanisms to make managers work in interest of SHs corporate control

�

primary issues

�

the power to make investment and financing decisions

this control resides with the parties having sufficient voting power to force decisions commonly imposed by installing sympathetic management team

corporate governance issues

�

the mechanisms via which SHs control or oversee managers

structure of the Board of Directors, voting rights, proxy fights are actions that shareholders can take to influence corporate decisions

SAIS 380.760 Lecture 12 Slide # 2

SAIS 370.760, 2008

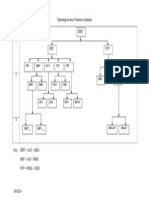

Corporate Structure

�

The issue of corporate control is part of a broader issue of corporate architecture

�

this is the financial organization of business shareholders

�

in the US corporations have the following structure

�

widely disperse with small ownership shares, but a key group of founders/managers often hold a functionally controlling block

shareholders with more than 5% must report to SEC on Form 14D

Board of Directors

�

a board, elected by the shareholders to represent them in overseeing the operation/running of the firm

in the U.S the BoD have a legal fiduciary responsibility to SHs

Officers of the firm

�

these are the managers of the firm, appointed by the Board of Directors

often many of the managers will come from the Board of Directors these are known as inside directors SAIS 380.760 Lecture 12

Slide # 3

Corporate Control

�

Lets start with how corporate control works in a freely functioning market

�

the issue is to try to change who controls the decision rights within the firm

�

this is related to gaining control of the assets, by acquisition or some other means mergers and acquisitions (M&A) leveraged buyots (LBOs) management buyouts (MBOs) spin-offs and carve-outs conglomerates private equity partnerships

methods

� � � � � �

SAIS 380.760 Lecture 12 Slide # 4

SAIS 370.760, 2008

Mergers

�

Mergers are the most common form of change in corporate control

�

mergers face a variety of difficulties

�

antitrust law scrutiny

� �

to insure that market power is not too concentrated done by national regulators (Dept of Justice and/or FTC in US)

enforce laws such as Sherman Act, FTC Act, and Clayton Act

form of acquisition

�

merger - a true combination of two firms

one firm assumes all assets and all liabilities of the other requires more than 50% of both firms SHs to agree

buy targets stock in exchange for cash, shares, or other securities

acquirer gains control of all assets of the target firm by dealing with shareholders

purchase of some or all of the assets of target firm

ownership of assets is transferred and payment is made to selling firm rather than its shareholders target firm does not immediately cease to exist

SAIS 380.760 Lecture 12 Slide # 5

Global Merger Activity

volume of announced deals (USD trillions) 4 3.5 3 2.5 2 1.5 1 0.5 0 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 Private Equity Corporate

Source: Are companies getting better at M&A, McKinsey Quarterly 12/06, data from Dealogic

SAIS 380.760 Lecture 12 Slide # 6

SAIS 370.760, 2008

Methods for Takeovers

�

Most mergers are negotiated by the firms top management and BoD

�

these are known as friendly takeovers

�

most common in US and (almost) exclusive form outside US

hostile takeovers

� �

acquiring firm goes around target management directly to SH two methods

�

proxy fight - acquiring firm seeks support of target SH at the next annual meeting

a proxy is the right to vote someone elses share

tender offer - make financial offer directly to target SH

if enough shareholders tender their shares, the acquirer gains control

tender battles are complex

�

arguments often over who needs protection: SH or management

should management be given tools to protect their positions against unwelcome predators? should managers hold an auction to obtain highest price for SH? should acquirers be required to explain what they will do with firm?

SAIS 380.760 Lecture 12 Slide # 7

Takeover Defenses

�

Management have come up with many ways to protect against unwanted takeovers

�

shark repellent measures

�

staggered BoD terms so new SH gain immediate control

would have to alter the corporate charter

supermajority

require higher % of SH votes (80%) to approve merger

fair price rule

mergers not allowed unless fair price is paid (based on rules)

poison pills

existing SH are issued rights, which if there is significant purchase of shares by a bidder, can be used to purchase additional shares in the firm at very low price

why would management/stakeholders resist a takeover

� �

bidder must offer premium over current market price to get a higher price or for fear of losing jobs

management at target are often offered golden parachutes generous payouts (bribes?) if they lose their jobs

SAIS 380.760 Lecture 12 Slide # 8

SAIS 370.760, 2008

Buyouts

�

Buyouts differ from M&A in several ways

�

done by group of investors rather than another firm

�

large fraction of purchase price is debt financed

� �

hence the term leveraged buyouts often some of the debt is very risky, (i.e., junk) it is privately controlled by owners and often once reorganized and rationalized, taken public later in IPO

the asset being bought becomes a private asset

�

buyouts are typically of two forms

�

leveraged buyouts (LBOs) are done by partnership of private investors management buyouts (MBOs) are when the group is led by (some) existing firm management

� �

buyouts can be used to gain control of specific assets

MBOs are often done on unwanted divisions of larger companies in US in 1980s LBOs were more often of entire firms

SAIS 380.760 Lecture 12 Slide # 9

Spin-offs and Carve-outs

�

Spin-off

�

a new independent company created by detaching part of a parent companys assets

�

existing SHs receive shares in the newly independent firm

they can then hold or sell these shares if not interested

these are not taxed as long as parent shareholders receive 80% of shares in new company

Carve-out

�

a spin-offexcept that shares in separated asset are sold to new shareholders in public offering

� � �

typically spin-offs are seen by the market as good news

value is potentially created by widening investor choice focus makes it easier to measure performance separate securities make it possible to create right incentives for managers

to understand how these create value we must understand conglomerates

SAIS 380.760 Lecture 12 Slide # 10

SAIS 370.760, 2008

Conglomerates

�

Conglomerates are a portfolio of different businesses within a single corporation

�

conglomerate mergers were very common in the 60s and 70s

� �

US saw a spin-off craze in 80s and early 90s most mergers are now between firms in related (same) business

conglomerates are very common in other (developing) countries diversification of businesses stabilizes income and reduces risk

�

pros and cons of conglomerates

�

but SH can diversify more easily than firms can

some gains to firm diversification cannot be replicated by SH

good management is fungible

�

but knowledge of the details of the industry are important free cash flow from mature divisions could invest in other divisions but internal market lacks rigor of external market evaluation

allows unprofitable cross subsidization

SAIS 380.760 Lecture 12 Slide # 11

conglomerate creates large internal capital market

� �

Financial Architecture of Conglomerates

�

For a conglomerate to be successful it must focus on the incentive issue of corporate governance

1. make sure divisional management has performance targets and incentives as strict as if they were separate firms 2. operate the internal capital market in as rigorous a fashion as the external markets

�

these are difficult things to do

1. market values of divisional performance cannot be observed within a conglomerate

�

market prices are valuable signals

2. an internal capital market is difficult to separate from politics and internal bargaining

�

typically capital providers (SHs) do not have active voice in internal market

the net result is the average US conglomerate is ~10% less valuable than the breakout value of its businesses

SAIS 380.760 Lecture 12 Slide # 12

SAIS 370.760, 2008

Conglomerates Outside the US

�

While disappearing in the US, conglomerates are very common elsewhere

� �

a significant percentage of Koreas GDP is from its large conglomerates called chaebols conglomerates very common in Latin America

why are conglomerates common outside US?

�

size

�

it is difficult to be large and focused in small markets

size means access to intl markets and more political power

underdeveloped local capital markets

�

internal capital market may be preferable to underdeveloped external markets

important issues besides liquidity include regulation, information efficiency, strong legal environment evidence that markets are stronger in common law countries

history

�

large companies are often given role of rescue investors

SAIS 380.760 Lecture 12 Slide # 13

Corporate Governance

�

The rules by which control within the firm is distributed, managed and regulated

�

these have been in the news most recently because of the corporate scandals

�

�

largely in US but also elsewhere

the primary issue in most of these cases was the issue of management behavior

�

arises from the separation of ownership and management

separation of ownership and management creates incentive for managers to work for their own interest rather than that of the firm

relates directly to issues of incentive given to managers

�

�

�

incentives of managers influenced most directly by their compensation contracts manager that are not controlling owners work for shareholders

since the early 1980s US shareholders have asked managers to focus on maximizing firm value

to do this contracts were written to align incentives

SAIS 380.760 Lecture 12 Slide # 14

SAIS 370.760, 2008

Incentive Contracts

�

Tie managers compensation to value of firm

�

stock based compensation

� �

rise of options rather than shares as costless compensation options created huge upside and no additional downside to taking risky steps to increase firm value

�

creates incentives for management to be more aggressive in actions to increase market value

large equity price rises in late 1990s created incentives to pump up firm value, cash in the options, and run

�

thus there was a huge increase in expected value to value increasing activity and no change in the expected punishment

little evidence of SEC enforcement of securities laws Boards and Shareholders didnt care if stock price kept going up

result was an increase in aggressive actions to increase value of firm

�

including illegal actions

SAIS 380.760 Lecture 12 Slide # 15

Where was the Governance?

�

In 2000 stock prices fell sharply

� �

with lower prices many activities to inflate value collapsed others were pressed harder to do things to keep value up

suddenly we were questioning how these activities could have gone on blame all around

�

complicity between management and auditors in reporting information to shareholders

�

auditor had incentive to keep firms happy as they made more money on consulting services than auditing

boards of directors that were too friendly to management and or caring only of insiders not outsiders

�

lack of independence and effort on the part of boards

shareholders not exercising the full extend of their corporate governance responsibilities

�

need to realize that agents act in accordance with their incentives

SAIS 380.760 Lecture 12 Slide # 16

SAIS 370.760, 2008

US Response

�

The US has see a marked increase in attention to corporate governance issues

�

compensation issues

�

reduced reliance on options and discussion of appropriate reporting

� �

Microsoft now to use restricted stock rather than options SEC discussing appropriate charge to income for options

options are valuable even when issued out of the money

Legislation: Sarbanes - Oxley 2002

� �

managers are liable for accuracy of info in financial statements creation of Public Company Accounting Oversight Board (PCAOB)

new regulatory arm to audit the auditors

� � �

increase in penalties for white collar crimes restrictions on soft payments from firm to managers rules to give more power to small shareholders to question management and propose board members

SAIS 380.760 Lecture 12 Slide # 17

Impact of Sarbanes-Oxley

�

Sarbanes-Oxley has been controversial

�

big problem has been costs relative to benefits and change to corporate incentives

�

costs

�

cash costs of Sec 404 compliance higher than anticipated

developing internal control systems cost more due to large demand auditing firms charged more to certify

indirect costs were significant

greater risk to officers and board members increased compensation costs and fees for legal and insurance qualified board members harder to find

incentives and opportunity costs

managers less like to take risky ventures, hoard more cash money diverted to compliance reduces investment and growth

impact on US markets

promote private equity shift of US listing to foreign markets

recently the PCAOB softened requirements on auditors

SAIS 380.760 Lecture 12 Slide # 18

SAIS 370.760, 2008

Governance Around the World

�

Differences in corporate governance around the world arise largely from two issues

�

the degree of the separation between ownership and management the role that outside creditors (banks) can play in corporate decisions

�

in turn these lead to some fundamental differences in the way business environment is structured

� �

the form of owner oversight on managers the nature of the market for corporate control

taken together, these issues go a long way to understanding differences in corporate governance around the world

SAIS 380.760 Lecture 12 Slide # 19

Separation of Ownership and Management

�

While it is a basis of most financial theory, it is not really very common

�

in the US, managers are often substantial owners ownership is often much more concentrated

�

outside the US, lack of separation is even more common

�

equity ownership is generally dominated by families and large institutional investors

explanations for this

�

lack of any type of external equity markets to pool funds for anonymous investors historical reasons

�

ownership is less concentrated in countries where the industrialization (therefore large corporations) was proceeded by democratization (individual rights)

for example, the U.S., U.K.

SAIS 380.760 Lecture 12 Slide # 20

10

SAIS 370.760, 2008

Overview of Differences in Financial Architecture

�

Differences in the role of banks

�

concentration of banking power

�

in the US, banking is more competitive than abroad

�

the result is a large number of banks with little market power

abroad there are often a few large banks, often state supported US commercial banks are more regulated than banks abroad

�

bank regulation

�

commercial banks are prohibited from holding equity in firms

eliminates US banks from being shareholders

while they may be credit provider to the firm, they have no role in providing protection to minority shareholders

outside US, banks often are allowed both to lend to and invest in firms (these are called universal banks)

�

banks can act as custodians of others shares and vote them

this mean banks can be large SH with significant decision rights

SAIS 380.760 Lecture 12 Slide # 21

Concentration of Ownership

�

Due to less developed equity markets abroad

�

financing is often obtained from other firms

�

this leads to large cross holdings of equity where firms will own significant shares in other firms

�

this is in lieu of outside individual investors

in some countries, this cross holding is done via firms within the same family

�

there are a series of firms all of which have cross holdings in one another

while this does not help raise equity, it does reduce influence of outside shareholders

this phenomenon, together with banks ability to hold equity means that outside the U.S. ownership is much more concentrated

�

often more than 80% of equity is held by friendly firms or banks

�

this equity is in friendly hands making hostile takeovers and changes in management oversight is virtually impossible SAIS 380.760 Lecture 12

Slide # 22

11

SAIS 370.760, 2008

Shareholder (Stakeholder) Oversight

�

In all countries there is an oversight mechanism

�

allows shareholders and/or stakeholders to oversee decisions of the management

�

insure that management acts in owners best interest typically 12 members elected by the shareholders

�

in the US this is done by the Board of Directors

�

big issue is number of insiders versus outsiders

elsewhere these boards may be all management or contain representatives of creditors and labor

�

in Germany there is a 2 tier structure

�

management board of only managers and supervisory board of outside directors representing SHs, creditors and employees

in Japan, the supervisory board is comprised mostly of the firms managers and managers of related firms and banks

SAIS 380.760 Lecture 12 Slide # 23

Financial Architecture Abroad

�

In Germany and Japan, we see a much closer link between banks and corporations

�

in Germany and Japan, there are a relatively small number of large banks

�

these banks are not prohibited from taking equity stakes in the firms to which they lend

bank managers have seats on the board of directors

also banks often hold individuals shares in the firm and vote the shares for the investors

often a bank may be close to a majority shareholder in a firm

this allows a closer relationship between creditors and shareholders and makes banks large shareholders

also, the late development of equity markets means that other equity is often held by other firms

�

thus there is extensive cross-holding of shares in these countries by other institutions or wealthy families

SAIS 380.760 Lecture 12 Slide # 24

12

SAIS 370.760, 2008

Comparison of Different Systems of Corporate Control

�

In the U.S.and U.K there is a market based system of corporate control

�

banks play almost no role in corporate control as they are prohibited from owning or voting stock

but with the resulting disperse share ownership an active market for corporate control exists parties that believe they can manage assets more effectively than existing management can purchase them

�

�

this is the market for corporate control mergers and takeovers

if they are successful, they become wealthy and the economy becomes more efficient if they fail, they lose and existing stakeholders lose as company fails

there is both an up and a down side to this system

SAIS 380.760 Lecture 12 Slide # 25

Bank-based System of Corporate Control

�

Germany

�

German banks control equity of firms in 3 ways

� � �

through direct ownership for their own account and trusts by actively voting the shares of their banking clients by acting as investment bankers to the firm

�

they effectively control the market for equity issues and control a large block of shares (sometimes more than 30%)

management reports to supervisory board

� �

board consists of non-managers of the firm SH vote for just over 50% of seats on supervisory board

�

banks and family have the most votes

they control the method by which shares are voted

�

�

vote for friendly outside directors difficult to make decisions that impose pain on workers

SAIS 380.760 Lecture 12 Slide # 26

workers get to elect the remaining representatives

�

13

SAIS 370.760, 2008

Equity Culture in Germany

�

Historically, equity not important in Germany

�

bank are main providers of credit and equity just 20% of total corporate sales are by exchange traded firms

�

only a small percent of German firms are publicly listed

�

large publicly traded firms are called Aktiengesellschaft (AG) these are called Mittlestand they are typically run and controlled by a single family

the majority of German firms are small- to medium sized firms

� �

corporate governance is not an issue for these firms as the owner and manager are the same

however, with mass privatizations there is a growing equity class in Germany

�

this will put pressure on the old style governance system

� �

individual investors will want action if performance of firms lags but poor performance and collapse of Neuer market has slowed growth of interest in equity as investment

SAIS 380.760 Lecture 12 Slide # 27

Governance in Japan

�

Japan also has bank system of governance

�

but banks are less powerful than in Germany

�

they act more as a corporate partner rather than major SH

most banks in Japan are aligned with (owned by) a group of integrated firms

�

these corporate conglomerates are called keiretsu

�

these vertically and horizontally integrated firms all share cross holdings and cooperate rather than compete major keiretsu in Japan are Mitsubishi, Mitsui, Sumitomo, DaiIchi, Fuyo, and Sanwa

in a keiretsu, no firm can hold more than 5% of another firms stock

�

but many groups have 20 50 companies in them

this allows large block holdings of equity to prevent takeovers

management of firms are overseen by managers of affiliated companies

SAIS 380.760 Lecture 12 Slide # 28

14

SAIS 370.760, 2008

Impacts on Market for Control

�

Large block shareholders and underdeveloped markets mean weak corporate control market

� �

cant mount a takeover if majority of equity is in friendly hands hostile takeover also difficult due to regulations and rules

�

Germany requires 75% SH vote to approve takeover and does not allow golden parachutes

how do outside shareholders press for change when performance lags

�

question management at shareholders meetings and vote against management nominated directors

minority SHs are becoming increasingly active in pressing management to pursue value maximization

�

in US this is being driven by institutional investors, like CALPERS, pushing for more outside directors, more disclosure of info, and tighter linkage of executive pay and firm performance SH activism is also increasing outside US

SAIS 380.760 Lecture 12 Slide # 29

15

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Agency Problems and Accountability of Corporate Managers and ShareholdersDocument29 pagesAgency Problems and Accountability of Corporate Managers and ShareholdersHarPearl Lie100% (3)

- Answer Key For Business Ethics and Corporate GovernanceDocument6 pagesAnswer Key For Business Ethics and Corporate GovernancelakshmiNo ratings yet

- The Theory of Corporate Finance by Jean Tirole Chapter 1 Notes - Corporate GovernanceDocument10 pagesThe Theory of Corporate Finance by Jean Tirole Chapter 1 Notes - Corporate GovernanceRupesh Sharma100% (1)

- Lessons From The Art of War As Building Blocks For Business StrategyDocument23 pagesLessons From The Art of War As Building Blocks For Business StrategyDr Rahul Mirchandani100% (1)

- Chapter 1 BowersoxDocument38 pagesChapter 1 Bowersoxssregens82100% (1)

- Role of Media in Ensuring Corporate GovernanceDocument44 pagesRole of Media in Ensuring Corporate GovernanceSwethan Akkenapelli80% (5)

- List of Members For Healthcare Service - 2353Document27 pagesList of Members For Healthcare Service - 2353Samish ChoudharyNo ratings yet

- Hull OFOD10e MultipleChoice Questions and Answers Ch12Document6 pagesHull OFOD10e MultipleChoice Questions and Answers Ch12Kevin Molly KamrathNo ratings yet

- Nuratiqah Binti Kubak (2020899576) - Individual Assignment 1Document10 pagesNuratiqah Binti Kubak (2020899576) - Individual Assignment 1NuratiqahNo ratings yet

- Lussier 3 Ech 05Document50 pagesLussier 3 Ech 05ssregens82No ratings yet

- Building Multi-Tier Web Applications in Virtual EnvironmentsDocument30 pagesBuilding Multi-Tier Web Applications in Virtual Environmentsssregens82No ratings yet

- Orchestro State Inventory Management 2015Document8 pagesOrchestro State Inventory Management 2015ssregens82No ratings yet

- Supplier General QualificationsDocument3 pagesSupplier General Qualificationsssregens82No ratings yet

- Static Picture Effects For Powerpoint Slides: Reproductio N Instructions Printing Instructions Removing InstructionsDocument17 pagesStatic Picture Effects For Powerpoint Slides: Reproductio N Instructions Printing Instructions Removing Instructionsssregens82No ratings yet

- CHP 3Document2 pagesCHP 3ssregens82No ratings yet

- Risk and Rates of Return: Learning ObjectivesDocument36 pagesRisk and Rates of Return: Learning Objectivesssregens82No ratings yet

- Problems, Problem Spaces and Search: Dr. Suthikshn KumarDocument47 pagesProblems, Problem Spaces and Search: Dr. Suthikshn Kumarssregens82No ratings yet

- Judicial Power of Supreme CourtDocument2 pagesJudicial Power of Supreme Courtssregens82No ratings yet

- Vcost DemoDocument2 pagesVcost Demossregens82No ratings yet

- Week 8 AssignmentDocument5 pagesWeek 8 Assignmentssregens82100% (2)

- Transportation and Logistics OptimizationDocument18 pagesTransportation and Logistics Optimizationssregens82No ratings yet

- AMIS 525 Pop Quiz - Chapters 22 and 23Document5 pagesAMIS 525 Pop Quiz - Chapters 22 and 23ssregens82No ratings yet

- Signs For Income VarianceDocument1 pageSigns For Income Variancessregens82No ratings yet

- Time Value PracticeDocument1 pageTime Value Practicessregens82No ratings yet

- Regular Flow Irregular Flow Irregular Flow DepreciationDocument1 pageRegular Flow Irregular Flow Irregular Flow Depreciationssregens82No ratings yet

- V Ac - SC V (Aa Ar) - (Sa SR) V (Aa Ar) - (Aa SR) + (Aa SR) - (Sa SR) V ( (Aa Ar) - (Aa SR) ) + ( (Aa SR) - (Sa SR) )Document1 pageV Ac - SC V (Aa Ar) - (Sa SR) V (Aa Ar) - (Aa SR) + (Aa SR) - (Sa SR) V ( (Aa Ar) - (Aa SR) ) + ( (Aa SR) - (Sa SR) )ssregens82No ratings yet

- I (P Q) - (V Q) - F: The Fundamental EquationDocument1 pageI (P Q) - (V Q) - F: The Fundamental Equationssregens82No ratings yet

- TPRICEDocument1 pageTPRICEssregens82No ratings yet

- Operating Income Variances DiagramDocument1 pageOperating Income Variances Diagramssregens82No ratings yet

- Ri RoiDocument1 pageRi Roissregens82No ratings yet

- Total For 5 Years Each YearDocument1 pageTotal For 5 Years Each Yearssregens82No ratings yet

- Percent DoneDocument1 pagePercent Donessregens82No ratings yet

- Process StepsDocument1 pageProcess Stepsssregens82No ratings yet

- Annual Report 2013Document158 pagesAnnual Report 2013Shoaib HasanNo ratings yet

- The Arab Bank - Governance and Ethics - FINALDocument26 pagesThe Arab Bank - Governance and Ethics - FINALHum92reNo ratings yet

- Basel Norms: Basel Is A City in SwitzerlandDocument3 pagesBasel Norms: Basel Is A City in Switzerlandsubhasis123bbsrNo ratings yet

- FRM 2014 Part 2 Practice Exam PDFDocument32 pagesFRM 2014 Part 2 Practice Exam PDFVitor SalgadoNo ratings yet

- Corporate Governance and Business Ethics Solved MCQs (Set 2)Document8 pagesCorporate Governance and Business Ethics Solved MCQs (Set 2)tech Nblik2No ratings yet

- Media Coverage and Stock Price SynchronicityDocument18 pagesMedia Coverage and Stock Price SynchronicityDuong Ha ThuyNo ratings yet

- BibliographyDocument9 pagesBibliographyAsm Saiful IslamNo ratings yet

- Accountability and Transparency An Guide For State Ownership - OECDDocument133 pagesAccountability and Transparency An Guide For State Ownership - OECDJuan I. RecabeitiaNo ratings yet

- Presented To: Sir Safdar Hussain Tahir By: M. Fahad Ali G.C. Uni. FaisalabadDocument18 pagesPresented To: Sir Safdar Hussain Tahir By: M. Fahad Ali G.C. Uni. FaisalabadFahad AliNo ratings yet

- Question Answer FINALDocument47 pagesQuestion Answer FINALLalit Barhate78% (9)

- Ethic AccessDocument15 pagesEthic AccessDike PeterNo ratings yet

- SEBI Circular On Margin Shortfall Penalty PDFDocument2 pagesSEBI Circular On Margin Shortfall Penalty PDFvvpvarunNo ratings yet

- RSK4802 Notes To Exam 2021Document61 pagesRSK4802 Notes To Exam 2021bradley.malachiclark11No ratings yet

- 5 6161346545657577683 PDFDocument6 pages5 6161346545657577683 PDFShivam GoyalNo ratings yet

- Vavaletskou BLRP No. 4 2020-MergedDocument45 pagesVavaletskou BLRP No. 4 2020-MergedTimeNo ratings yet

- The Greek Letters of An OptionDocument21 pagesThe Greek Letters of An OptionMinh Huỳnh Nguyễn NhậtNo ratings yet

- INS Answer KeyDocument3 pagesINS Answer Keyउमेश गावंडे100% (1)

- D15 Hybrid P1 QPDocument6 pagesD15 Hybrid P1 QPToriden RagavenNo ratings yet

- Tunneling or Proppingevidence From ChinaDocument40 pagesTunneling or Proppingevidence From ChinadependNo ratings yet

- Calculation of Exchange Ratio From The Perspective of The Acquired and The Acquiring FirmDocument16 pagesCalculation of Exchange Ratio From The Perspective of The Acquired and The Acquiring FirmabhishekNo ratings yet

- Conceptual Frameworks of Accounting SomeDocument7 pagesConceptual Frameworks of Accounting SomeParvesh SeeballackNo ratings yet

- Role of Ethics in Corporate GovernanceDocument11 pagesRole of Ethics in Corporate GovernancepranjalNo ratings yet