Professional Documents

Culture Documents

Adi Finechem Dec 2013 Update

Uploaded by

Duby RexCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Adi Finechem Dec 2013 Update

Uploaded by

Duby RexCopyright:

Available Formats

This is not a buy or sell recommendation.

We are in the process of compiling data sheets of companies that we track so that in future we may use these for buying / selling stocks of such companies. Reason for sharing is hopefully somebody who has more information may get in touch with us or for a healthy debate. We had written about Adi Finechem previously on Nov 2011 are just following it up now Nov 2011 report : http://www.scribd.com/doc/79813817/AdiFinechem

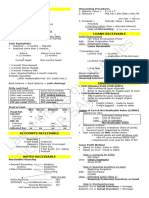

Adi Finechem Date Traded In Face Value CMP EPS (TTM) P/E Market Cap Enterprise Value 52 Week H/L Website Timeline 1985 Incorporated as H.K. Agro Oil. 1994 Name changed to H.K. Agrochem 1995 IPO 2000 Name changed to H.K.Finechem 2010 Open offer by group of investors who take management control of the company. 2010 Name changed to Adi Fincechem 2012 Bonus 1:5 2013 Bonus 1:10 : 08-Dec-13 : BSE B (530117) : 10 : 58.5 : 8.93 : 6.55 : 73 Cr : 90.15 Cr : 65.95 / 39.2 : http://www.adifinechem.com/

3nity.in@gmail.com

Since Then If you had 100 shares of Adi Finechem in Nov 2011, you would have had 120 shares in 2011. By the bonus issue in 2013 you would have had 132 shares Nov 2011: 100 shares X Rs 54 = 5400 Dec 2013: 132 shares X Rs 58.5 = 7722 A profit of Rs 2322 which would translate into 43% returns in 2 years. If we included the dividend for the 2 years profit would be Rs 2586 and that would correspond to a 49% return. Not bad I guess Ok ok the above was the theory part. What did I do actually? I bought the stock and sold most of my positions within a year (after the 1st bonus issue) at a return of 49.5%. This return does not include the dividend and also the short term capital gain that I had to shell out for selling within a year. Reason for selling 1) One of the main reasons I had sold the shares was that one of the products Cardanol / Cardol which they had recently started 2 years ago and which did very well was suddenly shelved in 2012 with no explanation in the annual report. 2) This along with the fact that I was not able to get the raw material and product data per unit pricing in the annual reports. Till 2011 annual reports had the tonnage and prices for the raw material and products, so we could calculate the price / unit and check the pricing data. From 2012 Annual report only the amount was enough to be displayed, thus we could not get the pricing data. I did not try to get the above information from the company. The share was doing well, I was lazy and trigger happy and thus disposed off my position. Recently I was going through some of old stocks and found that Adi Finechem was doing well in the results and thought of checking it out. Below are the updates I thought was relevant. Board Mr. Sharvil P. Patel has resigned from the board in 2012. Three new independent board members were inducted.They are 1. Shri Ganpatraj Lalchand Chowdhary: DOB: 23.03.1963 Date of appointment: 03.11.2012 He is a commerce graduate and worked in the family business of trading in maize and starches. He is the Managing Director and overall in charge of operations in M/s. Riddhi Siddhi Gluco Biols Limited, a Company listed on Bombay Stock Exchange, promoted by him and his family. With his experience and expertise in the Starch Industry and his vision for growth potential of the Industry, Company achieved a turnover of Rs.1200 crores within a span of 18 years being the largest player in the country.

3nity.in@gmail.com

2. Shri Nitin Ramchandrabhai Patel: DOB: 08.08.1954 Date of appointment: 03.11.2012 He is commerce graduate and associated with the Food Industry since last 35 years. He is the Chairman of M/s. Shree Bhagwati Flour And Foods Private Limited and is also associated with M/s. Shri Bhagwati Flour Mills Private Limited. Bhagwati Flour Mills Private Limited is one of India s first ISO 22000 and HACCP certified flour milling companies involved in manufacturing and trading of flours and spices. 3. Shri Bhavin Ajitkumar Shah: DOB: 14.03.1966 Date of appointment: 03.11.2012 He holds Master degree in the field of Business Administration. He is currently Managing Director and Chief Executive Officer of EQUIRUS SECURITIES PRIVATE LIMITED, Merchant Banker and has set up Institutional equities business. He is expert on IPO matter and successfully managed and got the success of IPO of TD Power inspite of negative market opinions. He was also associated with JP Morgan, Hong Kong and India as head of Asia-Pacific Technology Research and Global Sector Leader. He has also worked in Credit Suisse First Boston, Hong Kong as a Director (Head, Asia-Pacific Technology Research). He was also associated with Sun Microsystems Inc. CA, and Digital Equipment Corporation, Hudson as Hardware Engineer in his initial years. He is also a joint owner of two US patents for Microprocessor Design. The 2 other existing independent directors are 4. Mr. Jayesh K Shah (Age: 51) B.Com & C.A. He is a whole time director with the designation of Director and Chief Financial Officer of Arvind Limited (Formerly Known as Arvind Mills Limited) and he has been associated with Arvind Limited since 1st July, 1993. He has extensive financial, regulatory and managerial expertise with his vast experience in the field. He also holds directorship in other companies 5. Mr. Kalpesh A Patel. (Age: 44) B.E(Chemical Engineering) and M.B.A (Marketing) from U.S.A. At present he is an Executive director of Nirma Limited. He has wide experience in the production and operation related to soaps, detergent and allied chemicals. At present he is looking after healthcare division and lab facilities of Nirma Limited. A stellar board right and that too for a not so popular company with mcap near Rs 73 cr. As much as it is exciting, I am reminded about the erstwhile Satyam and its board and I pretty much brought back to the earth.

3nity.in@gmail.com

Financials Yearly Results Profit and Loss

Balance Sheet

3nity.in@gmail.com

Cash Flow

Quarterly Results

Synopsis Company seems to be doing well. Since the new mgmt take over, the sales and profitability has grown very well. The ratios are also becoming better. Dividend and 2 bonus offerings have been the rewards from the new management to the shareholders. Assume that the company and the share price will move steadily without any major moves. Whatever be the case, the company needs to be followed for its improving financials and stellar board. References 1. www.bseindia.com 2. www.adifinechem.com

3nity.in@gmail.com

Disclaimer General: This report is not a buy / sell recommendation. Buying stocks must be done after careful analysis and the above report can be used as a base for the analysis and should not be used as sole basis. Vested Interest: The author does NOT have any position in the above mentioned stock. He may purchase / sell the same in the future in the short or long term based on his conviction and his financial situation. Data Validity: The data is collated from various sites in the internet. Even though we have tried our best, there may be discrepancy due to human error while collating the data. The author should not be held responsible for such mistakes. The data can be looked up at various websites given in the reference section. Valuation: The author is not an expert and his valuation may be off the mark.

3nity.in@gmail.com

You might also like

- PCCL Jun 2014 UpdateDocument6 pagesPCCL Jun 2014 UpdateDuby RexNo ratings yet

- PCCPL May 2014 UpdateDocument4 pagesPCCPL May 2014 UpdateDuby RexNo ratings yet

- Punjab Chemicals - Apr 2014Document20 pagesPunjab Chemicals - Apr 2014Duby Rex100% (1)

- Premco GlobalDocument12 pagesPremco GlobalDuby RexNo ratings yet

- Rossell IndiaDocument26 pagesRossell IndiaDuby RexNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5795)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Trend: Double Distribution Trend DayDocument14 pagesTrend: Double Distribution Trend DayukmNo ratings yet

- Statement of Cash Flows: Powerpoint Presentation by Gail B. WrightDocument22 pagesStatement of Cash Flows: Powerpoint Presentation by Gail B. WrightMARY ACOSTANo ratings yet

- Enron Company Case StudyDocument6 pagesEnron Company Case StudyRabia FazalNo ratings yet

- Forward Start OptionsDocument2 pagesForward Start OptionsOscar JoelNo ratings yet

- CA Inter MarksheetDocument1 pageCA Inter Marksheetbharath reddyNo ratings yet

- Lesson .-Lesson 4: Supplier, Value, and Supply Chain-01Document15 pagesLesson .-Lesson 4: Supplier, Value, and Supply Chain-016jbfth7k4nNo ratings yet

- DCF ModelDocument7 pagesDCF ModelSai Dinesh BilleNo ratings yet

- UFCE FormatDocument2 pagesUFCE Formatytduyyuli yufyufNo ratings yet

- INfyDocument14 pagesINfyswaroop shettyNo ratings yet

- Profit Prior To IncorporationDocument4 pagesProfit Prior To Incorporationgourav mishraNo ratings yet

- Group Assignment Analyzing Financial Statement of VinamilkDocument24 pagesGroup Assignment Analyzing Financial Statement of VinamilkNhư ThảoNo ratings yet

- Lect 11 - FM&I - CAPM EtcDocument6 pagesLect 11 - FM&I - CAPM EtcAnonymous utSFl8No ratings yet

- Capital ExposureDocument12 pagesCapital ExposureNatalie SkinnerNo ratings yet

- Break Even AnalysisDocument6 pagesBreak Even AnalysishmarcalNo ratings yet

- Subject: International Finance Course Code: Semester: III Credit Hours: 04 Faculty: Dr. Lakshmi Rawat Course ObjectivesDocument2 pagesSubject: International Finance Course Code: Semester: III Credit Hours: 04 Faculty: Dr. Lakshmi Rawat Course ObjectivesLakshmi RawatNo ratings yet

- Lecture Notes For IAS 36Document9 pagesLecture Notes For IAS 36dương nguyễn vũ thùyNo ratings yet

- Financial Accounting 2022Document5 pagesFinancial Accounting 2022Siddhant GNo ratings yet

- FAR Last Minute by HerculesDocument10 pagesFAR Last Minute by Herculesjanjan3256No ratings yet

- Accounting For Managers Model Question Paper-2: First Semester MBA Degree ExaminationDocument5 pagesAccounting For Managers Model Question Paper-2: First Semester MBA Degree ExaminationRohan Chaugule0% (1)

- Non-Current Asset Held For SaleDocument28 pagesNon-Current Asset Held For SaleTrisha Mae AlburoNo ratings yet

- NSDLDocument11 pagesNSDLmanish7827No ratings yet

- Loan AgreementDocument2 pagesLoan AgreementKago KhachanaNo ratings yet

- Lembar JWB UD BUANADocument62 pagesLembar JWB UD BUANAernyNo ratings yet

- Comprehensive Portfolio ChartDocument4 pagesComprehensive Portfolio ChartsssmouNo ratings yet

- Chapter 1 SolutionDocument2 pagesChapter 1 SolutionRicha Joshi100% (1)

- International Financial MarketsDocument42 pagesInternational Financial MarketsVamsi Kumar0% (1)

- DESHAW On Stop Losses Options and Other Risk MeasuresInstitutionalInvestorBlindAmbitionsDocument8 pagesDESHAW On Stop Losses Options and Other Risk MeasuresInstitutionalInvestorBlindAmbitionsmercutiostwin50% (2)

- Accounting ChapterDocument66 pagesAccounting ChapterBrisa MasiniNo ratings yet

- Who Is On The Other Side?: Antti IlmanenDocument65 pagesWho Is On The Other Side?: Antti IlmanenaptenodyteNo ratings yet

- Dunder Mifflin Intermediate CCEDocument5 pagesDunder Mifflin Intermediate CCEPriyal AgarwalNo ratings yet