Professional Documents

Culture Documents

Bfs Roundup Flip 87

Uploaded by

Shresth KotishCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Bfs Roundup Flip 87

Uploaded by

Shresth KotishCopyright:

Available Formats

BFS87 20 Dec, 2013 Weekly

th

www.learnwithflip.com

BFS Roundup @ FLIP

The week that was.

Credit policy review: RBI keeps repo rate unchanged at 7.75% RBI surprised everybody by keeping the policy rates unchanged despite high inflation. The governor cited weak economy and expected decline in food prices as primary reasons to maintain the status quo. FLIPs View: This is interesting. He sounds hawkish, but is waiting for data. It will come as a big relief to ` banks and the corporate world, as he has done this despite tapering fears, and over 90% of the market expecting it. Is he privy to what fed is going to do? ------------------------------------------------Central bank moots stringent norms on stressed loans RBI has proposed stringent norms to deal with the problem of rising NPAs across banking sector. Guidelines include: Banks to classify accounts into Special Mention Accounts (SMAs) if the payment is overdue for a month (This wont attract additional provisioning). RBI will set up a central repository of information on all loans of more than INR 5 crore value and make this available to all lenders. NBFCs will be allowed to sell their bad loans, these entities, along with private equity firms, are now also allowed to participate in the NPA auction process. FLIPs View: This continues to remain the main focus for the govt., and the biggest problem facing public sector banks today. The signals are clear that banks must take more stringent steps to recover this money. ---------------------------------------------------SEBI to make IPO grading voluntary SEBI is considering to make the IPO grading nonmandatory. This is because IPO grading hasnt helped in the efficient price discovery in the past.

Updates @ FLIP

Helping them grow! FLIP has recently entered into an arrangement with few budding IT companies to help their employees in developing domain competence. These include emerging names like: Nous Infosystems Mindcraft Software Pvt. Ltd. Intertec Systems VSM Software Pvt. Ltd. Business Analysts/Tech Associates etc. in these companies will undergo FLIP courses to serve their clients better. FLIP - setting a BFS knowledge benchmark.

FLIPs View: I am not sure it is such a good idea. Grading like a credit rating helps an investor make a decision. ---------------------------------------------------Double whammy for RBI: Retail inflation surges, IIP contracts Retail inflation rate accelerated to an all-time high of 11.24 per cent in November (from 10.17 per cent the previous month). The Index of Industrial Production declined to a four-month low of 1.8 per cent in October, compared with 2 per cent growth in September. Economy is facing a high inflation-log growth situation, leading to a speculation of rise in policy rates. FLIPs View: True, but the only good thing about the inflation numbers is that it is driven by food prices, and core inflation especially manufacturing led inflation is just 2.6%. The food inflation can reverse quickly, given good monsoons, and that is what the RBI is expecting as well.

www.learnwithflip.com

BFS Roundup @ FLIP

Did you know?

ATMs in India: Problems galore

Apart from the security concerns in the ATM network spread nationwide, RBI is now concerned with the problem of chargebacks. Chargeback simply implies customer not getting cash, post performing the transaction, even though his/her account gets debited. The magnitude is estimated to be 3000 cases on a daily basis, which is huge. Considering that sufferers include people from low income groups and it takes time for dispute resolution in such cases, RBI is not happy about the current state of affairs. Looking at the rising use of plastic money in our day to day transactions, lets hope that these problems get sorted out sooner For more interesting BFS updates, like us on facebook.

Term of the Week

Shelf Prospectus

Recently, SEBI has proposed allowing public sector financial institutions, scheduled banks and NBFCs, among others, to file shelf prospectus for issuance of non-convertible debt securities. This is expected to simplify the process for them to raise money. Lets understand what is shelf prospectus and how is it helpful.

www.learnwithflip.com

BFS Roundup @ FLIP

Shelf Prospectus Shelf prospectus allows frequent issuers to raise money, without the requirement of filing a separate prospectus for every issuance. It provides details that the company plans to raise money by issuing different or a series of the same instrument, over a period of time. For example, a company may file for a series of bond issues and/or shares. It can than issue shares and bonds simultaneously or shares first and bonds later. It need not issue or file a prospectus each time. This helps reduce procedural delays and enable raising money efficiently. The company filing a shelf prospectus needs to furnish only an information memorandum detailing all material information (change in financials, operations etc.) between two issues. As per the panel's recommendations, NBFCs and other listed issuers would be eligible for filing shelf prospectus only if they meet certain criteria, including having a net worth of at least INR 500 crore. Hmm...quite a relief!

www.learnwithflip.com

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Event Planning Business Plan SampleDocument19 pagesEvent Planning Business Plan Samplerajdanish88% (17)

- A Buyers Guide To Treasury Management SystemsDocument28 pagesA Buyers Guide To Treasury Management Systemspasintfi100% (1)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Comprehensive Accounting Cycle Review ProblemDocument11 pagesComprehensive Accounting Cycle Review Problemapi-253984155No ratings yet

- DoD Risk MGT Guide v7 Interim Dec2014Document100 pagesDoD Risk MGT Guide v7 Interim Dec2014Bre TroNo ratings yet

- HSE CaseDocument95 pagesHSE CaseHafiz Akhtar100% (3)

- 5 - Lafidan Rizata Febiola - 041711333237 - Akm1 - M - Tugas Week 12Document14 pages5 - Lafidan Rizata Febiola - 041711333237 - Akm1 - M - Tugas Week 12SEPTINA GUMELAR R100% (1)

- Letter of AppoinmentDocument4 pagesLetter of Appoinmentmonu tyagi100% (1)

- BS en 33-2011Document16 pagesBS en 33-2011Abey Vettoor100% (1)

- Vsa PDFDocument7 pagesVsa PDFGerrard50% (2)

- PAGCOR Site Regulatory ManualDocument4 pagesPAGCOR Site Regulatory Manualstaircasewit4No ratings yet

- Continuous Casting Investments at USX Corporation: Group 9Document5 pagesContinuous Casting Investments at USX Corporation: Group 9Kartik NarayanaNo ratings yet

- IT Governance at INGDocument19 pagesIT Governance at INGChandan KhandelwalNo ratings yet

- LABOR - Consolidated Distillers of The Far East Vs ZaragosaDocument3 pagesLABOR - Consolidated Distillers of The Far East Vs ZaragosaIshNo ratings yet

- Payment ReceiptDocument1 pagePayment ReceiptShresth KotishNo ratings yet

- NHPC BSDocument2 pagesNHPC BSShresth KotishNo ratings yet

- Aiats Jeemain Test-6Document18 pagesAiats Jeemain Test-6Shivendra AgarwalNo ratings yet

- M A Strategy ArcelorMittal Part5Document2 pagesM A Strategy ArcelorMittal Part5Shresth KotishNo ratings yet

- BS NTPCDocument2 pagesBS NTPCShresth KotishNo ratings yet

- ReportDocument47 pagesReportShresth KotishNo ratings yet

- M A Strategy ArcelorMittal Part2Document2 pagesM A Strategy ArcelorMittal Part2Shresth KotishNo ratings yet

- History NTPCDocument2 pagesHistory NTPCShresth KotishNo ratings yet

- A Synopsis ON: Comparison of The Profitability and Performance in The Financial Market of PGCIL With Its CompetitorsDocument8 pagesA Synopsis ON: Comparison of The Profitability and Performance in The Financial Market of PGCIL With Its CompetitorsShresth KotishNo ratings yet

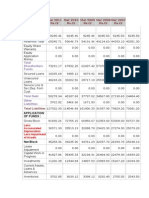

- Years Mar 2012 Rs - CR Mar 2011 Rs - CR Mar 2010 Rs - CR Mar 2009 Rs - CR Mar 2008 Rs - CRDocument1 pageYears Mar 2012 Rs - CR Mar 2011 Rs - CR Mar 2010 Rs - CR Mar 2009 Rs - CR Mar 2008 Rs - CRShresth KotishNo ratings yet

- Years Mar 2012 Rs - CR Mar 2011 Rs - CR Mar 2010 Rs - CR Mar 2009 Rs - CR Mar 2008 Rs - CRDocument1 pageYears Mar 2012 Rs - CR Mar 2011 Rs - CR Mar 2010 Rs - CR Mar 2009 Rs - CR Mar 2008 Rs - CRShresth KotishNo ratings yet

- Aakash Malhotra Model Financial Planning ReportsDocument18 pagesAakash Malhotra Model Financial Planning Reportssayedmaruf7866807No ratings yet

- (224888313) Financial-Plan AnupamDocument23 pages(224888313) Financial-Plan AnupamShresth KotishNo ratings yet

- Sample Family Financial Plan: Prepared ForDocument22 pagesSample Family Financial Plan: Prepared ForShresth KotishNo ratings yet

- Artha ShastraDocument1 pageArtha ShastraShresth KotishNo ratings yet

- Prepared For: Mr. Mahendra DixitDocument31 pagesPrepared For: Mr. Mahendra DixitShresth KotishNo ratings yet

- Sample Financial PlanDocument34 pagesSample Financial PlanShresth KotishNo ratings yet

- Artha ShastraDocument1 pageArtha ShastraShresth KotishNo ratings yet

- Financial PlanniingDocument14 pagesFinancial PlanniingShresth KotishNo ratings yet

- Years Mar 2012 Rs - CR Mar 2011 Rs - CR Mar 2010 Rs - CR Mar 2009 Rs - CR Mar 2008 Rs - CRDocument1 pageYears Mar 2012 Rs - CR Mar 2011 Rs - CR Mar 2010 Rs - CR Mar 2009 Rs - CR Mar 2008 Rs - CRShresth KotishNo ratings yet

- Invicuts '14 CricketDocument1 pageInvicuts '14 CricketShresth KotishNo ratings yet

- Investment Planning For Retired PeopleDocument30 pagesInvestment Planning For Retired Peoplemoli21No ratings yet

- History NTPCDocument2 pagesHistory NTPCShresth KotishNo ratings yet

- Pgcil Sip Report JhaDocument72 pagesPgcil Sip Report JhaShresth KotishNo ratings yet

- Shareholders ReportDocument37 pagesShareholders ReportShresth KotishNo ratings yet

- Dividends DeclaredDocument1 pageDividends DeclaredShresth KotishNo ratings yet

- Vishleshan CaseDocument3 pagesVishleshan CaseHarish SatyaNo ratings yet

- Letter of AuthorizationDocument1 pageLetter of AuthorizationRamanuja SuriNo ratings yet

- Mathematics of Finance Exercise and SolutionDocument14 pagesMathematics of Finance Exercise and Solutionfarid rosliNo ratings yet

- Client Representation LetterDocument5 pagesClient Representation LetterPuspita NingtyasNo ratings yet

- Sp12 General Probability ProblemsDocument5 pagesSp12 General Probability ProblemsRID3THELIGHTNINGNo ratings yet

- AMDocument4 pagesAMJohn Mikhail RollanNo ratings yet

- Sorelle Bakery and Café: Case Study On MGT204Document6 pagesSorelle Bakery and Café: Case Study On MGT204Mir SolaimanNo ratings yet

- Supply Chain Key Performance Indicators PDFDocument52 pagesSupply Chain Key Performance Indicators PDFErik VanNo ratings yet

- BIR-1905 Updated1Document3 pagesBIR-1905 Updated1Kevin CordovizNo ratings yet

- CSR of GoogleDocument28 pagesCSR of GooglePooja Sahani100% (1)

- 555Document3 pages555Carlo ParasNo ratings yet

- Indian Standard: Guidelines FOR Managing - The Economics of QualityDocument15 pagesIndian Standard: Guidelines FOR Managing - The Economics of QualityproxywarNo ratings yet

- Transportation Law TSN 1st ExamDocument26 pagesTransportation Law TSN 1st ExamArvin Clemm NarcaNo ratings yet

- University of LucknowDocument1 pageUniversity of LucknowDEVENDRA MISHRANo ratings yet

- Benefits of Centralized LearningDocument8 pagesBenefits of Centralized LearningAqeel ShaukatNo ratings yet

- Formulation of Strategy For EbusinessDocument11 pagesFormulation of Strategy For Ebusinessarun.vasu8412100% (2)

- Case Study 3Document4 pagesCase Study 3Anwar Iqbal50% (2)

- Compliance Calendar LLP Mandatory CompDocument4 pagesCompliance Calendar LLP Mandatory Comphanif4800No ratings yet

- Project Proposal On BuildingDocument5 pagesProject Proposal On BuildinghawiNo ratings yet