Professional Documents

Culture Documents

ArticleonLetterofCredit Part-II

Uploaded by

essakiCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

ArticleonLetterofCredit Part-II

Uploaded by

essakiCopyright:

Available Formats

ARTICLE ON LETTER OF CREDIT (LC) (PART-II)

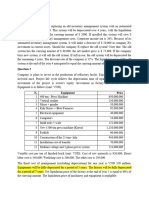

A. LC discounting (i.e. LC negotiation) Vs Bill Discounting Limit In Bill Discounting, the Bank buys the bill (i.e. Bill of Exchange or Promissory Note) before it is due and credits the value of the bill after a discount charge to the customer's account. The transaction is practically an advance against the security of the bill and the discount represents the interest on the advance from the date of purchase of the bill until it is due for payment. What is the role of LC now? The LC facilitate the transaction and confirms that the exporter/manufacturer do not have risk of being default. LC is as good as the cash. Even the exporter can discount the LC subject to acceptance by the importer. Hence if there is no bill discounting facility, the beneficiary gets the payment subject to deduction of margin and bank charges and approval by both banks along with the buyer. In case of bill discounting facility the seller gets the bill discounted immediately it shows and submit the required documents to its bank. But intimation needs to send to the buyer through its (buyers) bank as the transaction is backed with Letter of Credit. B. LC Vs Buyers Credit Buyer opens the letter of credit (usance) in favour of seller. Now the seller on submission of required documents can discount the LC or stays away i.e. hold the LC as it is. The seller will send the documents along with goods to the destination. The buyer will release the goods by accepting the documents at the bank. But the due date of payment has not come yet i.e. LC is not expired yet.

CA.ManojKumarGupta Page1

Suppose the buyer, due to any reason say to leverage its books, wants to postpone the payment. But extension is not possible in the same form. What is the solution now? The buyer will take the following course of action and if accepted by all the parties, it might get the extension for some period as approved: 1. The buyer will identify overseas bank/financial institution (or a bank having its branch overseas) (say X) which give the services of buyers credit. The buyer will request for availing the facility with all the details about transaction. On satisfaction, the bank (X bank) will generate the Offer in favour of the LC issuing bank (i.e. buyer bank or say Y bank) 2. On the basis of the Offer, the buyer approach to its bank (Y bank) for issuance a Letter of Comfort in favour of X bank against this LC. The Y bank will charge some fees for the services. Here Y bank works as a broker. But the bank will continue to hold the LC by marking the facts on its face and also continuously blocked the LC limit. 3. Now the buyer takes this Letter of Comfort and approach the X bank which will give payment to Y against this Letter of Comfort against some charges. It is totally a secured transaction where Y bank guarantees to X bank. The buyer gets the extension of payment period and also benefitted by getting the funds at LIBOR rate. C. If additional credit needs of exporters arises due to firm orders/ confirmed letter of credit (and which are not taken into account while fixing regular credit limits of borrower) are to be met in full even if sanction of such additional credit limits exceeds Maximum Permissible Bank Finance (MPBF). D. Receivables arising in domestic/inland sales by drawing bills of exchange under usance Letter of Credit and negotiated with the terms & conditions of LC are excluded while calculating minimum net working capital under MPBF (second method of lending). CA.ManojKumarGupta Page2

In other words domestic receivables covered by bills of exchange under usance LC shall be accorded the same treatment as export receivables and no margin on such receivables will have to be brought.

E. Advising and confirming the export Letter of Credit (LC)

Advising bank does not undertake any commitment except to verify the authenticity of the message received by it at the time of advising the LC to the exporter. Advising of LC does not, therefore, involve any credit risk for the bank. Confirmation of LC implies a definite undertaking being given by the confirming bank to the opening bank and the confirming bank is placed in the same position as that of opening bank in relation to beneficiary. But even in these cases the confirmation to the LC is added by the bank on behalf of the opening bank only and not on account of beneficiary (exporters)). This would also, therefore, not constitute a credit facility to the exporters. These services facilitate banking operations and the beneficiary of the LC need not necessarily the customers of the confirming bank.

For any query or assistance, kindly call or send a mail undersigned. CA. Manoj Kumar Gupta Cell: 9350760606 9899686676 E-mail id: mgupta2803@gmail.com

CA.ManojKumarGupta Page3

You might also like

- Axis BankDocument2 pagesAxis BankAyush LohiaNo ratings yet

- SBLC & Advance Performance Guarantee (Apg)Document11 pagesSBLC & Advance Performance Guarantee (Apg)Jasvinder Kaur100% (1)

- LOR PPP - Investment - Ven SBLC - Dragon Destiny 020223Document5 pagesLOR PPP - Investment - Ven SBLC - Dragon Destiny 020223EM CRNo ratings yet

- Step by Step Process of Letter of CreditDocument1 pageStep by Step Process of Letter of CreditDhoni KhanNo ratings yet

- Agreement CashDocument13 pagesAgreement Cashmgrace10090No ratings yet

- Interview Questions For Bank in BangladeDocument7 pagesInterview Questions For Bank in BangladeKhaleda Akhter100% (1)

- M71217Texas Oil PGLDocument1 pageM71217Texas Oil PGLPhryxus'z AsterismNo ratings yet

- Sales & Purchase Contract Agrement: As The SellerDocument8 pagesSales & Purchase Contract Agrement: As The SellerNote BuriNo ratings yet

- O F F E R 2 B MT 103 2way Swift 10+4 Etf 1302 KulDocument2 pagesO F F E R 2 B MT 103 2way Swift 10+4 Etf 1302 KulPool AtalayaNo ratings yet

- Application For Export Bills For CollectionDocument2 pagesApplication For Export Bills For CollectionsrinivasNo ratings yet

- Tan Boy Tee Takes Strategic Stake in VikingDocument2 pagesTan Boy Tee Takes Strategic Stake in VikingWeR1 Consultants Pte LtdNo ratings yet

- Parties Involved in A Letter of CreditDocument3 pagesParties Involved in A Letter of CreditGhulam AbbasNo ratings yet

- Mandate Letter BID - FDO - Ocr PDFDocument6 pagesMandate Letter BID - FDO - Ocr PDFMiguel AngelNo ratings yet

- Application Form: KINTEX, Seoul, KoreaDocument4 pagesApplication Form: KINTEX, Seoul, KoreaZainal ArifinNo ratings yet

- 2 - Bank Contract - Hongda Chem Vzla CADocument12 pages2 - Bank Contract - Hongda Chem Vzla CAjose cordovezNo ratings yet

- Deutsche Bank - Sipchem Sukuk Offering CircularDocument209 pagesDeutsche Bank - Sipchem Sukuk Offering CircularcheejustinNo ratings yet

- USD Agency L2L Transaction Procedures 20-15Document3 pagesUSD Agency L2L Transaction Procedures 20-15alehillarNo ratings yet

- WTC2014 NRL80%HSBCLondonDocument11 pagesWTC2014 NRL80%HSBCLondonMarcus StevensNo ratings yet

- Transaction Procedures En590 Fob DramsDocument1 pageTransaction Procedures En590 Fob DramsIchal Chelsea KasminNo ratings yet

- Education Loan Proposal FormDocument4 pagesEducation Loan Proposal FormRoshan SinghNo ratings yet

- SBLC Offer For A Leased BG-SBLC, Procedure and MemorandumDocument2 pagesSBLC Offer For A Leased BG-SBLC, Procedure and MemorandumSharonNo ratings yet

- Direct Credit Mandate FormDocument1 pageDirect Credit Mandate Formmanish_sfcNo ratings yet

- IcpoDocument4 pagesIcpoRonnie AdnalcamaNo ratings yet

- Muhibbah Engineering CLJDocument25 pagesMuhibbah Engineering CLJAdlyZulfadhlyZulkeflyNo ratings yet

- BG SBLC With Zero DepositDocument2 pagesBG SBLC With Zero DepositchristianNo ratings yet

- LC DiscountingDocument2 pagesLC Discountingfarm economyNo ratings yet

- DOA-SBLC Draft 15.JAN.2024Document28 pagesDOA-SBLC Draft 15.JAN.2024Faisal AlbdulrhmanNo ratings yet

- TC TBGF LEML LOAN Agreement V1.2-4 - 17911Document4 pagesTC TBGF LEML LOAN Agreement V1.2-4 - 17911ruby caldeNo ratings yet

- عقد حماية عمولة (IMFPA)Document3 pagesعقد حماية عمولة (IMFPA)Valdi GhifariNo ratings yet

- Se 19040047928444Document3 pagesSe 19040047928444yuanda syahfitraNo ratings yet

- Global Communication and Advisers CorpDocument32 pagesGlobal Communication and Advisers Corpkhalidcosmos100% (1)

- Draft SBLC JP Morgan - ClearDocument2 pagesDraft SBLC JP Morgan - ClearLUZ MOSNo ratings yet

- GAF Loan Funding ProceduresDocument3 pagesGAF Loan Funding ProceduresNamita SardaNo ratings yet

- Buyer'S Letterhead: Letter of Intent /deed of AgreementDocument21 pagesBuyer'S Letterhead: Letter of Intent /deed of Agreementchachou100% (1)

- CMO Monetization SummaryDocument7 pagesCMO Monetization Summarygalindo07No ratings yet

- Issue LC mt700 20221203090439Document5 pagesIssue LC mt700 20221203090439Centro turistico Los rosalesNo ratings yet

- IMPFA MODELO INGLES Sin MarcoDocument7 pagesIMPFA MODELO INGLES Sin MarcoFelix Jose Guevara Rodriguez100% (1)

- Private Financing Agreement: Company NameDocument33 pagesPrivate Financing Agreement: Company Namebaiterek1986No ratings yet

- Special NotesDocument1 pageSpecial NotesНизами КеримовNo ratings yet

- Aml PDFDocument6 pagesAml PDFPradeep YadavNo ratings yet

- 2023-DOA Leasing BG-SBLC CreditDocument18 pages2023-DOA Leasing BG-SBLC Creditelite.immo.80No ratings yet

- Bank GuaranteeDocument3 pagesBank GuaranteeNitesh Kotian100% (1)

- PunjabPolice DS PDFDocument1 pagePunjabPolice DS PDFHamza SheikhNo ratings yet

- 3 Sample SBLCDocument2 pages3 Sample SBLCDat Tran100% (2)

- Irrevocable Documentary Credit - Appl (EN) v1.1Document2 pagesIrrevocable Documentary Credit - Appl (EN) v1.1Firaol BelayNo ratings yet

- Islamic Bank in Tanzania - Amana BankDocument8 pagesIslamic Bank in Tanzania - Amana BankJaffer J. KesowaniNo ratings yet

- Application For Issuance of LC b2blcDocument4 pagesApplication For Issuance of LC b2blcYoridho ChendikaNo ratings yet

- Lol - 2019 09 06 Financial OpportunitiesDocument3 pagesLol - 2019 09 06 Financial OpportunitiesOildeals Ng100% (1)

- Tourist Visa Extension - ChecklistDocument3 pagesTourist Visa Extension - ChecklistAntonio ReyesNo ratings yet

- Draft - SBLCDocument1 pageDraft - SBLCocazetaNo ratings yet

- LIBF Level 4 Certificate For Documentary Credit Specialists (CDCS)Document10 pagesLIBF Level 4 Certificate For Documentary Credit Specialists (CDCS)Abhinav GuptaNo ratings yet

- KK - Displaying The Vendor Transaction Figures in Transaction FK10NDocument4 pagesKK - Displaying The Vendor Transaction Figures in Transaction FK10NSmith F. JohnNo ratings yet

- Deutsche Bank's MotionDocument15 pagesDeutsche Bank's MotionDealBookNo ratings yet

- Company Letter Head: Letter of Request (Lor)Document28 pagesCompany Letter Head: Letter of Request (Lor)Thomas HiggsNo ratings yet

- Bank Guarantees in International TradeDocument4 pagesBank Guarantees in International TradeMohammad Shahjahan SiddiquiNo ratings yet

- (Authorisation LETTER PDFDocument1 page(Authorisation LETTER PDFSethNo ratings yet

- 02 - International Corporate Joint VentureDocument19 pages02 - International Corporate Joint VentureMatías Sebastián DíazNo ratings yet

- Letter of CreditDocument63 pagesLetter of CreditHossain BelalNo ratings yet

- Letter of CreditDocument5 pagesLetter of CreditnavreenNo ratings yet

- Swede CLDocument20 pagesSwede CLessakiNo ratings yet

- Date Symbol Expiry Date Open High Low Close Previous CloseDocument7 pagesDate Symbol Expiry Date Open High Low Close Previous CloseessakiNo ratings yet

- Astro ExcelDocument3 pagesAstro ExcelessakiNo ratings yet

- Live Mud Crabs - Sinchi Exports PVT - LTDDocument2 pagesLive Mud Crabs - Sinchi Exports PVT - LTDessakiNo ratings yet

- Speed Rating AlgorithmDocument55 pagesSpeed Rating Algorithmessaki81% (26)

- TXTDocument3 pagesTXTessakiNo ratings yet

- Shop EGov - View DCBDocument2 pagesShop EGov - View DCBessakiNo ratings yet

- Commission Sales AgreementDocument3 pagesCommission Sales Agreementessaki100% (1)

- Mumbai Flight Ticket - FMN0Y85CUXWDocument2 pagesMumbai Flight Ticket - FMN0Y85CUXWessakiNo ratings yet

- SAP Online TutorialsDocument3 pagesSAP Online Tutorialsessaki100% (1)

- ஞானதானம்Document28 pagesஞானதானம்essakiNo ratings yet

- Creating Your DatabaseDocument3 pagesCreating Your DatabaseessakiNo ratings yet

- சித்தர் மயம்Document12 pagesசித்தர் மயம்essakiNo ratings yet

- Exchange RateDocument5 pagesExchange RateOng Wei Ling100% (1)

- How To Do Laundry in HatyaiDocument12 pagesHow To Do Laundry in HatyaiJoy InsaunNo ratings yet

- Bank Math BibleDocument195 pagesBank Math BibleRahul Roy ChowdhuryNo ratings yet

- Sole Traders QuestionsDocument5 pagesSole Traders QuestionsJawad Hasan0% (1)

- International Business: by Charles W.L. HillDocument32 pagesInternational Business: by Charles W.L. HillhabibshadNo ratings yet

- Mock Exam Paper - 28 - April - 2022Document3 pagesMock Exam Paper - 28 - April - 2022dilinhtinh04No ratings yet

- IIM Lucknow's Manjunath Shanmugam: Purpose-Driven Personality and The Value of Values - Interview With Sudhanshu VatsDocument5 pagesIIM Lucknow's Manjunath Shanmugam: Purpose-Driven Personality and The Value of Values - Interview With Sudhanshu VatsETCASESNo ratings yet

- City Capital Associates VintercoDocument2 pagesCity Capital Associates Vintercoviva_33No ratings yet

- Corporate Strategy DiversificationDocument24 pagesCorporate Strategy Diversificationharum77No ratings yet

- Report Nova VarosDocument75 pagesReport Nova VarosSrbislav GenicNo ratings yet

- Saving For The Rainy DaysDocument2 pagesSaving For The Rainy DaysRuby Refuerzo BuccatNo ratings yet

- Taxation of SMEs PDFDocument65 pagesTaxation of SMEs PDFBoby DonoNo ratings yet

- Money by John Eatwell, Murray Milgate, Peter Newman (Eds.)Document351 pagesMoney by John Eatwell, Murray Milgate, Peter Newman (Eds.)João Henrique F. Vieira100% (1)

- Logistics Invoice VerificationDocument58 pagesLogistics Invoice VerificationPhylax1100% (1)

- Quant Checklist 358 by Aashish Arora For Bank Exams 2023Document91 pagesQuant Checklist 358 by Aashish Arora For Bank Exams 2023Navneet KumarNo ratings yet

- Restructing P GDocument17 pagesRestructing P GAsif AliNo ratings yet

- SBM Sample QuestionsDocument10 pagesSBM Sample QuestionsvinnysriNo ratings yet

- Charles and KeithDocument3 pagesCharles and KeithKshitij GuptaNo ratings yet

- Maintenance CapexDocument2 pagesMaintenance CapexGaurav JainNo ratings yet

- Building Your SkillsDocument46 pagesBuilding Your SkillsCharlie Magne G. SantiaguelNo ratings yet

- Oracle Standard Test Script TAXES v1.1Document56 pagesOracle Standard Test Script TAXES v1.1Anonymous NnVgCXDwNo ratings yet

- Group-3 - Tata Bluescope Case - BWDocument21 pagesGroup-3 - Tata Bluescope Case - BWAnkit Bansal100% (2)

- Bikaji Bill 2Document1 pageBikaji Bill 2PRAMODNo ratings yet

- Heather EvansDocument35 pagesHeather Evansmizhar7863173100% (1)

- Gitman pmf13 ppt11Document53 pagesGitman pmf13 ppt11Sajjad AhmadNo ratings yet

- Oligopoly 8Document32 pagesOligopoly 8adriz89100% (1)

- 2010-2011 Q2. Compute The Following Financial Ratios For Merck's and Company Inc (December 2008)Document5 pages2010-2011 Q2. Compute The Following Financial Ratios For Merck's and Company Inc (December 2008)royaviNo ratings yet

- Capital BudjetingDocument94 pagesCapital Budjetingtulasinad123100% (1)

- Multiple Choice Questions Chapter 11 Perfect CompetitionDocument26 pagesMultiple Choice Questions Chapter 11 Perfect CompetitionAfrose KhanNo ratings yet

- CIVL4230 Lecture FourDocument10 pagesCIVL4230 Lecture FourDennisNo ratings yet