Professional Documents

Culture Documents

Students Preparing To Take Subsidized Government Loans Will See Their Interest Rates Double To 6

Uploaded by

Dinesh GodhaniOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Students Preparing To Take Subsidized Government Loans Will See Their Interest Rates Double To 6

Uploaded by

Dinesh GodhaniCopyright:

Available Formats

Students preparing to take subsidized government loans will see their interest rates double to 6.

8% from current levels, starting Monday, July 1.

But hope isn't lost yet. Lawmakers are working hard behind the scenes trying to strike a deal to save the 7 million college students who are slated to take the subsidized federal Stafford loans this year. Senate Democratic leaders are throwing their weight behind a bill that would extend the 3.4% rates for another year, just as Congress did last year. House Republicans have said they'd prefer a longer term solution, like the one they passed back in April to keep rates low for now but rise along with market rates in the future. Students are being told to prepare for the worst and hope for the best. "We're advising our schools to tell students that their subsidized Stafford interest rates are going to be 6.8% on July 1," said Justin Draeger, president of the National Association of Student Financial Aid Administrators. Students with loans at stake have been watching the debate on Capitol Hill with worry and apprehension. Related: How I found a job after graduation "I find it really frustrating that nothing is even being brought up, since Congress is now in recess," said Rachel McGovern, who will be a senior at University of Florida this fall and will be taking out $5,500 in subsidized federal loans. "It feels like they're just ignoring student needs right now." The higher rates that go into effect on July 1 only apply to new loans, such as McGovern's. These loans are generally awarded to only about a third of undergraduate students in financial need. Only Congress can change the rates and any tweak to the law is expected to be retroactive July 1. But there was no clear message if any deal would be reached before the end of summer, when the number of students taking out loans will ramp up ahead of the school year. Generally, lawmakers in both parties in Congress and the White House agree that something should be done, but they don't agree on what. "Students across this country would rather have no deal than a bad deal," said Jack Reed, a Rhode Island Democrat, at a press conference last week on student loans. Related: I will graduate with $100,000 in student loans The Republican-controlled House passed a bill to stop rates from doubling now, but would allow them to rise later. Senate Democrats don't like it. President Obama vowed to veto it,

calling it the "wrong approach." However, Obama has a plan that's very similar to the House plan. Senate Democratic leaders want to extend the low rates for a year or two, and give Congress time to come up with a longer term solution as a part of the normal budget process. Meanwhile, a group of two Senate Democrats and two Republicans struck a deal that also resembles the House plan. Undergraduates, who take out unsubsidized student loans from the government, are already paying the higher 6.8% rate since 2007. Related: Class of 2013 grads average $35,200 in total debt Some Washington leaders want to revamp the student loan program and peg rates to economic conditions. The President and House Republicans, for instance, have proposed ways of tying student loan rates to 10-year Treasury notes. However, the two sides disagree on the details, such as how to cap rates in a way that will ensure students don't get hosed if interest rates skyrocket. They also disagree on ways to let students "lock in" their rates from year to year. Outsized student debt has become a pressing issue, with many young graduates deep in debt and without jobs. It is second only to mortgages as the largest debt that consumers carry. In 2011, students on average owed nearly $27,000 in loans.

Oil prices topped $100 a barrel Wednesday, as traders feared tensions in Egypt could spread to the broader Middle East.

U.S. oil prices rose as high as $102.18 early Wednesday, the highest they've been in over a year. While oil production from Egypt is negligible, the country controls the Suez Canal and pipeline, which move about 4 million barrels of oil per day. Plus, the country is one of the largest and most powerful in the Middle East and North Africa -- home to about a third of the world's oil production. "The fear of contagion in the Middle East to major oil producers is the ultimate concern," Matt Smith, a commodities analyst at Summit Energy in Louisville, Ky, wrote in a research note Tuesday. Protestors in Egypt have been demanding the country's democratically elected, Islamist president step down, saying he has not governed the country in an inclusive manor. The

protests are the largest the county has seen since the 2011 uprising that ousted longtime dictator Hosni Mubarak. Related: Eight states raise their gas tax Seven people have died in the protests, and the Egyptian military has given the president 48 hours to resolve the dispute. Some have hinted there may be a coup, though it's uncertain what actions the military will take. That deadline approaches Wednesday night. Oil prices have risen about 16% in the last two months. Traders cite an improving economy, rising demand for crude oil from refiners in the United States, and problems getting supplies of light, sweet crude to market as other reasons for the price run up.

Credit rating agency Standard & Poor's downgraded three European banks on Wednesday, citing worries over the size of their investment banking portfolios and the impact of new regulations.

The banks are Credit Suisse, Deutsche Bank and Barclays, all of which rely heavily on investment banking to drive revenue growth. All three firms had their ratings cut from A+ to A. "We base today's rating actions on our opinion of the increasing risks that Europe's large banking groups active in investment banking face as regulators and uncertain market conditions continue to make operating in the industry more difficult," the bank said in a statement. The outlook on all three banks is now stable, meaning further cuts to their credit ratings are unlikely in the near term. The downgrades come amid a shifting regulatory landscape for banks, changes that are forcing some of the largest firms to make significant changes to their operations. In addition, large banks are now working to raise funds required to meet new capital requirements, at a time when market volatility and a dour economic environment could impact earnings. "We consider that these banks' debtholders face heightened credit risk owing to the industry's tighter regulation, fragile global markets, stagnant European economies, and rising litigation risk stemming from the financial crisis," S&P said. Related story: The best-paid central banker The primary theme running through S&P's analysis was that each bank faces significant levels of uncertainty.

Investment banking makes up 40% of revenues at Barclays (BCS), S&P said, a business facing risks that "are unlikely to abate in the near-to-medium term." Credit Suisse (CS) sources up to 50% of its revenue from investment banking. Meanwhile, the rating agency said that Deutsche Bank's (DB) "ability to generate stable, predictable revenues" has decreased. "Barclays, Credit Suisse, Deutsche Bank and UBS are among the most exposed in Europe to a combination of regulatory initiatives being undertaken globally on capital market-related businesses," S&P said.

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Strengths Finder Book SummaryDocument11 pagesStrengths Finder Book Summaryangelcristina1189% (18)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Concept of Law Studyguide - DabalosDocument49 pagesThe Concept of Law Studyguide - DabalosJoni Aquino100% (8)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The District Governess & Other Stories by Miss Regina SnowDocument118 pagesThe District Governess & Other Stories by Miss Regina SnowMarianne MartindaleNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Life InsuranceDocument36 pagesLife InsuranceDinesh Godhani0% (1)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Government Arsenal Safety and Security OfficeDocument5 pagesGovernment Arsenal Safety and Security OfficeMark Alfred MungcalNo ratings yet

- Lease FinancingDocument2 pagesLease FinancingDinesh GodhaniNo ratings yet

- TA Holdings Annual Report 2013Document100 pagesTA Holdings Annual Report 2013Kristi DuranNo ratings yet

- Risk Management in BankingDocument45 pagesRisk Management in BankingvivekanandaNo ratings yet

- Risk Management in Indian BanksDocument20 pagesRisk Management in Indian BanksDinesh Godhani100% (1)

- CareDocument1 pageCareDinesh GodhaniNo ratings yet

- Indian ArmyDocument9 pagesIndian ArmyDinesh GodhaniNo ratings yet

- DownloadDocument14 pagesDownloadDinesh GodhaniNo ratings yet

- ReformsDocument7 pagesReformsDinesh GodhaniNo ratings yet

- Detroit BankruptcyDocument10 pagesDetroit BankruptcyDinesh GodhaniNo ratings yet

- HDFC Floating Rate Income Fund December 2012Document24 pagesHDFC Floating Rate Income Fund December 2012Dinesh GodhaniNo ratings yet

- Being Able To Save Money Is Indeed A BonusDocument7 pagesBeing Able To Save Money Is Indeed A BonusDinesh GodhaniNo ratings yet

- HDFC BankDocument19 pagesHDFC BankDinesh GodhaniNo ratings yet

- HDFC Mid Cap Opportunities Fund 300812Document19 pagesHDFC Mid Cap Opportunities Fund 300812Dinesh GodhaniNo ratings yet

- Broking Firms..Project 10Document47 pagesBroking Firms..Project 10Dinesh GodhaniNo ratings yet

- Ism ProDocument30 pagesIsm ProDinesh GodhaniNo ratings yet

- User's GuideDocument108 pagesUser's GuidefrancislutherkingNo ratings yet

- Optical Data Capture: Optical Mark Recognition (OMR)Document17 pagesOptical Data Capture: Optical Mark Recognition (OMR)Dinesh GodhaniNo ratings yet

- Application SoftwareDocument5 pagesApplication SoftwareDinesh GodhaniNo ratings yet

- Remark Office OMR 6 User S GDocument352 pagesRemark Office OMR 6 User S GDinesh GodhaniNo ratings yet

- Soul2.0 UsermanualDocument222 pagesSoul2.0 UsermanualDinesh GodhaniNo ratings yet

- OMR Training Guide (Ver 6.0) v5Document56 pagesOMR Training Guide (Ver 6.0) v5Dinesh GodhaniNo ratings yet

- Remark Classic OMR 4 User S GuideDocument161 pagesRemark Classic OMR 4 User S GuideDinesh GodhaniNo ratings yet

- A Brief On MncsDocument102 pagesA Brief On MncsAjit Pal Singh HarnalNo ratings yet

- Lifeinsuranceppt 111228072540 Phpapp01Document33 pagesLifeinsuranceppt 111228072540 Phpapp01Dinesh GodhaniNo ratings yet

- India BullsDocument6 pagesIndia BullsDinesh GodhaniNo ratings yet

- EGES Impact Indiatrade PolicyissueDocument52 pagesEGES Impact Indiatrade PolicyissueSoma GhoshNo ratings yet

- InsuranceDocument12 pagesInsuranceDinesh GodhaniNo ratings yet

- Alternative Distribution Channels in IndiaDocument11 pagesAlternative Distribution Channels in IndiaDinesh GodhaniNo ratings yet

- Micro InsuranceDocument86 pagesMicro InsuranceVinod KumarNo ratings yet

- Sculi EMT enDocument1 pageSculi EMT enAndrei Bleoju100% (1)

- Document 2 - Wet LeasesDocument14 pagesDocument 2 - Wet LeasesDimakatsoNo ratings yet

- Financial Management: Usaid Bin Arshad BBA 182023Document10 pagesFinancial Management: Usaid Bin Arshad BBA 182023Usaid SiddiqueNo ratings yet

- Romantic Criticism of Shakespearen DramaDocument202 pagesRomantic Criticism of Shakespearen DramaRafael EscobarNo ratings yet

- Working Capital FinancingDocument80 pagesWorking Capital FinancingArjun John100% (1)

- Adobe Scan 04 Feb 2024Document1 pageAdobe Scan 04 Feb 2024biswajitrout13112003No ratings yet

- Bangladesh Labor Law HandoutDocument18 pagesBangladesh Labor Law HandoutMd. Mainul Ahsan SwaadNo ratings yet

- Gender View in Transitional Justice IraqDocument21 pagesGender View in Transitional Justice IraqMohamed SamiNo ratings yet

- History Esssay LayoutDocument2 pagesHistory Esssay LayoutArturo Daniel Laborde CortezNo ratings yet

- Project On Hospitality Industry: Customer Relationship ManagementDocument36 pagesProject On Hospitality Industry: Customer Relationship ManagementShraddha TiwariNo ratings yet

- Welcome To The Falcons School For GirlsDocument6 pagesWelcome To The Falcons School For GirlsSowmiyiaNo ratings yet

- JONES - Blues People - Negro Music in White AmericaDocument46 pagesJONES - Blues People - Negro Music in White AmericaNatalia ZambaglioniNo ratings yet

- Webinar2021 Curriculum Alena Frid OECDDocument30 pagesWebinar2021 Curriculum Alena Frid OECDreaderjalvarezNo ratings yet

- Construction Design Guidelines For Working Within and or Near Occupied BuildingsDocument7 pagesConstruction Design Guidelines For Working Within and or Near Occupied BuildingsAthirahNo ratings yet

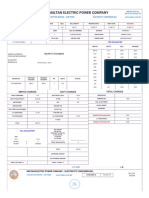

- Multan Electric Power Company: Say No To CorruptionDocument2 pagesMultan Electric Power Company: Say No To CorruptionLearnig TechniquesNo ratings yet

- Case 1. Is Morality Relative? The Variability of Moral CodesDocument2 pagesCase 1. Is Morality Relative? The Variability of Moral CodesalyssaNo ratings yet

- Strategic Management A Competitive Advantage Approach Concepts and Cases 17Th 17Th Edition Fred R David All ChapterDocument67 pagesStrategic Management A Competitive Advantage Approach Concepts and Cases 17Th 17Th Edition Fred R David All Chaptertabitha.turner568100% (3)

- Tok SB Ibdip Ch1Document16 pagesTok SB Ibdip Ch1Luis Andrés Arce SalazarNo ratings yet

- Witherby Connect User ManualDocument14 pagesWitherby Connect User ManualAshish NayyarNo ratings yet

- MhfdsbsvslnsafvjqjaoaodldananDocument160 pagesMhfdsbsvslnsafvjqjaoaodldananLucijanNo ratings yet

- Listening Practice9 GGBFDocument10 pagesListening Practice9 GGBFDtn NgaNo ratings yet

- Digi Bill 13513651340.010360825015067633Document7 pagesDigi Bill 13513651340.010360825015067633DAVENDRAN A/L KALIAPPAN MoeNo ratings yet

- A Review Essay On The European GuildsDocument11 pagesA Review Essay On The European GuildsAnonymous xDPiyENo ratings yet

- Ez 14Document2 pagesEz 14yes yesnoNo ratings yet

- CMSPCOR02T Final Question Paper 2022Document2 pagesCMSPCOR02T Final Question Paper 2022DeepNo ratings yet