Professional Documents

Culture Documents

FNCE 604 - Accelerated Corporate Finance: Alex Edmans

Uploaded by

Brian ValenzuelaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

FNCE 604 - Accelerated Corporate Finance: Alex Edmans

Uploaded by

Brian ValenzuelaCopyright:

Available Formats

FNCE 604 Accelerated Corporate Finance

Alex Edmans

The Wharton School

Summer 2013

Alex Edmans FNCE 604 Summer 2013 1

Introduction

Acknowledgements

A signicant amount of this material is taken from lecture notes by

Professor Simon Gervais, who taught this course for many years at

Wharton. I am extremely grateful to Simon for allowing me to use his

notes.

I also thank present and past teaching assistants Lucia Bonilla, Nacer

Bouhitem, Michael Graham, Adeel Ikram, Michelle Khundakar, Jon

Mensing, Ryan Peters, Jonathan Vogan, and Austin Zalkin for valued

input, and Indraneel Chakraborty and James Park for their help in

typesetting this packet.

Alex Edmans FNCE 604 Summer 2013 2

Introduction

0. Introduction

Alex Edmans FNCE 604 Summer 2013 3

Introduction

0. Introduction

Readings: Brealey, Myers and Allen, Chapter 1

This section will be especially relevant for:

FNCE 726: Advanced Corporate Finance.

FNCE 731: International Corporate Finance

Alex Edmans FNCE 604 Summer 2013 4

Introduction

The Finance Function and the Financial Manager

Broadly stated, the nance function is concerned with the ow of

funds between the capital markets and the rms operations

These ows include: (1) issues of securities to raise cash; (2)

purchases of real assets used in the rms operations; (3) cash inows

generated by the real assets; this cash is either (4a) reinvested in the

rm or (4b) returned to the rms investors.

The nancial manager therefore faces two main tasks:

Investment decisions (allocating funds to investments)

Financing decisions (choosing what instruments to issue to raise funds)

Alex Edmans FNCE 604 Summer 2013 5

Introduction

The Objective of the Financial Manager

Although many claimholders have a stake in the rms income, the

shareholders are the owners, and managers should act in their interest

We will see that shareholders are made better o by any decision

which increases the value of their stake in the rm. Therefore,

managers should act to maximize the value of the rms shares.

This is more complex than prot maximization and requires an

understanding of how nancial assets are valued.

Several institutional arrangements exist to ensure that managers will

indeed follow this objective:

Stock and option compensation

Reputation in managerial labor markets

Hostile takeovers

Boards

Alex Edmans FNCE 604 Summer 2013 6

Introduction

Objective of this Course

The course is intended to provide a framework for analyzing the

investment and nancing decisions made by corporations.

Since such a framework requires an understanding of the

determinants of value, the course provides an introduction to the

concepts underlying both corporate nance and asset pricing.

Alex Edmans FNCE 604 Summer 2013 7

Introduction

Checkpoint: BMA - Sections 1-3 and 1-4

Material relevant to this section:

BMA: chapter 1

Problem set: 1, 2, 4

Bulk pack problem set: none

What is next?

BMA: chapter 2 and section 3-5

Look at the Math/Stat reminder in Additional Materials; this will

be useful for the problem sets

Alex Edmans FNCE 604 Summer 2013 8

Investment Decisions

I. Investment Decisions

Alex Edmans FNCE 604 Summer 2013 9

Investment Decisions

I. Investment Decisions

Alex Edmans FNCE 604 Summer 2013 10

Investment Decisions Compounding and Discounting

I.1 Compounding and Discounting

Alex Edmans FNCE 604 Summer 2013 11

Investment Decisions Compounding and Discounting

I.1.1 Constant Interest Rate

Alex Edmans FNCE 604 Summer 2013 12

Investment Decisions Compounding and Discounting

I.1.1 Constant Interest Rate

Readings:

BMA chapter 2 and section 3-5

This section will be especially relevant for:

FNCE 725: Fixed Income Securities.

FNCE 728: Corporate Valuation.

Alex Edmans FNCE 604 Summer 2013 13

Investment Decisions Compounding and Discounting

Motivation

At the most general level, an investment is a claim to a stream of

cash ows.

This denition encompasses both real and nancial investments.

In order to choose between alternative investments, we must therefore

nd a way to compare cash ows diering in size, timing, and risk.

We will at rst ignore risk and compare certain cash ows.

The techniques of compounding and discounting allow us to compare

cash ows diering in size and timing.

Alex Edmans FNCE 604 Summer 2013 14

Investment Decisions Compounding and Discounting

Compounding and Future Value

Suppose that you invest $C in a bank account paying r %, and that

interest is credited once a year.

Money in the account after one year:

Investment: $C

Interest (C r %): $Cr

Total: $C(1 +r )

Money in the account after two years:

Investment: $C(1 +r )

Interest (C r %): $C(1 +r )r (> $Cr )

Total: $C(1 +r )

2

= $C(1 +r )(1 +r )

Continuing this reasoning, you have $C(1 +r )

T

after T years

$C(1 +r )

T

is the future value in T years of $C at r % compounded

annually. The quantity

CF

T

= (1 +r )

T

is called the T-period compounding factor.

Alex Edmans FNCE 604 Summer 2013 15

Investment Decisions Compounding and Discounting

More Frequent Compounding (Numerical Example)

Suppose that you invest $100 in a bank account paying an interest

rate of 10%, and that interest is credited twice a year.

Every six months, your account will generate

10%

2

= 5% interest.

Money in the account after 6 months:

Investment: $100.00

Interest (100

10%

2

): $5.00

Total: $105.00 = $100(1.05)

Money in the account after one year (12 months):

Investment: $105.00

Interest (105

10%

2

): $5.25 (> $5.00)

Total: $110.25 = $100(1.05)

2

Does it make sense that you get more than $110.00?

You can continue this reasoning to show that youll have

$100(1.05)

2T

after T years (i.e. 2T periods of six months)

Alex Edmans FNCE 604 Summer 2013 16

Investment Decisions Compounding and Discounting

More Frequent Compounding

More generally, suppose that you invest $C in a bank account paying

an interest rate of r , and that interest is credited to your account

twice a year.

You can then show that you will have $C(1 +

r

2

) after 6 months,

$C(1 +

r

2

)

2

after a year, ..., $C(1 +

r

2

)

2T

after T years.

$C(1 +

r

2

)

2T

is the future value in T years of $C at the annual rate r

compounded semiannually (i.e. two times a year)

Even more generally, the future value in T years of $C at the annual

rate r compounded m times a year is

FV

T

= C

_

1 +

r

m

_

mT

and the T-year compounding factor is

CF

T

=

_

1 +

r

m

_

mT

Alex Edmans FNCE 604 Summer 2013 17

Investment Decisions Compounding and Discounting

The Eect of More Frequent Compounding

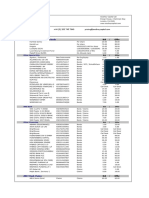

The following table shows the value after T years of $100 invested at

the rate of 10%, compounded m times a year.

T

m 1 5 10 30

1 110.00 161.05 259.37 1,744.94

2 110.25 162.89 265.33 1,867.92

4 110.38 163.83 268.51 1,935.81

12 110.47 164.53 270.70 1,983.74

365 110.51 164.86 271.79 2,007.73

Notice that more frequent compounding (as you go down each

column) means a higher eective annual rate. How far can we push

the benets of more and more frequent compounding?

Alex Edmans FNCE 604 Summer 2013 18

Investment Decisions Compounding and Discounting

The Eect of More Frequent Compounding (contd)

A standard result from algebra states that

lim

m

C

_

1 +

r

m

_

mT

= Ce

rT

,

where e 2.718 is the base for natural logarithms.

We express this result by saying that the future value in T years of

$C invested at an interest rate of r continuously compounded is

FV = Ce

rT

Important note: In this course (and all nance courses that you will

take here), log always means the natural logarithm ln.

Alex Edmans FNCE 604 Summer 2013 19

Investment Decisions Compounding and Discounting

Eective Annual Rate (Numerical Example)

Suppose that you invest $100 at an annual rate of 10% compounded

semi-annually.

From slide 16, you get $100(1 +

10%

2

)

2

= $110.25 after one year.

Question: What is the interest rate r (compounded annually) that

would generate the same amount after one year?

We need to solve

100(1 +r ) = 110.25 =r = 10.25%.

So the future value of $100 invested at an annual rate of 10%

compounded semi-annually is the same as the future value of $100

invested at an annual rate of 10.25% compounded annually.

This 10.25% is called the eective annual rate or the equivalent

annual rate (EAR).

The 10% is called the annual percentage rate (APR) or the annual

rate. It tells you how much interest is paid each year but not how

frequently the interest is paid. Therefore, it is an incomplete picture

Alex Edmans FNCE 604 Summer 2013 20

Investment Decisions Compounding and Discounting

Eective Annual Rate

More generally, suppose that you invest $C at an APR of r

compounded m times a year.

From slide 17, you will have $C(1 +

r

m

)

m

after one year.

The EAR r corresponding to an APR r compounded m times a year

satises

1 +r =

_

1 +

r

m

_

m

Similarly, the EAR r corresponding to an APR r continuously

compounded satises

1 +r = e

r

Notice that r = r if r is compounded annually (m = 1).

In what follows, unless otherwise specied, we will always assume that

APRs are compounded annually, i.e. are also EARs.

Alex Edmans FNCE 604 Summer 2013 21

Investment Decisions Compounding and Discounting

Eective Annual Rate: Example

Alex Edmans FNCE 604 Summer 2013 22

Investment Decisions Compounding and Discounting

Eective Annual Rate: Example (contd)

Why do these certicates of deposits (CDs) seem to oer two

dierent interest rates?

The small print says that the interest rate (APR) is a daily

compounded rate. This means that $1 invested in these CDs will

grow to

CF

1

=

_

1 +

0.065

365

_

365

= 1.0672

after one year

What they call the annual percentage yield is simply the eective

annual rate r , which can be found as follows:

1 +r = 1.0672 =r = 6.72%.

Alex Edmans FNCE 604 Summer 2013 23

Investment Decisions Compounding and Discounting

Eective Monthly (Weekly, Daily, etc.) Rate

Just as we can compute the eective annual rate, we can compute

the eective rate over a month (or a week, or a day).

The eective monthly rate r

M

corresponding to an annual interest

rate r compounded m times a year satises

(1 +r

M

)

12

=

_

1 +

r

m

_

m

= r

M

=

_

1 +

r

m

_

m

12

1

In particular, if r is compounded annually (m = 1), then

r

M

= (1 +r )

1/12

1 =

12

_

1 +r 1.

If r is compounded monthly (m = 12), then r

M

=

r

12

.

Similarly, the eective weekly rate r

W

satises

(1 +r

W

)

52

=

_

1 +

r

m

_

m

= r

W

=

_

1 +

r

m

_

m

52

1

Alex Edmans FNCE 604 Summer 2013 24

Investment Decisions Compounding and Discounting

A Source of Confusion

People can get confused about the link between the following rates:

Annual percentage rate r compounded monthly vs. monthly rate r

M

:

CF

1

=

_

1 +

r

12

_

12

= (1 +r

M

)

12

.

Annual percentage rate r compounded weekly vs. weekly rate r

W

:

CF

1

=

_

1 +

r

52

_

52

= (1 +r

W

)

52

.

Annual percentage rate r compounded daily vs. daily rate r

D

:

CF

1

=

_

1 +

r

365

_

365

= (1 +r

D

)

365

.

To practice, check the following are equivalent to a 10% EAR:

9.5690% compounded monthly, or a monthly rate of 0.7974%;

9.5398% compounded weekly, or a weekly rate of 0.1835%;

9.5323% compounded daily, or a daily rate of 0.0261%.

On Canvas I have posted a rate calculator, RateEquiv.xls, to help

convert between rates

Alex Edmans FNCE 604 Summer 2013 25

Investment Decisions Compounding and Discounting

Compounding and Eective Rates: Example

You want to invest $1,000 in a savings account for two years.

After visiting three dierent banks, you discover that you have three

possible options:

1

an annual percentage rate of 12.5%, compounded annually;

2

an annual percentage rate of 12%, compounded quarterly;

3

a continuously compounded rate of 11.75%.

Which savings account should you choose?

What is the eective monthly rate that you will then be getting?

Alex Edmans FNCE 604 Summer 2013 26

Investment Decisions Compounding and Discounting

Compounding and Eective Rates: Example (contd)

In two years, the three dierent accounts would respectively accrue to

1

1, 000(1 + 0.125)

2

= 1, 265.63;

2

1, 000

_

1 +

0.12

4

_

42

= 1, 266.77;

3

1, 000e

0.11752

= 1, 264.91.

You should therefore invest in the quarterly compounded account

You could also solve this problem by calculating CF

1

for all three

rates, or by comparing EARs (denoted by r below):

1

Obviously, r = 12.50%;

2

1 +r =

_

1 +

0.12

4

_

4

=r = 12.55%;

3

1 +r = e

0.11751

=r = 12.47%;

Again, the second bank oers the best deal.

As shown on Slide 24, the eective monthly rate r

M

must satisfy

(1 +r

M

)

12

=

_

1 +

0.12

4

_

4

=r

M

=

_

1 +

0.12

4

_

1/3

1 = 0.9902%.

Alex Edmans FNCE 604 Summer 2013 27

Investment Decisions Compounding and Discounting

Discounting and Present Value

Suppose you want $C in your account in T years, and that the

current EAR is r . How much must you invest today?

Again, let PV denote this amount.

0 1 2 3 ... T

PV C

So PV must satisfy: PV(1 +r )

T

= C, or PV = C/(1 +r )

T

.

PV is the present value of $C delivered in T years from now.

You are indierent between $PV now and $C in T years. (Why?)

We can also write PV = C DF

T

, where

DF

T

=

1

(1 +r )

T

is called the T-period discount factor.

Alex Edmans FNCE 604 Summer 2013 28

Investment Decisions Compounding and Discounting

Discounting and Present Value (contd)

More generally, suppose you want to receive $C

1

in one year, $C

2

in

two years, ..., $C

T

in T years. How much must you invest today?

We wish to nd the PV of an investment paying $C

1

in one year, $C

2

in two years, ..., $C

T

in T years.

0 1 2 3 ... T

PV C

1

C

2

C

3

... C

T

Using arguments similar to the previous two slides, we should nd that

PV =

C

1

1 +r

+

C

2

(1 +r )

2

+ ... +

C

T

(1 +r )

T

=

T

t=1

C

t

(1 +r )

t

The present value of a sequence of cash ows is the sum of the

present values of each individual cash ow.

Value additivity: you value an investment by valuing each constituent

cash ow.

Alex Edmans FNCE 604 Summer 2013 29

Investment Decisions Compounding and Discounting

Discount Factors

The following gure shows discount factors DF

T

as functions of time

and EAR.

Alex Edmans FNCE 604 Summer 2013 30

Investment Decisions Compounding and Discounting

Discounting: Example

Two years ago, you put $10,000 in a savings account earning an APR of

8% compounded semiannually. At the time, you thought that these

savings would grow enough for you to buy a new car ve years later (i.e. in

three years from now). However, you just reestimated the price that you

will have to pay for the new car in three years at $18,000.

1

How much more money do you need to put in your savings account

now for it to grow to this new estimate in three years?

2

Now suppose that you know that the car company will oer you to

pay for the car over some time. In particular, you will have the

opportunity to make a downpayment of $6,000 at the time you get

the car (three years from now) and to make additional payments of

$6,500 at the end of each of the following two years. With this oer,

how much money do you need to add to your account now?

Alex Edmans FNCE 604 Summer 2013 31

Investment Decisions Compounding and Discounting

Discounting: Example (contd)

1

Let us rst gure out how much money FV is now in the account.

-2 0 ... 3

10, 000 (1.04)

4

FV ...

FV = 10, 000

_

1 +

0.08

2

_

22

= 10, 000(1.04)

4

= 11, 698.59.

Alex Edmans FNCE 604 Summer 2013 32

Investment Decisions Compounding and Discounting

Discounting: Example (contd)

Now, the account should have an amount PV in it for it to grow to

$18,000 in three years.

-2 0 ... 3

PV (1.04)

6

PV =

18, 000

_

1 +

0.08

2

_

23

=

18, 000

(1.04)

6

= 14, 225.66.

So, you need to put $14, 225.66 $11, 698.59 = $2, 527.07 in the

account.

Alex Edmans FNCE 604 Summer 2013 33

Investment Decisions Compounding and Discounting

Discounting: Example (contd)

2. The PV (at time 0, or two years after the initial investment) of these

three payments is

PV =

6, 000

_

1 +

0.08

2

_

23

+

6, 500

_

1 +

0.08

2

_

24

+

6, 500

_

1 +

0.08

2

_

25

= 13, 882.54.

So, you need to add $13, 882.54 $11, 698.59 = $2, 183.95 to the

account

Alex Edmans FNCE 604 Summer 2013 34

Investment Decisions Compounding and Discounting

Shortcuts to Calculating PVs: Perpetuities

A perpetuity is an investment paying a xed sum C

1

at the end of

every period forever. (We will typically consider a period being one

year, but other period lengths are possible).

0 1 2 3 4 ...

PV C

1

C

1

C

1

C

1

...

From our general formula, the PV of the perpetuity is given by:

PV

0

=

C

1

1 +r

+

C

1

(1 +r )

2

+

C

1

(1 +r )

3

+ ...

How do we nd the value of this innite sum?

Dividing both sides of the above equation by 1 +r gives

PV

0

1 +r

=

C

1

(1 +r )

2

+

C

1

(1 +r )

3

+

C

1

(1 +r )

4

+ ...

Alex Edmans FNCE 604 Summer 2013 35

Investment Decisions Compounding and Discounting

Shortcuts to Calculating PVs: Perpetuities (contd)

We now subtract the second equation from the rst to obtain

PV

0

PV

0

1 +r

=

C

1

1 +r

+

C

1

(1 +r )

2

+

C

1

(1 +r )

3

+ ...

C

1

(1 +r )

2

C

1

(1 +r )

3

...

Notice that all but one term on the right can be canceled out.

We now solve for PV as follows (provided r > 0):

PV

0

PV

0

1 +r

=

C

1

1 +r

= PV

0

(1 +r ) PV

0

= C

1

= PV

0

r = C

1

= PV

0

=

C

1

r

Alex Edmans FNCE 604 Summer 2013 36

Investment Decisions Compounding and Discounting

Example: UK Consols

In the 1800s, the British government decided to consolidate the huge

debt accumulated during the Napoleonic wars and to replace it with a

single issue of bonds with no termination date and a coupon rate of

2

1

2

%. These bonds, called consols, are still traded today.

Suppose that the current interest rate in the U.K. is 9%. What is the

PV of a consol with a 1, 000 face value?

This is just a perpetuity promising to pay 25 each year. Its PV is

PV

0

=

25

0.09

= 277.78.

Alex Edmans FNCE 604 Summer 2013 37

Investment Decisions Compounding and Discounting

A More Challenging Example: Deferred Perpetuities

A rich entrepreneur would like to set up a foundation that, every year,

will pay $5,000 in the form of a scholarship to one deserving student

The rst such scholarship is to be awarded in three years, and a

scholarship will be awarded in perpetuity every year after that (even

after the entrepreneurs death).

How much money should the entrepreneur put in the foundations

account, if that account earns 8% compounded annually?

Alex Edmans FNCE 604 Summer 2013 38

Investment Decisions Compounding and Discounting

A More Challenging Example: Deferred Perps (contd)

First, let us calculate how much money will need to be in the account

at the end of the second year; let us denote that amount by PV

2

0 1 2 3 4 5 ...

PV

+

=

5000

0.08

5000 5000 5000 ...

For the account to be worth this much in two years, the amount that

the entrepreneur needs to contribute initially is

PV

0

= PV

2

1

1.08

2

=

5, 000

0.08

1

1.08

2

= 53, 583.68.

The perpetuity starts in three years, but the exponent on the discount

factor is a two.

The perpetuity formula used in the rst step calculates the value of a

stream of cash ows starting a year later, i.e. the perpetuity formula

from slide 36 gives us the value of the stream at time 2.

Alex Edmans FNCE 604 Summer 2013 39

Investment Decisions Compounding and Discounting

Shortcuts to Calculating PVs: Growing Perpetuities

A growing perpetuity is an investment paying, at the end of each

period, an amount C

1

that grows at an annual rate g forever.

0 1 2 3 4 ...

PV C

1

C

1

(1 +g) C

1

(1 +g)

2

C

1

(1 +g)

3

...

From our general formula, the PV of the growing perpetuity is:

PV

0

=

C

1

1 +r

+

C

1

(1 +g)

(1 +r )

2

+

C

1

(1 +g)

2

(1 +r )

3

+ ...

We now use a trick similar to that on slide 35. We multiply both

sides of the above equation by

1+g

1+r

:

PV

0

_

1 +g

1 +r

_

=

C

1

(1 +g)

(1 +r )

2

+

C

1

(1 +g)

2

(1 +r )

3

+ ...

Alex Edmans FNCE 604 Summer 2013 40

Investment Decisions Compounding and Discounting

Shortcuts to Calculating PVs: Growing Perps (contd)

Again, we subtract the second equation from the rst:

PV

0

PV

0

_

1 +g

1 +r

_

=

C

1

1 +r

+

C

1

(1 +g)

(1 +r )

2

+

C

1

(1 +g)

2

(1 +r )

3

+ ...

C

1

(1 +g)

(1 +r )

2

C

1

(1 +g)

2

(1 +r )

3

+ ...

As before, all but one term on the right can be canceled out

We can now solve for PV as follows (provided that g < r ):

PV

0

PV

0

_

1 +g

1 +r

_

=

C

1

1 +r

= PV

0

(1 +r ) PV

0

(1 +g) = C

1

= PV

0

(r g) = C

1

= PV

0

=

C

1

r g

Alex Edmans FNCE 604 Summer 2013 41

Investment Decisions Compounding and Discounting

Example: A Stock

Morgan Stanley has just paid a dividend of $1. It will grow its

dividend at 5% forever. With an interest rate of 10%, what is its

share price?

Alex Edmans FNCE 604 Summer 2013 42

Investment Decisions Compounding and Discounting

Example: A Stock (contd)

We have r = 10%, g = 5%. Note that $1 is C

0

, not C

1

.

C

1

= $1 1.05 = $1.05. Therefore,

PV

0

=

C

1

r g

=

1.05

0.10 0.05

= $21.

Alex Edmans FNCE 604 Summer 2013 43

Investment Decisions Compounding and Discounting

Another Shortcut to Calculating PVs: Annuities

An annuity is an investment paying a xed sum C

1

at the end of

every period for a given number T periods.

0 1 2 ... T 1 T T + 1 T + 2 ...

PV C

1

C

1

C

1

C

1

C

1

From our general formula, we can write the PV of the annuity as:

PV

0

=

C

1

1 +r

+

C

1

(1 +r )

2

+ ... +

C

1

(1 +r )

T

.

Alex Edmans FNCE 604 Summer 2013 44

Investment Decisions Compounding and Discounting

Another Shortcut to Calculating PVs: Annuities (contd)

A more convenient expression can be obtained by observing that the

cash ows from the annuity equal the dierence between the cash

ows of two perpetuities, one starting at time 1 and the other starting

at time T + 1:

0 1 2 ... T 1 T T + 1 T + 2 ...

PV

1

C

1

C

1

C

1

C

1

C

1

C

1

C

1

...

PV

2

C

1

C

1

...

Alex Edmans FNCE 604 Summer 2013 45

Investment Decisions Compounding and Discounting

Another Shortcut to Calculating PVs: Annuities (contd)

The PV of the rst perpetuity is PV

1

0

=

C

1

r

, as derived on slide 36

What about the second perpetuity, which is deferred for T periods?

Let us rst calculate the value of that perpetuity after T periods. We

call this value PV

2

T

.

0 1 2 ... T 1 T T + 1 T + 2 ...

PV

+

2

=

C

1

r

C

1

C

1

...

Now, since PV

2

T

is the value in T periods from now, we need to

discount this value to time 0 to get the value of the perpetuity:

0 1 2 ... T 1 T T + 1 T + 2 ...

PV

2

(1 +r )

T

PV

+

2

PV

2

0

=

PV

2

T

(1 +r )

T

=

C

1

/r

(1 +r )

T

.

Alex Edmans FNCE 604 Summer 2013 46

Investment Decisions Compounding and Discounting

Another Shortcut to Calculating PVs: Annuities (contd)

The calculation for the PV of the annuity then simply involves a

dierence of two perpetuities:

Perpetuity Cash Flow Present

starting at 1 2 ... T T + 1 T + 2 ... Value

1 C

1

C

1

... C

1

C

1

C

1

... PV

1

0

=

C

1

r

T + 1 0 0 ... 0 C

1

C

1

... PV

2

0

=

C

1

r

1

(1+r )

T

Annuity C

1

C

1

... C

1

0 0 ... PV

0

= PV

1

0

PV

2

0

The PV of the annuity is therefore given by:

PV

0

=

C

1

r

_

1

1

(1 +r )

T

_

.

Alex Edmans FNCE 604 Summer 2013 47

Investment Decisions Compounding and Discounting

Example: DiMaggios Vow

When Marilyn Monroe died, her ex-husband Joe DiMaggio vowed to

place fresh owers on her grave every Sunday (starting the week after

her death) as long as he lived.

A bouquet of fresh owers cost $4.00 a week after she died

Based upon actuarial tables, Joe could expect to live for 30 more

years when Monroe died.

Assuming that the cost of owers would grow every week at a rate

equivalent to 2% per year and that 6% was an appropriate annually

compounded discount rate, what was the PV of this commitment?

Hint: First derive the PV formula for an annuity that grows at rate g:

PV

0

=

C

1

r g

_

1

_

1 +g

1 +r

_

T

_

.

Note: the detailed solution is included in Additional Materials.

Alex Edmans FNCE 604 Summer 2013 48

Investment Decisions Compounding and Discounting

Example: DiMaggios Vow (contd)

To use the formula, we must calculate the equivalent weekly interest

rate r

W

, the equivalent weekly growth rate g

W

, as well as the number

of periods T. The rst cash ow is simply C

1

= 4.

Using slide 24, we have

(1 +r

W

)

52

= 1.06 =r

W

= (1.06)

1/52

1 = 0.1121%.

Using slide 24 again, we have

(1 + g

W

)

52

= 1.02 = g

W

= (1.02)

1/52

1 = 0.0381%.

The number of weeks over which owers will have to be bought is:

T = 52 30 = 1, 560.

Therefore, the PV of DiMaggios commitment is

PV =

4

0.1121%0.0381%

_

1

_

1.000381

1.001121

_

1,560

_

= 3, 699.21.

Alex Edmans FNCE 604 Summer 2013 49

Investment Decisions Compounding and Discounting

Other Useful Formulas

The formulas for perpetuities and annuities that we derived on slides

36, 40, 44 and 47 all assume that payments are always made at the

end of the year.

If the payments are made at the beginning of the year (i.e. the rst

payment is C

0

, paid immediately), these PV formulas become:

perpetuity: PV

0

=

C

0

(1 +r )

r

;

growing perpetuity: PV

0

=

C

0

(1 +r )

r g

;

annuity: PV

0

=

C

0

(1 +r )

r

_

1

1

(1 +r )

T

_

;

growing annuity : PV

0

=

C

0

(1 +r )

r g

_

1

_

1 +g

1 +r

_

T

_

.

Alex Edmans FNCE 604 Summer 2013 50

Investment Decisions Compounding and Discounting

Some Notation

The following notation for annuities will sometimes be useful. r

represents the EAR.

The PV of a T-year annuity of $1, payable at the end of each year:

a

T[r

=

1

r

_

1

1

(1 +r )

T

_

.

The PV of a T-year annuity of $1, payable at the start of each year:

a

T[r

=

1 +r

r

_

1

1

(1 +r )

T

_

.

These are called annuity factors, as any (constant) annuity can be

calculated using these factors.

For example, the PV of a T-year annuity of $C payable at the end of

each year is equal to PV = Ca

T[r

.

Alex Edmans FNCE 604 Summer 2013 51

Investment Decisions Compounding and Discounting

Nominal versus Real Interest Rates: Numerical Example

Suppose that all you buy are apples, which cost $1 each today, and

that r = 26%. Can you buy 26% more apples next year?

Answer: It will depend on the price of apples in one year.

Example:

Suppose that you have $100 today, and that the price of apples goes

up by 5% during the year.

Let us compare how many apples you could buy today vs. in one year.

today in one year

money available $100 $126

price of apples $1.00 $1.05

can buy

100

1.00

= 100 apples

126

1.05

= 120 apples

Since you can only buy 20% more apples, you are only 20% better o

(not 26%). In other words, your real rate of return is 20%.

Alex Edmans FNCE 604 Summer 2013 52

Investment Decisions Compounding and Discounting

Nominal versus Real Interest Rates

More generally, suppose that you invest for one year in the bond

market. Your investment next year is worth $ (1 +r ) for each dollar

invested. Does this mean you are better o by saving?

The answer depends on what happens to ination. Suppose that the

one-year rate of ination is i . Then, in order to buy the same amount

of goods you could have purchased with $1 today, you will need

$ (1 +i ) a year from now. This means that your actual return,

measured in todays dollars is given by

1 +R =

1 +r

1 +i

== R =

1 +r

1 +i

1.

R is known as the real rate of return, as opposed to r , which is a

nominal rate.

Alex Edmans FNCE 604 Summer 2013 53

Investment Decisions Compounding and Discounting

Nominal versus Real Interest Rates (contd)

People often calculate the real rate of return R to be the dierence

between the nominal rate of return r and the ination rate i :

R = r i .

This is only approximately true.

Indeed, notice that

1 +r = (1 +R)(1 +i ) = 1 +R +i + (R i )

. .

small

1 +R +i ,

so that

R r i .

Alex Edmans FNCE 604 Summer 2013 54

Investment Decisions Compounding and Discounting

Why Real Rates Are Important

Suppose you are in Germany at the beginning of 1923. Someone

oers you a one-year German Treasury bill denominated in marks with

a face value of DM10,000,000 ( $700) at the bargain price of

DM5,000,000. Since this implies a rate of return of

r =

10, 000, 000

5, 000, 000

1 = 100%,

you accept. Did this turn out to be a good deal?

The ination rate in Germany in 1923 turned out to be about

4,530,000,000%, so that the real return on your investment was

R =

1 + 100%

1 + 45, 300, 000

1 99.9999956%.

In other words, your investment was practically worthless at the end

of 1923!

Alex Edmans FNCE 604 Summer 2013 55

Investment Decisions Compounding and Discounting

Key Takeaways: Constant Interest Rate

Compounding factor gives future value of $1

CF

T

=

_

1 +

r

m

_

mT

= e

rT

if m

Eective annual rate gives equivalent rate under once-a-year

compounding

r =

_

1 +

r

m

_

m

1

Discount factor gives present value of $1

DF

T

= 1/CF

T

Growing perpetuity: PV

0

= C

1

/ (r g)

Annuity factor gives PV of $1 for T years. a

T[r

=

1

r

_

1

1

(1+r )

T

_

Real rate of return R =

1+r

1+i

1

Alex Edmans FNCE 604 Summer 2013 56

Investment Decisions Compounding and Discounting

Checkpoint: Constant Interest Rate

Material relevant to this section:

BMA: chapter 2

Problem set: 1, 2, 5, 9, 13, 22, 24, 29, 32

BMA: chapter 3

Problem set: none

Bulk pack problem set #1

What is next?

BMA: sections 3-3 and 3-4

Alex Edmans FNCE 604 Summer 2013 57

Investment Decisions Compounding and Discounting

I.1.2 Term Structure

Alex Edmans FNCE 604 Summer 2013 58

Investment Decisions Compounding and Discounting

I.1.2 Term Structure

Readings: BMA sections 3-3 and 3-4

This section will be especially relevant for:

FNCE 717: Financial Derivatives.

FNCE 725: Fixed Income Securities.

FNCE 731: International Corporate Finance.

FNCE 738: Funding Investments.

Alex Edmans FNCE 604 Summer 2013 59

Investment Decisions Compounding and Discounting

Accounting for the Term Structure of Interest Rates

Our PV formulas have assumed that the interest rate is the same for

all maturities. In practice, the interest rate at which you can

borrow/invest for, say, 1 year is typically dierent from the rate at

which you can borrow/invest for, say, 5 years.

The relationship among interest rates for dierent maturities is known

as the term structure of interest rates

In a at term structure, the interest rates are the same for all maturities

With a non-at term structure,

the cash ow at time: 1 2 3 ...

should be discounted at: r

1

r

2

r

3

...

where r

t

is known as the t-year spot rate. The PV formula of slide 29 has

to be modied to

PV =

C

1

1 +r

1

+

C

2

(1 +r

2

)

2

+ ... +

C

T

(1 +r

T

)

T

=

T

t=1

C

t

(1 +r

t

)

t

.

Alex Edmans FNCE 604 Summer 2013 60

Investment Decisions Compounding and Discounting

Term Structure: Example

Alex Edmans FNCE 604 Summer 2013 61

Investment Decisions Compounding and Discounting

More on Discount Factors

Letting

DF

t

=

1

(1 +r

t

)

t

we can write the PV formula of slide 60 as

PV = (C

1

DF

1

) + ... + (C

T

DF

T

) =

T

t=1

(C

t

DF

t

) .

DF

t

is known as the t-period discount factor, since multiplication by

DF

t

converts a cash ow C

t

in t periods into its PV.

Since r

t

_ 0, DF

t

< 1, i.e. $1 is worth less than $1 today. In fact, we

must have

1 > DF

1

> DF

2

> > DF

T

,

i.e. $1 the day after tomorrow is worth less than $1 tomorrow, and so

on.

Alex Edmans FNCE 604 Summer 2013 62

Investment Decisions Compounding and Discounting

Proof that DF

t

> DF

t+1

Suppose that r

1

= 20% and r

2

= 7%. This implies

DF

1

=

1

1.20

= 0.83 and DF

2

=

1

(1.07)

2

= 0.87,

so that DF

1

< DF

2

. Why can such a situation not occur?

The reason is that anyone who could borrow and lend at these rates

could become a billionaire overnight. How would you proceed?

Cash ows at the end of year

Strategy 0 1 2

Borrow $1,000 at 7% for 2 yrs +1,000.00 0 -1,144.90

Invest (lend) $954.08 at 20% for 1 yr -954.08 +1,144.90 0

Total +45.92 +1,144.90 -1,144.90

Since you can store the $1,144.90 that you receive after the rst year to

repay your loan at the end of the second year, the $45.92 represents an

arbitrage opportunity.

Alex Edmans FNCE 604 Summer 2013 63

Investment Decisions Compounding and Discounting

Proof that DF

t

> DF

t+1

(contd)

You borrow $1,000 at 7% for two years and invest $954.08 out of

these $1,000 at the rate of 20% for one year. After one year, your

investment will be worth $954.08(1.20) = $1,144.90. You owe the

bank $1,000(1.07)

2

= $1,144.90 at the end of the second year. If you

just store the proceeds from your investment under your mattress for

one year, you can be sure to have enough money to repay the loan.

The remaining $(1,000-954.08) = $45.92 is a free lunch.

Of course, there is no reason to limit yourself to borrowing $1,000.

Similarly, other investors will rush into borrowing at 7% and lending

at 20%. Eventually, r

1

will have to decrease and r

2

will have to

increase until DF

1

becomes greater than DF

2

.

Money machines like the one we just discussed are called arbitrage

opportunities. Arbitrage opportunities cannot exist for long in a well

functioning market.

Alex Edmans FNCE 604 Summer 2013 64

Investment Decisions Compounding and Discounting

Forward Rates: Numerical Example

Your friend tells you that he will have to borrow money for one year in

one year from now.

You agree (today) to lend him the money at that time (in one year)

at a rate f

2

specied today, i.e. you enter a forward rate agreement

with your friend. What is the correct rate?

For every dollar that you invest for two years, you now have two

possible investment alternatives:

Lend for 2 years at a rate of r

2

: FV

2

= (1 +r

2

)

2

.

Lend for 1 year at a rate of r

1

, and then lend to your friend at the

pre-specied rate of f

2

: FV

2

= (1 +r

1

)(1 +f

2

).

Since both investment alternatives involve no risk, neither should

result in a larger future value in two years, that is

(1 +r

2

)

2

= (1 +r

1

)(1 +f

2

) =f

2

=

(1 +r

2

)

2

1 +r

1

1.

The rate f

2

is known as a forward rate.

Alex Edmans FNCE 604 Summer 2013 65

Investment Decisions Compounding and Discounting

Forward Rates

More generally, suppose you were oered a forward rate agreement

(FRA), structured as follows. Your counterparty wishes to borrow for

a year at the end of year t 1 at a rate f

t

specied today. What

should this rate be?

Again, you could invest $1 today for t years in two dierent ways:

Lend for t years at the rate r

t

, resulting in (1 +r

t

)

t

at the end of year

t.

Lend for t 1 years at the rate r

t1

, and enter into a FRA, resulting in

(1 +r

t1

)

t1

(1 +f

t

) at the end of year t.

Alex Edmans FNCE 604 Summer 2013 66

Investment Decisions Compounding and Discounting

Forward Rates (contd)

Since both strategies involve no risk, we must have

(1 +r

t

)

t

= (1 +r

t1

)

t1

(1 +f

t

),

which implies

f

t

=

(1 +r

t

)

t

(1 +r

t1

)

t1

1 =

DF

t1

DF

t

1

The rates f

t

dened by the above equation are known as forward

rates.

Notice that saying that DF

t1

> DF

t

is equivalent to saying that

f

t

> 0.

Alex Edmans FNCE 604 Summer 2013 67

Investment Decisions Compounding and Discounting

The Relationship Between Interest Rates and Forward

Rates

The following gures show the relationship that exists between spot

rates and forward rates.

Alex Edmans FNCE 604 Summer 2013 68

Investment Decisions Compounding and Discounting

Nominal versus Real Interest Rates Revisited

The relationship between nominal and real interest rates derived on

slide 53 also applies to the one-year spot rates:

R

1

=

1 +r

1

1 +i

1

1.

More generally, the t-period real interest rate R

t

satises

1 +R

t

=

1 +r

t

1 +i

t

Alex Edmans FNCE 604 Summer 2013 69

Investment Decisions Compounding and Discounting

Key Takeaways: Term Structure

Spot rate r

T

is the rate per year for T years starting today

The term structure is the graph of r

1

, r

2

, ... for dierent T

With a non-at term structure, PV =

T

t=1

C

t

(1+r

t

)

t

Forward rate f

t

is the rate for 1 year starting at t 1 and ending at t:

f

t

=

(1+r

t

)

t

(1+r

t1

)

t1

1

Alex Edmans FNCE 604 Summer 2013 70

Investment Decisions Compounding and Discounting

Checkpoint: Term Structure

Material relevant to this section:

BMA: chapter 3

Problem set: 14, 18, 20, 25, 32

What is next?

BMA: section 3-1

Alex Edmans FNCE 604 Summer 2013 71

Investment Decisions The Valuation of Certain Cash Flows: Pricing Bonds

I.2 The Valuation of Certain Cash Flows:

Pricing Bonds

Alex Edmans FNCE 604 Summer 2013 72

Investment Decisions The Valuation of Certain Cash Flows: Pricing Bonds

I.2 The Valuation of Certain Cash Flows: Pricing Bonds

Readings: BMA section 3-1

This section will be especially relevant for:

FNCE 717: Financial Derivatives.

FNCE 725: Fixed Income Securities.

FNCE 731: International Corporate Finance.

FNCE 738: Funding Investments.

Alex Edmans FNCE 604 Summer 2013 73

Investment Decisions The Valuation of Certain Cash Flows: Pricing Bonds

What Is a Bond?

A bond is essentially a loan: the issuer (borrower) promises to repay

the investor (lender) the amount borrowed plus interest over some

specied period of time.

A coupon bond promises a periodic interest payment (e.g. every six

months) and repayment of the face value (F) at the maturity

date (T). The periodic interest payment is known as the coupon (C)

and the APR on the face value is called the coupon rate (i.e.,

C

F

is the

coupon rate).

0 1 2 3 ... T 1 T (maturity date)

C (coupon) C C ... C C +F (face value)

For a zero coupon bond there are no periodic coupon payments, and

both principal and interest are paid together at the maturity date.

Alex Edmans FNCE 604 Summer 2013 74

Investment Decisions The Valuation of Certain Cash Flows: Pricing Bonds

Treasury Securities

The U.S. Treasury is the largest single issuer of debt in the world.

U.S. Treasury securities are backed by the full faith and credit of the

U.S. government, so that they are viewed by market participants as

having no (or very low) default risk (i.e. no risk that the issuer will

default on his payments of interest and/or principal).

There are three major types of Treasury securities:

Treasury Bills are issued with maturities of 3, 6, or 12 months.

Treasury Notes are issued with maturities between 2 and 10 years.

Treasury Bonds are issued with maturities greater than 10 years.

Treasury bills are zero-coupon bonds (ZCBs), while Treasury notes

and bonds are coupon bonds with interest paid every 6 months.

A coupon bond is basically a portfolio of several zero-coupon bonds,

one for each coupon or principal payment. The Treasury allows buyers

of T-bonds or T-notes to exchange them for the individual

component ZCBs. These ZCBs corresponding to unbundled Treasury

coupon bonds are called Treasury Strips.

Alex Edmans FNCE 604 Summer 2013 75

Investment Decisions The Valuation of Certain Cash Flows: Pricing Bonds

How Treasury Securities Are Quoted

Treasury bills are quoted in terms of a discount rate (in percent), not

of a price. If d is the quoted discount rate, N the maturity (in days)

and F the face value, then the price is computed according to the

formula

P = F

_

1 d

N

360

_

For example, if the quote for a 100-day T-bill with a face value of

$100,000 is 8.75, then the price is

$100,000

_

1 0.0875

100

360

_

= $97,569.

Treasury coupon securities and Treasury strips are quoted in terms of

prices (in percent of face value), with the decimal part expressed in

units of 1/32. For example, a quote of 92:14 refers to a price of 92

and 14/32, or 92.4375 for a security with $100 face value.

Alex Edmans FNCE 604 Summer 2013 76

Investment Decisions The Valuation of Certain Cash Flows: Pricing Bonds

Alex Edmans FNCE 604 Summer 2013 77

Investment Decisions The Valuation of Certain Cash Flows: Pricing Bonds

How Treasury Securities Are Quoted: Example (contd)

For example, if we look at the Treasury bill with the Dec 26 96

maturity date, the Wall Street Journal tells us:

The bond has 135 days to maturity.

The (best) bid discount is 5.05%, which means that the price at

which you can sell that T-bill with a face value of $100,000 is

100,000

_

1 0.0505

135

360

_

= 98,106.25.

The (best) ask discount is 5.03%, which means that the price at

which you can buy that T-bill with a face value of $100,000 is

100,000

_

1 0.0503

135

360

_

= 98,113.75.

See Additional Materials for the meaning of ask yld (not part of

this course)

Alex Edmans FNCE 604 Summer 2013 78

Investment Decisions The Valuation of Certain Cash Flows: Pricing Bonds

Present Value and Market Price

Consider a Treasury bill with 1 year to maturity and a face value of

$100. If the 1-year interest rate is 10%, we know that the PV of the

T-bill is 100/1.10 = 90.91.

Why must $90.91 be its market price?

Since the current interest rate is 10%, nobody would buy the bill if P

> $90.91, since it would be possible to obtain $100 in a year by

lending $90.91 at 10% for one year.

Conversely, if P < $90.91, nobody would sell it, since it would be

possible to obtain $90.91 today by borrowing this amount from a bank

at 10% and using the payo from the bill a year from now to repay the

loan.

Therefore, the market price of the bill must be $90.91.

These no-arbitrage arguments are shown on the following pages:

In a well-functioning (ecient) market, the price of an investment

equals its present value.

Things of equal value trade at equal prices.

Alex Edmans FNCE 604 Summer 2013 79

Investment Decisions The Valuation of Certain Cash Flows: Pricing Bonds

Present Value and Market Price (contd)

If the T-bill on page 79 were priced at $90:

Cash ow

Strategy 0 1

Buy T-bill -90.00 100

Borrow $90.91 90.91 -100

Total 0.91 0

This $0.91 is an arbitrage opportunity.

If the T-bill on page 79 were priced at $92:

Cash ow

Strategy 0 1

Sell (short) T-bill 92.00 -100

Lend $90.91 -90.91 100

Total 1.09 0

This $1.09 is an arbitrage opportunity.

Alex Edmans FNCE 604 Summer 2013 80

Investment Decisions The Valuation of Certain Cash Flows: Pricing Bonds

Pricing a Coupon Bond

Suppose that the term structure of interest rates is as follows:

r

0.5

= 4%, r

1

= 4.1%, r

1.5

= 4.3%, r

2

= 4.5%. What is the current

price of a T-note with 2 years to maturity, a coupon rate of 8%

semiannual, and a face value of $100?

Using the general PV formula, we have:

P =

4

(1.040)

0.5

+

4

(1.041)

+

4

(1.043)

1.5

+

104

(1.045)

2

= 106.756

Does it make sense that P > $100?

Alex Edmans FNCE 604 Summer 2013 81

Investment Decisions The Valuation of Certain Cash Flows: Pricing Bonds

Estimating the Term Structure

Since bond prices reect the current term structure, we can use bond

prices to estimate the term structure, provided we have a sucient

number of bonds with diering maturities and/or coupons.

Some nd it simpler to rst solve for the discount factors, and then

obtain the interest rates from the discount factors.

Alex Edmans FNCE 604 Summer 2013 82

Investment Decisions The Valuation of Certain Cash Flows: Pricing Bonds

Estimating the Term Structure: Example

Suppose you observe the following prices for a bond with $100 face

value:

Bond Security Coupon Maturity Quote Price

A T-bill 180 days 4.98 97.51000

B T-bill 360 days 5.44 94.56000

C T-note 6% 2 years 99:10 99.31250

D T-note 8% 2 years 103:01 103.03125

Determine the 6, 12, 18 and 24 month interest rates (spot rates).

Alex Edmans FNCE 604 Summer 2013 83

Investment Decisions The Valuation of Certain Cash Flows: Pricing Bonds

Estimating the Term Structure: Example (contd)

First, let us gure out the timing of the bonds payments

Cash ow at the end of

6 months 12 months 18 months 24 months

(0.5 year) (1 year) (1.5 year) (2 years)

Bond A 100 0 0 0

Bond B 0 100 0 0

Bond C 3 3 3 103

Bond D 4 4 4 104

Alex Edmans FNCE 604 Summer 2013 84

Investment Decisions The Valuation of Certain Cash Flows: Pricing Bonds

Estimating the Term Structure: Example (contd)

Let us now calculate the discount factors that are consistent with the

bonds prices and the above payments. In particular, each bond must

satisfy the PV formula on slide 52:

97.51000 = (100 DF

0.5

)

94.56000 = (0 DF

0.5

) + (100 DF

1

)

99.31250 = (3 DF

0.5

) + (3 DF

1

) + (3 DF

1.5

) + (103 DF

2

)

103.03125 = (4 DF

0.5

) + (4 DF

1

) + (4 DF

1.5

) + (104 DF

2

)

Solving the above system gives DF

0.5

= 0.9751, DF

1

= 0.9456,

DF

1.5

= 0.9165 and DF

2

= 0.8816.

We can then use the fact that DF

t

=

1

(1+r

t

)

t

(see slide 62) to nd

r

0.5

= 5.17%, r

1

= 5.75%, r

1.5

= 5.99% and r

2

= 6.51%.

On Canvas I have posted a spreadsheet, TermStructure.xls, which

estimates the term structure from bonds.

Alex Edmans FNCE 604 Summer 2013 85

Investment Decisions The Valuation of Certain Cash Flows: Pricing Bonds

Bond Yields

The yield to maturity or internal rate of return for a bond is the rate

y that solves

P =

T

t=1

C

(1 +y)

t

+

F

(1 +y)

T

(1)

If you recall (from the PV formula on slide 60) that

P =

T

t=1

C

(1 +r

t

)

t

+

F

(1 +r

T

)

T

,

you will see that the yield of a bond is a complicated average of the

current interest rates. In particular, the yields of two bonds with the

same maturity but with dierent coupon rates will generally dier.

Solving for y in (1) involves solving a polynomial of degree T.

For a zero-coupon bond with maturity T, or if the term structure is

at, we have y = r

T

.

Alex Edmans FNCE 604 Summer 2013 86

Investment Decisions The Valuation of Certain Cash Flows: Pricing Bonds

Computing the Yield of a Bond

We compute yields by trial and error: pick a y and compute the PV

at this rate; if PV > bond price, try a higher y and vice-versa.

For example, suppose we want to compute the yield of a 3-year bond

with a face value of $100, paying an annual coupon of 10%, and

selling for $103.83. That is, we want to solve for y in

103.83 =

10

1 +y

+

10

(1 +y)

2

+

110

(1 +y)

3

.

The following table and graph show the required computations.

y PV

9.00% 102.53

8.00% 105.15

8.50% 103.85

There is an inverse relationship between price and yield. (Why?)

Alex Edmans FNCE 604 Summer 2013 87

Investment Decisions The Valuation of Certain Cash Flows: Pricing Bonds

Yields of Treasury Securities

When nancial practitioners talk of the yield of a Treasury security,

they dont generally refer to the rate y as dened on page 86, but to

the annual percentage rate under semi-annual compounding y given

by

_

1 +

y

2

_

2

= 1 + y.

where y is the eective annual yield (under annual compounding).

Note that the eective semi-annual yield (see slide 25) is y

S

= y/2

y is also referred as a bond-equivalent yield.

Alex Edmans FNCE 604 Summer 2013 88

Investment Decisions The Valuation of Certain Cash Flows: Pricing Bonds

Problems with Bond Yields

You should never use the information on bond yields reported by the

nancial press as a substitute for the term structure of interest rates.

Knowing the term structure of interest rates allows you to price any

riskless asset.

Knowing the yield of a bond tells you the price of that particular bond

only.

Two bonds with the same maturity but dierent coupons will in

general have dierent yields.

Alex Edmans FNCE 604 Summer 2013 89

Investment Decisions The Valuation of Certain Cash Flows: Pricing Bonds

Key Takeaways: Pricing Bonds

Treasury bills pay no coupon, and are quoted in terms of a discount

rate: P = F

_

1 d

N

360

_

Treasury notes and bonds pay a semiannual coupon (

C

2

every 6

months), and are quoted in units of 1/32

The price of a bond is P =

T

t=1

C

(1+r

t

)

t

+

F

(1+r

T

)

T

where r

t

is the

t-year spot rate

The yield of a bond is the single constant discount rate y that solves

P =

T

t=1

C

(1+y )

t

+

F

(1+y )

T

. It is a (weighted geometric) average of

the spot rates

For Treasuries, quoted yields are semiannual APRs: y given by

_

1 +

y

2

_

2

= 1 + y

The coupon of a bond is xed. Its yield depends on market

conditions, and is inversely related to its price

Alex Edmans FNCE 604 Summer 2013 90

Investment Decisions The Valuation of Certain Cash Flows: Pricing Bonds

Checkpoint: Pricing Bonds

Material relevant to this section:

BMA: chapter 3

Problem Set: 4, 8.

Bulk pack problem set #2.

The institutional details of short-selling are carefully explained in

Additional Materials.

What is next?

BMA: section 5-1

Alex Edmans FNCE 604 Summer 2013 91

Investment Decisions Capital Budgeting Under Certainty

I.3 Capital Budgeting Under Certainty

Alex Edmans FNCE 604 Summer 2013 92

Investment Decisions Capital Budgeting Under Certainty

I.3 Capital Budgeting Under Certainty

Three questions:

What is a good rule for selecting projects? (section I.3.1)

How do we apply it? (section I.3.2)

What are the alternatives, and are they useful at all? (section I.3.3)

Alex Edmans FNCE 604 Summer 2013 93

Investment Decisions Capital Budgeting Under Certainty

I.3.1 The NPV Rule: Theoretical Foundation

Alex Edmans FNCE 604 Summer 2013 94

Investment Decisions Capital Budgeting Under Certainty

I.3.1 The NPV Rule: Theoretical Foundation

Readings: BMA section 5-1

This section will be especially relevant for:

FNCE 726: Advanced Corporate Finance.

FNCE 728: Corporate Valuation.

Alex Edmans FNCE 604 Summer 2013 95

Investment Decisions Capital Budgeting Under Certainty

Motivation

Suppose you are at a Volkswagen shareholders meeting. Two

shareholders are quite vocal about what the rm should do.

An old man wants money right now: he wants VW to invest in sport

cars which would yield a quick prot.

A little childs trust fund representative wants money a long way in the

future: he wants VW to invest in developing electric cars.

What do you think VWs managers should do?

To answer this question we will look at how an individual should

choose among dierent investment opportunities. We will show that

there is a simple rule that managers should follow, regardless of

shareholders preferences. Hence both VW shareholders will agree on

the same project.

Until Part III, we will ignore the impact on investment decisions of

taxes and other complications.

Alex Edmans FNCE 604 Summer 2013 96

Investment Decisions Capital Budgeting Under Certainty

Mr. Rossis Problem

Mr. Rossi has inherited $1M. He grew up in Italy and has developed a

real aversion to work, which he completely detests. He therefore plans

to use his inheritance to nance himself for the rest of his life.

For simplicity, we will divide his life into two periods, youth and old

age.

We are going to assume that the current interest rate available in

capital markets (for borrowing or lending) is 20%, so that for every

dollar Mr. Rossi saves in his youth, he gets $1.20 in old age.

Alex Edmans FNCE 604 Summer 2013 97

Investment Decisions Capital Budgeting Under Certainty

How the Capital Market Helps Smooth Consumption

Once the possibility of borrowing/lending is taken into account, here

are some of the possibilities available to Mr. Rossi:

Go on a fantastic trip around the world, spend the whole $1M and then

live in poverty in his old age.

Spend $0.5M in his youth, put $0.5M in the bank, and have $0.6M in

his old age.

Spend nothing in his youth and take a $1.2M trip in old age.

More generally, the capital markets allow him to choose any

combination in the following gure:

Alex Edmans FNCE 604 Summer 2013 98

Investment Decisions Capital Budgeting Under Certainty

The Eect of Real Investment Opportunities

While borrowing/lending gives him some choice as to how to allocate

his money, Mr. Rossi also has real investment opportunities. He

fancies himself as an entrepreneur and sits down to work out what

investments he can make.

Mr. Rossi is a wine lover. He reckons that a small vineyard that has

just come on the market will cost him $50,000 and will yield $200,000

for his old age. This is the best project he can think of.

Mr. Rossi is also a gourmet. His next best project is to run a

restaurant. This will cost $100,000 now and give $140,000 in old age.

Alex Edmans FNCE 604 Summer 2013 99

Investment Decisions Capital Budgeting Under Certainty

The Eect of Real Investment Opportunities (contd)

We can represent these and the other projects Mr. Rossi can think of

through the following curve:

Alex Edmans FNCE 604 Summer 2013 100

Investment Decisions Capital Budgeting Under Certainty

Should Mr. Rossi Invest in the Vineyard?

Suppose Mr. Rossi invests in the vineyard. He is left with

$1M $0.05M = $0.95M now;

$0.20M later

Instead of simply consuming these amounts, Mr. Rossi could use

borrowing and lending to achieve other consumption patterns:

Suppose he invests the whole $0.95M. This will generate

$0.95M 1.2 = $1.14M later, so he is left with

$0 now (since the whole $1M was invested);

$1.14M + $0.2M = $1.34M later

Or he can borrow the PV of $0.2M, that is $0.2/1.2 = $0.167M, and

repay $0.2M later. So Mr. Rossi is left with

$0.95M + $0.167M = $1.117M now;

$0.2M $0.2M = $0 later

In fact, by borrowing or lending, Mr. Rossi could achieve any

consumption on the following line. (see next slide)

Alex Edmans FNCE 604 Summer 2013 101

Investment Decisions Capital Budgeting Under Certainty

Should Mr. Rossi Invest in the Vineyard? (contd)

Investing in the vineyard expands his consumption possibility frontier

Alex Edmans FNCE 604 Summer 2013 102

Investment Decisions Capital Budgeting Under Certainty

Should Mr. Rossi Invest in the Vineyard? (contd)

Mr. Rossi is better o by investing in the vineyard.

If he chose to consume everything today, he could consume $1.117M

now. In other words, his current wealth is increased by

$1.117M $1M = $0.117M.

Notice that this increase in wealth corresponds exactly to the

projects net present value (the PV minus the initial cost):

NPV

Vineyard

=

$0.2M

1.2

$0.05M = $0.117M.

More generally, Mr. Rossi can consume more both in his young and

old age.

Optimal decision rule: accept (reject) all projects with positive

(negative) NPV

Alex Edmans FNCE 604 Summer 2013 103

Investment Decisions Capital Budgeting Under Certainty

Should Mr. Rossi Invest in the Restaurant?

Similarly, if Mr. Rossi also invests in the restaurant, in addition to

investing in the vineyard, he will be left with

$1M $0.05M $0.1M = $0.85M now

$0.20M + $0.14M = $0.34M later.

As before, instead of simply consuming these amounts, Mr. Rossi can

borrow and lend to achieve other consumption patterns:

Suppose he invests the whole $0.85M. This will generate

$0.85M (1.2) = $1.02M later, so he is left with

$0 now (since the whole $1M was invested);

$1.02M + $0.34M = $1.36M later

Or he can borrow the PV of $0.34M, that is $0.34M/1.2 = $0.283M,

and repay $0.34M later. So he is left with:

$0.85M + $0.283M = $1.133M now

$0.34M $0.34M = $0 later

Alex Edmans FNCE 604 Summer 2013 104

Investment Decisions Capital Budgeting Under Certainty

Should Mr. Rossi Invest in the Restaurant? (contd)

In fact, by borrowing or lending the appropriate amounts, Mr. Rossi

can achieve any consumption on the following line:

Alex Edmans FNCE 604 Summer 2013 105

Investment Decisions Capital Budgeting Under Certainty

Should Mr. Rossi Invest in the Restaurant? (contd)

Mr. Rossi is better o by investing in both the vineyard and the

restaurant, than just the vineyard:

If he chose to consume everything today, he could consume $1.133M

now. In other words, his current wealth is increased by

$1.133M $1.117M = $0.016M.

Again, this increase in wealth corresponds exactly to the projects

NPV (i.e. the PV minus the initial cost)

NPV

restaurant

=

$0.14M

1.2

$0.1M = $0.016M.

The consumption possibility frontier is pushed further out, i.e. he can

consume more in both periods.

Therefore, Mr. Rossi should invest in the restaurant: this is true no

matter what his preferences are, as long as he prefers more to less.

Alex Edmans FNCE 604 Summer 2013 106

Investment Decisions Capital Budgeting Under Certainty

How Much Should Mr. Rossi Invest?

Clearly, Mr. Rossi should keep investing as long as he can keep

pushing out the consumption possibility frontier, i.e. as long as he can

nd positive-NPV investments. Again, this is true independently of

his preferences.

Alex Edmans FNCE 604 Summer 2013 107

Investment Decisions Capital Budgeting Under Certainty

How Much Should Mr. Rossi Invest? (contd)

By investing I

+

, Mr. Rossi would be investing up to the point at which

the slope of the investment opportunity line just equals (minus) 1 +r

The slope of the investment opportunity line tells you how many more

dollars tomorrow you can have for an additional dollar of investment

today, and thus equals (minus) 1 plus the rate of return of the

marginal investment. Therefore, we can also say that Mr. Rossi

should invest for as long as he can nd investments whose rates of

return are above the interest rate.

r is also known as the opportunity cost of capital. By investing $1

in a project, Mr. Rossi forgoes the opportunity to put the dollar in the

bank and earn r . Thus, it is ecient to invest in the project if and

only if it gives a return of at least r

This links to the IRR rule analyzed in more detail later

Alex Edmans FNCE 604 Summer 2013 108

Investment Decisions Capital Budgeting Under Certainty

Solution to Mr. Rossis Problem

Now that Mr. Rossi has decided how much to invest in real

investment opportunities, he can choose how much to borrow/lend.

This will depend on his preferences for consumption in youth versus

consumption in old age, as represented by the shape of his

indierence curves.

Alex Edmans FNCE 604 Summer 2013 109

Investment Decisions Capital Budgeting Under Certainty

Implications for the Financial Manager

When facing investment decisions managers should accept

investments with positive NPV regardless of the preferences of

individual shareholders.

The managers sole objective is to maximize shareholder wealth. Once

their wealth is maximized, individual shareholders can use the capital

market to achieve their preferred prole of consumption.

This powerful result is the Fisher separation theorem. A rms

optimal choice of investments is separate from its owners attitudes

towards the investments. This allows dierent shareholders to be

willing to own shares in the same rm and delegate the running of the

rm to a professional manager.

Alex Edmans FNCE 604 Summer 2013 110

Investment Decisions Capital Budgeting Under Certainty

A Word of Caution

The FST (and optimality of the NPV rule) requires the market to be:

Complete: markets for shares and borrowing/lending exist

Ecient: market prices reect all available information

Perfect: no distorting taxes and frictions (such as transaction costs);

individuals can borrow and lend at the same rate.

What happens if investors face dierent interest rates?

Behavioral nance studies nancial decisions under market ineciency.

Alex Edmans FNCE 604 Summer 2013 111

Investment Decisions Capital Budgeting Under Certainty

Key Takeaways: Capital Budgeting Under Certainty

The required rate of return on a project is determined exclusively by

the rate of return available elsewhere in the capital market

It is independent of shareholders preferences for consumption today vs.

consumption tomorrow

A nancial manager can therefore ignore shareholder preferences.

His/her goal is simply to maximize shareholder value, by taking

positive-NPV projects and rejecting negative-NPV projects

Once shareholder value is maximized, shareholders can use borrowing

and lending to choose whatever consumption pattern suits their

individual preferences

The Fisher separation theorem assumes capital markets are complete,

ecient and perfect

Alex Edmans FNCE 604 Summer 2013 112

Investment Decisions Capital Budgeting Under Certainty

Checkpoint: Capital Budgeting Under Certainty

Material relevant to this section:

BMA: chapter 5

Problem set: none

Bulk pack problem set #3

What is next?

BMA: chapter 6

Alex Edmans FNCE 604 Summer 2013 113

Investment Decisions Capital Budgeting Under Certainty

I.3.2 Using the NPV Rule for Capital Budgeting

Alex Edmans FNCE 604 Summer 2013 114

Investment Decisions Capital Budgeting Under Certainty

I.3.2 Using the NPV Rule for Capital Budgeting

Readings: BMA, chapter 6.

This section will be especially relevant for:

FNCE 726: Advanced Corporate Finance.

FNCE 728: Corporate Valuation.

FNCE 731: International Corporate Finance.

FNCE 750: Venture Capital and the Finance of Innovation.

Alex Edmans FNCE 604 Summer 2013 115

Investment Decisions Capital Budgeting Under Certainty

The NPV Formula

We have seen that nancial managers act in the best interest of the

shareholders by undertaking investments with positive NPV.

For a one-period investment the NPV formula is

NPV = C

0

+

C

1

1 +r

1

where C

0

is the initial cash ow (which is generally negative) and C

1

is the end-of-period cash ow (which is usually positive).

The general formula is

NPV = C

0

+

T

t=1

C

t

(1 +r

t

)

t

=

T

t=0

C

t

(1 +r

t

)

t

We have already discussed how to use bond prices to infer the interest

rates r

t

. We now discuss how to compute the cash ows C

t

.

Alex Edmans FNCE 604 Summer 2013 116

Investment Decisions Capital Budgeting Under Certainty

Free Cash Flow Is Not Prot

Net income (prot) is how much the company earns in year t,

according to its accounts

C

t

is how much cash physically ows into the rm and is available to

investors, after all other claimants have been paid o

Time value of money: cash can be invested elsewhere, unlike prot

Key dierences:

Capital expenditure aects cash ow but not prot

Depreciation aects prot but not cash ow, except via its eect on

taxes T

T = t

c

(Revenues Expenses Depreciation + Extraordinary Gains)

where t

c

is the corporate tax rate

Free cash ow = Cash from operations Capex

Alex Edmans FNCE 604 Summer 2013 117

Investment Decisions Capital Budgeting Under Certainty

Cash From Operations

Three equivalent ways to calculate cash from operations:

1

Start from net income and add back depreciation:

CFO = (R E D +X)(1 t

c

) + D

2

Add up only the cash items

CFO = R E +X t

c

(R E D +X)

3

Tax the cash items and add back the depreciation tax shield

CFO = (R E +X)(1 t

c

) + t

c

D

Alex Edmans FNCE 604 Summer 2013 118

Investment Decisions Capital Budgeting Under Certainty

Working Capital

Where there is working capital, the Free Cash Flow equation becomes

FCF = CFO Increase in Working Capital Capex

Working capital = Current Assets (restricted cash, inventories,

accounts receivable, others) Current Liabilities (accounts payable,

others)

An investment in working capital is a cash outow, just like an

investment in capital expenditure

Cash is treated as working capital only if it is necessary for the

companys operations e.g. cash in a cash register cannot be put in

a bank to earn interest. In most cases, cash is assumed to be earning

interest in a bank and thus not counted as working capital

We will not consider working capital in FNCE604; however, it is