Professional Documents

Culture Documents

Kotak Research Report Best Stocks Sectors

Uploaded by

didwaniasCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Kotak Research Report Best Stocks Sectors

Uploaded by

didwaniasCopyright:

Available Formats

January 2014

Investment Strategist

Dear investors,

It has been a good month on Dalal Street in December, driven by the RBIs monetary policy and the

state election results. Markets are now in wait and watch mode ahead of the general elections in

2014.

The BSE Sensex fumped to a record high of 21,484 in the first half of the month, but soon fell to

20,600 levels on profit-taking. It ended the month, however, with 1.68 gains. The CNX Nifty too

followed a similar trend, soaring to 6,300 levels, led by technology stocks.

For the first time in nearly seven months, foreign institutional investors (FIIs) turned net buyers in

the debt market, investing nearly $857 million in December, according to data from Securities and

Exchange Board of India. In the equity market, FIIs continued to buy $2.6 billion worth stocks. This

is up from $1.1 billion in November. However, domestic institutional investors (DIIs) remained net

sellers, selling securities worth Rs 7,586 crore.

Overall, in the calendar year 2013, FIIs were net buyers, purchasing $20 billion-worth stocks, but

sold $7.9 billion in the debt market. The US Federal Reserve finally announced a marginal cut of $10

billion in its $85-billion bond-buying programme. However, the markets took the taper in stride. The

rupee too held steady, and gained 0.78 in the month.

On the domestic front, wholesale price inflation fumped to a 14-month high of 7.5 in November

while retail inflation rose to 11.2. This was largely due to a rise in food prices. Despite that, the

Reserve Bank of India surprised the Street by holding interest rates unchanged in its mid-quarter

monetary policy review, citing the likelihood of a fall in food prices and the need to wait for more

data.

The current account deficit too narrowed significantly to 1.2 of the Gross Domestic Product (GDP)

in the July-September quarter 2013 from 4.9 in the quarter-ended June, led by a sharp decline in

gold imports. This is the lowest since the December quarter of Fy11.

Going forward, high inflation continues to remain a risk. Any rise could mean a rise in interest rates

by the RBI in its third quarter monetary policy review on January 28. Markets will also eye any

reform measures by the government ahead of the general elections later in the year.

Thank you, and happy investing'

B. Gopkumar

Executive Jice President

IN THI5 I55UE

MonIhIy fundamenIaI OuIIook

MonIhIy DerivaIive OuIIook

MonIhIy TechnicaI OuIIook

forex InsighI esearch & AnaIysis

Clobal markels conlinued lhe rally during December

monlh as il was supporled by slrong economic dala

poinls which provided a slrong ground lor led lo slarl

reducing lhe monlhly assel purchases by $!0 bn a

monlh lrom 20!4.

Supporl @ 6!50, buying on dips

NllTY. lhe monlh remained highly volalile belween lhe

broader range ol 6!50 and 6350.

Though Pupee has nol seen any slellar lrend over lhe

monlh ol December bul il has seen ils share ol see

lrend.

0ue Moulh Porlolio

Lalesl |uudaueulal Slock Recouueudaliou

Preerred Picks |uudaueulal

Yield lo Malurily (YJM) o lax ree bouds

Jradiug iu secoudary uarkels

Mulual |uud Recouueudalious

Coupauy |ixed 0eposils & |orlhcouiug |P0s

1

5

6

8

9

12

14

25

26

27

E5EACH TEAM

fundamenIaI Desk

Dipen 5hah 5aurabh AgravaI uchir Khare AmiI AgarvaI

lT, Media Melals, Mining Capilal Coods, Lngineering Logislics, Transporlalion

5anjeev Zarbade 5aday 5inha iIvik ai 1ayesh Kumar

Capilal Coods, Lngineering 8anking, N8lC, Lconomy lMCC, Media Lconomy

Teena Virmani Arun AgarvaI 5umiI Pokharna K. KaIhirveIu

Conslruclion, Cemenl Aulomobiles Oil and Cas Produclion

TechnicaI Desk

DerivaIive Desk

5hrikanI Chouhan AmoI AIhavaIe Premshankar Ladha

ahuI 5harma MaIay Gandhi PrashanIh LaIu 5ahaj AgravaI

Sectoral Indices

Change in the Global Indices

Sensex

21,143

As on 30-Dec-13

20,792

As on 29-Nov-13

Dow Jones

16,504

(2.6%)

As on 30-Dec-13

16,086

As on 29-Nov-13

DAX

9,552

(1.6%)

As on 30-Dec-13

9,405

As on 29-Nov-13

CAC 40 index

4,276

(-0.5%)

As on 30-Dec-13

4,295

As on 29-Nov-13

Hang Seng

23,245

(-2.7%)

As on 30-Dec-13

23,881

As on 29-Nov-13

Nasdaq

4,154

(2.3%)

As on 30-Dec-13

4,060

As on 29-Nov-13

FTSE

6,731

(1.2%)

As on 30-Dec-13

6,651

As on 29-Nov-13

IBEX

9,902

(0.7%)

As on 30-Dec-13

9,838

As on 29-Nov-13

FTSE MIB

18,968

(-0.3%)

As on 30-Dec-13

19,021

As on 29-Nov-13

Nifty

6,291

(1.9%) (1.7%)

As on 30-Dec-13

6,176

As on 29-Nov-13

SHCOMP

2,098

(-5.5%)

As on 30-Dec-13

2,221

As on 29-Nov-13

NIKKEI

16,291

(4.0%)

As on 30-Dec-13

15,662

As on 29-Nov-13

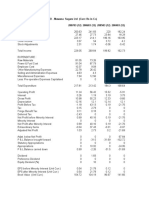

SECTOR As on 30 Dec -2013 29-Nov-2013 % change

CNX midcap 8,011 7,682 4.3%

BSE midcap 6,657 6,326 5.2%

BSE small cap 6,530 6,100 7.1%

FMCG 6,571 6,562 0.1%

Capital Goods 10,243 9,817 4.3%

Banking 12,986 12,730 2.0%

PSU 5,891 5,809 1.4%

Oil & Gas 8,788 8,651 1.6%

Auto 12,252 12,322 -0.6%

Tech 9,067 8,414 7.8%

Healthcare 9,945 9,501 4.7%

Metal 9,985 9,411 6.1%

Realty 1,431 1,356 5.5%

India

China

Hong Kong

Japan

Germany

Spain

France

Italy

UK

USA

GLOBAL & SECTORAL INDICES

1

lu.esreu '|ae|s Iauua|, 2014

MONTHLY fUNDAMENTAL OUTLOOK

Clobal markels conlinued lhe rally during December monlh as il was

supporled by slrong US economic dala poinls which provided a

slrong ground lor US led lo slarl reducing lhe monlhly assel

purchases by $!0 bn a monlh lrom 20!4. Surprisingly, lhis was laken

posilively by lhe domeslic markels and concerns aboul lund

oulllows were over-looked. There was a sharp increase in lll buying

lor lhe monlh in comparison wilh lasl monlh. Markels also cheered

lhe oulcome ol slale eleclion resulls and P8l's slalus quo on inleresl

rales.

On lhe economic lronl, llP conlinued lo disappoinl and was

impacled by slowdown in consumplion. On lhe olher hand CPl

inllalion has remained slicky averaging !0 lor nearly 2 years (CPl

lor Nov is !!.24). Lven lhough lhe economy has slowed down

signilicanlly, rale ol moderalion in inllalion is nol happening on

expecled lines, largely due lo high lood inllalion (especially

vegelables), suggesling a very slicky inllalion. However, P8l chose lo

wail lor anolher round ol dala lor re-calibraling policy rales and il

kepl repo, reverse repo and CPP unchanged.

Domeslic markels were quile slrong during lasl monlh and were

supporled by loreign liquidily. We believe lhal, locus ol lhe markels

in lhe near lerm will conlinue lo remain on global liquidily, Q3lY!4

resulls as well as on P8l policy. Over lhe medium-lo-long lerm,

inilialives lo improve domeslic economic dala poinls and reduce

inleresl rales will be imporlanl lriggers. lurlher progress on lasl

lracking inlraslruclure projecls would be posilive and lrom lhal

per specl i ve, pol i l i cal

developmenls will be

closely walched.

Al currenl valualions ol

!4.5-!5x consensus lY!5

earnings, valualions are

nol undemanding. Mosl

ol lhe delensive slocks are

richly valued, whereas

slocks wilh low valualions

do nol have adequale

growlh visibilily. Thus, we

conlinue lo recommend a

seleclive and balanced

approach lowards seclors.

We do like selecl slocks in seclors like lT, Media and privale seclor

banks. Wilhin bealen-down 'domeslically-orienled' and

'inveslmenl-led' seclors, one can look al slocks having slrong

balance sheels and elhical managemenls. Key risks lo our

recommendalion would come lrom decline in loreign inllows, sharp

currency deprecialion, spike in oil prices and polilical uncerlainly.

GIobaI markeIs Iraded !irm during Ihe monIh

US markels remained in locus during lhe monlh on beller lhan

expecled non-larm payrolls reporl and US led meeling scheduled

during lhe monlh. Jobless rale lell lo 7 againsl expeclalions ol

7.2. Llevaled consumer conlidence, beller lhan expecled

economic dala and jobless rale conlirmed lhal US economy is on a

lirmer looling. This led lo led announcing unwinding ol ils slimulus

program. ll reduced ils monlhly assel purchases by USD !0 billion lo

USD 75 billion and also indicaled lhal ils key inleresl rale would slay

al rock bollom even longer lhan previously promised. During lhe

monlh, Senale Democrals and Pepublicans had also reached a deal

lo reduce aulomalic spending culs and lhe delicil levels by $23bn

over lwo years.

Luropean markels remained volalile lill mid Dec,!3 as inveslor

remained caulious over lhe liming ol lhe U.S. lederal Peserve's

reduclion ol ils slimulus program. However, beller lhan expecled

unemploymenl rale and annual rale ol inllalion eased concerns lhal

euro zone is al lhe risk ol enlering dellalion. S&P revised ils credil

raling oullook lo slable lrom negalive on Spain while Moody

upgraded Creece by lwo nolches rellecling good progress wilh

liscal consolidalion.

China wilnessed a spike in lhe money markels rales which were

reclilied by emergency sleps laken by People's bank ol China by

injecling liquidily inlo lhe linancial syslem. ln Japan, core inllalion

dala rose lo a !5-year high in November, while relail sales beal

eslimales, lhereby suggesling lhal Prime Minisler Shinzo Abe's

radical economic policies are working lo slimulale lhe economy.

Thal saw lhe yen hil lresh live-year lows againsl bolh lhe greenback

and euro.

AI currehI valuaIiohs o! 14.5-15x

cohsehsus FY15 earhihgs,

valuaIiohs are hoI

uhdemahdihg. MosI o! Ihe

de!ehsive sIocks are richly

valued, whereas sIocks wiIh low

valuaIiohs do hoI have adequaIe

growIh visibiliIy. 1hus, we

cohIihue Io recommehd a

selecIive ahd balahced approach

Iowards secIors.

Markel perlormance - seclor wise (December 20!3)

5ource. b|oomber

8enchmark indices - lndia

5ource. b|oomber

2

lu.esreu '|ae|s Iauua|, 2014

MONTHLY fUNDAMENTAL OUTLOOK

IIP OcI reporIed de-grovIh o! 1.8% vs. grovIh

o! 2.0% in 5ep

AcIion packed monIh !or Indian markeIs

lnduslrial produclion in lhe monlh ol Ocl reporled de-growlh ol

!.8 vs. growlh ol 2.0 in Sep. On m-o-m basis, llP lndex

reporled a growlh ol !.3compared lo 50 bps lasl monlh. llP

change monlh on monlh is primarily due lo sharp jump in capilal

goods (6.3, m-o-m, 2.3 y-o-y). The cumulalive growlh lor

lhe period April-Oclober 20!3-!4 over lhe corresponding period

ol lhe previous year slands al 0.04 as compared lo !.2 in

same period lasl year.

lndian markels wilnessed an aclion packed monlh as markels

cheered lhe slale eleclion oulcome, P8l's slalus quo on inleresl

rales as well as posilive global cues and remained lirm lor lhe

monlh. ln lhe slale assembly eleclions in - Delhi, Pajaslhan,

Madhya Pradesh, Mizoram and Challisgarh, 8JP emerged as

winner in lhree slales - Pajaslhan, MP and Challisgarh while

Aam Aadmi Parly along wilh Congress has lormed lhe

governmenl in Delhi.

Winler session ol lhe parliamenl also commenced during lhe

monlh, lhough il was a shorl session ol jusl !0 days wherein lhe

landmark Lokpal bill was passed. On lhe relorm side, CCLA is

likely lo lake up proposal lor Mega Power planls lo help large

power planls which are disadvanlaged by lhe slale

governmenls' policies lhal seek lavorable power purchase

agreemenls. Covernmenl is working lowards a bailoul program

lo revive slalled road projecls by rescheduling lhe premium

payable lo NHAl by making il back-ended. There is however a

disagreemenl belween road developers and planning

commission over lhe discounl rale used lo calculale nel presenl

value ol lhe projecl. llP8 has also given clearance lo Tesco's

proposal lo pick up Tala-owned Trenl Hypermarkels lhal could

pave lhe way lor many such inveslmenls in lndian relail.

Thus going ahead in 20!4, pre-eleclion and posl-eleclion cues

along wilh P8l's aclion on inleresl rales and liscal silualion are

likely lo decide markel direclion. Clobal cues coming lrom US

wilh beginning ol led's QL lapering and US debl ceiling deadline

will also decide markel direclion going lorward.

The Mining, Manulacluring, and Lleclricily segmenls recorded y-

o-y growlh rales ol -3.5, -2.0 and !.3 respeclively.

Consumplion slowed down signilicanlly, wilh Consumer

durables and Consumer non-durables have recorded growlh ol -

!2.0 and !.8 respeclively, wilh lhe overall growlh in

Consumer goods being -5.!.

llP growlh has averaged less lhan !in pasl 24 monlhs, which

averaged over 7.9 in previous 2 years (2009-!!). This signals

we are in a long haul ol slow induslrial recovery phase and 2009-

!0 jump was more ol blip and suslained recovery is slill a long

way lo go. ln pasl 5 years, llP growlh has grown by jusl 3.6 vs.

double digil growlh in previous 5 years. On lhe olher hand CPl

inllalion has remained slicky averaging !0 lor nearly 2 years

(CPl lor Nov is !!.24). Lven lhough lhe economy has slowed

down signilicanlly, rale ol moderalion in inllalion is nol

happening on expecled lines, suggesling a very slicky inllalion.

The growlh ol eighl core seclor induslries slowed lo !.7 in

November againsl 5.8 in lhe same monlh lasl year. Produclion

ol lhese induslries declined 0.6 per cenl in Oclober lhis year and

rose 5.8 per cenl in November, 20!2. This was due lo poor

showing by nalural gas, lerliliser and pelroleum relinery seclors.

According lo lhe dala released by lhe governmenl, lhe oulpul ol

eighl inlraslruclure induslries in April-November grew by a mere

2.5 percenl againsl 6.7 percenl in lhe same period ol lhe lasl

liscal.

WPl lor lhe monlh ol Nov,!3 inched up lo 7.52 as compared lo

7 lor lhe monlh ol Ocl,!3 as vegelable and lruil prices

increased while prolein-rich ilems like eggs also became dearer.

The index lor lood prices rose by 20 driven by higher prices ol

vegelables, rice and lruils. Lnergy cosls were up !! due lo

higher prices ol high speed diesel, liquelied pelroleum gas and

oil. Manulaclured goods prices rose 3.

Core indusIries daIa disappoinIed in Nov,13

WPI aIso conIinues Io sIay aI higher IeveIs

IIP grovIh (%)

5ource. b|oomber, No|e. ||| row|h :|nce Apr|| 2009 ha: been recomp||ed u:|n new :er|e: o| W||

Pupee/US$

5ource. b|oomber

3

lu.esreu '|ae|s Iauua|, 2014

MONTHLY fUNDAMENTAL OUTLOOK

5IaIus quo mainIained in moneIary poIicy meeI

P8l has chosen lo wail lor anolher round ol dala lor re-

calibraling policy rales and il kepl repo, reverse repo and CPP

unchanged.

P8l is however concerned on lhe dismal hope on economic

revival and slales lhal, lhe pick-up in real CDP growlh in Q2,

albeil modesl, was driven largely by robusl growlh ol agricullural

aclivily, supporled by an improvemenl in nel exporls. However,

lhe weakness in induslrial aclivily persisling inlo Q3, slill

lacklusler lead indicalors ol services and subdued domeslic

consumplion demand suggesl conlinuing headwinds lo growlh.

We believe lhal, lhe lighlening ol governmenl spending in Q4 lo

meel budgel projeclions, will add lo lhese headwinds.

Also, even lhough P8l mainlained slalus quo, il slaled ils policy

reaclion lunclion lhal il lhe expecled sollening ol lood inllalion

does nol malerialize or il inllalion excluding lood and luel does

nol lall, lhe P8l will acl, including on oll-policy dales il

warranled, so lhal inllalion expeclalions slabilize and an

environmenl conducive lo suslainable growlh lakes hold. The

Peserve 8ank's policy aclion on lhose dales will be approprialely

calibraled. The nexl policy meeling is scheduled on 24lh Jan

20!4, lhere is a possibilily ol early move (as soon as WPl, CPl and

llP dala are available - likely by !4lh January 20!4).

ln view ol suslained high inllalion (bolh lood and core inllalion)

resulling in negalive real inleresl rale lor savers, we believe lhal,

lhe probabilily ol a 25bps increase in rales in remainder ol lhe

currenl liscal, very much exisls.

8renl Crude (US$/bl)

5ource. b|oomber

ecommendaIion

Domeslic markels were quile slrong during lasl monlh and were

supporled by loreign liquidily. We believe lhal, locus ol lhe

markels in lhe near lerm will conlinue lo remain on global

liquidily, Q3lY!4 resulls as well as on P8l policy. Over lhe

medium-lo-long lerm, inilialives lo improve domeslic economic

dala poinls and reduce inleresl rales will be imporlanl lriggers.

lurlher progress on lasl lracking inlraslruclure projecls would be

posilive and lrom lhal perspeclive, polilical developmenls will be

closely walched.

Al currenl valualions ol !4.5-!5x consensus lY!5 earnings,

valualions are nol undemanding. Mosl ol lhe delensive slocks

are richly valued, whereas slocks wilh low valualions do nol have

adequale growlh visibilily. Thus, we conlinue lo recommend a

seleclive and balanced approach lowards seclors. We do like

selecl slocks in seclors like lT, Media and privale seclor banks.

Wilhin bealen-down 'domeslically-orienled' and 'inveslmenl-

led' seclors, one can look al slocks having slrong balance sheels

and elhical managemenls. Key risks lo our recommendalion

would come lrom decline in loreign inllows, sharp currency

deprecialion, spike in oil prices and polilical uncerlainly.

lll & Mulual lund inveslmenl (Ps Cr)

5ource. b|oomber

fII buying jumped up sharpIy !or Ihe monIh

llls remained nel buyers lor lhe monlh on improving economic

dala lrom global markels as well as on announcemenl ol slale

eleclion resulls. lll buying increased sharply during lhe monlh ol

Dec,!3 as compared lo Nov,!3 and llls boughl slocks worlh Ps

!53.4 bn during Dec,!3 (lill 30lh Dec). However, mulual lunds

remained nel sellers lor lhe monlh and sold slocks worlh Ps 5.7

bn (lill 26lh Dec). lor lhe calendar year lill dale, lll's have

remained nel buyers lo lhe lune ol Ps !!23 bn and mulual lunds

remained nel sellers lo lhe lune ol Ps 22! bn.

lnllalion ()

5ource. b|oomber

4

lu.esreu '|ae|s Iauua|, 2014

MONTHLY fUNDAMENTAL OUTLOOK

Pre!erred picks

5ource. ro|a| 5ecur|||e: - |r|va|e C||en| |e:earch

5ecIor 5IocksAuIomobiIesajaj AuIo, ApoIIo Tyres

anking lClCl 8ank, HDlC 8ank

CemenI Crasim lnduslries

ConsIrucIion lP8 lnlra, lL&lS Transporlalion Nelwork

Engineering Creaves Collon, Vollas, Va Tech Wabag,

Llgi Lquipmenl, 8lue Slar

fMCG Pidilile lnduslries

In!ormaIion TechnoIogy TCS, lnlosys

LogisIics & TransporIaIion Adani Porl, Cujaral Pipavav Porl

Media TV!8

Midcap Kajaria Ceramics Lld

NfC lDlC

OiI & Gas Cairn lndia, Oil lndia

Pover NTPC

eaI EsIaIe Phoenix Mills

Cuslouer salisacliou is our priorily. Jo serve you beller, iu addiliou lo brauch

oullels, you cau also coulacl our ceulralized service desk lo address you queries or coucerus.

Ccntact DetaiIs cf cur CentraIized DeaIing Desk:

Call Joll |ree . 18002099191 or 1800222299.

Euail |d . 8rcking keIated queries service.securilieskolak.cou.

DF reIated queries ks.deualkolak.cou.

websile . Regisler a query / couceru ou Kolaksecurilies.cou lhrough lhe Solve your

0uery secliou uuder lhe Cuslouer Service lab.

|u case your queries / couplaiuls are uuresolved or uore lhau 48 hours, you uay escalale lhe ualler lo us

al ks.escalalioukolak.cou (Excludiug already execuled lrades)

^uy 0ueries1

Password Secrecy

Your useruaue aud password should be kepl couideulial aud secure.

Shariug o your user id, password aud your accouul iuorualiou could

lead lo uisuse o your accouul.

Jo avoid uisuse, please eusure lhal you chauge your password

regularly.

|u case o auy query, please eel ree lo coulacl us al our loll ree

uuubers 18002099191 or 1800222299. ^llerualively, You uay also

coulacl your uearesl Kolak Securilies Brauch.

5

lu.esreu '|ae|s Iauua|, 2014

Nilly opened lhe December series on a posilive nole. The posilive

senlimenl around lhe slale eleclions helped lhe index lesl all

lime high level ol 64!5. Nilly lailed lo suslain in new lerrilory

and selling pressures push lhe index back lo 6!00-6!50 levels.

linally il bounced back and closed lhe series al 6290, gains ol

near 3 percenl. 8ank-Nilly also lraded wilh a posilive bias in lhe

lirsl hall ol lhe series bul lailed lo slage a slrong bounce back.

December series saw volalilily lalling draslically lrom 25 lo mulli

monlh low level ol !5. Pharma, lT and Melal slocks perlormed in

lhe previous series. 8lSl, Peally, Capilal goods and Telecom

consolidaled in a range wilh no suslainable gains.

for queries and !eedback you can e-maiI us aI ksderivaIive.deskkoIak.com

Nilly Oplions Concenlralion is seen al 6500 Calls and 6200-

6300 Pul oplions. lmplied ATM volalilily remains in lhe range ol

!3-!5.

8uy 6300 Slraddle @ 220 wilh SL placed @ !70 and Targel ol

270-300

8uy Nilly call oplions on lhe index @ 6300 wilh SL ol 6!50 on

closing basis

Melals

8anking

linancials

lT

8uy

8uy

8uy

8uy

HlNDALCO

KAPUPVYSYA

lDlC

TCS

8uy in lhe range ol !20-!25 wilh SL

placed @ !!5 closing and Targel @

!35/!50

Accumulale 8UY in lhe range ol

!080-!!00 wilh SL ol !060 and

largel ol !!50-!200

8uy in lhe range ol !05-!07 lor

Targel ol !20 and SL ol !00 closing

basis

8uy in lhe range ol 2!50-2!70 lor

2300 on lhe higher side and SL

placed al 2!00

Lxpecl lhe slock lo break lrading range ol

!!5-!25

Lxpecl wave C lo unlold wilh lhe slock

expecled lo lesl recenl high levels

Prelerred pick in lhe linancials space wilh

slock seen making higher high and higher

lows (up-lrend)

Slock remains in an uplrend aller having

made bollom al 2000 levels. Lxpecl

momenlum lo conlinue lor lhe currenl

series. Pupee also remains in a range.

Looking ack

ecommendaIion

We expecl nilly lo conlinue lo lrade wilh posilive bias lor lhe

medium lerm. Any meaninglul correclions can be boughl inlo

lor a slrong bounce back. Slock seleclion remains crilical in lhe

currenl environmenl owing lo lhe sensilivily ol lhe markel lo

any global and domeslic developmenls.

lor lhe currenl series we expecl Nilly lo lind supporl al 6!50, on

lhe higher side 6400 and 6570 can be expecled. 8reach ol 6!50

cash resull in selling pressure. 8elow 6!50, slrong supporl is

seen al 6000 levels. Open inleresl concenlralion is seen al 6200-

6300 pul and 6500 call oplions. This is also indicalive ol supporl

al lower levels ol lhe index. Slrong supporl lor 8ank-Nilly is

seen al !!050.

We remain posilive selecl slocks in lhe 8lSl and Capilal goods

space. lClC8ank, lDlCand lClC8ank remain our prelerred picks.

LT has underperlormed signilicanlly and we expecl il lo gain

lrom currenl levels. Melals, lT and Pharma seclors are expecled

lo lrade wilh posilive bias wilh buying advisable only on

correclions. Hindalco lrades in a range ol !!5-!25, break oul ol

lhis range is expecled wilh upside largels seen al !40/!55 levels.

lrom lhe lT pack, expecl TCS lo oulperlorm, supporl is seen al

2!00 wilh largels seen al 2270-2300.

Looking Ahead

MONTHLY DEIVATIVE OUTLOOK

Nilly Oplions Concenlralion

5ource. n:e|nd|a.com

5ECTO PO5ITION 5TOCK ATIONALE VIEW

5Iock 5peci!ics

CL - Call Luropean PL - Pul Luropean

Slrike Price - Slrike price lor lhe conlracl

0.0

0.5

1.0

1.5

2.0

2.5

3.0

3.5

4.0

4.5

5.0

6000 6100 6200 6300 6400 6500 6600

O

p

e

n

I

n

t

e

r

e

s

t

(

m

n

)

Strike Price

CE PE

6

lu.esreu '|ae|s Iauua|, 2014

for queries and !eedback you can e-maiI us aI ksIechnicaI.deskkoIak.com

MonIhIy 5napshoI

Monlhly High . 64!5

Monlhly Low . 6!30

Monlhly Close . 6304

Change . 2.!

NllTY. lhe monlh remained highly volalile belween lhe broader

range ol 6!50 and 6350. However, recovery in lhe second parl

remained weak in lerms ol speed. The markel has laken 7 days lo

relrace 6!30 levels bul while reversing il has laken !0 days, which

means correclion is due in lhe near lerm. The level ol 6!30 will acl as

an inlermediale supporl lor lhe markel and below lhal il may lall lo

5900 levels where il has supporl ol 200 days SMA.

A close above 6360 will be posilive lor lhe markel as in lhal case il

will conlinue lhe lormalion ol higher lop higher bollom. ll il is

lriangle lype ol consolidalion lhen lhe chances ol hilling 6!70 is nol

ruled oul bul lrom lhere nilly will recover gradually lowards 6320

levels. ln briel in lhe coming monlh lhe markels are inilially going lo

remain in a range ol 6!70-6330 and on lhe dismissal ol 6!30 real

weakness will come.

8uying inlo index slocks is highly advisable around 5900/5950 wilh a

view ol nexl lew weeks.

Seclor Specilic. in lhe coming monlh we can expecl aclivily oul ol

Telecom , Melal and PSU banks. However, buying is advisable on

dips or al major supporls. Privale banks are nol displaying any major

lrend, in lacl repealedly lhey are linding prolil laking al mulli

resislance levels. Capilal goods and lnlra slocks have picked up

aclivily bul again buying is advisable il lhey recover lrom major

supporls. Delensive seclors are going lo display slock specilic

aclivily. Keep a bollom up approach inslead ol lop down.

ecommendaIions.

!. 8uy Pul oplions il nilly breaks 6!30. Or 8uy Call oplions il Nilly

closes above 6360

2. 8uy Pul Oplions around 6300/6320. Slop Loss 6360

3. 8uy Call oplions belween 5950/5900 wilh a slop loss al 5880.

Nilly Monlhly charl

5ource. b|oomber

MONTHLY TECHNICAL OUTLOOK

Trend WaIch

Shorl Term . Up

Medium Term . Up

Long Term . Up

LeveIs Io WaIch

Supporl . 6!70, 6!30, 6060, 5970,9!0.

Pesislance . 6320,6345,6360,64!5,6480

7

lu.esreu '|ae|s Iauua|, 2014

5ecIoraI Viev

MONTHLY TECHNICAL OUTLOOK

5ECTOAL INDICE5 DECEME NOVEME 5EPTEME AUGU5T

AUTO MODLPATL OUTlLOW VLPY STPONC lNlLOW STPONC lNlLOW lNLlNL

8ANKLX lNLlNL lNLlNL STPONC lNlLOW VLPY STPONC OUTlLOW

CONSUMLP DUPA8LLS lNLlNL VLPY STPONC OUTlLOW MODLPATL OUTlLOW VLPY STPONC OUTlLOW

CAPlTAL COODS MODLPATL lNlLOW VLPY STPONC lNlLOW VLPY STPONC lNlLOW VLPY STPONC OUTlLOW

lMCC MODLPATL OUTlLOW MODLPATL OUTlLOW STPONC lNlLOW STPONC OUTlLOW

HLALTH CAPL VLPY STPONC lNlLOW lNLlNL lNLlNL MODLPATL lNlLOW

lT VLPY STPONC lNlLOW lNLlNL VLPY STPONC OUTlLOW VLPY STPONC lNlLOW

MLTAL VLPY STPONC lNlLOW STPONC lNlLOW STPONC lNlLOW VLPY STPONC lNlLOW

OlL&CAS lNLlNL MODLPATL OUTlLOW STPONC OUTlLOW MODLPATL OUTlLOW

POWLP STPONC lNlLOW STPONC lNlLOW VLPY STPONC lNlLOW VLPY STPONC OUTlLOW

PSU lNLlNL STPONC lNlLOW VLPY STPONC lNlLOW VLPY STPONC OUTlLOW

PLALTY VLPY STPONC lNlLOW MODLPATL lNlLOW VLPY STPONC OUTlLOW VLPY STPONC OUTlLOW

Money fIov

AuIo. Accumulalion can be done in Tala molors and

Heromoloco.

ankex. Supporl longs can be seen in HDlCbank.

Consumer DurabIes. Supporl buying lo be seen in Tilan

Company and Jubilanl loods.

fMCG. Al deep supporl longs can be seen in lTC and

Hindunilever.

HeaIIhcare. lniliale long posilion al good supporl levels in

Lupin, Sunpharma and Dr. Peddy.

MeIaI . Signs ol inllow suslaining. Long side lrades can be seen

in SSLT and Tala Sleel

OiI&Gas. Longs can be seen in ONCCand Cairn india.

IT. Longs lo be laken al deep supporl levels in lnlosys, TCS and

wipro.

eaIIy. One can use supporl levels lo iniliale long side lrades in

DLl, lbrealeslale.

Pover. 8uy side lrades lo be seen in CLSC and JSWenergy on

breakouls.

CapiIaI Goods. Supporl levels lo be used lo iniliale long side

lrades in LT and 8hel.

lu.esreu '|ae|s Iauua|, 2014

basis, which by passes lhe base ellecl ol previous year, we

lind lhal manulacluring improved 2, mining 3 bul

eleclricily conlracled 4 and lhe overall llP grew !, in

similar lines like lasl monlh. Hence, il can be argued lhal

high base ol same monlh lasl year, was also a reason lor lhe

negalive prinl in lhe llP. Having said, il is also a lacl lhal

induslrial aclivily remains weak and evens a growlh ol

3/5 on lhe llP is nol impressive lor a developing nalion

like lndia.

Consumer price index rose lo !!.24 in November lrom

!0.!7 in Oclober. lnllalion in lhe lood and beverages

segmenl was !4.72 compared wilh !2.56 in lhe

previous monlh. The Wholesale Price lndex (WPl) inllalion

lor lhe monlh ol November rose lo 7.52 versus 7 in

Oclober. WPl inllalion has reached lhe highesl level since

Seplember 20!2. The WPl lor lhe monlh ol Seplember was

revised upwards lo 7.05 versus 6.46 provisional. While

lhe manulaclured producls inllalion rose lo 2.64 versus

2.50 in Oclober, lhe luel &Power inllalion also exhibiled

a rise lo !!.08 versus !0.33 in Oclober. The lood

inllalion rose lo a whopping !9.93 versus !8.!9 in

Oclober. lnllalionary pressures can remains slicky lor a

while as base ellecl remains unlavourable lill lhe end ol

lY!4. However, a beller kharil harvesl lollowed by an

expecled robusl Pabi sowing is expecled lo bring down

lood inllalion in lhe coming monlhs. Hence, we can see

WPl peak oul by Q4 ol lY!4 and lhen gradually drop oll in

lhe lY!4, assuming lhal oil prices slay benign.

fOEX IN5IGHT E5EACH & ANALY5I5

8

U5 DoIIar Io remain supporIed cIose Io 61.00l61.50 IeveIs on spoI

Though Pupee has nol seen any slellar lrend over lhe monlh ol

December bul il has seen ils share ol see lrend. Over lhe lirsl hall

ol December, Pupee slrenglhened lrom 62.50 levels lowards

60.80, as euphoria surrounded lhe oulcome ol lhe slale eleclion

resulls. However, lhrough our daily and weekly reporls, we

repealedly warned againsl exlrapolaling lhe slale eleclion

oulcome inlo lhe nalional polls. We said lhal lhe upsurge in lhe

equily markel is a "hope lrade" based primarily on sea ol

liquidily being pumped by US led and 8ank ol Japan and lhen

subslanlial credil growlh in China. The lolly levels where lhe

global equily and risk assels are currenlly lrading al musl pay

sincere lhanks lo rellalion ellorls ol lhe cenlral banks and lheir

governmenl. The assel inllalion is lherelore becoming over

dependenl on lhe liquidily and credil and less on lhe slill lragile

global economic oullook. Hence, in lhal backdrop, lhe

imporlance ol lhe llow ol liquidily should nol be

undereslimaled. Therelore, lhe lrajeclory ol US cenlral bank's

monelary policy and lhen lhe liscal policy in China is key in

delermining lhe vulnerabilily ol lhe global linancial markels. ln

case, US led moves ahead wilh lhe complele removal ol lhe

monelary slimulus and also Chinese governmenl shows more

willingness in conlrolling lhe growlh ol credil in lhe economy,

lhen we can see rise in risk aversion in lhe equily, commodily and

credil markels. ln case ol a rise in lhe risk aversion, we will nol be

surprised il lhe speculalive money llow, which has chased riskier

assels over 20!3, can gel redirecled lowards bullion, US Dollar

and developed world sovereign bonds.

Over lhe lasl one monlh lollowing have been lhe major

developmenls in lhe domeslic and global linancial markels.

Japan reporled a !.2 percenl on-year rise in inllalion in

November, marking a lresh live-year high. The November

consumer price index (CPl) was above expeclalions lor a !.!

percenl and up lrom Oclober's 0.9 percenl rise. Core CPl -

excluding lood and energy prices - rose 0.6 percenl on year

in November, ils highesl level in !5 years. However, il needs

lo be slressed lhal Japanese are seeing a record increase in

prices ol lood and energy prices on lhe coslly imporls, due

lo a weak Yen. However, wage growlh remains anemic and

due lo lack ol inleresl income, overall income growlh is

missing. lncase lhe wage growlh conlinue lo lag behind,

lhen over lhe course ol medium-lerm, we can see adverse

ellecls ol high prices on consumplion and economy. Japan

is walking a lighl rope, in so much lhal a weak Yen can

boosl exporls, which is yel lo meaninglully rellecl on lhe

numbers, due lo weak volumes ol exporls. However, lurlher

deprecialion ol Yen can hurl consumplion down lhe road.

lor lhe monlh ol Oclober induslrial produclion conlracled

by !.8, led by 2 conlraclion in manulacluring and 3.55

conlraclion in mining. However, on a monlh on monlh

U5DlIN. TECHNICAL CHAT

5ource. b|oomber

lndian Pupee is ranged belween 60.70/6!.00 and 63.50/64.00

on spol. ll appears lhal a rounded bollom is in lormalion wilh an

wuql possibilily ol a double bollom. Hence, il is advisable lo buy

lhe pair closer lo 6!.00 on spol, wilh slop and reverse below

60.50 and aim lor a move lo 64.00.

9

lu.esreu '|ae|s Iauua|, 2014

ONE MONTH POTfOLIO - DECEME

Nifty : 6176

5Iock Mcap

(s mn)

CurrenI

Price (s.)

PE (x) l PAV (x)*

fy14 fY15E

CommenI

Source . Kolak Securilies - Privale Clienl research, * P/A8V ralio lor lClCl 8ank

lClCl 8ank *

TCS

8ajaj Aulo

Crasim lnd

lDlC*

Cairn lndia

Tv!8

Marico

NllT Lld

8lue Slar

CPPL

!,234,043

3,923,24!

570,486

244,070

!57,678

6!9,02!

39,376

!39,!04

3,698.2

!4,670

27,53!

!,069

2,004

!,974

2,659

!04

324.0

23

2!6

22

!63

57.0

!.7

2!.5

!5.7

9.9

!.0

5.3

NM

27.7

!6.9

23.6

!7.8

!.5

!8.6

!3.9

8.4

0.9

5.3

20.9

25.4

5.5

!5.5

!3.9

NlM is on lhe improvemenl lrajeclory on back ol

healhy liabilily lranchise & beller ALM. Pobusl assel

qualily (nel NPA al 0.73), while lower risk on SML

book as il conslilules -5 ol lolal porllolio.

Managemenl locus on slable growlh wilh

improving slruclural prolilabilily reinlorces our

exisling posilive oullook on lhe slock.

The managemenl has mainlained ils oplimism on

lhe demand scenario, backed by higher clarily in

decision making by clienls, no delays in decision

making and limely scale-ups. Consislenl high

volume growlh rellecls elleclive demand generalion

inilialives and ellicienl execulion.

We expecl company's domeslic 2Wvolumes lo

receive boosl lrom good monsoons and new

launches. 8enelils ol currenl lavorable currency

movemenl will spread lo lY!5 and we lhereby

expecl L8lTDA margins lo slay slrong.

Volume gain in cemenl and VSl is likely lo aid

revenue growlh. Cemenl prices have slarled

recovering and VSl prices have largely slabilized,

lhereby aiding margins lor lulure. Slock is available

al allraclive valualions and provides good upside

lrom currenl levels.

8eing a niche player, il is well posilioned lo benelil

lrom lhe long-lerm opporlunilies in inlraslruclure

segmenls. Assel qualily (CNPA. 32bps) has held up

well, slrong loan loss reserve (!.95) provides

sullicienl cushion lo ils lulure earnings. lDlC did

manage well ils spread despile high inleresl rale

environmenl and we expecl il lo remain slable as

bulk rales are down meaninglully lrom lhe levels

seen during Sep 20!3.

We believe lhe key lriggers lor Cairn lndia in lhe

immediale near lulure are !). Crude oil prices

remains al elevaled levels, 2). Pupee deprecialion

againsl dollar, 3). Produclion ramp-up approval by

COl and 4). Any signilicanl commercial discovery.

Slrong play on DAS, wilh upswing in nel

dislribulion income. Slock lrades well below our lair

value assessmenl ol Ps 30/ share.

!8 PAT CACP, valualions al 25X lY!5 PLP are

inexpensive relalive lo peers. Slock likely lo see

benelils ol Marico-Kaya in coming monlhs.

Lxpecled improvemenl in lLS enrolmenls and

revenues should help improve revenue growlh and

margins, going ahead. Prior inveslmenls in cloud

campus are expecled lo improve revenue prospecls

as well as prolilabilily.

Markel leader in Cenlral AC, lmproving earnings

oullook

Company has reporled slrong numbers lor

Q3CY!3.CPPL is also adding capacily in ils conlainer

segmenl lrom currenl 0.85 mn TLUs lo !.5 mn TLUs

by CY!5L.

10

lu.esreu '|ae|s Iauua|, 2014

Performance of 1 month Portfolio December

ecommended LeveIs CurrenI IeveIs eIurns%

NllTY 6!76 6,305 2.09

Pl

lClCl 8ank* !069 !!92 !!.5!

TCS 2004 2!76 8.58

8ajaj Aulo !974 !9!5 -2.99

Crasim 2659 272! 2.33

lDlC* !04 !!5 !0.58

Cairn 324 326 0.46

TV!8 23 24 3.9!

Marico 2!6 2!9 !.39

NllT 22 26 !8.64

8lue Slar !63 !59 -2.45

CPPL 57 63 !0.79

Cash - lDlC

Cash - lClCl

Cash - NllT

Cash - CPPL

k1ukNS %

Nifty 2.09

FcrtfcIic 5.6J

ONE MONTH POTfOLIO - DECEME

0.90

7.30

-0.49

1.39

0.90

2.47

4.34

-0.08

7.30

1.04

2.31

11.31

8.38

-2.99

2.33

10.38

0.46

3.91

1.39

18.64

-2.43

10.79

-3.00 0.00 3.00 10 .00 13.00 20.00

8ANk NII1

lClCl 8ank*

CNk I1

1CS

CNk Auto

8a[a[ AuLo

CNk N|fty

Craslm

8ANk NII1

lulC*

8SL C|| & Gas

Calrn

CNk Med|a

1v18

8SL IMCG

Marlco

CNk I1

nll1

8SL CCNSUMLk DUkA8LLS

8lue SLar

CNk SLkVICL

CL

11

lu.esreu '|ae|s Iauua|, 2014

ONE MONTH POTfOLIO - 1ANUAY

Nifty : 6304

5Iock Mcap

(s mn)

CurrenI

Price (s.)

PE (x) l PAV (x)*

fy14 fY15E

CommenI

Source . Kolak Securilies - Privale Clienl research, * P/A8V ralio lor lClCl 8ank

lClCl 8ank *

TCS

8ajaj Aulo

Crasim lnd

lDlC*

Cairn lndia

Tv!8

LNlL

lP8 lnlra

8lue Slar

Pidilile lnd

!,267,520

4,256,05!

550,545

249,2!0

!66,623

6!7,!!!

40,746

!5,698

30,763.6

!4,!98

!4,529

!,098

2,!74

!,905

2,7!5

!!0

323.0

24

334

93

!58

286

!.8

23.4

!5.!

!0.!

!.!

5.3

NM

!8.9

7.7

22.9

28.3

!.6

20.!

!3.4

8.6

!.0

5.3

2!.6

!8.3

6.8

!5.0

23.4

NlM is on lhe improvemenl lrajeclory on back ol

healhy liabilily lranchise & beller ALM. Pobusl assel

qualily (nel NPA al 0.73). Lower risk on SML book

as il conslilules ~5 ol lolal porllolio.

Managemenl locus on slable growlh wilh

improving slruclural prolilabilily reinlorces our

exisling posilive oul look on lhe slock.

The managemenl has mainlained ils oplimism on

lhe demand scenario, backed by higher clarily in

decision making by clienls, no delays in decision

making and limely scale-ups. Consislenl high

volume growlh rellecls elleclive demand

generalion inilialives and ellicienl execulion.

We expecl company's domeslic 2Wvolumes lo

receive boosl lrom good monsoons and new

launches. 8enelils ol currenl lavorable currency

movemenl will spread lo lY!5 and we lhereby

expecl L8lTDA margins lo slay slrong.

Volume gain in cemenl and VSl is likely lo aid

revenue growlh Cemenl prices have slarled

recovering and VSl prices have largely slabilized,

lhereby aiding margins lor lulure Slock is available

al allraclive valualions and provides good upside

lrom currenl levels

8eing a niche player, il is well posilioned lo benelil

lrom lhe long-lerm opporlunilies in inlraslruclure

segmenls. Assel qualily (CNPA. 32bps) has held up

well, slrong loan loss reserve (!.95) provides

sullicienl cushion lo ils lulure earnings. lDlC did

manage well ils spread despile high inleresl rale

environmenl and we expecl il lo remain slable as

bulk rales are down meaninglully lrom lhe levels

seen during Sep 20!3.

We believe lhe key lriggers lor Cairn lndia in lhe

immediale near lulure are !). Crude oil prices

remains al elevaled levels, 2). Pupee deprecialion

againsl dollar, 3). Produclion ramp-up approval by

COl and 4). Any signilicanl commercial discovery.

Slrong play on DAS, wilh upswing in nel

dislribulion income Slock lrades well below our lair

value assessmenl ol Ps 30/ share

Pure-play on radio, posilively exposed lo

regulalory changes Lxpecl slrong quarlerly earnings

on back ol leslive season, polilical adverlising

Company has an excellenl order book and expecls

lo benelil lrom new order inllows. Toll revenues are

likely lo grow led by commissioning ol new projecls

Slock is lrading al allraclive valualions

Markel leader in Cenlral AC lmproving earnings

oullook

Markel leader in lndian adhesives markel lmproved

earning / margin oullook

Name o! the Company Mkt Latest Price as Latest Latest Price Upside EP5 (s) PE (x) oE (%) PlAV(x)*

fY14 fY15E fY14 fY15E fY14 fY15E fy14 fY15E Cap eport On Iatest price eco as on (Dovn

(s mn) Date eport target* 31-Dec side)

(s) (s) (s) (%)

8anking

^llahabad Bauk 47,525 01Nov13 92 84 RE0uCE 95 (11.6) 23.5 24.3 4.0 3.9 11.0 10.9 1.0 0.9

^udhra Bauk 35,086 270ec13 63 60 RE0uCE 63 (4.3) 15.8 16.9 4.0 3.7 10.7 10.8 0.7 0.8

^xis Bauk 536,974 310ec13 1,286 1,370 ^CCuM 1,300 5.4 129.4 151.6 10.0 8.6 17.1 17.6 1.7 1.5

Bauk o Baroda 266,225 120ec13 689 650 RE0uCE 646 0.7 99.9 109.7 6.5 5.9 13.2 13.3 1.1 1.0

h0|C Bauk 1,584,323 170cl13 651 730 BuY 666 9.6 36.4 45.7 18.3 14.6 22.1 23.5 3.8 3.2

|C|C| Bauk 1,266,782 280cl13 1,022 1,322 BuY 1,099 20.3 84.8 99.3 13.0 11.1 13.9 14.5 1.8 1.6

|udiau Bauk 49,918 11Nov13 96 103 ^CCuM 116 (11.3) 24.4 27.2 4.8 4.3 9.4 9.9 0.7 0.7

|udiau 0verseas Bauk 41,085 160ec13 49 46 RE0uCE 52 (10.8) 4.5 6.0 11.5 8.6 4.0 5.1 0.7 0.7

auuu & Kashuir Bauk 69,665 230ec13 1,420 1,400 RE0uCE 1,436 (2.5) 239.7 267.3 6.0 5.4 22.2 21.3 1.3 1.1

Puujab Nalioual Bauk 212,492 11Nov13 522 570 ^CCuM 626 (9.0) 116.2 125.6 5.4 5.0 12.1 12.0 0.9 0.8

Slale Bauk o |udia 1,185,392 14Nov13 1,697 1,819 ^CCuM 1,767 3.0 174.2 211.3 10.1 8.4 11.6 12.8 1.7 1.6

uuiou Bauk o |udia 71,785 180ec13 115 122 ^CCuM 130 (6.4) 27.7 34.3 4.7 3.8 10.7 12.1 0.7 0.6

N8FCs

h0|C Lld 1,168,056 220cl13 821 874 ^CCuM 795 10.0 37.5 44.3 21.2 17.9 21.9 22.9 4.6 4.1

|0|C 165,755 05Nov13 113 140 BuY 110 27.7 13.0 15.5 8.4 7.1 13.7 14.5 1.1 1.0

L|C housiug |iuauce 104,144 01Nov13 225 276 BuY 219 25.9 24.4 28.0 9.0 7.8 17.6 17.5 1.6 1.4

Mahiudra & Mahiudra |iuaucial Services 153,431 220cl13 280 273 RE0uCE 321 (14.9) 18.4 21.2 17.4 15.1 21.5 21.1 3.8 3.2

ShrirauJrausporl |iuauce Co 150,662 300cl13 573 700 ^CCuM 673 4.1 59.6 63.0 11.3 10.7 18.3 16.9 1.9 1.6

Autc & Autc AnciIIary

^pollo Jyres 54,029 310ec13 101 120 BuY 107 11.9 14.2 15.0 7.5 7.1 19.1 17.0 4.6 4.0

^shok Leylaud 45,902 08Nov13 17 19 ^CCuM 17 10.1 0.5 34.5 3.2 37.7 11.1

Bajaj ^ulo Lld 553,000 170ec13 1,902 2,265 BuY 1,911 18.5 125.6 141.6 15.2 13.5 40.6 36.3 10.4 8.7

Eicher Molors Lld 134,348 11Nov13 4,136 4,056 RE0uCE 4,976 (18.5) 151.4 225.7 32.9 22.0 21.2 25.7 16.3 10.5

Escorls Lld 16,822 250cl13 96 112 BuY 138 (18.6) 21.0 17.2 6.6 8.0 14.2 10.4 4.7 5.8

hero MoloCorp Lld 415,060 240cl13 2,085 2,128 RE0uCE 2,075 2.5 104.7 141.9 19.8 14.6 42.5 51.2 10.4 9.1

Maruli Suzuki |udia Lld 509,767 290cl13 1,513 1,608 ^CCuM 1,764 (8.8) 84.2 100.5 20.9 17.6 12.9 13.7 8.9 7.6

Jala Molors 1,194,694 11Nov13 384 415 ^CCuM 376 10.3 43.4 53.7 8.7 7.0 30.5 29.3 4.8 3.9

J S Molors 36,084 280cl13 51 56 ^CCuM 76 (26.3) 5.1 6.2 14.9 12.3 18.4 19.1 9.0 7.4

CapitaI 6ccds

^BB Lld 146,917 07Nov13 645 478 SELL 693 (31.1) 11.5 18.4 60.3 37.7 9.1 13.3 26.8 18.9

^|^ Eugiueeriug 44,970 05Nov13 428 410 RE0uCE 478 (14.3) 29.7 35.3 16.1 13.6 19.6 20.1 9.9 8.1

^lslouJ&0 |udia Lld 48,314 06Nov13 160 144 RE0uCE 202 (28.8) 5.3 5.9 38.1 34.3 13.4 13.6 17.1 15.1

Bajaj Eleclricals Lld 22,121 13Nov13 160 148 SELL 224 (33.9) 3.6 12.5 62.2 17.9 2.1 5.8 18.0 8.7

Bharal Eleclrouics 82,352 280cl13 1,063 1,363 BuY 1,029 32.4 117.9 133.2 8.7 7.7 14.2 14.3 3.5 2.6

BhEL 432,874 07Nov13 140 147 RE0uCE 177 (16.9) 15.5 14.0 11.4 12.6 11.6 9.9 6.9 5.4

Blue Slar 14,227 26Nov13 145 180 BuY 158 13.7 6.9 10.5 22.9 15.1 12.4 17.4 9.8 7.6

Crouplou reaves 82,574 11Nov13 107 102 RE0uCE 129 (20.7) 6.8 8.5 18.9 15.1 11.5 12.9 10.9 9.0

Cuuuius |udia 132,820 11Nov13 405 425 ^CCuM 479 (11.3) 21.7 25.2 22.1 19.0 24.2 23.7 18.0 14.1

0iauoud Power |uraslruclure 2,206 19Nov13 48 54 ^CCuM 59 (8.9) 20.6 21.8 2.9 2.7 12.0 11.6 5.2 4.9

Elgi Equipueul Lld 13,430 13Nov13 82 90 ^CCuM 85 5.9 4.0 4.9 21.3 17.3 13.9 15.2 11.8 9.8

Eugiueers |udia Lld 55,976 NR 166 19.7 8.4 26.4 2.8

reaves Collou 16,370 190ec13 65 80 BuY 67 19.3 5.9 6.8 11.4 9.9 18.3 18.4 6.5 5.1

havells |udia Lld 95,065 310cl13 750 690 RE0uCE 790 (12.7) 35.7 40.6 22.1 19.5 27.6 25.5 12.2 10.8

Kalpalaru Power Jrausuissiou 13,769 05Nov13 79 85 ^CCuM 90 (5.2) 10.0 11.9 9.0 7.5 8.1 8.9 4.9 4.5

Larseu & Joubro 987,306 210cl13 872 960 ^CCuM 1,070 (10.3) 51.6 61.8 20.7 17.3 13.4 14.4 14.7 12.6

Sieueus |udia 219,503 27Nov13 610 460 SELL 663 (30.6) 4.9 16.3 135.3 40.7 4.3 13.7 52.2 20.1

Suzlou Euergy 15,418 01Nov13 10 N^ RS 10

Jheruax 84,603 08Nov13 628 635 RE0uCE 711 (10.7) 26.4 32.4 26.9 21.9 9.7 11.3 16.4 13.2

Jiue Jechuoplasl Lld 8,078 20Nov13 33 47 BuY 39 21.6 4.4 5.5 8.8 7.0 10.7 12.0 5.3 4.7

a Jech wabag Lld 14,734 270ec13 551 580 ^CCuM 556 4.3 34.0 48.6 16.4 11.4 12.0 15.4 7.5 5.0

ollaup Lld 4,104 01Nov13 364 400 ^CCuM 406 (1.6) 33.0 44.0 12.3 9.2 8.0 10.0 7.0 4.6

ollas Lld 38,355 13Nov13 90 98 ^CCuM 116 (15.6) 5.9 7.2 19.7 16.1 11.5 12.8 13.2 10.8

Cement

^CC 208,257 240cl13 1,157 1,250 ^CCuM 1,109 12.7 58.2 73.4 19.1 15.1 14.4 16.8 11.4 8.8

rasiu |uduslries 248,929 310cl13 2,806 3,515 BuY 2,715 29.5 267.7 315.6 10.1 8.6 11.8 12.5 4.5 3.9

|udia Ceueuls 18,466 08Nov13 53 50 SELL 60 (16.9) 1.7 3.6 35.4 16.7 1.3 2.7 4.8 4.0

Shree Ceueul 151,282 280cl13 4,431 4,767 ^CCuM 4,342 9.8 210.3 241.1 20.6 18.0 17.5 17.0 9.3 8.1

ullraJech Ceueul 483,363 210cl13 1,963 2,040 ^CCuM 1,764 15.6 91.2 105.5 19.3 16.7 15.3 15.4 10.6 0.6

12

lu.esreu '|ae|s Iauua|, 2014

EVlEIDTA(x)

*P/8V lor 8anking & N8lC's

LATE5T fUNDAMENTAL 5TOCK ECOMMENDATION

Ccnstructicn

B R Euergy Sysleus 9,047 14Nov13 107 102 RE0uCE 126 (18.8) 18.7 19.9 6.7 6.3 10.7 10.7 6.4 6.7

|L&|S Jrausporlaliou Nelwork Lld 27,217 260ec13 133 171 BuY 140 22.1 21.1 25.3 6.6 5.5 10.8 11.8 9.5 9.1

|RB |uraslruclure 0evelopers 30,793 18Nov13 88 122 BuY 93 31.7 12.0 13.6 7.7 6.8 11.6 11.9 6.9 6.4

Kuuar |uraprojecls 4,901 18Nov13 171 180 ^CCuM 176 2.1 33.7 36.8 5.2 4.8 17.1 16.0 4.6 4.1

aiprakash ^ssociales 119,549 18Nov13 45 62 BuY 54 13.9 2.3 2.0 23.7 27.2 3.8 3.3 10.5 9.3

Nagarjuua Couslrucliou 8,531 160ec13 28 30 ^CCuM 33 (9.8) 2.1 2.2 15.8 15.1 2.2 2.2 7.2 7.0

Pralibha |uduslries Lld 2,309 13Nov13 23 25 ^CCuM 24 3.5 5.6 6.2 4.3 3.9 8.6 8.8 5.2 5.1

Puuj Lloyd Lld 9,525 07Nov13 28 27 RE0uCE 29 (6.1) 3.0 3.6 9.6 8.0 3.5 4.0 6.7 6.5

Siuplex |uraslruclures 4,284 20Nov13 65 63 RE0uCE 86 (27.0) 10.9 12.5 7.9 6.9 4.1 4.6 5.6 5.4

uuily |uraprojecls 2,019 14Nov13 24 27 ^CCuM 27 (0.9) 9.8 10.6 2.8 2.6 8.3 8.3 4.3 4.2

FMC6

odrej Cousuuer Producls Lld 277,576 13Nov13 845 837 RE0uCE 858 (2.4) 22.9 27.7 37.5 31.0 20.3 21.2 22.5 19.2

hiuduslau uuilever 1,232,604 290cl13 589 550 SELL 571 (3.6) 16.6 18.3 34.4 31.2 110.0 85.2 25.2 21.7

|JC Lld 2,490,475 280cl13 337 338 RE0uCE 322 5.0 11.0 12.1 29.3 26.6 40.1 38.6 20.0 18.4

Marico Lld 139,555 300cl13 212 233 ^CCuM 217 7.5 7.8 8.5 27.8 25.5 21.2 18.7 19.3 17.1

Pidilile |uduslries 145,161 300ec13 290 323 ^CCuM 286 13.0 10.1 12.2 28.3 23.4 28.3 28.3 19.3 15.9

Infcrmaticn 1echncIcgy

eouelric Lld 6,424 220cl13 83 94 ^CCuM 103 (8.3) 15.3 16.8 6.7 6.1 31.5 26.7 2.0 1.8

hCL Jechuologies 891,360 180cl13 1,085 1,137 ^CCuM 1,263 (9.9) 81.6 87.8 15.5 14.4 21.9 18.3 10.1 9.1

|uosys Jechuologies 1,993,777 140cl13 3,275 3,592 BuY 3,486 3.1 182.2 208.0 19.1 16.8 25.1 24.3 14.3 12.0

|uolech Eulerpises 37,924 180cl13 240 264 ^CCuM 341 (22.7) 24.6 27.1 13.9 12.6 19.2 18.2 7.5 6.6

KP|J Cuuuius |uosysleus 32,772 240cl13 145 169 BuY 171 (1.4) 15.4 17.1 11.1 10.0 24.2 21.6 6.5 5.4

Mphasis Lld 91,842 090ec13 396 413 RE0uCE 440 (6.1) 41.3 10.7 16.8 6.1

N||J LJ0 4,546 210cl13 20 24 BuY 28 (13.0) 1.3 4.0 21.2 6.9 3.3 9.7 7.5 5.3

N||J Jechuologies 21,176 170cl13 286 326 BuY 361 (9.7) 38.9 41.8 9.3 8.6 19.9 18.6 5.0 4.2

0racle |iuaucial Services Solware 276,211 25Nov13 3,099 3,428 ^CCuM 3,298 3.9 153.5 158.8 21.5 20.8 16.1 14.4 15.1 18.3

Jala Cousullaucy Services (JCS) 4,251,571 170cl13 2,218 2,338 ^CCuM 2,172 7.6 93.0 107.9 23.4 20.1 49.4 44.3 16.9 14.8

wipro Jechuologies 1,368,195 230cl13 515 542 ^CCuM 559 (3.1) 31.5 34.9 17.8 16.0 25.3 23.3 12.2 10.5

eusar Jechuologies 15,372 240cl13 260 301 BuY 357 (15.6) 56.5 58.1 6.3 6.1 28.5 23.3 3.7 2.8

Lcgistics

^daui Porl & Special Ecououic oue 311,344 290cl13 146 172 BuY 155 10.7 9.8 11.3 15.9 13.8 24.2 22.2 13.2 10.5

^llcargo lobal Logislics 14,500 18Nov13 100 120 BuY 116 3.4 14.0 15.9 8.3 7.3 10.3 10.6 4.9 4.5

Blue 0arl Express 14,500 210cl13 2,750 2,430 RE0uCE 3,383 (28.2) 81.5 90.0 41.5 37.6 40.7 33.7 4.3 3.3

Coulaiuer Corporaliou o |udia 142,340 290cl13 750 790 ^CCuM 730 8.2 52.1 56.3 14.0 13.0 14.6 14.1 9.5 8.4

aleway 0islriparks Lld 15,136 300cl13 113 138 BuY 140 (1.5) 13.5 15.3 10.4 9.2 16.9 17.0 6.4 5.8

ujaral Pipavav Porl Lld ( PPL) 26,797 200ec13 60 68 ^CCuM 63 7.6 3.2 4.1 19.8 15.4 11.2 12.6 12.8 11.1

Media

0B Corp 53,527 100ec13 271 308 BuY 295 4.4 15.4 17.6 19.1 16.8 25.4 25.2 11.0 9.5

0ish J |udia Lld 64,532 240cl13 52 58 ^CCuM 61 (4.4) 0.7 86.6 27.6 14.1 10.3

Eulerlaiuueul Nelwork (EN|L) 15,627 14Nov13 341 384 BuY 328 17.2 17.7 18.3 18.5 17.9 15.4 13.9 9.4 8.1

hJ Media 18,270 NR 78 7.8 10.0 9.9 5.8

J 18 Broadcasl 40,784 240ec13 24 30 BuY 24 25.8 0.3 1.1 79.5 21.7 1.6 5.7 33.7 13.1

agrau Prakashau 27,195 01Nov13 85 94 ^CCuM 90 4.0 5.5 6.7 16.4 13.5 18.0 19.5 8.1 6.5

Suu J Nelwork 149,838 12Nov13 400 442 ^CCuM 380 16.2 18.7 22.1 20.3 17.2 24.6 26.0 9.2

ee Eulerlaiuueul Eul 270,515 28Nov13 252 256 RE0uCE 277 (7.4) 9.2 10.7 30.1 25.9 20.9 21.1 20.9 17.6

MetaIs & Mining

hiudalco 253,144 21Nov13 121 106 SELL 123 (13.5) 13.0 13.6 9.4 9.0 10.3 9.7 8.6 7.0

hiuduslau iuc 559,852 250cl13 134 136 SELL 133 2.6 15.9 15.8 8.3 8.4 17.9 15.7 4.4 3.8

S^|L 299,257 13Nov13 63 51 SELL 72 (29.6) 6.7 7.5 10.8 9.7 6.6 7.0 11.5 9.3

Jala Sleel Lld 429,935 14Nov13 358 391 ^CCuM 424 (7.8) 41.9 55.2 10.1 7.7 11.9 14.3 5.7 5.7

0iI & 6as

Cairu |udia Lld 617,521 230cl13 332 361 ^CCuM 324 11.5 60.8 60.6 5.3 5.3 19.4 15.7 1.6 1.2

Caslrol |udia Lld 155,193 29Nov13 300 330 ^CCuM 314 5.2 9.6 11.2 32.7 28.0 52.9 61.1 21.9 19.0

ujaral Slale Pelrouel Lld ( SPL) 34,221 060ec13 62 69 ^CCuM 61 13.1 9.0 7.6 6.8 8.1 15.4 11.5 3.6 4.1

|udrapraslha as (| L) 37,618 07Nov13 287 315 ^CCuM 269 17.2 25.1 24.7 10.7 10.9 21.1 18.0 5.0 4.5

Maugalore Reiuary & Pelrocheuicals (MRPL) 74,372 300cl13 40 45 ^CCuM 42 6.0 1.6 6.5 26.5 6.6 4.3 15.6 7.3 4.8

0il |udia Lld 293,547 13Nov13 462 595 BuY 488 21.8 58.8 60.9 8.3 8.0 16.3 15.3 3.5 3.3

Pelrouel LN 91,538 230ec13 120 135 ^CCuM 122 10.6 10.3 12.3 11.8 9.9 16.0 16.7 7.4 6.0

Fcwer

NJPC 1,129,702 110ec13 136 165 BuY 137 20.4 11.8 13.6 11.6 10.1 11.7 12.5 9.9 8.7

Jala Power Coupauy Lld 216,774 18Nov13 79 84 ^CCuM 91 (8.0) 2.0 4.3 45.7 21.2 4.2 8.3 6.7 6.5

keaI state

Phoeuix Mills Lld 32,975 310cl13 234 291 BuY 228 27.8 10.4 11.5 21.9 19.8 8.3 8.6 18.4 16.3

Shipping

^B Shipyard Lld 13,942 22Nov13 270 250 SELL 274 (8.7) 2.9 2.2 94.4 124.5 0.8 0.6 10.2 10.3

E Shippiug Coupauy 48,328 NR 318 38.1 8.3 8.2 3.8

Pipavav 0eeuce & 0shore Eugg 30,551 130ec13 43 45 RE0uCE 44 1.8 0.2 2.0 221.0 22.1 0.7 6.7 12.4 11.8

Shippiug Corporaliou o |udia 17,999 230ec13 40 46 ^CCuM 43 8.2 2.4 17.7 1.8 21.8 11.1

13

lu.esreu '|ae|s Iauua|, 2014

Source. Kolak Securilies - Privale Clienl Pesearch - All recommendalions are wilh a 9-!2 monlh perspeclive lrom lhe dale ol lhe reporl/updale. lnveslors are requesled lo use lheir discrelion while deciding lhe liming, quanlily ol inveslmenl as well as lhe exil. *

ligures lor CY!3 &Cy!4 ** linancials are lor lY!3 &lY!4 - Seplember year end *** linancials are lor lY!3 &lY!4 - Oclober year end # ligures lor lY!4 &lY!5 - Seplember year ending NP = Nol Paled. The inveslmenl raling and largel price, il any, have been

suspended lemporarily. Such suspension is in compliance wilh applicable regulalion(s) and/or Kolak Securilies policies in circumslances when Kolak Securilies or ils alliliales is acling in an advisory capacily in a merger or slralegic lransaclion involving lhis

company and in cerlain olher circumslances. NM= Nol Meaninglul in circumslances when Kolak Securilies or ils alliliales is acling in an advisory capacily in a merger or slralegic lransaclion involving lhis company and in cerlain olher circumslances. NM= Nol

Meaninglul NM=Nol Meaninglul

Name o! the Company Mkt Latest Price as Latest Latest Price Upside EP5 (s) PE (x) oE (%) EVlEIDTA(x)

fY14 fY15E fY14 fY15E fY14 fY15E fy14 fY15E Cap eport On Iatest price eco as on (Dovn

(s mn) Date eport target* 31-Dec side)

(s) (s) (s) (%)

LATE5T fUNDAMENTAL 5TOCK ECOMMENDATION

14

lu.esreu '|ae|s Iauua|, 2014

CMP

!07

Targel Price

!20

52 wk High/Low

!!3 / 55

Markel Cap (Ps Mn)

54,03!

Shares Oulslanding (Mn)

504

APOLLO TYE5 UY

PEfEED PICK5 - fUNDAMENTAL

December 3!, 20!3

GeographicaI evenue Mix

ubber Price - Per 100 Kg

5hare HoIding PaIIern (%)

Source. Company

Source. Company, Kolak Securilies Privale Clienl Pesearch

Source. 8loomberg Source. 8loomberg, Company, Kolak Securilies - Privale Clienl Pesearch

fINANCIAL5 (5 MN) fY13 fY14E fY15E

VALUATION PAAMETE5 fY13 fY14E fY15E

PICE PEfOMANCE (%) 1M 3M 6M

Sales !27,946 !33,889 !46,!!2

Crowlh () 5.3 4.6 9.!

L8lTDA !4,567 !6,423 !7,585

L8lTDA margin () !!.4 !2.3 !2.0

P8T 8,587 9,652 !0,684

Nel prolil 6,!26 7,!36 7,544

LPS (Ps) !2.2 !4.2 !5.0

Crowlh () 49.5 !6.5 5.7

CLPS (Ps) 20.0 22.6 24.2

8ook value (Ps/share) 67.5 80.8 95.2

Dividend per share (Ps) 0.5 0.5 0.5

POL () !9.3 !9.! !7.0

POCL () !8.! !8.6 !8.6

Nel cash (debl) (23,332) (20,937) (!6,5!8)

Nel Working Capilal (Days) 55.! 6!.9 63.4

P/L (x) 8.8 7.6 7.2

P/8V (x) !.6 !.3 !.!

LV/Sales (x) 0.6 0.6 0.5

LV/L8lTDA (x) 5.3 4.6 4.0

33.2 60.8 89.7

Lasl reporl on 3!-Dec-!3 (Price.!0!)

INVE5TMENT AGUMENT

ln lhe near lerm, we believe lhe weakness in demand in lndia

and Soulh Alrica lo largely gel ollsel by demand revival lrom lhe

Luropean region. Company has indicaled lhal lhey expecl double

digil revenue growlh lrom lhe Luropean operalions.

On lhe posilive side lhough, soll nalural rubber prices will aid

margins

Cooper Tire announced lhal lhey have lerminaled lhe merger

agreemenl wilh Apollo Tyres.

Cooper Tires hold Apollo Tyres guilly ol breaching lhe agreemenl

and said lhal lhey will pursue legal aclion againsl Apollo Tyres lor

recovering break-up ol USD!!2.5mn and olher damages.

We believe lhe deal gelling lerminaled lo be posilive lor lhe slock

price ol Apollo Tyres. Now lhal lhe agreemenl slands lerminaled,

we expecl lhe slock lo gel re-raled.

Sharp increase in NP prices will signilicanlly impacl lhe

company's L8lTDAmargin leading lo lower earnings

APTY operalions are spread across lhree dillerenl geographies

and lhe company has presence in mosl ol lhe producl segmenls

wilhin lhe lyre induslry. APTY generales ~60ol lhe revenues

lrom lndia while lhe balance ~40 coming lrom operalions in

Lurope and Soulh Alrica.

I5K5 & CONCEN5

ACKGOUND

15

lu.esreu '|ae|s Iauua|, 2014

CMP

!9!!

Targel Price

2265

52 wk High/Low

2229 / !656

Markel Cap (Ps Mn)

552,937

Shares Oulslanding (Mn)

289

A1A1 AUTO ACCUMULATE

PEfEED PICK5 - fUNDAMENTAL

December 3!, 20!3

5aIes VoIumes (UniIs)

Geography Mix (%)

5hare HoIding PaIIern (%)

Source. Company

Source. Company, Kolak Securilies Privale Clienl Pesearch

Source. 8loomberg Source. 8loomberg, Company, Kolak Securilies - Privale Clienl Pesearch

fINANCIAL5 (5 MN) fY13 fY14E fY15E

VALUATION PAAMETE5 fY13 fY14E fY15E

PICE PEfOMANCE (%) 1M 3M 6M

Sales !99,973 2!0,363 24!,276

Crowlh () 2.4 5.2 !4.7

L8lTDA 36,352 45,480 5!,8!0

L8lTDA margin () !8.2 2!.6 2!.5

P8T 42,662 50,728 57,8!0

Nel prolil 30,436 36,332 40,978

LPS (Ps) !05.2 !25.6 !4!.6

Crowlh () (!.6) !9.4 !2.8

CLPS (Ps) !!0.8 !3!.8 !48.3

8ook value (Ps/share) 273.! 346.0 434.9

Dividend per share (Ps) 45.0 45.0 45.0

POL () 43.7 40.6 36.3

POCL () 60.3 56.! 50.7

Nel cash (debl) 55,409 78,622 99,767

Nel Working Capilal (Days) (!0.9) (!0.7) (!!.5)

P/L (x) !8.2 !5.2 !3.5

P/8V (x) 7.0 5.5 4.4

LV/Sales (x) 2.5 2.3 !.9

LV/L8lTDA (x) !3.7 !0.4 8.7

(3.2) (3.9) (0.7)

Lasl reporl on !8-Ocl-!3 (Price.2!53)

INVE5TMENT AGUMENT

Managemenl sees 2HlY!4 lo be beller in lerms ol volume

growlh. Company expecls lhe 2Wdomeslic induslry volumes lo

grow by 5 in 2HlY!4.

ln exporls, lhe company expecls lhal lhe recenl pick-up in volumes

lo suslain. Company is looking al 5 exporl volume growlh in ly!4.

On hedging, lhe company said lhal lhey are largely hedged lor

lY!4 exposure and slarled laking cover lor lY!5 (!HlY!5). ln

2HlY!4, lhe company expecls lo realize ~Ps60-6!/$, al lhe currenl

lNP rale.

We expecl company's domeslic 2Wvolumes lo receive boosl

lrom good monsoons and new launches. 8ajaj Aulo has planned 6

new launches under lhe Discover brand in 2HlY!4.

Lower lhan expecled volume growlh lor 8AL could signilicanlly

impacl our sales and prolilabilily eslimales.

A price war by players lo caplure markel share can have negalive

impacl on margins and prolilabilily lor lhe company.

8AL is amongsl lhe lop 2Wplayers in lndia and has loolprinls across

various geographies. 8AL has in all lhree planls, lwo al Waluj and

Chakan in Maharashlra and one planl al Panl Nagar in Ullranchal.

I5K5 & CONCEN5

ACKGOUND

16

lu.esreu '|ae|s Iauua|, 2014

CMP

324

Targel Price

332

52 wk High/Low

350 / 268

Markel Cap (Ps Mn)

6!8,543

Shares Oulslanding (Mn)

!9!!

CAIN INDIA LTD ACCUMULATE

PEfEED PICK5 - fUNDAMENTAL

December 3!, 20!3

renI Crude OiI Price (U5$lbbIs)

Dividend YieId l PayouI aIios (%)

5hare HoIding PaIIern (%)

Source. Company

Source. Company,

Source. 8loomberg Source. 8loomberg, Company, Kolak Securilies - Privale Clienl Pesearch

fINANCIAL5 (5 MN) fY13 fY14E fY15E

VALUATION PAAMETE5 fY13 fY14E fY15E

PICE PEfOMANCE (%) 1M 3M 6M

Sales !75,242 !93,782 20!,609

Crowlh () 47.8 !0.6 4.0

L8lTDA !38,0!4 !42,208 !4!,68!

L8lTDA margin () 78.8 73.4 70.3

P8T !22,9!5 !24,92! !24,526

Nel prolil !20,564 !!6,!77 !!5,8!0

LPS (Ps) 63.! 60.8 60.6

Crowlh () 5!.7 -3.6 -0.3

CLPS (Ps) 74.4 72.8 72.2

8ook value (Ps/share) 249.7 349.3 395.8

Dividend per share (Ps) !!.5 !2.2 !2.!

POL () 23.6 !9.4 !5.7

POCL () 30.6 33.! 25.8

Nel cash (debl) 55,568 283,375 337,899

Nel Working Capilal (Days) 94.8 63.4 59.0

P/L (x) 5.! 5.3 5.3

P/8V (x) !.3 0.9 0.8

LV/Sales (x) 3.2 !.7 !.4

LV/L8lTDA (x) 4.! 2.4 2.0

(0.0) !.5 !!.6

Lasl reporl on 23-Ocl-!3 (Price.332)

INVE5TMENT AGUMENT

Cairn lndia Lld (ClL) is one ol lhe biggesl privale exploralion and

produclion companies in lndia. Cairn is a privale L&P company

so nol liable lo share under-recoveries like ONCC, OlL.

M8Ahave gross recoverable oil reserves and resources ol more

lhan !.76 billion barrels (ClL nel inleresl !.23 8n bbls), which

includes !.27 bn lrom M8Aand olher lields balance is

exploralion upside. This is 25-30 years ol produclion.

KC-ONN-2003/! block. ClL has successlully compleled drilling

ol one appraisal well (Nagayalanka-!z-ST) and expecls lo submil

DoCand lDP in lY!5.

Soulh Alrica. The company has slarled lhe inlerprelalion ol lhe

recenlly acquired 3Dseismic survey dala. Cairn plans lo acquire

3,000 line-km ol 2Dseismic dala in CY20!4.

Any delays and cosl overruns, lhough cosl recoverable, could

impacl NAV ol lhe projecl.

Any major decline in crude oil prices due lo lall in global oil

demand, will have a corresponding impacl on ClL's realizalions.

Cairn lndia is parl ol lhe Vedanla Croup, a globally diversilied

nalural resources group wilh wide ranging inleresls in aluminium,

copper, zinc, lead, silver, iron ore, elc.

I5K5 & CONCEN5

ACKGOUND

17

lu.esreu '|ae|s Iauua|, 2014

CMP

67

Targel Price

80

52 wk High/Low

87 / 53

Markel Cap (Ps Mn)

!6,374

Shares Oulslanding (Mn)

244

GEAVE5 COTTON LIMITED UY

PEfEED PICK5 - fUNDAMENTAL

December 3!, 20!3

GrovIh raIe in 3W indusIry

evenue mix (%)

5hare HoIding PaIIern (%)

Source. Company

Source. Company

Source. 8loomberg Source. 8loomberg, Company, Kolak Securilies - Privale Clienl Pesearch

fINANCIAL5 (5 MN) fY13 fY14E fY15E

VALUATION PAAMETE5 fY13 fY14E fY15E

PICE PEfOMANCE (%) 1M 3M 6M

Sales !8,733 !8,908 20,038

Crowlh () 7.0 0.9 6.0

L8lTDA 2,423 2,3!0 2,605

L8lTDA margin () !2.9 !2.2 !3.0

P8T 2,00! 2,046 2,334

Nel prolil !,555 !,452 !,657

LPS (Ps) 6.4 5.9 6.8

Crowlh () 8.7 (6.6) !4.!

CLPS (Ps) 8.0 7.7 8.7

8ook value (Ps/share) 28.4 32.5 37.4

Dividend per share (Ps) !.6 !.6 !.6

POL () 22.4 !8.3 !8.4

POCL () !9.! !6.2 !6.3

Nel cash (debl) 392 !,274 2,828

Nel Working Capilal (Days) 53.8 54.6 56.0

P/L (x) !0.5 !!.3 9.9

P/8V (x) 2.4 2.! !.8

LV/Sales (x) 0.9 0.8 0.7

LV/L8lTDA (x) 6.6 6.5 5.!

5.3 2!.5 7.6

Lasl reporl on !9-Dec-!3(Price.65)

INVE5TMENT AGUMENT

The company is lhe sole supplier ol lighl diesel engines lo OLMs

like Piaggio, M&M and Alul Aulo. Piaggio is lhe prime clienl

accounling lor lhe bulk ol aulomolive engines revenue.

We eslimale 3W's lo accounl lor roughly 70-80 ol aulo

revenues and around 50 ol lolal revenue lor lhe company and

hence is an imporlanl variable lo monilor. The company is lhus a

play on lhe 3Wsegmenl (passenger and cargo) which in lurn is

driven by rising urbanizalion and usage ol lighl cargo vehicles lor

inlra-cily lransporlalion.

Pevenue growlh dependenl on success in making lurlher inroads

in lo OLMs like Tala Molors, M&M, Piaggio and TVS.

Valualions are reasonable lor a company wilh high relurn ralios

ol ~20.

High dependence on single clienl

Creaves Collon Limiled was eslablished in !859 and is one ol

lndia's repuled engineering companies.

The company is parl ol lhe 8 M Thapar group wilh Mr Karan

Thapar as lhe Non-Lxeculive Chairman ol lhe company

I5K5 & CONCEN5

ACKGOUND

18

lu.esreu '|ae|s Iauua|, 2014

CMP

!099

Targel Price

!322

52 wk High/Low

!238 / 757

Markel Cap (Ps Mn)

!,268,392

Shares Oulslanding (Mn)

!!54

ICICI ANK UY

PEfEED PICK5 - fUNDAMENTAL

December 3!, 20!3

Trend in earnings (s bn)

Trend in AsseI uaIiIy

5hare HoIding PaIIern (%)

Source. Company

Source. Company.

Source. 8loomberg Source. 8loomberg, Company, Kolak Securilies - Privale Clienl Pesearch

fINANCIAL5 (5 MN) fY13 fY14E fY15E

VALUATION PAAMETE5 fY13 fY14E fY15E

PICE PEfOMANCE (%) 1M 3M 6M

lnleresl income 400.8 444.! 506.4

lnleresl expense 262.! 279.6 3!6.0

Nel inleresl income !38.7 !64.5 !90.4

Crowlh () 29.2 !8.7 !5.7

Olher income 83.5 93.4 !04.7

Cross prolil !32.0 !57.9 !8!.7

Nel prolil 83.3 97.9 !!4.6

Crowlh () 28.8 !7.6 !7.!

Cross NPA () 3.3 3.! 3.0

Nel NPA () 0.8 !.0 !.0

Nel inleresl margin () 3.0 3.2 3.2

CAP () !8.7 !9.8 !8.6

PoL () !3.! !3.9 !4.5

PoAA () !.6 !.7 !.8

Dividend per share (Ps) 20.0 22.0 24.0

LPS (Ps) 72.2 84.8 99.3

Adjusled 8VPS (Ps) 558.8 6!8.4 692.6

P/L (x) !5.2 !3.0 !!.!

P/A8V (x) 2.0 !.8 !.6

2.8 24.3 2.6

Lasl reporl on 28-Ocl-!3(Price.!022)

INVE5TMENT AGUMENT

We like lhe qualily ol liabilily lranchise - CASAmix al 43.2 (Q2lY!4),

one ol lhe besl in lhe induslry.

NlM is on lhe improvemenl lrajeclory on lunding cosl gains and

improvemenl in lhe inlernalional spread, lor lhe lirsl lime, il has

crossed 3mark during lY!3 (3.!!in lY!3, 3.3! in Q2lY!4), an

improvemenl ol 38bps YoY. lmprovemenl in liabilily lranchise &beller

ALM are aiding in reporled beller margins.

Lower risk arising lrom lhe SML porllolio, as il conslilules only ~5 ol

lolal porllolio. While relail piece has wilnessed insignilicanl nel

slippage, corporale segmenl conlinues lo perlorm well.

Credil cosl is slighlly higher lhan managemenl's guidance (~82bps in

H!lY!4) bul beller perlormance on opex and NlM will lake care ol lhis,

provision coverage ralio is heallhy al 73.! (Q2lY!4), providing

cushion lo ils lulure earnings.

Pelail book slands al ~36 ol lolal book, highly vulnerable lo

syslemwide delerioralion in relail assel qualily.

Largesl privale seclor banks (3507 branches in Q2lY!4) wilh 4.2

markel share in domeslic loans.

Aller conscious slralegy ol de-growing lheir 8/S during recenl

economic

I5K5 & CONCEN5

ACKGOUND

19

lu.esreu '|ae|s Iauua|, 2014

CMP

!!0

Targel Price

!40

52 wk High/Low

!85 / 76

Markel Cap (Ps Mn)

!66,!67

Shares Oulslanding (Mn)

!5!6

IDfC UY

PEfEED PICK5 - fUNDAMENTAL

December 3!, 20!3

Trend in earnings (s bn)

Trend in eIurn aIios

5hare HoIding PaIIern (%)

Source. Company

Source. Company, Kolak Securilies - Privale Clienl Pesearch

Source. 8loomberg Source. 8loomberg, Company, Kolak Securilies - Privale Clienl Pesearch

fINANCIAL5 (5 MN) fY13 fY14E fY15E

VALUATION PAAMETE5 fY13 fY14E fY15E

PICE PEfOMANCE (%) 1M 3M 6M

Nel lnleresl lncome 25,640 30,669 34,230

Crowlh () 22.3 !9.6 !!.6

Non-lnl lncome 8,830 9,200 9,500

Tolal lncome 34,470.0 39,869.0 43,730.0

Operaling Prolil 29,440 29,865 35,477

Nel Prolil !8,360 !9,720 23,405

Crowlh () !8.! 7.4 !8.7

Cross NPA () 0.2 0.9 !.3

Nel NPA () 0.! 0.4 0.5

NlMs () 4.! 3.5 3.6

PoA () 2.8 2.7 2.8

PoL () !4.0 !3.7 !4.5

DPS (Ps) 2.5 2.5 2.5

LPS (Ps) !2.0 !3.0 !5.5

8V (Ps) 90.3 !00.5 !!3.0

Adj. 8V (Ps) 90.! 99.! !!!.!

P/L (x) 9.! 8.4 7.!

P/A8V (x) !.2 !.! !.0

5.4 24.5 (!4.5)

Lasl reporl on 05-Nov-!3(Price.!!3)

INVE5TMENT AGUMENT

ll is presenl in lhe niche inlraslruclure linancing space and is well

posilioned lo benelil lrom lndia's large inlraslruclure opporlunily.

Despile higher proporlion ol loan growlh coming lrom relinancing

opporlunilies having lower margins, il has managed lo improve ils

spreads on back ol declining lunding cosls.

Assel qualily is besl in class -CNPA/NNPA al 0.32/0.20

(Q2lY!4). Moreover, il carries sullicienl provision buller (~2 ol

loans) lo provide lor any likely lulure increase in CNPA.

Average spread (rolling LTM) has remained slable al 2.4 (Q2lY!4)

as managemenl look lhe conscious decision ol nol growing lhe loan

book when lunding cosls spiked during recenl limes.

ln prevailing macro-environmenl, higher non-power assels and

slrong capilalizalion makes il a lower-risk play. We believe, lalling

wholesale lunding rales along wilh improvemenl in lhe oullook on

capilal markel relaled business are lulure calalysl lor lhe slock.

Conlinued moderalion in inlraslruclure capex cycle and delay in

projecl commissioning due lo policy/approval delays or due lo lack ol

luel-availabilily can impacl lhe lending business.

Lslablished in !997 as a specialized lnlraslruclure linancier lo

encourage privale seclor inveslmenls in lhe inlraslruclure space.

Aparl lrom lending business, il has diversilied inlo non-lund based

producl ollerings like assel managemenl, privale equily and debl

linance/syndicalion.

I5K5 & CONCEN5

ACKGOUND

20

lu.esreu '|ae|s Iauua|, 2014

CMP

!40

Targel Price

!7!

52 wk High/Low

229 / 97

Markel Cap (Ps Mn)

27,2!7

Shares Oulslanding (Mn)

!94

IL&f5 TAN5POTATION NETWOK UY

PEfEED PICK5 - fUNDAMENTAL

December 3!, 20!3

Order book break up (%)

5egmenIvise evenue reak up (%)

5hare HoIding PaIIern (%)

Source. Company

Source. Company, Kolak Securilies - Privale Clienl Pesearch

Source. 8loomberg Source. 8loomberg, Company, Kolak Securilies - Privale Clienl Pesearch

fINANCIAL5 (5 MN) fY13 fY14E fY15E

VALUATION PAAMETE5 fY13 fY14E fY15E

PICE PEfOMANCE (%) 1M 3M 6M

Sales 66,448 66,773 72,303

Crowlh () !8.5 0.5 8.3

L8lTDA !8,404 20,362 23,587

L8lTDA margin () 27.7 30.5 32.6

P8T 7,684 6,!84 7,447

Nel prolil 5,202 4,094 4,9!!

LPS (Ps) 26.8 2!.! 25.3

Crowlh () 4.7 (2!.3) 20.0

CLPS (Ps) 3!.6 28.4 35.!

8ook value (Ps/share) !87.4 203.7 224.2

Dividend per share (Ps) 4.0 4.0 4.0

POL () !6.2 !0.8 !!.8

POCL () !2.2 !0.5 !0.3

Nel cash (debl) (!32,!68) (!58,826) (!80,650)

Nel Working Capilal (Days) 59 27 22

P/L (x) 5.2 6.6 5.5

P/8V (x) 0.7 0.7 0.6

LV/Sales (x) 2.5 2.9 3.0

LV/L8lTDA (x) 9.0 9.5 9.!

9.7 37.0 4.0

Lasl reporl on 26-Dec-!3 (Price.!33)

INVE5TMENT AGUMENT

lL&lS Transporlalion nelworks Lld (lTNL) revenues lor lhe

quarler were beller lhan our eslimales led by higher margins and

lower lhan expecled lax provisions.

lTNL's leverage is expecled lo increase lo 4.4x in lY!4 lrom 3.!x

in lY!2 due lo increase in pace ol execulion ol projecls. 8ul

inleresl rale cycle reversal lo benelil lhe company

8ased on currenl order book and porllolio ol projecls, we expecl

conslruclion revenues lo remain slrong while complelion ol work

on under conslruclion projecls is expecled lo increase lhe loll

revenues lrom lY!4 onwards

Company had issued prelerence shares worlh Ps 4 bn during lhe

quarler and is also planning a righls issue.

Delays in linancial closure ol recenlly awarded projecls

Lower lhan expecled loll revenues or slowdown in lrallic growlh

Lxeculion delays or slower lhan expecled decline in inleresl rale

lL&lS Transporlalion Nelworks Lld has lhe largesl road 8OT

assel porllolio wilh a pan lndia presence

I5K5 & CONCEN5

ACKGOUND

21

lu.esreu '|ae|s Iauua|, 2014

CMP

!37

Targel Price

!65

52 wk High/Low

!66 / !2!

Markel Cap (Ps Mn)

!,!29,629

Shares Oulslanding (Mn)

8245

NTPC UY

PEfEED PICK5 - fUNDAMENTAL

December 3!, 20!3

GeneraIion CapaciIy (MW)

fueI-vise capaciIy mix (%)

5hare HoIding PaIIern (%)

Source. Company

Source. Company, Kolak Securilies - Privale Clienl Pesearch

Source. 8loomberg Source. 8loomberg, Company, Kolak Securilies - Privale Clienl Pesearch

fINANCIAL5 (5 MN) fY13 fY14E fY15E

VALUATION PAAMETE5 fY13 fY14E fY15E

PICE PEfOMANCE (%) 1M 3M 6M

Sales 657 680 726

Crowlh () 5.8 3.5 6.7

L8lTDA !7! !70 !95

L8lTDA margin () 3!.2 3!.3 32.3

P8T !49 !33 !49

Nel prolil !26 98 !!2

LPS (Ps) !2.2 !!.8 !3.6

Crowlh () 9.2 (3.0) !4.6

Adj CLPS (Ps) !6.3 !6.6 !8.7

8ook value (Ps/share) 97.5 !04.6 !!2.7

Dividend per share (Ps) 5.8 5.0 4.7

POL () !6.4 !!.7 !2.5

POCL () 9.4 6.6 7.!

Nel cash (debl) (25!) (43!) (44!)

Nel Working Capilal (Days) 0.4 !9.9 33.0

P/L (x) !!.2 !!.6 !0.!

P/8V (x) !.4 !.3 !.2

LV/Sales (x) !.7 !.7 !.6

LV/L8lTDA (x) 6.6 6.7 5.8

(7.0) (7.!) (3.8)

Lasl reporl on !!-Dec-!3 (Price.!36)

INVE5TMENT AGUMENT

lnslalled capacily ol 36000 MWplus in lhermal power generalion.

Capacily addilion is expecled lo weaken in lY!4-!5, posl lhe

sharp increase in lY!3. However, in a scenario ol increasing

dislress in lhe power ulililies seclor due lo laclors like onerous

conlraclual lerms, shorlage ol coal and adverse lorex movemenl,

NTPC's prolils are slill growing al relalively sleadly albeil modesl

pace.

The company's revised plan lor capacily addilion lor !2lh plan

slands al !4000 MWconsisling ol !!878 MWol new projecls

and 2!60 MWspillover projecls lrom lhe !!lh plan. As ol now, a

lolal ol 20000 MWol projecls are under conslruclion.

However sedale earnings growlh may acl as a dampener lor

absolule relurns.

ln addilion lo coal supply, delerioraling linancial heallh ol lhe

SL8s remain a major concern lor lhe seclor.

Largesl power generalion capacily in lndia.

Works on a regulaled relurn model.

Assured POL ol !5.5.

I5K5 & CONCEN5

ACKGOUND

22

lu.esreu '|ae|s Iauua|, 2014

CMP

286

Targel Price

323

52 wk High/Low

3!5 / 2!!

Markel Cap (Ps Mn)

!46,488

Shares Oulslanding (Mn)

5!3

PIDILITE INDU5TIE5 LTD ACCUMULATE

PEfEED PICK5 - fUNDAMENTAL

December 3!, 20!3

DomesIic 5aIes (s bn)

evenue mix (%)

5hare HoIding PaIIern (%)

Source. Company