Professional Documents

Culture Documents

Paint

Uploaded by

moe_kyawCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Paint

Uploaded by

moe_kyawCopyright:

Available Formats

Waste Management Trends in the Paint Manufacturing Industry

Paint Makers Have Come a Long Way i n Reducing Hazardous Residuals

Editors Note: This is the first installment of a two-part report on waste management trends in the paint industry. while this part focuses on paint manufacturers, the second installment w i l l focus on the major paint-using industries.

by Alan J. Dug

T h e paint industry makes a variety of products that preserve, protect and enhance the objects to which they are applied. Although the post-consumer residuals of these products are usually labeled non-hazardous, they have often been termed environmentally as has the industry unfriendly responsible for creating them.

With 1,400 manufacturing plants and an output of more than 1.1 billion gallons per year, the U.S. paint industry is a significant customer group for waste service vendors. In a recent study involving three paint factories, non-wastewater generation rates ranged from about 300 to 450 pounds per 1,OOO gallons of paint. In recent years, however, paint makers have reduced the toxicity and ignitability of many types of paint by curtailing the use of metallic pigments and organic solvents, and a growing trend toward recycling paint wastes has meant volume reductions as well.

The paint manufacturing industry in the United States has done much to change this image in recent years. Paint makers have reduced the toxicity and ignitability of many types of paint. In addition, the industry has taken steps toward further reducing the amount of manufacturingwaste it generates by recycling pre-consumer materials that have traditionally been discarded. This report introduces readers to the current state of paint manufacturing. A brief overview of the industry is followed by an examination of recent changes that have been incorporated into paint-making processes to make them more environmentally friendly. The f i n a l section reviews waste re-

Paint Production in the U . S . ,1986-1993

$12,000 $10,000 $8,000 $6,000 $4,000 $2,000 1986 1987 1988 1989 1990

$0 1993 Source: U. S. Department of Commerce, I994

8 1

.r(

s 4

2 2

1991

1992

Figure 1

E1 DIGEST Copyright @July1994 Environmental Information, Ltd./Minneapolis

- 12 -

Photocopying or any other unauthorized use of this information is illegal.

GENERATOR TRENDS

duction activities currently being implemented at paint plants.

The Paint-Making Industry

A total of 1,421 paint manufacturing plants in the U.S.were tallied by the Department of Commerce in 1992. The fact that these 1,421 plants are owned by 1,133 companies suggests that the industry is dominated by small manufacturers; in fact, most paint manufacturing plants have fewer than 20 employees, and only about one plant in 10 has a payroll of 100 or more. Both the number of plants and the number of companies that manufacture paint have decreased nominally over the past 15 years, a trend that is generally attributed to consolidation of the industry. Many of the larger paint manufacturers have recently purchased smaller competitors that have been unable to keep up with the industrys increasing R&D demands for product improvement and environmental compliance. Although paint manufacturers are found near major cities across the US., a few states host a disproportionate number of paint manufacturing facilities. California is home to nearly 15 percent of U.S.paint plants, while the top-five paint-producing states (California, Illinois, New Jersey, Texas and Ohio) comprise 42 percent of the total. And two of every three paint plants in the U.S. is located in one of the top-10 paint-making states, which also include Florida, New York, Michigan, Missouri and Pennsylvania. If all U.S. paint makers were to consolidate into one corporation, the conglomeratewould rank 36th among Fortune 500 companies. And the industry is still growing; since 1986, production levels have grown by about 2 percent per year, on average (see Figure 1). The domestic paint market accounts for the vast majority of sales by U.S. producers; over the past decade, only 2 to 3 percent of domestically-made paint has been exported. Neverthe-

less, recent trends indicate that paint exports are increasing. In 1992 and 1993, paint exports ran at around 4 to 5 percent of domestic production levels, while imports represented only about 1 percent of total U.S. sales, according to data compiled by the U.S. Department of Commerce. Most of the foreign trade involves paints used in residential applications.

Table 1 Primary Raw Materials in Paint Pigments 0 Titanium dioxide Iron oxides Many others, depending on color desired Solvents Hydrocarbon compounds Ketone compounds 0 Alcohol 0 Water Resins Alkyd 0 Acrylic Vinyl Additives 0 Talc 0 Clay 0 Silicates ardous due to their reduced organic content. 0 Powder Coatings With powder coatings, the use of a solvent is completely eliminated -as are many of the environmental concerns that typically accompany paint residuals. The ingredients in powder coatings include thermo-setting and thermoplasticresins, pigment, curing agents, catalysts, reinforcing filler, and flowcontrol agents. The coatings are applied to surfaces by a variety of techniques, including dry electrostatic spraying, fluidized bed application, and flame spray application. Although powdercoating technology has been around since the 1950s, it wasnt commercialized until the early 1980s. During that decade, powder coatings enjoyed tremendous success; annual production grew by as much as 15 percent in some years. While early growth in the powdercoating market was achieved by displacing oil- and water-based paints in established applications, about half the current growth in powder-coating markets consists of newly emerging

Three Types of Paint

Although there are thousands of different paints on the market, they can generally be categorized into one of three types: oil-based paints, waterbased paints and powder coatings. While some may argue that powder coatings are not technically paints, they are essentially paint substitutes and are therefore also addressed in this report. 0 Oil-Based Paints According to industry estimates, about 57 percent of paint produced in the U.S. is oil-based, or solventborne, meaning that it contains a hydrocarbon-based solvent. These paints are used primarily in industrial and special-purpose applications. The solvents in oil-based paints contain a variety of naturally occurring organic petroleum distillates. Oilbased paints generally have higher heat values and greater concentrations of volatile organic compounds (VOCs) than do water-based paints. Paints in this group typically contain solids concentrationsof 60 percent or greater. 0 Water-Based Paints Water-based, or latex, paints account for about 41 percent of domestic production, and that portion is growing. Water-based paints feature an aqueous solvent base augmented by an organic co-solvent in concentrations of 5 to 40 percent. Waterborne coatings include aqueous emulsions (latex paint), colloidal dispersions, and water-reducible coatings. Latex paint is used primarily for architectural purposes. As residuals, these paints are less likely to be haz-

Photocopying or any other unauthorized use of this information is illegal.

- I3 -

E 1 DIGEST Copyright July 1994 Minneapolis Environmental Information, Ltd .

Raw Material Usage by U . S . Paint Manufacturers, 1982-1992

1982 Usage* (millions of pounak)

Pigments (1,062 )

Solvents (3,774 )

1992 Usage** (inillions of pounds)

Pigments (1,296 )

..

* 1982 data from Chemical Economics Handbook of 1977, adjusted for 1982 production rates. ** 1992 data supplied by U.S. Department of Commerce; additives are estimated based on sales quantities and total raw material usage of approximately 9 billion pounds.

Figure 2

applications, according to paint industry representatives. Despite the obvious desirability of a paint that leaves virtually no residuals, industry insiders predict that the overall impact of powder coatings on paint sales will be minimal. Reasons for this include the limited techniques available to apply powdered coatings, the incompatibilityof certain surfaces with electrostatic spray systems, and the need to heat painted parts after application.

The Changing Components of Paint

Paint is comprised of four main components: pigments, resins, solvents and additives (see Table 1). Pigments are tiny particles of organic or inorganic material that provide color and impart glossiness, opacity and durability to the finish. The most common pigment is titanium dioxide, a synthetic, inorganic chemical that provides a white pigment base.

Resins, or binders, provide the paint with film continuity and adhesiveness. Solvents dissolve or disperse the binder component to modify the viscosity of coatings, while additives are used to improve coating performance and coverage, enhance durability and reduce material costs. Traditionally, the residuals of most paints have been considered nonhazardous; paint residuals bearing the hazardous label have generally exceeded certain toxicity or ignitability thresholds. Nevertheless, in response to customer concerns, manufacturers of many of these paints have altered their batch compositions in recent years. Mercury Paint formulas in the past often included such toxic metals as mercury, lead, chromium and cadmium. Mercury was added to water-based paints and ship coatings to retard fungal growth in the paint. During the 1970s, when mercury use in paint reached its peak, concentrations of

the metal in paint were limited to 200 parts per million, but its use continued; as of 1989, about 30 percent of water-based paints contained mercury. However, during the late 1980s, the paint industry struck an agreement with the U.S. Environmental Protection Agency to completely eliminate the use of mercury by August of 1990. Nevertheless, mercury can still be found in some water-based paints because some pre1991 paints are still in circulation. Lead While leaded solvents have been used in certain types of paint, leadcontaining pigments are the primary source of lead in paint. Lead pigments are relatively inexpensive and offer good protection against sunlight and corrosion. However, due to concern over the poison risks for children, the Consumer Products Safety Commission in 1972limited lead content in residential paints to 500 parts per million. Today, lead pigments are used primarily for industrial maintenancepurposes and in roadway markings, where the metal can account for as much as 30 percent of the paints mass. Efforts are underway to eliminate the use of lead in all paint. An initiative forwarded by the Coalition of Northeast Governors (CONEG) and adopted by 13 states will phase out lead, cadmium, mercury and hexavalent chromium in paint production by July 1 of this year. In addition to the 13states under the regulation, several other states have followed suit by enacting similar or identical laws of their own. However, the changeout will have its drawbacks. Organic substitutes for lead cause higher paint prices and lower quality, explains Jay Willner, president of San Francisco-based WEH Corp., which recently published a report entitled -Residential Lead-Based Paint Remediation. Alternative materials are about 20 times more expensive than lead, and they offer less opacity and corrosion resistance.

E1 DIGEST Copyright @July1994 Environmental Information, Ltd ./Minneapolis

- 14 -

Photocopying or any other unauthorized use of this information is illegal.

GENERATOR T R E N D S

Wastes Produced During Paint Manufacture

Inputs

F I -0

Raw Material

Process

Wastes

Water-BasedPaints: Water, Organic Solvent-Based Paints:

Resins, Pigments, Extenders, Solvents, Plasticizers Ammonia, Dispersant, Pigments, Extenders

1

I

Grinding

I11111,

Baghouse Pigment Dust,

Water-Based Paints: Resin,

Preservative, Antifoam, PVA Emulsion, Water

VOCs, Spills,

Raw Material Containers,

Organic Solvent-Based Paints:

Tints, Thinners

Filter Cartridges

-+ElFiltering

Equipment Cleaning Waste

Containers

1

I

Photocopying or any other unauthorized use of this information is illegal.

F i n d Product Inventory

I-

0 0

VOCs, Spills, Equipment Cleaning Waste, Off-Spec Paint Returned Paints, Obsolete Paints

Figure 3

- 15 -

E1 DIGEST Copyright *July 1994 Environmental Information, Ltd.lMinneapolis

Chromium For years, chromium has been -added to paint in the form of zinc chromate to produce a conversion coating, or primer, for aluminum, galvanized steel and other substrates that resist adherence. Chromium is especially useful in this application because it is the only pigment reactive enough to convert aluminum surfaces. Alternative products are available, says Phil Strom of Minneapolis-based Ti-Kromatic Paints, but they are having only limited success in producing the properties that chromium accomplishes. Cadmium Cadmiumpigments, which are similar to lead and zinc chromate pigments, are used primarily in red and orange paints for automobiles, outdoor equipment and other applications that demand strong resistance to sunlight. Inexpensive cadmium pigments also offer good colorfastness and excellent heat resistance. And, due to cadmiums high color component, very little of the pigment is needed. The use of cadmium pigments has been curtailed due to concerns over the safety of raw-material handlers. However, in January of this year, the Occupational Safety & Health Administration (OSHA) acknowledged the importance of this material and announced that the current TCLP standard of 1,OOO parts per million

0

would not be further reduced. An affordable replacement for cadmium pigments has eluded the industry; however, Rhone-Poulenc, a European chemical manufacturer, recently completed a multi-year study of a possible substitute. Dubbed cerium sulfide, the inorganic material contains no heavy metals and is reportedly comparable in price and quality to cadmium pigments. Volatile Organic Compounds The movement toward water-based paints has helped to reduce the VOC content of paints in general. Although oil-based paints are still burdened with VOC and ignitability problems, recent efforts to increase water-reducible co-solvents in oilbased paints have partially alleviated these concerns as well. As a result of paint composition changes, raw material ratios have changed dramatically over the past decade; significant reductions in the use of solvent have meant corresponding increases in the use of resins, pigments and additives (see Figure 2). This trend is the direct result of the paint industrys efforts to reduce VOCs, according to Joe Maty, editor of American Paint & Coatings Journal, who adds that the trend could accelerate as more states impose stricter air regulations. Recycled Paint A final development in paint formulation is the cautious movement to-

ward using recycled paint. Major Paint Co., based in Torrance, California and the largest paint manufacturer on the West Coast, now produces a recycled paint - which includes about 50 percent virgin materials - that accounts for about 10 percent of its sales. About 90percent of the recycled half comes from preconsumer, in-house streams and the other 10 percent from household hazardous waste programs. Major Paint has a blanket agreement to supply the federal General Services Administration with the recycled paint for distribution to offices worldwide. Paint industry innovators are now working to increase the ratio of recycled material and to utilize more postconsumer paint waste. Minneapolisbased Hirschfield Paints manufactured recycled paint as part of a cooperative pilot project with several countiesin the Twin Cities metropolitan area. The recycled product, which was batch-processed and returned to the original owner of the paint, contained more than 90 percent post-consumer latex; titanium paste was added to improve the paints appearance. This closed-loop recycling project is still in the early stages of analysis, says Mark Uglem, a vice president for Hirschfield P a t s . But early results are promising for manufacturing recycled paints in this type of program.

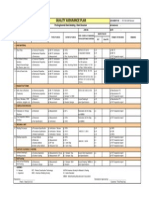

Table 2

Overview of Paint Manufacturing Plants in UCSC Study

I I

Plant A Annual Production (gallons)

Plant B 2.7 million

Plant C

1.5 million

I

6.0 million

IAnnual Production Time (hours) 1

Year of UCSC Assessment Product M i x

4,000

1991

I

1

2,000 1990

I

I

4,125

1991

Oil-based paints (2/3 of total output); waterbased paints; lacquers

Oil-based paints (2/3 of total output); waterbased paints; stains; varnishes

Architectural paints; metal surface coatings

E1 DIGEST Copyright July 1994 Environmental Information, Ltd./Minneapolis

-16-

Photocopying or any other unauthorized use of this information i s illegal.

GENERATOR TRENDS

Table 3

Waste Generation Rates and Disposal Costs for Plants in UCSC Study* Plant A Plant B Plant C

Waste Type Raw material bags with containers

Pigment dust Off-spec paint product Spills and leaks Contaminated solvents Paint sludge Filter cartridges

Totals

40.7 $0.501 n/a

1 S2 $2.81 4.24 $2.11 234.l4 $133.11 150.64 $17.99 12.02 $.21 443.1 $156.73

1 9 . 6 $19.a2 17.22 $29.03 da

123.0 $21.33 76.2 $34.172 n/a

(incorporated elsewhere)

33.d $11.31 172.43 $49.08 49.l3 $12.42 14.42 $23.99 306.5 $145.47

208. 83 $49.08 45.3 $0 n/a 453.3 $104.58

Sources: U. S. Environmental Protection Agency, University City Science Center (I 994)

Paint Manufacturing Waste:

A Three-Facility Case Study Making paint is a relatively simple operation; pigments and additives are dispersed into a solution of resin and solvent and then mixed. Most manufacturers use the same set of equipment to produce many different types and colors of paint, including both organic solvent-borne and waterborne paints. Each type and color of paint is manufactured in a separate batch, and manufacturing equipment is thoroughly cleaned between batches to prevent contamination. Caustic or alkaline cleaning solutions are generally used to remove dried paint from equipment. A historical review of paint manufacturing waste shows that, while a fair amount of innovative reuse techniques have been implemented since

1960,most of the implementationhas been limited to the largest of facilities. However, as disposal costs have risen over the past decade, smaller manufacturers have signed on to more progressive waste prevention measures. The EPA has contracted with the University City Science Center, a research group based in Philadelphia, to help small and mid-sized paint manufacturers minimize their generation of hazardous waste. Four paint manufacturing plants were selected to take part in a pilot assessment program. While one of the case studies was too limited in scope to be included here, the studies conducted a t the other three plants provide useful insights into the waste management concerns of the industry as a whole. Due to variations among the three studies - they were performed by different universities using different waste categories - it is difficult to

compare the plants in a strict applesto-apples sense. Nevertheless, the major manufacturing steps used at each plant - the grinding, mixing and filtering processes - are relatively universal. Production levels at the three plants, which make a wide variety of paints and coatings, ranged from 1 . 5 million to 6.O million gallons during the year of the study (see Table 2 ) . The paint-waste generation rates of the three plants ranged from about 300 to 450 pounds per 1,000 gallons ) . Although great of paint (see Table 3 variance exists among paint makers in terms of waste generation, these figures provide a good picture of the industrys typical plant, according to several paint manufacturers. At each of the plants studied, contaminated solvents made up about 50 percent of the total waste stream. Due to in-house minimization efforts

Photocopying or any other unauthorized use of this information is illegal.

- 17-

E1 DIGEST Copyright July 1994 Environmental Information, Ltd./Minneapolis

Table 4

Selected Waste Minimization Opportunities at Paint Manufacturing Plants*

Waste Type Spent Filter Cartridges

Opportunity Replace disposable cartridges with stainless steel

Anticipated Reduction

Capital Investment Payback Period

1 month

90-100%

Spent Wash Solvent Solvent Vapors

Store spent solvent and reuse

7590%

1 month

Cover portable tanks

60-80 %

18-24 months

Modify process tanks for submerged filling

40-50 %

3 4 months

Sludge

Extend settling and decanting time

30-60%

18-24 months

Computerize batch scheduling and inventory Comment: Improves the long-range mixture forecasting. Pigment Bags and Dust Modify feed-in process Comment: Simply move delivery area closer to tanks. Install bulk storage silos

25-50%

12-24 months

1 1

I

20-50%

Immediate

20-25%

I

1

24-36 months

Comment: Only practical for producers of large quantities of specific paints. This also greatly reduces the amount of bags and pigment dust generated. Paint Waste Coat let-down tanks prior to cleaning

20-25% 18-24 months

Squeegee let-down tanks prior to cleaning

15-25%

Immediate

* Comments provided by Mark Levine, manufacturing committee chair for the National Paints & Coating Association.

Sources: US. Environmental Protection Agency, University City Science Center (1 994)

E 1 DIGEST Copyright D I July 1994

Environmental Information, Lt d Minneapolis

- 18-

Photocopying or any other unauthorized use of this information is illegal.

GENERATOR T R E N D S

(reclaiming solvents and using no caustic cleaners), plants B and C generated 100 pounds less paint sludge per 1,OOO gallons of paint than Plant

A.

Total costs for waste treatment and disposal ranged from $105 to $157 per 1 , O O O gallons of paint manufactured. Plant A had the highest perunit disposal costs, possibly because the larger plants were better able to negotiate favorable prices. Note that Table 3 does not include wastewater or wash-water disposal costs, which may add $25 to $100 for every 1,OOO gallons of paint produced, depending on a plants product mix and local wastewater regulations. Table 4 shows a summary of the waste reduction methods implemented or considered by at least one of the three plants. Note that, when applied to other plants, waste reduction amounts and payback periods can vary greatly. Prior to assessing a paint manufacturing waste stream, a review of these minimization efforts is prudent as most plants will eventually incorporate many of these activities due to the relatively short payback periods.

Current Options Limited

While many regulations impinge on the production of paint, wastes generated by the paint manufacturing in-

dustry have not been specifically targeted by the EPA for reduction efforts. Because of this, the industry has traditionally been more concerned with producing paints that meet exacting customer specifications than paints that have minimal impacts on the environment. Paint manufacturers are generally complacent with existing waste-handling options, says Phil Farina, marketing director for EnvironmentalPurification Industries (EPI), a paintwaste recycling company based in Toledo, O h i o . The environmental staff person at most paint plants has several other duties in addition to waste management, Farina explains; because of this, waste treatment and disposal options are seldom given comprehensive consideration. During Els discussions with paint manufacturers, three main criteria for choosing waste-management options emerged: cost (with long-term liability factored in), convenience (Le., options that dont require extensive pretreatment), and transportation requirements. As for disposal options, the industrys stated preference is clearly,with solvent recovery and fuel blending; however, landfill disposal is still the most common choice for many paint waste streams because of cost and convenience. Most paint producers use hazardous waste landfills for some portion of their waste, although

many plants segregate nonhazardous waste streams for disposal in Subtitle D landfills. Smaller plants are much more likely to use incinerators and fuel blenders, while larger facilities tend to rely more on landfills and solvent recyclers.

Conclusion

Over the past decade, the paint manufacturing industry has become responsive to environmental issues and consumer demands. Paints in general have become less toxic, and ignitability concerns have been addressed. Many paint manufacturers have implemented significant inhouse waste reduction measures, reusing and recycling many materials that were previously discarded. It also appears that the paint-making industry is meeting most consumer demands -in particular, the demand for more water-based paints. Although paint manufacturers generate significant quantities of waste, substantially greater w a s t e streams are generated by end users. The second installment of this report will focus on the major paint users including building contractors,equipment manufacturers, building contractors and specialty paint users and their associated paint waste streams. A

Photocopying or any other unauthorized use of this information is illegal.

-19-

E 1 DIGEST Copyright @July1994 Environmental Information, Ltd.Minneapolis

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5795)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Handbook of Industrial Membrane TechnologyDocument619 pagesHandbook of Industrial Membrane Technologyecco100% (14)

- Exec Summary Biz Proposal Packaging Palm Oil Product Factory - Latest 270614 PDFDocument25 pagesExec Summary Biz Proposal Packaging Palm Oil Product Factory - Latest 270614 PDFzulhariszan abd manan100% (2)

- Group 10 IT Project ReportDocument24 pagesGroup 10 IT Project Reportabhisht89No ratings yet

- Vappro 872-In-House Publication PDFDocument14 pagesVappro 872-In-House Publication PDFmoe_kyawNo ratings yet

- Combating Water Scarcity and Waste Generation Through Waterless Car WashDocument13 pagesCombating Water Scarcity and Waste Generation Through Waterless Car Washmoe_kyawNo ratings yet

- Ascertaining The Efficacy of The VapourDocument7 pagesAscertaining The Efficacy of The Vapourmoe_kyawNo ratings yet

- (Corrosion Reviews) Technological Applications of Volatile Corrosion inhibitors-UABCDocument13 pages(Corrosion Reviews) Technological Applications of Volatile Corrosion inhibitors-UABCmoe_kyaw100% (1)

- Ascertaining The Vapour Inhibition Ability of Vappro VBCI Corro-Pill-PrintedDocument5 pagesAscertaining The Vapour Inhibition Ability of Vappro VBCI Corro-Pill-Printedmoe_kyawNo ratings yet

- White Oil Specifications and Applications Uid62320091115061Document2 pagesWhite Oil Specifications and Applications Uid62320091115061moe_kyawNo ratings yet

- Additives Reference Guide 2013Document80 pagesAdditives Reference Guide 2013moe_kyawNo ratings yet

- Ubrika 404 Heavy DutyDocument2 pagesUbrika 404 Heavy Dutymoe_kyawNo ratings yet

- Additives Reference Guide 2013Document80 pagesAdditives Reference Guide 2013moe_kyawNo ratings yet

- ChlorhexidineDocument2 pagesChlorhexidinemoe_kyawNo ratings yet

- Bt-5 Curtain Wall CladdingDocument37 pagesBt-5 Curtain Wall CladdingMarc Gregory Queral Olanio80% (5)

- Summary Standard 1010Document20 pagesSummary Standard 1010chrisgargeNo ratings yet

- Toyota WayDocument30 pagesToyota Waydeden_stiadiNo ratings yet

- ER90SD2Document3 pagesER90SD2thindmanmohanNo ratings yet

- A-Z of Bearings With ImagesDocument18 pagesA-Z of Bearings With ImagesArasu PandianNo ratings yet

- Standard Operating ProcedureDocument23 pagesStandard Operating Procedurezhangj5No ratings yet

- Automation Book MitsubishiDocument200 pagesAutomation Book MitsubishiPaulina Voicu100% (1)

- Bottle PozzDocument19 pagesBottle Pozzattarsf1952No ratings yet

- Submitted By: Haritha K Roll No: 4912 (Mcom 3 Semester) : Topic: DumpingDocument6 pagesSubmitted By: Haritha K Roll No: 4912 (Mcom 3 Semester) : Topic: DumpingJohn HonnaiNo ratings yet

- Gear Solutions May 2011 Company Profile PDFDocument3 pagesGear Solutions May 2011 Company Profile PDFmarijaNo ratings yet

- W1.2379 X153CrMoV12Document2 pagesW1.2379 X153CrMoV12serkandmNo ratings yet

- Copper AlloysDocument1 pageCopper AlloysuzairmetallurgistNo ratings yet

- Short History Og LNG VesselDocument32 pagesShort History Og LNG VesseljwsommermannNo ratings yet

- India S 501 1000 CompaniesDocument38 pagesIndia S 501 1000 Companiespaul_costasNo ratings yet

- Iloilo City Regulation Ordinance 2015-305Document2 pagesIloilo City Regulation Ordinance 2015-305Iloilo City CouncilNo ratings yet

- BIS0148 - C2L9P2 - Spec Sheet - Wear 450 Steel - WebDocument1 pageBIS0148 - C2L9P2 - Spec Sheet - Wear 450 Steel - Webidontlikeebooks100% (1)

- Tan Thuan Industrial ParkDocument10 pagesTan Thuan Industrial ParkNguyen Tran AnhNo ratings yet

- Definition of BiopharmaceuticsDocument3 pagesDefinition of BiopharmaceuticsvafaashkNo ratings yet

- Systematic Layout PlanningDocument45 pagesSystematic Layout Planningkevin punzalan94% (31)

- Chapter 6 Process Selection and Facility LayoutDocument55 pagesChapter 6 Process Selection and Facility Layoutjessica50% (4)

- JLT CompaniesDocument4 pagesJLT CompaniesAjay KrishnanNo ratings yet

- Structural Steel S235 S275 S355 Chemical Composition Mechanical Properties and Common ApplicationsDocument5 pagesStructural Steel S235 S275 S355 Chemical Composition Mechanical Properties and Common ApplicationsCharles OnyechereNo ratings yet

- Tridecs: Quality Assurance ManualDocument35 pagesTridecs: Quality Assurance Manualzahid_497No ratings yet

- QAP GeneralDocument1 pageQAP GeneralVenkatRaghavendar100% (2)

- Keppel Seghers: Schematic DiagramDocument2 pagesKeppel Seghers: Schematic DiagramhaiNo ratings yet

- 5.material Handling System Design and DecisionDocument19 pages5.material Handling System Design and DecisionSaranya SathiyamoorthyNo ratings yet

- Effect of Water-Cement Ratio On Abrasive Strength, Porosity and Permeability of Nano-Silica ConcreteDocument5 pagesEffect of Water-Cement Ratio On Abrasive Strength, Porosity and Permeability of Nano-Silica ConcreteEsthi KusumaNo ratings yet