Professional Documents

Culture Documents

Annual Report ENG

Uploaded by

sodbayargCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Annual Report ENG

Uploaded by

sodbayargCopyright:

Available Formats

DEVELOPMENT BANK OF MONGOLIA

01

DEVELOPMENT BANK OF MONGOLIA

ANNUAL REPORT 2012

02

CONTENTS

03 04 06 08 10 11 11 11 11 12 12 14 16 17 18 20 21 22 24 26 27 29 31 32 33 33 33 33 34 36 37 38 40

Mission and Vision Message from the Chairman of the Board of Directors Message from the Chief Executive Officer Economic Overview of Mongolia Economic Outlook State Budget Foreign Trade Inflation Money Supply Exchange Rate Banking System Corporate Development Corporate Governance Organization Structure Board of Directors Management Team Our Staff Highlights Business Operation Medium and Long-Term Business Operation Funding Operation Credit and Financing Operation Business Cooperation Risk Management Credit Risk Market Risk Liquidity Risk Operational Risk Corporate Social Responsibility Corporate Social Responsibility Corporate Social Responsibility Review Financial Overview Independent Auditors Report

DEVELOPMENT BANK OF MONGOLIA

03

Mission

Development Bank of Mongolia is a leading Mongolian financial institution that provides solutions to ensure sustainable economic growth, achieve economic diversification, support the production of value-added goods and integrate nationwide development policies.

Vision

To develop a prosperous and sound Mongolian economy that is competitive on an international level.

DeVeLoPment banK of monGoLia

AnnUaL rePort 2012

04

The primary aim of Development Bank of Mongolia is to promote the competitiveness of the Mongolian nation through investment in longterm development projects so that all Mongolian citizens can benefit from the countrys entry into the global marketplace.

MessaGe FROM THE CHAIRMAN OF THE BOARD OF DIRECTORS

05

MESSAGE FROM THE CHAIRMAN OF THE BOARD OF DIRECTORS

We must strive to be innovative and keep pace with the changes that are re-shaping Mongolia. We must maintain long-term profitability and implement prudent policies so that the Bank can sustain long-term operations. The success of our Bank lies in the prudent and efficient financing of large-scale investment programs. We are collaborating with the Government of Mongolia, international investors and, most importantly, the people of Mongolia to find the best financing solution for investment projects in our country.

Even though 2012 was a difficult year globally we were able to overcome the difficulties without considerable hardship in the political and economic spheres. With support from the Government of Mongolia, the Development Bank of Mongolia raised capital through successful issuance of our debut bond on the international capital markets. This capital was put to good use, financing major infrastructure and mining projects. The successful issuance was testament to the confidence of investors in Mongolia and to the excellent management of the Bank. The economy grew at 12.3 percent in 2012, considerably lower than the record 17.5 percent of previous year. Despite this moderate slowdown, sectors such as transportation, communication and construction were able to maintain consistent growth, in part due to effficient financing. Our aim is to become a national institution that provides medium to long-term financing solutions for large-scale investment programs in Mongolia, implemented in line with the growth cycles of the local economy.

In 2013 the Bank plans to set yet another strong benchmark by becoming a strong national institution that provides financing solutions to the Governments medium to long-term investment programs. This will be achieved through meticulously advancing our funding options and assuring that all operations of the Bank are sustainable in the long-term. The responsibility to provide financing solutions for the infrastructure, energy, mining and manufacturing sectors has been placed firmly on the shoulders of our Bank. Our financing options must be in line with the Governments medium and long-term investment policies. The Bank will be a pillar that supports Mongolias sustainable growth. The Bank and its members will continue to strengthen business operations through vigorous collaboration with our investors. My sincere appreciation and thanks go out to all the organizations and individuals that support our operations. In closing, I wish you all great success.

B.Shinebaatar Chairman of the Board of Directors

DeVeLoPment banK of monGoLia

AnnUaL rePort 2012

06

The Development Bank of Mongolia was established one year ago to provide financial solutions for large scale strategic projects that ensure sustainable economic growth.

MessaGe FROM THE Chief eXecUtiVe officer

07

MESSAGE FROM THE CHIEF EXECUTIVE OFFICER

The Development Bank of Mongolia has employed best practices and solidified its status in the financial sector. It is a privilege and honor for the Bank to be part of Mongolias growth story.

Two significant events took place in 2012. The first was the 6th parliamentary election held in June and the second was the commencement of exports from the Oyu Tolgoi gold, copper and silver project. These events set a strong positive outlook for Mongolias social and economic sectors and opens vast opportunities for the countrys future. Given the global economic headwinds in 2012, the Bank received numerous offers from international financial groups to strengthen the Banks presence in the international markets. We raised USD 580 million on March 21st, 2012 through the successful issuance of our bond with maturity of 5 years on the international capital markets. As a quasi-sovereign guaranteed by the Government of Mongolia, this historic transaction set a strong stepping stone for later issuances from Mongolia. With this funding the Bank financed projects that will enhance key sectors such as mining, energy, infrastructure, industrial, construction and small medium enterprises.

To ensure a brighter future for the Mongolian people in 2013 we will strive to accelerate economic growth by operating effectively, strengthening our position in the industry, expanding business cooperation, increasing the transparency and independence of the Banks operations, focusing on social responsibility and achieving new heights in the banking sector with help of our skilled employees. At the end of the reporting period, the Bank financed 46 projects totaling MNT 489.7 billion or USD 351.8 million under the Mid Term New Development Program of the Government. On behalf of our management team, I would like to wish our partners, investors and staff great success in their future endeavors.

Kim Jang Jin Chief Executive Officer

DeVeLoPment banK of monGoLia

AnnUaL rePort 2012

08

ECONOMIC REVIEW OF MONGOLIA

09

DEVELOPMENT BANK OF MONGOLIA

ANNUAL REPORT 2012

010

Economic Outlook

GDP growth

16 17.5% 14 12 10 8.9% 8 6 4 2 -1.3% 6.4%

(MNT billion)

20%

15% 12.4% 10%

5%

Mongolias GDP grew by 12.4 percent in 2012, lower than the growth rate of 17.5 percent during 2011. Key component of export or coal exports decreased during the reporting period. The overall economic growth was lower than forecasted but other sectors such as agriculture, construction, transportation and telecommunications performed well. The increase in mining and construction sector in addition to purchase and import of equipments and petroleum based products drove foreign trade deficit to 20 percent of GDP during 2011 and 2012, higher than levels of 7.6 percent during 2010.

0%

-5% 2008 2009 GDP

GDP structure

2010

2011 GDP growth

2012

100% 80% 60% 40% 20% 0% 2008 2009 2010 2011 2012 Source: National Statistic Committee

Although GDP growth remains at two-digits, contributions to GDP growth of sectors of the economy have changed significantly in 2012. For instance, the mining sector revenue made the largest contribution or accounted for 20.0 percent of GDP. Its contribution to GDP decreased by 3.9 percent from 2011. Revenue from wholesale and retail trade and repair of motor vehicles was the second largest contributor and accounted for 17.7 percent of GDP. Contribution of the agriculture sector increased by 2.1 percent and accounted for 14.2 percent of GDP. Another significant change was the revenue from the education sector, contribution of which increased by 0.6 percent and reached 4.6 percent of GDP. Contribution of the processing industry sector, which is one of the largest contributors to the Mongolian economy, decreased in 2012. The Government was able to successfully close its USD 1.5 billion debut sovereign bond issuance on November 2012. Pricing was tightest among debut issuers and order book was over-subscribed by a factor of 10. Successful completion is a testament to the positive business environment in Mongolia. GDP per capita reached MNT 4.9 million or USD 3,300. GDP is expected to grow by 18.1 percent during 2013 and in 2013 GDP per capita is expected to reach USD 5,300. This puts Mongolia among countries with above-average living standards. Given the moderate slowdown of the economy and decline in foreign direct investment, the vast natural resources of the country during 2013 and future years will provide growth opportunities.

Net taxes on products Services Industry, construction Agriculture

ECONOMIC REVIEW OF MONGOLIA

011

State Budget

Government budget revenue and debt reached MNT 4,975.8 billion and MNT 6,017.8 billion, representing an increase of 13.0 percent and 26.1 percent, respectively. Budget deficit reached MNT 1,042.0 billion or 7.4 percent of GDP. Preliminary government budget revenue is expected to increase by 42.4 percent to MNT 7.1 trillion or 40.2 percent of GDP. Non-tax revenue and Value added tax (VAT) are expected to increase to MNT 617.0 billion and MNT 1,942.7 billion, respectively. VAT representing a 50.0 percent increase from previous year. Government expenditure is expected to increase by 62.9 percent to MNT 7,444.6 billion. 81.4 percent of investment from state budget will focus on construction.

Inflation

Inflation reached 14.0 percent, higher than Central Bank of Mongolia target rate, as a result of rapid economic growth. Food items contributed 5.1 points or one-third of inflation was attributable to food items in the consumer basket. Monitory policy to curb inflation was dealt with by the Central Bank of Mongolia through increasing policy rate to 13.25 percent and increasing reserve requirements. Memorandum of Understanding was signed on October of 2012 between Government of Mongolia and Central Bank of Mongolia to establish Price Stabilization of Consumer Goods program. The program consists of: 1) Staple Food Price Stability Pogrom; 2) Fuel Price Stability Program; 3) Consumer Goods Price Stability Program; 4) Construction and Housing Sector Price Stability Program. The States guidelines, which was ratified by the Parliament of Mongolia, on monetary policies during 2013 states that the Central Bank will target inflation at 8.0 percent.

Foreign Trade

Mongolia has 142 trade partners and trade turnover reached USD 11.0 billion, 2.6 percent lower than previous year. Exports decreased by 9.0 percent while imports increased by 2.1 percent. Trade deficit reached USD 2.4 billion or 23.5 percent of GDP. Largest trade partners were China and Russia accounting for 53.0 percent and 17.0 percent of trade. Commodities such as coking coal, copper concentrate, iron ore concentrate, molybdenum, fluorspar and gold continue to account for more than 80.0 percent of total exports. Import of fuel related products reached USD 1.3 billion or 21.0 percent more than previous year. Equipments and machinery imports reached USD 2.9 billion. Foreign direct investment decreased to USD 3.8 billion or by 20.0 percent compared to previous year. Capital raised through the Hong Kong Stock Exchange accounted for 51.0 percent of investments. Other countries such as China, United States of America, Great Britain and Canada accounted for 9.0 percent, 7.0 percent, 5.0 percent and 3.0 percent of investments into Mongolia.

Money Supply

During the 2012, Mongolias money supply reached MNT 7.6 trillion, increasing by 19.0 percent. This increase was relatively low compared to previous years. In 2012, the Central Bank raised its policy rate to 13.25 percent and the reserve requirement ratio to 12.0 percent in order to reduce the impact of the money supply on inflation, which in turn affected the money supply growth rate. Tugrug current accounts did not increase significantly while Tugrug savings accounts increased by 19.8 percent. Foreign currency current and savings accounts increased by 10.0 percent and foreign currency savings accounts increased by 46.7 percent. Consequently, the current account balance in the money supply decreased and savings balance in the money supply increased.

DEVELOPMENT BANK OF MONGOLIA

ANNUAL REPORT 2012

012

Exchange Rate

The exchange rate of USD to Tugrug as of December 2012 stood at MNT 1,396.1, representing a 21.9 Tugrug depreciation compared to last year. Prior to the first quarter of 2012 the Tugrug appreciated in value before subsequently declining after May of 2012. Exchange rate volatility was fairly low throughout the year.

1450.0 1400.0 1350.0 1300.0 1250.0 1200.0 1150.0 1100.0

1 2 3 4 5 6 7 8 9 10 11 12 1 2 3 4 5 6 7 8 9 10 11 12 2011 2012 1228.5 1323.4 1246.9 1291.9 1259.9 1235.7 1395.1 1374.2 1364.2 1340.7 1328.0 1256.4 1313.1 1396.1

During the financial crisis of 2008 to 2009, two banks switched to the conservatorship of the Central Bank. Non-performing loans reached 4.2 percent during the reporting period, lower than 5.8 percent during 2011. The decrease in non-performing loans was primarily due to the overall loan portfolio expansion of commercial banks.

Total Loans

( MNT billion)

8,000 6,000 4,000 2,000 2010-I II III IV 2011-I II III IV 2012-I II III IV

20% 15% 10% 5% 0%

Total loans Non-performing loans Percentage of non-performing loans

Source: Central Bank of Mongolia

Banking System

Commercial Banks At the end of 2012, 14 commercial banks were operating in Mongolia. Banking assets increased by MNT 2.6 trillion to MNT 11.9 trillion or 86.0 percent of GDP. Deposits of commercial banks increased by MNT 1.1 trillion or 30.0 percent to reach MNT 4,855.9 billion. Deposit base consists of 70.9 percent denominated in local currency and the rest in foreign currencies.

Source: Central Bank of Mongolia

At the end of 2011, loans issued to the mining sector comprised 12.0 percent of total loan portfolio but in 2012 decreased to 11.5 percent. Real estate sector loans decreased from 14.1 percent to 13.9 percent and loans for construction sector increased from 11.8 percent to 12.9 percent from 2011 to 2012. The total amount of loan issued to these three sectors grew from 37.9 percent in 2011 to 38.5 percent in 2012.

Banking assets to GDP

14.0 12.0

( MNT trillion) 85% 74% 86%

90% 80%

Loan concentration (Business sectors)

100%

67%

10.0 8.0 6.0 4.0 2.0 0.0

11.9 9.4

70% 60% 50%

80%

56%

60%

6.3 3.7 4.4

40% 30% 20% 10% 0% 20% 40%

2008 Asset / GDP (percent)

2009

2010

2011

2012

0% 2008

Trade

Banking Assets

2009

Real State

2010

Construction

2011

Industry

2012

Mining

Source: Central Bank of Mongolia

Source: Central Bank of Mongolia

ECONOMIC REVIEW OF MONGOLIA

013

The 2007 global financial crisis affected the Mongolian economy to some degree. The Law on Insurance for Bank Deposits was adopted on November 25th, 2008 in order to establish a mandatory scheme for protection of bank deposits. At that time, the Government took it as the optimal tool to prevent additional turmoil in the market caused by withdrawal of bank deposits. It was decided that the insurance for bank deposits shall be implemented for four years and in November 25th, 2012 the law expired.

Non-Banking Financial Institutions A total of 212 Non-Banking Financial Institutions (NBFI) operate in Mongolia, only 17 of which are foreign invested. 8 new NBFIs opened their offices in 2012. According to Mongolias law on the operation of financial Institutions, NBFIs can provide credits, foreign exchange services, investment, advisory services, factoring and other services. Assets of NBFIs reached MNT 252.0 billion or 2.1 percent of the total banking system. The loan portfolio of NBFIs increased by MNT 38.7 billion or 32.6 percent during 2012. Performing loans increased by 32.1 percent, while past due loans increased 1.8 times and non-performing loans increased by 5.6 percent. The minimum and maximum average lending rates were 2.1 percent and 3.8 percent, respectively. The average monthly lending of NBFIs was 2.9 percent, 2.2 times higher than rates of commercial banks. Total NBFI assets were comprised of MNT 80.7 billion (32.0 percent) in liabilities and MNT 171.3 (67.9 percent) in shareholders equity. This represents an increase of liabilities and shareholders equity of 20.1 percent and 24.0 percent, respectively. During the reporting period, NBFIs revenue increased by 52.1 percent to MNT 70.5 billion. NBFIs cost of goods sold increased by 48.4 percent to MNT 51.9 billion. Finally, profit after tax was MNT 18.6 billion. NBFIs revenue is generated through 39.3 percent from interest income and 20.1 percent from non-interest income. 47.0 percent of non-interest income is generated from foreign exchange trade and an additional 30.1 percent comes from exchange rate arbitrage. The remaining 17.1 percent comes from other financial services. Compared to last year, total expenditure increased by 48.4 percent. Interest expenses, non-interest expenses, contingency expenses, non-operating expenses and tax expenses, increased by 28.4 percent, 54.4 percent, 9.8 percent, 59.6 percent and 64.8 percent, respectively.

Capital Markets A total of 133.8 million shares with value of MNT 145.1 billion were traded on the Mongolian Stock Exchange in 2012. This represents a decline in value of MNT 205.1 billion from the previous year. The regulation formed under the Decree on Government Security Issuances and Secondary Market Trading from the Central Bank of Mongolia and the Ministry of Finance regulates the governments bond issuances on the Central Banks platform. As a result, the total turnover of government bonds on the MSE declined sharply. The total market capitalization of the MSE declined by 17.0 percent, while the Top 20 Index declined by 3,973.6 points or 18.3 percent. However, despite declines, 29 companies distributed dividends of MNT 79.1 billion to their shareholders. Dividend per share and profitability of companies listed on the MSE showed improvement since last year. According to data provided from the Securities Clearing House and Central Depository the value of securities traded by Golomt Bank, Khan Bank, Xac Bank and Trade Development Bank reached MNT 2.6 billion during the six months following the installation of the Millennium IT system. At the end of the reporting period, the number of listed companies on the MSE reached 328. 83.8 percent of the companies were privately owned and the rest stated owned. New regulations and policies were approved by Financial Regulatory Commission. These regulations were updated to meet already published laws and the Company Law. Insurance Total assets of insurance companies rose 1.3 times compared to the previous year and reached MNT 107.6 billion. Companies with foreign ownership hold 35.3 percent of market share. The working capital of insurance companies rose 1.3 times as a result of Financial Regulatory Commissions Resolution to increase minimum requirements for paid in capital. At the end of 2012, two companies held 10.0 percent or more of total assets of insurance companies. Eight companies held up 1.0 percent to 5.0 percent and seven companies held up 5.0 percent to 10.0 percent of total assets. 77.2 percent of total collection of these companies was from insurance policies on fixed assets, construction and transportation. Insurance of the indemnity amount during the previous years increased and reached MNT 16.9 billion. Mongol Daatgal LLC issued 41.9 percent of the total indemnities during the reporting period. The reserve fund for insurance rose to MNT 48.2 billion. This is 2.2 times higher than five years ago.

DeVeLoPment banK of monGoLia

AnnUaL rePort 2012

014

COrPorate deVeLoPment

015

DEVELOPMENT BANK OF MONGOLIA

ANNUAL REPORT 2012

016

Corporate Governance

The Bank is committed to conducting its operations in compliance with international corporate governance and financial standards by fulfilling principles of transparency and integrity in its operations. The Bank aims to integrate the interests of the Board of Directors, to make prudent decisions by building effective management, to support the equality of rights, and conduct open financial operations.

The Board of Directors consists of nine members. Three independent members are from the Central Bank of Mongolia, the National Chamber of Commerce and Industry, and the Mongolian Bankers Association. The other six members are appointed from the Government of Mongolia. In 2012 with accordance Resolution No.45 of the Board of Directors of the Development Bank of Mongolia, three committees on Nomination, Audit, and Remuneration were set up under the Board of Directors. Committees are operating within international corporate governance standards. Korean Development Bank was selected as a partner through an open international tender based on Government Resolution No.195 of July 20th, 2010 and State Property Committee Resolution No.346 of September 2nd, 2010. The Executive Management is carried out by a joint team from the Development Bank of Mongolia and the Korean Development Bank. The Executive Management leads and organizes daily activities of the Bank in accordance with the Banks principles and rules, as specified in the agreement concluded with the Board of Directors. To support daily activities and to improve its efficiency, department and division direc-

The highest level of authority of the Bank is the shareholders meeting and the sole shareholder is the Government of Mongolia. The management of the Bank adopts principles of integrity and transparency in its operations.

tors report regularly to the Chief Executive Officer and the First Deputy Chief Executive Officer. The committees structure shall be defined by Executive Management. The Executive Management Committee, the Credit Committee, and the Asset and Liability Management Committee monitor the Banks business operations within corporate governance regulations.

COrPorate deVeLoPment

017

Organization Structure

To meet the needs of newly expanding business activity, the developing economy, and market demands the Bank continued with the improvements of its organizational structure. In 2012, the Bank made structural changes to cope with expanding activities.

Shareholders Meeting

Nomination Committee Remuneration Committee Audit Committee Internal Audit Chief Executive Officer Executive Management Committee Asset and Liability Committee Credit Committee Board of Directors Secretary to the Board of Directors

Advisor

First Deputy Chief Executive Officer

Asset and Liability Management Department

Credit Department

Risk Management Department

Monitoring and Administration Department

Accounting and Reporting Division

Public-Private Partnership Division

Public Finance and Due Diligence Division

Correspondent Banking Division

Treasury Management Division

Strategy and Planning Division

Corporate Finance Division

Credit Risk Provision Unit

Human Resources and Development Unit

Financial Risk Division

Co-Finance Division

Administration Unit

Funding Division

Experts Counsel

Research Unit

Public Relations Unit

In 2011, Bank had four departments Asset and Liability Department, Credit Department, Risk Management Department and Monitoring and Administration Department 11 divisions and two units. In 2012, by Resolution No.54 of the Board of Directors, a new organizational structure of the Bank was approved. At the end of 2012, the Bank started operations with four departments, 13 divisions and five units with total staff of 46 highly professional individuals.

Legal Division

IT Division

DEVELOPMENT BANK OF MONGOLIA

ANNUAL REPORT 2012

018

Board of Directors

The Board of Directors determine the strategy of the Bank, and approve its risk management policy, annual budget, and business plans. They monitor the performance indicators of the Bank and provide strategic guidance.

Shinebaatar Begzsuren State Secretary, Ministry of Economic Development

Boldbaatar Danzannorov Head of Economic Cooperation, Loan and Assistance Policy Department, Ministry of Economic Development

Lkhagvasuren Byadran Head, Supervision Department, Central Bank of Mongolia

Batzaya Baasandorj State Secretary, Ministry of Road and Transportation

Bayanmunkh Myagmarsuren Head, Heavy Industry Policy Implementation and Coordination Department, Ministry of Industry and Agriculture

Otgochuluu Culuuntseren Head of Strategic Policy and Planning Department, Ministry of Mining

Naidalaa Badrakh Chief Executive Officer and General Secretary, Mongolian Bankers Association

Nergui Chuluunbat Head, Consolidated Policy, Planning and Coordination Department, Mongolian National Chamber of Commerce and Industry

Battur Davaakhuu State Secretary, Ministry of Finance

COrPorate deVeLoPment

019

Nomination Committee The Nomination Committee is focused on nominating, selecting, and determining requirements for candidates for the Board of Directors, for committee membership, and for Executive Management. The nomination committee is responsible for evaluating the activities of members of the Board of Directors and Executive Management, as well as providing advice to the Board of Directors.

Committee Head

Shinebaatar Begzsuren State Secretary, Ministry of Economic Development

Member

Bayanmunkh Myagmarsuren Head, Heavy Industry Policy Implementation and Coordination Department, Ministry of Industry and Agriculture

Member

Naidalaa Badrakh Chief Executive Officer and General Secretary, Mongolian Bankers Association

Audit Committee The Audit Committee shall review the reliability of accounting statements of the Bank and its compliance with international standards. It also monitors and evaluates internal audit and risk management activities and the integrity of financial and economic data. They present their reports to the Board of Directors.

Committee Head

Lkhagvasuren Byadran Head, Supervision Department Central Bank of Mongolia

Member

Otgochuluu Culuuntseren Head of Strategic Policy and Planning Department, Ministry of Mining

Member

Battur Davaakhuu State Secretary, Ministry of Finance

Remuneration Committee The Remuneration Committee was established to develop and approve salary and reward system policies for the members of Board of Directors and Executive Management. They ensure that remuneration arrangements support the strategic aims of the business and other governing authorities.

Committee Head

Boldbaatar Danzannorov Head of Economic Cooperation, Loan and Assistance Policy Department, Ministry of Economic Development

Member

Batzaya Baasandorj State Secretary, Ministry of Road and Transportation

Member

Nergui Chuluunbat Head, Consolidated Policy, Planning and Coordination Department, Mongolian National Chamber of Commerce and Industry

DEVELOPMENT BANK OF MONGOLIA

ANNUAL REPORT 2012

020

Management Team

The Executive Management leads and organizes daily activities in accordance with Banks principles and rules, as specified within the agreement concluded with the Board of Directors. The Executive Management of the Bank exercises the following powers in addition to the ones specified in the Company Law: they can approve internal rules, regulations and instructions; establish criteria for a prudential ratio on the activities of the Bank; determine the policy on selecting, training, and re-training its personnel; decisions related with loans and financial accounting activities.

im Jang Jin Chief Executive Officer

Sandagdorj Sukhbaatar First Deputy Chief Executive Officer

Dashzevge Gantumur Deputy Chief Executive Officer, Administration and Monitoring Department

Batbaatar Otgonbat Deputy Chief Executive Officer, Asset and Liability Department

Choi Jong Kook Deputy Chief Executive Officer, Credit Department

Park Yong Bae Deputy Chief Executive Officer, Risk Management Department

Furthermore, the Executive Management shall implement business plans, define asset and liability management policy, take actions to enforce financial disciplines, and establish a supervision system for loan operations. The Executive Management team consists of experienced Mongolian and foreign specialists. The Executive Management team includes the Chief Executive Officer, the First Deputy Chief Executive Officer and four Deputy Chief Executive Officers.

COrPorate deVeLoPment

021

Our Staff

The key to our success lies in our professional, experienced staff who have the aspiration to contribute to development of Mongolia and who are creative and determined team players.

The mission of all Banks staff is to establish reliable and professional financial activities that are consistent with international standards.

Since the establishment of the Bank, we have strived the top professionals in the industry in order to develop human resources in line with the scope and development of the Banks operations. We always strive to find the best management. The Bank started its activities on May 12th, 2011 with nine employees and by December 31st, 2012 the number of employees had grown to 46. The average age of Banks staff members is 33. 60.0 percent of our staff members have obtained diplomas abroad and 40.0 percent have obtained diplomas domestically. 60.0 percent of the employees hold Bachelors Degree, 37.0 percent Masters Degrees and 2.9 percent hold a Ph.D. During the reporting period, 41 employees attended training programs organized by investment banks, financial institutions and law firms such as Deutsche Bank, Barclays, Korea Development Bank, Korea Development Institution, International Financial Corporation of the World Bank Group and law firm Allen & Overy. In accordance with the Banks 2013 business plan, we are planning to expand our employees to 76 so that we can improve our operations and keep pace with our growing activities. We will increase the number of credit officers and raise the number of staff in other departments and divisions as necessary. A sophisticated training program has been developed to expand the human resources development in line with that of other development banks.

In order to improve the skills of managerial personnel and to ensure these skills are passed down to future management, we are planning to implement a Best Leader program, which will involve mentoring of mid-level managers. This program will establish a management culture that fits our unique business activities. The curriculum will coves development bank management methods, team work and individual leadership skills, as well as problem solving and mentoring skills.

DeVeLoPment banK of monGoLia

AnnUaL rePort 2012

022

Highlights

November 30th, 2011

Euro Medium Term Note program is established. For the first time, the Development Bank of Mongolia establishes a USD 600.0 million Euro Medium Term Note program backed by sovereign guarantee.

July 20th, 2010

Mongolian Government Resolution is issued to establish the Development Bank of Mongolia.

May 12th, 2011

State owned Development Bank is established for the first time in Mongolia. With the purpose of accelerating economic growth in Mongolia by financing projects and programs in strategically important sectors of Mongolia.

February 10th, 2011

Law on Development Bank of Mongolia is approved.

December 9th, 2011 March 25th, 2011

Development Bank of Mongolia has received its State Registration license and its permission to start operations. Debut bond issuance within Euro Medium Term Note program. Development Bank of Mongolia issues an initial USD 20.0 million privately placed bond with 1 year maturity as part of the USD 600.0 million Euro Medium Term Note program.

August 30th, 2011

A Management Contract is established between Development Bank of Mongolia and Korea Develoment Bank. The State Property Committee announced an open international tender to select an experienced management team for the Development Bank of Mongolia. Korea Development Bank was selected.

March 21st, 2012

Development Bank of Mongolia issued USD 580.0 million bonds at 5.75 percent coupon. After holding a roadshow in Hong Kong, Singapore and London, the Development Bank of Mongolia issues USD 580.0 million 5 year bond on the international market at 5.75 percent coupon.

COrPorate deVeLoPment

023

August 6th, 2012 June 15th, 2012

Development Bank of Mongolia provides financing for low interest housing mortgage program. Development Bank of Mongolia provides MNT 50.0 billion financing to the State Bank for the Program to provide civilians with 6 percent interest mortgage loans in accordance with the Mongolian Government Resolution No.55 of 2012. Development Bank of Mongolia provides financing for road projects. In accordance with Government Resolution No.47, 110, 106, 336, 124 and 105, Development Bank of Mongolia disbursed MNT 202.5 billion financing for road projects. A total of 1,280 km road construction work has been carried out with this financing.

October 19th, 2012

Development Bank of Mongolia provides financing for Khutul cement plant expansion. Development Bank of Mongolia disbursed USD 61.3 million to Basement LLC for the purpose of increasing the capacity of Khutul cement and limestone plant to 1 million tons per annum.

October 5th, 2012

Development Bank of Mongolia provides financing for Erdenes Tavan Tolgoi LLC. USD 100.0 million in financing was disbursed in accordance with the Government Resolution No.148 of 2012. The implementation of this project will lead to the development of mining, energy and other strategically important sectors.

December 31st, 2012

Development Bank of Mongolia received Bloomberg Award. Development Bank of Mongolia received Bloombergs Best Debut Bond Award at the closing reception ceremony of The Mongolian Economic Forum 2013 for the issuance of it first quasi-sovereign bond on the international markets

DeVeLoPment banK of monGoLia

AnnUaL rePort 2012

024

BUSINESS OPERATION

025

DEVELOPMENT BANK OF MONGOLIA

ANNUAL REPORT 2012

026

Medium and Long-Term Business Operation

The Bank was established to create economic stability and accelerate economic growth by providing long-term sources of funding for processing industries and the production of value-added, import subtitution products in the infrastructure and mining sectors.

The Bank shall finance large scale projects and programs in strategically important sectors approved by the Parliament and Government. Financing will be provided in the following areas to help support sustainable development of the economy, promote ecological balance and support production of value-added export products and import replacement goods, including: Energy production and energy transfer infrastructure Manufacturing (to introduce eco-friendly advanced tech niques and technologies, upstream and/or downstream pro duction of raw materials and minerals) Infrastructure (road and railway networks, utilities) Mining We shall strive to provide financial advisory services for strategically important projects in accordance with the Law on Development Bank of Mongolia, the decisions of the Parliament and the decrees of the Government. We shall focus on the following activities: Support priority sectors through medium and long-term loans, co-financing, syndicated loans and other financial solutions, focusing on development projects and programs for energy production, infrastructure, processing industries and engineering facilities, Promote foreign capital inflow and foster domestic capital formation, Allocate required funds for proper economic diversification which in turn will increase the export of domestically produced goods, create new areas for export, and improve national competitiveness, Support sustainable social development and regional development, reduce urban rural disparities by generating jobs and applying good governance principles.

BUSINESS OPERATION

027

Funding Operation

The Bank established its Euro Medium Term Note program in November 2011. Within the program the Bank successfully issued USD 20.0 million of 1 year bond with 6.0 percent coupon in December 2011 and an additional USD 580 million of 5 year bond with 5.75 percent coupon, the lowest rate for a debut Asian sovereign bond in its rating class, on March 2013.

Other Asian issuances in the same ratings class such as Sri Lanka (8.75 percent), Vietnam (6.75 percent) and the Philippines (8.75 percent), have a substantially higher coupon. This shows that investors have high expectation and confidence in the Bank and Mongolia. The final order book for the Banks was over USD 6.25 billion. The issuance was 11 times oversubscribed and more than 300 separate accounts participated. The transaction was highlighted by international news agencies and investment banks as one of the most successful transactions in recent years. In 2013, the Bank is planning to diversify its funding sources by issuing bonds in foreign currencies (Yen Samurai bonds and Yuan Dim Sum bonds), receiving bilateral and syndicated loans from international investment and commercial banks, co-financing and cooperating with other countries development and export-import banks.

The Mongolian Law on 2013 budget has included MNT 50.0 billion to increase the Banks equity as a support given from the Government as well as to increase capital adequacy.

Issuer Program establishment date

The Development Bank of Mongolia USD 600 million Euro Medium Term Note Program

Development Bank of Mongolia November 30th, 2011 Moodys: B1 (Stable) / S&P: BB- (Positive) / Fitch: B+ (Stable) Unconditionally and irrevocably guaranteed by the Government of Mongolia USD 600.0 million 5 years Singapore Stock Exchange 6 months after first proceed and semi-annually

Credit rating Guarantor Issuance size Tenor Listing venue Interest payment

Use of proceeds

Underwritters

To finance new railway projects, design and construction of roads and infrastructure projects related to housing.

Issuance type

Private and public placement

Drawdowns

2011-12-09, 1 year, 20 million USD, 6.0% (private) 2012-03-21, 5 years, 580 million USD, 5.75% (public)

DeVeLoPment banK of monGoLia

AnnUaL rePort 2012

028

Credit Rating

In December 2011, Standard & Poors and Moodys credit rating agencies assigned BB- (positive) and B1 (stable) ratings respectively to Banks USD 600.0 million Euro Medium Term Note program which are same as the sovereign`s rating, on the back of irrevocable and unconditional guarantee provided by Ministry of Finance on behalf of the Government of Mongolia.

March 6th, 2012 - Standard & Poors Ratings Services assigned its BB- foreign currency issue rating to the proposed issue of U.S. dollar notes by Development Bank of Mongolia.

March 6th, 2012 - Moodys Investors Service has assigned a definitive long-term rating of B1 applicable to the initial draw down under the Euro Medium Term Note Program of the Development Bank of Mongolia LLC.

BUSINESS OPERATION

029

1.0% 2.0%

1.0%

Credit and Financing Operation

Starting in 2012, the Bank has been providing financing for projects and programs to be implemented in key economic sectors approved by the Government from the funds raised on the international market. The Banks lending activities are in four main areas, which include: 1) socially beneficial projects 2) corporate financing projects 3) trade financing and co-financing projects and 4) public-private partnership projects.

10.0%

17.0%

41.0%

28.0%

At the end of 2012, Banks loan portfolio was MNT 489.7 billion or USD 351.8 million, which was comprised of 46 projects operating within the framework of the New Development program. As of December 31st, 2012, the Bank disbursed loans in the following sectors:

Repaid by State budget

Number of Projects Disbursed Amount MNT billion

Projects Road Mining Construction materials Housing program finance SME Fund Air transportation Power plant Infrastructure Total

Number of Projects 39 1 1 1 1 1 1 1 46

Disbursed Disbursed Percentage of Amount MNT Amount USD Portfolio billion million 202.5 139.2 85.3 50 2.1 7.4 2.8 0.4 489.7 145.5 100 61.3 35.9 1.478 5.3 2 0.3 351.8 41.0% 28.0% 17.0% 10.0% 2.0% 1.0% 1.0% 0.0% 100.0%

Repaid by Project cash flow

Disbursed Amount USD million Number of Projects Disbursed Amount MNT billion Disbursed Amount USD million

Projects

Projects

Road Infrastructure Housing program finance

39 1 39

202.5 0.4 202.5

145.5 0.3 145.5

Mining

39

202.5

145.5

Air transportation

0.4

0.3

SME Fund

2.1

1.5 Construction materials 1 85.3 61.3

Power plant Total

1 43

2.8 257.8

2.0 185.2 Total 3 231.9 166.6

52.6 percent of the loan portfolio or MNT 257.8 billion or USD 185.2 million in financing was provided for projects to be repaid from the State budget. The remaining 47.4 percent or MNT 231.9 billion or USD 166.6 million in financing was provided to projects to be repaid from project cash flows.

DEVELOPMENT BANK OF MONGOLIA

ANNUAL REPORT 2012

030

Summary of Project Financing for the Reporting Year within the Framework of the New Development program:

Road financing The Government resolved that MNT 2.4 trillion will be issued to 104 projects in order to improve the nation-wide auto road network, connect rural roads to the network, reduce migration from rural to urban areas and increase the circulation of goods among economic sectors. At the end of 2012, the Bank had disbursed MNT 202.5 billion or USD 145.5 million for 39 road design, consulting, construction and monitoring projects in Ulaanbaatar and rural areas. As a result, 1,280 km of road construction has been carried out. Utilities financing The Government Resolution No.149 of 2011 resolved to provide MNT 425.7 billion for 64 projects (20 heat distribution utilities projects with cost of MNT 161.1 billion, 14 electricity, power source and transmission utilities projects with cost of MNT 58.6 billion, 25 clean water and sewage utilities projects with cost of MNT 151.9 billion and five inter-sum projects with total cost of MNT 54.1 billion). According to this decision MNT 450.0 million financing was disbursed to a water treatment facility with a 4,200m3 capacity in Khovd Province. Housing program In order to implement Government Resolution No.138 on Course of Action to Provide Housing for Civilians of 2011 and Government Resolution No.55 on Issuing Securities and Government Guarantee of 2012 the Bank disbursed MNT 50 billion or USD 35.9 million to the State Bank to issue mortgage loan to civilians with 6 percent interest rate. Promoting small and medium-sized enterprises The Government Resolution No.138 and 208 of 2012 resolved to provide concessionary loans to generate jobs through increasing SME capacity in regional centers, provinces and rural areas. According to this decision the Bank has started disbursing MNT 50.0 billion to commercial banks. Power plant The Government Resolution No.99 and 119 of 2012 authorized the Bank to issue USD 70.0 million financing for the project to install 100MW turbine to increase the capacity of Power Plant IV. Accordingly, initial disbursement of MNT 2.8 billion or USD 1.9 million was made in 2012.

Electric power consumption from the Central Energy System is expected to increase by 35-50 MW annually and heating consumption is expected to increase by 80 Gcal per hour. Thus, expansion of Power Plant IV plays an important role in accommodating the increasing demand for energy. Upon completion of this project, Power Plant IV capacity shall increase to 680 MW where annual production of energy shall increase by 500 million KW per hour and production of heating shall increase by 400,000 Gcal per hour. Supporting Strategically Important Sectors: Erdenes Tavantolgoi project The Government Resolution No.148 and 161 of 2012 resolved to issue USD 200.0 million to Erdenes Tavan Tolgoi JSC to support strategically important projects in the mining sector. MNT 139.2 billion or USD 100.0 million has been disbursed as the initial funding for the project. Completion of this project shall increase the capacity of the mining sector and reduce product cost. Air transportation Due to increasing demand for air travel, MIAT LLC has been working on renewing its aircraft fleet in order to reduce its operational costs and improve its services. The purchase of aircraft was included in the Public Investment Program for 2013 to 2017 approved by Government Resolution No.223 of 2012. State Policy to be Implemented in the Civil Aviation Sector Until 2020 was approved by the Parliament Resolution No.18 dated February 7th, 2013. In April 2011, MIAT LLC established a purchase agreement with Boeing company. The Bank has provided financing of MNT 7.4 billion or USD 5.3 million for the pre-delivery payment of the aircraft. The purchase of this aircraft shall increase the operational efficiently of MIAT LLC and further promote development of the air transportation sector in Mongolia. Construction material plant 60.0 percent of products imported through Zamiin-Uud port are construction materials, 90.0 percent of which are cement. Therefore, in order to reduce imported cement and to support domestic production, Line II of the Khutul Cement and Lime LLC is being replaced by dry technology line and the capacity is being increased to 1 million tons per annum. An open cut mining and auto transportation complex are also being built in order to promote development of the construction material sector. Completion of this project will stabilize the construction material prices, which in turn will create the conditions to reduce housing prices. A continuous supply of cement will facilitate the implementation development projects. The Bank disbursed MNT 85.3 billion or USD 61.3 million for implementation of this project.

BUSINESS OPERATION

031

Business Cooperation

Since its founding, the Bank has actively built partnerships and signed cooperation agreements with various international financial institutions. Cooperation Agreements Signed in 2011: August 24th, 2011 Memorandum of Understanding with the Export-Im port Bank of China of Peoples Republic of China to sup-

port the diplomatic cooperation of the two countries and finance various projects. October 10th, 2012: Memorandum of Understanding with GAUFF Engineer ing, Germany to organize training and seminars in Memorandum of Understanding with association of Ex- Im Banks of North-East Asian countries, Greater Tumen

Technical Issues of Road Projects and Infrastructure Financing. December 06th, 2011 Memorandum of Understanding with Kuwait Investment Authority to invest in minerals, mining,

Initiative (GTI), to support regional cooperation in economic development and technical assistance. In 2013, the Bank is planning to further increase its contacts and cooperation with international organizations in the Asia Pacific region. Training Seminars Organized Under Cooperation Initiatives: Memorandum of Understanding with Kuwait Fund for Arab Economic Development to conduct feasibility The Bank and Japan International Cooperation Agency (JICA) organized a Project Finance training seminar in Ulaanbaatar on July 5th to 6th of 2011. During this training, relevant experts presented on issues related to project financing, project evaluation, feasibility studies as well as case studies on projects financed by Development Bank of Ja Memorandum of Understanding with Sumitomo-Mit- sui Banking Corporation (SMBC) to contribute to ecopan. Representatives from the Bank, the National Development and Innovation Committee, the Ministry of Finance, the State Property Commission, the Ministry of Road, Transportation, Construction and Urban Development, the Ministry of Mining and Energy and government agencies on roads and railways participated March 21st, 2012 Cooperation Agreement with China Development Bank to finance rural and urban road construction, resithe training. The Bank organized trainings on Technical Issues of Road Projects and Infrastructure Financing with GAUFF Engineering in Germany from September 20th to 23rd of 2011. The training included sessions by German experts (i) on financing of road projects, its quality, safety and usage along with case studies and (ii) on financing of May 01 , 2012

st

banking and financial services sectors as well as railway and strategic projects.

studies and provide concessionary loans to projects with high impact potential for the Mongolian economy. Cooperation Agreements Signed in 2012: March 12th, 2012

nomic development by financing infrastructure, mining and development projects.

dential housing construction and other projects agreed between the banks.

infrastructure projects, associated risks and its management and public-private partnerships.

Memorandum of Understanding with the Export-Im port Bank of the United States (US Ex-Im) to finance The Bank and Shearman & Sterling LLP, a global law firm, organized a seminar titled Project Financing and International Capital Markets in Relation to Development of Mongolias Mining Sector on February 8th, 2012, which was attended by over 100 participants from various public and private entities.

large scale projects by utilizing the countrys latest technologies and long-term low-cost funding. US Ex-Im will be able to provide funding to mining, infrastructure, railway, roads, energy, housing and industrial projects.

DeVeLoPment banK of monGoLia

AnnUaL rePort 2012

032

RISK MANAGEMENT

033

Risk management The Executive Management Committee, Credit Committee and Risk Management Department cooperates closely with the Board of Directors to carry out operations in line with prudential risk management ratios in order to monitor ever changing social, economic and business environments.

The Executive Management Committee and Risk Management Committees will supervise the banks credit risk management, influence of international and domestic factors as well as funds for provision of possible loss on loans and its relevant policies and procedures. In 2012, the Risk Management Department carried out its operations by providing professional advice and instructions as well as by cooperating with the Banks other departments and clients in areas of operating efficiently in uncertain economic and financial situations, managing financial discipline and mitigating associated risks. The Bank has prepared internal policies, procedures and instructions in line with internationally accepted standards to ensure continued stable operations. Also, routine risk management procedures such as risk analysis and reports were introduced to the core risk management structure. Credit Risk According to the Credit Policy approved by the Board of Directors, the Credit Committee has the authority to approve loans and guarantees with a total amount of up to MNT 5.0 billion. Any requests with higher amounts need to approved by the Board of Directors, before which the Risk Management Department will issue an independent risk analysis report on case by case basis. The Law of the Development Bank of Mongolia states that the banks loan assets, guarantees and securities must not be greater than 50 times the value of its equity. The Bank complied with this regulation in 2012. 51.0 percent of loan portfolio consists of projects repaid from the State budget. Projects that are paid through State budget are deemed to have low credit risk. At the end of 2012, the Banks loan operations had no non-performing loan outstanding, which demonstrates a favorable social and economic environment for clients and the Banks efficient and prudent execution of risk management strategy. In 2013, the Bank is planning to introduce an internationally accepted system to manage evaluation counterpart risk, approval of loans, prevention and management of risks as well as allocation of funds. The Bank will reflect Mongolias social and economic environment to the system as well.

Market Risk The foreign exchange rate and interest rate risks of the Bank are managed through close monitoring of mismatch in borrowing and lending positions. The majority of the Banks funding resources are proceeds from the Banks U.S Dollar bond and when the Bank issues loans in MNT, the potential loss from foreign exchange rate fluctuations is covered by a specific agreement with the Ministry of Finance of Mongolia. Going forward, the Bank is planning to utilize value-at-risk (Var) method, which is commonly used worldwide. Liquidity Risk Development banks give liquidity risk higher priority than commercials due to their lack of access to deposits or central bank supports. The Asset and Liability Management Committee manages liquidity risk of the bank and at any given time, the committee places funds with same amount as equity at minimum in liquid assets. Going forward, the Bank is planning to place funds in liquid assets that will be utilized to meet financial obligations such as operational expenses, financial expenses and disbursement of approved projects as well as managing liquidity risk by closely monitoring cash flows for the next 12 months. Operational Risk The Risk Management Department has worked tirelessly to identify, standardize and manage the banks operational risk and introduced relevant policies and procedures. In 2012, the Bank has focused on the following matter within initiative of managing operational risks, which include: Anti-corruption operations; Business operation consistency and stability management; Anti-fraud crimes risk management; Anti-money laundering and fighting of terrorism financing; Information risk management; Compliance operations management. The Risk Management Department has produced and introduced relevant policies, procedures and instruction in terms of above mentioned operational risk and conducted internal trainings for employees.

DeVeLoPment banK of monGoLia

AnnUaL rePort 2012

034

CORPORATE SOCIAL RESPONSIBILITY

035

DEVELOPMENT BANK OF MONGOLIA

ANNUAL REPORT 2012

036

Corporate Social Responsibility

One of the most concerning issues the world is facing today is safeguarding the natural environment. This goal is given high priority by Mongolia, whose economy based on the extraction of rich mineral resources. Mongolia is on the brink of rapid economic acceleration and in order to realize its full potential, the country has to develop complete solutions to infrastructure bottlenecks and employ innovative technologies that are environmentally friendly to promote national development. As operations expand, the Bank has an increasing level of responsibility to its clients, shareholder, employees and country. The Banks role is to finance large revenue generating and socially ben-

To promote the competitiveness of the Mongolian nation through investment in long-term development projects so that all Mongolian citizens can benefit from the countrys entry into the global marketplace.

eficial projects that will contribute to Mongolias economic growth. As a result of its operations, the Bank has contributed to economic and social developments on the national and regional level. Going further, the bank will cooperate with various entities from the public and private sectors to contribute to the economic development of a humane and ecologically friendly society.

CORPORATE SOCIAL RESPONSIBILITY

037

Corporate Social Responsibility Review

The Bank has financed national projects and programs aimed at Mongolias development while taking consideration of environmental issues and organizing publicly oriented events.

The Bank employees have planted trees under Lets Plant Trees initiative at Shavi Complex school in Bayanzurkh District under plant and transfer agreement, where teachers and students will look after the trees.

To promote Mongolian culture, the Bank auctioned painter Ch.Khurelbaatar and sculpturist N.Sukhburens creations. The proceeds were later donated to good-cause activities for the youth. Financing Environmentally Friendly Developments to Foster Mongolias Economic Development: The Bank has allocated funds to projects in relation to their contribution to national development and usage of innovative green technology as well as generation of employment opportunities for national companies. The Bank did not put profits first and took associated risks for a holistic contribution to the national interest. The Bank has participated in the Open Government event organized by the Government along with all of the ministries to showcase economic and social contributions of strategic projects that are being financed by the Bank. Support for Humanitarian Activities: Employees have volunteered to participate in social events on a good will basis.

The employees have donated a days salary to rural herders to support their preparation ahead of the winter under Herders Day campaign.

DEVELOPMENT DeVeLoPment BANK banK OF MONGOLIA of monGoLia

ANNUAL REPORT 2012

038

038

FINANCIAL REVIEW

039

Financial Overview

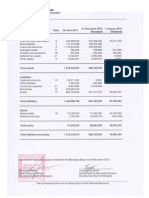

The Development Bank of Mongolia started operations in 2011 with total assets of MNT 76.9 billion and increased 11.5 times in 2012 to MNT 888.6 billion. In terms of total asset breakdown, 24.0 percent was cash, current accounts at Central Bank of Mongolia and commercial banks, 19.0 percent was deposits at commercial banks, 55.0 percent was loans provided to companies and 2.0 percent was other assets. Balance Sheet

1,000 888.6 800 600 489.7 400 200 0 Total Asset Loan Equity (MNT billion)

The Banks revenue generating assets increased from 12.0 percent in 2011 to 74.0 percent in 2012, which was a 62.0 percent increase, equal to MNT 647.7 billion. Bank has successfully started to finance projects of strategic importance in various sectors.

The Bank established its USD 600.0 million Euro Medium Term Note program and issued USD 20.0 million bond with 6 percent coupon in 2011, which was followed by successful public offering of 5 year USD 580.0 million bond with 5.75 percent coupon in 2012. The bank is planning to diversify its funding resources in 2013 by upsizing its current program or by establishing a new bond program and issuing bonds through public placement and/or public offering in international capital markets. The Banks assets have increased by a factor of nearly 30 since 2011 (36.0 percent of total assets) to MNT 820.7 billion in 2012 (92.0 percent of total assets). The Law on the Development Bank of Mongolia states that the Banks equity can consist of budget allocations and other resources. Operations started with equity equal MNT 16.7 billion and subsequently increased equity by MNT 33.0 billion in 2011 and MNT 23.6 billion in 2012, for a total of MNT 73.3 billion in equity at the end of 2012. The Bank had capital adequacy ratio of 8.2 percent. The Bank generated interest revenues of MNT 36.8 billion and paid interest expenses of MNT 37.7 billion in 2012. The net interest expense of MNT 0.9 billion was caused by a placement mismatch between funds raised and funds disbursed. The net before tax loss of MNT 8.3 billion incurred during the tax year was attributable to losses resulting from foreign currency exchange rate fluctuations on funds raised (MNT 5.7 billion or 69.0 percent of net loss) and other factors.

76.9 0

49.7

72.7

Profit and Loss Statement

2 0 -2 -4 -6 -8 -10 Net interest income -8.3 -0.67 -0.9 0.12 2011 2012

(MNT billion)

Profit and loss before taxes

DEVELOPMENT DeVeLoPment BANK banK OF MONGOLIA of monGoLia

ANNUAL REPORT 2012

040

040

INDEPENDENT AUDITORs REPORT

041

Deliotte Onch Audit LLC 4th floor, suite 409, Khukh Tenger Tower Peace Avenue 17, Sukhbaatar district, 1st khoroo Ulaanbaatar 14240, Mongolia Tel: +976-11-325852, +976-70120450 Fax: +976-11-329611, www.deloitte.com

INDEPENDENT AUDITORS REPORT To the Board of Members of Development Bank of Mongolia We have audited the accompanying financial statements of Development Bank of Mongolia (the Bank),which comprise the statement of financial position as at 31 December 2012, and the statement of comprehensive income, statement of changes in equity and statement of cash flows for the period then ended, and a summary of significant accounting policies and other explanatory information. Managements Responsibility for the Financial Statements Management is responsible for the preparation and fair presentation of these financial statements in accordance with International Financial Reporting Standards, and for such internal control as management determines is necessary to enable the preparation of financial statements that are free from material misstatement, whether or due to fraud or error. Auditors Responsibility Our responsibility is to express an opinion on these financial statements based on our audit. We conducted our audit in accordance with International Standards on Auditing. Those standards require that we comply with ethical requirements and plan and perform the audit to obtain reasonable assurance whether the financial statements are free from material misstatement. An audit involves performing procedures to obtain audit evidence about the amounts and disclosures in the financial statements. The procedures selected depend on the auditors judgment, including the assessment of the risks of material misstatement of the financial statements, whether due to fraud or error. In making those risk assessments, the auditor considers internal control relevant to the entitys preparation and fair presentation of the financial statements in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the entitys internal control. An audit also includes evaluating the appropriateness of accounting policies used and the reasonableness of accounting estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our audit opinion. Opinion In our opinion, the financial statements present fairly, in all material respects, the financial position of Development Bank of Mongolia as at 31 December 2012, and its financial performance and cash flows for the period then ended in accordance with International Financial Reporting Standards.

Deloitte Onch Audit LLC Ulaanbaatar, Mongolia May 7, 2013

DEVELOPMENT BANK OF MONGOLIA

ANNUAL REPORT 2012

042

DEVELOPMENT BANK OF MONGOLIA

15160 Ulaanbaatar, Chingeltei district UN Street 5/1, Government Building II Fax: 976-70130602, Tel: 701305013 http://www.dbm.mn , info@dbm.mn Date Ref 2013.05.07 2/253

STATEMENT BY EXCUTIVES

I, Kim Jang Jin is the Executive Director of Development Bank of Mongolia LLC (the Company)and Tuyachimeg Sevjid is the Chief Accountant, being the officers primarily responsible for the financial reporting of the Company , do hereby state that, in our opinion, the accompanying financial statements set out on pages 43 to 83 are drawn up in accordance with applicable International Financial Reporting Standards so as to give a true and fair view of the financial position of the Company as at December 31st, 2012 and of the results and the cash flows of the Company for the year then ended.

KIM JANG JIN EXECUTIVE DIRECTOR

TUYACHIMEG SEVJID HEAD OF ACCOUNTING DIVISION

INDEPENDENT AUDITORs REPORT

043

DEVELOPMENT BANK OF MONGOLIA NOTES TO FINANCIAL STATEMENTS AS AT AND FOR THE YEAR ENDED 31 DECEMBER 2012 (IN THOUSAND MONGOLIAN TUGRUGS)

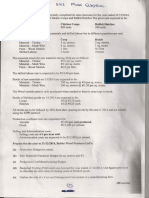

December 31 ASSETS Cash and balances at central banks Investments Loans and advances Accrued interest receivable Other current assets Property, Plant and Equipment, net Intangible assets, net Deferred tax asset 6 7 8 9 10 11 12 22 215,990,270 167,052,000 489,704,568 9,121,272 2,285,515 234,558 726,688 3,465,282 888,580,153 LIABILITIES AND EQUITY Liabilities Accounts and Other Liabilities Current account from customers Accrued interest payable Long-term debt Equity Share capital Retained earnings 17 73,300,000 (5,469,669) 67,830,331 888,580,153 49,700,000 (602,190) 49,097,810 76,860,194 15 14 13 3,425,135 6,960 12,896,260 804,421,467 820,749,822 1,139,593 102,400 26,520,391 27,762,384 66,709,512 9,000,000 108,233 3,667 182,563 811,286 44,933 76,860,194 Notes 2012 2011

The accompanying notes form an integral part of these financial statements.

DeVeLoPment banK of monGoLia

AnnUaL rePort 2012

044

DEVELOPMENT BANK OF MONGOLIA NOTES TO FINANCIAL STATEMENTS AS AT AND FOR THE YEAR ENDED 31 DECEMBER 2012 (IN THOUSAND MONGOLIAN TUGRUGS)

Interest income and similar income Interest expense and similar expense Net Interest (Expense)/Income Non-Interest Income Operating Income Operating Expenses Profit (Loss) Before Tax Income tax benefit Profit (Loss) for the Year Other comprehensive income Total comprehensive loss for the year

Notes 18 19

2012 36,787,338 (37,652,609) (865,271)

For the period from 12 May 2011 to 31 December 2011 253,433 (120,503) 132,930 132,930 780,053 (647,123) 44,933 (602,190) (602,190)

20

48,057 (817,214)

21

7,470,614 (8,287,828)

22

3,420,349 (4,867,479) (4,867,479)

The accompanying notes form an integral part of these financial statements

Notes Balance, May 12, 2011 Contribution from Government Profit (Loss) for the period Balance, December 31, 2011 Profit (Loss) for the year Additional contribution from Government Balance, December 31, 2012 1 1 Share Capital 49,700,000 49,700,000 23,600,000 73,300,000 Retained Earnings (602,190) (602,190) (4,867,479) - (5,469,669) Total 49,700,000 (602,190) 49,097,810 (4,867,479) 23,600,000 67,830,331

The accompanying notes form an integral part of these financial statements

INDEPENDENT AUDITORs REPORT

045

DEVELOPMENT BANK OF MONGOLIA NOTES TO FINANCIAL STATEMENTS AS AT AND FOR THE YEAR ENDED 31 DECEMBER 2012 (IN THOUSAND MONGOLIAN TUGRUGS)

Cash Flows from Operating Activities Profit (loss) for the period Adjustments for: Income tax expense Interest income Interest expense Loss (gain) from foreign exchange rate differences Depreciation and amortization (3,420,349) (36,787,338) 37,652,609 34,913,681 149,868 27,640,992 Change in loans and advances Change in other current assets Other cash payments Interest paid Interest received Net cash from (used) in operating activities Cash Flows from Investing Activities Purchase of fixed assets Purchase of intangible assets Net investment in time deposit Interest received Net cash from (used in) investing activities Cash Flows from Financing Activities Proceeds from borrowings Payment of borrowings Proceeds of capital from the government Net cash from (used in) financing activities Effects of exchange rate changes on cash Net Increase (Decrease) in Cash and Cash Equivalents Cash and Cash Equivalents, Beginning Cash and Cash Equivalents, End 769,717,076 (28,019,600) 23,600,000 765,297,476 20,232 149,280,758 66,709,512 215,990,270 25,497,955 49,700,000 75,197,955 509,036 66,709,512 66,709,512 (117,265) (158,410,070) 3,275,584 (155,251,751) (212,579) (840,732) (9,000,000) (10,053,311) (488,377,343) (2,281,848) 2,292,555 (488,366,636) (24,846,075) 24,786,520 (460,785,199) (44,933) (253,433) 120,503 515,463 59,462 (205,128) (3,667) 1,138,619 1,134,952 (19,192) 145,200 1,055,832 (4,867,479) (602,190)

2012

2011

DeVeLoPment banK of monGoLia

AnnUaL rePort 2012

046

DEVELOPMENT BANK OF MONGOLIA NOTES TO FINANCIAL STATEMENTS AS AT AND FOR THE YEAR ENDED 31 DECEMBER 2012 (IN THOUSAND MONGOLIAN TUGRUGS)

1. CORPORATE INFORMATION

The Development Bank of Mongolia (the Bank) is a Government-owned, policy-implemented statutory financial institution established on 25 March, 2011 pursuant to Resolution No. 195 dated 20 July, 2010 by the Government of Mongolia. The Bank conducts its business under the direct supervision of the Board of Directors by the Government, and is regulated, principally, by the Development Bank Law. The Bank commenced operations in May 2011. The Government of Mongolia is the Banks sole shareholder. In May and December 2011, the Government contributed MNT 16.7 billion and MNT 33.0 billion, respectively, in cash to the Banks capital. During 2012, the Government contributed a further MNT 23.6 billion and as at 31 December, 2012, the Banks share capital was 73.3 billion. In accordance with Article 21.1 of the Development Bank Law, Parliament determines the source and amount of equity financing the Government can provide to the Bank and determines the limits of loan guarantees to be provided by the Government. The executive management of the Bank is carried out by a joint team from the Bank and the Korean Development Bank. The Korean Development Bank was selected through an open international tender. The executive management of the Bank is carried out by a joint team from the Bank and the Korean Development Bank, which was selected through an open international tender, under the pursuant to Resolution No. 195 dated 20 July, 2010 by the Government of Mongolia. The Banks principal place of business is at Government Building 2, 5/1 United Nations Street, Ulaanbaatar 15160. The Bank had 46 employees during the year ended 31 December 2012 (2011: 38). These financial statements were approved for issue by the Board of Directors of the Bank on May 7, 2013. 2. FINANCIAL REPORTING FRAMEWORK AND BASIS OF PREPARATION AND PRESENTATION

Statement of Compliance The financial statements of the Bank have been prepared in accordance with International Financial Reporting Standards (IFRS), which includes all applicable IFRS, International Accounting Standards (IAS), and interpretations issued by the International Financial Reporting Interpretations Committee (IFRIC) and Standing Interpretations Committee (SIC). Basis of Preparation and Presentation The financial statements have been prepared on the historical cost basis except for certain financial instruments carried at amortized cost. Functional Currency These financial statements are presented in Mongolian tugrugs (MNT) the currency of the primary economic environment in which the Bank operates. 1. APPLICATION OF NEW AND REVISED INTERNATIONAL FINANCIAL REPORTING STANDARDS (IFRSs)

3.1 New and revised IFRSs affecting amounts reported in the current year (and/or prior years) For the year ended 31 December 2012, there were no new or revised IFRSs that affected either the reported financial performance and financial position or the presentation and disclosure. 3.2 New and revised IFRSs applied with no material effect on the financial statements The following new and revised IFRSs have been applied in the current year. The application of these new and revised IFRSs has not had any material impact on the amounts reported for the current and prior years but may affect the accounting for future transactions or arrangements.

INDEPENDENT AUDITORs REPORT

047

DEVELOPMENT BANK OF MONGOLIA NOTES TO FINANCIAL STATEMENTS AS AT AND FOR THE YEAR ENDED 31 DECEMBER 2012 (IN THOUSAND MONGOLIAN TUGRUGS)

Amendments IFRS 1 - Severe Hyperinflation1

The amendments regarding severe hyperinflation provide guidance for entities emerging from severe hyperinflation either to resume presenting IFRS financial statements or to present IFRS financial statements for the first time.

IFRS 1 - Removal of Fixed Dates for First-time Adopters1

The amendments regarding the removal of fixed dates provide relief to first-time adopters of IFRSs from reconstructing transactions that occurred before their date of transition to IFRSs.

IFRS 7 - Disclosures Transfers of Financial Assets1

The amendments to IFRS 7 increase the disclosure requirements for transactions involving transfers of financial assets. These amendments are intended to provide greater transparency around risk exposures of transactions where a financial asset is transferred but the transferor retains some level of continuing exposure in the asset.

IAS 12 - Deferred Tax -Recovery of Underlying Assets2

The amendment provides a presumption that recovery of the carrying amount of an asset measured using the fair value model in IAS 40 Investment Property will, normally, be through sale.

1 2

Effective for annual periods beginning on or after 1 July 2011. Effective for annual periods beginning on or after 1 January 2012.

DeVeLoPment banK of monGoLia

AnnUaL rePort 2012

048

DEVELOPMENT BANK OF MONGOLIA NOTES TO FINANCIAL STATEMENTS AS AT AND FOR THE YEAR ENDED 31 DECEMBER 2012 (IN THOUSAND MONGOLIAN TUGRUGS)

3. APPLICATION OF NEW AND REVISED INTERNATIONAL FINANCIAL REPORTING STANDARDS (IFRSs) (CONTD) 3.3 New and revised IFRSs in issue but not yet effective The Company has not applied the following new and revised IFRSs that have been issued but are not yet effective. IFRS 9 - Financial Instruments2 IFRS 9 issued in November 2009 introduces new requirements for the classification and measurement of financial assets. IFRS 9 amended in October 2010 includes the requirements for the classification and measurement of financial liabilities and for derecognition. Key requirements of IFRS 9 are described as follows: IFRS 9 requires all recognised financial assets that are within the scope of IAS 39 Financial Instruments: Recognition and Measurement to be subsequently measured at amortised cost or fair value. The most significant effect of IFRS 9 regarding the classification and measurement of financial liabilities relates to the accounting for changes in the fair value of a financial liability (designated as at fair value through profit or loss) attributable to changes in the credit risk of that liability. Changes in fair value attributable to a financial liabilitys credit risk are not subsequently reclassified to profit or loss. Previously, under IAS 39, the entire amount of the change in the fair value of the financial liability designated as at fair value through profit or loss was presented in profit or loss.

IFRS 10 - Consolidated Financial Statements1

IFRS 10 replaces the parts of IAS 27 Consolidated and Separate Financial Statements that deal with consolidated financial statements. SIC-12 Consolidation Special Purpose Entities has been withdrawn upon the issuance of IFRS 10. Under IFRS 10, there is only one basis for consolidation that is control. In addition, IFRS 10 includes a new definition of control that contains three elements: (a) power over an investee, (b) exposure, or rights, to variable returns from its involvement with the investee, and (c) the ability to use its power over the investee to affect the amount of the investors returns. Extensive guidance has been added in IFRS 10 to deal with complex scenarios.

IFRS 11- Joint Arrangements1

IFRS 11 replaces IAS 31 Interests in Joint Ventures. IFRS 11 deals with how a joint arrangement of which two or more parties have joint control should be classified. SIC-13 Jointly Controlled Entities Non-monetary Contributions by Venturers has been withdrawn upon the issuance of IFRS 11. Under IFRS 11, joint arrangements are classified as joint operations or joint ventures, depending on the rights and obligations of the parties to the arrangements. In contrast, under IAS 31, there are three types of joint arrangements: jointly controlled entities, jointly controlled assets and jointly controlled operations.

INDEPENDENT AUDITORs REPORT

049

DEVELOPMENT BANK OF MONGOLIA NOTES TO FINANCIAL STATEMENTS AS AT AND FOR THE YEAR ENDED 31 DECEMBER 2012 (IN THOUSAND MONGOLIAN TUGRUGS)

3. APPLICATION OF NEW AND REVISED INTERNATIONAL FINANCIAL REPORTING STANDARDS (IFRSs) (CONTD) 3.3 New and revised IFRSs in issue but not yet effective (Contd) IFRS 11- Joint Arrangements1 (Contd) In addition, joint ventures under IFRS 11 are required to be accounted for using the equity method of accounting, whereas jointly controlled entities under IAS 31 can be accounted for using the equity method of accounting or proportionate accounting.

IFRS 12 - Disclosure of Interests in Other Entities1