Professional Documents

Culture Documents

Sample Response - Midterm 1

Uploaded by

Mike PetersOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Sample Response - Midterm 1

Uploaded by

Mike PetersCopyright:

Available Formats

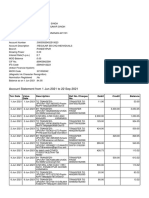

To :Trey Dobson, owner GMI From: CPA Re: accounting issues pertaining to GMI and fiscal year 2013

Users and objectives Trey Dobson is a user as the owner of GMI and objective is for the financials to be a true reflection of the business and to present the company as profitable since he is hoping to take the company public next year. Bank is a user as they have lent money to GMI. Their objective is to assess that GMI is in a financial position to certainly make its payments Investors are a user of the financial statements as they will be basing their decision to invest on the success of the company reflected in the f/s

Primary User and Objective The primary user is Trey Dovson, owner of GMI. He wants to take the company public and thus wants to present the company in a profitable light.

Constraints Accounting standard the company currently uses ASPE which is acceptable as a private company. However, now that there is intent to go public, it is recommended to adopt IFRS now so that the transition to a public company goes smooth next year. As a public company, you must adhere to IFRS and GAAP.

Conflicts: There is a potential conflict between the owner Trey Dobson and investors as they have opposite goals. As the owner of GMI, Trey Dobson will want to maximize the IPO when the company goes public and hence bias; where the investors will want to pay as little as possible when the company goes public. Issues: Coupons the issue here is how to account for coupons. Under IFRS if the item that is sold is still profitable after the redemption, then it is treated as a discount to the sale price. For example if an item sold with the $3 discount still generates a profit, then the sale price less than 3 is recorded as revenue. On the other hand, the item is sold at a loss after the $3 redemption then you will have to estimate a provision for the coupons. Given that the price of your items starts at $2.00 it is likely that some items sold will indeed not be profitable with the $3 redemption. Therefore you must estimate a provision as per IFRS to determine the amount coupon redemption. This estimate should be based on historical information if available.

Bank loan interest the issue here is whether the interest, or portion thereof, can be capitalized. Under IFRS interest can be capitalized for a qualifying asset. A qualifying asset is one in which it takes a substantial period of time to get it ready for its intended use. In this case, the kitchen and food storage facility is considered a qualifying asset as it took over six months to complete. As well, interest is permitted to be capitalized under IFRS if you have 1) Incurred borrowing costs which you did as you took out a bank loan for construction in sept 2013 2) Undertake activities to get asset ready for use which is evident as the facility was built and capitalized which began in November 2012. 3) Incurred expenses to get asset ready for use which presumably were incurred as construction materials, labour etc, would need to be paid for. Thus form the above, under IFRS, you would be permitted to capitalize a portion of the interest cost related to the bank loan for the construction of your new facility. Specifically, you could capitalize the interest for the month when construction was taking place, November and January through to March. Please note that since construction in December ceased, this month cannot capitalized. Therefore, interest for 5 months can be capitalized which equates to 28125 (1250000x15%x5/12). Overall this helps your bottom line as this amount is no longer expensed and essentially makes the company more attractive to investors. Red Apple Inc Investment the issue here is how to properly account for this investment. Currently if you continue to follow ASPE, this investment could be treated as an equity investment and valued at FV. Any gains or losses would subsequently be reported in your net income. Under IFRS this investment would also be valued at Fair Value. However you do have the option to declear the asset as fair value throught OCI investment. This would mean that any gains or losses on the investment are nto filtered through the income statement but rather through OCI. For reporting purposes this would present a truer picture on the income statement of the options of the core business. Flat fee membership the issue here is how to recognize the revenue derived from this arrangement. Under IFRS revenue is to be recognized once performance is complete, costs are measurable and collection is reasonably assured. In this case, given that you have already collected $250,000 it appreats that the balance of payment should be reasonably collectable. As well, with one year of the arrangement already completed, presumably you can reliably estimate the costs. However, given that this is a two-year contract, performance is not yet complete. Thus you need to continue to recognize revenue from this arrangement over time. It should be advisable to recognize half the income for 2013 from the contract, $350,000. For 2013. This will increase revenues and the bottom line, therefore making the company more attractive to potential investors. The second issue that pertains to this contract is whether or not it is considered on onerous contract whereby a loss on the value is being incurred by you. Specifically, are you incurring a loss by fulfilling this contract. You have indicated that membership fees dropped significantly as you did not anticipate the number of people who would use the gym to be so many. Therefore this contract would be considered

as onerous and you would need to provide for that loss as per IFRS on your financial statements. This would increase your expense and therefore your overall NI. Foreign exchange derivate the issue here is how to account for this investment. Under IFRS if you have identified a specific risk then you can use a derivative instrument to account for the hedge. Any gains/losses in the value of the derivative are shown through P&L. Alternatively, you can elect to use hedge accounting for this instrument if you have a formal risk strategy in place, have identified the specific risk and documented it as well expert to hedge against with the derivative. The difference in this case would be that the gains/losses from the derivative could be directly offset against the gains/ losses from the assets hedged. This would negate the impact to the financial statements. Lawsuit the issue here is whether or not a liability (provision) or a contingency item needs to be disclosed in this case. Depending upon the probability and whether or not the estimated settlement could reasonable be estimated would determine whether a provision or a liability is recorded. Under IFRS a provision is to be recorded if the probability is greater than 50%. In this case, given that your lawyers are suggesting a settlement be made and that some of the allegations are not unfounded, this would indicate the probability is at least 50% or greater. Therefore a provision for the lawsuit needs to be included in the financial statements. This will increase the liabilities of the firm and potentially deter some investors if there is a potential lawsuit that is probably going to result in a payout. As well, please note that under ASPE no provision is to be made, the item would only be disclosed in the financial notes. Financing options the issue here is determining which option is best given the current situation of GMI a) Issuing callable convertible pref shares which can be called back at the corporation options this option would be recorded as debt as the conversion is not necessarily mandatory since the shares can be called by the firm. The downside of this is that the d/e rather on the f/s worsens. This could be detrimental if you want to try to obtain additional financing and over for potential investors who may want a company that is not fully leveraged. Another negative to this option is that the dividends on preferred shares are to be paid first before any common shares that may be declared. b) Issuing redeemable shares, redeemable at the corporations option with an escalation clause (increasing annual rate). These shares would be recorded as equity themselves, but given the escalation clause, these are considered debt as it is unlikely that these shares would not be redeemed prior to the increase in annual rate. This would increase the d/e ratio and potentially deter investors if this ratio gets too high. Another downside is the fact that there is an escalation clause. If the company is unable to redeem the share then the interest penalty is significant. The rate is even higher in third year at 14%. An advantage to this is that the shares can be redeemed can this be used to buy back shares with a potential profit. c) Cumulative pref shares with 20% dividend. Cumulative means that these shares accumulate any dividends and must first be paid prior to any other dividends being distributed any time a dividend is declared. These shares would be classified as equity since there is no mandatory repayment of the principal amount required. This would improve your d/e ratio and make the company more attractive to potential investors. As well, pref shares normally do not have any

voting rights therefore you would retain more control of the company with this options. The downside is that the cumulative dividends do need to be paid prior to any other distribution of dividends to common shareholders. Overall, I would select the cumulative preferred shares as it would strategically fit best with your company.

Business issues Controller the issue here is that the fact that the controller quit 9 months ago and yet to be replaced. The controller is an integral position in any company and this position should be fulfilled as soon as possible. This will help to ensure that your records are managed in a professional and accounted for on a timely basis. Insurance coverage as the company has grown, the amount of insurance coverage needs to as well. It is apparent that the business does not have adequate investment in place to cover the potential lawsuit. It is prudent business practice to ensure adequate insurance is in place and thus to be recommend to address this immediately. Staff training given the company has grown significantly, it would appear that there maybe a breakdown in the training of stuff. This had led to this potential lawsuit. Thus it is advisable to review your procedures for employees and how they deal with the clientele. Method for accounting for taxes Currently GMI uses the taxes payable method to account for taxes. This was perfectly acceptable under ASPE. However, the issue here is that going forward, under IFRS the income statement or balance sheet approach must be used. The impact of this is that there is likely to be deferred tax asset or tax liability created that must be recorded and accounted for. Under ASPE if there was a DITL or DITA, it was classified as asset or non-current depending on the underlying instrument. However under IFRS, there is no choice and it must be recorded as current asset / liability. The impact is that this could potentially negatively impact the current ratio of the company if a liability is recorded and therefore decrease the attractive to investors.

You might also like

- GMI Case Trey DobsonDocument4 pagesGMI Case Trey DobsonMike PetersNo ratings yet

- Case: GMI, Trey DobsonDocument4 pagesCase: GMI, Trey DobsonMike PetersNo ratings yet

- Case: GMI, Trey DobsonDocument4 pagesCase: GMI, Trey DobsonMike PetersNo ratings yet

- IMSLP50626 PMLP30809 Dvorak Op045n1.TromboneDocument6 pagesIMSLP50626 PMLP30809 Dvorak Op045n1.TromboneMike PetersNo ratings yet

- East of The SunDocument1 pageEast of The SunMike PetersNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5782)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Lessee - Capital Lease Lessor - Direct Financing LeaseDocument4 pagesLessee - Capital Lease Lessor - Direct Financing LeaseFeruz Sha RakinNo ratings yet

- Employment Notice No 01-2021 (Administrative Post)Document14 pagesEmployment Notice No 01-2021 (Administrative Post)Rushikesh patelNo ratings yet

- AIMA Due Diligence Questionnaire 20160331Document27 pagesAIMA Due Diligence Questionnaire 20160331nyguy06100% (1)

- Case#14 Analysis Group10Document7 pagesCase#14 Analysis Group10Mohammad Aamir100% (1)

- Documents 143148.1550477SBM-Toolkit-2016 PDFDocument28 pagesDocuments 143148.1550477SBM-Toolkit-2016 PDFMOUDWE BIDJIKAMLANo ratings yet

- 1031 Exchanges Made Easy Second EditionDocument60 pages1031 Exchanges Made Easy Second EditionWalter FernandezNo ratings yet

- Fintech Industry in BDDocument13 pagesFintech Industry in BDAlvi HasanNo ratings yet

- Stocks Commodities PDFDocument64 pagesStocks Commodities PDFFernando Lopez100% (2)

- Template Intercompany LoanDocument4 pagesTemplate Intercompany LoanRosa Alia S. Mendoza-Martelino100% (2)

- CAF2-Tax Changes by FarazDocument2 pagesCAF2-Tax Changes by Farazbroken GMDNo ratings yet

- International Financial Management: Msc. Hoang Ngoc Nhu YDocument9 pagesInternational Financial Management: Msc. Hoang Ngoc Nhu YRose PhamNo ratings yet

- 2011 UBS Rogue Trader Scandal - Wikipedia-1Document30 pages2011 UBS Rogue Trader Scandal - Wikipedia-1RadityaNo ratings yet

- Ax2012 Enus Fini 09 Accounts Payable SetupDocument48 pagesAx2012 Enus Fini 09 Accounts Payable Setupnaveenkumar7754918No ratings yet

- Case StudiesDocument3 pagesCase StudiesdZOAVIT GamingNo ratings yet

- FMGHDocument3 pagesFMGHKeith Joanne SantiagoNo ratings yet

- Idx Monthly October 2021Document142 pagesIdx Monthly October 2021Trick UnikNo ratings yet

- US GAAP meaning and objectivesDocument2 pagesUS GAAP meaning and objectivesAshwini PrabhakaranNo ratings yet

- Circular Flow Model Explained in 40 CharactersDocument26 pagesCircular Flow Model Explained in 40 CharactersErra PeñafloridaNo ratings yet

- EPAP BrochureDocument21 pagesEPAP BrochureAbhishek BajpaiNo ratings yet

- Sales Budget in Units and in PesosDocument4 pagesSales Budget in Units and in PesosJeson MalinaoNo ratings yet

- 5.2. Investmnt-FunctionDocument21 pages5.2. Investmnt-FunctionAbhishek VermaNo ratings yet

- N 7 Venj S89 RJ 2 Z KCBDocument14 pagesN 7 Venj S89 RJ 2 Z KCBShoeb KhanNo ratings yet

- Insurance Code (RA No. 10607 Amending PD No. 612, As Amended)Document7 pagesInsurance Code (RA No. 10607 Amending PD No. 612, As Amended)Czar Ian AgbayaniNo ratings yet

- By Ben Carlson: The Only Rational Deployment of Our IgnoranceDocument33 pagesBy Ben Carlson: The Only Rational Deployment of Our IgnoranceBen CarlsonNo ratings yet

- Instant Download Ebook PDF Forensic Accounting and Fraud Examination 2nd Edition PDF ScribdDocument41 pagesInstant Download Ebook PDF Forensic Accounting and Fraud Examination 2nd Edition PDF Scribdmichael.cahill319100% (39)

- Solved Describe The Effects Damage Estimates Would Have On The FinancialDocument1 pageSolved Describe The Effects Damage Estimates Would Have On The FinancialAnbu jaromiaNo ratings yet

- Auditing - Evidence NotesDocument11 pagesAuditing - Evidence NotesrashmiajNo ratings yet

- O2C Cycle Accounting EntriesDocument3 pagesO2C Cycle Accounting Entriessudharsan49100% (1)

- HSBC Business ModelDocument12 pagesHSBC Business ModelSidra AhsanNo ratings yet

- Account Q1Document47 pagesAccount Q1Saurabh KumarNo ratings yet