Professional Documents

Culture Documents

26 USC6013 G

Uploaded by

rhouse_1Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

26 USC6013 G

Uploaded by

rhouse_1Copyright:

Available Formats

(g) Election to treat nonresident alien individual as resident of the United States (1) In general A nonresident alien individual

with respect to whom this subsection is in effect for the taxable year shall be treated as a resident of the United States (A) for purposes of chapter 1 for all of such taxable year, and (B) for purposes of chapter 24 (relating to wage withholding) for payments of wages made during such taxable year. (2) Individuals with respect to whom this subsection is in effect This subsection shall be in effect with respect to any individual who, at the close of the taxable year for which an election under this subsection was made, was a nonresident alien individual married to a citizen or resident of the United States, if both of them made such election to have the benefits of this subsection apply to them. (3) Duration of election An election under this subsection shall apply to the taxable year for which made and to all subsequent taxable years until terminated under paragraph (4) or (5); except that any such election shall not apply for any taxable year if neither spouse is a citizen or resident of the United States at any time during such year. (4) Termination of election An election under this subsection shall terminate at the earliest of the following times: (A) Revocation by taxpayers If either taxpayer revokes the election, as of the first taxable year for which the last day prescribed by law for filing the return of tax under chapter 1 has not yet occurred. (B) Death In the case of the death of either spouse, as of the beginning of the first taxable year of the spouse who survives following the taxable year in which such death occurred; except that if the spouse who survives is a citizen or resident of the United States who is a surviving spouse entitled to the benefits of section 2, the time provided by this subparagraph shall be as of the close of the last taxable year for which such individual is entitled to the benefits of section 2. (C) Legal separation In the case of the legal separation of the couple under a decree of divorce or of separate maintenance, as of the beginning of the taxable year in which such legal separation occurs. (D) Termination by Secretary At the time provided in paragraph (5). (5) Termination by Secretary The Secretary may terminate any election under this subsection for any taxable year if he determines that either spouse has failed (A) to keep such books and records, (B) to grant such access to such books and records, or (C) to supply such other information, as may be reasonably necessary to ascertain the amount of liability for taxes under chapter 1 of either spouse for such taxable year. (6) Only one election If any election under this subsection for any two individuals is terminated under paragraph (4) or (5) for any taxable year, such two individuals shall be ineligible to make an election under this subsection for any subsequent taxable year.

http://www.law.cornell.edu/uscode/text/26/6013

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- 0010a Kill Them With Paper WorkDocument21 pages0010a Kill Them With Paper Workrhouse_192% (12)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Jose Ferreira Criminal ComplaintDocument4 pagesJose Ferreira Criminal ComplaintDavid Lohr100% (1)

- Security Awareness TrainingDocument95 pagesSecurity Awareness TrainingChandra RaoNo ratings yet

- 1 - Instructions - Enforcement ProcessDocument5 pages1 - Instructions - Enforcement Processrhouse_1No ratings yet

- William Cooper HOTT Facts Expose of IRS Fraudulent RacketeeringDocument272 pagesWilliam Cooper HOTT Facts Expose of IRS Fraudulent Racketeeringrhouse_1No ratings yet

- 0001 Cheryl Wiker-Affirmation of National-As Amended 05.19.2014 PDFDocument4 pages0001 Cheryl Wiker-Affirmation of National-As Amended 05.19.2014 PDFrhouse_1No ratings yet

- Federalist Papers 15Document1 pageFederalist Papers 15rhouse_1No ratings yet

- 0001 When You Are BornDocument3 pages0001 When You Are Bornrhouse_1100% (2)

- Federalist Papers 15Document1 pageFederalist Papers 15rhouse_1No ratings yet

- DwightAvis-TaxVoluntaryDocument3 pagesDwightAvis-TaxVoluntaryrhouse_1No ratings yet

- Federal Jurisdiction Tax Question AnsweredfedjurisdictionDocument2 pagesFederal Jurisdiction Tax Question Answeredfedjurisdictionrhouse_1No ratings yet

- 26CFR1 871-1Document1 page26CFR1 871-1rhouse_1No ratings yet

- Avis Testimony Feb 53Document3 pagesAvis Testimony Feb 53rhouse_1No ratings yet

- Definition VoluntaryDocument1 pageDefinition Voluntaryrhouse_1No ratings yet

- LegalBasisForTermNRAlien PDFDocument0 pagesLegalBasisForTermNRAlien PDFmatador13thNo ratings yet

- Eye of The Eagle Volume 1 Number 5Document12 pagesEye of The Eagle Volume 1 Number 5rhouse_1No ratings yet

- 0002a Legisl Intent 16thaDocument3 pages0002a Legisl Intent 16tharhouse_1No ratings yet

- CDP Hearing RequestDocument4 pagesCDP Hearing Requestrhouse_1No ratings yet

- 0005b SampleaDocument1 page0005b Samplearhouse_1No ratings yet

- Steps To Terminate IRS 668 Notice of LienDocument10 pagesSteps To Terminate IRS 668 Notice of Lienrhouse_1100% (3)

- 0005c SamplebDocument1 page0005c Samplebrhouse_1No ratings yet

- Jurisdiction Is The Key FactorDocument6 pagesJurisdiction Is The Key Factorrhouse_1100% (1)

- Notary Verification: Andrea K GindeleDocument1 pageNotary Verification: Andrea K Gindelerhouse_1No ratings yet

- 0002a Legisl Intent 16thaDocument3 pages0002a Legisl Intent 16tharhouse_1No ratings yet

- Power Authority Power PointDocument7 pagesPower Authority Power Pointrhouse_1No ratings yet

- Gov Exists in Two FormsDocument2 pagesGov Exists in Two Formsrhouse_1100% (1)

- 9b Corp Political Society - PsDocument52 pages9b Corp Political Society - Psrhouse_1No ratings yet

- Mecanica Moderna Del Dinero PDFDocument50 pagesMecanica Moderna Del Dinero PDFHarold AponteNo ratings yet

- First Estate Comprehensive DiagramDocument1 pageFirst Estate Comprehensive Diagramrhouse_1No ratings yet

- Treatise SovereigntyDocument46 pagesTreatise Sovereignty1 watchman100% (1)

- 9 Natural Order - PsDocument53 pages9 Natural Order - Psrhouse_1100% (1)

- Lesson Plan Curriculum IntegrationDocument12 pagesLesson Plan Curriculum Integrationapi-509185462No ratings yet

- Um Tagum CollegeDocument12 pagesUm Tagum Collegeneil0522No ratings yet

- Lesson 2 - BasicDocument7 pagesLesson 2 - BasicMichael MccormickNo ratings yet

- Difference Between Reptiles and Amphibians????Document2 pagesDifference Between Reptiles and Amphibians????vijaybansalfetNo ratings yet

- Seryu Cargo Coret CoreDocument30 pagesSeryu Cargo Coret CoreMusicer EditingNo ratings yet

- AR Reserve Invoice - 20005152 - 20200609 - 094424Document1 pageAR Reserve Invoice - 20005152 - 20200609 - 094424shady masoodNo ratings yet

- FM - Amreli Nagrik Bank - 2Document84 pagesFM - Amreli Nagrik Bank - 2jagrutisolanki01No ratings yet

- Toms River Fair Share Housing AgreementDocument120 pagesToms River Fair Share Housing AgreementRise Up Ocean CountyNo ratings yet

- This PDF by Stockmock - in Is For Personal Use Only. Do Not Share With OthersDocument4 pagesThis PDF by Stockmock - in Is For Personal Use Only. Do Not Share With OthersPdffNo ratings yet

- Account Statement 2012 August RONDocument5 pagesAccount Statement 2012 August RONAna-Maria DincaNo ratings yet

- Wa0256.Document3 pagesWa0256.Daniela Daza HernándezNo ratings yet

- Analysis of Chapter 8 of Positive Psychology By::-Alan CarrDocument3 pagesAnalysis of Chapter 8 of Positive Psychology By::-Alan CarrLaiba HaroonNo ratings yet

- Letter of Appeal Pacheck Kay Tita ConnieDocument2 pagesLetter of Appeal Pacheck Kay Tita ConnieNikko Avila IgdalinoNo ratings yet

- Terminal Injustice - Ambush AttackDocument2 pagesTerminal Injustice - Ambush AttackAllen Carlton Jr.No ratings yet

- LAZ PAPER Ethics Ethical Conduct Challenges and Opportunities in Modern PracticeDocument15 pagesLAZ PAPER Ethics Ethical Conduct Challenges and Opportunities in Modern PracticenkwetoNo ratings yet

- Fundamentals of Accounting I Accounting For Manufacturing BusinessDocument14 pagesFundamentals of Accounting I Accounting For Manufacturing BusinessBenedict rivera100% (2)

- Department of Environment and Natural Resources: Niño E. Dizor Riza Mae Dela CruzDocument8 pagesDepartment of Environment and Natural Resources: Niño E. Dizor Riza Mae Dela CruzNiño Esco DizorNo ratings yet

- Principles of ManagementDocument107 pagesPrinciples of ManagementalchemistNo ratings yet

- Quotation 017-2019 - 01-07-2019Document8 pagesQuotation 017-2019 - 01-07-2019Venkatesan ManikandanNo ratings yet

- Municipal Development Plan 1996 - 2001Document217 pagesMunicipal Development Plan 1996 - 2001TineNo ratings yet

- Hymns by John Henry NewmanDocument286 pagesHymns by John Henry Newmanthepillquill100% (1)

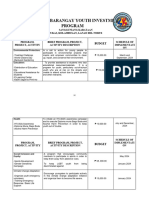

- Annual Barangay Youth Investment ProgramDocument4 pagesAnnual Barangay Youth Investment ProgramBarangay MukasNo ratings yet

- Luke 1.1-56 Intros & SummariesDocument8 pagesLuke 1.1-56 Intros & SummariesdkbusinessNo ratings yet

- Course SyllabusDocument9 pagesCourse SyllabusJae MadridNo ratings yet

- GAAR Slide Deck 13072019Document38 pagesGAAR Slide Deck 13072019Sandeep GolaniNo ratings yet

- Juarez, Jenny Brozas - Activity 2 MidtermDocument4 pagesJuarez, Jenny Brozas - Activity 2 MidtermJenny Brozas JuarezNo ratings yet

- Bài Tập Tiếng Anh Cho Người Mất GốcDocument8 pagesBài Tập Tiếng Anh Cho Người Mất GốcTrà MyNo ratings yet

- Nature of Vat RefundDocument7 pagesNature of Vat RefundRoselyn NaronNo ratings yet