Professional Documents

Culture Documents

Ninth

Uploaded by

Nishant RanjanCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ninth

Uploaded by

Nishant RanjanCopyright:

Available Formats

Cyber Laws (Including Information Technology Act, 2000) Lessons Plan 9th semester (2013-2014)

(1)Introduction Cyberspace vs. Physical space; Scope of Cyber Laws. (2)Components of Cyber Laws in India - Information Technology Act, 2000; Relevant provisions from Indian Penal Code, Indian Evidence Act, Bankers Book Evidence Act, Reserve Bank of India Act, etc. (3)Information Technology Act a brief overview; Documents or transactions to which IT Act shall not be applicable; meaning of Computer, Computer system and Computer network; E commerce; E governance; Concept of Electronic Signature; Concept of Cyber contraventions and Cyber Offences. (4)E- Contract legal provisions regulating the e contract with special reference to the provisions of IT Act, 2000. (5)Copyright issues in Cyberspace relevant provisions under Copyright Act, 1957 regulating copyright issues in Cyberspace; Online Software Piracy legal issues involved; Analysis of sufficiency of provisions of Copyright Act to deals with Online Software Piracy. (6)Trademark issues in Cyberspace Domain Name; Cyber squatting as a form of Domain Name dispute; Case law. (7) Concept of Cyber Crimes Cyber Contraventions & Cyber Offences (8) Study Of Some Specific Kinds Of Cyber Crimes(a) Unauthorised Access & Accessing the Protected System- meaning with reference to an idea of Cyber Hacking; the legal issues involved. (b) Introducing Computer contaminant or virus legal issues involved. (c) Denial Of Access To Authorised Person e.g.- Denial of Service (DoS) Attacks; E mail bombing legal issues involved. (d) Web jacking, Web Defacement & Salami Attacks - legal issues involved. (e) Cyber Defamation meaning; applicability of provisions of IPC; penal liabilities.

(f) Phishing a kind of online fraud; meaning; legal issues involved with reference to applicable provisions from IT Act, 2000. (g) Cyber Stalking - meaning; elements; applicable provisions from IT Act, 2000. (h) Cyber pornography meaning; relevant provisions from Constitution of India; relevant provisions from IPC; relevant provisions from IT Act; reported case law. (i) Cyber Terrorism meaning; various modes of committing Cyber terrorism; applicable provisions from IT Act. (9) Information Security Management System and other Security Compliances.

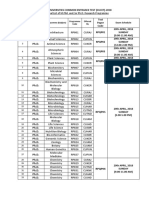

Cyber Law Project Topics - IX th Semester, Session - 2013 - 14 Sl No.

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24

Roll No.

301 303 304 305 306 307 308 309 310 311 313 314 315 317 318 319 320 321 322 323 324 325 326 328

Project Topics

Interface of Information Technology Law and Intellectual Property Laws Obscenity and Child Pornography - Applicability of Hicklin Test Cyber Crimes & Investigation procedures in India Cyber Cafes : Emerging as a New Tool for Cyber Offenders Concept of Electronic Signature with special reference to UNCITRAL Model Law on Electronic Signature Money laundering & IT Act, 2000 Blocking of Websites Disputes related with Online Contracts in Cyberspace Cyber Crimes and the IT Act, 2000 Hacktivism and Wikileaks : New Challenges to Cyberworld Applicability of IPC in Cyber Offences Judiciary on Cyber Jurisdiction Cracking, Phreaking, Whacking and Hacking : Legal issues Linking, Framing, Caching and Meta-tagging : Legal issues involved Domain Naming Disputes and approach of Indian Judiciary Computer Related Crimes & IT Act, 2000 Prevention of Cyber Hacking : International initiatives Software Piracy - A Study with special reference to Apple vs Samsung Controversy Obscenity and Child Pornography - Applicability of Hicklin Test Cyber Cafes : Emerging as a New Tool for Cyber Offenders Legal Consequences of Online Defamation Laws Applicale to Protection from Computer Virus Legal Issues involved in Net Banking -An Indian Perspective E-Mail Privacy Disputes

25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68

330 331 332 333 334 335 336 337 339 340 341 342 343 344 346 347 349 350 351 352 354 357 359 360 361 362 364 365 366 368 370 371 372 374 375 377 378 379 380 380(A) 3156 3212 3264 3279

Spoofing and Indian Laws Prevention and Control of Cyber terrorism : International initiatives Computer frauds and Abuse : An analysis Patent protection in the Cyberspace Tax issues relating to E - commerce and Internet Cyber Offences under the IT Act, 2000 Evidentiary issues in Cyber Laws Taxation of Digital Goods Provisions of Cybercontraventions under the IT Act, 2000 Internet Chatting & Socio - legal issues Cyber Crimes and Challenges to Criminal Justice System Cryptography and Stagnography Electronic Signature vis--vis IT Act, 2000 Laws relating to Privacy in the Online World : A Comparative Study Internet and Privacy Issues International Conventions on Cyber Crime : A Study Hacking - Its Different Modes and Legal Consequences Cyber Appellate Tribunals and its working Copyright Protection in the Digital age Trademark Law in Cyberspace Freedom of Expression in Cyberspace Various forms of Copyright Infringement in the Digital Environment E - Commerce initiatives in India Online Sale of Goods and Consumer Protection E - Evidences and their admissibility issues Unsolicited Commercial Communications and Spamming : A Critical Study E - Contracts - Legal challenges Electronic Signature and Encryption Internet a New platform for White Collar Crimes Copyright issues in Cyberspace Cyber Laws in India : A Critical Analysis of its Effectiveness Social Networking and Privacy Issues Privacy Law Jurisprudence and IT Act Data Protection Laws : An Analysis Patenting of Business Software Prevention of Cyberpornography and Legislative approach in India Cyber Stalking : A Socio Legal Study Human Right Issues in Cyberspace Role of Internet in the Growth of Economic Crimes : A Legal Analysis Privacy and Data Protection in Cyberspace E - Payment and Legal Challenges Interface of Information Technology Law and Intellectual Property Laws Principles applicable to Online Contract Contemporary challenges in Cyberspace

Investment and Security Law

Semester IX

Introduction and objective of the course: Today, Investment and security Law forms the heart of commercial Law. The economic development of any country has become intricately connected to the events in the security market. Also, the phenomenon of inter connectedness of securities markets across the world and consequently, uniformity in regulation in these countries, has become a norm. The following syllabus seeks to equip students with basic understanding of role of securities, security market, their regulation and their relation and impact on investment.

Syllabus 1. Historical Background of securities and investment laws 1.1. Securities: the concept 1.2. Historical evolution of securities, securities market and its regulation 1.3. India: from usury laws to the modern system

2. Securities: Kinds 2.1. Government Securities 2.2. Securities issued by banks 2.3. Securities issued by corporations 2.4. Securities in mutual fund and collective investment scheme 2.5. Depository receipts

3. Government Securities 3.1. Bonds issued by government and semi government institutions 3.2. Role of Central Bank (the RBI in India) 3.3. Impact of issuance of bonds on economy 3.4. Government loan from the general public 3.5. External borrowing 3.5.1. World Bank 3.5.2. I.M.F. 3.5.3. Asian Development Bank 3.5.4. Direct loan from foreign government. 3.6. Government loan: the constitutional dilemma and limitations 3.7. Can a state go for external loans? 3.8. Impact on economic sovereignty 3.9. Dilution of power of the Central Bank (RBI) 3.10. Treasury deposits

4. Securities Issued by Banks 4.1. Bank notes: is it the exclusive privilege of the Central Bank in the issue 4.2. Changing functions of banks from direct lending and borrowing to modern System 4.3. Bank draft, travellers' cheques, cheque cards, credit cards, cast cards 4.4. Deposits' nature: current, saving and fixed deposits, interest warrants

5. Corporate Securities 5.1. Shares 5.2. Debentures 5.3. Company deposits 5.4. Control over corporate securities 5.4.1. Central government: Company Law Board 5.4.2. SEBI: guide lines on capital issues 5.4.3. RBI 5.5. Protection of investor 5.5.1. Administrative regulation 5.5.2. Disclosure regulation 5.5.3. Protection by criminal sanction

6. Collective Investment 6.1. Unit Trust of India 6.2. Venture capital 6.3. Mutual fund 6.4. Control over issue and management of UTI, venture capital and mutual funds 6.5. Plantations and horti-culture farms 6.5.1. General control 6.5.2. Control by rating 6.5.3. Regulation on rating.

7. Depositories 7.1. Denationalized securities 7.2. Recognition of securities 7.3. Types of depository receipts: IDR, ADR, GDR and Euro receipts 7.4. SEBI guideline on depositories

8. Investment in non-banking financial institutions 8.1. Control by usury laws 8.2. Control by RBI 8.3. Regulation on non-banking financial and non-financial companies 8.3.1. Private-financial companies: registration and regulation 8.3.2. Chit funds

9. Foreign Exchange Control Regime in India 9.1 .Concept of foreign exchange regulation 9.2. Administration of exchange control

Suggested Text Books Avdhani. V.A, Himalaya Publishing House, 2005, Investment and Securities Markets in India. Khan. M. Y, Tata McGraw Hill Publication, 2009, Financial Services.

K.P.M. Sundaram, P.N.Varshney, Sultan Chand & Sons, Banking theory, Law and Practice Duttas banking law and Investments,

Suggested References Ranald C Michie, Thr Global Securities Market, a History, (2006), Oxford University Press Inc., New York Loss Louis, Seligman Joel and Paredes Troy, Securities Regulation (2006), Aspen Publishers Farrar, John, H. and Hanniyan, Brenda, Farrr's Company Law, (1998) Butterworths, London Gupta, S.N., the Banking Law in Theory and Practice, (1999) Universal, New Delhi. Tannan, M.L., Tannan's Banking Law and Practice in India, (2000) India Law House, New Delhi Ramaiya, A., Guide to the Companies Act, (1998) Wadhwa and Co., New Delhi. Bhandari, M.C., Guide to Company Law Procedures, (1996) Wadhwa and Co., New Delhi. Ford, Haj A.M., et. al. Ford's Principles of Corporations Law, (1999) Butterworths, London. Purithavathy Pandian, Vikas Publishing House, Delhi. Security Analysis and Portfolio Management. Kucchal. S.C, Chaitanya publishing House,21 st ed. Corporate Finance. Shekhar. K.C. Shekar Lekshmy, Vikas Publishing House, 20 th ed, Banking theory and Practice. Dr. S. Gurusamy, Tata McGraw Hill, 2009, Financial Markets and Institutions. Mithani.D.M, Himalaya Publishing House, Money banking, International trade and Public Finance. Singh Preeti, Himalya Publishing House, Investment management.

G.Vijayragvan Iyenger, Excel books, New Delhi, Introduction to Banking. Bholey. L. M, Financial Institutions and Markets.

Reading Material Compulsory: Tannans Banking Law, visit website of NSE, BSE, SEBI and NCFM Modules. Reference: Reading material from The Economic Times, Business Line, capital markets magazines, moneycontrol.com, Investment strategies for institutional investors and policies for foreign investors.

Investment and Security Law

IXth Semester

Project List Serial No. 1 2 3 4 5 6 7 8 Roll No. Project name 301 303 304 305 306 307 308 309 The Sub prime crisis in the US in 2008 and its impact Call Money markets Credit rating agencies and their regulation European sovereign debt crisis The Sahara India-Sebi dispute The Micro finance companies and their regulation Capital Bailouts and their impact A study of Participatory notes in governing the foreign investor in India

9 10 11 12 13 14

310 311 313 314 315 317

Commercial papers Merchant Bank: A critical analysis

Indian Derivatives Market and its regulation

Risk management Public issues by Insurance companies Anti Money laundering and combating financing of terrorism Repos as controlling factor in various issues and legal aspects Regulation of NBFCs Payment and settlement system FDI in Retail sector in India Corporate governance in financial sector Asian Development bank Interest rate structure and its genuineness in India Asset management companies Regulation of FII Insider Trading Commercial paper and certificate of Deposits Sovereign Debt

Securities and Exchange Board of India (Substantial Acquisition of shares and takeovers) Regulations. 2013 Securities and Exchange Board of India (Prohibition of Fraudulent and unfair trade practices relating to securities market) Regulations, 2003

15

318

16 17 18 19 20 21 22 23 24 25 26 27 28

319 320 321 322 323 324 325 326 328 330 331 332 333

29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51

334 335 336 337 339 340 341 342 343 344 346 347 349 350 351 352 354 357 359 360 361 362 364

Clearing corporations The Depositories Act 1996 Sovereign Wealth funds Dematerialisation Priority Sector Lending Investor protection Credit rating agencies and their role: a critical analysis NRI Investment in India Vodafone Investment in India and related issues Impact of Micro finance companies: a critical analysis Investment arbitration in India Credit facilities to minority communities Islamic Investment Banking FCCBs Employee Stock Option Scheme New Financial Instruments Sustainable development in Investment Law

Delisting of securities

Book building process Bombay Stock Exchange Euro Receipts Impact of borrowings from IMF Buy Back of Securities

52 53 54 55 56 57 58 59 60

365 366 368 370 371 372 374 375 377

Chit Funds Debenture Trustee Hedge Fund Impact of currency rate on investment Private equity Regulation of investment banks History of financial instruments Stock Market Impact of takeover regulation on corporate sector in India Forecasting and its impact on investment Index fund Ombudsman for security market Justice Wadhwa committee report on reallocation of shares in the matter of IPO irregularities India EU BTIA negotiations Portfolio management Small Investors Securitisation

61 62 63 64

378 379 380 380 (A)

65 66 67 68

3156 3212 3264 3279

You might also like

- Rahul Dutta Vs BPSC PDFDocument2 pagesRahul Dutta Vs BPSC PDFNishant RanjanNo ratings yet

- Rahul Dutta Vs BPSC PDFDocument2 pagesRahul Dutta Vs BPSC PDFNishant RanjanNo ratings yet

- Search Tips For Searching India Code: 1. BrowseDocument17 pagesSearch Tips For Searching India Code: 1. BrowseNishant RanjanNo ratings yet

- Likely D A NOV 2018Document1 pageLikely D A NOV 2018Nishant RanjanNo ratings yet

- 1445 2018 Judgement 23-Feb-2018Document35 pages1445 2018 Judgement 23-Feb-2018Nishant RanjanNo ratings yet

- Rahul Dutta Vs BPSC PDFDocument2 pagesRahul Dutta Vs BPSC PDFNishant RanjanNo ratings yet

- CalenderDocument2 pagesCalenderRaghu RamNo ratings yet

- UPSC CAPF AC Recruitment 2018Document14 pagesUPSC CAPF AC Recruitment 2018TopRankersNo ratings yet

- Exim Bank AODocument4 pagesExim Bank AODuma DumaiNo ratings yet

- Cucet 2017 LLM QP PDFDocument13 pagesCucet 2017 LLM QP PDFNishant RanjanNo ratings yet

- SSC Status Report of Result As On 20. 2. 2018Document4 pagesSSC Status Report of Result As On 20. 2. 2018TopRankersNo ratings yet

- Exim Bank Officers On Contract RecruitmentDocument3 pagesExim Bank Officers On Contract RecruitmentNimisha ChouhanNo ratings yet

- Probation of Offenders ActDocument52 pagesProbation of Offenders ActSaurav Khanna100% (2)

- The Probation of Offenders Act, 1958 A N - 20 1958Document5 pagesThe Probation of Offenders Act, 1958 A N - 20 1958kashif zafarNo ratings yet

- Professional Ethics and Professional Accounting SystemDocument40 pagesProfessional Ethics and Professional Accounting SystemDinesh Kumar N100% (1)

- Summary-Gist Criminal LawDocument29 pagesSummary-Gist Criminal LawNishant RanjanNo ratings yet

- What Is It Like To Work As Administrative Officer (AO) in Public Sector General Insurance Company in India - What Are The Career Opportunities Lie Ahead - QuoraDocument4 pagesWhat Is It Like To Work As Administrative Officer (AO) in Public Sector General Insurance Company in India - What Are The Career Opportunities Lie Ahead - QuoraNishant RanjanNo ratings yet

- Employment Opportunities in Insurance SectorDocument38 pagesEmployment Opportunities in Insurance SectorNishant RanjanNo ratings yet

- Probation of Offenders Act - Academike PDFDocument24 pagesProbation of Offenders Act - Academike PDFNishant RanjanNo ratings yet

- Do Insurance AO Jobs Give A Promising Career - QuoraDocument3 pagesDo Insurance AO Jobs Give A Promising Career - QuoraNishant RanjanNo ratings yet

- Professional EthicsDocument26 pagesProfessional EthicsRocky RanaNo ratings yet

- Legal Ethics by Kailash RaiDocument40 pagesLegal Ethics by Kailash RaiNishant Ranjan100% (2)

- Professional Cond 029273 MBPDocument274 pagesProfessional Cond 029273 MBPNishant RanjanNo ratings yet

- Probation of Offenders Act - Academike PDFDocument24 pagesProbation of Offenders Act - Academike PDFNishant RanjanNo ratings yet

- Summary-Gist Criminal LawDocument29 pagesSummary-Gist Criminal LawNishant RanjanNo ratings yet

- Program RPDocument8 pagesProgram RPNishant RanjanNo ratings yet

- Corruption in India PDFDocument10 pagesCorruption in India PDFNishant RanjanNo ratings yet

- Prevention of Corruption Act, 1988Document5 pagesPrevention of Corruption Act, 1988Nishant RanjanNo ratings yet

- Program PGDocument11 pagesProgram PGNishant RanjanNo ratings yet

- PGMQP PGQP02 PDFDocument13 pagesPGMQP PGQP02 PDFNishant RanjanNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- DMS 348 - FRM - VEET Accreditation Application Form - V2.0 - 20140303Document21 pagesDMS 348 - FRM - VEET Accreditation Application Form - V2.0 - 20140303Maruf Hasan NirzhorNo ratings yet

- Velamma - The Chief Guest - Episode 05Document31 pagesVelamma - The Chief Guest - Episode 05Lovejeet Brar67% (6)

- NCM 210 LECT - Ethical ConsiderationsDocument3 pagesNCM 210 LECT - Ethical ConsiderationsLYRIZZA LEA BHEA DESIATANo ratings yet

- Reputational Privacy and The Internet - A Matter For LawDocument389 pagesReputational Privacy and The Internet - A Matter For LawasmirgetsNo ratings yet

- Sample Discussion For Ethical Considerations Following The 10 DimensionsDocument16 pagesSample Discussion For Ethical Considerations Following The 10 DimensionsMaria Lorraine AninoNo ratings yet

- 2020 06 16 Bulletin-Brochure Rev 01 PagesDocument120 pages2020 06 16 Bulletin-Brochure Rev 01 PagesTaj MartinNo ratings yet

- A Good AmericanDocument5 pagesA Good AmericanJackNo ratings yet

- Team Code-001: 1 Asian Law College National Moot Court Competition 2020Document33 pagesTeam Code-001: 1 Asian Law College National Moot Court Competition 2020Anusha ReddyNo ratings yet

- Customer Authorization Form - EnglishDocument1 pageCustomer Authorization Form - EnglishsamNo ratings yet

- Professional Indemnity Proposal FormDocument9 pagesProfessional Indemnity Proposal FormCredsureNo ratings yet

- Glossary of Fingerprint TermsDocument4 pagesGlossary of Fingerprint Termsroncarl29No ratings yet

- FB Class ActionDocument57 pagesFB Class Actionjeff_roberts881100% (1)

- Freedom of Expression PDFDocument280 pagesFreedom of Expression PDFJane RexNo ratings yet

- CH 30Document15 pagesCH 30Aini ChNo ratings yet

- Column WritingDocument39 pagesColumn WritingCARLOS TIAN CHOW CORREOSNo ratings yet

- Twitter Complaint - Court StampedDocument73 pagesTwitter Complaint - Court StampedErin Fuchs100% (2)

- An Anthropological Analysis of Home InteriorsDocument14 pagesAn Anthropological Analysis of Home InteriorsJJ__martinezNo ratings yet

- ASM2 - Security - Dinh Tran Nam HungDocument12 pagesASM2 - Security - Dinh Tran Nam HungNguyen Hoang Long (FPI DN)No ratings yet

- What Is Cultural Sensitivity? Discover Definition & TheoryDocument14 pagesWhat Is Cultural Sensitivity? Discover Definition & TheoryLumina MoreNo ratings yet

- 2021 Guide in Accomplishing AAO FormsDocument12 pages2021 Guide in Accomplishing AAO FormsjhunNo ratings yet

- Intl Survey of Investment Adviser Regulation PhilsDocument88 pagesIntl Survey of Investment Adviser Regulation Philsfightingmaroon100% (1)

- Tech MahindraDocument4 pagesTech MahindraMohd EjazNo ratings yet

- Boost Admit Card - Bansal Classes PVT LTD - Kota (Rajasthan)Document1 pageBoost Admit Card - Bansal Classes PVT LTD - Kota (Rajasthan)Tauseef AnjumNo ratings yet

- Etec 565a Assignment One Kelly NicholsDocument11 pagesEtec 565a Assignment One Kelly Nicholsapi-21437117No ratings yet

- MailDocument1 pageMailhihi20230716No ratings yet

- KKMMI Application Form FINAL New LogoDocument2 pagesKKMMI Application Form FINAL New LogoKarlmarxjim Alburo100% (4)

- Interview Call Letter WiproDocument1 pageInterview Call Letter Wiprokoti4nammuNo ratings yet

- Imm 5645 eDocument2 pagesImm 5645 eArpon DebNo ratings yet

- Electronic Commerce ActDocument6 pagesElectronic Commerce ActJohn Rey BallesterosNo ratings yet

- Online Purchase Behaviour QuestionsDocument7 pagesOnline Purchase Behaviour QuestionsCarol SiiNo ratings yet