Professional Documents

Culture Documents

Departmental Accounting

Uploaded by

Robert HensonOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Departmental Accounting

Uploaded by

Robert HensonCopyright:

Available Formats

Departmental Accounting

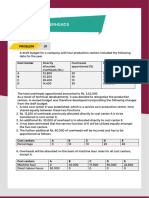

Illustration 1: Trading and Profit and Loss A/c. of G.E. Radio and Gramophone Equipment Co., for the six months ended 31.3.1988 is presented to you in the following form: Amt. Amt. Rs. Rs. Purchases : Sales: Radios (A) 140700 Radios (A) 150000 Gramophones(B) 90600 Gramophones(B) 100000 Spare Parts (C) 64400 Receipts from Spare Salaries and Wages 48000 Parts (C) 25000 Rent 10800 Stock on 31.3.85 Sundry Expenses 11000 Radios (A) 60100 Profit 34500 Gramophones(B) 20300 Spare Parts (C) 44600 400000 400000 Prepare Departmental Accounts for each of the three departments A, B, and C mentioned above after taking into consideration the following information: 1. Radios and Gramophones are sold at the showroom. Spare parts are sold at the workshop. 2. Salaries and Wages comprise as follows: Showroom , Workshop . It was decided to allocate the show room salaries and wages in the ratio of 1:2 between the Departments A and B. 3. The workshop Rent is Rs. 500 per month. The rent of the showroom is to be divided equally between the departments A and B. 4. Sundry expenses are to be allocated on the basis of the turnover of each department Illustration 2: M/s D, B, R carried on a business of drapers and Tailors in Sangli, D was in charge of Department A dealing in cloth B that of Department B, selling garments and R of Department C, the Tailoring section. It has been agreed that each of the three partners would receive 75% of the profits disclosed by the account of the department of which he was in charge and the balanced of the profits would be

shared in the proportions , , among D, B and R respectively. The following is the Trading and Profit and Loss A/c of the firm for the six months ended March 31st, 1986. Amt. Amt. Rs. Rs. To open Balance of Stock: By Sales: Cloth(A) 40000 Cloth(A) 180000 Readymade Readymade Garments(B) 130000 Garments(B) 24000 Tailoring/goods(C) 90000 Tailoring/goods(C) 20000 84000 By Discounts 800 To Purchases: By closing balance: Cloth(A) 140700 Cloth(A) 45100 Readymade garments(B) 80600 Readymade Garments(B) 22300 Tailoring/goods(C) 44400 Tailoring(C) 21600 To salaries and wages 48000 To advertisement 2400 To rent 10800 To discount allowed 1200 To sundry expenses 12000 To depreciation : Furniture and Fitting 750 To net profit 64950 489800 489800 After taking into consideration the following, prepare Departmental Accounts for each of the three departments and also prepare a profit and loss appropriation A/c to show the distribution of profit amongst the partners. 1. Cloth of the value of Rs. 10700 and other goods of the value of Rs. 600 were transferred and cost by departments A and B respectively to Department C. 2. Cloth and garments are sold in the showroom, Tailoring work is carried out at the workshop. 3. The details of salaries and wages were as follows: a) General Office 50 p.c., workshop 25 p.c.,(75 p.c. of which is for tailoring wages alone). b) Allocate General Office Expenses in the proportion 3:2:1 among the Depts. A, B, C c) Distribute showroom expenses in the proportion 1:2 between depts. A& B.

4. The workshop rent is Rs. 1000 per month. The rent of the general office and showroom is to be divided equally between the depts.. A & B. 5. Depreciation charges to be allotted equally among the three departments. 6. All other expenses are to be allocated on the basis of turnover of each department 7. Discount received are to be distributed amongst the three departments as follows: A. Rs. 400, B. Rs. 250, C. Rs. 150. Illustration 3: Tailors Ltd. have two departments A and B. the latter department gets all its requirements from the A department at the usual selling price. On December 31, 1988, the following was the trial balance: Dr. Cr. Rs. Rs. Share Capital 100000 Stock(A department) 40000 Stock(B department) 2500 Purchases-A 550000 Purchases-B 5000 Sales-A 625000 Sales-B 75000 Transfer of goods to B department 25000 25000 Directors Fees and remuneration 15000 Wages and salaries-A 10000 Wages and salaries-B 20000 Rent and rates(3/4 to A) 4000 Lighting(3/4 to B) 1000 Depreciation-B 2500 Depreciation-A 500 Office Expenses 1500 Furniture and fittings 10000 Office salaries 8000 Equipment 25000 Carriage Inwards(A) 33000 Investment 50000 Income from investments 5000 Cash at bank 27000

830000 830000 Closing stock of A on hand was rs. 48000 and that B amounted to rs. 3750. It is desired to ascertain profit or loss on strict accountancy principles. Illustration 4: From the following list of balance prepare Departmental trading and Profit and Loss Account for the year ended 31st March, 1986: Debit Credit Rs. Rs. Stock 1.4.85 Dept. A 17000 Dept. B 14500 Purchases Dept. A 35400 Dept. B 30200 Sales Dept. A 60800 Dept. B 51250 Wages Dept. A 8200 Dept. B 2700 Rent, Rates, Taxes and Insurance 9390 Sundry Expenses 3600 Salaries 3000 Light and heating 2100 Discount allowed 2220 Discounts received 650 Advertising 3680 Carriage Inwards 2340 Furniture, Plant and Machinery 24000 The following information is also provided: 1. Internal transfer of goods Dept. A to Dept. B Rs. 420. 2. The items rent, rates, taxes and insurance, sundry expenses, lighting and heating, salaries and carriage inwards to be apportioned 2/3 to dept. A and 1/3 to Dept. B. 3. Advertising to be apportioned equally. 4. Discount allowed and received are apportioned in the ratio of 60: 51 and 7:6 respectively. 5. Depreciation at 10% per annum on furniture and fittings, and on plant and machinery. Depreciation is to be charged 3/4to Dept. A and to Dept. B.

6. 7.

Services rendered by B Dept. to A Dept. including in wages Rs. 500. Stock as at 31.3.76 A Dept. Rs. 16740 and B Dept. Rs. 12050.

Illustration 5: The following balances have been extracted from the books of M/S Protone and Co. for the year ended 31st Dec 2003 having three departments K, S and M. partners A, B and C share profit and loss of the business in the ratio of 5:3:2. Amt. Rs Amt. Rs. Purchases : Salaries 36000 (Excluding InterCarriage Inward 6000 department transfers) Rent 9000 K 60000 Discount received 1200 S 40000 Discount allowed 2700 M 20000 Advertising 4500 Sales: Sundry expenses 6000 (Excluding InterDepreciation on Furniture department transfers) and Fixture 900 K 90000 Interest from Investments 10000 S 67500 Donations made 5000 M 45000 Interest on Loans paid 1000 Opening Stocks: K 19000 S 12000 M 10000 Closing Stocks: K 22900 S 8600 M 11000 Prepare Departmental Trading and Profit and Loss Account for the year ended 31st December, 1982 after taking into account the following: 1. Allocate the expenses in the following proportion: Dept. Dept. Dept. K S M i. Rent 4 4 1 ii. Salaries and Discount allowed: On the basis of outside sales. iii. Sundry Expenses: Equally amongst all the three departments. iv. Discount received: On the basis of purchases.

2. During the year, goods having cost price of Rs. 10200 and Rs. 800 were transferred from Department K and S respectively to Department M. Illustration 6: Akbarali Department Stores had three Departments X, Y and Z. the following particulars regarding the three Departments are given: Dept. X Dept. Y Dept. Z Rs. Rs. Rs. Opening Stock 40000 20000 60000 Purchases 110000 55000 220000 Sales 400000 300000 200000 Closing stock 24000 12000 240000 The following expenses were also incurred: Rs. General Expenses 24000 Rent, Rates, Taxes 18000 Commission received 9000 Discount allowed 27000 Sales Promotion Expenses 36000 Salesmans Salary 9000 Discount received 14000 Goods worth Rs. 10000 were transferred from Department X to Department Y. Goods worth Rs. 5000 were transferred from Department Z to Y. 1. Allocate General Expenses and Rent, Rates and Taxes equally between the three Departments. 2. Commission received is divided in the ratio of 3:2:1 between departments X, Y and Z respectively. Prepare Depatmental Trading and Profit and Loss Account allocating other expenses on appropriate basis. Illustration 7: Prepare Departmental Trading and Profit and Loss Account in columnar form of the three Departments of the Oasis ltd.: Departments T L O Rs. Rs. Rs. st Opening stock on 1 Jan, 1988 123840 101925 281163

Closing stock(31st Dec, 1988) 98520 131484 244878 Purchases during the year 631026 225888 417327 Returns outwards 43146 16887 5469 sales during the year 1200519 462555 1086567 Sales Returns Nil 9777 33651 Wages 218469 90252 73839 Goods were transferred from T Department to L Department Rs.1167 and to O Department Rs. 20037, from L Department to T Department Rs. 15945. Form O Department to T Department Rs. 12813 and to L Department Rs. 17403. The following expenditure has been apportioned to Department as shown below: T L O Rs. Rs. Rs. Stationery 921 921 921 Postage 663 663 663 General expenditure 13627 13627 13627 Insurance 1785 1785 1785 Depreciation 5460 5460 5460 Establishment Expenditure 83682 32331 74172 Bad Debts 26166 10110 23193 Advertisement 9627 3720 8532 Rent and Taxes 49569 24783 37176 Rent and Taxes for common space 8259 8262 8262 Illustration 8: From the following figures for the year 1988 prepare accounts to disclose total profit and the profit of the two departments X and Y: Rs. Opening Stock: X 13400 Y 11200 Purchases: X 73600 Y 71400 Sales X 113000 Y 90000 Sales Returns: X 3000 Y 2000 Carriage Inwards 2900 Salaries: X 8000 Y 7000

General Salaries Rent and Rates Advertising Insurance (for building) General Expenses Discount allowed Discount received The following further information is supplied: 1. General Salaries and General expenses are to be allocated equally. 2. The area occupied is in the ratio of 5:4. 3. The Closing Stock of the two departments were: X Rs. 20500 and Y Rs. 17600.

7500 5400 8100 1800 4500 2700 1450

Illustration 9: Spencers Stores has three departments: a) Cosmetics, b) Garments, and c) Confectionery. From the following data, prepare a Departmental Profit and Loss Account in columnar form for the year ended 31st March 1980: Amt. Amt. Rs. Rs. Rs. Rs. Purchases: Insurance 900 Cosmetics(A) 52800 Commission 3840 Garments(B) 43600 Delivery Expenses 2400 Confectionery(C) 34800 131200 Rent 4200 Sales: Discount received 1968 Cosmetics(A) 80000 Salaries 31500 Garments(B) 64000 Advertisement 1944 Confectionery(C) 48000 192000 Administration Exps. 7890 Opening Stock: Depreciation 2940 Cosmetics(A) 14600 Closing Stock: Garments(B) 11240 Cosmetics(A) 12400 Confectionery(C) 9120 34960 Garments(B) 8654 Confectionery(C) 9746 30800

All the expenses are to be apportioned equally between the three departments, except the following: a) Delivery Expenses : In proportion to Sales, b) Commission : 2% of Sales, c) Salaries and Insurance in proportion of 6:5:4. d) Discount received: 1.5% of Purchases. Illustration 10: The following balances as at 31st December, 1988 are extracted from the books of Industrial Products Co. Ratnagiri consisting of the departments P and Q. Dept. P Dept. Q Total Rs. Rs. Rs. Sales(finished goods) 400000 600000 1000000 Purchases(Raw materials) 140000 377000 517000 Manufacturing wages 80000 100000 180000 Factory overhead 48000 60000 108000 Stock(Raw Material) 1.1.88 50000 65000 115000 Purchases Returns(Raw Materials) 6000 4000 10000 Sales Returns(finished) 2000 1000 3000 Sundry debtors 150000 Sundry Creditors 90000 Plant and Machinery 45000 Furniture and Fittings 9000 Salaries 60000 Office Expenses 36000 Capital 200000 Cash in hand and at Bank 77000 Plant and Machinery is to be depreciated at 12 % and Furniture and Fittings at 10%. Debts standing in the books at Rs. 1000 are to be written off as bad, and a reserve of 2 % to be made for doubtful debts. Factory overheads (including depreciation on plant and machinery) is to be allocated in the ratio of manufacturing wages, salaries, office expenses and depreciation on furniture and fittings and other debits to profit and loss account are to be allocated in the ratio 2:3 The closing stock(raw material) was valued: P Department Rs. 56000 and Q Department Rs. 70000.

Prepare Trading and P & L A/c for the year ended 31st December 1988 for the two departments separately as well as for the entire business in a columnar form and a balance sheet as on that date. All the financial stock produced was sold.

You might also like

- 7056 ESG ReportDocument44 pages7056 ESG Reportfrancis280No ratings yet

- Final Accounts ProblemDocument21 pagesFinal Accounts Problemkramit1680% (10)

- OG1 9 Branch AccountingDocument25 pagesOG1 9 Branch AccountingsridhartksNo ratings yet

- Single Entry System Assignment +1Document10 pagesSingle Entry System Assignment +1Gautam KhanwaniNo ratings yet

- Conversion of Partnership Firm Into CompanyDocument8 pagesConversion of Partnership Firm Into CompanyAthulya MDNo ratings yet

- Departmental AccountingDocument6 pagesDepartmental AccountingAmit KumarNo ratings yet

- Chapter - 7 Departmental Accounting: Mark-Up Accounting Journal EntriesDocument17 pagesChapter - 7 Departmental Accounting: Mark-Up Accounting Journal EntriesAyush AcharyaNo ratings yet

- Kakasuleff, Chris - Predicting Market Trends Using The Square of 9Document4 pagesKakasuleff, Chris - Predicting Market Trends Using The Square of 9Mohamed ElAgamy100% (4)

- Final AccountsDocument9 pagesFinal AccountsBhuvaneshwari Palani0% (2)

- Laundry ServicesDocument40 pagesLaundry ServicesVivek VardhanNo ratings yet

- G1 6.4 Partnership - Amalgamation and Business PurchaseDocument15 pagesG1 6.4 Partnership - Amalgamation and Business Purchasesridhartks100% (2)

- Journalizing TransactionsDocument38 pagesJournalizing TransactionsPratyush mishraNo ratings yet

- Department Accounts - SolutionDocument17 pagesDepartment Accounts - Solution203 596 Reuben RoyNo ratings yet

- Branch AccountsDocument12 pagesBranch AccountsRobert Henson100% (1)

- Departmental Acc.Document22 pagesDepartmental Acc.Somsindhu Nag100% (2)

- Coc Departmental Accounting Ca/Cma Santosh KumarDocument11 pagesCoc Departmental Accounting Ca/Cma Santosh KumarAyush AcharyaNo ratings yet

- Department AccountsDocument14 pagesDepartment Accountsjashveer rekhiNo ratings yet

- Hire Purchase Notes 10 YrDocument80 pagesHire Purchase Notes 10 YrLalitKukreja100% (2)

- 3 Departmental AccountsDocument13 pages3 Departmental AccountsJayesh VyasNo ratings yet

- 5 Debenture Material3619080524732228932Document14 pages5 Debenture Material3619080524732228932Prabin stha100% (1)

- Group - I Paper - 1 Accounting V2 Chapter 13 PDFDocument13 pagesGroup - I Paper - 1 Accounting V2 Chapter 13 PDFjashveer rekhiNo ratings yet

- Departmenatal AccountsDocument4 pagesDepartmenatal Accountsmanjunatha TKNo ratings yet

- Chapter 4 Overhead ProblemsDocument5 pagesChapter 4 Overhead Problemsthiluvnddi100% (1)

- Fin Account-Sole Trading AnswersDocument10 pagesFin Account-Sole Trading AnswersAR Ananth Rohith BhatNo ratings yet

- Costing AssignmentDocument15 pagesCosting AssignmentSumit SumanNo ratings yet

- Chapter # 6 Departmental AccountDocument36 pagesChapter # 6 Departmental AccountRooh Ullah KhanNo ratings yet

- PT 06 (Partnership) (5 Dec)Document8 pagesPT 06 (Partnership) (5 Dec)Rajesh Kumar100% (1)

- Insurance Company Final AccountsDocument17 pagesInsurance Company Final AccountsKirti_Bhatia_5739No ratings yet

- 5 Accounting Problems On RoyaltiesDocument16 pages5 Accounting Problems On RoyaltiesHakim JanNo ratings yet

- DepartmentalDocument17 pagesDepartmentalPapiya DeyNo ratings yet

- Practical Question For Final AccountsDocument2 pagesPractical Question For Final AccountsAmit Sinha100% (3)

- Chapter 8 Operating CostingDocument13 pagesChapter 8 Operating CostingDerrick LewisNo ratings yet

- Partnership PDFDocument28 pagesPartnership PDFBasant OjhaNo ratings yet

- Branch Account Problems & AnswerDocument11 pagesBranch Account Problems & Answeranand dpiNo ratings yet

- Revision Test Paper: Cap-Ii: Advanced Accounting: QuestionsDocument158 pagesRevision Test Paper: Cap-Ii: Advanced Accounting: Questionsshankar k.c.No ratings yet

- Underwriting of Shares & Debentures - CWDocument32 pagesUnderwriting of Shares & Debentures - CW19E1749 BALAJI MNo ratings yet

- Study Note 4.2, Page 169-197Document29 pagesStudy Note 4.2, Page 169-197s4sahith0% (1)

- Capinew Account June13Document7 pagesCapinew Account June13ashwinNo ratings yet

- II Sem-IV Problems of Farm AccountingDocument7 pagesII Sem-IV Problems of Farm AccountingAniket BhojaneNo ratings yet

- Worksheet For Issue of Share and DebentureDocument2 pagesWorksheet For Issue of Share and DebentureLaxmi Kant SahaniNo ratings yet

- CA IPCC Branch AccountsDocument19 pagesCA IPCC Branch AccountsAkash Gupta75% (4)

- Accountancy Question BankDocument146 pagesAccountancy Question BankSiddhi Jain100% (1)

- 5 6168179598107345065Document14 pages5 6168179598107345065Madhan Aadhvick0% (1)

- 3 Pre - PostDocument7 pages3 Pre - PostParul Bhardwaj VaidyaNo ratings yet

- 02 Per. Invest 26-30Document5 pages02 Per. Invest 26-30Ritu SahaniNo ratings yet

- 6 Sem Bcom - Management Accounting PDFDocument71 pages6 Sem Bcom - Management Accounting PDFaldhhdNo ratings yet

- From The Following Summary of Cash Account of X LTDDocument2 pagesFrom The Following Summary of Cash Account of X LTDLysss EpssssNo ratings yet

- 1st Semester Accounts Selected Question PDFDocument32 pages1st Semester Accounts Selected Question PDFVernon Roy100% (1)

- 11 CaipccaccountsDocument19 pages11 Caipccaccountsapi-206947225No ratings yet

- 3246accounting - CA IPCCDocument116 pages3246accounting - CA IPCCPrashant Pandey100% (1)

- Operating CostingDocument13 pagesOperating CostingJoydip DasguptaNo ratings yet

- Consignment AccountsDocument6 pagesConsignment AccountsMadhura Khapekar30% (10)

- Xii Mcqs CH - 4 Change in PSRDocument4 pagesXii Mcqs CH - 4 Change in PSRJoanna GarciaNo ratings yet

- Valuation of GoodwillDocument6 pagesValuation of GoodwillPrasad NaikNo ratings yet

- Marginal Costing and Its Application - ProblemsDocument5 pagesMarginal Costing and Its Application - ProblemsAAKASH BAIDNo ratings yet

- As 11 Question 12 SolutionDocument3 pagesAs 11 Question 12 SolutionDebjit Raha100% (1)

- Study Note 4.3, Page 198-263Document66 pagesStudy Note 4.3, Page 198-263s4sahithNo ratings yet

- M/s Alag Pre Post SolutionDocument2 pagesM/s Alag Pre Post SolutionAyush VermaNo ratings yet

- Cash Flow StatementDocument2 pagesCash Flow StatementAmolsKordeNo ratings yet

- Department AccountsDocument9 pagesDepartment Accountssridhartks100% (1)

- 11 DepartmentalDocument15 pages11 DepartmentalBharat ThackerNo ratings yet

- DU B.com (H) First Year (Financial Acc.) - Q Paper 2010Document7 pagesDU B.com (H) First Year (Financial Acc.) - Q Paper 2010mouryastudypointNo ratings yet

- Fund Flow StatementDocument4 pagesFund Flow Statementsoumya_2688No ratings yet

- IPCC Cost - Kol73cck4annhfcjovu6Document17 pagesIPCC Cost - Kol73cck4annhfcjovu6aryanraghuvanshi758No ratings yet

- Investment AccountsDocument4 pagesInvestment AccountsMadhura KhapekarNo ratings yet

- Management AccountingDocument3 pagesManagement AccountingRobert HensonNo ratings yet

- Marketing ManagementDocument1 pageMarketing ManagementRobert HensonNo ratings yet

- Single SystemDocument7 pagesSingle SystemRobert HensonNo ratings yet

- Hire Purchase SystemDocument4 pagesHire Purchase SystemMadhura KhapekarNo ratings yet

- Royalty AccountsDocument5 pagesRoyalty AccountsRobert Henson100% (2)

- Installment Purchase SystemDocument1 pageInstallment Purchase SystemRobert HensonNo ratings yet

- Computer SoftwareDocument1 pageComputer SoftwareMadhura KhapekarNo ratings yet

- AmalgamationDocument4 pagesAmalgamationMadhura KhapekarNo ratings yet

- Cma Q. PaperDocument2 pagesCma Q. PaperRobert HensonNo ratings yet

- Struktur Organisasi Personil OC-2 KOTAKU SumutDocument1 pageStruktur Organisasi Personil OC-2 KOTAKU SumuttomcivilianNo ratings yet

- QH1133Document8 pagesQH1133Whitney KellyNo ratings yet

- GlobalChallengesandtheRoleofCivilEngineering Bled2011 Springer PDFDocument11 pagesGlobalChallengesandtheRoleofCivilEngineering Bled2011 Springer PDFsaurav rajNo ratings yet

- FAR1 ASN02 Financial Transaction WorksheetDocument2 pagesFAR1 ASN02 Financial Transaction WorksheetPatricia Camille AustriaNo ratings yet

- Management In: Verification NeededDocument12 pagesManagement In: Verification NeededLakshanmayaNo ratings yet

- Phiếu Giao Bài Tập Số 3Document3 pagesPhiếu Giao Bài Tập Số 3Phạm Thị Thúy HằngNo ratings yet

- 1 Principles of TaxationDocument11 pages1 Principles of TaxationDiana SheineNo ratings yet

- HRM Assignment 1Document5 pagesHRM Assignment 1Laddie LMNo ratings yet

- Chapter 11 Regaining Customer Confidence Through Customer Service and Service RecoveryDocument24 pagesChapter 11 Regaining Customer Confidence Through Customer Service and Service Recoverymarco delos reyesNo ratings yet

- Allwyn Nissan Group 8Document58 pagesAllwyn Nissan Group 8Jayesh VasavaNo ratings yet

- Running Head: Business Ethics - Week 5 Assignment 1Document4 pagesRunning Head: Business Ethics - Week 5 Assignment 1MacNicholas 7No ratings yet

- Case Study - DaburDocument1 pageCase Study - DaburMonica PandeyNo ratings yet

- Tom Brass Unfree Labour As Primitive AcumulationDocument16 pagesTom Brass Unfree Labour As Primitive AcumulationMauro FazziniNo ratings yet

- ResearchesDocument29 pagesResearchesGani AnosaNo ratings yet

- UTS Bahasa Inggris Nanda Pratama Nor R 202210100087Document4 pagesUTS Bahasa Inggris Nanda Pratama Nor R 202210100087Nanda Pratama Nor RochimNo ratings yet

- Measure Progress Using Working HoursDocument3 pagesMeasure Progress Using Working HoursLaiqueShahNo ratings yet

- November 2021 Recent Opportunities - 1Document42 pagesNovember 2021 Recent Opportunities - 1shiv vaibhavNo ratings yet

- Hamburg Eco City and The Creative Inustrial CoDocument3 pagesHamburg Eco City and The Creative Inustrial CoEvan SchoepkeNo ratings yet

- Công Ty DHGDocument83 pagesCông Ty DHGThu Hoai NguyenNo ratings yet

- AE12 Module 1 Economic Development A Global PerspectiveDocument3 pagesAE12 Module 1 Economic Development A Global PerspectiveSaclao John Mark GalangNo ratings yet

- A Study of Impact of Macroeconomic Variables On Performance of NiftyDocument3 pagesA Study of Impact of Macroeconomic Variables On Performance of NiftyMamta GroverNo ratings yet

- A Case Study and Presentation of TATA NANODocument11 pagesA Case Study and Presentation of TATA NANOK Y RajuNo ratings yet

- MODULE 8 Learning ActivitiesDocument5 pagesMODULE 8 Learning ActivitiesChristian Cyrous AcostaNo ratings yet

- LDYKhE9pQcmnLVhrrdpW Solve Earth Intro Course 4.0Document14 pagesLDYKhE9pQcmnLVhrrdpW Solve Earth Intro Course 4.0Jose M TousNo ratings yet

- Irrelevant-Potential Socio-Economic Implications of Future Climate Change and Variability For Nigerien Agriculture-A Countrywide Dynamic CGE-Microsimulation AnalysisDocument15 pagesIrrelevant-Potential Socio-Economic Implications of Future Climate Change and Variability For Nigerien Agriculture-A Countrywide Dynamic CGE-Microsimulation AnalysisWalaa MahrousNo ratings yet

- Section 5 QuizDocument14 pagesSection 5 QuizSailesh KattelNo ratings yet