Professional Documents

Culture Documents

AKD Daily Sep 05 2013

Uploaded by

trillion5Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

AKD Daily Sep 05 2013

Uploaded by

trillion5Copyright:

Available Formats

AKD Securities Limited

Member Karachi Stock Exchange

Equity Research / Pakistan

Todays Daily

BAFL: TP revised to PkR24.50/share

Following inline earnings of PkR1.94bn (EPS: PkR1.44) in 1HCY13 we keep our EPS estimates for CY13F largely unchanged at PkR2.73 but factor in higher interest rates next year for an EPS of PkR3.38 in CY14F, which would represent robust 22%YoY growth. Together with rollover onto CY14F, this raises our target price for BAFL to PkR24.50/share which offers attractive upside of 18%. Our bullish premise is based upon a projected 20% NPAT CAGR across CY13FCY18F, driven by higher NII, lower credit costs and gradual realization of scale efficiencies. Further upside can emerge from potential divestment of Warid Telecom where BAFL has already completely written down its investment in the same. Having gained 24%CYTD (vs. a 29%CYTD return by the KSE-100), BAFL trades at a CY14F P/B of 0.85x, P/E of 6.2x and D/Y of 9.6%. We believe these are attractive valuations which are gradually set to re-rate as BAFL's ROE converges to levels posted by the larger, private banks. Accumulate!

KSE 100 - Index Current Previous Chg. 21,875.83 21,808.48 0.31%

Mkt Cap. (PkRbn/US$bn) Current Previous Chg. 5,423 / 51.69 5,417 / 51.63 0.11%

Daily Turnover (mn) Current Previous Chg. 149.49 169.48 -11.8%

Thursday, September 05, 2013

AKD Daily

Value Traded (PkRmn/US$mn) Current Previous Chg. 5,615 / 53.52 5,996 / 57.15 -6.4%

SCRA Flow FYTD (US$mn)

News and Views

IMF has approved a 3-yr US$6.68bn loan for Pakistan equal to 435% of Pakistan's quota. The program will allow the IMF to make an initial disbursement of US$544mn. The rest of the payments will be spread out evenly over the next three years and will be made on quarterly basis. In the amended notice issued by the KSE yesterday regarding the result of DGKC, the company announced a capacity expansion of 2.6mn tons per annum at Hub District. Moreover, the company has also said that they are abandoning plans for investment in Mozambique due to lack of infrastructure required to set up the plant. CCP has raised objections about the capacity tax levied on aerated beverages manufacturers. According to the CCP this will put small manufacturers at a disadvantage. In this regard, CCP has urged the government to withdraw the capacity tax.

3-Sep-13 2-Sep-13 Val. Chg

60.35 60.88 (0.53)

(mn) 800 700 600 500 400 300 200 100 0 Sep-12 May-13

(Index) 26,000 24,000 22,000 20,000 18,000 16,000 14,000 12,000 Sep-13 Dec-12 Mar-13 Jan-13 Oct-12 Apr-13 Jul-13

Volume (LHS)

KSE-100 Index

Raza Jafri, CFA raza.jafri@akdsecurities.net

UAN:111-253-111 Ext: 693

Important disclosures, including investment banking relationships and analyst certification at end of this report. AKD Securities does and seeks to do business with companies covered in its research reports. As a result, investors should be aware that the firm may have a conflict of interest that could affect the objectivity of the report. Investors should consider this report as only a single factor in making their investment decision.

Find AKD research on Bloomberg (AKDS<GO>), firstcall.com and Reuters Knowledge UAN: 111-253-111

Copyright2013 AKD Securities Limited. All rights reserved. The information provided on this document is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation or which would subject AKD Securities or its affiliates to any registration requirement within such jurisdiction or country. Neither the information, nor any opinion contained in this document constitutes a solicitation or offer by AKD Securities or its affiliates to buy or sell any securities or provide any investment advice or service. AKD Securities does not warrant the accuracy of the information provided herein.

www.akdsecurities.net

AKD Securities Limited

Member Karachi Stock Exchange

BAFL: TP revised to PkR24.50/share

Following inline earnings of PkR1.94bn (EPS: PkR1.44) in 1HCY13 we keep our EPS estimates for CY13F largely unchanged at PkR2.73 but factor in higher interest rates next year for an EPS of PkR3.38 in CY14F, which would represent robust 22%YoY growth. Together with rollover onto CY14F, this raises our target price for BAFL to PkR24.50/share which offers attractive upside of 18%. Our bullish premise is based upon a projected 20% NPAT CAGR across CY13F-CY18F, driven by higher NII, lower credit costs and gradual realization of scale efficiencies. Further upside can emerge from potential divestment of Warid Telecom where BAFL has already completely written down its investment in the same. Having gained 24%CYTD (vs. a 29%CYTD return by the KSE-100), BAFL trades at a CY14F P/B of 0.85x, P/E of 6.2x and D/Y of 9.6%. We believe these are attractive valuations which are gradually set to re-rate as BAFL's ROE converges to levels posted by the larger, private banks. Accumulate! Improving asset quality: BAFL's NPL stock came off by 10%QoQ to PkR21.5bn in 2QCY13 with coverage pushed up to 69%, the highest level in 2yrs. Going forward, we continue to see improvement in asset quality with a declining NPL ratio to be supplemented by higher coverage (we factor in 80%+ coverage by end-CY15F). This should still result in declining credit costs over the mediumterm. In addition, Warid investment has already been completely written down. Some concerns on costs: After increasing at a CAGR of 40% across CY03CY08 (rapid branch expansion phase), core admin expenses have grown at a more sedate 12% CAGR since then. However, with management eyeing a 40% increase in branches to 700 by end-CY15F, there is a risk that the Cost/Income ratio may remain high. While we believe incremental staffing may remain light (core workforce has remained flat at 7k-7.5k, even as branches have doubled to more than 470 over the last 5yrs), we conservatively expect the Cost/Income ratio to remain in excess of 60% of the next 5yrs even as we build in gradual improvement. Payout capability: BAFL's CAR has improved by ~90bps YoY to 12.64% at present with management indicating that CAR cushion of 200bps (min. requirement is 10%) will likely entail consistent dividends. In this regard, even with tighter Basel III criteria coming into play across the medium-term, we believe the bank will be comfortably placed to pay cash dividends in each of the next two years followed by a blend of cash/stock dividends from CY15F onwards. Sustainably depressed earnings posit the key risk to our call for consistent annual dividends going forward. The Warid angle: Should BAFL sell its Warid stake at a price which values the cellular operator at US$500mn, we see a one-off EPS impact of PkR2.4 for BAFL and a recurring annual EPS of ~PkR0.20 if realized cash is placed in Tbills yielding 10%. In our view, provided Warid is divested by the Abu Dhabi Group, it makes sense for BAFL to offload its stake as well considering 1) comfort it would provide on CAR and 2) no alteration to already-in-place plans for ADCs including a JV with Warid for launch of branchless banking and intended launch of mobile banking in 4QCY13.

www.akdsecurities.net

KATS Code Bloomberg Code Price PkR Market Cap (PkRmn) Market Cap (US$mn) Shares (mn) 3M High (PkR) 3M Low (PkR) 1Yr High (PkR) 1Yr Low (PkR) 3M Avg Turnover '000 1 Yr Avg Turnover '000 3M Avg DT Value (PkRmn) 3M Avg DT Value (US$mn) 1Yr Avg DT Value (PkRmn) 1Yr Avg DT Value (US$mn) BAFL BAFL.PA 20.84 28,116 272.97 1,349.16 22.04 17.31 22.04 14.77 5,484.71 3,042.94 107.63 1.04 55.07 0.53

Thursday, September 05, 2013

AKD Daily

BAFL: Price Performance

1M Absolute (%) Rel. Index (%) 0.5 5.8 3M 10.5 2.0 12M CYTD 23.8 4.0 23.9 -5.5 4.0

10.9 -18.3

Absolute (PkR) 0.1

Source: AKD Research

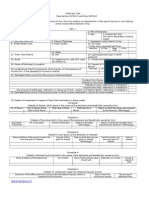

BAFL: EPS Estimates Revision

(PkR) New Old Change CY13F CY14F CY15F 2.76 2.70 2% 3.38 3.25 4% 3.97 4.29 -7% TP 24.50 20.02 22%

Source: AKD Research

BAFL: 1HCY13 P&L accounts

(PkRmn) 1HCY13 YoY 2QCY13 QoQ -6% 0% 10,868 6,830 4,039 3,298 2,028 5,325 4,107 1,219 932 0.69 3% 1% 6% -11% 9% -4% 2% -20% -8% -8% Gross Int Inc 21,440 Gross Int Exp 13,578 NII Provisions Post Prov NII Non-int inc Total Inc Expenses NPBT NPAT EPS (PkR)

7,863 -14% 873 -11% 6,990 -14% 3,891 26% 10,881 8,135 -3% 6%

741 461%

2,746 -23% 1,943 -16% 1.44 -16%

Source: Company Reports & AKD Research

02

AKD Securities Limited

Member Karachi Stock Exchange

BAFL: Valuation Statistics

Year End Dec 31 EPS (PkR) EPS Growth BVS (PkR) P/B (Tier I + Tier II) (x) PER (x) Loan to Deposit Yield on earning assets Cost of Funds NIMs Market Cap to Deposits Cost/Income ROE (average) ROA (average) DPS (PkR) Dividend yield Payout Ratio CY11A 2.60 362% 19.11 1.09 8.03 49% 12.08% 6.33% 5.75% 7.0% 59% 14.6% 0.80% 1.75 8.4% 67% CY12A 3.38 30% 22.42 0.93 6.17 51% 10.96% 5.95% 5.01% 6.2% 60% 16.3% 0.91% 2.00 9.6% 59% CY13F 2.76 -18% 22.86 0.91 7.55 49% 9.07% 5.36% 3.72% 5.5% 70% 12.2% 0.66% 1.75 8.4% 63% CY14F 3.38 22% 24.43 0.85 6.17 47% 9.78% 5.66% 4.12% 4.8% 67% 14.3% 0.72% 2.00 9.6% 59% CY15F 3.97 18% 26.57 0.78 5.25 47% 9.75% 5.66% 4.10% 4.2% 66% 15.6% 0.74% 2.25 10.8% 57%

Thursday, September 05, 2013

AKD Daily

Source: Company Reports & AKD Research

BAFL: Income Statement

(PkRmn) Mark-up / return / interest earned Mark-up / return / interest expensed Net Mark-up / interest income Total Provisions Post Provisioning NII Fee Income Total Income Total non mark-up / interest expenses NPBT NPAT CY11A 44,298 25,687 18,611 4,330 14,281 2,148 19,649 14,215 5,434 3,503 CY12A 46,080 27,500 18,580 3,559 15,021 2,537 7,281 22,303 15,519 6,783 4,556 CY13F 43,792 27,967 15,826 1,855 13,971 2,854 7,620 21,591 16,476 5,114 3,725 CY14F 53,747 33,336 20,411 2,646 17,764 3,139 7,645 25,409 18,850 6,559 4,559 CY15F 60,981 37,928 23,052 2,765 20,287 3,375 8,180 28,467 20,713 7,754 5,361

Total non mark-up / return / interest income 5,368

Source: Company Reports & AKD Research

BAFL: Balance Sheet

(PkRmn) Investments Loans and advances Total Assets Deposits and Other Accounts Total Liabilities Net Assets Total Tier I Equity Total Tier II Equity Total SHEQ Total SHEQ and Liabilities CY11A 166,532 198,469 468,174 401,248 442,397 25,777 22,840 2,937 25,777 468,174 CY12A 189,487 233,933 536,467 457,119 506,219 30,247 25,690 4,558 30,247 536,467 CY13F 232,467 250,172 596,927 508,011 566,090 30,837 26,736 4,102 30,837 596,927 CY14F 276,561 274,511 676,924 580,483 643,967 32,957 28,958 3,999 32,957 676,924 CY15F 312,090 314,263 767,504 662,156 731,660 35,844 31,645 4,199 35,844 767,504

Source: AKD Research

www.akdsecurities.net

03

AKD Securities Limited

Member Karachi Stock Exchange

Disclosure Section

Neither the information nor any opinion expressed herein constitutes an offer or a solicitation of an offer to transact in any securities or other financial instrument and is for the personal information of the recipient containing general information only. AKD Securities Limited (hereinafter referred as AKDS) is not soliciting any action based upon it. This report is not intended to provide personal investment advice nor does it provide individually tailored investment advice. This report does not take into account the specific investment objectives, financial situation/financial circumstances and the particular needs of any specific person. Investors should seek financial advice regarding the appropriateness of investing in financial instruments and implementing investment strategies discussed or recommended in this report and should understand that statements regarding future prospects may not be realized. AKDS recommends that investors independently evaluate particular investments and strategies and it encourages investors to seek the advice of a financial advisor. The appropriateness of a particular investment or strategy will depend on an investor's individual circumstances and objectives. The securities or strategies discussed in this report may not be suitable for all investors, and certain investors may not be eligible to purchase or participate in some or all of them. Reports prepared by AKDS research personnel are based on public information. AKDS makes every effort to use reliable,

Thursday, September 05, 2013

AKD Daily

comprehensive information, but we make no representation that it is accurate or complete. Facts and views presented in this report have not been reviewed by and may not reflect information known to professionals in other business areas of AKDS including investment banking personnel. AKDS has established information barriers between certain business groups maintaining complete independence of this research report. This report has been prepared independently of any issuer of securities mentioned herein and not in connection with any proposed offering of securities or as agent of any issuer of any securities. Neither AKDS, nor any of its affiliates or their research analysts have any authority whatsoever to make any representation or warranty on behalf of the issuer(s). AKDS Research Policy prohibits research personnel from disclosing a recommendation, investment rating, or investment thesis for review by an issuer prior to the publication of a research report containing such rating, recommendation or investment thesis. We have taken all reasonable care to ensure that the information contained herein is accurate, up to date, and complies with all prevailing Pakistani legislations. However, no liability can be accepted for any errors or omissions, or for any loss resulting from the use of the information provided as any data and research material provided ahead of an investment decision are for information purposes only. We shall not be liable for any errors in the provision of this information, or for any actions taken in reliance thereon. We reserve the right to amend, alter, or withdraw any of the information contained in these pages at any time and without notice. No liability is accepted for such changes. Stock Ratings Different securities firms use a variety of rating terms as well as different rating systems to describe their recommendations. A rating system which uses similar terms such as Buy, Accumulate, Neutral, Reduce and Sell is not equivalent to our rating system. Investors should carefully read the definitions of all ratings used in each research report. In addition, research reports contain information carrying the analyst's view and investors should carefully read the entire research report and not infer its contents from the rating ascribed by the analyst. In any case, ratings or research should not be used or relied upon as investment advice. An investor's decision to buy, sell or hold a stock should depend on individual circumstances (such as the investors existing holdings or investment objectives) and other considerations. Please see our table below for ratings definitions which are based on price returns.

Rating Definitions

Buy Accumulate Neutral Reduce Sell > 20% upside potential > 5% to < 20% upside potential < 5% to > -5% potential < -5% to > -20% downside potential < -20% downside potential

www.akdsecurities.net

03 04

AKD Securities Limited

Member Karachi Stock Exchange

Analyst Certification of Independence The analysts hereby certify that their views about the companies and their securities discussed in this report are accurately expressed and that they have not received and will not receive direct or indirect compensation in exchange for expressing specific recommendations or views in this report. The research analysts, strategists or research associates principally having received compensation responsible for the preparation of this AKDS research report based upon various factors including quality of research, investor client feedback, stock picking, competitive factors and firm revenues. Disclosure of Interest Area AKDS and the authoring analyst do not have any interest in any companies recommended in this research report irrespective of the fact that AKD Securities Limited may have, within the last three years, served as manager or co-manager of a public offering of securities for, or currently may make a primary market in issues of, any or all of the entities mentioned in this report or may be providing, or have provided within the previous 12 months, significant advice or investment services in relation to the investment concerned or a related investment.

Thursday, September 05, 2013

AKD Daily

Regional Disclosures (Outside Pakistan) The information provided in this report and the report itself is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation or which would subject AKDS or its affiliates to any registration or licensing requirements within such jurisdiction or country. Furthermore, all copyrights, patents, intellectual and other property in the information contained in this report are held by AKDS. No rights of any kind are licensed or assigned or shall otherwise pass to persons accessing this information. You may print copies of the report or information contained within herein for your own private non-commercial use only, provided that you do not change any copyright, trade mark or other proprietary notices. All other copying, reproducing, transmitting, distributing or displaying of material in this report (by any means and in whole or in part) is prohibited.

www.akdsecurities.net

05

You might also like

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- 表1:豪州E车主手册标题Document361 pages表1:豪州E车主手册标题djdr1100% (3)

- Bafwm1 - Lhe - 24092021082244Document1 pageBafwm1 - Lhe - 24092021082244trillion5No ratings yet

- Compact: Uhf RadioDocument12 pagesCompact: Uhf Radiotrillion5No ratings yet

- Myeloma UK AL Amyloidosis Serum Free Light Chain Assay InfosheetDocument8 pagesMyeloma UK AL Amyloidosis Serum Free Light Chain Assay Infosheettrillion5No ratings yet

- Manual: Safety Warning 【Please read carefully.】Document2 pagesManual: Safety Warning 【Please read carefully.】trillion5No ratings yet

- Understanding The Results of Your VAP Cholesterol TestVapDocument4 pagesUnderstanding The Results of Your VAP Cholesterol TestVapcmdcscribdNo ratings yet

- Performance Electronics: 2018/2019 Master CatalogDocument88 pagesPerformance Electronics: 2018/2019 Master Catalogtrillion5No ratings yet

- A Brief On Regulations For EMIsDocument14 pagesA Brief On Regulations For EMIstrillion5No ratings yet

- Usws PricelistDocument3 pagesUsws Pricelisttrillion5No ratings yet

- Solar DishDocument17 pagesSolar DisharhlboyNo ratings yet

- Lucasdist 46 To 60Document49 pagesLucasdist 46 To 60trillion5No ratings yet

- Cat 13 ELqdddDocument14 pagesCat 13 ELqdddtrillion5No ratings yet

- 02 Foods You Should Never EatDocument113 pages02 Foods You Should Never EatmrsorenNo ratings yet

- 02 Foods You Should Never EatDocument113 pages02 Foods You Should Never EatmrsorenNo ratings yet

- First FloorDocument1 pageFirst Floortrillion5No ratings yet

- Ground FloorDocument1 pageGround Floortrillion5No ratings yet

- Gpac Presentation November 2010 2Document41 pagesGpac Presentation November 2010 2trillion5No ratings yet

- AKD Daily Sep 05 2013Document5 pagesAKD Daily Sep 05 2013trillion5No ratings yet

- RPRDocument20 pagesRPRtrillion5No ratings yet

- BAFL: Lower Provisions A Key Factor - Maintain Hold': Morning BriefingDocument2 pagesBAFL: Lower Provisions A Key Factor - Maintain Hold': Morning Briefingtrillion5No ratings yet

- OrnithopterDocument10 pagesOrnithopterRicardo Luis Martin Sant'AnnaNo ratings yet

- Rice BranDocument19 pagesRice Brantrillion5No ratings yet

- Bank Alfalah Detail ReportDocument17 pagesBank Alfalah Detail Reporttrillion5No ratings yet

- Guidelines For Rabies Prevention 1Document40 pagesGuidelines For Rabies Prevention 1trillion5No ratings yet

- Introduction to the Nature and Classification of LawDocument1 pageIntroduction to the Nature and Classification of Lawtrillion5No ratings yet

- Constitution of Pakistan 1973 PDFDocument138 pagesConstitution of Pakistan 1973 PDFmrasadNo ratings yet

- Organic Restaurant Business PlanDocument71 pagesOrganic Restaurant Business Plantrillion5No ratings yet

- By Mge Ups Systems: Merlin GerinDocument60 pagesBy Mge Ups Systems: Merlin GerinGhulam MustafaNo ratings yet

- ICI Paints Pakistan Internship Report on FinanceDocument57 pagesICI Paints Pakistan Internship Report on Financetrillion5No ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- MSFT 10qDocument145 pagesMSFT 10qAaron WardNo ratings yet

- Form No 15HDocument3 pagesForm No 15HsaymtrNo ratings yet

- Understanding Long-Term Debt FinancingDocument22 pagesUnderstanding Long-Term Debt FinancingBlack boxNo ratings yet

- Statement of Financial Capability For NotarizationDocument1 pageStatement of Financial Capability For NotarizationEdd Bautista55% (11)

- Banks' Lending Functions and Loan ProductsDocument26 pagesBanks' Lending Functions and Loan ProductsAshish Gupta100% (1)

- Bank Management Koch 8th Edition Solutions ManualDocument8 pagesBank Management Koch 8th Edition Solutions Manualmeghantaylorxzfyijkotm100% (47)

- Fundamental Analysis of Kotak 1Document91 pagesFundamental Analysis of Kotak 1Abhijith V AshokNo ratings yet

- CF Chap027Document16 pagesCF Chap027AgnesNo ratings yet

- ARES 2004-8A - ProspectusDocument242 pagesARES 2004-8A - ProspectusnagobadsNo ratings yet

- Quarterly Securities Market Indicators: Securities Board of NepalDocument42 pagesQuarterly Securities Market Indicators: Securities Board of NepalManoj ShreshtaNo ratings yet

- Practical Auditing of Financial InstrumentsDocument8 pagesPractical Auditing of Financial InstrumentsNiño Mendoza MabatoNo ratings yet

- Nyse FFG 2002Document114 pagesNyse FFG 2002Bijoy AhmedNo ratings yet

- BFM ASSIGNMENT 2 ANALYSISDocument14 pagesBFM ASSIGNMENT 2 ANALYSISTabrej AlamNo ratings yet

- Accounting of Share CapitalDocument102 pagesAccounting of Share Capitalmohanraokp22790% (1)

- Investor Presentation Q3FY22 23Document31 pagesInvestor Presentation Q3FY22 23Dimitrios LiakosNo ratings yet

- NEW HUF Declaration Attachments - Final PDFDocument3 pagesNEW HUF Declaration Attachments - Final PDFVineetNo ratings yet

- Investment Analysis & Portfolio ManagementDocument23 pagesInvestment Analysis & Portfolio ManagementUmair Khan Niazi67% (3)

- Remaning Part of Audit NotesDocument21 pagesRemaning Part of Audit NotesVrushaliChavanNo ratings yet

- 6-Functions of Financial MarketsDocument4 pages6-Functions of Financial MarketsTahir RehmaniNo ratings yet

- Beneficiary Trustee Status in Court CasesDocument19 pagesBeneficiary Trustee Status in Court CasesAkil Bey100% (6)

- MCX Stock Exchange LimitedDocument62 pagesMCX Stock Exchange LimitedRaju MondalNo ratings yet

- Fin544 - Mind Mapping (Chapter 2)Document2 pagesFin544 - Mind Mapping (Chapter 2)nur fatihahNo ratings yet

- KskdraftDocument356 pagesKskdraftadhavvikasNo ratings yet

- Regulating Initial Public Offerings in EthiopiaDocument17 pagesRegulating Initial Public Offerings in EthiopiaAbnet BeleteNo ratings yet

- New Asian Abstracts June 2009Document10 pagesNew Asian Abstracts June 2009Restu AnggrainiNo ratings yet

- Assignment: Financial Markets & InstitutionDocument38 pagesAssignment: Financial Markets & InstitutionFaraz AamirNo ratings yet

- Prelim Exam - Bus Fin For PrintDocument2 pagesPrelim Exam - Bus Fin For PrintArgene AbellanosaNo ratings yet

- Shareholders' Agreement Template SampleDocument22 pagesShareholders' Agreement Template SampleLegal ZebraNo ratings yet

- Comparative Financial Analysis Between Bangladesh and USADocument9 pagesComparative Financial Analysis Between Bangladesh and USAZiad Bin HashemNo ratings yet

- Form A2Document2 pagesForm A2primefxNo ratings yet