Professional Documents

Culture Documents

A Study On The Relationship Between Accounting Conservatism and Earnings Management in Teheran Stock Exchange Listed Companies

Uploaded by

Amin MojiriOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

A Study On The Relationship Between Accounting Conservatism and Earnings Management in Teheran Stock Exchange Listed Companies

Uploaded by

Amin MojiriCopyright:

Available Formats

International Journal of Scientific Research in Knowledge, 2(2), pp. 105-115, 2014 Available online at http://www.ijsrpub.

com/ijsrk ISSN: 2322-4541; 2014 IJSRPUB http://dx.doi.org/10.12983/ijsrk-2014-p0105-0115

Full Length Research Paper A Study on the Relationship between Accounting Conservatism and Earnings Management in Teheran Stock Exchange Listed Companies

Abbas Ramezanzadeh Zeidi1*, Zabihollah Taheri2, Ommolbanin Gholami Farahabadi3

1

Department of Accounting, Neka Branch, Islamic Azad University, Neka, Iran 2 Department of Accounting, Payamenour University, Sari, Iran 3 Department of Accounting, Payamenour University, Neka, Iran *Corresponding Author: E-mail: Rameznzadeha@yahoo.com

Received 06 December 2013; Accepted 26 January 2014

Abstract. The present study focuses on the link between accounting conservatism and earnings management in Teheran Stock exchange listed companies. To this aim, the researches selected a statistical sample consisting of 154 companies and gathered statistical data for time period from 1385 to 1390. Using multiple variable combinational regressions, the researchers extracted the proper research model and examined the research hypothesis. The models developed for conservatism and earnings management were respectively book value to market value ratio of the stockholders' equity, and Jones's adjusted model. Primarily, research findings indicated that the models are insignificant and a significant link between conservatism and earnings management does not exist. However, when the researches fitted the examination based on logarithm of conservatism, they found out that there is significant and negative link between conservatism and earnings management. Keywords: conservatism, earnings management, discretionary accruals

1. INTRODUCTION Regarded as the basic providers of companies' resources, investors always require accurate and comprehensive databases from the companies. Accounting information appears in financial statements and investors regularly refer to such information without adjustingitto the changes in accounting methods or the way those information were calculated (Hendriksen et al., 1982). Income statements are a key tool among the financial statements for evaluating the performance as well as the profitability of the business enterprise. The information needs to be shared in a way that itenables the investors to evaluate preceding performance and to effectively assess and forecast the profitability of the business enterprise. As a result, the profit reported in the statements helps the investors evaluate the performance and profitability of the firm and fulfill their expectations about theiridealreturn profit. Therefore, boththe reported profitand the qualitative characteristics of the profit mean a lot to the investors (Francis et al., 2004). Earnings management is a means managers take advantage of to manipulate reported profit. It is, in effect, a targeted interference bypersonal motives of managers in the process of

financial reporting to the individuals outside the business enterprise and is achieved by manipulating the information of the current period. In other words, managers let their personal judgments meddle in the process of financial reporting and manipulate the mechanism of transactions to make changes in the financial reports. Conservatism has been a controversial premise from the outset and plays an important part in the practice of Accounting. A conservative approach defines a level of caution in forecasting the profit; however, itdoes the same with the possible lossesonly if it is risk-free for the upcoming cash flow. Preparing conservative financial statements heightens reliability of accounting data and indicates the ability of accounting profit to illustrate financial profit (positive dividend yield) and financial loss (negative dividend yield). Conservative approach stresses on distinguishing between positive and negative dividend yield (financial profit and loss) (Basu, 1997). The notions of profit management and conservatism in accounting have other functions in financial reporting, and each of them solely is capable of influencing immensely the quality of financial reporting and consequently the efficiency of capital market and also the behavior of investors, creditors and in general the

105

Zeidi et al. A Study on the Relationship between Accounting Conservatism and Earnings Management in Teheran Stock Exchange Listed Companies

users of financial statements. Therefore, the researchers believe that studying the correlation between these two parameters can be a step forward and contribute significantly to the literature on this subject. The researchers seek to answer the following questions: does conservatism in accounting procedure have any influence on profit management? Is there any correlation of any kind between conservatism and profit management? 2. THEORETICAL FRAMEWORK RELATED LITERATURE 2.1. Defining conservatism Basu (1997) defines conservatism as the necessity to gainhigh degree of certainty to differentiate between desirable news e.g. profit from undesirable ones e.g. loss. Such a definition views conservatism from a profit/loss standpoint. However, other definitions (Feltham and Ohlson, 1995) examine conservatism in the balance sheets. Based on this, where there is an actual uncertainty in selecting from among a number of reporting methods, that method is preferable which has the least desirable effect on the rights of the shareholders. The third definition (Givoly and Hayn, 2000) combines the two aforementioned methods of balance sheets and profit / loss. In this third approach, conservatismis defined as an accounting notion and results in a reduction in reported cumulated dividendcaused by belated acknowledgement of profit and prompt acknowledgement of expenses, low evaluation of assets and high evaluation of debts. Ryan (2006) draws another category to define conservatism i.e. conditional and unconditional conservatism. Conditional conservatism is obligated by accounting standards. This translates into prompt recognition of the losses in case of any undesirable news and not acknowledging the profit in case of any desirable news. For instance, applying the law of minimum cost or that of net sales value in inventory evaluation is an example of conditional conservatism, also called profit / loss or retrospective conservatism. On the other hand, unconditional conservatism is not obligated by the widely accepted accounting standards. This type of conservatism does not go beyond indicating net book value of the assets through traditional accounting procedures. It is also known as balance sheet or futuristic conservatism. 2.2. Literature Review Many studies have ever been conducted on topics related to profit management and conservatism. Basu (1997) studied the link between earnings and dividend using regression to estimate the conservatism index. AND

He realized that in companies whose dividend yield is negative, the dividend yield has higher correlation with earnings compared with companies whose dividend yield is positive. He also found out that in periods of judicial and court trials, conservatism increases. Watts and Zimmerman (1978) hold that companies with higher political costs tend to apply more conservative accounting procedures. Just to prove this fact, Ahmed et al. (2002) showed that big companies apply conservative accounting procedures more than other companies. Their study also revealed that in case of any discrepancies between the interests of the loaners and those of the shareholders concerning distribution of the income, the managers of the borrowing companies are more likely to apply conservative accounting procedures. He also discovered that there is negative relation between conservatism and profit management. In another study (2007), Ahmed concludes that conservative accounting discourages managers from investing on projects with negative return. In addition, Nikolav (2008) examined the relation between conservative accounting and the limitations of debt covenants. He found out that the more limited the debt covenant is, the more the conservatism grows. This fact had already been reached at in Ball et al. (2007). Watts (2003), believes that if a company's contract with different groups e.g. investors and creditors should be based on accounting figures, then the companies' managers, due to discrepancies between their own interests and those of the groups, will try to unfairly manipulate the figures in their own favor. For example, they may increase the profit or asset and on the other hand decrease the debts. In such cases, conservatism, as an effective regular mechanism, neutralizes the manager's unfair manipulations by postponing the acknowledgement of profit and helping a prompt recognition of the debt and loss. In their research Zhou and Lebov (2006) found out that companies that offer conservative financial statement are able to handle profit management more efficiently. However, as Zhou discovered, such companies normally do not get involved in earning management. Richardson (2005) claims that accrual items have proven to be more reliable and can predict loss and profits of the coming year as well. Bur Gestaller et al. (2006) concluded in their research that private companies make bigger profits compared with state-run companies and in countries with more efficient judicial system, these companies have a smaller share in profit management. Lafond and Wattz (2007) showed that informational asymmetry between aware and unaware investors gives rise to conservatism in financial statements. Conservatism lowers managers' motiveand ability to

106

International Journal of Scientific Research in Knowledge, 2(2), pp. 105-115, 2014

manipulate accounting figures and consequently, informational asymmetry and great losses it is responsible for are reduced and the value of the company increases. Moreover, in another study (2008) Lafond and Watz pointed out that conservative financial reporting is part of a regulation system that makes managers less able to manipulate profit and to raise cash flow in the company. Ball and Shivakumar (2006) believe that once the managers realize that they can no longer postpone loss recognition to the coming years, they appreciate conservative accounting since it helps solve potential issues and restricts company's investments on projects with negative Net Present Value (NPV). 3. THESIS HYPOTHESIS

Considering these requirements, the researchers selected 154 companies for a study period from 1385 until 1390. 4.2. Research Methodology The present study is categorized as a descriptiveexplorative research. It studies the status quo and describes it regularly trying to examine its different features in relation to the variables. Such a research is significant both for applied and theoretical areas. The findings may well be put into use in decision and policy making, and the explorations can contribute substantially to theories since they have been reached at through deductive methods. 4.3. Research parameters

Based on the primary studies that were already carried out in the field, the hypothesis of the research is as follows: There is a meaningful link between accounting procedures and profit management 4. MTHODOLOGY 4.1. Statistical population and sample volume Statistical population of the present research includes Tehran Stock Exchange listed companies. The statistical sample has been narrowed down using a systematic omission method regarding the following requirements: (1) The business enterprise must not be an investment company, a leasing company or a bank, due to their field of activity (2) The end of fiscal year of the business enterprise must coincide the end of Esfand (3) The business enterprise must not experience a shift in fiscal year during the study period (4) Financial data of the business enterprise must be available during the study period

4.3.1. Independent variable In the present study profit management has been considered as the independent variable. Based on the study, the proper variable to indicate profit management is the accrual items. These items may be subcategorized into non-discretionary and discretionary accrual items. The former is determined by activity levels and is out of the control of the managers; the latter is within the control of the managers and may simply be manipulated. The researchers hold that the residual of accrual items model is a criterion of discretionary accrual items and may be considered as profit management, meaning that after estimating the model and ensuring that its statistical qualities are effective, the residual amount of the model is considered as profit management variable. Dechow et al. (1995) and Guay et al. (1996) argued that Jonse's adjusted model is the most practical one among the existing models to estimate discretionary accrual items. Because of this, the researchers have applied this model in the present study. The model is formulated as follows:

Where, TACit = total accruals for company i in year t; TAit-1 = Lagged total asset for company I; REVit = change in operating revenues for company i in year t; RECit = change in net receivables for for company i in year t; PPE it = gross property, plant and equipment for company i in year t; 0j - 3j = regression parameters; E = error term

4.3.2. Dependent variable Conservatism is the dependent variable in this study. According to other studies ever carried out on the topic (Ahmed et al., 2002; Zang, 2007; Lebov et al., 2008; Jean and Rezaee, 2004) the ratio of book value to the market value of stockholders' interest has been chosen to represent conservatism. Therefore, if the ratio of book value to the market value of stockholders' interest is less than one, then it can indicate accounting conservatism.

107

Zeidi et al. A Study on the Relationship between Accounting Conservatism and Earnings Management in Teheran Stock Exchange Listed Companies

4.3.3. Control variables In this research, variables such as company size, financial leverage and shareholders' dividend yield have been used as control variables in an attempt to control the effects of other factors. Zimmerman (1983) states that, because of more political sensitivities, bigger companies tend to apply conservatism more than other companies. Previous researches prove that we may use common logarithm of total asset at the end of each fiscal period (Derashid AND Zang, 2003) and also logarithm of the total sales income (Zimmerman, 1983) as a criterion to measure a company size. Since the total sales income has direct effect on the profit, it can influence the results of the study in a way that are not desirable, therefore, the researchers have decided that common logarithm of total asset at the end of each fiscal period is an acceptable criterion to indicate the company size. Besides, the study conducted by Chen et al. (2007) proved that companies with lower profitability tend to manage profits more cautiously and effectively. Kowthari et al. also believe that discretionary accrual items are connected with a company's performance which was calculated and evaluated through Return on Equity (ROE). On the other hand, accounting methods relate to financial leverage, since one of the essential criteria of the creditors in Iran (banks mainly) is the company's debt ratio. Therefore the higher the company's debt ratio is, the less it tends to apply conservative methods. As a result, managers are expected to apply less conservative methods in their financial statements in a bid to minimize the risk that their offer to receive loans from the banks may not be granted, and to stop to be imposed a burden of higher interest rates.Therefore, the researchers have decided that debt ratio represents financial leverage. The ratio is estimated by dividing the total debt by total asset. 4.4. Research model The following regression model has been applied in the research to study the links between the use of conservatism in accounting procedures and earnings management: EM = 0 + 1 CON + 2 Size + 3 ROE + 4 Lev +e

5. STATISTICAL TECHNIQUES

METHODS

AND

Since the objective of the present study is to examine the links between conservatism and earnings management, multiple variable regression models has been used based on mixedmethod data analysis to test the research hypothesis. In this analysis, the proper models were fitted based on the results from Chaw test and Hausman test. To run significant test for the fitted regression model, Fischer statistic was used in 95% assurance level. Respectively, the researchers used T-student statistic to studyvariable coefficient of regression model; Durbin-Watson test to study autocorrelation among observations; and finally adjusted determining variable statistic to examine how explainable the model is. 6. DATA ANALYSIS AND EXAMINATION OF THE RESEARCH HYPOTHESES In the present research, the ratio of book value to market value of the stockholders' equity has been considered as a criterion of conservatism in accounting procedures. The reason why such a criterion was chosen was that notable researches such as Ahmad et al. (2002), Zhang (2007) and Lobo et al. (2008) also took advantage of this criterion in their studies. They found out that there is a meaningful negative link between conservatism and discretionary accruals. Jain & Rezaee showed in their research that when the ratio of book value to market value of the stockholders' equity is less than one, it can indicate accounting conservatism. Besides, as once mentioned earlier, residual sum of adjusted Jones's discretionary accruals model has been used to estimate earnings management. To examine the research core model, the researchers embedded the variable of book value ratio to market value of the stockholders' equity as an indicator of accounting conservatism asindependent variable. On the other hand, they embedded residual sum of adjusted Jones's discretionary accruals model that is the same as discretionary accruals as independent variable to indicate earnings management. Moreover, control variable such as company size, company leverage and return on equity have been exerted to control the undesirable effects. 6.1. Descriptive statistics of research core model variables Descriptive statistics of research variables include central tendency, variability and distribution indicators. In this research, the relevant data related to mean and median have been presented in category of central tendency, standard deviationin category of

Where, EM: Earnings management / CON: Conservatism / SIZE: Company's Size / REO: Return On Equity; LEV: Financial Leverage / : fixed parameter / e: error term

108

International Journal of Scientific Research in Knowledge, 2(2), pp. 105-115, 2014

variability, and finally elongation and skewness in category of distribution. Moreover, Jarko-bra statistic and relevant significant level have been presented in

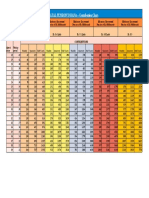

this chart to test normality of distribution of research variables. Descriptive statistics of research core model variables have been presented in Table 1.

Table 1: Descriptive Statistics of the Main Model Variables

variable Mean Median Standard deviation 4.854001 0.233599 1.483872 5.445384 1.332373 Skewness Elongation Jarco-bra statistic 22.24455 -6.818365 0.808653 4.407300 15.5463 591.4461 154.5776 4.018428 131.4621 288.6741 13218915 857948.6 137.1351 624521.4 624521.4 Probability 0.000000 0.000000 0.000000 0.000000 0.000000

Con Em Size ROE Lev

0.880815 -7.49E-19 13.38333 0.405161 0.765846

0.550846 0.003025 13.17000 0.261357 0.649520

The observations indicate that in average, book value of the sample companies is about 88% of their market value. As mentioned earlier, Jain & Rezaee believe that when the ratio of book value to market value of the stockholders' equity is less than one, it can indicate accounting conservatism. Since this ratio is below one in the sample companies, therefore on may conclude that conservative accounting exists in these companies. The ratio for half of the companies is above 0.55 and for the second half it is below 0.55. According to the observations, earnings management in the sample companies is on average -7.49E-19. The negative mark implies that the companies either have adopted an earnings reduction policy or have not taken any measure at all to manage the earnings. However, this does not suggest any lack of earnings management in those companies. This might be due to the fact that the average accrual items are negative. These items have already been referred earlier in this paper. In other words, companies on average possess negative accrual items. The mean size of the sample companies according to asset logarithm is 13.38. The median of this variable decreased by 0.21 unit and amounted to 13/17. Mean ROE of the sample companies are 40.5 percent, which means that net profit is on average 40.5 percent of shareholders' equity. In half of the

companies the equity is above 26 percent and in the other half it is below 26 percent. The observations suggest that the sample companies' debts make up an average of 76.5 percent of their assets. In half of the companies, this ratio is above 65 percent and in the other half it is less than 65 percent. All the research variables have positive skewness except for earnings management indicator. Positive skewness implies that distant samples from central tendency indicator are located on the right domain of the measurement scale. When earnings management indicator has negative skewness then distant samples from central tendency indicator are located on the left domain of the measurement scale. Besides, all the research variables have positive elongation which means that variable distribution curve is longer than normal distribution curve. As Jarco-Bra statistic and its corresponding significant level suggests, not all the research variables have normal distribution. 6.2. Examining correlation among the research variables In this section, researchers examine the correlation among the core model variables of the research applying Pearson correlation coefficient. Table 2 presents correlation coefficient matrix.

Table 2: Correlation coefficients between the variables of the main model

Con : Pearson Correlation Sig. Size: Pearson Correlation Sig. ROE: Pearson Correlation Sig. Lev: Pearson Correlation Sig. con 1.000000 0.003540 0.9175 -0.010421 0.7604 -0.025484 0.4557 Size ROE Lev

1.000000 -0.043804 0.1996 0.068145 0.0459 1.000000 -0.017358 0.6114 1.000000

As the table shows, the only significant correlation regarding level of significance of correlation coefficient among the variables (below 0.05) is the correlation between size and leverage, being about

0.068. This means that the correlation is affirmative; however, the correlation intensity between them is evaluated as weak. Therefore, applying the variables

109

Zeidi et al. A Study on the Relationship between Accounting Conservatism and Earnings Management in Teheran Stock Exchange Listed Companies

to the model at the same time will not cause any interference concerning collinearity. 6.3. Examination of research core models 6.3.1. Examining the model on links between conservatism and earning management

Test type Chow test Sample statistic F

The researchers primarily examined required tests in each case to select a proper pattern. According to F statistic ofChaw test and the sum of related probability (above 0.05) the model lacks required effects. Since this test does not recommend applying mixed data along with the effects, therefore there is no need to Hausman test and the model is immediately fitted. The results are presented in Table 3.

Statistic quantity 0.008238 df 153,723 sig 1.0000

Table 3: The Results of Choosing a Model for Model Test of Relation between conservatism and earning management

Table 4: Estimating the model of relation between conservatism index and earning management

Explanatory variable The width of source: (0) BV to MV ratio Fischer statistic: Probability of Fishers Statistic: Dependent variable: discretionary accruals Coefficients Standard error T statistic 0.000168 0.002285 0.073643 -0.000345 .0000800 -0.431327 0.083745 Adjusted coefficient of explanation statistic : 0.772354 Durbin-Watsons Statistic : sig 0.9413 0.6663 0.000043 2.188045

The results from model estimation indicate that tstatistic and its relevant probability show lack of (0) significance and book value to market value ratio in the model. In other words, there is no evidence that there is significant link between conservatism and earnings management. The adjusted R2 model statistic indicates that conservatism cannot explain earning management efficiently. Since all the findings suggested the inefficiency of the model to explain the link between conservatism and earnings management, once again another model was fitted based on logarithm of book value to market value ratio to examine the link more closely. 6.4. Testing the model of links conservatism and earning management between

was fitted based on logarithm of book value to market value ratio. In other words, logarithm of book value to market value ratio has been considered as a criterion of conservatism. To select a proper pattern, the researchers examined required tests in each case. According to F statistic of Chaw test and the sum of related probability (above 0.05) the model lacks required effects. Since this test does not recommend applying mixed data along with the effects, therefore there is no need to Hausman test and the model is immediately fitted. The results are presented in Table 5. Table 6 introduces the results of model estimation using combinational method without exercising the effects.

As it was earlier mentioned, to examine the links between the variables more closely, another model

Table 5: The Results of Choosing a Model for Model Test of Correlation between conservatism and earning management

Test type Chow test Sample statistic F Statistic quantity 0.992227 df 153,698 sig 0.5139

Table 6: Estimating the model of correlation between conservatism index and earnings management

Explanatory variable The width of source (0) BV to MV ratio Fischer statistic: Probability of Fishers Statistic: Dependent variable: discretionary accruals Coefficients Standard error T statistic -0.003538 0.002619 -1.350927 -0.005332 0.002352 -2.267174 4.641173 Adjusted coefficient of explanation statistic : 0.031494 Durbin-Watsons Statistic : sig 0.1771 0.0236 0.014601 2.201023

110

International Journal of Scientific Research in Knowledge, 2(2), pp. 105-115, 2014

Regression equation extracted from model estimation is as follows: EM = -0.003538 - 0.005332*LNCONS Having studied the results from model estimation, the researchers found out that t statistic and its related probability (less than 0.05) indicates significance of conservatism (logarithm of Book value to market value ratio). Negative coefficient of the variable proves that it has negative and significant effect on the model. This means that there exists a negative and significant link between conservatism and earnings management. In other words, the higher the conservatism index becomes, the less the earnings management is exercised, and vice versa. (0), however, does not influence the model significantly. Adjusted R2 statistic of the model indicates that only 1.4 percent of the earnings management may be explained via conservatism. Of course, coefficient of explanation of the model is too low. One may conclude that the model is poorly explainable. Durbin-

Watson statistic of the model suggests that the remaining model is still independent. 6.5. Testing the model of links between conservatism and earning management along with control variables To control the undesirable effects, researchers involved other variables such as company size, company leverage and performance as control variables. First, Chaw and Hausman test were used to select a proper model. The results of these tests have been presented in Table 7. According to F statistic of Chaw test and the sum of related probability (below 0.05) the model carries the required effects. Again, with regard to X2 statistic of Hausman test the related sum of the probability (higher than 0.05) the model contains random effect. Table 8 introduces the results of model estimation using random method

Table 7: The Results of Choosing a Model for Model Test of Correlation between conservatism index and Earnings Management at the Presence of the Control Variables

Test Type Chow Test Hausman Test Sample Statistic F X2 Statistic Quantity 1.423763 7.972217 df 153,658 4 sig 0.0018 0.0926

Table 8: Estimating the model of correlation between conservatism index and earning management at the presence of the control variables

Dependent variable: discretionary accruals Explanatory variable Coefficients Standard error T statistic sig The width of source (0) 0.0222000 0.028989 0.765811 0.4441 BV to MV ratio -0.028492 0.013198 -2.158818 0.0312 size -0.003145 0.001755 -1.792030 0.0736 ROE 4.72E-05 0.000508 0.092848 0.9261 Lev 0.012039 0.002036 5.913195 0.0000 Fischer statistic: 1.418300 Adjusted coefficient of explanation statistic: 0.074572 Fischer statistical probability: 0.001843 Durbin-Watson statistic: 1.714347

Regression equation extracted from model estimation is as follows: EM= 0.0222 0.028492 * Ln Cons 0.003145 * Size + 4.72E-05* ROE + 0.012039* Lev+ [CX=R] Having studied the results from model estimation, the researchers found out that F statistic and its related probability (less than 0.05) indicates significance of the whole model. Negative coefficient of the variable proves that it has negative and significant effect on the model. This means that there exists a negative and significant link between conservatism and earnings management. In other words, the higher the conservatism index becomes, the less the earnings management is exercised, and vice versa. (0), however, does not influence the model significantly. T statistic and the related probability (less than 0.05) indicates significance of leverage variable. Positive coefficient of the variable proves that it has Positive

and significant effect on the model. In other words, the higher the leverage (debt to asset ratio) becomes, the more the earnings management is exercised, and vice versa. T statistic and the related probability (more than 0.05) indicates lack of significance of size and ROE variables.However, size variable up to 10 percent error has negative significance on the model. In this case, as the size increases (assets logarithm) earnings management increases, and vice versa. 6.6. Testing the model of links between conservatism and earning management along with significant control variables In this model, researchers involved only company size variable, since it had significant effect on the model. First, Chaw and Hausman test were used to select a proper model. The results of these tests have been presented in Table 9. According to F statistic of Chaw

111

Zeidi et al. A Study on the Relationship between Accounting Conservatism and Earnings Management in Teheran Stock Exchange Listed Companies

test and the sum of related probability (below 0.05) the model carries the required effects. Again, with regard to X2 statistic of Hausman test the related sum of the probability (lower than 0.05) the model lacks

proper consistent effects. Table 10 introduces the results of model estimation using consistent method.

Table 9: The Results of Choosing a Model for Model Test of Correlation between Earnings Management and Earnings Response Coefficient at the Presence of the Control Variables

Test Type Chow Test Hausman Test Sample Statistic F X2 Statistic Quantity 1.457958 8.323279 df 153,683 2 sig 0.0009 0.0156

Table 10: Estimating the model of correlation between conservatism index and earnings management along with significant control variables

Dependent variable: discretionary accruals Explanatory variable Coefficients Standard error T statistic sig The width of source (0) -0.020441 0.002852 -7.167389 0.0000 BV to MV ratio -0.029073 0.003773 -7.706612 0.0000 Lev 0.010837 0.000666 16.26696 0.0000 Fischer statistic: 8.231768 Adjusted coefficient of explanation statistic: 0.572214 Fischer statistical probability: 0.000000 Durbin-Watson statistic: 2.238676

Regression equation extracted from model estimation is as follows: EM= -0.020441 0.029073*Ln Cons + 0.010837* Lev = [CX=F] Having studied the results from model estimation, the researchers found out that F statistic and its related probability (less than 0.05) indicates significance of the whole model. T statistic and the related probability (less than 0.05) indicates significance of conservatism (logarithm of book value to market value ratio) Negative coefficient of the variable proves that it has negative and significant effect on the model. This means that there exists a negative and significant link between conservatism and earnings management. In other words, the higher the conservatism index becomes, the less the earnings management is exercised, and vice versa. T statistic and the related probability (less than 0.05) indicates significance of the width of source, however, it influences the model negatively and significantly. T statistic and the related probability (less than 0.05) indicates significance of leverage variable. Positive coefficient of the variable proves that it has Positive and significant effect on the model. In other words, the higher the leverage (debt to asset ratio) becomes, the more the earnings management is exercised, and vice versa. Adjusted R2 statistic of the model indicates that about 57.2 percent of the earnings management may be explained via conservative variables in relation to leverage control variable. It is noteworthy that coefficient of explanation of the model has increased dramatically compared with prior models, to the extent that the model is explainable more than 50 percent.

7. CONCLUSION With regard to the tests that were run, the findings indicate that the whole model lacks significance. Book value to market value ratio lacks significance, as well. This means that no significant link was explored between conservatism and earnings management. Since all the cases that were examined showed inefficiency of the model, therefore another model was fitted based on logarithm of book value to market value ratio. This time the findings proved that the whole model as well as logarithm of book value to market value ratio is significant. Negative coefficient of this variable indicates negative and significant effect of the variable on the model. Afterwards, to control undesirable effects, other variables such as company size, company leverage and ROE were also involved in the study. Having fitted the model, the researchers found out that the whole model as well as logarithm of book value to market value ratio is significant. The findings also indicate that leverage variable is significant, since positive coefficient of the variable signifies its positive and significant effect. Next, the final model was fitted applying the leverage, a significant control variable. Eventually, the final findings of the study proved that the whole model as well as logarithm of book value to market value ratio is significant. Adjusted coefficient of determination of the model indicates that about 57.2 percent of earnings management by conservatism is explainable using leveraging control variable. 7.1. Research implications (1) As it was once mentioned in the descriptive statistics chapter, the observations showed that on

112

International Journal of Scientific Research in Knowledge, 2(2), pp. 105-115, 2014

average, book value of the sample companies are less than their market value. That the ratio of book value to market value of the stockholders' equity is below one indicates accounting conservatism is very likely to be there. Since this ratio is below one in sample companies, therefore one may rightly conclude that accounting conservatism is being exercised in these companies. The researchers recommend the possible users to refer to the findings and take this matter into their consideration when making financial decisions. (2) Since there is a negative and significant link between conservatism and earnings management, it is expected that as conservatism increases, earnings management decrease. In some instances in which earnings management takes a negative aspect, the negative and significant link between conservatism and earnings management can stop manipulating the earnings. Therefore, analysts and possible users of the research findings are recommended to take this matter into consideration when making financial decisions. 7.2. Suggestions for further research (1) The researchers suggest a similar study with an emphasis on the notion of earnings quality. (2) The researchers suggest that links between conservatism and income smoothing be studied. (3) The researchers suggest that links between conservatism and diverse features of time series of profit such as profit stability, profit predictability and the like are studied. REFERENCES Ahmed AS, Billings BK, Morton RM, Stanford-Harris M (2002). The Role of Accounting Conservatism in Mitigating BondholderShareholder Conflicts over Dividend Policy and in Reducing Debt Costs. The Accounting Review, 77(4): PP.867890. Ahmed AS, Duellman S (2007). Evidence on the role of accounting conservatism in corporate governance. Journal of Accounting and Economics, 43: PP, 411437. Basu S (1997). The Conservatism Principle and the Asymmetric Timeliness of Earnings. Journal of Accounting and Economics, 24: 3-37. Ball R, Shivakumar L (2006). The role of accruals in asymmetrically timely gain and loss recognition. Journal of Accounting Research, 44: 402-24. Burgstahler D, Hail L, Leuz C (2006).The Importance of Reporting Incentives: Earnings Management in European Private and Public Firms. The Accounting Review, 81(5): 983-1016.

Chen Q, Hemmer T, Zhang Y )2007(. On the relation between conservatism in accounting standards and incentives for earnings management. Journal of Accounting Research, 45(3): 541. Dechow P, Sloan R, Sweeney A )1995(. Detecting earnings management. The Accounting Review, 70)4): 193-225. Ding Y, Stolowy H (2007). Timeliness and conservatism changes over time in the properties of net income in France. on line: http://www.ssrn.com. Dimitrios V, Kousenidis, Anestis C, Ladas, ChristosI Negakis.( 2009), Value relevance of conservatism and non-conservatism accounting information, the international journal of accounting; 44:219-238. Feltham G, Ohlson JA (1995) Valuation and clean surplus accounting for operating and financial activities, Contemporary Accounting Research, 11(2): 689731. Francis J, LaFond R, Olsson P, Schipper K (2004). Cost of Equity and Earnings Attribute. The Accounting Review, 79 (4): 967-1010. Guay WR, Kothari SP, Watts RL (1996). A Marketbased Evaluation of Discretionary Accruals Models. Journal of Accounting Research, 34: 83-105. Givoly D, Hayn C (2000). The changing time-series properties of earnings, cash flows and accruals: Has financial reporting become more conservative?. Journal of Accounting and Economics, 29(3): 287-320. Givoly D, Hayn C, Natarajan A (2006). Measuring reporting conservatism. The Accounting Review, 82(1): 65-106. Guay WR, Kothari SP, Watts RL (1996). A Marketbased Evaluation of Discretionary Accruals Models. Journal of Accounting Research, 34: 83-105. Hendriksen Eldon S, Van Breda, Michael F (1982). Accounting Theory. McGraw-Hill. Jain P, Rezaee Z (2004). The Sarbanes-Oxley Act of 2002 and Accounting Conservatism. Working Paper Series, available at: www.ssrn.com. Lafond R, Watts RL (2007). The Information Role of Conservative Financial Statements. http://ssrn.com/abstract=921619 or http://dx.doi.org/10.2139. Nikolaev V )2008(. Debt covenants and accounting conservatism: complements or substitutes? www.ssrn.com. Penman SH, Zhang XJ (2002). Accounting Conservatism the quality of earnings, and Stock Returns. Accounting Review, 77: 237-264. QIchen Hemmer T, Zhang Y (2007). On the relation between conservatism and incentive for earning

113

Zeidi et al. A Study on the Relationship between Accounting Conservatism and Earnings Management in Teheran Stock Exchange Listed Companies

management. Journal of Accounting Research, 45(3). Richardson S, Sloan R, Soliman M, Tuna I (2005). Accrual Reliability, Earnings Persistence and Stock Prices. Journal of Accounting and Economics, 39: 437-485. Ryan S (2006). Identifying conditional conservatism. European Accounting Review, 15(4): 511-525. Watts R, Zimmerman J (1978). Towards a Positive Theory of the Determinants of Accounting Standards. The Accounting Review, 53(1): 112134.

Watts, R, (2003), Conservatism in accounting, Part II: evidence and research opportunities. Accounting Horizons 17: 287-301. Zimmerman J, watts R (1986). Positive accounting theory. prentice hall, inc. Zhang J (2008). The Contracting Benefits of Accounting Conservatism to Lenders and Borrowers. Journal of Accounting and Economics, 45: 2754. Zhou J (2008). Financial Reporting After the Sarbanes-Oxley Act: Conservative or Less Earnings Management?, Research in Accounting Regulation, 20: 187-192.

114

International Journal of Scientific Research in Knowledge, 2(2), pp. 105-115, 2014

Abbas Ramezanzadeh Zeidi received his MA in Accounting from Tehran Branch, Islamic Azad University. Currently, he is PhD Candidate at AMU India. He has more than 20 papers in the referees journals and conferences. He is faculty member of Neka Branch, Islamic Azad University.

Zabihollah Taheri received his MA in Accounting from Tehran Branch, Islamic Azad University. He is faculty member of Payamenour University, Sari, Iran.

Ommolbanin Gholami Farahabadi received her MA in Accounting from Payamenour University, Behshahr, Iran. She is faculty member of Payamenour University, Neka, Iran.

115

You might also like

- Co-Treatment of Landfill Leachate and Settled Domestic Wastewater Using Composite Adsorbent in Sequencing Batch ReactorDocument232 pagesCo-Treatment of Landfill Leachate and Settled Domestic Wastewater Using Composite Adsorbent in Sequencing Batch ReactorAmin Mojiri100% (1)

- Electronic Band Structure and Metallization of Aluminium Nitride (AlN) Under High PressureDocument6 pagesElectronic Band Structure and Metallization of Aluminium Nitride (AlN) Under High PressureAmin MojiriNo ratings yet

- Computational Prediction For The Binding Affinity of Interleukins 3 and 5 and GM-CSF To Cell Surface Receptors On Human EosinophilsDocument7 pagesComputational Prediction For The Binding Affinity of Interleukins 3 and 5 and GM-CSF To Cell Surface Receptors On Human EosinophilsAmin MojiriNo ratings yet

- Assessment of Environmental Stress As Meteorological Drought Due To Rainfall Variability in Jaipur, Rajasthan (India)Document8 pagesAssessment of Environmental Stress As Meteorological Drought Due To Rainfall Variability in Jaipur, Rajasthan (India)Amin MojiriNo ratings yet

- Effects of Contour Furrow On Ecological Indices of Range Health Using Landscape Function Analysis (Case Study: Ghick Sheikha Rangeland, Jiroft, Iran)Document8 pagesEffects of Contour Furrow On Ecological Indices of Range Health Using Landscape Function Analysis (Case Study: Ghick Sheikha Rangeland, Jiroft, Iran)Amin MojiriNo ratings yet

- Liver Histopathology of Broiler Chickens Fed With Aluminium Phosphide-Treated Maize-Based DietsDocument6 pagesLiver Histopathology of Broiler Chickens Fed With Aluminium Phosphide-Treated Maize-Based DietsAmin MojiriNo ratings yet

- GIS-Based Air Pollution Monitoring Using Static Stations and Mobile Sensor in Tehran/IranDocument14 pagesGIS-Based Air Pollution Monitoring Using Static Stations and Mobile Sensor in Tehran/IranAmin MojiriNo ratings yet

- Experimental Investigation of Electrochemical Machining Process Using Taguchi ApproachDocument13 pagesExperimental Investigation of Electrochemical Machining Process Using Taguchi ApproachAmin MojiriNo ratings yet

- Photocatalytic Degradation of Congo Red Dye On Thermally Activated Zinc OxideDocument13 pagesPhotocatalytic Degradation of Congo Red Dye On Thermally Activated Zinc OxideAmin MojiriNo ratings yet

- Effect of Gypsum On The Reclamation and Soil Chemical Properties in Sodic Soils of Raebareli District, Uttar PradeshDocument6 pagesEffect of Gypsum On The Reclamation and Soil Chemical Properties in Sodic Soils of Raebareli District, Uttar PradeshAmin MojiriNo ratings yet

- Presentation of Tuberculosis in GynecologyDocument6 pagesPresentation of Tuberculosis in GynecologyAmin MojiriNo ratings yet

- Molecular Radius, Molar Refraction, Polarizability and Internal Pressure Studies On THP + 1-Hexanol at Different Temperatures - Molecular InteractionsDocument8 pagesMolecular Radius, Molar Refraction, Polarizability and Internal Pressure Studies On THP + 1-Hexanol at Different Temperatures - Molecular InteractionsAmin MojiriNo ratings yet

- Assessment of The Relative Yielding Abilities and Stability of Maize (Zea Mays L) Genotypes Under Different Levels of Nitrogen Fertilization Across Two Agro-Ecological Zones in GhanaDocument14 pagesAssessment of The Relative Yielding Abilities and Stability of Maize (Zea Mays L) Genotypes Under Different Levels of Nitrogen Fertilization Across Two Agro-Ecological Zones in GhanaAmin MojiriNo ratings yet

- Treatment of Leachate by Electrocoagulation Technique Using Iron and Hybrid ElectrodesDocument12 pagesTreatment of Leachate by Electrocoagulation Technique Using Iron and Hybrid ElectrodesAmin MojiriNo ratings yet

- Agro-Rural Development As A Source of Socio-Economic Change With Special Reference To IranDocument8 pagesAgro-Rural Development As A Source of Socio-Economic Change With Special Reference To IranAmin MojiriNo ratings yet

- Fluoride Toxicity and Its Distribution in Groundwater of South East Part of Nagaur District, Rajasthan, IndiaDocument8 pagesFluoride Toxicity and Its Distribution in Groundwater of South East Part of Nagaur District, Rajasthan, IndiaAmin MojiriNo ratings yet

- Evaluation of Wheat Advance Lines Under Rainfed ConditionsDocument5 pagesEvaluation of Wheat Advance Lines Under Rainfed ConditionsAmin MojiriNo ratings yet

- The Changing Scenario in Indian Agriculture: A ReviewDocument10 pagesThe Changing Scenario in Indian Agriculture: A ReviewAmin MojiriNo ratings yet

- Application of Morphometric Traits For Live Body Weight Estimation in Dhofari CalvesDocument7 pagesApplication of Morphometric Traits For Live Body Weight Estimation in Dhofari CalvesAmin MojiriNo ratings yet

- Impact of Aggregate Size On Soil Carbon Sequestration and Aggregate StabilityDocument10 pagesImpact of Aggregate Size On Soil Carbon Sequestration and Aggregate StabilityAmin MojiriNo ratings yet

- Mayflies (Order Ephemeroptera) : An Effective Indicator of Water Bodies Conditions in JordanDocument10 pagesMayflies (Order Ephemeroptera) : An Effective Indicator of Water Bodies Conditions in JordanAmin MojiriNo ratings yet

- Impact of Irrigation Systems, Fertigation Rates and Using Drainage Water of Fish Farms in Irrigation of Potato Under Arid Regions ConditionsDocument13 pagesImpact of Irrigation Systems, Fertigation Rates and Using Drainage Water of Fish Farms in Irrigation of Potato Under Arid Regions ConditionsAmin MojiriNo ratings yet

- Sediment Carbon Storage of Two Main Wetlands in Pondicherry, IndiaDocument8 pagesSediment Carbon Storage of Two Main Wetlands in Pondicherry, IndiaAmin MojiriNo ratings yet

- EDTA Enhanced Phytoextraction Capacity of Scirpus Maritimus L. Grown On PB-CR Contaminated Soil and Associated Potential Leaching RisksDocument10 pagesEDTA Enhanced Phytoextraction Capacity of Scirpus Maritimus L. Grown On PB-CR Contaminated Soil and Associated Potential Leaching RisksAmin MojiriNo ratings yet

- Groundwater Quality Assessment in Haraz Alluvial Fan, IranDocument15 pagesGroundwater Quality Assessment in Haraz Alluvial Fan, IranAmin MojiriNo ratings yet

- Equilibrium Modeling and Kinetic Studies On The Adsorption of Basic Dye by A Low-Cost Adsorbent: Sugarcane BagasseDocument7 pagesEquilibrium Modeling and Kinetic Studies On The Adsorption of Basic Dye by A Low-Cost Adsorbent: Sugarcane BagasseAmin MojiriNo ratings yet

- Influence of Cadmium Ions On Growth and Antioxidant System Activity of Wheat (Triticum Aestivum L.) SeedlingsDocument8 pagesInfluence of Cadmium Ions On Growth and Antioxidant System Activity of Wheat (Triticum Aestivum L.) SeedlingsAmin MojiriNo ratings yet

- Effect of Different Insecticides Against Insect Pests and Predators Complex On Brassica Napus L., Under Field ConditionsDocument6 pagesEffect of Different Insecticides Against Insect Pests and Predators Complex On Brassica Napus L., Under Field ConditionsAmin MojiriNo ratings yet

- Evaporative Cooling of Wet Soil Surface Under Different Agricultural Land Use SystemsDocument9 pagesEvaporative Cooling of Wet Soil Surface Under Different Agricultural Land Use SystemsAmin MojiriNo ratings yet

- Carbofuran-Induced Alterations in Body Morphometrics and Histopathology of Liver and Kidneys in The Swiss Albino Mice Mus Musculus L.Document15 pagesCarbofuran-Induced Alterations in Body Morphometrics and Histopathology of Liver and Kidneys in The Swiss Albino Mice Mus Musculus L.Amin MojiriNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Letter To Vermillion ShareholdersDocument2 pagesLetter To Vermillion ShareholdersGeorgeBessenyeiNo ratings yet

- Transfer Pricing: Mcgraw-Hill/IrwinDocument17 pagesTransfer Pricing: Mcgraw-Hill/Irwinmkkaran90No ratings yet

- Question Bank NvsDocument6 pagesQuestion Bank NvsDeepak DileepNo ratings yet

- Guidelines For Travel Agents PDFDocument14 pagesGuidelines For Travel Agents PDFPragnendra RahevarNo ratings yet

- Income Statement (Accrual) PT ManunggalDocument1 pageIncome Statement (Accrual) PT ManunggalDelia OktaNo ratings yet

- Chapter 8Document30 pagesChapter 8carlo knowsNo ratings yet

- Becker f6Document71 pagesBecker f6Safa RoxNo ratings yet

- Financial Accounting SyllabusDocument6 pagesFinancial Accounting SyllabusIan Wang100% (1)

- Atal Pension Yojana contribution chart and minimum guaranteed pension amountsDocument1 pageAtal Pension Yojana contribution chart and minimum guaranteed pension amountsG Pavan Kumar100% (1)

- Income Withholding DeclarationDocument2 pagesIncome Withholding DeclarationMoi EscalanteNo ratings yet

- M&A StudyDocument90 pagesM&A Studyapp04127No ratings yet

- 04 Victorias Milling Co. Inc. vs. Municipality of VictoriasDocument2 pages04 Victorias Milling Co. Inc. vs. Municipality of VictoriasJamaica Cabildo ManaligodNo ratings yet

- CH 02 The Firm and Its Goals - RevisedDocument26 pagesCH 02 The Firm and Its Goals - RevisedAbeer83No ratings yet

- Cost Online QuestionDocument7 pagesCost Online QuestionKashif RaheemNo ratings yet

- Government Accounting: (Unified Account Code Structure)Document13 pagesGovernment Accounting: (Unified Account Code Structure)Mariella AngobNo ratings yet

- 9706 Accounting: MARK SCHEME For The May/June 2015 SeriesDocument8 pages9706 Accounting: MARK SCHEME For The May/June 2015 Seriesasad HgdfjjNo ratings yet

- S B S RDocument48 pagesS B S Rnira5050No ratings yet

- Engineering - Economics 2020Document18 pagesEngineering - Economics 2020Arshad MahmoodNo ratings yet

- Principles of AccountingDocument13 pagesPrinciples of AccountingRoe BelleNo ratings yet

- On Kingfisher AirwaysDocument22 pagesOn Kingfisher AirwaysPratik Sukhani100% (5)

- 2014 15 Tax Planning Guide - 29 01 15Document252 pages2014 15 Tax Planning Guide - 29 01 15DaneGilbertNo ratings yet

- Joint Stock CompanyDocument26 pagesJoint Stock CompanyPratik ShahNo ratings yet

- FIDIC (Silver Book)Document15 pagesFIDIC (Silver Book)a74engNo ratings yet

- Aaya PrakaranaDocument10 pagesAaya Prakaranaking1q100% (1)

- Buss Law AsinmentDocument27 pagesBuss Law AsinmentAnupam Kumar ChaudharyNo ratings yet

- Chapter 2 PQ FMDocument5 pagesChapter 2 PQ FMRohan SharmaNo ratings yet

- Rashtriya Chemicals standalone financial ratiosDocument18 pagesRashtriya Chemicals standalone financial ratiosritikNo ratings yet

- Accounting For Sole Proprietorship Problem1-5Document8 pagesAccounting For Sole Proprietorship Problem1-5Rocel Domingo100% (1)

- TM Case Study NotesDocument3 pagesTM Case Study NoteslylavanesNo ratings yet