Professional Documents

Culture Documents

Sbi Ratio

Uploaded by

Kavita NadarOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Sbi Ratio

Uploaded by

Kavita NadarCopyright:

Available Formats

COMPARISON RATIO ANALYSIS OF SBI AND PNB

CHAPTER 1 INTRODUCTION OF SBI AND PNB

STATE BANK OF INDIA

Not only many financial institution in the world today can claim the antiquity and majesty of the State Bank Of India founded nearly two centuries ago with primarily intent of imparting stability to the money market, the bank from its inception mobilized funds for supporting both the public credit of the companies governments in the three presidencies of British India and the private credit of the European and India merchants from about 1860s when the Indian economy book a significant leap forward under the impulse of quickened world communications and ingenious method of industrial and agricultural production the Bank became intimately in valued in the financing of practically and mining activity of the SubContinent Although large European and Indian merchants and manufacturers were undoubtedly thee principal beneficiaries, the small man never ignored loans as low as Rs.100 were disbursed in agricultural districts against glad ornaments. Added to these the bank till the creation of the Reserve Bank in 1935 carried out numerous Central Banking functions.

Adaptation world and the needs of the hour has been one of the strengths of the Bank, In the post depression exe. For instance when business opportunities become extremely restricted, rules laid down in the book of instructions were relined to ensure that good business did not go post. Yet seldom did the bank contravenes its value as depart from sound banking principles to retain as expand its business. An innovative array of office, unknown to the world then, was devised in the form of branches, sub branches, treasury pay office, pay office, sub pay office and out students to exploit the opportunities of an expanding economy. New business strategy was also evaded way back in 1937 to render the best banking service through prompt and courteous attention to customers.

A highly efficient and experienced management functioning in a well defined organizational structure did not take long to place the bank an executed pedestal in the areas of business, profitability, internal discipline and above all credibility A impeccable

VIVEK COLLEGE OF COMMERCE

Page 1

COMPARISON RATIO ANALYSIS OF SBI AND PNB financial status consistent maintenance of the lofty traditions if banking an observation of a high standard of integrity in its operations helped the bank gain a pre- eminent status. No wonders the administration for the bank was universal as key functionaries of India successive finance minister of independent India Resource Bank of governors and representatives of chamber of commercial showered economics on it.

Modern day management techniques were also very much evident in the good old days years before corporate governance had become a puzzled the banks bound functioned with a high degree of responsibility and concerns for the shareholders. An unbroken records of profits and a fairly high rate of profit and fairly high rate of dividend all through ensured satisfaction, prudential management and asset liability management not only protected the interests of the Bank but also ensured that the obligations to customers were not met. The traditions of the past continued to be upheld even to this day as the State Bank years itself to meet the emerging challenges of the millennium.

STATE BANK OF INDIA (SBI)

In 1955, the imperial bank of India was nationalized and renamed as State Bank of India. Today it is largest bank of India. As a commercial bank and views pointing to branches, it is worlds largest bank with 10,836 Branches. Subsidiary Bank of SBI State Bank of Bikaner and Jaipur State Bank of Hyderabad State Bank of Mysore State Bank of Indore State Bank of Pateyala State Bank Of Saurashtra State Bank of Travancore

ABOUT Togetherness is the theme of this corporate loge of SBI where the world of banking services meet the ever changing customers needs and establishes a link that is like a circle, it indicates complete services towards customers. The logo also denotes a bank that it has prepared to do anything to go to any lengths, for customers. VIVEK COLLEGE OF COMMERCE Page 2

COMPARISON RATIO ANALYSIS OF SBI AND PNB

The blue pointer represent the philosophy of the bank that is always looking for the growth and newer, more challenging, more promising direction. The key hole indicates safety and security. MISSION, VISION AND VALUES

MISSION STATEMENT: To retain the Banks position as premiere Indian Financial Service Group, with world class standards and significant global committed to excellence in customer, shareholder and employee satisfaction and to play a leading role in expanding and diversifying financial service sectors while containing emphasis on its development banking rule.

VISION STATEMENT: Premier Indian Financial Service Group with prospective world-class Standards of efficiency and professionalism and institutional values. Retain its position in the country as pioneers in Development banking. Maximize the shareholders value through high-sustained earnings per Share. An institution with cultural mutual care and commitment, satisfying and Good work environment and continues learning opportunities.

VALUES: Excellence in customer service Profit orientation Belonging commitment to Bank Fairness in all dealings and relations Risk taking and innovative Team playing Learning and renewal VIVEK COLLEGE OF COMMERCE Page 3

COMPARISON RATIO ANALYSIS OF SBI AND PNB Integrity Transparency and Discipline in policies and systems.

3.4 ORGANIZATION STRUCTURE AND CHART

GROUP HEADS FOR RESPECTIVE DIVISIONS

REGIONAL BUSINESS MANAGER

STATE MANAGER

BRANCH MANAGER

SUPERVISOR / AUTHORIZER

SUPERVISOR / AUTHORIZER

PERSONAL BANKERS

TELLERS & RELATIONSHIP MANAGERS

VIVEK COLLEGE OF COMMERCE

Page 4

COMPARISON RATIO ANALYSIS OF SBI AND PNB

PUNJAB NATIONAL BANK

INTRODUCTION: Punjab National Bank (PNB) is an Indian financial services company based in New Delhi, India. PNB is the third largest bank in India in terms of asset size. It was founded in 1895 as a private banking company by Lala Lajpat Rai and is currently the second largest state-owned commercial bank in India ahead of Bank of Baroda with about 5000 branches across 764 cities. It serves over 37 million customers. The bank has been ranked 248th biggest bank in the world by the Bankers' Almanac. The bank's total assets for financial year 2007 was about US$60 billion. PNB has a banking subsidiary in the UK, as well as branches in Hong Kong, Dubai and Kabul, and representative offices in Almaty, Dubai, Oslo, and Shanghai. HISTORY: Punjab National Bank was registered on 19 May 1894 under the Indian Companies Act , with its office in Anarkali Bazaar, Lahore. The founding board was drawn from different parts of India professing different faiths and a varied back-ground with, however, the common objective of providing country with a truly national bank which would further the economic interest of the country. PNB's founders included several leaders of the Swadeshi movement such as Dyal Singh Majithia and Lala Harkishan Lal, Lala Lalchand, Shri Kali Prosanna Roy, Shri E.C. Jessawala, Shri Prabhu Dayal, Bakshi Jaishi Ram, and Lala Dholan Dass. Lala Lajpat Rai was actively associated with the management of the Bank in its early years. The board first met on 23 May 1894. Ironically, the PNB Website now claims Lala Lajpat Rai to be the founding father, surpassing Rai Mul Raj and Dyal Singh Majithia. The bank opened for business on 12 April 1895 in Lahore. PNB has the distinction of being the first Indian bank to have been started solely with Indian capital that has survived to the present. (The first entirely Indian bank, Commercial Bank, was established in 1881 in Faizabad, but failed in 1958.) PNB has had the privilege of maintaining accounts of national leaders such as Mahatma Gandhi, Shri JawaharLal Nehru, Shri LalBahadur Shastri,Shrimati Indira Gandhi, as well as the account of the famous Jalianwala Bagh Committee. Punjab National Bank with 4497 offices and the largest nationalised bank is serving its 3.5 crore customers with the following wide variety of banking services:

VIVEK COLLEGE OF COMMERCE

Page 5

COMPARISON RATIO ANALYSIS OF SBI AND PNB

Corporate banking Personal banking Industrial finance Agricultural finance Financing of trade International banking

Punjab National Bank has been ranked 38th amongst top 500 companies by The Economic Times. PNB has earned 9th position among top 50 trusted brands in India. Punjab National Bank India maintains relationship with more than 200 leading international banks world wide. PNB India has Rupee Drawing Arrangements with 15 exchange companies in UAE and 1 in Singapore.

Punjab National Bank Branches Punjab National Bank has its Branches in all the 7 metropolitan and cosmopolitan cities in Inadi namely New Delhi, Mumbai, Calcutta, Chennai, Bangalore, Hyderabad and Ahmedabad. It even has its branches in small town in both urban as well as rural areas.

VIVEK COLLEGE OF COMMERCE

Page 6

COMPARISON RATIO ANALYSIS OF SBI AND PNB

CHAPTER 2 RATIO ANALYSIS

2.1 MEANING :

Absolute figures expressed in financial statements by themselves are meaningfulness. These figures often do not convey much meaning unless expressed in relation to other figures. Thus, it can be say that the relationship between two figures, expressed in arithmetical terms is called a ratio. A ratio is simply one number expressed in terms of another. It is found by dividing one number into the other. According to R.N. Anthony. The ratio analysis is one of the most powerful tools of financial analysis. It is the process of establishing and interpreting various ratios (quantitative relationship between figure and groups of figures). It is with the help of ratios that the financial statement can be analyzed more clearly and decision made from such analysis. The Balance Sheet and the Statement of Income are essential, but they are only the starting point for successful financial management. Apply Ratio Analysis to Financial Statements to analyze the success, failure, and progress of your business. Ratio Analysis enables the business owner/manager to spot trends in a business and to compare its performance and condition with the average performance of similar businesses in the same industry. To do this compare your ratios with the average of businesses similar to yours and compare your own ratios for several successive years, watching especially for any unfavorable trends that may be starting. Ratio analysis may provide the all-important early warning indications that allow you to solve your business problems before your business is destroyed by them. Ratios are presentation technique, which helps the reader to get idea about the performances & Position of a firm with least efforts. He can get overall view of the firm from the ratios presented to him. He can compare such ratios with the ratios of the past & also with ratios other firm in industry. For getting insight we must know how such ratios are calculated.

VIVEK COLLEGE OF COMMERCE

Page 7

COMPARISON RATIO ANALYSIS OF SBI AND PNB

2.2 IMPORTANCE OF RATIO ANALYSE:

The importances of ratio analysis are as follow: Aid to measure general efficiency: Ratios enable the mass of accounting data to be summarized and simplified. They act as an index of the efficiency of the enterprise. As such they served as instrument of management control.

Aid to measure financial solvency: Ratio are useful tools in the hands of management and other concerned to evaluate the firms performance over a period of time by comparing the present ratio with the past ones. They point out firms liquidity position to meet its short term obligations and long term solvency.

Aid in forecasting and planning: Ratio analysis is an invaluable aid to management in the discharge of its basic function such as planning, forecasting, control etc. the ratio that are derived after analyzing and scrutinizing the past result, helps the management to prepared budgets to formulate policies and to prepared the future plan of action etc.

Facilitate decision making: It shows light on the degree of efficiency of the management and utilization of the assets and that is why it is called surveyor of efficiency. They help management in decision making.

Effective tool: Ratio analysis is help in making effective control of the businessmen. Ratio ensures secrecy.

VIVEK COLLEGE OF COMMERCE

Page 8

COMPARISON RATIO ANALYSIS OF SBI AND PNB

2.3 LIMITATION OF RATIO ANALYSIS:

Ratio analysis is, as already mentioned, a widely- used tool of financial analysis. It is because ratio is simple and easy to understand. But they must be used very carefully. They suffer from various limitations. If due care is not taken, they might confuse than clarity the situation. Different firms may use these terms in different senses or the same firm may use them to mean different things at different times. Some of the limitations of the ratio analysis are given below:

Limitation of accounting records: Ratio analysis is based on financial statements which are themselves subject to limitations. Thus, ratios calculated on the figures given in the financial statements, also suffers from similar limitation.

No allowances for price level changes: Due to change in price level of various years, comparison of ratio of such years cannot give correct conclusion. A change in the price level can seriously affect the validity of comparison of ratio computed for different time periods. For instance, a firm which has purchased an assets at a lower price, will show a higher return, then the firm which has purchased the at an assets at a higher price.

Changes in accounting procedure: Comparison between two variables proves worth provided their basis of valuation is identical. But in reality, it is not possible, such as methods of valuation of stick or charging different firms for their valuation, and then comparison will practically be of no use.

Limited used of single ratio: A single ratio would not be able to convey anything. Ratio can be useful only when they are computed in a sufficient large number. If too many ratios are calculated, they are likely to instead of revealing meaningful conclusion.

VIVEK COLLEGE OF COMMERCE

Page 9

COMPARISON RATIO ANALYSIS OF SBI AND PNB Background is overlooked: When inter- firm comparison is made, they differ substantially in age, size, nature of product etc. when an inter firm comparison is made, these factors are not considered. Therefore, ratio analysis cannot give satisfactory result. Changing policies: Ratio is computed on the basis of past result. Past is not an indicator of future. Ratios computed from historical data are used for predicting and projecting the likely events in the future. Such ratio may provide a glimpse of firms past performance. But forecast for nature may not be correct as several other factors like management policies, market condition etc. may induce future operations.

2.4 USE AND SIGNIFICANCE OF RATIO ANALYSIS

The ratio analysis is one of the most powerful tool of financial analysis. It is used as a device to analysis and interpret the financial health of enterprise. The use of ratios is not confined to financial managers only. The supplier of goods on credit, banks, financial institution, investors, shareholders and management all make use of ratio analysis as a tool in evaluating the financial position and performance of a firm for granting credit, providing loans or making investment in the firm. With the use of ratio analysis one can measure the financial condition of the firm and can point out whether the condition is strong, good, questionable or poor. The conclusion can also be drawn as to whether the performance of the firm is improving or deteriorating. Thus, ratios have wide applications and are of immense use today. a) Managerial uses of Ratio Analysis: Helps in decision-making: Financial statements are prepared primarily for decision-making. But the information provided in financial statements is not an end in itself and no meaningful conclusion can be drawn from these statements alone. Ratio analysis helps in making decisions from the information provided in these financial statements. Helps in financial forecasting and planning: Ratio analysis is much help in financial forecasting and planning. Planning is looking ahead and the ratios calculated for a number of

VIVEK COLLEGE OF COMMERCE

Page 10

COMPARISON RATIO ANALYSIS OF SBI AND PNB years work as a guide for the future. Meaningful conclusion can be drawn for future from these ratios. Helps in communicating: The financial strength and weakness of the firm are communicated in a more easy and understandable manner by the use of ratios. The information contained in the financial statements is conveyed in a meaningful manner to the one for whom it is meant. Thus, ratios help in communication and enhance the value of the financial statements. Helps in co-ordination: Ratios even help in co-ordination which is of utmost important in effective business management. Better communication of efficiency and weakness of an enterprise results in better co-ordination in the enterprise. Helps in control: Ratio analysis even helps in making effective control of the business. Standard ratios can be based upon Performa financial statements and variances or deviations, if any, can be found by comparing the actual with the standard so as to take a corrective action at the right time. The weaknesses or otherwise, if any, come to the knowledge of the management which helps in effective control of the business. b) Utility to Shareholders/Investors: An investor in the company will like to assess the financial position of the concern where he is going to invest. His first interest will be the security of his investment and then a return in the form of dividend or interest. For the first purpose he will try to assess the value of fixed assets and the loans raised against them. The investor will feel satisfied only if the concern has sufficient amount of assets. Long term solvency ratios will help him in assessing financial position of the concern. Profitability ratios, on the other hand, will be useful to determine profitability position. Ratio analysis will be useful to the investor in making up his mind whether present financial position of the concern warrants further investment or not. c) Utility to Creditors: The creditors or suppliers extend short term credit to the concern. They are interested to know whether financial position of the concern warrants their payments at a specified time or not. The concern pays short term creditors out of its current assets. If the current assets are quite sufficient to meet current liabilities then the creditor will not hesitate in extending credit VIVEK COLLEGE OF COMMERCE Page 11

COMPARISON RATIO ANALYSIS OF SBI AND PNB facilities. Current and acid-test ratios will given an idea about the current financial position of the concern. d) Utility to Employees: The employees are also interested in the financial position of the concern especially profitability. Their wage increases and amount of fringe benefits are related to the volume of profits earned by the concern. The employees make use of information available in financial statements. Various profitability ratios relating to gross profit, operating profit, net profit, etc. enable employees to put forward their viewpoint for the increase of wages and other benefits. e) Utility to Government: Government is interested to know the overall strength of the industry. Various financial statements published by industrial units to calculate ratios for determining short-term, longterm and overall financial position of the concerns. Profitability indexes can also be prepared with the help of ratios. Government may base its future policies on the basis of industrial information available from various units. The ratios may be used as indicators of overall financial strength of public as well as private sectors. In the absence of the reliability economic information, government plans and policies may not prove sucessful. f) Tax Audit Requirement: Section 44 AB was inserted in the Income Tax Act by the Finance Act, 1984. Under this section every assesses engaged in any business and having turnover or gross receipts exceeding Rs. 40 lakh is required to get the accounts audited by a charted accountant and submit the tax audit report before the due date for filling the return of income under section 139(1). In case of a professional, a similar report is required if the gross receipts exceed Rs.10 lakh. Clause 32 of the income tax act requires that the following accounting ratios should be given: Gross Profit/Turnover Net Profit/Turnover Stock-in-trade/Turnover Material Consumed/Finished Goods Produced.

VIVEK COLLEGE OF COMMERCE

Page 12

COMPARISON RATIO ANALYSIS OF SBI AND PNB

CHAPTER 3 CLASSIFICATION OF RATIOS

The use of ratio analysis is not confined to the financial manager only. There are different parties interested in the ratio analysis for knowing the financial position of the firm for different purpose. In view of the various users of ratios, there are many types of ratios, which can be calculated for the given information in the financial statements. Following is the classification of ratios: A. Liquidity Ratio B. Profitability Ratio C. Leverage Ratio D. Activity Ratio.

A.Liquidity Ratio:

These ratios analyse the short-term financial position of a firm and indicate the ability of the firm to meet its short-term commitments (current liabilities) out of its short-term resources (current assets). The various ratios are: Current Ratio Liquid Ratio Quick Ratio

a) Current Ratio. It may be defined as the relationship between the current assets and current liabilities. The ratio is a measure of general Liquidity of the firm for a short period of time. A ratio of 2 : 1 is considered satisfactory as a rule of thumb. It is the relationship between current asset and current liability. this ratio is also known as working capital ratio is widely used to make the analysis of short term financial position all liquidity of the firm

1.

Current Ratio

Current Assets Current Liabilities

VIVEK COLLEGE OF COMMERCE

Page 13

COMPARISON RATIO ANALYSIS OF SBI AND PNB

Objective: The objective is to measure the ability of the firm to meet its short term obligations and to reflect the short term financial strength/ solvency of a firm. It suggests whether firm can meet its short term obligation from short term Assets.

Components: Current Assets refer to those assets which are held for their conversion into cash normally within a year and include the following: 1. Inventories of raw material, WIP, finished goods, 2. stores and spares, 3. sundry debtors/receivables, 4. short term loans deposits and advances, 5. cash in hand and bank, 6. prepaid expenses, 7. incomes receivables and 8. marketable investments and short term securities. Current Liabilities refer to those liabilities which are expected to be matured normally within a year and include the followi 1. sundry creditors/bills payable, 2. outstanding expenses, 3. unclaimed dividend, 4. advances received, 5. incomes received in advance, 6. provision for taxation, 7. proposed dividend,

VIVEK COLLEGE OF COMMERCE

Page 14

COMPARISON RATIO ANALYSIS OF SBI AND PNB 8. instalments of loans payable within 12 months, 9. bank overdraft and cash credit

2.

Liquid Assets Liquid Ratio or Acid Test Ratio = Liquid Liabilities

Liquid Assets = Current Assets Stock Liquid Liability = Current liabilities Bank O/D cash credit

Objective: The objective is to measure the ability of the firm to meet its short term obligations as and when due without relying upon the realization of stock.

3.

Quick Ratio

Quick Assets Liquid Liabilities

Quick Assets = Current ratio less stock and debtor. This ratio suggests whether available cash & cash equivalent (which can quickly convertible in cash) are sufficient to meet its short term liabilities.

B. Profitability Ratios (Always is percentage except EPS):

These ratios measure the operating efficiency of the firm and its ability to ensure adequate returns to its shareholders. The profitability of a firm can be measured by its profitability ratios. Further the profitability ratios can be determined (i) in relation to sales and (ii) in relation to investments

In relation to Sales

In relation to Investment

VIVEK COLLEGE OF COMMERCE

Page 15

COMPARISON RATIO ANALYSIS OF SBI AND PNB a) Gross profit ratio b) Net profit Ratio c) Operating Ratio a) Return on Cap. Employed b) Return on Equity c) Return on equity shareholder Fund d) Return on equity share capital e) Earning per share f) Return on total assets

Income statement

Net Sales Less: = Less: Add : = Less: Non operating Expenses: Int. on Debentures Loss on Sale of assets or loss due to fire Add: Non-operating Income: Interest & Dividend on Investment Profit on sale of Assets & Investment = Less: = Less: = Net Profit before tax Tax Net Profit after tax Preference dividend Equity Profit Cost Of Goods Sold Gross Profit Operating Exp (Administrative & Selling Expense) Operating income (commission, discount received.) Operating Profit (PBIT)

VIVEK COLLEGE OF COMMERCE

Page 16

COMPARISON RATIO ANALYSIS OF SBI AND PNB

1.

Gross Profit Ratio

Gross Profit 1 00 Net Sales

Gross Profit = Sales Cost of goods sold. Cost of goods sold = Opening stock + Net purchase + Purchase Exp +wages closing stock

Objective : The objective is to determine the efficiency with which production and/or purchase operations are carried on. Gross profit is the result of relationship between prices, sales volume and costs.

2.

Net Profit Ratio

Net Profit After Tax 1 00 Net Sales

Objective:The objective is to determine the overall profitability due to various factors such as operational efficiency. This ratio is indicative of the firms ability to leave a margin of reasonable compensation to the owners for providing capital, after meeting the cost of production, operating charges and the cost of borrowed funds.

3.

Operating Ratio =

Cost of Goods sold + Administrative / Selling / Distribution/ Financial Expenses 100 Net Sales

Objective: The objective is to determine the operational efficiency with which production and /or purchases and selling operations are carried on.

Interpretation:This ratio indicates an average operating cost incurred on sales of goods worth Rs. 100. Lower the ratio, greater is the operating profit to cover the non operating expenses, to pay dividend and to create reserves and viceversa.

VIVEK COLLEGE OF COMMERCE

Page 17

COMPARISON RATIO ANALYSIS OF SBI AND PNB In relation to Investment: Profit before Int & tax [profit available to equity shareholder, Pref. shareholder, debenture holder Less: Interest Profit before tax Less: Tax Profit after tax [Profit available to equity shareholder & Pref. shareholder] Less: = Pref. Dividend Equity Profit [Profit available to equity share holder]

Format of Capital Employed:

Equity share capital Add: Less: = Add: = Add: = Reserve & Surplus Miscellaneous Expenditure Equity share holders fund Preference share capital Share holders fund (Equity) Debt (debenture and term loan) Capital Employed

1.

Return on Capital Employed =

P.B.I.T 100 Capital Employed

Capital employed = total investment=long term fund Objective: The objective is to find out how efficiently the long term funds supplied by the Debenture holder and shareholders have been used. This ratio measures the relationship between net profit and capital employed. It indicates how efficiently the long-term funds of owners and creditors are being used.

VIVEK COLLEGE OF COMMERCE

Page 18

COMPARISON RATIO ANALYSIS OF SBI AND PNB

2. Return on Equity =

P. A. T 100 Equity

Equity = shareholder Fund = Owners fund = Proprietors Fund

Objective:The objective is to find out how efficiently the funds belonging to the shareholders (equity and preference) have been used.

Equity Profit 100 Equity shareholder fund 3. Return on Equity shareholder fund =

Objective: The objective is to find out how efficiently the funds supplied by the equity shareholders have been used. This ratio measures the relationship of profits to owners funds. Shareholders fall into two groups i.e. preference shareholders and equity shareholders. So the variants of return on shareholders equity are

4. Return on equity share capital =

Equity Profit 100 Equity Share Capital

Objective: The objective is to find out how efficiently the funds supplied by the equity shareholders have been used.

5. Earning Per Share =

Equity Profit No. of Equity Shares

Objective:The objective is to measure the profitability of the firm on per equity share basis. This ratio measures the profit available to the equity shareholders on a per share basis. This

VIVEK COLLEGE OF COMMERCE

Page 19

COMPARISON RATIO ANALYSIS OF SBI AND PNB ratio is calculated by dividing net profit available to equity shareholders by the number of equity shares. 6. Dividend Per Share(Dps) = Dividend paid to ordinary shareholders Number of equity shares This ratio shows the dividend paid to the shareholder on a per share basis. This is a better indicator than the EPS as it shows the amount of dividend received by the ordinary shareholders, while EPS merely shows theoretically how much belongs to the ordinary shareholders

7. Price Earning Ratio = market price per share Earnings per share This ratio is computed by dividing the market price of the shares by the earnings per share. It measures the expectations of the investors and market appraisal of the

performance of the firm.

C. LEVERAGE RATIO (Long term Solvency):

These ratios indicate the long term solvency of a firm and indicate the ability of the firm to meet its long-term commitment with respect to (i) (ii) repayment of principal on maturity or in predetermined instalments at due dates and periodic payment of interest during the period of the loan. Debt Equity Ratio Capital Gearing Ratio Proprietary Ratio

Interest Coverage Ratio Debt Service Coverage Ratio Long term fund to fixed Asset

1. Debt Equity Ratio (Leverage Ratio) = Objective :-

Debt 100 Equity

The objective is to measure the relative proportion of debt and equity in financing the assets of a firm. This ratio indicates the relative proportion of debt and equity in financing the assets of the firm. It is calculated by dividing long-term debt by shareholders funds. VIVEK COLLEGE OF COMMERCE Page 20

COMPARISON RATIO ANALYSIS OF SBI AND PNB LONG-TERM FUNDS are long-term loans whether secured or unsecured like debentures, bonds, loans from financial institutions etc. SHAREHOLDERS FUNDS are equity share capital plus preference share capital plus reserves and surplus minus fictitious assets (eg. Preliminary expenses, past accumulated losses, discount on issue of shares etc.)

2.Capital Gearing Ratio =

Debt Pref. Shares 100 Equity Share Capital

Objective:The objective is to find proportion of fix return bearing security to not fix return bearing securities in total capital of firm.

3.Proprietary ratio =

Prop. fund (equity) 100 Total Asset

Objective:The objective is to find out how much the proprietors have financed for the purchases of assets. This ratio indicates the general financial strength of the firm and the long- term solvency of the business. PROPRIETORS FUNDS are same as explained in shareholders funds TOTAL FUNDS are all fixed assets and all current assets. Alternatively it can be calculated as proprietors funds plus long-term funds plus current liabilities.

4.Interest Coverage Ratio =

P. B. I. T Interest On Loan

Objective:The objective is to measure the debt servicing capacity of a firm so far fixed interest on long term debt and debenture is concerned.

VIVEK COLLEGE OF COMMERCE

Page 21

COMPARISON RATIO ANALYSIS OF SBI AND PNB This ratio measures the debt servicing capacity of a firm in so far as the fixed interest on long-term loan is concerned. It shows how many times the interest charges are covered by EBIT out of which they will be paid.

5.Debt Service Coverage Ratio =

Cash Available for Debt Service Int. On. Debt Install Due On Loan during finance year

Cash available for debt payment means P.A.T. +Depreciation & other non cash expenditure dr. to P & L account + Interest on debt This is a more comprehensive measure to compute the debt servicing capacity of a firm. It shows how many times the total debt service obligations consisting of interest and repayment of principal in instalments are covered by the total operating funds after payment of tax.

6. Long term Fund to Fixed Assets =

Long Term Fund 100 Fixed Assets

Interpretation: Sound business technique it to Acquire major permanent assets from permanent capital & temporary capital should be invested in current assets. If temporary capital is invested in permanent assets than financial position may get disturb? This ratio suggests how much proportion of permanent assets is purchased from permanent capital. Higher the ratio more is the finance from long term sources.

D.ACTIVITY RATIOS:These ratios are also called efficiency ratios / asset utilization ratios or turnover ratios. These ratios show the relationship between sales and various assets of a firm. The various ratios under this group are: Capital Turnover Ratio Debtors Turnover Ratio (Debtors Ratio) Fixed Assets Turnover Ratio Creditors Turnover Ratio (Creditors Ratio) Stock Turnover Ratio

VIVEK COLLEGE OF COMMERCE

Page 22

COMPARISON RATIO ANALYSIS OF SBI AND PNB

1.Capital Turnover Ratio (In times) =

Net Sales (Avg.) Capital Employed [Debt Equity]

Objective: The objective is to determine the efficiency with which the capital employed is utilized.

Net Sales 2.Fixed Assets Turnover Ratio (in times) = (Avg.)Fixed Assets

Objective: The objective is to determine the efficiency with which the fixed assets are utilized.

3.Stock Turnover Ratio (in times) =

Cost Of Goods Sold Avg. Stock

Objective:The objective is to determine the efficiency with which the inventory is utilised.

4.Debtors Turnover Ratio (in times) =

Cr. Sales (Avg.) Debtors B/R

Debtors Ratio OR Debt Velocity Ratio (in days) = Objective:The objective is to determine the efficiency with which the trade debtors are managed. 5.Creditors Turnover Ratio (in times) = Creditors Velocity Ratio (in days) OR Creditors Ratio =

(Avg)Debtors B/R 365/360/12/52( week) Credit Sales

Net Credit Purchase (Avg) Creditors B. P.

(Avg)Creditors B. P. 365/360/12/52(week) Net CreditPurchase

VIVEK COLLEGE OF COMMERCE

Page 23

COMPARISON RATIO ANALYSIS OF SBI AND PNB Objective: The objective is to determine the efficiency with which the creditors are managed.

Total Assets Turnover Ratio (in times) = Objective:

Net Sales Total Assets

How efficiently assets are employed in business. Interpretation:

This ratio suggests how a rupee of asset contributes to earn sales more the ratio more efficiently assets are used in gainful operation

VIVEK COLLEGE OF COMMERCE

Page 24

COMPARISON RATIO ANALYSIS OF SBI AND PNB

CHAPTER 4 BALANCE SHEET OF SBI AND PNB

Capital Liabilities:

and March 12 mths 671.04

Assets Cash & Balances with RBI Balance with Banks, Money at Call Advances

March 12 mths 54,075.94

Total Share Capital

Equity Share Capital Share Money Preference Capital Reserves Revaluation Reserves Net Worth Deposits Share Application

671.04

43,087.23

0.00

867,578.89

0.00 83,280.16 0.00 83,951.20 1,043,647.36

Investments Gross Block Accumulated Depreciation Net Block Capital Progress Other Assets Work In

312,197.61 14,792.33 9,658.46 5,133.87 332.68

Borrowings Total Debt Other Liabilities &

127,005.57 1,170,652.93 80,915.09 1,335,519.22

53,113.02

Provisions Total Liabilities

Total Assets

1,335,519.24

VIVEK COLLEGE OF COMMERCE

Page 25

COMPARISON RATIO ANALYSIS OF SBI AND PNB 4.1 BALANCE SHEET OF PUNJAB NATIONAL BANK

Mar'13 12 mths Capital and Liabilities: Total Share Capital Equity Share Capital Share Application Money Preference Share Capital Reserves Revaluation Reserves Net Worth Deposits Borrowings Total Debt Other Liabilities & Provisions Total Liabilities 353.47 353.47 0.00 0.00 32,323.43 0.00 32,676.90

Mar '12 12 mths

339.18 339.18 0.00 0.00 26,028.37 1,449.53 27,817.08

391,560.06 379,588.48 39,620.92 37,264.27

431,180.98 416,852.75 15,019.15 13,524.18

478,877.03 458,194.01 Mar '13 12 mths Mar '12 12 mths

Assets Cash & Balances with RBI Balance with Banks, Money at Call Advances Investments Gross Block Accumulated Depreciation Net Block 17,886.25 9,249.13 18,492.90 10,335.14

308,725.21 293,774.76 129,896.19 122,629.47 3,357.68 0.00 3,357.68 5,265.08 2,096.22 3,168.86

VIVEK COLLEGE OF COMMERCE

Page 26

COMPARISON RATIO ANALYSIS OF SBI AND PNB Capital Work In Progress Other Assets Total Assets Contingent Liabilities Bills for collection Book Value (Rs) 0.00 9,762.58 0.00 9,792.88

478,877.04 458,194.01 180,510.17 173,768.84 51,300.36 924.45 50,981.22 777.39

COMMENT: 1. In March12 the Net Worth of Punjab National Bank is Rs. 27,817.08 and March13 is Rs. 32,676.90 as comparing to both years of them the March13 is more. 2. In March12 the Total Liabilities is Rs. 458,194.01 and March13 is Rs.478.877.03 as comparing to both of years the March13 is more as compare to the March12. 3. In March12 the Advances is Rs. 293,774.76 and March13 is Rs. 308,725.21 as comparing to both of years the March13 is more as compare to March12. 4. In March12 the Investment is Rs. 122,629.47 and March13 is Rs. 129,896.19 as comparing to both of years the March13 is more as compare to March12. 5. In March12 the Total Assets is Rs. 458,194.01 and March13 is Rs. 478,877.04 as comparing to both of years the March13 is more than the March12.

VIVEK COLLEGE OF COMMERCE

Page 27

COMPARISON RATIO ANALYSIS OF SBI AND PNB

4.2 .RATIOS

Mar '13 Investment Valuation Ratios Face Value Dividend Per Share Operating Profit Per Share (Rs) Net Operating Profit Per Share (Rs) Free Reserves Per Share (Rs) Bonus in Equity Capital Profitability Ratios Interest Spread Adjusted Cash Margin(%) Net Profit Margin Return on Long Term Fund(%) Return on Net Worth(%) Adjusted Return on Net Worth(%) Return on Assets Excluding -10.98 10.29 97.26 14.52 14.52 924.45 4.51 12.80 12.09 113.95 18.52 18.50 777.39 10.00 27.00 198.32 1,185.19 --10.00 22.00 223.61 1,170.81 130.21 --

Mar '12

Revaluations Return on Assets Including

Revaluations Management Efficiency Ratios Interest Income / Total Funds Net Interest Income / Total Funds Non Interest Income / Total Funds Interest Expended / Total Funds

924.45

820.13

8.96 3.18 0.90 5.78

9.53 4.01 0.16 5.52

VIVEK COLLEGE OF COMMERCE

Page 28

COMPARISON RATIO ANALYSIS OF SBI AND PNB Operating Expense / Total Funds 1.68 2.19 1.91 1.17 0.15 9.69 5.52 0.10 0.10

Profit Before Provisions / Total Funds 2.33 Net Profit / Total Funds Loans Turnover Total Income / Capital Employed(%) Interest Expended / Capital 1.01 0.29 9.86 5.78 0.09 0.09

Employed(%) Total Assets Turnover Ratios Asset Turnover Ratio Profit And Loss Account Ratios Interest Expended / Interest Earned Other Income / Total Income Operating Expense / Total Income

64.54 9.14 17.02

63.18 1.68 22.56 0.09

Selling Distribution Cost Composition -Balance Sheet Ratios Capital Adequacy Ratio Advances / Loans Funds(%) Debt Coverage Ratios Credit Deposit Ratio Investment Deposit Ratio Cash Deposit Ratio Total Debt to Owners Fund Financial Charges Coverage Ratio Financial Charges Coverage Ratio Post Tax Leverage Ratios Current Ratio Quick Ratio 0.78 22.40 38.10 32.75 4.72 11.98 0.42 1.19 12.72 --

12.63 77.17

77.39 31.45 6.10 14.40 0.36 1.22

0.02 23.81

VIVEK COLLEGE OF COMMERCE

Page 29

COMPARISON RATIO ANALYSIS OF SBI AND PNB Cash Flow Indicator Ratios Dividend Payout Ratio Net Profit Dividend Payout Ratio Cash Profit Earning Retention Ratio Cash Earning Retention Ratio Adjusted Cash Flow Times 23.51 22.03 76.49 77.97 77.29 Mar '13 Earnings Per Share Book Value 134.31 924.45 17.75 16.75 82.23 83.24 73.39 Mar '12 144.00 777.39

RATIOS OF STATE BANK OF INDIA

Investment Valuation Ratios

Face Value Dividend Per Share Operating Share (Rs) Net Operating Profit Per Share (Rs) Free Reserves Per Share (Rs) Bonus in Equity Capital Profit Per

10.00 35.00 289.44

1,776.47

645.05 --

VIVEK COLLEGE OF COMMERCE

Page 30

COMPARISON RATIO ANALYSIS OF SBI AND PNB Profitability Ratios

Interest Spread Adjusted Cash Margin(%) Net Profit Margin Return on Long Term Fund(%) Return on Net Worth(%) Adjusted Return on Net Worth(%) Return on Assets Excluding Revaluations Return on Assets Including Revaluations

5.04 10.59 9.73 96.84 13.94 13.97 1,251.05 1,251.05

Management Efficiency Ratios

Interest Income / Total Funds Net Interest Income / Total Funds Non Interest Income / Total Funds Interest Expended / Total Funds Operating Expense / Total Funds Profit Before Provisions / Total Funds Net Profit / Total Funds Loans Turnover

9.32 4.37 0.08 4.94 2.86 1.52 0.91 0.15

Total Income / Capital Employed(%) 9.40 Interest Expended / Capital 4.94 0.09 0.10

Employed(%) Total Assets Turnover Ratios Asset Turnover Ratio

VIVEK COLLEGE OF COMMERCE

Page 31

COMPARISON RATIO ANALYSIS OF SBI AND PNB

Profit And Loss Account Ratios

Interest

Expended

/ 59.36 total 0.85

Interest Earned Other income Operating Expense / Total Income Selling Distribution Cost Composition income/

30.40

0.17

Balance Sheet Ratios

Capital Adequacy Ratio Advances / Loans Funds(%)

13.86 78.01

Debt Coverage Ratios

Credit Deposit Ratio Investment Deposit Ratio Cash Deposit Ratio Total Debt to Owners Fund Financial Charges Coverage Ratio Financial Charges Coverage Ratio Post Tax

82.14 30.73 7.51 12.43 0.32 1.20

VIVEK COLLEGE OF COMMERCE

Page 32

COMPARISON RATIO ANALYSIS OF SBI AND PNB

Leverage ratio

Current Ratio Quick Ratio

0.05 12.05

Cash Flow Indicator Ratios

Dividend Payout Ratio Net Profit Dividend Payout Profit Earning Retention Ratio Cash Earning Retention Ratio AdjustedCash Flow Times Ratio Cash

22.59 20.80 77.45 79.24 81.94

VIVEK COLLEGE OF COMMERCE

Page 33

COMPARISON RATIO ANALYSIS OF SBI AND PNB

CHAPTER 6 CONCLUSION

The study may be a helpful step ahead in increasing them orale of each Employee By studying this, Bank will can come to know that what effective measure can be take to maintain the effective use of resources. Such results and conclusions are definitely helpful in order to achieve goals of the organization in this modern business world.There is a lot to be said for valuing a company, it is no easytask. I

VIVEK COLLEGE OF COMMERCE

Page 34

COMPARISON RATIO ANALYSIS OF SBI AND PNB

CHAPTER 7 BIBILOGRAPHY

www.wikinvest.com www.studymode.com www.investopedia.com indianresearchjournals.com

VIVEK COLLEGE OF COMMERCE

Page 35

You might also like

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Direct Tax Main ProjectDocument44 pagesDirect Tax Main ProjectKavita NadarNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Direct Tax Sem III PRJCTDocument9 pagesDirect Tax Sem III PRJCTKavita NadarNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Working Capital Management of EscortDocument74 pagesWorking Capital Management of EscortKavita NadarNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- RM Main Project... KavitaDocument32 pagesRM Main Project... KavitaKavita NadarNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- Annual Report of RelianceDocument9 pagesAnnual Report of RelianceKavita NadarNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Introduction to Value Added Tax in MaharashtraDocument38 pagesIntroduction to Value Added Tax in MaharashtraKavita NadarNo ratings yet

- Working Capital Management of EscortDocument74 pagesWorking Capital Management of EscortKavita NadarNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Annual Report of RelianceDocument9 pagesAnnual Report of RelianceKavita NadarNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- International Business KavitaDocument4 pagesInternational Business KavitaKavita NadarNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Current Economy Crux (Prelims) by CA Rahul Kumar IAS Prelims 2020Document44 pagesCurrent Economy Crux (Prelims) by CA Rahul Kumar IAS Prelims 2020asha manchandaNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- Acc 3 - RRNDDocument27 pagesAcc 3 - RRNDHistory and EventNo ratings yet

- Principles of Accounting IIDocument175 pagesPrinciples of Accounting IIsamuel debebe95% (22)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Hewlett PackardDocument31 pagesHewlett PackardAamir Awan0% (2)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Micro and Small Enterprises in India PDFDocument23 pagesMicro and Small Enterprises in India PDFSuryamaniNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Insurance Fraud: Atty. Dennis B. FunaDocument47 pagesInsurance Fraud: Atty. Dennis B. FunaShie La Ma RieNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- ITODDocument8 pagesITODMukesh KumarNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- HSBC Uk Launches Green Finance Proposition To Support Uk Businesses PDFDocument2 pagesHSBC Uk Launches Green Finance Proposition To Support Uk Businesses PDFSahjeet MenonNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- Model Question BBS 3rd Taxation in NepalDocument6 pagesModel Question BBS 3rd Taxation in NepalAsmita BhujelNo ratings yet

- Preqin Quarterly Private Debt Update Q2 2015Document8 pagesPreqin Quarterly Private Debt Update Q2 2015ed_nycNo ratings yet

- Valuing Rent-Controlled Residential PropertiesDocument14 pagesValuing Rent-Controlled Residential PropertiesiugjkacNo ratings yet

- Econ2300A+Week+1+-Fall+2023 3Document19 pagesEcon2300A+Week+1+-Fall+2023 3zakariaNo ratings yet

- Global Strategy: Yield Curve, Markets and StrategyDocument12 pagesGlobal Strategy: Yield Curve, Markets and StrategySiphoKhosaNo ratings yet

- Finalised Interest Rate Swaps ConfirmationDocument18 pagesFinalised Interest Rate Swaps ConfirmationSurbhi GuptaNo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Prospectus - Optimal SA FundDocument45 pagesProspectus - Optimal SA FundMigle BloomNo ratings yet

- Ab Jaiib Capsule 2.o Paper 1 PPB PDFDocument287 pagesAb Jaiib Capsule 2.o Paper 1 PPB PDFSubhasis MohapatraNo ratings yet

- Investing Strategy: Paul Tudor Jones Shares 7 Timeless Trading Rules - Business InsiderDocument1 pageInvesting Strategy: Paul Tudor Jones Shares 7 Timeless Trading Rules - Business InsiderCosimo Dell'OrtoNo ratings yet

- Withdraw PayPal Money in Malaysia SolutionDocument16 pagesWithdraw PayPal Money in Malaysia Solutionafarz2604No ratings yet

- Supreme Court: Gullas, Lopez, Tuaño and Leuterio For Plaintiff-Appellant. Jose Delgado For Defendant-AppellantDocument47 pagesSupreme Court: Gullas, Lopez, Tuaño and Leuterio For Plaintiff-Appellant. Jose Delgado For Defendant-AppellantArzaga Dessa BCNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Employment Vs Independent Contractor AnalysisDocument4 pagesEmployment Vs Independent Contractor AnalysisLarry HaberNo ratings yet

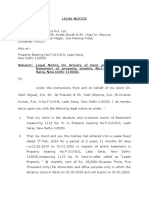

- Prince Bhai Legal NoticeDocument3 pagesPrince Bhai Legal Noticepradeep kumarNo ratings yet

- MA Florian Gronde Flashloans-Ohne AppendixDocument75 pagesMA Florian Gronde Flashloans-Ohne AppendixCollors TPLNo ratings yet

- Intrim Report - Avinash Kumar SinghDocument26 pagesIntrim Report - Avinash Kumar SinghArjun KhareNo ratings yet

- The Effect of Capital Flight On Nigerian EconomyDocument127 pagesThe Effect of Capital Flight On Nigerian EconomyAdewole Aliu OlusolaNo ratings yet

- Money and BankingDocument8 pagesMoney and BankingMuskan RahimNo ratings yet

- Clark Vs Sellner DigestDocument1 pageClark Vs Sellner Digestjim jim100% (1)

- Formulation of Portfolio StrategyDocument9 pagesFormulation of Portfolio StrategyKhyati KhokharaNo ratings yet

- New Homes For Sale in Austin, TX by KB HomeDocument1 pageNew Homes For Sale in Austin, TX by KB HomeNini KikabidzeNo ratings yet

- NICEHoldingsInvestorsRelations 2020 3Q ENGDocument31 pagesNICEHoldingsInvestorsRelations 2020 3Q ENGSimonasNo ratings yet

- Accounting MCQDocument15 pagesAccounting MCQsamuelkish50% (2)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)