Professional Documents

Culture Documents

CASE METHODOLOGY - Colgate

Uploaded by

Fakhrul Anour AbdullahCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

CASE METHODOLOGY - Colgate

Uploaded by

Fakhrul Anour AbdullahCopyright:

Available Formats

MASTER OF BUSINESS ADMINISTRATION

MGT 6798

CASE METHODOLOGY:

SOFT N SHINY

An Individual Assignment

Submitted to: Mr. Ayub bin Hj. Khalid

Submitted by: Fakhrul Anour bin Abdullah G1136857

0|Page

CONTENTS

1- ABSTRACTS 2- INTRODUCTION 3- PROBLEM STATEMENT 4- SWOT ANALYSIS 5- CONCLUSION 6- RECOMMENDATION 7- REFERENCES

Page 02 Page 03 Page 05 Page 07 Page 08 Page 09 Page 10

1|Page

ABSTRACT

We are used to being the number one in the market. Besides, we have a good product and we strongly believe that we can manage to get a bigger portion of the pie if we try harder.

Cik Rose (Product Manager of Colgate-Palmolive (M) Sdn. Bhd.)

This case will foresee that a certain confident and prove of a brand profit-making is not necessarily beneficial to become the subject of supported income, especially in market strategy. It is a lesson for other businesses to learn that an identity of a brand cannot simply be transformed into other feature especially when it has fulfilled the four criteria (rare, variable, costly to imitate and nonsubstitutable) of core competencies in creating competitive advantage. Further analysis of the problem statement will raise certain factors of branding misplaced and tendency of business misinterpretation.

2|Page

INTRODUCTION

Colgate is known for its famous toothpaste, Colgate (44.7% of global market share for toothpaste) and its Palmolive cleaning products. Colgate Palmolive is one of the largest consumer product companies with $16.7 billion in sales operating in over 200 countries. 75% of Colgate Palmolives sales come from outside the USA. CL is basically divided in four segments: Oral, Personal care, Home care and Others (Others includes Pet nutrition).1

Based in United States of America, Colgate-Palmolive (M) Sdn. Bhd. started off in 1960 as a manufacturing company of tooth-paste. It all began with the success of parent company; Colgate-Palmolive Company USA manufactured soap and detergent products. With good research and development teams from all around the world, the company has garnered profitable world sales in many of its product categories. But even though, the parent company was directly involved in the subsidiary companies, but there is freedom in making decision of products well-being of marketing and sales in its respective region. Thus in Malaysia, the subsidiary was responsible for the manufacturing of product lines in four main ranges (Oral, Household, Toiletries and Personal Cares) but the business strategy build mostly by the team worked in Colgate-Palmolive (M) Sdn. Bhd.

3|Page

Colgate-Palmolive (M) Sdn. Bhd. was a market leader in its entire product lines in Malaysia, except for the category of soap and shampoo. The company conquered 55% of the toothpaste market to make it a leader, meanwhile its soap lines maintain at number two positions. In toothpaste market the company was a leader with Colgate, the brand has become a generic name among consumers. The company was also a market leader for the most competitive household product category; the laundry detergents. Brand such as Fab and Trojan held 34% of the market share with Fab laundry bar captured 65% of it. Then there was Glo, the dishwashing liquid introduced in 1975 that also had become a market leader. Followed by a brand of fabric softener in 1980, Soflan that has captured 65% of the market share. Active in its research and development with manufacturing new products with great successes, the company began exporting their products specifically to Singapore, Hong Kong, Brunei, Fiji and Papua New Guinea. But not everything produced and made by Colgate-Palmolive (M) Sdn. Bhd. has its magic touch of success. One sector of market that the company was still trying to conquer is the shampoo market. In 1980 with Beecham, Bristol-Myers and Kao Tradings as its close competitors, the company had yet struggled to find the right formula in its business strategy to produce a shampoo brand that will be a market leader.

In 1938 the Colgate-Palmolive-Peet Company in Jersey City, N.J., introduced Halo, the zero soap shampoo. Their slogan was "Soaping dulls hair, while Halo glorifies it." The product came with a double-your-money back guarantee. Advertisements claimed that the lack of oils and harsh chemicals made the product clean-rinsing and safe for children.2

4|Page

PROBLEM STATEMENT

Over the years the Colgate-Palmolive Company used celebrities and program sponsorships to endorse their product. In the 1940s, the product jingle, "Halo, Everybody, Halo," was introduced on the radio and early TV. While the Halo bottle retained its distinctive shape, at the end of 1954, Colgate-Palmolive introduced this new blue, white, and gold packaging. In 1956, their ads claimed they were Americas #1 Selling Shampoo.2

In 1976, Colgate-Palmolive (M) Sdn. Bhd. introduced its Colgate Family Shampoo with the idea of low-priced product in good quality. Portrayed as value for your money in its advertisement campaigns, the shampoo claimed to be medicated to eliminate dandruff and make hair soft. Packaged in containers of three different sizes (60ml, 150ml and 300ml), the target market was Malays and young users with low income. It was a success because of low pricing and promised benefits. A year after launched, the product has captured 13% of market share before it became market leader in 1978 with 20% of total market share. But in 1979, the sales began to drop with market share slipped to 18% and continue to drop to 16% in 1981. It had become an alert situation for the company to look for solution of the problem. Based on the analysis made by the company, theory made that the increase in competition contributed to the loss in sales. It was proven later with the flood of more new brands came into the market. Hence in January 1982, revitalization strategy was made to the product of Colgate Family Shampoo by changing the brand, size and variants offered. The size increased (120ml, 200ml and 350ml), the brand changed to Colgate Herbal Shampoo (dropped the family name) with variant added of herbal to further enhance the cosmetic image and revived the notion of its ability to make hair healthier. Without changing the advertisement campaign of Value for Your Money, the changes in product image hoped to increase sales but it didnt. Its market shares continued to shrink in the following years and with more entry of other brands, by the end of 1984, the company only held 9% of the market share.

5|Page

In 1985, after further analysis to improve market share of its shampoo product thus released new brand called Colgate Soft N Shiny Shampoo for cosmetic and medicated use. With this new brand entry, Colgate-Palmolive (M) Sdn. Bhd. put a different product positioning, modern packaging and a new advertising copy. With this new entry, it helped the rate of decline in the market. But as the market share received more new entry of other brands from competitors, efforts made by the company to achieve its target to be a market leader of the segment was clarity that was hard to condition. To further simplify the problem existed in the product segmentation of market for Colgate-Palmolive (M) Sdn. Bhd., it is adequate to quantify the matters into these perspectives: Shampoo market was shared by many producers and brands that caused high intensity in competition. Branding options offered to consumers were seemed not attractive enough to define certain image of the product that was related to distinctive image of the company. The companys name has been synonyms with certain type of product that the entry of the new product within the companys line couldnt establish a different approach to the consumers awareness. Promotional campaign by the hired agent based in United States, HDM-DYR Sdn. Bhd. only believed in visual presentation of electronic media instead of printed media. With a limited airtime and non-frequent airing schedule, may affected short of awareness among consumers. Majority competitors than enter the shampoo market and made lead were genuinely focus on the hair-care products before any other products.

The latest shampoo products release by Colgate-Palmolive in UK and US which based on herbal formulation. The same concept has been used on its subsidiaries in Asia like Vietnam, Philippine, Australia and Malaysia as well.

6|Page

SWOT ANALYSIS

OPPORTUNITES

1) In the industry of simple product with easy formulation 2) High market demand 3) Distribution channels that also penetrated into the rural areas 4) Flexible pricing model

THREATS

1) Highly competitive market 2) Product easily imitated 3) Easy entry and exit market 4) Consumers demand on branding before contents 5) Scarce supply on resources

STRENGTHS

1) A world leader in the respective market with most of its products especially in toothpaste, detergents and soap 2) Strong strategy in research and development 3) Strong distribution channels and branches of proper business networks 4) Centralized support

S-O

As subsidiary of such successful business would give more benefit to further extends its product credibility. It also gave extra assurance of the company to run proper analysis of the market in order to understand about entry and exit of product segmentation.

S-T

With success of other product line in its production, the company had better distribution channel and proper networking to strengthen its ability to expand sales of new product. Proven best in producing good products, new product entry convince certain level of acceptance.

WEAKNESSES

1) Unable to differentiate its product segmentation to the company established label 2) Bestselling products obscured the entrance of new products 3) Limited advertising strategy

W-O

More trial and error needed to be done to further regulate new ideas of its shampoo brands. Most importantly, the company needed to take out its company name to the products brand in order to avoid confusion.

W-T

Evaluate the packaging style of the competitors, examined the contents offered by them and rebranding to discriminate simulacrum. Use the easy and entry as the process of endless trial and error to exceed vitality.

7|Page

CONCLUSION

Brand switching was common among consumers, because cosmetic shampoo was regarded as a fashionable item. Meanwhile, shampoo industry was considered a dynamic market in the cosmetic segment. Consumers tastes and preferences changed quite rapidly. Based on a survey commissioned by Colgate-Palmolive (M) Sdn. Bhd. dated 10th & 11th January 1985; the results indicated that, on average, about eight out of ten Malaysian female adults washed their hair with shampoo. Out of these users, three quarters of them washed their hair two to three times a week. The users were mainly urban Chinese, earning more than $300 a month. Most of the time, users washed their hair themselves, while one third visited hair saloons for that purpose.

Since shampoo could be considered a personal product, most purchases were made by female family members. However, for married females, it was also quite common for their husbands to buy the shampoo, mainly from provision shops and supermarkets.

The key attributes often sought by consumers in shampoo purchase, either in the cosmetic or medicated segment were: Fragrance Color Translucence (or opacity of the shampoo) The package image The additional product ingredients

Beside the key attributes sought in the purchase of a shampoo, consumers also expected some benefits from the use of the shampoo. Generally, the basic functional benefits were the ability to clean hair, to stop hair loss, and to eliminate dandruff.

In addition, consumers would also expect to enjoy the cosmetic benefits of the shampoo, which included making the hair soft and shiny, making it smell nice, and becoming more manageable.

8|Page

RECOMMENDATION

In 1998, a year after the second generation of the Soft N Shiny Shampoo was relaunched, Colgate-Palmolive (M) Sdn. Bhd. managed to capture 6% of the market share. Looking at the sales, although there was an increase of 1% in market share from the previous, there was actually a decrease from 11% to 9% of the actual amount of shampoo sold. The product management team led by Cik Rose knew that performance of its shampoo products was not enough for the company and there was a need to reanalyze the product marketing strategy to determine what went wrong, and to reformulate a more effective market strategy. The problem of its shampoo would not be about the content but most of it about the branding strategy. Colgate-Palmolive (M) Sdn. Bhd. needed to think more out of the box, diversified its branding name for shampoo without taking familiarity of its company name. Accordance to the survey it did in 1985, the company knew the choise of a suitable name would be dependent on whether one wants either; a product related name or a reflection of being special and unique. The answer is the second choice; reflection of being special and unique!

The team should ponder back to the classic time of Colgate-Palmolive trend of early shampoo, Halohow the brand name was distinctive from its company name, to deliver a special and unique appeal to consumers instead of stood popular because of its producer.

To further relate the product to consumers, the trend of its classic Halo promotion that used celebrities and other media like comic media for extensive awareness are recommended, so it could be appealing to all level of consumers.

9|Page

REFERENCES

http://seekingalpha.com/article/923911-colgate-palmolive-dividend-stock-analysis http://americanhistory.si.edu/collections/search/object/nmah_210364 http://forums.longhaircommunity.com/showthread.php?t=111187

I used Halo shampoo when I was a little girl (a looonnng time ago) and to this day I remember how delicious it smelled. Are there any other shampoos you remember from childhood that aren't around any more?

PetuniaBlossom3

Colgate-Palmolive-Peet Companys Halo Shampoo Top RCD Recording Star Ralph Flanagan

Hits a high note in dance tunes. "Halo, Everybody, Halo!" (1954)

10 | P a g e

You might also like

- Marketing Plan SURF & ARIELDocument25 pagesMarketing Plan SURF & ARIELTabz Hussain100% (10)

- QSPMDocument2 pagesQSPMMaysa84100% (4)

- Essay Chp7Document8 pagesEssay Chp7barrettm82a1No ratings yet

- Kraft FoodsDocument22 pagesKraft FoodsVrajesh Shah82% (17)

- Case Methodology: Case Study 4 - Colgate Soft N ShinyDocument6 pagesCase Methodology: Case Study 4 - Colgate Soft N ShinyZia100% (1)

- Product Life Cycle of Colgate: Introduction, Growth, Maturity and Decline StagesDocument15 pagesProduct Life Cycle of Colgate: Introduction, Growth, Maturity and Decline StagesRahul TambiNo ratings yet

- Submitted By: Submitted ToDocument4 pagesSubmitted By: Submitted ToRomina Gravamen100% (1)

- Asean ConclusionDocument2 pagesAsean Conclusionkeshni_sritharanNo ratings yet

- CSR at KFC HoldingDocument4 pagesCSR at KFC HoldingAr-rasyid Md SaadNo ratings yet

- Colgate Palmolive PakDocument21 pagesColgate Palmolive Pakdark coffee100% (2)

- Integrated Marketing Communication OutlineDocument48 pagesIntegrated Marketing Communication OutlineRonieth Dayao50% (2)

- Colgate Palmolive'sDocument4 pagesColgate Palmolive'sMuhammad Shakeel0% (1)

- Analyze The Gardenia in Porter Five Competitive ForcesDocument7 pagesAnalyze The Gardenia in Porter Five Competitive ForcesChesca AlonNo ratings yet

- Role of NestleDocument28 pagesRole of Nestlefkushindarti100% (1)

- 2GO Group, Inc.Document5 pages2GO Group, Inc.john lloyd Jose100% (1)

- India's largest sports goods manufacturer goes globalDocument4 pagesIndia's largest sports goods manufacturer goes globalAnusha Ramesh33% (3)

- Perodua Introductry Marketing AssignmentDocument8 pagesPerodua Introductry Marketing AssignmentDarshiniKarunakaran50% (2)

- Financial Analysis of Samsung PLCDocument17 pagesFinancial Analysis of Samsung PLCROHIT SETHI89% (9)

- Aeon Co MalaysiaDocument435 pagesAeon Co MalaysiaDataGroup Retailer Analysis100% (1)

- DistDocument9 pagesDistkeithguruNo ratings yet

- Bakery & Sweets Marketing PlanDocument39 pagesBakery & Sweets Marketing PlanAdnan AzizNo ratings yet

- Nokia Information SystemDocument3 pagesNokia Information SystemRia Singh67% (3)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Colgate (Brand Management)Document18 pagesColgate (Brand Management)Abhishek PramanikNo ratings yet

- Colgate PalmoliveDocument11 pagesColgate Palmolivedivya_jaiswal_dj100% (1)

- Colgate's Rise as the Top Oral Care Brand WorldwideDocument10 pagesColgate's Rise as the Top Oral Care Brand WorldwideSalman Chudhary100% (2)

- HupSeng Industries Berhad: Financial Ratios AnalysisDocument9 pagesHupSeng Industries Berhad: Financial Ratios Analysissuyaqi100% (1)

- Sun Life FinancialDocument2 pagesSun Life Financialchristine geronimo100% (1)

- Nestlé External Environment AnalysisDocument77 pagesNestlé External Environment AnalysisBùi Nguyễn Hoàng VânNo ratings yet

- Coca-Cola Marketing Strategy Case StudyDocument1 pageCoca-Cola Marketing Strategy Case StudyJanet OrtizNo ratings yet

- The Nokia Story...Document35 pagesThe Nokia Story...Nilesh SolankiNo ratings yet

- FranchisingDocument5 pagesFranchisingTwinkle TricksNo ratings yet

- Capitalizing On The New M-Commerce Environment: A Gcash Case StudyDocument11 pagesCapitalizing On The New M-Commerce Environment: A Gcash Case StudyAaditya ParanjapeNo ratings yet

- Minute BurgerDocument2 pagesMinute BurgerZ DelosoNo ratings yet

- Strategic Management BOAST COMPANYDocument55 pagesStrategic Management BOAST COMPANYPamela Ledesma SusonNo ratings yet

- Causes of Nokia Failure How Microsoft Acquired NokiaDocument7 pagesCauses of Nokia Failure How Microsoft Acquired NokiaNoraNo ratings yet

- Chapter 5Document4 pagesChapter 5mr223131No ratings yet

- Success Story of NokiaDocument12 pagesSuccess Story of Nokiabon2bautista100% (4)

- Air AsiaDocument20 pagesAir AsiaAngela TianNo ratings yet

- 2.the Advertising TriadDocument13 pages2.the Advertising TriadGladymae MaggayNo ratings yet

- (Date) : School of Business and Social SciencesDocument21 pages(Date) : School of Business and Social SciencesRamko IlyasNo ratings yet

- Globpro Case HWDocument2 pagesGlobpro Case HWJoseph KyleNo ratings yet

- Miranda, Sharmaine C. BSA-2A 1. Draw The Product Life Cycle of Nokia Cellphone. (10 PTS)Document5 pagesMiranda, Sharmaine C. BSA-2A 1. Draw The Product Life Cycle of Nokia Cellphone. (10 PTS)SHARMAINE CORPUZ MIRANDANo ratings yet

- Market Value Ratio of SP SETIADocument7 pagesMarket Value Ratio of SP SETIALeeyaRazakNo ratings yet

- Strategic Analysis of Unilever PakistanDocument29 pagesStrategic Analysis of Unilever PakistanmudassirsaeedNo ratings yet

- Netflix HistoryDocument4 pagesNetflix HistoryAlbert OtienoNo ratings yet

- Nestle Multinational CompanyDocument3 pagesNestle Multinational CompanyShebel AgrimanoNo ratings yet

- International Marketing PlanDocument119 pagesInternational Marketing PlanAnuradhaSaliyaAmarathunga100% (3)

- Sunsilk Marketing ReportDocument38 pagesSunsilk Marketing ReportCik SyafiQah100% (1)

- SM Prime Holdings Company Profile FINALDocument1 pageSM Prime Holdings Company Profile FINALAldrin CabangbangNo ratings yet

- Vice CosmeticsDocument37 pagesVice CosmeticsBlessie BinabiseNo ratings yet

- F&N and NestleDocument16 pagesF&N and Nestlekalahoney83% (6)

- Driving Australia's Green Car MarketDocument3 pagesDriving Australia's Green Car MarketAndrea ValdezNo ratings yet

- Competitor Analysis of ColgateDocument4 pagesCompetitor Analysis of ColgateJiawei Lee100% (3)

- Overview of HartalegaDocument4 pagesOverview of HartalegaPiyu MahatmaNo ratings yet

- Coulorette CosmeticsDocument4 pagesCoulorette CosmeticsArianne CabritoNo ratings yet

- On NokiaDocument18 pagesOn NokiaChandan Kumar Singh80% (5)

- Case Study On SamsungDocument7 pagesCase Study On SamsungAtin SoodNo ratings yet

- International Business hw1Document3 pagesInternational Business hw1Zbw88No ratings yet

- Colgate Case StudyDocument9 pagesColgate Case Studyguulleed99_265184442No ratings yet

- Case Study On Phamela ShampooDocument4 pagesCase Study On Phamela ShampooAkram ShovonNo ratings yet

- Colgate Brand Image Mapping PDFDocument27 pagesColgate Brand Image Mapping PDFSumedha DuttaNo ratings yet

- QDM - Us Top Comic AnalysisDocument67 pagesQDM - Us Top Comic AnalysisFakhrul Anour AbdullahNo ratings yet

- CASE METHODOLOGY - EyeblasterDocument14 pagesCASE METHODOLOGY - EyeblasterFakhrul Anour AbdullahNo ratings yet

- CASE METHODOLOGY - de BeersDocument15 pagesCASE METHODOLOGY - de BeersFakhrul Anour Abdullah100% (2)

- CASE METHODOLOGY - NissanDocument15 pagesCASE METHODOLOGY - NissanFakhrul Anour AbdullahNo ratings yet

- CASE METHODOLOGY - StarbuckDocument15 pagesCASE METHODOLOGY - StarbuckFakhrul Anour Abdullah100% (3)

- Transcend 2.0 - Team Noodle - IIM LucknowDocument7 pagesTranscend 2.0 - Team Noodle - IIM LucknowPRONOY BIKASH PHUKONNo ratings yet

- Perkins, One of The Earliest, Most Successful, and Most Long-Lived of The Genre That Came To BeDocument5 pagesPerkins, One of The Earliest, Most Successful, and Most Long-Lived of The Genre That Came To BeGlenn WatsonNo ratings yet

- Comparative Advertising WordDocument7 pagesComparative Advertising WordAparna MongaNo ratings yet

- History of Colgate-Palmolive CompanyDocument2 pagesHistory of Colgate-Palmolive CompanyRithik TiwariNo ratings yet

- Laundry Industry Analysis and Guidelines for New Detergent Launch in PakistanDocument54 pagesLaundry Industry Analysis and Guidelines for New Detergent Launch in PakistanJawad UsmaniNo ratings yet

- Toothpaste Industry - SegmentationDocument21 pagesToothpaste Industry - SegmentationAbhiJith U KrishnanNo ratings yet

- Colgate, Close-Up, Beam, Hapee Toothpaste Brand Analysis & ComparisonDocument3 pagesColgate, Close-Up, Beam, Hapee Toothpaste Brand Analysis & ComparisonClaire JustineNo ratings yet

- CRM Business Transformation Study Colgate Palmolive - MexicoDocument2 pagesCRM Business Transformation Study Colgate Palmolive - MexicoAditya NagulaNo ratings yet

- Marketing Plan PDFDocument27 pagesMarketing Plan PDFNicolas FerreroNo ratings yet

- HAPEEDocument6 pagesHAPEERozzel PalacioNo ratings yet

- ICICI Pru Balanced Advantage Fund - PortfolioDocument2 pagesICICI Pru Balanced Advantage Fund - PortfolioSunil ChaudharyNo ratings yet

- Carta Promocional Oct. GelvezDocument27 pagesCarta Promocional Oct. GelvezJERSON EDUARDO CALDERON CONTRERASNo ratings yet

- Enterprise Analysis Desk Research: Group MembersDocument16 pagesEnterprise Analysis Desk Research: Group MembersShraddha JamdarNo ratings yet

- Study of India's Fast-Moving Consumer Goods IndustryDocument28 pagesStudy of India's Fast-Moving Consumer Goods IndustryNikhil GuptaNo ratings yet

- Hair Care in VietnamDocument12 pagesHair Care in VietnamMai NguyenNo ratings yet

- Fast Moving Consumer Goods (FMCG) Sector in India: A StudyDocument7 pagesFast Moving Consumer Goods (FMCG) Sector in India: A StudyAzim SachoraNo ratings yet

- Pre-Mid Assignment #1 Quality Policy AnalysisDocument7 pagesPre-Mid Assignment #1 Quality Policy AnalysisIqra IshtiaqNo ratings yet

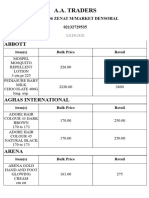

- A.A. Traders: AbbottDocument37 pagesA.A. Traders: AbbottTALAL ALINo ratings yet

- Toothpaste Industry in IndiaDocument30 pagesToothpaste Industry in IndiaNaureen ShabnamNo ratings yet

- The Product Lifecycle of ColgateDocument4 pagesThe Product Lifecycle of ColgateIgor BaciuNo ratings yet

- Colgate Marketing Mix and Strategy AnalysisDocument74 pagesColgate Marketing Mix and Strategy AnalysisVarshaNo ratings yet

- Priciples of Marketing Digital Assignment 2: Name:S.Jayagokul REG NO:19BCC0020Document9 pagesPriciples of Marketing Digital Assignment 2: Name:S.Jayagokul REG NO:19BCC0020Jayagokul SaravananNo ratings yet

- 21 Colgate V GimenezDocument1 page21 Colgate V GimenezPu PujalteNo ratings yet

- 1 Describe The Different Types of Business Intelligence Users atDocument1 page1 Describe The Different Types of Business Intelligence Users atAmit PandeyNo ratings yet

- Colgate ToothpasteDocument14 pagesColgate ToothpasteUyen NgoNo ratings yet

- HimalayaDocument17 pagesHimalayaNidhi Mehta100% (2)

- Angel Soap Industry ReportDocument94 pagesAngel Soap Industry ReportSakina MakdaNo ratings yet

- Procter Gamble Co The in Beauty and Personal Care World PDFDocument48 pagesProcter Gamble Co The in Beauty and Personal Care World PDFJa JUOINo ratings yet

- Sector Capsule: Oral Care in India: Key Data FindingsDocument3 pagesSector Capsule: Oral Care in India: Key Data FindingsShriniket PatilNo ratings yet