Professional Documents

Culture Documents

Tax Investigation Framework

Uploaded by

Ukht Ain SamadCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tax Investigation Framework

Uploaded by

Ukht Ain SamadCopyright:

Available Formats

INLAND REVENUE BOARD MALAYSIA

TAX INVESTIGATION FRAMEWORK

Translation from the original Bahasa Malaysia text.

EFFECTIVE DATE: 1 JANUARY 2007

TAX INVESTIGATION FRAMEWORK

INLAND REVENUE BOARD MALAYSIA Effective Date: 1 January 2007

CONTENTS

1. 2. 3. INTRODUCTION STATUTORY PROVISIONS WHAT IS TAX INVESTIGATION 3.1 Civil Tax Investigation 3.2 Criminal Tax Investigation OBJECTIVE OF TAX INVESTIGATION YEARS OF ASSESSMENT COVERED SELECTION OF CASES HOW A TAX INVESTIGATION IS CARRIED OUT 7.1 7.2 7.3 7.4 7.5 7.6 8. The Visit Examination of Records Findings and Discussions Finalisation of Tax Investigation Conclusion of Tax Investigation Quality Standards for Tax Investigation

Page

1 1 3 3 3 4 4 4 4 4 6 6 7 8 8 9 9 10 12 13 13 14 14 15 16

4. 5. 6. 7.

RIGHTS AND RESPONSIBILITIES 8.1 Inland Revenue Board Malaysia (IRBM) 8.2 Taxpayer 8.3 Tax Agent / Representative CONFIDENTIALITY OF INFORMATION OFFENCES AND PENALTIES COMPLAINTS PAYMENT PROCEDURES APPEALS EFFECTIVE DATE APPENDIX A

9. 10. 11. 12. 13. 14. 15.

Translation from the original Bahasa Malaysia text

TAX INVESTIGATION FRAMEWORK

INLAND REVENUE BOARD MALAYSIA 1. INTRODUCTION 1.1 To create and maintain public confidence in the tax administration system, the tax system must be fair, transparent and equitable. Compliance with the tax legislation must be strictly enforced and tax offences such as noncompliance and tax evasion should be penalised as provided for in the Income Tax Act 1967 (ITA). The Inland Revenue Board of Malaysia (IRBM) carries out tax investigation (civil investigation) as one of its measures of enforcement. In addition, a Criminal Investigation Division (CID) has been established by the IRBM with the main objective being to prove, where deemed necessary, that an offence has been committed, to ascertain the person responsible for the offence and to pursue criminal prosecution in accordance with the provisions of the ITA. This framework is issued by IRBM to ensure that tax investigation is carried out in a fair, transparent and impartial manner. This framework outlines the rights and responsibilities of an investigation officer, the taxpayer and the tax agent/representative in respect of a tax investigation. Generally, this framework aims to: 1.3.1 Assist investigation officers to carry out their tasks efficiently and effectively; and 1.3.2 Assist taxpayers in fulfilling their obligations. Effective Date: 01 January 2007

1.2

1.3

2.

STATUTORY PROVISIONS 2.1 The provisions of the ITA which are applicable to tax investigation are as follows: 2.1.1 2.1.2 2.1.3 2.1.4 2.1.5 Section 68 Section 75A Section 78 Section 79 Section 80 : : : : : Power to appoint agent. Directors liability. Power to call for specific returns and production of books. Power to call for statement of bank accounts etc. Power of access documents etc. 1 to buildings and

Translation from the original Bahasa Malaysia text

TAX INVESTIGATION FRAMEWORK

INLAND REVENUE BOARD MALAYSIA 2.1.6 2.1.7 2.1.8 2.1.9 Section 81 Section 82 Section 90 Section 91 : : : : Effective Date: 01 January 2007 Power to call for information. Duty to keep records and give receipts. Assessments generally. Assessments and additional assessments in certain cases. Composite assessment. Right of appeal. Extension of time for appeal. Review by Director General. Disposal of appeal. Payment of tax. Recovery from persons leaving Malaysia. Recovery by suit. Failure to furnish return or give notice of chargeability. Incorrect returns. Wilful evasions. Obstruction of officers. Offences by officials. Other offences. Additional provisions as to offences under sections 113, 115, 116, 118 and 120. Power to compound offences and abate or remit penalties. Certain material confidential. to be treated as

2.1.10 Section 96A 2.1.11 Section 99 2.1.12 Section 100 2.1.13 Section 101 2.1.14 Section 102 2.1.15 Section 103 2.1.16 Section 104 2.1.17 Section 106 2.1.18 Section 112

: : : : : : : : :

2.1.19 Section 113 2.1.20 Section 114 2.1.21 Section 116 2.1.22 Section 118 2.1.23 Section 120 2.1.24 Section 121

: : : : : :

2.1.25 Section 124

2.1.26 Section 138

2.1.27 Section 140

Power to disregard certain transactions.

Translation from the original Bahasa Malaysia text

TAX INVESTIGATION FRAMEWORK

INLAND REVENUE BOARD MALAYSIA 2.1.28 Section 141 : Effective Date: 01 January 2007 Powers regarding certain transactions by non-residents. Evidential provisions

2.1.29 Section 142 2.2

Statutory provisions relating to tax investigation are not limited to the provisions cited above. Statutory provisions also include other provisions in the ITA, Real Property Gains Tax Act 1976, Petroleum (Income Tax) Act 1967, Promotion of Investments Act 1986, Stamp Act 1949, Labuan Offshore Business Activity Tax Act 1990 and other acts administered by IRBM.

3.

WHAT IS TAX INVESTIGATION Tax investigation is an examination of taxpayers business and / or individual books, records and documents. This examination is to ensure that the correct amount of income has been reported and tax thereon paid in accordance with the tax laws and provisions. The investigation will only be carried out in cases where it is suspected based on precise and definite evidence that the taxpayer is deliberately trying to avoid paying tax or has committed an act of wilful evasion under ITA and other Act such as Real Property Gains Tax Act 1976, Petroleum (Income Tax) Act 1967, Promotion of Investments Act 1986, Stamp Act 1949 and Labuan Offshore Business Activity Tax Act 1990. Investigation activity carried out is of two categories which are as follows: 3.1 Civil Tax Investigation Civil tax investigation activity involves detection of tax evasion. The primary concern being recovery of tax loss and imposition of heavy penalties. 3.2. Criminal Tax Investigation Functions and work procedures involving criminal tax investigation are similar to that of civil investigation. However with criminal investigation, focus is on gathering admissible evidence with a view towards prosecution and conviction of the tax evader for commission of offences pursuant to ITA, Penal Code (Act 574), Criminal Procedure Code (Act 593), Evidence Act 1950 (Act 56) and other relevant Acts.

Translation from the original Bahasa Malaysia text

TAX INVESTIGATION FRAMEWORK

INLAND REVENUE BOARD MALAYSIA 4. OBJECTIVE OF TAX INVESTIGATION Tax investigation activities act as a deterrent against tax evasion, and 4.1 4.2 Ensure the correct amount of tax is collected; Ascertain the person responsible for the offence, to pursue criminal prosecution; and 4.3 Enhance voluntary compliance with tax laws and regulations. Effective Date: 01 January 2007

5.

YEARS OF ASSESSMENT COVERED Where there is fraud, wilful default and negligence, the statutory limitation is not applicable for investigation cases as provided under subsection 91(3) of the ITA.

6.

SELECTION OF CASES Cases selected for investigation will be based on the provisions and regulations of the relevant Acts. Case selection methodologies for investigation purposes are many and varied. Some methods employed are: 6.1. 6.2. 6.3. 6.4. Selection through risk analysis; Information from informers and / or the public; Review of income tax return; and Information based on intelligence.

7.

HOW A TAX INVESTIGATION IS CARRIED OUT 7.1 The Visit The tax investigation carried out by IRBM will be a surprise visit to taxpayers business premises, personal residences, agent / representatives and various third parties premises. The investigation will be conducted in a professional, courteous, fair and reasonable manner in accordance with the provisions and regulations of the ITA.

Translation from the original Bahasa Malaysia text

TAX INVESTIGATION FRAMEWORK

INLAND REVENUE BOARD MALAYSIA Effective Date: 01 January 2007

During the visit, the investigation officer is required to: 7.1.1 Introduce himself, show the authority card bearing his name and photograph. The authority card contains a statement authorizing the officer to have full and free access to all places and to all books and other documents and may search such places and may inspect, copy or make extract from any such books or documents without making any payment by way of fee or reward; Explain the purpose of the visit to the taxpayer at the outset of the visit; Inform the taxpayer the scope and period of investigation and the documents and records needed for purposes of investigation; Inform the taxpayer the name, telephone number of the investigation officer, including senior officers who would be overseeing the investigation during the visit; Outline the rights and responsibilities of taxpayer during the visit; Conduct a search at all the places visited; To access, download and take possession of relevant information from all electronic storage media ; Interview and take statements from taxpayer and relevant persons during inspection visits. Provide reasonable time for taxpayer to collate documents, records and papers to assist in; and are relevant to tax investigation; Seize and take possession of books, records and documents relevant to investigation; and Provide a written acknowledgement of receipt of the documents, books of accounts and records, duly confirmed by the investigation officer and taxpayer.

7.1.2 7.1.3

7.1.4

7.1.5 7.1.6 7.1.7 7.1.8 7.1.9

7.1.10 7.1.11

Translation from the original Bahasa Malaysia text

TAX INVESTIGATION FRAMEWORK

INLAND REVENUE BOARD MALAYSIA 7.2 Examination of Records The investigation officer is required to: 7.2.1 7.2.2 Examine taxpayers business or individual books, records and documents; Examine taxpayers personal books, records and documents. This examination is conducted to assist IRBM to ascertain the amount of taxable income evaded, if any, through direct or indirect methods of proof; and Request a person to provide information, documents, records or other papers in the custody of or under the control of that person. Effective Date: 01 January 2007

7.2.3

7.3

Findings and Discussions The investigation officer is required to: 7.3.1 Interview and conduct meetings at all times at IRBMs offices except during inspection visits. For criminal tax investigation cases however, meetings, interviews and witness statement recordings can be conducted at any suitable location provided the proceedings are at all times attended by two investigation officers; Allow the taxpayer to choose a tax agent / representative to act on his behalf; 7.3.2.1 Permit the tax agent / representative to attend interview with the taxpayer with the express condition that the letter of authority be duly submitted. Where the existing tax agent is representing the taxpayer, a separate letter of authority is required to liaise with the IRBM; and Tax agent / representative statements taken during interviews / meetings with IRBM can be used in criminal tax investigation court proceedings.

7.3.2

7.3.2.2

Translation from the original Bahasa Malaysia text

TAX INVESTIGATION FRAMEWORK

INLAND REVENUE BOARD MALAYSIA 7.3.3 Effective Date: 01 January 2007

Ensure all correspondence between IRBM and tax agent / representative be on Without Prejudice basis, with the exception of criminal tax investigation cases; Allow the taxpayer to take notes of any conversation or interview; Permit copies of interview or discussion notes on request, such copies will bear the signatures of both parties and the investigation officer should explain all evidence, agreements, matters discussed is confidential between IRBM and the taxpayer or the appointed agent. For criminal tax investigation cases however, copies of interview / discussion notes and recordings of witness statements cannot be given to the taxpayer, representative or witness. Formally explain the findings and state the basis for any adjustments as a result of the investigation; Explain to the taxpayer the penalty structure and the installment payment scheme; Where there is no agreement as to the findings and the adjustments IRBM seeks to make as a result of the investigation, IRBM will: 7.3.9.1 State the issues and basis for the adjustments formally and give the taxpayer a reasonable period to respond; Upon the expiration of the stipulated period, issue notice/s of assessment/s to the best of Director Generals judgment with a penalty equal to the amount of tax which has been undercharged;

7.3.4

7.3.5

7.3.6

7.3.7

7.3.8

7.3.9

7.3.9.2

7.4

Finalisation of Tax Investigation 7.4.1 Upon finalisation of a civil tax investigation case, a written settlement agreement will be entered into between the Director General of Inland Revenue (DGIR) and the taxpayer. The following information should be included: 7

Translation from the original Bahasa Malaysia text

TAX INVESTIGATION FRAMEWORK

INLAND REVENUE BOARD MALAYSIA 7.4.1.1 7.4.1.2 7.4.1.3 7.4.1.4 Effective Date: 01 January 2007 Name, identity card / company registration number; Period covered by the tax investigation; The amount of tax undercharged and penalties; and Initial payment and the installment payment / scheme in respect of the tax undercharged and penalties, where applicable.

7.4.2

If no findings are made, the IRBM will issue a letter of confirmation to the taxpayer stating that no findings were made for the period investigated.

7.5

Conclusion of Tax Investigation 7.5.1 Civil tax investigation cases are deemed settled upon the approval by DGIR. Where the DGIR and taxpayer have come to an agreement, a composite assessment under section 96A of the ITA will be issued; Criminal tax investigation cases are deemed settled when judgment has been duly granted by the court; and Assessments will be issued upon approval / judgments obtained.

7.5.2 7.5.3

7.6 Quality Standards for Tax Investigation 7.6.1 Civil Tax Investigation Settlement of civil tax investigation cases are subject to cooperation from taxpayer and tax agent. The standards for settlement of civil tax investigation cases are as follows: 7.6.1.1 7.6.1.2 Capital statement cases within 24 months from the date of issue of notice. Accounts cases within 18 months from the date of commencement.

Translation from the original Bahasa Malaysia text

TAX INVESTIGATION FRAMEWORK

INLAND REVENUE BOARD MALAYSIA 7.6.2 Criminal Tax Investigation Settlement of criminal tax investigation cases is dependent upon court decisions. 8. RIGHTS AND RESPONSIBILITIES 8.1 IRBM 8.1.1 An investigation officer must adhere to rules and code of ethics drawn up by IRBM and is required to carry out duties in the following manner: 8.1.1.1 8.1.1.2 Professional, well mannered, trustworthy, honest and with integrity; Always ready to give explanations on the objectives of investigation and the rights and responsibilities of taxpayer; Knowledgeable and fair in administering tax laws; Respect the rights and responsibilities of the taxpayer and tax agent / representative. Effective Date: 01 January 2007

8.1.1.3 8.1.1.4 8.1.2

The investigation officer is prohibited from: 8.1.2.1 8.1.2.2 Having any personal or financial interest whatsoever in a business being investigated; Proposing and suggesting to taxpayer that a certain tax agent / representative be appointed as the tax agent / representative of the case; and Abusing his position or power in carrying out his duties as provided under section 118 of the ITA.

8.1.2.3

Translation from the original Bahasa Malaysia text

TAX INVESTIGATION FRAMEWORK

INLAND REVENUE BOARD MALAYSIA 8.1.3 Effective Date: 01 January 2007

Payments to investigation officer Taxpayer is forbidden from making any form of payment to the investigation officer. All payments towards back duty have to be made payable to DGIR.

8.2

Taxpayer 8.2.1 The taxpayer has the right to know the consequences of failing to submit the necessary information. Disclosure of any information obtained from a tax return or during the course of an investigation by the investigation officer to any unauthorized person is strictly prohibited; The taxpayer has the right to the identification of officers; The taxpayer has the right to appoint an approved tax agent / representative or a team of advisers / spokespersons acting individually or collectively. However a proper written authorisation letter to act on the taxpayers behalf must be submitted to IRBM; Tax agent / representative is allowed to be present during the interview / discussion. The taxpayer will be given reasonable opportunity to consult with tax agent / representative during the interview / discussion session; The taxpayer is allowed to bring along interpreter/s during the interview / discussion session if the taxpayer is not conversant in Bahasa Malaysia or English; The taxpayer has the opportunity to state views on any relevant issue, including any proposed adjustment, taking into account that the business practices and commercial reasons for the specific action taken by him are within the provisions of the regulation and law concerned; The taxpayer has the right to request return of all non-essential documents taken during an investigation visit. Where the taxpayer requires documents still in the possession of the IRBM, the investigation officer should allow the taxpayer to make relevant copies. Acknowledgment slips will be given; 10

8.2.2 8.2.3

8.2.4

8.2.5

8.2.6

8.2.7

Translation from the original Bahasa Malaysia text

TAX INVESTIGATION FRAMEWORK

INLAND REVENUE BOARD MALAYSIA 8.2.8 The taxpayer is required to: 8.2.8.1 Provide the investigation officers with access to and make copies of; records and documents in the custody of or under the control of or belonging to the taxpayer; Permit investigation officers to take possession of records and documents in the custody of or under the control of or belonging to the taxpayer; Where records and documents are maintained in a language other than the national language, to render a translation in the national language of the said records and documents within the time specified not being less than thirty (30) days from the date of service of notice by the DGIR. Where East Malaysia is concerned, translation is permitted either in the national language or in English, as the case maybe; Provide complete responses for information either in writing or orally; request of Effective Date: 01 January 2007

8.2.8.2

8.2.8.3

8.2.8.4

8.2.8.5 8.2.8.6 8.2.9

Co-operate with the investigation officers; and Attend interviews / discussions.

The taxpayer is prohibited from: 8.2.9.1 Giving any form of gifts to the investigation officer and transacting any business with the investigation officer; Making any form of payments to the investigation officer; Obstructing or hindering the investigation officer in the exercise of his functions. Such obstruction is an offence under section 116 of the ITA. Obstruction includes the following: i. Obstructing or refusing an investigation officer from entering lands, buildings, places and 11

8.2.9.2 8.2.9.3

Translation from the original Bahasa Malaysia text

TAX INVESTIGATION FRAMEWORK

INLAND REVENUE BOARD MALAYSIA Effective Date: 01 January 2007 premises to perform his duties in accordance with section 80 of the ITA; ii. Refusing to provide books of accounts, or other documents in the custody of or under his control when required by the investigation officer; Failing to provide reasonable assistance to the investigation officer in carrying out his duties; and Refusing to answer or give responses to questions raised during the course of an investigation.

iii.

iv.

8.2.9.4 8.3

Appointing unapproved tax agent / representative.

Tax Agent / Representative 8.3.1 The conduct of a tax agent / representative is governed by the code of ethics formulated by IRBM which based on principles of integrity, accountability, transparency and social responsibility; A tax agent / representative is expected to carry out his duties in the following manner: 8.3.2.1 8.3.2.2 Professional, be fully conversant with tax laws and practices; Be honest, trustworthy, transparent, act with integrity and give fullest co-operation when dealing with taxpayer and IRBM; Refrain from using information acquired or abusing his position as tax agent / representative to his advantage; Always give complete and accurate feedback relating to the progress of an investigation and advise taxpayer correctly based on the true facts of the investigation case;

8.3.2

8.3.2.3

8.3.2.4

Translation from the original Bahasa Malaysia text

12

TAX INVESTIGATION FRAMEWORK

INLAND REVENUE BOARD MALAYSIA 8.3.2.5 Effective Date: 01 January 2007 Safeguard the confidentiality of all information and ensure that information is not disclosed to any unauthorized party; and

8.3.3

The tax agent / representative is prohibited from: 8.3.3.1 Giving wrong advice to taxpayer and collaborating with taxpayer to avoid paying the correct amount of tax; Delaying investigation work or acting irresponsibly towards entrusted duties; and Offering inducements to the investigation officer.

8.3.3.2 8.3.3.3 9.

CONFIDENTIALITY OF INFORMATION IRBM will ensure confidentiality of all information obtained from the taxpayer during an inspection, interview, discussion, through correspondence or examination of records and that it is utilized for tax purposes only.

10.

OFFENCES AND PENALTIES 10.1 If there is omission or understatement of income as a result of investigation, penalties will be imposed based on the provisions of Sections 112, 113 and 114 of the ITA. 10.1.1 10.1.2 Under subsection 112(3) of the ITA, a penalty treble to the amount of tax undercharged (300%) is exigible; Under subsection 113(1) of the ITA be liable to a fine of not less than RM1,000 and not more than RM10,000 and shall pay a special penalty of double the amount of tax which has been undercharged (200%); Or as provided for under subsection 113(2) of the ITA, a penalty equal to the amount of tax undercharged (100%) can be impose; and Section 114 of the ITA stipulates a fine of not less than RM1,000 and not more than RM20,000 or to imprisonment for a 13

10.1.3

10.1.4

Translation from the original Bahasa Malaysia text

TAX INVESTIGATION FRAMEWORK

INLAND REVENUE BOARD MALAYSIA Effective Date: 01 January 2007 term not exceeding 3 years or both, and shall pay a special penalty of treble the amount of tax. 10.2 DGIR has the power to compound any offences and abate or remit penalties imposed under ITA with the exception of penalties imposed on conviction. 11. COMPLAINTS 11.1 If the taxpayer is dissatisfied with the issues investigated or the manner in which the investigation is conducted, he should make the complaint known to: 11.1.1 11.1.2 11.1.3 11.1.4 11.1.5 11.2 11.3 11.4 The Director of the Investigation Centre; State Director; Director of the Investigation Department; Deputy Director General of Inland Revenue; and Director General of Inland Revenue.

IRBM will take an objective, fair and balanced approach to all complaints made; IRBM will not entertain any complaint judged to be done not in good faith; and IRBM may take action and file a complaint with the relevant authority such as Ministry of Finance / Malaysian Institute of Taxation / Malaysian Institute of Accountants / Malaysian Institute of Certified Public Accountants / Malaysian Association of Tax Agents / Bar Council, if tax agent / representative do not co-operate or behave unprofessionally which is inconsistent with their code of ethics.

12.

PAYMENT PROCEDURES 12.1 All payments towards back duty taxes should be made payable to the DGIR;

Translation from the original Bahasa Malaysia text

14

TAX INVESTIGATION FRAMEWORK

INLAND REVENUE BOARD MALAYSIA Effective Date: 01 January 2007 12.2 Taxpayer is encouraged to make full payment of taxes and penalties assessed in one single payment; 12.3 However, where taxpayer is unable to do so, the DGIR will consider allowing taxpayer to settle the total tax liability by installments for a predetermined period; If taxpayer seeks an installment payment plan, then an amount representing twenty five percent (25%) of the total tax liability is requested as initial payment; the balance outstanding will then be settled by installments, the settlement period will be determined by the DGIR; Where a taxpayer has been allowed to settle back duty liability by way of an installment plan, he is encouraged to forward post dated cheques to cover the balance of taxes. This facility initiated by IRBM is to assist taxpayer, ensuring installment payments are made on due dates; Where a taxpayer seeks a longer installment payment scheme than usually permitted, the penalties exigible will be much higher compared with a taxpayer who opts to settle in one lump sum payment or requests for an installment payment scheme of a shorter duration; (Refer to Appendix A - Penalty Schedule effective for civil tax investigation cases taken from 1st March 2002 onwards); and 12.7 Taxpayer is reminded to adhere strictly to the payment scheme agreed upon; failure to do so will entail imposition of late payment penalties on the balance of tax outstanding as provided for under subsections 103(7) and 103(8) of the ITA.

12.4

12.5

12.6

13.

APPEALS Sections 99 to 102 of the ITA lay the ground rules for appeals relating to assessment raised by IRBM. 13.1 A taxpayer can appeal against an assessment as a result of a tax investigation; 13.2 The appeal must be made to the Special Commissioners of Income Tax within 30 days after the service of the notice of additional assessment;

Translation from the original Bahasa Malaysia text

15

TAX INVESTIGATION FRAMEWORK

INLAND REVENUE BOARD MALAYSIA Effective Date: 01 January 2007 13.3 Should either party be dissatisfied with the decision of the Special Commissioners of Income Tax, the aggrieved party may apply to have the case heard in the High Court and henceforth the Court of Appeal; and

13.4 There is no appeal against a composite assessment. 14. EFFECTIVE DATE The Tax Investigation Framework is effective from 1 January 2007.

HASMAH BINTI ABDULLAH Director General of Inland Revenue Malaysia Date: January 2007

Translation from the original Bahasa Malaysia text

16

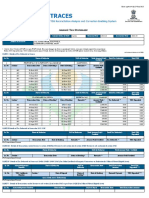

LAMPIRAN A

JADUAL PENALTI

TEMPOH ANSURAN TIDAK MELEBIHI

BULAN 3 6 9 12 15 18 21 24 27 30 33 36 39 42 45 48 51 54 57 60

3 45+0 45+0 50+0 55+0 60+0 60+0 65+0 65+0 70+0 70+0 75+0 75+0 80+0 80+0 85+0 85+0 90+0 90+0 95+0 95+0

6 45+0 45+0 50+0 55+0 60+0 60+0 65+0 65+0 70+0 70+0 75+0 75+0 80+0 80+0 85+0 85+0 90+0 90+0 95+0 95+0

9 45+5 45+5 50+5 55+5 60+5 60+5 65+5 65+5 70+5 70+5 75+5 75+5 80+5 80+5 85+5 85+5 90+5 90+5 95+5 95+5

12 45+10 45+10 50+10 55+10 60+10 60+10 65+10 65+10 70+10 70+10 75+10 75+10 80+10 80+10 85+10 85+10 90+10 90+10 95+10 95+10

15 45+15 45+15 50+15 55+15 60+15 60+15 65+15 65+15 70+15 70+15 75+15 75+15 80+15 80+15 85+15 85+15 90+15 90+15 95+15 95+15

18 45+15 45+15 50+15 55+15 60+15 60+15 65+15 65+15 70+15 70+15 75+15 75+15 80+15 80+15 85+15 85+15 90+15 90+15 95+15 95+15

21 45+20 45+20 50+20 55+20 60+20 60+20 65+20 65+20 70+20 70+20 75+20 75+20 80+20 80+20 85+20 85+20 90+20 90+20 95+20 95+20

24 45+20 45+20 50+20 55+20 60+20 60+20 65+20 65+20 70+20 70+20 75+20 75+20 80+20 80+20 85+20 85+20 90+20 90+20 95+20 95+20

27 45+25 45+25 50+25 55+25 60+25 60+25 65+25 65+25 70+25 70+25 75+25 75+25 80+25 80+25 85+25 85+25 90+25 90+25 95+25 95+25

30 45+25 45+25 50+25 55+25 60+25 60+25 65+25 65+25 70+25 70+25 75+25 75+25 80+25 80+25 85+25 85+25 90+25 90+25 95+25 95+25

33 45+30 45+30 50+30 55+30 60+30 60+30 65+30 65+30 70+30 70+30 75+30 75+30 80+30 80+30 85+30 85+30 90+30 90+30 95+30 95+30

36 45+30 45+30 50+30 55+30 60+30 60+30 65+30 65+30 70+30 70+30 75+30 75+30 80+30 80+30 85+30 85+30 90+30 90+30 95+30 95+30 (A+B)

TEMPOH PENYELESAIAN TIDAK MELEBIHI

A = Kadar penalti atas cukai tambahan B = Kadar penalti atas jumalah baki selepas bayaran ke dalam akaun

You might also like

- Tax Administration and EnforcementDocument189 pagesTax Administration and EnforcementDaniela Erika Beredo InandanNo ratings yet

- Tax Remedies (Part 1)Document32 pagesTax Remedies (Part 1)AysNo ratings yet

- Guidance On Tax Audit Procedure: National Tax Service Instructions No. 1661Document8 pagesGuidance On Tax Audit Procedure: National Tax Service Instructions No. 1661Arya FlyingboyNo ratings yet

- WK 3 v2 THE BIR AND CIRDocument10 pagesWK 3 v2 THE BIR AND CIRandrea arapocNo ratings yet

- Tax Audit Framework 2019Document20 pagesTax Audit Framework 2019nonameNo ratings yet

- Survey Manual 2007: A Guide for Effective Tax AdministrationDocument97 pagesSurvey Manual 2007: A Guide for Effective Tax Administrationbonnie.barma28310% (1)

- Philippine Tax Reform Act SummaryDocument161 pagesPhilippine Tax Reform Act SummarybiklatNo ratings yet

- National Internal Revenue Code of 1997Document160 pagesNational Internal Revenue Code of 1997Keerthan ManjunathNo ratings yet

- Philippine Tax Reform Act SummaryDocument160 pagesPhilippine Tax Reform Act SummaryabbdeloNo ratings yet

- Nirc 1997Document160 pagesNirc 1997Charlie Magne G. SantiaguelNo ratings yet

- Nirc PDFDocument160 pagesNirc PDFCharlie Magne G. Santiaguel100% (3)

- Nirc CodalDocument183 pagesNirc CodalLoueli IleuolNo ratings yet

- Philippine Tax Code SummaryDocument160 pagesPhilippine Tax Code SummaryOkin NawaNo ratings yet

- Tax AdministrationDocument31 pagesTax AdministrationEryn GabrielleNo ratings yet

- COA Presentation - RRSADocument155 pagesCOA Presentation - RRSAKristina Dacayo-Garcia100% (1)

- Assignment 1 - Nacino, Allana Marie P.Document4 pagesAssignment 1 - Nacino, Allana Marie P.Allana NacinoNo ratings yet

- Philippine Tax Reform Act of 1997 summaryDocument195 pagesPhilippine Tax Reform Act of 1997 summaryJennybabe PetaNo ratings yet

- NIRC As AmendedDocument249 pagesNIRC As Amendedsteve_roldanNo ratings yet

- 7.5 Chinese Taipei - Case Study of Customs Post-Clearance Audit System by Chinese TaipeiDocument7 pages7.5 Chinese Taipei - Case Study of Customs Post-Clearance Audit System by Chinese TaipeiRuwen Joice Abacan BunquinNo ratings yet

- National Internal Revenue Code of 1997Document167 pagesNational Internal Revenue Code of 1997Ahmad Deedatt KalbitNo ratings yet

- Philippine Tax Reform Act SummaryDocument154 pagesPhilippine Tax Reform Act SummaryRuzzel Diane Irada OducadoNo ratings yet

- National Internal Revenue Code of 1997Document192 pagesNational Internal Revenue Code of 1997Zaifa D'sNo ratings yet

- Tax 1 CHP 3 Att 6 Tax Investigation Framework 2020 Version 2020.01.01Document18 pagesTax 1 CHP 3 Att 6 Tax Investigation Framework 2020 Version 2020.01.01Cp LimNo ratings yet

- JC National Internal Rvenue CodeDocument234 pagesJC National Internal Rvenue CodejuanonymousNo ratings yet

- 16 Rmo 5-2009 PDFDocument6 pages16 Rmo 5-2009 PDFJoyceNo ratings yet

- Taxation Week 2Document9 pagesTaxation Week 2Jurian Jaan PeligroNo ratings yet

- Impt Provs in NIRCDocument134 pagesImpt Provs in NIRCAziel Marie C. GuzmanNo ratings yet

- Nigeria Customs CharterDocument6 pagesNigeria Customs CharterFrancis Chuki NwaobodoNo ratings yet

- Q1. What Is Tax Administration?Document10 pagesQ1. What Is Tax Administration?Joyce Ann RepanaNo ratings yet

- THE National Internal Revenue Code of The PhilippinesDocument232 pagesTHE National Internal Revenue Code of The PhilippinesadfjaldjfakljfklNo ratings yet

- Title I Organization and Function of The Bureau of Internal RevenueDocument170 pagesTitle I Organization and Function of The Bureau of Internal RevenueheymissrubyNo ratings yet

- NIRC, Tax Reform Act - RA 8424Document231 pagesNIRC, Tax Reform Act - RA 8424Max MannNo ratings yet

- The National Internal Revenue Code of the Philippines (1997Document240 pagesThe National Internal Revenue Code of the Philippines (1997peachy_swakkNo ratings yet

- National Internal Revenue Code of the Philippines summaryDocument3 pagesNational Internal Revenue Code of the Philippines summaryjurisNo ratings yet

- Business and Transfer Tax GuideDocument6 pagesBusiness and Transfer Tax Guideman ibeNo ratings yet

- Tax Reform Act of 1997 summaryDocument220 pagesTax Reform Act of 1997 summaryembiesNo ratings yet

- Settlement of Accounts GuideDocument155 pagesSettlement of Accounts GuideRonnie Balleras Pagal100% (1)

- National Internal Revenue CodeDocument230 pagesNational Internal Revenue CodeJacinto Jr JameroNo ratings yet

- Tax Administration Income TaxationDocument11 pagesTax Administration Income TaxationXyriel RaeNo ratings yet

- Rmo 5-2009Document0 pagesRmo 5-2009Peggy SalazarNo ratings yet

- NIRCDocument225 pagesNIRCJohn MenguitoNo ratings yet

- Overview of The Powers and Authority of The Commissioner of Internal RevenueDocument13 pagesOverview of The Powers and Authority of The Commissioner of Internal Revenuechadskie20No ratings yet

- Tax 2 Group 2 NotesDocument9 pagesTax 2 Group 2 NotesBetelguese AbaricoNo ratings yet

- Lecture Notes Tax Enforcement PDFDocument7 pagesLecture Notes Tax Enforcement PDFEstele EstellaNo ratings yet

- Rmo 15-03 - One Time TinDocument81 pagesRmo 15-03 - One Time Tinjd100% (1)

- Provided, However That Failure To File A Return Shall Not Prevent The Commissioner From Authorizing The Examination of Any TaxpayerDocument53 pagesProvided, However That Failure To File A Return Shall Not Prevent The Commissioner From Authorizing The Examination of Any Taxpayertimmy_zamoraNo ratings yet

- Rmo 15-2003Document68 pagesRmo 15-2003rodrigoNo ratings yet

- Taxation 1 TSN - 2nd ExamDocument45 pagesTaxation 1 TSN - 2nd ExamPearl Angeli Quisido CanadaNo ratings yet

- Tax Remedies Under The NircDocument119 pagesTax Remedies Under The NircCaliNo ratings yet

- FWAudit 2Document19 pagesFWAudit 2Teh Chu LeongNo ratings yet

- Taxation: SEC 1-83 p347Document347 pagesTaxation: SEC 1-83 p347ArtLayeseNo ratings yet

- Notes in Tax RemediesDocument104 pagesNotes in Tax RemediesJeremae Ann CeriacoNo ratings yet

- Bar Review Companion: Taxation: Anvil Law Books Series, #4From EverandBar Review Companion: Taxation: Anvil Law Books Series, #4No ratings yet

- CBEC Guidelines Prosecution Central Excise Service TaxDocument4 pagesCBEC Guidelines Prosecution Central Excise Service TaxDipesh Chandra BaruaNo ratings yet

- Basics About Sales, Use, and Other Transactional Taxes: Overview of Transactional Taxes for Consideration When Striving Toward the Maximization of Tax Compliance and Minimization of Tax Costs.From EverandBasics About Sales, Use, and Other Transactional Taxes: Overview of Transactional Taxes for Consideration When Striving Toward the Maximization of Tax Compliance and Minimization of Tax Costs.No ratings yet

- Tool Kit for Tax Administration Management Information SystemFrom EverandTool Kit for Tax Administration Management Information SystemRating: 1 out of 5 stars1/5 (1)

- Add Acc Current Brs 3Document2 pagesAdd Acc Current Brs 3gargee thakareNo ratings yet

- Chapter2 Article7 ProfessionalTax PDFDocument2 pagesChapter2 Article7 ProfessionalTax PDFWilmer urbanoNo ratings yet

- Pay Durham College Fees Before October 20Document2 pagesPay Durham College Fees Before October 20hkc123No ratings yet

- Direct Incorporation CCM MyCoid PDFDocument21 pagesDirect Incorporation CCM MyCoid PDFSanjevee NathanNo ratings yet

- 2-Principles For Financial Market InfrastructuresDocument188 pages2-Principles For Financial Market InfrastructuresLaura BolívarNo ratings yet

- Construction: Price List - Regional ManagersDocument23 pagesConstruction: Price List - Regional ManagersJoshua Hobson100% (1)

- FinacleDocument129 pagesFinacleShobhit Undefined Fundamentally89% (28)

- SRT - Payments WorkMarketDocument9 pagesSRT - Payments WorkMarketMy Office is RoçaNo ratings yet

- Ajdpd2330g 2023Document4 pagesAjdpd2330g 2023TAX INDIANo ratings yet

- BSNL mobile bill details for account no. 1025201155Document3 pagesBSNL mobile bill details for account no. 1025201155sachin_bhingareNo ratings yet

- Online Training for Oracle Fusion Cloud FinancialsDocument12 pagesOnline Training for Oracle Fusion Cloud FinancialsAkash33% (3)

- Process Financial Transactions and Extract ReportsDocument49 pagesProcess Financial Transactions and Extract Reportsnigus93% (14)

- BBOTA 2022 v10 08102022 EnglishDocument64 pagesBBOTA 2022 v10 08102022 EnglishHelen Hubra100% (1)

- Private & Confidential: Legal SectionDocument1 pagePrivate & Confidential: Legal SectiondheuvNo ratings yet

- BSNL Franchisee EOI for Andaman & Nicobar CircleDocument57 pagesBSNL Franchisee EOI for Andaman & Nicobar Circlebetsegaw123No ratings yet

- Chandi Prasad Uniyal and Ors Vs State of Uttarakhand and Ors On 17 August 2012Document7 pagesChandi Prasad Uniyal and Ors Vs State of Uttarakhand and Ors On 17 August 2012VV SNo ratings yet

- Payment InstructionDocument2 pagesPayment InstructionNeel PatelNo ratings yet

- Current Bill - New House PDFDocument2 pagesCurrent Bill - New House PDFSwath M MuraliNo ratings yet

- A Sample Beach Resort Business Plan TempDocument15 pagesA Sample Beach Resort Business Plan Tempyonatan100% (2)

- Sample Import Bill For CollectionDocument6 pagesSample Import Bill For CollectionjgaeqNo ratings yet

- BIR FORM 2551Q InstructionsDocument2 pagesBIR FORM 2551Q InstructionskehlaniNo ratings yet

- Bill - FebDocument4 pagesBill - FebBalaji SNo ratings yet

- The History of EFT PaymentsDocument9 pagesThe History of EFT PaymentsDerick du ToitNo ratings yet

- Evaluate IOCL's Cash Management and FinancialsDocument75 pagesEvaluate IOCL's Cash Management and FinancialsSubramanya DgNo ratings yet

- 200414124627et1lvhi6sjbew PDFDocument2 pages200414124627et1lvhi6sjbew PDFRafid Al ZahurNo ratings yet

- SAP FICO Practice6Document37 pagesSAP FICO Practice6yashpalNo ratings yet

- FEWA Service GuideDocument75 pagesFEWA Service GuideHabib KhanNo ratings yet

- Rent Invoice: INVOICE NO. 662346692 DELIVERY DATE Jan 01, 2024 02:36:00 ACCOUNT NO. 6627181Document1 pageRent Invoice: INVOICE NO. 662346692 DELIVERY DATE Jan 01, 2024 02:36:00 ACCOUNT NO. 6627181Chinmay BeheraNo ratings yet

- Ocmt Tuition Funding Options March3Document4 pagesOcmt Tuition Funding Options March3api-732786054No ratings yet

- Formato IMFPADocument14 pagesFormato IMFPAJORGE ENRIQUE CABRERA NUÑEZ100% (1)