Professional Documents

Culture Documents

Risk of Return and Beta

Uploaded by

Sammy Ben MenahemOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Risk of Return and Beta

Uploaded by

Sammy Ben MenahemCopyright:

Available Formats

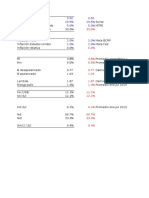

Question 1 : Consider the following information on three stocks: State of the economy Boom Normal Bust Probability 0.

30 0.50 0.20 Rate of Return if State Occurs Stock A Stock B Stock C 0.40 0.35 0.60 0.15 0.15 0.05 0.00 -0.25 -0.75

a. If your portfolio is invested 40% each in A and B and 20% in C, what is the portfolio expected return? The variance? The standard deviation?. b. If the expected T-bill is 3.80%, what is the expected risk premium on the portfolio? c. If the expected ination rate is 3.50%, what are the expected real returns on the portfolio and real risk premium on the portfolio. Question 2 : Part I Given E ( rM ) = 0 :12 ; rF = 0 :05 ; 2 (rM ) = 0:01; refer to the following data to answer the following questions: Stock i A B Correlation coecient i with M 0.5 0.3 Standard Deviation of i 0.25 0.30

1. Compute betas for Stock A, Stock B, and for an equally weighted portfolio of Stocks A and B. 2. Compute the equilibrium expected return according to the CAPM for Stock A, Stock B, and for an equally weighted portfolio of Stocks A and B. Part II Suppose you observe the following information: Security ABC corporation XYZ corporation Beta 1.15 0.80 Expected return 18% 15%

Assume that these securities are correctly priced. Based on the CAPM, what is the expected return on the market? What is the risk-free rate?

Question 3 : Miss Maple is considering two securities, A and B, and the relevant information is given below: State of the economy Bear Bull Pr 0.6 0.4 Return on A (%) 3.0% 15.0 Return on B (%) 6.5% 6.5

a. Calculate the expected returns and standard deviation of the two securities. b. Suppose Miss Maple invested $2,500 in security A and $3,500 in security B. Calculate the expected return and standard deviation of her portfolio. c. Suppose Miss Maple borrowed from her friend 40 shares of security B, which is currently sold at $50, and sold all share of the security. (She promised her friend she would pay her back in a year with the same number of shares of security B). Then she bought security A with the proceeds obtained in the sales of security B shares and the cash of $6,000 she owned. Calculate the expected return and standard deviation of the portfolio. Question 4 : Suppose the current risk-free is 7.6 percent. Potpourri Inc. stock has a beta of 1.7 and an expected return of 16.7 percent. (Assume the CAPM is true) a. What is the risk premium on the market? b. Magnolia Industries stock has a beta of 1.8. What is the expected return on the Magnolia stock? c. Suppose you have invested $100,000 in a portfolio of Potpourri and Magnolia, and the beta of the portfolio is 1.77. How much did you invest in each stock? what is the expected return on the portfolio? Question 5 : 1. According to corporate nance theory, it is stated that nancial managers should act to maximize shareholders wealth. In your view, why are the ecient markets hypothesis (EMH), the CAPM, and the SML so important in the accomplishment of this objective.[10 marks] . 2. We routinely assume that investors are risk-averse seekers; i.e., they like returns and dislike risk. If so, why do we contend that only systematic risk is important (Alternatively, why is total risk not important to investors, in and of itself).[10 marks].

Question 1: a. Boom: E(R P ) = 0 :4(0 :40) + 0 :4(0 :35) + 0 :2(0 :6) = 0 :42 Normal E(R P ) = 0:4(0:15) + 0:4(0 :15) + 0 :2(0 :05) = 0:13 Bust: E(R P ) = 0:4(0) + 0 :4(0 :25) + 0:2( 0 :75) = 0:25 E(RP ) = 0 :30(0:42) + 0:50(0:13) + 0:2(0 :25) = 0:1410 2 2 2 2 P = 0 :30(0: 42 0: 1410) + 0: 50(0 : 13 0 : 1410) + 0 : 2( 0 :25 0: 1410) = 0 : 05399 P = [0:05399]1= 2 = 0 :2324 b. Risk premium =E(R P ) Rf = 0:1410 0 :038 = 0 :103 c. Expected real return = 0:1410 0 :035 = 0 :106 Expected real risk premium = Risk premium - ination rate = 0:103 0 :035 Question 2: 1. Recall that: C ov (ri; rM ) = i;M (ri) (rM ) and i = Cov (ri; rM )= 2 (rM ) so Cov( rA;rM ) = A;M (rA ) (rM ) = (0 :5)(0 :25)(0 :01)0:5 = 0 :0125 therefore A = Cov( rA;rM )= 2 (rM ) = 0 :0125 =0 :0100 = 1 :25 For B, Cov( rB; rM ) = B ;M (rB ) (rM ) = (0 :30)(0 :30)(0 :01)0: 5 = 0 :009 therefore B = C ov (rB ;rM )= 2 (rM ) = 0 :009= 0:010 = 0:90 For portfolio beta: P = wA A + w B B = (0 :50)(1 :25) + (0 :5)(0 :90) = 1 :075 2. The equation for the expected return can be written as: E (ri) = rF + [E ( rM ) rF ] i or alternatively, as E (ri) = rF + [E ( rM ) rF ] i = rF + [E ( rM ) rF ]Cov (ri; rM )= 2 (rM ) = rF + [E (rM ) rF ](i;M (ri) (rM )= 2( rM )) We could use the above equation to nd the equilibruim expected return, but both are perfectly satisfatory. For stock A: E (rA ) = 0:05 + [(0 :12 0 :05)(0 :5)= (0 :01)0:5 ]0 :25 = 0 :1375 We do the same for B, we get E (rB ) = 0 :1130 For an equally weighted portfolio, E (rP ) = (0 :5)(0 :1375) + (0:5)(0 :1130) = 0:1253 Question 3: a. E(R A) = 0 :6(0 :3) + (0:4)(0 :15) = 0:078 = 7:8% E(RB ) = 0 :6(0 :065) + (0 :4)(0:065) = 0:065 = 6:5% 2 2 2 A = 0: 6(0 :03 0: 078) + 0 : 4(0: 15 0 : 078) = 0 : 003456 1 =2 A = (0 :003456) = 0:05878 = 5 :88% 2 = = 0 B B b. W A = $2 ; 500= $6; 000 = 0:417 W B = 1 0:417 = 0:583 E(RP ) = 0 :417(0 :078) + 0 :583(0:065) = 0:0704 = 7 :04% 2 2 2 P = W A A = 0: 0006 P = (0 :0006)1 =2 = 0:0245 = 2 :45% c. Amount borrowed = -40*$50=-$2,000 W A = $8 ; 000= $6; 000 = 4= 3 W B = 1 4= 3 = 1= 3 R P = (4 = 3)(0:078) + (1 = 3)(0:065) = 0:0823 = 8 :23% 3

2 2 2 2 P = W A A = (4= 3) (0 :003456) = 0 :006144 P = (0 :006144)1 =2 = 0 :07838 Question 4: a. The risk premium =Rm Rf Potpourri stock return: 16.7=7.6+1.7[Rm Rf ], then [Rm Rf ] = [16 :7 7 :6]= 1:7 = 5 :3529% b. E(RM ag ) = 7 :6 + 1 :8(5:353) = 17 :2353% c. WP ot P ot + W M ag M ag = 1:77 1.7W P ot + 1 :8(1 W P ot ) = 1:77 0.1W P ot = 0:03 , then W P ot = 0 :3 and WM ag = 0 :7 Thus invest $30,000 in Potpourri stock and $70,000 in Magnolia. E(RP ) = 7 :6 + 1 :77(5 :353) = 17:07% Note: the other way to calculate E(R P ) = 0 :30(0 :167) + 0:7(0 :17235) = 17 :07% Question 5: 1. In simple terms, one could say that maximizing shareholder wealth by maximizing a share price is a reasonable objective if and only if we have some assurance that observed prices are meaningful - i.e., that they reect the value of the rm. This is a major implication of the EMH. Further, if we are to be able to assess the wealth eects of future decisions on security and rm values, we must have a valuation model whose parameters can be shown to be aected by those decisions (Models that depend on future dividends, and interest rates, are the subject). Finally, any valuation model we employ will require us to quantify return and risk, as represented by the SML or CAPM equations. 2. This question postulates that rational investors will diversify away as much risk as possible. From the discussion carried in the class, most students will have picked up that it is quite easy to eliminate diversiable risk in practice - either by holding small (15 - 20 stock) portfolios, or by holding one share in a diversied mutual fund. As noted, there will be no return for bearing diversiable risk, thus, total risk is not particularly important to a diversied investor.

You might also like

- Chapter 6 - Problem Solving (Risk)Document5 pagesChapter 6 - Problem Solving (Risk)Shresth KotishNo ratings yet

- Sapm - Solution, Assignment 2Document5 pagesSapm - Solution, Assignment 2nikhilchatNo ratings yet

- Portfolio QsDocument3 pagesPortfolio QsTom Psy50% (2)

- Midterm Exam Investments May 2010 InstructionsDocument5 pagesMidterm Exam Investments May 2010 Instructions张逸No ratings yet

- Corporate Answer 13 Ledt PDFDocument11 pagesCorporate Answer 13 Ledt PDFHope KnockNo ratings yet

- Risk ReturnDocument6 pagesRisk ReturnDamian Lee-Gomez0% (1)

- BKM CH 06 Answers W CFADocument11 pagesBKM CH 06 Answers W CFAKyThoaiNo ratings yet

- Prob 14Document6 pagesProb 14LaxminarayanaMurthyNo ratings yet

- Demo Qs Topic 5 Part 1Document6 pagesDemo Qs Topic 5 Part 1Triet NguyenNo ratings yet

- Fin 6310-Investment Theory and Practice Homework 6: Chapter - 9Document5 pagesFin 6310-Investment Theory and Practice Homework 6: Chapter - 9Ashna AggarwalNo ratings yet

- BKM CH 06 Answers W CFADocument11 pagesBKM CH 06 Answers W CFAAhmed Bashir100% (19)

- Finance Homework 3Document5 pagesFinance Homework 3LâmViênNo ratings yet

- Exercises On Chapter Five - Return & CAPM Oct. 19 - AnswerDocument10 pagesExercises On Chapter Five - Return & CAPM Oct. 19 - Answerbassant_hegaziNo ratings yet

- PS 4Document7 pagesPS 4Gilbert Ansah YirenkyiNo ratings yet

- m339w Sample ThreeDocument8 pagesm339w Sample ThreeMerliza JusayanNo ratings yet

- Investment Theory Body Kane MarcusDocument5 pagesInvestment Theory Body Kane MarcusPrince ShovonNo ratings yet

- Chapter7 Practice QuestionsDocument7 pagesChapter7 Practice QuestionsNoor TaherNo ratings yet

- FinMan - Risk and Return QuizDocument3 pagesFinMan - Risk and Return QuizJennifer RasonabeNo ratings yet

- Bkm9e Answers Chap006Document13 pagesBkm9e Answers Chap006AhmadYaseenNo ratings yet

- Question No 02: Calculate Market Value of Equity For A 100% Equity Firm, Using Following Information Extracted From ItsDocument7 pagesQuestion No 02: Calculate Market Value of Equity For A 100% Equity Firm, Using Following Information Extracted From ItsrafianazNo ratings yet

- Muqaddas Zulfiqar 30101assignment 7Document12 pagesMuqaddas Zulfiqar 30101assignment 7Muqaddas ZulfiqarNo ratings yet

- FINM2003 - Mid Semester Exam Sem 1 2015 (Suggested Solutions)Document6 pagesFINM2003 - Mid Semester Exam Sem 1 2015 (Suggested Solutions)JasonNo ratings yet

- Seminar 5Document6 pagesSeminar 5EnnyNo ratings yet

- Answers To Practice Questions: Introduction To Risk, Return, and The Opportunity Cost of CapitalDocument9 pagesAnswers To Practice Questions: Introduction To Risk, Return, and The Opportunity Cost of CapitalShireen QaiserNo ratings yet

- Assignment 3 - Kelompok 2Document3 pagesAssignment 3 - Kelompok 2Putri Ayuningtyas KusumawatiNo ratings yet

- Exercises Chapter 4 - Part II With SolutionsDocument4 pagesExercises Chapter 4 - Part II With SolutionsDiana AzevedoNo ratings yet

- Answers To Practice Questions: Risk and ReturnDocument11 pagesAnswers To Practice Questions: Risk and ReturnmasterchocoNo ratings yet

- Risk and Return EquationsDocument7 pagesRisk and Return EquationssitswaroopNo ratings yet

- Chapter 8 Emba 503Document6 pagesChapter 8 Emba 503Arifur NayeemNo ratings yet

- EXERCISE FinalDocument23 pagesEXERCISE FinalVân Nhi PhạmNo ratings yet

- Excel TaskDocument14 pagesExcel Taskmarc willNo ratings yet

- Chap 10 Bodie 9eDocument9 pagesChap 10 Bodie 9eCatherine WuNo ratings yet

- Exercise chapter 6 - ChẵnDocument4 pagesExercise chapter 6 - ChẵnAnh Lê Thị LanNo ratings yet

- Homework IPM March 2016Document11 pagesHomework IPM March 2016Berry FransNo ratings yet

- Chapter 06 - Risk & ReturnDocument42 pagesChapter 06 - Risk & Returnmnr81No ratings yet

- Kwame Nkrumah University of Science and Technololgy College of Arts and Social Sciences School of BusinessDocument5 pagesKwame Nkrumah University of Science and Technololgy College of Arts and Social Sciences School of BusinessYAKUBU ISSAHAKU SAIDNo ratings yet

- Chapter 6: Risk Aversion and Capital Allocation To Risky AssetsDocument14 pagesChapter 6: Risk Aversion and Capital Allocation To Risky AssetsBiloni KadakiaNo ratings yet

- FIN 640 - Assignment 1 - Part 1 With SolutionsDocument17 pagesFIN 640 - Assignment 1 - Part 1 With SolutionsVipulNo ratings yet

- Study Questions 12 Risk and Return SolutionsDocument4 pagesStudy Questions 12 Risk and Return SolutionsAlif SultanliNo ratings yet

- CMCUni Chapter 13Document78 pagesCMCUni Chapter 13Hiếu NguyễnNo ratings yet

- Additional CAPM ExercisesDocument8 pagesAdditional CAPM ExercisesMuhammad OsamaNo ratings yet

- Chapter 6Document13 pagesChapter 6John W. Paterson IVNo ratings yet

- CH5 Tutorial ManagementDocument18 pagesCH5 Tutorial ManagementSam Sa100% (1)

- Problem Set 1 Fundamentals of ValuationDocument3 pagesProblem Set 1 Fundamentals of ValuationSerin SiluéNo ratings yet

- Solutions To Practice Questions (CAPM) : FIN 350 Global Financial ManagementDocument4 pagesSolutions To Practice Questions (CAPM) : FIN 350 Global Financial Managementvivek1119No ratings yet

- Homework 5 SolutionDocument3 pagesHomework 5 SolutionalstonetNo ratings yet

- Chapter 8 Part 2Document7 pagesChapter 8 Part 2abdulraufdghaybeejNo ratings yet

- mcq1 PDFDocument15 pagesmcq1 PDFjack100% (1)

- Banking Risk Management - Homework 2Document3 pagesBanking Risk Management - Homework 2Bảo Ngọc LêNo ratings yet

- BKM Chapter 6 SolutionsDocument14 pagesBKM Chapter 6 SolutionsAhtsham Ahmad100% (2)

- Answer 3Document7 pagesAnswer 3Quân LêNo ratings yet

- Arbitrage Pricing TheoryDocument22 pagesArbitrage Pricing TheorySharif ChowdoryNo ratings yet

- Tutorial-2 212 Mba 680 SolutionsDocument9 pagesTutorial-2 212 Mba 680 SolutionsbillyNo ratings yet

- Assignment 3Document3 pagesAssignment 3Putri Ayuningtyas KusumawatiNo ratings yet

- Chapter 6: Risk Aversion and Capital Allocation To Risky AssetsDocument14 pagesChapter 6: Risk Aversion and Capital Allocation To Risky AssetsNatalie OngNo ratings yet

- Aps502h1 20209 6316201532472020Document4 pagesAps502h1 20209 6316201532472020HannaNo ratings yet

- TutorialDocument13 pagesTutorialHabiba BiboNo ratings yet

- Real Estate Math Express: Rapid Review and Practice with Essential License Exam CalculationsFrom EverandReal Estate Math Express: Rapid Review and Practice with Essential License Exam CalculationsNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Answers For Wong PDFDocument47 pagesAnswers For Wong PDFSkyezine Via Kit FoxNo ratings yet

- Ps 1Document2 pagesPs 1Sammy Ben MenahemNo ratings yet

- Cost Accumulation CompDocument29 pagesCost Accumulation CompSammy Ben MenahemNo ratings yet

- Managerial Accounting (Solutions) - 1Document1,258 pagesManagerial Accounting (Solutions) - 1Sammy Ben Menahem100% (4)

- Chapt 6Document5 pagesChapt 6Sammy Ben MenahemNo ratings yet

- Ess8 Im Ch11Document24 pagesEss8 Im Ch11Sammy Ben MenahemNo ratings yet

- Thomson Lear Ning1267Document40 pagesThomson Lear Ning1267Sammy Ben MenahemNo ratings yet

- Pre CalDocument5 pagesPre CalSammy Ben MenahemNo ratings yet

- Chapt 6Document5 pagesChapt 6Sammy Ben MenahemNo ratings yet

- Problem Set 3 Day 5 Questions and AnswersDocument2 pagesProblem Set 3 Day 5 Questions and AnswersSammy Ben MenahemNo ratings yet

- Pre CalDocument5 pagesPre CalSammy Ben MenahemNo ratings yet

- 724516538Document3 pages724516538Sammy Ben MenahemNo ratings yet

- Algebra SolDocument6 pagesAlgebra SolSammy Ben MenahemNo ratings yet

- Ed5 IM - Solutions ManualDocument75 pagesEd5 IM - Solutions ManualSammy Ben Menahem0% (1)

- 2014744536Document8 pages2014744536Sammy Ben MenahemNo ratings yet

- Slo 02 Acc230 08 TestDocument5 pagesSlo 02 Acc230 08 TestSammy Ben MenahemNo ratings yet

- Learning Team Writing Objectives Activity 1Document5 pagesLearning Team Writing Objectives Activity 1Sammy Ben MenahemNo ratings yet

- Simulation On Pricing For Different MarketsDocument3 pagesSimulation On Pricing For Different MarketsSammy Ben MenahemNo ratings yet

- Management Planning Presentation For BoeingDocument15 pagesManagement Planning Presentation For BoeingSammy Ben MenahemNo ratings yet

- Revision New CostsingsDocument10 pagesRevision New CostsingsSammy Ben MenahemNo ratings yet

- 05 Optimization ProblemsDocument7 pages05 Optimization ProblemsSammy Ben MenahemNo ratings yet

- Chapter 3 Worksheet - SolutionsDocument2 pagesChapter 3 Worksheet - SolutionsSammy Ben MenahemNo ratings yet

- Project 1 Summer 2014 (1) - 1-1Document7 pagesProject 1 Summer 2014 (1) - 1-1Sammy Ben MenahemNo ratings yet

- Slo 02 Acc230 08 TestDocument5 pagesSlo 02 Acc230 08 TestSammy Ben MenahemNo ratings yet

- Excel Xapplication Capstone Exercise001Document2 pagesExcel Xapplication Capstone Exercise001Sammy Ben Menahem0% (1)

- YangYang StatsDocument1 pageYangYang StatsSammy Ben MenahemNo ratings yet

- Learning Image Similarity From Flickr Groups Using Fast Kernel MachinesDocument13 pagesLearning Image Similarity From Flickr Groups Using Fast Kernel MachinesSammy Ben MenahemNo ratings yet

- 1246777397Document54 pages1246777397Sammy Ben MenahemNo ratings yet

- 880165719Document23 pages880165719Sammy Ben MenahemNo ratings yet

- Final Proposal (Chee)Document13 pagesFinal Proposal (Chee)Faraliza JumayleezaNo ratings yet

- The Impact of Auditor Quality, Financial Stability, and Financial Target For Fraudulent Financial Statement.Document6 pagesThe Impact of Auditor Quality, Financial Stability, and Financial Target For Fraudulent Financial Statement.Surya UnnesNo ratings yet

- Power Point Presentations On WB ProcurementDocument66 pagesPower Point Presentations On WB ProcurementICT AUTHORITY100% (2)

- Badoi A. 387318 PDFDocument53 pagesBadoi A. 387318 PDFIrna P LestariNo ratings yet

- Indian Bank AssociationDocument29 pagesIndian Bank AssociationBankNo ratings yet

- IRR ModelingDocument75 pagesIRR ModelingChandra PrakashNo ratings yet

- DEPRECIATIONDocument10 pagesDEPRECIATIONJohn Francis IdananNo ratings yet

- Coca Cola Internship ReportDocument74 pagesCoca Cola Internship ReportSaswat ChoudhuryNo ratings yet

- Indiabulls Housing Finance Annual Report Fy 2019 20 0253611001597460978 PDFDocument300 pagesIndiabulls Housing Finance Annual Report Fy 2019 20 0253611001597460978 PDFArun KanagarajNo ratings yet

- Theises Urabn Entertainment CenterDocument84 pagesTheises Urabn Entertainment CenterShah Prachi100% (4)

- Home and Branch AccountingDocument3 pagesHome and Branch AccountingKathleen Anne CabreraNo ratings yet

- WithholdingTaxTable RatesDocument3 pagesWithholdingTaxTable Ratesafzallodhi736No ratings yet

- Investment Banking SyllbusDocument2 pagesInvestment Banking SyllbusAaditya JhaNo ratings yet

- Money Back PolicyDocument58 pagesMoney Back PolicyUppal Patel83% (6)

- Case StudyDocument4 pagesCase StudyRam NutakkiNo ratings yet

- Opc and Corporate VeilDocument12 pagesOpc and Corporate Veilmugunthan100% (1)

- John Law and The Mississippi Bubble 1718-1720Document5 pagesJohn Law and The Mississippi Bubble 1718-1720truepatriot1992No ratings yet

- Chapter 5 Financial Accounting LibbyDocument6 pagesChapter 5 Financial Accounting Libbymr. fiveNo ratings yet

- First Quarter 2023 Results: Empresa Nacional de Telecomunicaciones S.ADocument34 pagesFirst Quarter 2023 Results: Empresa Nacional de Telecomunicaciones S.Afioreb12No ratings yet

- Shuffled FinalDocument54 pagesShuffled FinalAllen Robert SornitNo ratings yet

- Bodie Investments 12e PPT CH03Document32 pagesBodie Investments 12e PPT CH03kaylakshmi8314100% (2)

- Time Value of MoneyDocument37 pagesTime Value of Moneyansary75No ratings yet

- SFM Short Revision - Formula BookDocument153 pagesSFM Short Revision - Formula Bookqamaraleem1_25038318No ratings yet

- Lemons Problems Arise in Capital Markets WhenDocument1 pageLemons Problems Arise in Capital Markets WhenDipak MondalNo ratings yet

- CST MelcaDocument6 pagesCST MelcaMelca Rojo MelendresNo ratings yet

- Internship Report of Sjibl-GbDocument45 pagesInternship Report of Sjibl-GbsaminbdNo ratings yet

- Solucionario - PC1 2019-02 EF71Document37 pagesSolucionario - PC1 2019-02 EF71Adrian Pedraza AquijeNo ratings yet

- Subrat Tripathi Sap Fico Consultant345681318598114Document6 pagesSubrat Tripathi Sap Fico Consultant345681318598114riteshNo ratings yet

- Bank of America HELOC Short Sale ApprovalDocument2 pagesBank of America HELOC Short Sale ApprovalkwillsonNo ratings yet

- Long Term Source of FinanceDocument35 pagesLong Term Source of FinanceAditya100% (1)