Professional Documents

Culture Documents

AAIB Mutual Fund (Shield) : Fact Sheet January 2014

Uploaded by

api-237717884Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

AAIB Mutual Fund (Shield) : Fact Sheet January 2014

Uploaded by

api-237717884Copyright:

Available Formats

AAIB Mutual Fund (Shield)

Fact Sheet January 2014

Investment Objective

The fund seeks long-term capital appreciation by investing in publicly traded Egyptian stocks.

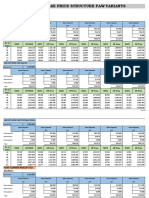

Fund Details Fund Type Fund Manager Launch Date Structure Domicile Fund Currency Administrator Custodian Auditors NAV per Certificate* Subscription/Redemption** Management Fee Performance Fee Administration Fee Custodian Fee Subscription Fee Redemption Fee Min. Initial Investment Equity Fund AAIM February 26,1998 Open Ended Egypt EGP AAIB AAIB KPMG Hazem Hassan EGP 119.52 Daily 0.9% 12% above excess return over CB discount rate 1.0% 0.25% None 0.75% 1 certificate

Fund Managers Commentary The benchmark index kicked off the first month of the year on a strong note largely accentuated by political catalysts. The newlydrafted constitution passed by 98.1% with a 38.6% turnout ratio, confirming consensus building and marks a key step towards political stability. It is worth mentioning that 2012 constitutional referendum had a total turnout ratio of 32% and was approved by roughly 63%. The results were later followed by another market trigger with the interim President announcing an alteration to the initial political roadmap by running presidential elections ahead of parliamentary elections. The news was well received in the market as investors believed the move should speed up the election of a permanent government that is expected to take vital decisions and carryout structural reforms necessary to revive the economy. The aforementioned news coupled with a clear interest by the army chief General, Abdel Fatah al-Sisi, to run for president flourished market gains to close January up 9.2%. On the economic spectrum, the budget deficit narrowed c.3% y-o-y to reach EGP89.4 billion (4.4% of GDP) during 1H2014 down from EGP91.7 billion (5.2% of GDP) reported a year earlier. This comes relatively in line with the governments target to lower the budget deficit to c.10.0% of GDP in FY2014 as opposed to 13.7% reported in FY2013. On a similar note, the minister of planning stated that the government is targeting a real GDP growth rate of 3.0%-3.5% in FY2014. In terms of funding avenues, oil-rich GCC countries continue to lend support to the country. Saudi Arabia announced an additional USD4.0 billion worth of aid in the form of deposits at the Central Bank of Egypt (CBE) as well as fuel shipments. UAE also extended an additional USD1.8 billion aid package in the form of fuel shipments. We continue to expect additional financial support from GCC countries especially if the elected President gains broad consensus from key supporters like Saudi Arabia, UAE, and Kuwait. On the corporate front, EFG Hermes announced plans to buy back shares worth EGP1.0 billion to be executed over two phases. The first phase was executed end of January and incorporated the buyback of c.36.6 million shares at EGP11.50 per share with a total value of c.EGP425 million. The second phase is valued at EGP575 million and is expected to take place during 2Q/3Q-2014. The stock reacted positively to the news as some investors believed that management are in pursuit to unlock value in the stock while others anticipate a major corporate action over the coming period.

*As of 01/01/2014 ** Daily subscription and redemption until 12 pm throughout AAIB branches NAV is published weekly in Al Masry Al Yom Newspaper

Fund Performance

January 2014 Shield EGX30 8.2% 9.2%

2014 YTD 8.2% 9.2%

2013 21.2% 24.2%

2012 28.3% 50.8%

Shield vs. EGX30*

140 120 100 80 60 40 20 -

Shield

EGX30

*Performance since 15/10/2008 date at which AAIM started managing the fund

Key Statistics* Shield Standard Deviation EGX 30

Return vs. Volatility *

10.0% 8.0%

16.6% 0.07 0.27 -9.7% 61.7%

28.9% -0.15 N/A -20.9% 56.7%

Return

Shield

Investment Approach Sharpe Ratio**

Information Ratio*** Max. Monthly Loss % Of Positive Months

6.0%

4.0% 2.0% 0.0% 0% 10% 20% Standard Deviation 30% 40%

EGX 30

*Data since 15/10/2008 date at which AAIM started managing the fund **Measures risk adjusted return compared to risk free rate ***Measures risk adjusted return compared to EGX 30

*Annualized data since 15/10/2008 date at which AAIM started managing the fund

We are value investors. We invest in quality companies we believe are undervalued by the market. In an effort to limit downside risk and maximize upside potential, we typically seek out companies that have strong competitive positions, solid financials, and capable management teams. Our goal is to generate return through stock selection. We seek inefficiencies in the valuation of companies we aim to invest in. Our investment decisions are primarily long term and research driven.

About Arab African Investment Management Arab African Investment Management (AAIM), a subsidiary of the Arab African International Bank (AAIB), was established in 2006 with investment management as our area of expertise. AAIM covers different asset classes in effort to enhance investors diversification and investment opportunities through Shield (Equity Fund), Juman (Money Market Fund), and Gozoor (Fixed Income Fund). We also manage tailored portfo lios for institutions and high-net-worth individuals. Contact Details Arab African Investment Management 5 Midan Al-Saraya Al Koubra, Garden City 11516, Cairo, Egypt Tel. +202 27926825(7)(9) - Fax +202 27961879 Website: www.aaim.com.eg AAIB Call Center: 19555

You might also like

- Cash BudgetDocument18 pagesCash BudgetMichelle Tabacoan100% (2)

- 0 How To Trade GoldDocument11 pages0 How To Trade GoldChrisTheodorou100% (4)

- Black MoneyDocument2 pagesBlack MoneyGaurav VijNo ratings yet

- The Myth of Manipulation The Economics of Minimum WageDocument65 pagesThe Myth of Manipulation The Economics of Minimum WageAndrew Joliet100% (1)

- Technical Analysis in Stock MarketDocument24 pagesTechnical Analysis in Stock MarketSOURAV GOYAL67% (3)

- Report Internship PDFDocument70 pagesReport Internship PDFMr. Romantic100% (1)

- The Fashion ChannelDocument19 pagesThe Fashion ChannelAmit Mehra100% (1)

- Contract Document Development StageDocument103 pagesContract Document Development StageMiz SamejonNo ratings yet

- Summary of Michael J. Mauboussin & Alfred Rappaport's Expectations InvestingFrom EverandSummary of Michael J. Mauboussin & Alfred Rappaport's Expectations InvestingNo ratings yet

- AAIB Mutual Fund (Shield) : Fact Sheet December 2013Document2 pagesAAIB Mutual Fund (Shield) : Fact Sheet December 2013api-237717884No ratings yet

- AAIB Mutual Fund (Shield) : Fact SheetDocument2 pagesAAIB Mutual Fund (Shield) : Fact Sheetapi-237717884No ratings yet

- Al Nokhitha Factsheet Aug09 Tcm7-10580Document1 pageAl Nokhitha Factsheet Aug09 Tcm7-10580Mahesh ButaniNo ratings yet

- AAIB Fixed Income Fund (Gozoor) : Fact Sheet MayDocument2 pagesAAIB Fixed Income Fund (Gozoor) : Fact Sheet Mayapi-237717884No ratings yet

- AAIB Mutual Fund (Shield) : Fact SheetDocument2 pagesAAIB Mutual Fund (Shield) : Fact Sheetapi-237717884No ratings yet

- AAIB Fixed Income Fund (Gozoor) : Fact Sheet JuneDocument2 pagesAAIB Fixed Income Fund (Gozoor) : Fact Sheet Juneapi-237717884No ratings yet

- AAIB Fixed Income Fund (Gozoor) : Fact Sheet AprilDocument2 pagesAAIB Fixed Income Fund (Gozoor) : Fact Sheet Aprilapi-237717884No ratings yet

- Aaib AAIB Money Market Fund (Juman) : Fact Sheet Sheet JanuaryDocument1 pageAaib AAIB Money Market Fund (Juman) : Fact Sheet Sheet Januaryapi-237717884No ratings yet

- Al Ameen Funds-Fund Manager Report-Jan-2024Document21 pagesAl Ameen Funds-Fund Manager Report-Jan-2024aniqa.asgharNo ratings yet

- Private Equity in MENA RegionDocument109 pagesPrivate Equity in MENA RegionkmghazaliNo ratings yet

- AAIB Money Market Fund (Juman) : Fact Sheet FebruaryDocument1 pageAAIB Money Market Fund (Juman) : Fact Sheet Februaryapi-237717884No ratings yet

- Mena-1 Tuesday Morning Round-UpDocument3 pagesMena-1 Tuesday Morning Round-Upapi-66021378No ratings yet

- Fund Period Dividend (RS.) Per Unit % of Par Value of Rs. 50/-FYTD Return Meezan Cash Fund (MCF)Document12 pagesFund Period Dividend (RS.) Per Unit % of Par Value of Rs. 50/-FYTD Return Meezan Cash Fund (MCF)faisaladeemNo ratings yet

- AAIB Money Market Fund (Juman) : Fact Sheet MayDocument1 pageAAIB Money Market Fund (Juman) : Fact Sheet Mayapi-237717884No ratings yet

- AAIB Money Market Fund (Juman) : Fact Sheet JuneDocument1 pageAAIB Money Market Fund (Juman) : Fact Sheet Juneapi-237717884No ratings yet

- Mena-1 Thursday Morning Round-Up: C C C C C C C C C C C C C CDocument3 pagesMena-1 Thursday Morning Round-Up: C C C C C C C C C C C C C Capi-66021378No ratings yet

- AAIB Money Market Fund (Juman) : Fact Sheet AprilDocument1 pageAAIB Money Market Fund (Juman) : Fact Sheet Aprilapi-237717884No ratings yet

- 2009 Annual MENA PE VC ReportDocument74 pages2009 Annual MENA PE VC ReportMatthew Craig-GreeneNo ratings yet

- Mena-1 Monday Morning Round-Up: NBF - Ad Nbad - AdDocument3 pagesMena-1 Monday Morning Round-Up: NBF - Ad Nbad - Adapi-66021378No ratings yet

- AAIB Mutual Fund (Shield) : Fact Sheet June 2014Document2 pagesAAIB Mutual Fund (Shield) : Fact Sheet June 2014api-237717884No ratings yet

- Mena-1 Wednesday Morning Round-Up: C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C CDocument4 pagesMena-1 Wednesday Morning Round-Up: C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C Capi-66021378No ratings yet

- AssignmentDocument8 pagesAssignmentfatini farghalyNo ratings yet

- Mena Equity CommentDocument5 pagesMena Equity CommentlochoeNo ratings yet

- Aaib AAIB Money Market Fund (Juman) : Fact Sheet Sheet NovemberDocument1 pageAaib AAIB Money Market Fund (Juman) : Fact Sheet Sheet Novemberapi-237717884No ratings yet

- Mena-1 Sunday Morning Round-Up: UAE KuwaitDocument3 pagesMena-1 Sunday Morning Round-Up: UAE Kuwaitapi-66021378No ratings yet

- Mena-1 Thursday Morning Round-Up: Dana - AdDocument5 pagesMena-1 Thursday Morning Round-Up: Dana - Adapi-66021378No ratings yet

- Aaib AAIB Money Market Fund (Juman) : Fact Sheet Sheet SeptemberDocument1 pageAaib AAIB Money Market Fund (Juman) : Fact Sheet Sheet Septemberapi-237717884No ratings yet

- AAIB Money Market Fund (Juman) : Fact Sheet OctoberDocument1 pageAAIB Money Market Fund (Juman) : Fact Sheet Octoberapi-237717884No ratings yet

- Ing Philippine Equity Fund A Unit Investment Trust Fund of ING Bank N.V. Philippine Branch (Trust Department)Document1 pageIng Philippine Equity Fund A Unit Investment Trust Fund of ING Bank N.V. Philippine Branch (Trust Department)sunjun79No ratings yet

- AAIB Fixed Income Fund (Gozoor) : Fact Sheet FebruaryDocument2 pagesAAIB Fixed Income Fund (Gozoor) : Fact Sheet Februaryapi-237717884No ratings yet

- Authorization For Issuance of Stock RightsDocument6 pagesAuthorization For Issuance of Stock Rightsaccounting probNo ratings yet

- Mena-1 Sunday Morning Round-UpDocument2 pagesMena-1 Sunday Morning Round-Upapi-66021378No ratings yet

- Mena-2 Tuesday Morning Round-Up: EgyptDocument3 pagesMena-2 Tuesday Morning Round-Up: Egyptapi-66021378No ratings yet

- May GroWealth Report Published SECZ Advertorial 002Document2 pagesMay GroWealth Report Published SECZ Advertorial 002Vic JingoNo ratings yet

- Mena-1 Sunday Morning Round-Up: GCC UAEDocument3 pagesMena-1 Sunday Morning Round-Up: GCC UAEapi-66021378No ratings yet

- 02 Jan 2014 Fact Sheet1Document1 page02 Jan 2014 Fact Sheet1faisaladeemNo ratings yet

- UntitledDocument2 pagesUntitledapi-66021378No ratings yet

- Gulf Arab SWFDocument11 pagesGulf Arab SWFNoaman Abdul MajidNo ratings yet

- Mena - 1 Wednesday Morning Round - UpDocument3 pagesMena - 1 Wednesday Morning Round - Upapi-66021378No ratings yet

- Commentary On Q3 FY19 Financial Results IDFCFIRST BankDocument8 pagesCommentary On Q3 FY19 Financial Results IDFCFIRST BankHimanshu GuptaNo ratings yet

- Qatar Insurance Co. S.A.Q.: August 9, 2010Document12 pagesQatar Insurance Co. S.A.Q.: August 9, 2010jebaNo ratings yet

- Helping You Spot Opportunities: Investment Update - October, 2012Document56 pagesHelping You Spot Opportunities: Investment Update - October, 2012Carla TateNo ratings yet

- Mena-1 Tuesday Morning Round-UpDocument3 pagesMena-1 Tuesday Morning Round-Upapi-66021378No ratings yet

- AAOIFI Standards: Definition of 'Accounting and Auditing Organization For Islamic Financial Institutions - AAOIFI'Document15 pagesAAOIFI Standards: Definition of 'Accounting and Auditing Organization For Islamic Financial Institutions - AAOIFI'riskyplayerNo ratings yet

- Fs PDFDocument1 pageFs PDFJuhaizan Mohd YusofNo ratings yet

- Mena-2 Wednesday Morning Round-Up: EgyptDocument4 pagesMena-2 Wednesday Morning Round-Up: Egyptapi-66021378No ratings yet

- Shariah Growth Fund: Fund Fact Sheet October 2011Document1 pageShariah Growth Fund: Fund Fact Sheet October 2011Wan Mohd FadhlanNo ratings yet

- Annual Report Avenue CapitalDocument44 pagesAnnual Report Avenue CapitalJoel CintrónNo ratings yet

- 11th MENAPEA AnnualVCReport 2016 PDFDocument70 pages11th MENAPEA AnnualVCReport 2016 PDFTarek DomiatyNo ratings yet

- Mena-2 Thursday Morning Round-Up: EgyptDocument4 pagesMena-2 Thursday Morning Round-Up: Egyptapi-66021378No ratings yet

- Islamic Banking & FinanceDocument10 pagesIslamic Banking & FinanceKashif DayoNo ratings yet

- Keynote Address at 2016 Businessday ConferenceDocument10 pagesKeynote Address at 2016 Businessday ConferencegregNo ratings yet

- Knowledge Initiative - July 2014Document10 pagesKnowledge Initiative - July 2014Gursimran SinghNo ratings yet

- Cumulative Performance (%) : NAVPU Graph Investment ObjectiveDocument1 pageCumulative Performance (%) : NAVPU Graph Investment ObjectivescionchoNo ratings yet

- AAIB Fixed Income Fund (Gozoor) : Fact Sheet JanuaryDocument2 pagesAAIB Fixed Income Fund (Gozoor) : Fact Sheet Januaryapi-237717884No ratings yet

- Impact of Budget 2014 On MarketsDocument20 pagesImpact of Budget 2014 On Marketssweetcrys3No ratings yet

- Press Release: Summary of Consolidated Results For Q4 2012Document5 pagesPress Release: Summary of Consolidated Results For Q4 2012Ahmed FoudaNo ratings yet

- FMR - Aug17 - Islamic NewwDocument21 pagesFMR - Aug17 - Islamic NewwPradeep PerwaniNo ratings yet

- AAIB Money Market Fund (Juman) : Fact Sheet JuneDocument1 pageAAIB Money Market Fund (Juman) : Fact Sheet Juneapi-237717884No ratings yet

- AAIB Mutual Fund (Shield) : Fact Sheet June 2014Document2 pagesAAIB Mutual Fund (Shield) : Fact Sheet June 2014api-237717884No ratings yet

- AAIB Fixed Income Fund (Gozoor) : Fact Sheet JuneDocument2 pagesAAIB Fixed Income Fund (Gozoor) : Fact Sheet Juneapi-237717884No ratings yet

- UntitledDocument2 pagesUntitledapi-237717884No ratings yet

- M M M M M M: PRCL 18-Jun-14 Daily ChartDocument3 pagesM M M M M M: PRCL 18-Jun-14 Daily Chartapi-237717884No ratings yet

- AAIB Money Market Fund (Juman) : Fact Sheet MayDocument1 pageAAIB Money Market Fund (Juman) : Fact Sheet Mayapi-237717884No ratings yet

- K K K K K K: Watp 19-Mar-14 Daily ChartDocument2 pagesK K K K K K: Watp 19-Mar-14 Daily Chartapi-237717884No ratings yet

- AAIB Fixed Income Fund (Gozoor) : Fact Sheet FebruaryDocument2 pagesAAIB Fixed Income Fund (Gozoor) : Fact Sheet Februaryapi-237717884No ratings yet

- AAIB Mutual Fund (Shield) : Fact Sheet April 2014Document2 pagesAAIB Mutual Fund (Shield) : Fact Sheet April 2014api-237717884No ratings yet

- K K K K K K: Heli 19-May-14 Daily ChartDocument1 pageK K K K K K: Heli 19-May-14 Daily Chartapi-237717884No ratings yet

- Amer 18-May-14 Daily Chart: Trend Forecast CurrentDocument1 pageAmer 18-May-14 Daily Chart: Trend Forecast Currentapi-237717884No ratings yet

- AAIB Money Market Fund (Juman) : Fact Sheet AprilDocument1 pageAAIB Money Market Fund (Juman) : Fact Sheet Aprilapi-237717884No ratings yet

- AAIB Fixed Income Fund (Gozoor) : Fact Sheet AprilDocument2 pagesAAIB Fixed Income Fund (Gozoor) : Fact Sheet Aprilapi-237717884No ratings yet

- EGX (30) Index: Trend Close CHG % CHG S/L 19-Mar-14Document3 pagesEGX (30) Index: Trend Close CHG % CHG S/L 19-Mar-14api-237717884No ratings yet

- K K K K: Engc 18-Mar-14 Daily ChartDocument2 pagesK K K K: Engc 18-Mar-14 Daily Chartapi-237717884No ratings yet

- EGX (30) Index: Trend Close CHG % CHG S/L 18-Mar-14Document3 pagesEGX (30) Index: Trend Close CHG % CHG S/L 18-Mar-14api-237717884No ratings yet

- UntitledDocument16 pagesUntitledapi-237717884No ratings yet

- UntitledDocument2 pagesUntitledapi-237717884No ratings yet

- Aaib AAIB Money Market Fund (Juman) : Fact Sheet Sheet JanuaryDocument1 pageAaib AAIB Money Market Fund (Juman) : Fact Sheet Sheet Januaryapi-237717884No ratings yet

- AAIB Money Market Fund (Juman) : Fact Sheet FebruaryDocument1 pageAAIB Money Market Fund (Juman) : Fact Sheet Februaryapi-237717884No ratings yet

- EGX (30) Index: Trend Close CHG % CHG S/L 17-Mar-14Document3 pagesEGX (30) Index: Trend Close CHG % CHG S/L 17-Mar-14api-237717884No ratings yet

- AAIB Mutual Fund (Shield) : Fact Sheet January 2014Document2 pagesAAIB Mutual Fund (Shield) : Fact Sheet January 2014api-237717884No ratings yet

- EGX (30) Index: Trend Close CHG % CHG S/L 12-Jan-14Document3 pagesEGX (30) Index: Trend Close CHG % CHG S/L 12-Jan-14api-237717884No ratings yet

- EGX (30) Index: Trend Close CHG % CHG S/L 06-Jan-14Document3 pagesEGX (30) Index: Trend Close CHG % CHG S/L 06-Jan-14api-237717884No ratings yet

- AAIB Fixed Income Fund (Gozoor) : Fact Sheet JanuaryDocument2 pagesAAIB Fixed Income Fund (Gozoor) : Fact Sheet Januaryapi-237717884No ratings yet

- EGX (30) Index: Trend Close CHG % CHG S/L 26-Jan-14Document3 pagesEGX (30) Index: Trend Close CHG % CHG S/L 26-Jan-14api-237717884No ratings yet

- Abrd 12-Jan-14 Daily Chart: Trend Forecast CurrentDocument2 pagesAbrd 12-Jan-14 Daily Chart: Trend Forecast Currentapi-237717884No ratings yet

- Breif Marketting Mix 7psDocument16 pagesBreif Marketting Mix 7psMarco IbrahimNo ratings yet

- Buzz Chronicles - Thread 23453Document6 pagesBuzz Chronicles - Thread 23453sahil ajaytraderNo ratings yet

- UKEA1013 EconomicsDocument18 pagesUKEA1013 EconomicsCharles QuanNo ratings yet

- Fundamental Analysis of Stocks Quick GuideDocument13 pagesFundamental Analysis of Stocks Quick GuidejeevandranNo ratings yet

- Step by Step Guide To Exporting 2011Document54 pagesStep by Step Guide To Exporting 2011Kathy PrestaNo ratings yet

- Jose Antonio Herrero, Analysis of LMM Airport PrivatizationDocument22 pagesJose Antonio Herrero, Analysis of LMM Airport PrivatizationdarwinbondgrahamNo ratings yet

- CH 12Document49 pagesCH 12Natasya SherllyanaNo ratings yet

- Products and Services StrategyDocument63 pagesProducts and Services Strategyerielle mejicoNo ratings yet

- Car PricesDocument47 pagesCar PricesMajoo SonsNo ratings yet

- 3.1 Quantitative Skills Practice QuestionsDocument3 pages3.1 Quantitative Skills Practice QuestionsRayan SibariNo ratings yet

- VIRAY, NHICOLE S. Audit of PPE 1 - AssignmentDocument4 pagesVIRAY, NHICOLE S. Audit of PPE 1 - AssignmentZeeNo ratings yet

- David Esquivel 2019Document3 pagesDavid Esquivel 2019David EsquivelNo ratings yet

- Review Chapter 8-10 WK Session With AnswerDocument13 pagesReview Chapter 8-10 WK Session With AnswerJijisNo ratings yet

- Wheel Alignment SpecificationsDocument15 pagesWheel Alignment SpecificationsBAla0% (1)

- Game Theory of E Commerce CompaniesDocument13 pagesGame Theory of E Commerce CompaniesAsif ShaikhNo ratings yet

- Stone Oak FlyerDocument2 pagesStone Oak FlyerConrado Gonzalo Garcia JaminNo ratings yet

- VCE Summer Internship Program 2021: Tushar Gupta 1 Equity ResearchDocument7 pagesVCE Summer Internship Program 2021: Tushar Gupta 1 Equity ResearchTushar GuptaNo ratings yet

- Trends and Issues in Tax Policy and Reform in IndiaDocument68 pagesTrends and Issues in Tax Policy and Reform in India9892830073No ratings yet

- SuzlonDocument23 pagesSuzlonPuneet GuptaNo ratings yet

- Biological AssetsDocument1 pageBiological AssetsUlaine Gayle EsnaraNo ratings yet

- Basic STD CostingDocument5 pagesBasic STD CostingSajidZiaNo ratings yet

- fm4chapter03 기업가치평가Document45 pagesfm4chapter03 기업가치평가quynhnhudang5No ratings yet

- Tendernotice 1Document38 pagesTendernotice 1Photostat CenterNo ratings yet