Professional Documents

Culture Documents

Sales Taxes

Uploaded by

The Council of State GovernmentsCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Sales Taxes

Uploaded by

The Council of State GovernmentsCopyright:

Available Formats

EAST

THE COUNCIL OF STATE GOVERNMENTS | 2014

THE BOOK OF THE STATES 2014 Facts & Figures

SALES TAXES

Forty-ve states levy a general statewide sales tax, with rates ranging from 2.9 cents to 7.5 cents per dollar. During the past decade, sales tax rates have remained relatively stable, with few states making signicant changes to them. While rates have remained stable, depressed consumer spending has led to declines in total sales tax revenue and many states continue to struggle to get back to pre-recessionary levels of revenue. In 16 states, the rate has declined, the most signicant of which occurred in Massachusetts, where the 2014 tax rate of 5 cents per dollar is 1.25 cents less than its 2004 rate of 6.25 cents per dollar. `` From 2013 to 2014, the sales tax rate changed in ve statesArizona, Arkansas, Kansas, Ohio and Virginiaand in the District of Columbia. `` In two states and the district, the rate decreasedfrom 6.6 percent to 5.6 percent in Arizona; from 6.3 percent to 6.15 percent in Kansas; and from 6 percent to 5.75 percent in the district `` In three states, the rate increasedfrom 6 percent to 6.5 percent in Arkansas; from 5.5 percent to 5.75 percent in Ohio; and from 5 percent to 5.3 percent in Virginia.

Forty-five states plus the District of Columbia levied a general statewide sales tax as of Jan. 1, 2014.1

`` Alaska, Delaware, Montana, New Hampshire and Oregon do not have a statewide sales tax. `` Among the 45 states that levied a sales tax, the average rate was 5.6 percent,2 while rates ranged from a low of 2.9 percent in Colorado to a high of 7.5 percent in California. `` In 2004, the average sales tax rate for states that levied a sales tax was 5.4 percent; in 2014, the rate was 5.6 percent.

For many states, sales taxes are an important source of revenue, but that level of importance varies across states.4

`` In the 2012 scal year, general sales and gross receipts tax revenue totaled $245 billion nationally, or $787 per capita, and represented 31 percent of all state taxes collected.5 `` Sales tax revenue has grown for two consecutive years after two years of year-over-year declines. From 2011 to 2012, sales tax revenue grew 3.2 percent. `` In nominal terms, post-recessionary sales tax revenue has recovered beyond the peak gure of $240 billion in 2008. When adjusted for ination,6 however, revenues remain below pre-recessionary highs.

During the past decade, state sales tax rates have remained relatively stable.3

`` Between 2004 and 2014, no state decided to start or stop levying a general sales tax. `` The tax rate in 2014 is different than the tax rate in 2004 in 18 states. `` In two statesNew York and Ohiothe rate is higher by 0.25 cents.

Reliance on Sales Tax - Percentage of Total Tax Revenue from General Sales Taxes

NO sales tax 0-24.9% 25-49.9% 50% +

FOR MORE INFORMATION VISIT WWW.CSG.ORG/BOOKOFTHESTATES

A PRODUCT OF CAPITOL RESEARCH

THE COUNCIL OF STATE GOVERNMENTS

`` Revenues from sales taxes have not rebounded as quickly as revenues from income taxes, stalling overall revenue growth in those states that rely heavily on sales taxes. `` In 2012, California ($31.3 billion), Texas ($24.5 billion) and Florida ($19.4 billion) had the most sales tax revenue, while Vermont ($342 million), South Dakota ($838 million) and Rhode Island ($842 million) had the least. `` From 2011 to 2012, only four statesCalifornia, Michigan, New Jersey and North Carolinasaw their sales tax revenue decline, with North Carolina decreasing the most at 9.9 percent. The remaining 41 states saw revenues increase year-over-yearfrom 0.1 percent in Louisiana and 0.3 percent in Washington to 44.6 percent in North Dakota and 17.1 percent in Nevada. `` Among the 45 states that levy a general sales tax, the percentage of total tax revenue from sales taxes ranges from a low of 12.4 percent in Vermont and 16.6 percent in New York to a high of 60.2 percent in Washington and 58.1 percent in Florida. States that rely more heavily on sales taxes tend not to levy one or both kinds of income tax (individual or corporate).

$300 $290 $280 $270 $262 $251 $241 $230 $231 $265 $257 $243 $236 $243 $245

Billions of Dollars*

$260 $250 $240 $230 $220 $210 $200 2002 2003 2004

2005

2006

2007

2008

2009

2010

2011

2012

*2012 Dollars

RESOURCES

Compiled by The Federation of Tax Administrators from various sources, 2004, 2013, 2014, http://www.taxadmin.org/fta/rate/tax_stru.html#Sales. The statewide rate used in calculations throughout this report for two statesUtah (1.25 percent) and Virginia (1 percent)includes a local tax levied statewide. Otherwise, state tax rates do not include taxes levied by local jurisdictions. According to the Tax Foundation, local sales taxes are collected in 38 states. 3 Federation of Tax Administrators 4 U.S. Census Bureau, Annual Survey of State Government Tax Collections, http://www.census.gov/govs/statetax/ 5 Note: This figure does not include selective sales tax revenue from taxes on motor fuels, tobacco products, alcoholic beverages, etc. Selective sales taxes contributed an additional $132 billion in revenue to states in fiscal 2012. 6 Authors calculation of inflation-adjusted 2012 dollars using the Bureau of Labor Statistics Consumer Price Index

1 2

A PRODUCT OF CAPITOL RESEARCH

STATE SALES TAX RATES

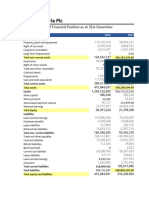

State Sales Tax Rates Sales Tax Rates1 Change in rate (%p) 2004 (%) 2013 (%) N/A 6.35 5 6 6.25 7 4 6 7 6 6.25 7 6 6.3 6 6.875 5.5 5 5.5 4 5 4 6 6 4 6 4 7 4.225 4.75 4.5 6 7 6.25 5 6 2014 (%) N/A 6.35 5 6 6.25 7 4 6 7 6 6.25 7 6 6.15 6 6.875 5.5 5 5.75 4 5 4 6.5 6 4 6 4 7 4.225 4.75 4.5 6 7 6.25 5.3 6 2004-2014 N/A 2013-2014 N/A 2012 (in $ thousands) 245,316,442 3,758,881 1,064,342 4,076,578 5,079,105 8,099,549 11,904,357 9,166,842 842,134 342,085 8,034,466 6,621,954 2,423,160 2,825,880 8,933,937 4,942,140 1,570,450 1,122,783 8,272,728 838,240 4,288,739 2,274,658 2,809,416 19,403,788 5,303,524 3,052,236 2,815,919 3,072,243 3,103,410 5,573,658 2,415,964 2,926,177 6,512,362 24,500,909 3,487,343 1,277,328

THE COUNCIL OF STATE GOVERNMENTS

Sales tax revenue ($)2

As percent of total tax revenue (%) 30.7 24.4 28.2 23.9 22.3 29.5 16.6 27.8 29.8 12.4 22.2 42.2 30.9 38.1 37.3 24.0 36.2 20.0 31.9 55.1 26.8 25.1 33.9 58.8 32.0 29.1 31.3 44.2 28.7 24.5 27.3 36.4 54.3 50.4 19.2 24.2

Percent Change - 2011-2012 3.2 13.9 5.4 4.6 3.2 -0.6 2.8 2.4 3.6 5.1 8.3 5.6 8.6 13.6 -7.5 6.1 1.8 44.6 6.5 3.7 4.4 4.6 2.6 5.6 4.4 5.4 0.1 3.5 4.4 -9.9 11.0 4.7 5.3 12.4 0.8 5.5

United States EAST REGION Connecticut Delaware Maine Maryland Massachusetts New Hampshire New Jersey New York Pennsylvania Rhode Island Vermont MIDWEST REGION Illinois Indiana Iowa Kansas Michigan Minnesota Nebraska North Dakota Ohio South Dakota Wisconsin SOUTH REGION Alabama Arkansas Florida Georgia Kentucky Louisiana Mississippi Missouri North Carolina Oklahoma South Carolina Tennessee Texas Virginia West Virginia WEST REGION Alaska Arizona California Colorado Hawaii Idaho Montana Nevada New Mexico Oregon Utah Washington Wyoming

N/A 6 5 5 5 6 4.25 6 7 6 6.25 6 5 5.3 6 6.5 5.5 5 6 4 5 4 6 6 4 6 4 7 4.225 4.5 4.5 5 7 6.25 4.5 6

-0.35 0 NO SALES TAX 0 0 -1 0 -1.25 0 NO SALES TAX -1 0 0.25 0 0 0 0 0 0 0 0 -1 -1 -0.85 0 -0.375 0 0 0.25 0 0 0 -0.5 0 0 0 0 0 0 -0.25 0 -1 0 0 -0.8 0 0 0 0 -0.15 0 0 0 0 0.25 0 0 0 0.5 0 0 0 0 0 0 0 0 0 0 0 0.3 0

5.6 7.25 2.9 4 6 6.5 5 4.75 6.5 4

6.6 7.5 2.9 4 6 6.85 5.125 5.95 6.5 4

5.6 7.5 2.9 4 6 6.85 5.125 5.95 6.5 4

NO SALES TAX 0 -1 -0.25 0 0 0 0 0 0 0 NO SALES TAX -0.35 0 -0.125 0 NO SALES TAX -1.2 0 0 0 0 0

6,210,756 31,253,629 2,302,333 2,697,951 1,224,656 3,433,958 1,990,535 1,857,035 10,614,137 994,167

47.9 27.2 22.5 48.9 36.3 50.7 39.1 32.0 60.2 39.0

5.7 -6.6 5.9 8.1 3.2 17.1 5.2 0.4 0.3 15.2

1 Compiled by The Federation of Tax Administrators from various sources, 2004, 2013, 2014, http://www. taxadmin.org/fta/rate/tax_stru. html#Sales. Year-over-year changes calculated by author. 2 U.S. Census Bureau, Annual Survey of State Government Tax Collections, http://www.census.gov/govs/statetax/

Jennifer andServices Economic Development Policy | jburnett@csg.org Jennifer Burnett, Burnett, CSG CSG Program Program Manager, Manager, Fiscal Research and Special Projects | jburnett@csg.org

A PRODUCT OF CAPITOL RESEARCH

EAST

THE COUNCIL OF STATE GOVERNMENTS | 2014

THE BOOK OF THE STATES 2014 Facts & Figures

SALES TAXES

Forty-ve states levy a general statewide sales tax, with rates ranging from 2.9 cents to 7.5 cents per dollar. During the past decade, sales tax rates have remained relatively stable, with few states making signicant changes to them. While rates have remained stable, depressed consumer spending has led to declines in total sales tax revenue and many states continue to struggle to get back to pre-recessionary levels of revenue. In 16 states, the rate has declined, the most signicant of which occurred in Massachusetts, where the 2014 tax rate of 5 cents per dollar is 1.25 cents less than its 2004 rate of 6.25 cents per dollar. `` From 2013 to 2014, the sales tax rate changed in ve statesArizona, Arkansas, Kansas, Ohio and Virginiaand in the District of Columbia. `` In two states and the district, the rate decreasedfrom 6.6 percent to 5.6 percent in Arizona; from 6.3 percent to 6.15 percent in Kansas; and from 6 percent to 5.75 percent in the district `` In three states, the rate increasedfrom 6 percent to 6.5 percent in Arkansas; from 5.5 percent to 5.75 percent in Ohio; and from 5 percent to 5.3 percent in Virginia.

Forty-five states plus the District of Columbia levied a general statewide sales tax as of Jan. 1, 2014.1

`` Alaska, Delaware, Montana, New Hampshire and Oregon do not have a statewide sales tax. `` Among the 45 states that levied a sales tax, the average rate was 5.6 percent,2 while rates ranged from a low of 2.9 percent in Colorado to a high of 7.5 percent in California. `` In 2004, the average sales tax rate for states that levied a sales tax was 5.4 percent; in 2014, the rate was 5.6 percent.

For many states, sales taxes are an important source of revenue, but that level of importance varies across states.4

`` In the 2012 scal year, general sales and gross receipts tax revenue totaled $245 billion nationally, or $787 per capita, and represented 31 percent of all state taxes collected.5 `` Sales tax revenue has grown for two consecutive years after two years of year-over-year declines. From 2011 to 2012, sales tax revenue grew 3.2 percent. `` In nominal terms, post-recessionary sales tax revenue has recovered beyond the peak gure of $240 billion in 2008. When adjusted for ination,6 however, revenues remain below pre-recessionary highs.

During the past decade, state sales tax rates have remained relatively stable.3

`` Between 2004 and 2014, no state decided to start or stop levying a general sales tax. `` The tax rate in 2014 is different than the tax rate in 2004 in 18 states. `` In two statesNew York and Ohiothe rate is higher by 0.25 cents.

Reliance on Sales Tax - Percentage of Total Tax Revenue from General Sales Taxes

NO sales tax 0-24.9% 25-49.9% 50% +

Source: Barnett, W.S., Carolan, M.E., Fitzgerald, J., & Squires, J.H. The State of Preschool 2012: State Preschool Yearbook, National Institute for Early Education Research, 2013. http://nieer.org/publications/state-preschool-2012

FOR MORE INFORMATION VISIT WWW.CSG.ORG/BOOKOFTHESTATES

A PRODUCT OF CAPITOL RESEARCH

`` Revenues from sales taxes have not rebounded as quickly as revenues from income taxes, stalling overall revenue growth in those states that rely heavily on sales taxes. `` In 2012, California ($31.3 billion), Texas ($24.5 billion) and Florida ($19.4 billion) had the most sales tax revenue, while Vermont ($342 million), South Dakota ($838 million) and Rhode Island ($842 million) had the least. `` From 2011 to 2012, only four statesCalifornia, Michigan, New Jersey and North Carolinasaw their sales tax revenue decline, with North Carolina decreasing the most at 9.9 percent. The remaining 41 states saw revenues increase year-over-yearfrom 0.1 percent in Louisiana and 0.3 percent in Washington to 44.6 percent in North Dakota and 17.1 percent in Nevada. `` Among the 45 states that levy a general sales tax, the percentage of total tax revenue from sales taxes ranges from a low of 12.4 percent in Vermont and 16.6 percent in New York to a high of 60.2 percent in Washington and 58.1 percent in Florida. States that rely more heavily on sales taxes tend not to levy one or both kinds of income tax (individual or corporate).

Sales tax rates and the percentage of total tax revenue that comes from sales taxes vary across regions.

`` Two of the 11 states in CSGs Eastern regionDelaware and New Hampshiredid not levy a general sales tax as of Jan. 1, 2014. `` Among the nine states in the region that did levy a sales tax, the average rate was 6 percent, ranging from a low of 4 percent in New York and 5 percent in Maine to a high of 7 percent in New Jersey and Rhode Island. `` From 2011 to 2012, Eastern regional sales tax revenue grew by 3.2 percent. All states in the region, except for New Jersey, saw an increase in revenue in 2012. `` Among the nine states in the Eastern region that levied a sales tax, collectively 22.7 percent of total tax revenue came from sales taxes. `` Vermont derived the smallest percentage of tax revenue from sales taxes at 12.4 percent, followed by New York at 16.6 percent, while Rhode Island at 29.8 percent and New Jersey at 29.5 percent relied on sales tax revenue the most.

$300 $290 $280 $270 $262 $251 $241 $230 $231 $265 $257 $243 $236 $243 $245

Billions of Dollars*

$260 $250 $240 $230 $220 $210 $200 2002 2003 2004

2005

2006

2007

2008

2009

2010

2011

2012

*2012 Dollars

RESOURCES

Compiled by The Federation of Tax Administrators from various sources, 2004, 2013, 2014, http://www.taxadmin.org/fta/rate/tax_stru.html#Sales. The statewide rate used in calculations throughout this report for two statesUtah (1.25 percent) and Virginia (1 percent)includes a local tax levied statewide. Otherwise, state tax rates do not include taxes levied by local jurisdictions. According to the Tax Foundation, local sales taxes are collected in 38 states. 3 Federation of Tax Administrators 4 U.S. Census Bureau, Annual Survey of State Government Tax Collections, http://www.census.gov/govs/statetax/ 5 Note: This figure does not include selective sales tax revenue from taxes on motor fuels, tobacco products, alcoholic beverages, etc. Selective sales taxes contributed an additional $132 billion in revenue to states in fiscal 2012. 6 Authors calculation of inflation-adjusted 2012 dollars using the Bureau of Labor Statistics Consumer Price Index

1 2

A PRODUCT OF CAPITOL RESEARCH

MIDWEST

THE COUNCIL OF STATE GOVERNMENTS | 2014

THE BOOK OF THE STATES 2014 Facts & Figures

SALES TAXES

Forty-ve states levy a general statewide sales tax, with rates ranging from 2.9 cents to 7.5 cents per dollar. During the past decade, sales tax rates have remained relatively stable, with few states making signicant changes to them. While rates have remained stable, depressed consumer spending has led to declines in total sales tax revenue and many states continue to struggle to get back to pre-recessionary levels of revenue. In 16 states, the rate has declined, the most signicant of which occurred in Massachusetts, where the 2014 tax rate of 5 cents per dollar is 1.25 cents less than its 2004 rate of 6.25 cents per dollar. `` From 2013 to 2014, the sales tax rate changed in ve statesArizona, Arkansas, Kansas, Ohio and Virginiaand in the District of Columbia. `` In two states and the district, the rate decreasedfrom 6.6 percent to 5.6 percent in Arizona; from 6.3 percent to 6.15 percent in Kansas; and from 6 percent to 5.75 percent in the district `` In three states, the rate increasedfrom 6 percent to 6.5 percent in Arkansas; from 5.5 percent to 5.75 percent in Ohio; and from 5 percent to 5.3 percent in Virginia.

Forty-five states plus the District of Columbia levied a general statewide sales tax as of Jan. 1, 2014.1

`` Alaska, Delaware, Montana, New Hampshire and Oregon do not have a statewide sales tax. `` Among the 45 states that levied a sales tax, the average rate was 5.6 percent,2 while rates ranged from a low of 2.9 percent in Colorado to a high of 7.5 percent in California. `` In 2004, the average sales tax rate for states that levied a sales tax was 5.4 percent; in 2014, the rate was 5.6 percent.

For many states, sales taxes are an important source of revenue, but that level of importance varies across states.4

`` In the 2012 scal year, general sales and gross receipts tax revenue totaled $245 billion nationally, or $787 per capita, and represented 31 percent of all state taxes collected.5 `` Sales tax revenue has grown for two consecutive years after two years of year-over-year declines. From 2011 to 2012, sales tax revenue grew 3.2 percent. `` In nominal terms, post-recessionary sales tax revenue has recovered beyond the peak gure of $240 billion in 2008. When adjusted for ination,6 however, revenues remain below pre-recessionary highs.

During the past decade, state sales tax rates have remained relatively stable.3

`` Between 2004 and 2014, no state decided to start or stop levying a general sales tax. `` The tax rate in 2014 is different than the tax rate in 2004 in 18 states. `` In two statesNew York and Ohiothe rate is higher by 0.25 cents.

Reliance on Sales Tax - Percentage of Total Tax Revenue from General Sales Taxes

NO sales tax 0-24.9% 25-49.9% 50% +

FOR MORE INFORMATION VISIT WWW.CSG.ORG/BOOKOFTHESTATES

A PRODUCT OF CAPITOL RESEARCH

`` Revenues from sales taxes have not rebounded as quickly as revenues from income taxes, stalling overall revenue growth in those states that rely heavily on sales taxes. `` In 2012, California ($31.3 billion), Texas ($24.5 billion) and Florida ($19.4 billion) had the most sales tax revenue, while Vermont ($342 million), South Dakota ($838 million) and Rhode Island ($842 million) had the least. `` From 2011 to 2012, only four statesCalifornia, Michigan, New Jersey and North Carolinasaw their sales tax revenue decline, with North Carolina decreasing the most at 9.9 percent. The remaining 41 states saw revenues increase year-over-yearfrom 0.1 percent in Louisiana and 0.3 percent in Washington to 44.6 percent in North Dakota and 17.1 percent in Nevada. `` Among the 45 states that levy a general sales tax, the percentage of total tax revenue from sales taxes ranges from a low of 12.4 percent in Vermont and 16.6 percent in New York to a high of 60.2 percent in Washington and 58.1 percent in Florida. States that rely more heavily on sales taxes tend not to levy one or both kinds of income tax (individual or corporate).

Sales tax rates and the percentage of total tax revenue that comes from sales taxes vary across regions.

`` All 11 states in CSGs Midwestern region levied a general sales tax as of Jan. 1, 2014. `` The average sales tax rate for the region was 5.8 percent, ranging from a low of 4 percent in South Dakota and 5 percent in North Dakota and Wisconsin to a high of 7 percent in Indiana and 6.875 percent in Minnesota. `` From 2011 to 2012, Midwestern regional sales tax revenue grew by 4.5 percent. All states in the region, except for Michigan, saw an increase in revenue. `` Collectively, 30.2 percent of total tax revenue in the region came from sales taxes in 2012. `` North Dakota derived the smallest percentage of tax revenue from sales taxes20 percent, followed by Illinois at 22.2 percent, while South Dakota at 55.1 percent and Indiana at 42.2 percent relied on sales tax revenue the most.

$300 $290 $280 $270 $262 $251 $241 $230 $231 $265 $257 $243 $236 $243 $245

Billions of Dollars*

$260 $250 $240 $230 $220 $210 $200 2002 2003 2004

2005

2006

2007

2008

2009

2010

2011

2012

*2012 Dollars

RESOURCES

Compiled by The Federation of Tax Administrators from various sources, 2004, 2013, 2014, http://www.taxadmin.org/fta/rate/tax_stru.html#Sales. The statewide rate used in calculations throughout this report for two statesUtah (1.25 percent) and Virginia (1 percent)includes a local tax levied statewide. Otherwise, state tax rates do not include taxes levied by local jurisdictions. According to the Tax Foundation, local sales taxes are collected in 38 states. 3 Federation of Tax Administrators 4 U.S. Census Bureau, Annual Survey of State Government Tax Collections, http://www.census.gov/govs/statetax/ 5 Note: This figure does not include selective sales tax revenue from taxes on motor fuels, tobacco products, alcoholic beverages, etc. Selective sales taxes contributed an additional $132 billion in revenue to states in fiscal 2012. 6 Authors calculation of inflation-adjusted 2012 dollars using the Bureau of Labor Statistics Consumer Price Index

1 2

A PRODUCT OF CAPITOL RESEARCH

SOUTH

THE COUNCIL OF STATE GOVERNMENTS | 2014

THE BOOK OF THE STATES 2014 Facts & Figures

SALES TAXES

Forty-ve states levy a general statewide sales tax, with rates ranging from 2.9 cents to 7.5 cents per dollar. During the past decade, sales tax rates have remained relatively stable, with few states making signicant changes to them. While rates have remained stable, depressed consumer spending has led to declines in total sales tax revenue and many states continue to struggle to get back to pre-recessionary levels of revenue. In 16 states, the rate has declined, the most signicant of which occurred in Massachusetts, where the 2014 tax rate of 5 cents per dollar is 1.25 cents less than its 2004 rate of 6.25 cents per dollar. `` From 2013 to 2014, the sales tax rate changed in ve statesArizona, Arkansas, Kansas, Ohio and Virginiaand in the District of Columbia. `` In two states and the district, the rate decreasedfrom 6.6 percent to 5.6 percent in Arizona; from 6.3 percent to 6.15 percent in Kansas; and from 6 percent to 5.75 percent in the district `` In three states, the rate increasedfrom 6 percent to 6.5 percent in Arkansas; from 5.5 percent to 5.75 percent in Ohio; and from 5 percent to 5.3 percent in Virginia.

Forty-five states plus the District of Columbia levied a general statewide sales tax as of Jan. 1, 2014.1

`` Alaska, Delaware, Montana, New Hampshire and Oregon do not have a statewide sales tax. `` Among the 45 states that levied a sales tax, the average rate was 5.6 percent,2 while rates ranged from a low of 2.9 percent in Colorado to a high of 7.5 percent in California. `` In 2004, the average sales tax rate for states that levied a sales tax was 5.4 percent; in 2014, the rate was 5.6 percent.

For many states, sales taxes are an important source of revenue, but that level of importance varies across states.4

`` In the 2012 scal year, general sales and gross receipts tax revenue totaled $245 billion nationally, or $787 per capita, and represented 31 percent of all state taxes collected.5 `` Sales tax revenue has grown for two consecutive years after two years of year-over-year declines. From 2011 to 2012, sales tax revenue grew 3.2 percent. `` In nominal terms, post-recessionary sales tax revenue has recovered beyond the peak gure of $240 billion in 2008. When adjusted for ination,6 however, revenues remain below pre-recessionary highs.

During the past decade, state sales tax rates have remained relatively stable.3

`` Between 2004 and 2014, no state decided to start or stop levying a general sales tax. `` The tax rate in 2014 is different than the tax rate in 2004 in 18 states. `` In two statesNew York and Ohiothe rate is higher by 0.25 cents.

Reliance on Sales Tax - Percentage of Total Tax Revenue from General Sales Taxes

NO sales tax 0-24.9% 25-49.9% 50% +

FOR MORE INFORMATION VISIT WWW.CSG.ORG/BOOKOFTHESTATES

A PRODUCT OF CAPITOL RESEARCH

`` Revenues from sales taxes have not rebounded as quickly as revenues from income taxes, stalling overall revenue growth in those states that rely heavily on sales taxes. `` In 2012, California ($31.3 billion), Texas ($24.5 billion) and Florida ($19.4 billion) had the most sales tax revenue, while Vermont ($342 million), South Dakota ($838 million) and Rhode Island ($842 million) had the least. `` From 2011 to 2012, only four statesCalifornia, Michigan, New Jersey and North Carolinasaw their sales tax revenue decline, with North Carolina decreasing the most at 9.9 percent. The remaining 41 states saw revenues increase year-over-yearfrom 0.1 percent in Louisiana and 0.3 percent in Washington to 44.6 percent in North Dakota and 17.1 percent in Nevada. `` Among the 45 states that levy a general sales tax, the percentage of total tax revenue from sales taxes ranges from a low of 12.4 percent in Vermont and 16.6 percent in New York to a high of 60.2 percent in Washington and 58.1 percent in Florida. States that rely more heavily on sales taxes tend not to levy one or both kinds of income tax (individual or corporate).

Sales tax rates and the percentage of total tax revenue that comes from sales taxes vary across regions.

`` All 15 states in CSGs Southern region levied a general sales tax as of Jan. 1, 2014. `` The average sales tax rate for the region was 5.4 percent, ranging from a low of 4 percent in Alabama, Georgia and Louisiana to a high of 7 percent in Mississippi and Tennessee. `` From 2011 to 2012, Southern regional sales tax revenue grew by 5.6 percent. All states in the region, except for North Carolina, saw an increase in revenue. `` Collectively, 39.4 percent of total tax revenue in region came from sales taxes in 2012. `` Virginia derived the smallest percentage of tax revenue from sales taxes19.2 percent, followed by West Virginia at 24.2 percent, while Florida at 58.8 percent and Tennessee at 54.4 percent relied on sales tax revenue the most.

$300 $290 $280 $270 $262 $251 $241 $230 $231 $265 $257 $243 $236 $243 $245

Billions of Dollars*

$260 $250 $240 $230 $220 $210 $200 2002 2003 2004

2005

2006

2007

2008

2009

2010

2011

2012

*2012 Dollars

RESOURCES

Compiled by The Federation of Tax Administrators from various sources, 2004, 2013, 2014, http://www.taxadmin.org/fta/rate/tax_stru.html#Sales. The statewide rate used in calculations throughout this report for two statesUtah (1.25 percent) and Virginia (1 percent)includes a local tax levied statewide. Otherwise, state tax rates do not include taxes levied by local jurisdictions. According to the Tax Foundation, local sales taxes are collected in 38 states. 3 Federation of Tax Administrators 4 U.S. Census Bureau, Annual Survey of State Government Tax Collections, http://www.census.gov/govs/statetax/ 5 Note: This figure does not include selective sales tax revenue from taxes on motor fuels, tobacco products, alcoholic beverages, etc. Selective sales taxes contributed an additional $132 billion in revenue to states in fiscal 2012. 6 Authors calculation of inflation-adjusted 2012 dollars using the Bureau of Labor Statistics Consumer Price Index

1 2

A PRODUCT OF CAPITOL RESEARCH

WEST

THE COUNCIL OF STATE GOVERNMENTS | 2014

THE BOOK OF THE STATES 2014 Facts & Figures

SALES TAXES

Forty-ve states levy a general statewide sales tax, with rates ranging from 2.9 cents to 7.5 cents per dollar. During the past decade, sales tax rates have remained relatively stable, with few states making signicant changes to them. While rates have remained stable, depressed consumer spending has led to declines in total sales tax revenue and many states continue to struggle to get back to pre-recessionary levels of revenue. In 16 states, the rate has declined, the most signicant of which occurred in Massachusetts, where the 2014 tax rate of 5 cents per dollar is 1.25 cents less than its 2004 rate of 6.25 cents per dollar. `` From 2013 to 2014, the sales tax rate changed in ve statesArizona, Arkansas, Kansas, Ohio and Virginiaand in the District of Columbia. `` In two states and the district, the rate decreasedfrom 6.6 percent to 5.6 percent in Arizona; from 6.3 percent to 6.15 percent in Kansas; and from 6 percent to 5.75 percent in the district `` In three states, the rate increasedfrom 6 percent to 6.5 percent in Arkansas; from 5.5 percent to 5.75 percent in Ohio; and from 5 percent to 5.3 percent in Virginia.

Forty-five states plus the District of Columbia levied a general statewide sales tax as of Jan. 1, 2014.1

`` Alaska, Delaware, Montana, New Hampshire and Oregon do not have a statewide sales tax. `` Among the 45 states that levied a sales tax, the average rate was 5.6 percent,2 while rates ranged from a low of 2.9 percent in Colorado to a high of 7.5 percent in California. `` In 2004, the average sales tax rate for states that levied a sales tax was 5.4 percent; in 2014, the rate was 5.6 percent.

For many states, sales taxes are an important source of revenue, but that level of importance varies across states.4

`` In the 2012 scal year, general sales and gross receipts tax revenue totaled $245 billion nationally, or $787 per capita, and represented 31 percent of all state taxes collected.5 `` Sales tax revenue has grown for two consecutive years after two years of year-over-year declines. From 2011 to 2012, sales tax revenue grew 3.2 percent. `` In nominal terms, post-recessionary sales tax revenue has recovered beyond the peak gure of $240 billion in 2008. When adjusted for ination,6 however, revenues remain below pre-recessionary highs.

During the past decade, state sales tax rates have remained relatively stable.3

`` Between 2004 and 2014, no state decided to start or stop levying a general sales tax. `` The tax rate in 2014 is different than the tax rate in 2004 in 18 states. `` In two statesNew York and Ohiothe rate is higher by 0.25 cents.

Reliance on Sales Tax - Percentage of Total Tax Revenue from General Sales Taxes

NO sales tax 0-24.9% 25-49.9% 50% +

FOR MORE INFORMATION VISIT WWW.CSG.ORG/BOOKOFTHESTATES

A PRODUCT OF CAPITOL RESEARCH

`` Revenues from sales taxes have not rebounded as quickly as revenues from income taxes, stalling overall revenue growth in those states that rely heavily on sales taxes. `` In 2012, California ($31.3 billion), Texas ($24.5 billion) and Florida ($19.4 billion) had the most sales tax revenue, while Vermont ($342 million), South Dakota ($838 million) and Rhode Island ($842 million) had the least. `` From 2011 to 2012, only four statesCalifornia, Michigan, New Jersey and North Carolinasaw their sales tax revenue decline, with North Carolina decreasing the most at 9.9 percent. The remaining 41 states saw revenues increase year-over-yearfrom 0.1 percent in Louisiana and 0.3 percent in Washington to 44.6 percent in North Dakota and 17.1 percent in Nevada. `` Among the 45 states that levy a general sales tax, the percentage of total tax revenue from sales taxes ranges from a low of 12.4 percent in Vermont and 16.6 percent in New York to a high of 60.2 percent in Washington and 58.1 percent in Florida. States that rely more heavily on sales taxes tend not to levy one or both kinds of income tax (individual or corporate).

Sales tax rates and the percentage of total tax revenue that comes from sales taxes vary across regions.

`` Three of the 13 states in CSGs Western regionAlaska, Montana and Oregondid not levy a general sales tax as of Jan. 1, 2014. `` Among the 10 states in the region that levied a sales tax, the average sales tax rate was 5.4 percent, ranging from a low of 2.69 percent in Colorado and 4 percent in Hawaii and Wyoming to a high of 7.5 percent in California and 6.85 percent in Nevada. `` From 2011 to 2012, Western regional sales tax revenue shrank by 1.2 percent, primarily because of the decline in Californias revenue due to the expiration of the temporary sales tax rate increase. California was the only state in the region to see a year-over-year decrease in sales tax revenue. `` Among the 10 states in the region that levied a sales tax, collectively, 33.8 percent of total tax revenue came from sales taxes in 2012. `` Colorado derived the smallest percentage of tax revenue from sales taxes22.5 percent, followed by California at 27.2 percent, while Washington at 60.2 percent and Nevada at 50.7 percent relied on sales tax revenue the most.

$300 $290 $280 $270 $262 $251 $241 $230 $231 $265 $257 $243 $236 $243 $245

Billions of Dollars*

$260 $250 $240 $230 $220 $210 $200 2002 2003 2004

2005

2006

2007

2008

2009

2010

2011

2012

*2012 Dollars

RESOURCES

Compiled by The Federation of Tax Administrators from various sources, 2004, 2013, 2014, http://www.taxadmin.org/fta/rate/tax_stru.html#Sales. The statewide rate used in calculations throughout this report for two statesUtah (1.25 percent) and Virginia (1 percent)includes a local tax levied statewide. Otherwise, state tax rates do not include taxes levied by local jurisdictions. According to the Tax Foundation, local sales taxes are collected in 38 states. 3 Federation of Tax Administrators 4 U.S. Census Bureau, Annual Survey of State Government Tax Collections, http://www.census.gov/govs/statetax/ 5 Note: This figure does not include selective sales tax revenue from taxes on motor fuels, tobacco products, alcoholic beverages, etc. Selective sales taxes contributed an additional $132 billion in revenue to states in fiscal 2012. 6 Authors calculation of inflation-adjusted 2012 dollars using the Bureau of Labor Statistics Consumer Price Index

1 2

A PRODUCT OF CAPITOL RESEARCH

You might also like

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Sports Betting in The SouthDocument16 pagesSports Betting in The SouthThe Council of State GovernmentsNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Blown Away: Wind Energy in The Southern States (Part II)Document16 pagesBlown Away: Wind Energy in The Southern States (Part II)The Council of State GovernmentsNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Scoot Over: The Growth of Micromobility in The SouthDocument12 pagesScoot Over: The Growth of Micromobility in The SouthThe Council of State GovernmentsNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- By Roger Moore, Policy AnalystDocument6 pagesBy Roger Moore, Policy AnalystThe Council of State GovernmentsNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- By Roger Moore, Policy AnalystDocument16 pagesBy Roger Moore, Policy AnalystThe Council of State GovernmentsNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Body-Worn Cameras: Laws and Policies in The SouthDocument24 pagesBody-Worn Cameras: Laws and Policies in The SouthThe Council of State GovernmentsNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- CSG Capitol Research: Driving Under The Influence of CannabisDocument3 pagesCSG Capitol Research: Driving Under The Influence of CannabisThe Council of State GovernmentsNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Reducing The Number of People With Mental IllnessesDocument16 pagesReducing The Number of People With Mental IllnessesThe Council of State GovernmentsNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Psa Class Notes Daf 2020-21Document22 pagesPsa Class Notes Daf 2020-21kitderoger_391648570No ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Multi-Step Income Statement - CRDocument16 pagesMulti-Step Income Statement - CRVivian BastoNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Financial-Aspect - CyrineDocument68 pagesFinancial-Aspect - CyrineAnjelica MarcoNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- BNLIDocument3 pagesBNLIsisalim nurNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Class Case 1: Krispy Kreme Doughnuts, IncDocument9 pagesClass Case 1: Krispy Kreme Doughnuts, IncJeanDianeJoveloNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- L3 L5Document15 pagesL3 L5RomeNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Duracell'S Acquisition by Berkshire Hathaway: A Case StudyDocument19 pagesDuracell'S Acquisition by Berkshire Hathaway: A Case Studytanya batraNo ratings yet

- Chapter 10Document21 pagesChapter 10RBNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- A Project Report On Minda Autocare: Submitted in Partial Fulfillment of The Requirements For The Award of The Degree ofDocument46 pagesA Project Report On Minda Autocare: Submitted in Partial Fulfillment of The Requirements For The Award of The Degree ofAchin Agarwal33% (3)

- Apple Inc Assignment, Financial ModuleDocument15 pagesApple Inc Assignment, Financial ModuleRahmati RahmatullahNo ratings yet

- Global Semi Trailer Sales Market Report 2017Document3 pagesGlobal Semi Trailer Sales Market Report 2017Shaun Martin0% (1)

- Accounting ReviewerDocument6 pagesAccounting ReviewerFictional PlayerNo ratings yet

- Second Division: Republic of The Philippines Court of Tax Appeals Quezon CityDocument8 pagesSecond Division: Republic of The Philippines Court of Tax Appeals Quezon CityCamille CastilloNo ratings yet

- V-AIR Headset PF Final Version 1Document71 pagesV-AIR Headset PF Final Version 1K BNo ratings yet

- Finance Solved CasesDocument79 pagesFinance Solved CasesPranjal SinghalNo ratings yet

- Xerox Corporation Fraud Case 1233641589554599 2Document22 pagesXerox Corporation Fraud Case 1233641589554599 2Tarun KumarNo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Nestle Financial Statements - Keystone BankDocument15 pagesNestle Financial Statements - Keystone Bankemmanuelleonard54No ratings yet

- CMA+Part+2+Formula+Guide+ +CMA+Exam+AcademyDocument57 pagesCMA+Part+2+Formula+Guide+ +CMA+Exam+AcademyMonica D’SilvaNo ratings yet

- Sample Revenue PolicyDocument6 pagesSample Revenue Policyvb_krishnaNo ratings yet

- Ias 18 Revenue Recognition FinalsDocument8 pagesIas 18 Revenue Recognition FinalssadikiNo ratings yet

- Investor Presentation - 2303 - ENG PDFDocument25 pagesInvestor Presentation - 2303 - ENG PDFJoseph ChoiNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Our Classroom EconomyDocument14 pagesOur Classroom Economyapi-279807682No ratings yet

- Life Cycle CostingDocument34 pagesLife Cycle Costingpednekar30No ratings yet

- Cost12 Study03 PDFDocument12 pagesCost12 Study03 PDFVINCENT GAYRAMON100% (1)

- Session 4 Practice ProblemsDocument11 pagesSession 4 Practice ProblemsRishika RathiNo ratings yet

- Final Report of Engro PDF FreeDocument58 pagesFinal Report of Engro PDF FreeMadni Enterprises DGKNo ratings yet

- Project Report E&K's BakeryDocument19 pagesProject Report E&K's BakeryRamesh ChandraNo ratings yet

- Managala Marine Exim India Pvt. LTDDocument50 pagesManagala Marine Exim India Pvt. LTDnineeshkkNo ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Jharkhand Economic Survey 2015-16Document465 pagesJharkhand Economic Survey 2015-16Kaushal KishoreNo ratings yet

- Complicated Financial Words Made Easy .Document30 pagesComplicated Financial Words Made Easy .anon_591006593No ratings yet