Professional Documents

Culture Documents

Receivables Cwer

Uploaded by

redearth2929Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Receivables Cwer

Uploaded by

redearth2929Copyright:

Available Formats

Receivables A. Classification 1.

Short-term Receivables--short-term receivables are receivables that will mature in less than one year or one operating cycle, whichever is longer 2. Long-term Receivables--long-term receivables are receivables that will mature in greater than one year or one operating cycle, whichever is longer Accounts Receivable--an oral promise from others to pay for goo!s an! services sol! on open account 1. "aluation--in practice, interest income relate! to the accounts receivable is ignore! because the amount of the !iscount is not usually material in relation to the net income for the perio! 2. Cash #iscounts--cash !iscounts are re!uctions in the invoice price offere! as an in!ucement for prompt payment $state! in the following symbolism% a&b,n&! where a is the ' !iscount, b is the length of time in which payment must be ma!e to receive the !iscount an! n&! is the length of time in which full payment must be ma!e( an! may be recor!e! using either the gross metho! or the net metho! a. )ross *etho!--the gross metho! assumes that cash !iscounts will not be ta+en an! highlights the !iscounts ta+en 1( Accounting a( #ate of Sale--accounts receivable an! sales are recor!e! at the gross invoice price b( #ate of ,ayment--any !iscounts ta+en are recor!e! as a re!uction in sales 2( -llustrations a( A corporation sol! inventory to a customer on open account at an invoice price of ./,0001 terms 2&10, n&201 the customer pai! the invoice within the !iscount perio! #ate of Sale% Accounts Receivable /,000 Sales /,000 #ate of ,ayment% Cash $/,000 5 2' 6 /,000( Sales #iscounts Accounts Receivable b( 3,400 100 /,000

A corporation sol! inventory to a customer on open account at an invoice price of ./,0001 terms 2&10, n&201 the customer !i! not pay the invoice within the !iscount perio!

#ate of Sale% Accounts Receivable Sales #ate of ,ayment% Cash Accounts Receivable b.

/,000 /,000 /,000 /,000

7et *etho!--the net metho! assumes that cash !iscounts will be ta+en an! highlights the !iscounts not ta+en 1( Accounting a( #ate of Sale--accounts receivable an! sales are recor!e! at the gross invoice price less any available !iscount b( #ate of ,ayment--any !iscounts not ta+en are recor!e! as an other revenue 2( -llustrations a( A corporation sol! inventory to a customer on open account at an invoice price of ./,0001 terms 2&10, n&201 the customer pai! the invoice within the !iscount perio! #ate of Sale% Accounts Receivable 3,400 $/,000 5 2' 6 /,000( Sales 3,400 #ate of ,ayment% Cash Accounts Receivable b( 3,400 3,400

A corporation sol! inventory to a customer on open account at an invoice price of ./,0001 terms 2&10, n&201 the customer !i! not pay the invoice within the !iscount perio! #ate of Sale% Accounts Receivable 3,400 $/,000 5 2' 6 /,000( Sales 3,400 #ate of ,ayment% Cash Accounts Receivable Sales #iscounts 8orfeite! /,000 3,400 100

2.

9ncollectibility--the loss from uncollectible accounts receivable may be recor!e! using either the !irect write-off metho! or the allowance metho! a. #irect :rite-off *etho!--the !irect write-off metho! recogni;es ba! !ebt e6pense in the perio! in which the account receivables prove to be uncollectible

1(

2(

Accounting a( Actual Loss--when a specific account receivable has been !etermine! to be uncollectible, the loss is recor!e! by !ebiting ba! !ebt e6pense an! cre!iting accounts receivable b( Recovery--when a previously written off account receivable is collecte!, the entry to write off the account is reverse! an! the collection is recor!e! as a normal collection -llustration a( #uring year 1 a corporation ma!e cre!it sales of .200,000 an! ma!e collections of .1/0,0001 !uring year 2 the corporation ma!e cre!it sales of .200,000, ma!e collections of .3<,=00 from year 1 cre!it sales an! .22/,000 from year 2 cre!it sales, an! wrote-off cre!it sales from year 1 in the amount of .2,200 >ear 1% Accounts Receivable 200,000 Sales 200,000 Cash Accounts Receivable >ear 2% Accounts Receivable Sales Cash $3<,=00 @ 22/,000( Accounts Receivable a! #ebts A6pense Accounts Receivable b( 200,000 200,000 2?1,=00 2?1,=00 2,200 2,200 1/0,000 1/0,000

#uring year 1 a corporation wrote off an account receivable in the amount of .3,0001 !uring year 2 the corporation collecte! the account receivable >ear 1% a! #ebt A6pense 3,000 Accounts Receivable 3,000 >ear 2% Accounts Receivable a! #ebt A6pense Cash Accounts Receivable 3,000 3,000 3,000 3,000

b.

Allowance *etho!--the allowance metho! recogni;es ba! !ebt e6pense in the perio! in which the cre!it sale is ma!e 1( Accounting a( Astimate! Loss--an estimate of the loss from uncollectible accounts receivable is recor!e! in the perio! in which the cre!it sales are ma!e by !ebiting ba! !ebt e6pense an! re!ucing accounts receivable through an allowance account using either the percentage of sales metho! or percentage of receivables metho! -( ,ercentage-of-sales *etho!--the amount of the estimate! loss is eBual to the cre!it sales for the perio! multiplie! by the estimate! percentage of the cre!it sales that will prove to be uncollectible --( ,ercentage-of-receivables *etho!--the amount of the estimate! loss is eBual to the uncollecte! accounts receivable at the en! of the perio! multiplie! by the estimate! percentage of the accounts receivable that will prove to be uncollectible increase!&!ecrease! by the !ebit&cre!it balance in the allowance account b( Actual Loss--when a specific account receivable has been !etermine! to be uncollectible, the actual loss is recor!e! by !ebiting the allowance account an! cre!iting accounts receivable c( Recovery--when a previously written off account receivable is collecte!1 the entry to write off the account is reverse! an! the collection is recor!e! as a normal collection 2( -llustrations a( #uring year 1 a corporation ma!e cre!it sales of .200,000 an! ma!e collections of .1/0,0001 !uring year 2 the corporation ma!e cre!it sales of .200,000, ma!e collections of .3<,=00 from year 1 cre!it sales an! .22/,000 from year 2 cre!it sales, an! wrote-off cre!it sales from year 1 in the amount of .2,2001 the percentage-of-sales metho! was use! to estimate ba! !ebt e6pense1 ba! !ebt e6pense was estimate! to be 1 1&2' of cre!it sales each year >ear 1% Accounts Receivable 200,000 Sales 200,000 Cash Accounts Receivable a! #ebt A6pense $1 1&2' 6 200,000( Allowance for 9ncollectible Accounts 2,000 2,000 1/0,000 1/0,000

>ear 2% Accounts Receivable Sales Cash $3<,=00 @ 22/,000( Accounts Receivable Allowance for 9ncollectible Accounts Accounts Receivable a! #ebt A6pense $1 1&2' 6 200,000( Allowance for 9ncollectible Accounts b(

200,000 200,000 2?1,=00 2?1,=00 2,200 2,200 3,/00 3,/00

#uring year 1 a corporation ma!e cre!it sales of .200,000 an! ma!e collections of .1/0,0001 !uring year 2 the corporation ma!e cre!it sales of .200,000, ma!e collections of .3<,=00 from year 1 cre!it sales an! .22/,000 from year 2 cre!it sales, an! wrote-off cre!it sales from year 1 in the amount of .2,2001 the percentage-of-receivables metho! was use! to estimate the allowance for uncollectible accounts1 the allowance for uncollectible accounts was estimate! to be <' of uncollecte! accounts receivable each year >ear 1% Accounts Receivable 200,000 Sales 200,000 Cash Accounts Receivable a! #ebt A6pense Allowance for 9ncollectible Accounts $<' 6 $200,000 5 1/0,000(( >ear 2% Accounts Receivable Sales 2,000 2,000 1/0,000 1/0,000

200,000 200,000

Cash $3<,=00 @ 22/,000( Accounts Receivable Allowance for 9ncollectible Accounts Accounts Receivable

2?1,=00 2?1,=00 2,200 2,200

a! #ebt A6pense 3,?00 Allowance for 9ncollectible Accounts $<' 6 $/0,000 @ 200,000 5 2?1,=00 5 2,200( 5 $2,000 5 2,200(( c(

3,?00

#uring year 1 a corporation wrote off an account receivable in the amount of .3,0001 !uring year 2 the corporation collecte! the account receivable >ear 1% Allowance for 9ncollectible Accounts 3,000 Accounts Receivable 3,000 >ear 2% Accounts Receivable Allowance for 9ncollectible Accounts Cash Accounts Receivable 3,000 3,000 3,000 3,000

C.

7otes Receivable--a written promise to pay a certain sum of money at a specific future !ate 1. Short-term 7otes a. -nterest-bearing 7otes--the borrower is reBuire! to pay at the !ate of maturity the face value of the note plus an e6plicitly state! interest on the face value of the note 1( Accounting a( #ate of Receipt--the amount of cash or the value of goo!s or services given is eBual to the face value of the note -( 7otes Receivable--the notes receivable account is !ebite! for the face value of the note b( #ate of ,ayment -( 7otes Receivable--the notes receivable account is cre!ite! for the face value of the note --( -nterest -ncome--interest income is recor!e! for an amount eBual to the face rate of interest times the face amount of the note times the length of time from

<

2(

!ate of receipt of the note to the !ate of maturity of the note -llustration--a corporation sol! inventory on *arch 1 an! receive! a .10,000, =', <-month note1 the note was pai! on September 1 *arch 1% 7otes Receivable 10,000 Sales 10,000 September 1% Cash $10,000 @ =' 6 10,000 6 < & 12( 7otes Receivable -nterest -ncome 10,300 10,000 300

b.

7oninterest-bearing 7ote--the borrower is reBuire! to pay at the !ate of maturity the face value of the note 1( Accounting a( #ate of Receipt--the amount of cash or the value of the goo!s or services given is eBual to the face value of the note less the implie! rate of interest on the face value of the note -( 7otes Receivable--the notes receivable account is !ebite! for the face value of the note --( #iscount on 7otes Receivable--the !iscount on notes receivable account is cre!ite! for an amount eBual to the face rate of interest times the face amount of the note times the length of time from !ate of receipt of the note to the !ate of maturity of the note b( #ate of ,ayment -( 7otes Receivable--the notes receivable account is cre!ite! for the face value of the note --( #iscount on 7otes Receivable--the !iscount on notes receivable is amorti;e! as interest income over the life of the note 2( -llustration--a corporation sol! inventory on *arch 1 an! receive! a .10,000, <-month, noninterest-bearing note with an implie! interest rate of ='1 the note was pai! on September 1 *arch 1% 7otes Receivable 10,000 #iscount on 7otes Receivable 300 $=' 6 10,000 6 < & 12( Sales 4,<00

September 1% Cash 7otes Receivable #iscount on 7otes Receivable -nterest -ncome 2.

10,000 10,000 300 300

Long-term 7otes a. Accounting 1( Cost *etho!--a note receivable is value! at its cost at the !ate the note receivable is acBuire! with the fair mar+et value of the note receivable !isclose! in the notes to the financial statements a( #ate of Receipt--the note receivable is recor!e! at the present value of the future cash payments using the mar+et rate of interest -( 7otes Receivable--the notes receivable account is !ebite! for the face value of the note --( #iscount&,remium on 7otes Receivable--the !iscount&premium on notes receivable account is cre!ite!&!ebite! for the !ifference between the face value an! the present value of the note b( #ate of ,ayment--each payment is allocate! between interest an! principal -( 8ace Rate of -nterest--interest income is recogni;e! for the face rate of interest times the beginning carrying value of the note receivable account A( 7otes Receivable--the notes receivable account is cre!ite! for the e6cess of the amount of the payment over the amount of interest income --( *ar+et Rate of -nterest--interest income is recogni;e! for the !ifference between the mar+et rate of interest times the beginning carrying value of the note an! the face rate of interest A( #iscount&,remium on 7otes Receivable--the !iscount&premium on notes receivable account is !ebite!&cre!ite! for the !ifference between the face rate of interest an! the mar+et rate of interest 2( -llustrations a( A .1/0,000, 2-year noninterest bearing note was receive! on Canuary 1 of year 1 when the mar+et rate of interest was ='1 the note is to be repai! in 2 eBual installments of ./0,000 on #ecember 21 of year 1, year 2, an! year 2 /0,000 6 2./??10 D 12=,=//

Amorti;ation Sche!ules% 8ace Rate% eginning -nterest alance -ncome 1/0,000 @ --100,000 @ --/0,000 @ --*ar+et Rate% eginning alance 12=,=// =4,1<2 3<,24< -nterest -ncome 10,20= ?,122 2,?03

Cash ,ayment /0,000 /0,000 /0,000 Cash ,ayment /0,000 /0,000 /0,000

D D D

An!ing alance 100,000 /0,000 --An!ing alance =4,1<2 3<,24< ---

@ @ @

D D D

>ear 1% 7otes Receivable #iscount on 7otes Receivable Cash Cash 7otes Receivable #iscount on 7otes Receivable -nterest -ncome $10,20= 5 0( >ear 2% Cash 7otes Receivable #iscount on 7otes Receivable -nterest -ncome $?,122 5 0( >ear 2% Cash 7otes Receivable #iscount on 7otes Receivable -nterest -ncome $2,?03 5 0( b(

1/0,000 21,13/ 12=,=// /0,000 /0,000 10,20= 10,20=

/0,000 /0,000 ?,122 ?,122

/0,000 /0,000 2,?03 2,?03

A .12=,=//, 2-year, =' note was receive! on Canuary 1 of year 1 when the mar+et rate of interest was ='1 the note is to be repai! in 2 eBual installments of ./0,000 on #ecember 21 of year 1, year 2, an! year 2

/0,000 6 2./??10 D 12=,=// Amorti;ation Sche!ule $8ace eginning -nterest alance -ncome 12=,=// @ 10,20= =4,1<2 @ ?,122 3<,24< @ 2,?03 >ear 1% 7otes Receivable Cash Cash -nterest -ncome 7otes Receivable >ear 2% Cash -nterest -ncome 7otes Receivable >ear 2% Cash -nterest -ncome 7otes Receivable c( /0,000 2,?03 3<,24< /0,000 ?,122 32,=<? Rate D *ar+et Rate(% Cash An!ing ,ayment alance /0,000 D =4,1<2 /0,000 D 3<,24< /0,000 D --12=,=// 12=,=// /0,000 10,20= 24,<42

A .1/0,000, 2-year noninterest bearing note was receive! on Canuary 1 of year 1 when the mar+et rate of interest was ='1 the note is to be repai! in 2 installments of .<0,000 on #ecember 21 of year 1, ./0,000 on #ecember 21 of year 2, an! .30,000 on #ecember 21 of year 2 <0,000 6 .42/42 @ /0,000 6 .=/?23 @ 30,000 6 .?42=2 D 120,1?< Amorti;ation Sche!ules% 8ace Rate% eginning -nterest alance -ncome 1/0,000 @ --40,000 @ --30,000 @ ---

Cash ,ayment <0,000 /0,000 30,000

D D D

An!ing alance 40,000 30,000 ---

10

*ar+et Rate% eginning alance 120,1?< =0,/40 2?,02?

@ @ @

-nterest -ncome 10,313 <,33? 2,4<2

Cash ,ayment <0,000 /0,000 30,000

D D D

An!ing alance =0,/40 2?,02? ---

>ear 1% 7otes Receivable 1/0,000 #iscount on 7otes Receivable Cash Cash 7otes Receivable #iscount on 7otes Receivable -nterest -ncome $10,313 5 0( >ear 2% Cash 7otes Receivable #iscount on 7otes Receivable -nterest -ncome $<,33? 5 0( >ear 2% Cash 7otes Receivable #iscount on 7otes Receivable -nterest -ncome $2,4<2 5 0( !( 2,4<2 <,33? 10,313 <0,000

14,=23 120,1?< <0,000 10,313

/0,000 /0,000 <,33?

30,000 30,000 2,4<2

A .120,1?<, 2-year, =' note was receive! on Canuary 1 of year 1 when the mar+et rate of interest was ='1 the note is to be repai! in 2 installments of .<0,000 on #ecember 21 of year 1, ./0,000 on #ecember 21 of year 2, an! .30,000 on #ecember 21 of year 2 <0,000 6 .42/42 @ /0,000 6 .=/?23 @ 30,000 6 .?42=2 D 120,1?<

11

Amorti;ation Sche!ule $8ace eginning -nterest alance -ncome 120,1?< @ 10,313 =0,/40 @ <,33? 2?,02? @ 2,4<2 >ear 1% 7otes Receivable Cash Cash -nterest -ncome 7otes Receivable >ear 2% Cash -nterest -ncome 7otes Receivable >ear 2% Cash -nterest -ncome 7otes Receivable e(

Rate D *ar+et Rate(% Cash An!ing ,ayment alance <0,000 D =0,/40 /0,000 D 2?,02? 30,000 D --120,1?< 120,1?< <0,000 10,313 34,/=< /0,000 <,33? 32,//2 30,000 2,4<2 2?,02?

A .1/0,000, 2-year noninterest bearing note was receive! on Canuary 1 of year 1 when the mar+et rate of interest was ='1 the note is to be repai! in a single installment of .1/0,000 on #ecember 21 of year 2 1/0,000 6 .?42=2 D 114,0?/ Amorti;ation Sche!ules% 8ace Rate% eginning -nterest alance -ncome 1/0,000 @ --1/0,000 @ --1/0,000 @ --*ar+et Rate% eginning alance 114,0?/ 12=,<01 12=,==4 -nterest -ncome 4,/2< 10,2== 11,111

Cash ,ayment 0 0 1/0,000 Cash ,ayment 0 0 1/0,000

D D D

An!ing alance 1/0,000 1/0,000 --An!ing alance 12=,<01 12=,==4 ---

@ @ @

D D D

12

>ear 1% 7otes Receivable #iscount on 7otes Receivable Cash #iscount on 7otes Receivable -nterest -ncome $4,/2< 5 0( >ear 2% #iscount on 7otes Receivable -nterest -ncome $10,2== 5 0( >ear 2% Cash 7otes Receivable #iscount on 7otes Receivable -nterest -ncome $11,111 5 0( f(

1/0,000 20,42/ 114,0?/ 4,/2< 4,/2<

10,2== 10,2==

1/0,000 1/0,000 11,111 11,111

A .114,0?/, 2-year, =' note was receive! on Canuary 1 of year 1 when the mar+et rate of interest was ='1 the note is to be repai! in a single installment of .1/0,000 on #ecember 21 of year 2 1/0,000 6 .?42=2 D 114,0?/ Amorti;ation Sche!ule $8ace eginning -nterest alance -ncome 114,0?/ @ 4,/2< 12=,<01 @ 10,2== 12=,==4 @ 11,111 >ear 1% 7otes Receivable Cash -nterest Receivable -nterest -ncome >ear 2% -nterest Receivable -nterest -ncome Rate D *ar+et Rate(% Cash An!ing ,ayment alance 0 D 12=,<01 0 D 12=,==4 - 1/0,000 D --114,0?/ 114,0?/ 4,/2< 4,/2< 10,2== 10,2==

12

>ear 2% -nterest Receivable -nterest -ncome Cash -nterest Receivable 7otes Receivable g(

11,111 11,111 1/0,000 20,42/ 114,0?/

A .12=,=//, 2-year, =' note was receive! on Canuary 1 of year 1 when the mar+et rate of interest was 11'1 the note is to be repai! in 2 eBual installments of ./0,000 on #ecember 21 of year 1, year 2, an! year 2 /0,000 6 2./??10 D 12=,=// /0,000 6 2.332?1 D 122,1=< Amorti;ation Sche!ules% 8ace Rate% eginning -nterest alance -ncome 12=,=// @ 10,20= =4,1<2 @ ?,122 3<,24< @ 2,?03 *ar+et Rate% eginning alance 122,1=< =/,<2< 3/,03/ -nterest -ncome 12,330 4,314 3,4//

Cash ,ayment /0,000 /0,000 /0,000 Cash ,ayment /0,000 /0,000 /0,000

D D D

An!ing alance =4,1<2 3<,24< --An!ing alance =/,<2< 3/,03/ ---

@ @ @

D D D

>ear 1% 7otes Receivable #iscount on 7otes Receivable Cash Cash -nterest -ncome 7otes Receivable #iscount on 7otes Receivable -nterest -ncome $12,330 - 10,20=(

12=,=// <,<<4 122,1=< /0,000 10,20= 24,<42 2,122 2,122

13

>ear 2% Cash -nterest -ncome 7otes Receivable #iscount on 7otes Receivable -nterest -ncome $4,314 - ?,122( >ear 2% Cash -nterest -ncome 7otes Receivable #iscount on 7otes Receivable -nterest -ncome $3,4// - 2,?03( 2(

/0,000 ?,122 32,=<? 2,2=< 2,2=<

/0,000 2,?03 3<,24< 1,2/1 1,2/1

8air "alue Eption--the fair value option is optional an! must be electe! at the !ate the note receivable is acBuire! an! use! until the note receivable is no longer owne! a( #ate of Receipt--the note receivable is recor!e! at the present value of the future cash payments using the mar+et rate of interest -( 7otes Receivable--the notes receivable account is !ebite! for the face value of the note --( #iscount&,remium on 7otes Receivable--the !iscount&premium on notes receivable account is cre!ite!&!ebite! for the !ifference between the face value an! the present value of the note b( #ate of ,ayment--each payment is allocate! between interest an! principal -( 8ace Rate of -nterest--interest income is recogni;e! for the face rate of interest times the beginning carrying value of the note receivable account A( 7otes Receivable--the notes receivable account is cre!ite! for the e6cess of the amount of the payment over the amount of interest income --( *ar+et Rate of -nterest--interest income is recogni;e! for the !ifference between the mar+et rate of interest times the beginning carrying value of the note an! the face rate of interest A( #iscount&,remium on 7otes Receivable--the !iscount&premium on notes receivable account is !ebite!&cre!ite! for the !ifference between the face rate of interest an! the mar+et rate of interest

1/

c(

alance Sheet #ate--the note receivable is value! at its fair mar+et value at the balance sheet !ate with the change in fair mar+et value from the previous balance sheet !ate inclu!e! in income as an unreali;e! hol!ing gain or loss

#.

Receivable 8inancing 1. Secure! orrowing--the owner of the receivables borrows cash from a len!er by issuing a promissory note !esignating or ple!ging the receivables as collateral a. )eneral Assignment--all receivables serve as collateral for the note 1( Accounting--no special entries are ma!e to receivables accounts 2( #isclosure--information concerning assigne! receivables is !isclose! either in a parenthetical e6planation or in a note to the financial statements b. Specific Assignment--the borrower an! len!er enter into an agreement as to $1( who receives the collection, $2( the finance charges, $2( the specific receivables that serve as collateral, an! $3( notification or non-notification of account !ebtors 1( Accounting a( #ate of Assignment -( orrower A( 7ote--the issuance of the note is recor!e! the same as the issuance of any note ( 8inance A6pense--an e6pense from the assignment of the receivables is recogni;e! eBual to the finance charge C( ,rocee!s--the procee!s from the assignment of the receivables is eBual to the recor!e! value of the note less the finance charges --( Len!er A( 7ote--the receipt of the note is recor!e! the same as the receipt of any note ( 8inance Revenue--a revenue from the assignment of the receivables is recogni;e! eBual to the finance charge C( ,rocee!s--the procee!s from the assignment of the receivables is eBual to the recor!e! value of the note less the finance charges b( #ate of Collection -( orrower--the collection of the assigne! receivables is recor!e! the same as the collection of unassigne! receivables with the procee!s from the collection being use! to repay the !ebt an! interest --( Len!er--the receipt of the procee!s from the collection is allocate! to the !ebt an! interest

1<

2(

-llustration-a corporation assigne! .10,000 of accounts receivable as security for a note1 the len!er a!vance! =0' of the assigne! accounts receivable less a finance charge of 2' of the assigne! accounts receivable1 the len!er charge! interest of 1' per month on the unpai! balance of the note1 !uring the first month .2,120 of assigne! accounts receivable less a ./0 !iscount an! .100 return were collecte!1 !uring the secon! month the rest of the assigne! accounts receivable less a .200 ba! !ebt were collecte! orrower% Cash ?,=00 $10,000 5 2' 6 10,000( 8inance Charge 200 7otes ,ayable =,000 Cash Sales #iscounts Sales Returns an! Allowances Accounts Receivable -nterest A6pense $1' 6 =,000( 7otes ,ayable Cash Cash Allowance for 9ncollectible Accounts Accounts Receivable -nterest A6pense $1' 6 $=,000 5 1400(( 7otes ,ayable Cash Len!er% 7otes Receivable 8inance Revenue Cash Cash -nterest -ncome 7otes Receivable Cash -nterest -ncome 7otes Receivable <,1<1 <1 <,100 1,4=0 /0 100 2,120 =0 1,400 1,4=0 ?,/?0 200 ?,=?0 <1 <,100 <,1<1 =,000 200 ?,=00 1,4=0 =0 1,400

1?

2.

Sale of Receivables--the seller an! the purchaser enter into an agreement as to $1( the specific accounts that are being sol!, $2( the finance charges, $2( the party responsible for ba! !ebts, an! $3( the amount of the procee!s from the sale to be retaine! to cover estimate! !iscounts, returns, allowances, an! ba! !ebts a. :ithout Recourse--the purchaser of the accounts receivable assumes the ris+ of any ba! !ebts 1( Accounting a( #ate of Sale -( Seller A( Loss--a loss on the sale of the receivables is recogni;e! eBual to the finance charge ( Retainer--a receivable is recogni;e! eBual to the amount retaine! to cover estimate! !iscounts, returns, an! allowances C( ,rocee!s--the procee!s from the sale of the receivables is eBual to the recor!e! amount of the receivables less the finance charges an! the retainer --( ,urchaser A( 8inance Revenue--finance revenue from the purchase of the receivables is recogni;e! eBual to the finance charge ( Retainer--a liability is recogni;e! eBual to the amount retaine! to cover estimate! !iscounts, returns, an! allowances C( ,rocee!s--the procee!s from the purchase of the receivables is eBual to the recor!e! amount of the receivables less the finance charges an! the retainer b( #ate of ,ayment -( Seller--actual !iscounts, returns, an! allowances are recor!e! offsetting the retainer --( ,urchaser--the collection of the purchase! receivables is recor!e! the same as the collection of unpurchase! receivables with the actual !iscounts, returns, an! allowances offsetting the retainer c( #ate of Settlement -( Seller--the !ifference between the retainer an! the actual !iscounts, returns, an! allowances is transferre! between the parties --( ,urchaser--the !ifference between the retainer an! the actual !iscounts, returns, an! allowances is transferre! between the parties 2( -llustration--a corporation sol! .10,000 of accounts receivable to a factor1 the factor assesse! a finance charge of 2' of the purchase! accounts receivable an! retaine! 3' of the purchase!

1=

accounts receivable to cover sales !iscounts, returns, an! allowances1 !uring the first month the factor collecte! .<,000 of the purchase! accounts receivable less a .100 !iscount an! a .2/0 return1 !uring the secon! month the factor collecte! the rest of the purchase! accounts receivable less a .1/0 ba! !ebt1 at the en! of the secon! month the parties settle! the balance of the retainer Seller% Cash 4,300 $10,000 5 2' 6 10,000 5 3' 6 10,000( Loss on Sale of Receivables 200 #ue 8rom 8actor 300 Accounts Receivable 10,000 Sales #iscounts Sales Returns an! Allowances #ue 8rom 8actor Cash $300 5 2/0( #ue 8rom 8actor ,urchaser% Accounts Receivable 8inance Revenue #ue to Seller Cash Cash #ue to Seller Accounts Receivable Cash Allowance for 9ncollectible Accounts Accounts Receivable #ue to Seller Cash b. 100 2/0 2/0 /0 /0 10,000 200 300 4,300 /,</0 2/0 <,000 2,=/0 1/0 3,000 /0 /0

:ith Recourse--the seller of the receivables assumes the ris+ of any ba! !ebts 1( Accounting a( #ate of Sale -( Seller A( Recourse Liability--a recourse liability is recogni;e! eBual to the estimate! loss from ba! !ebts

14

2(

Loss--a loss on the sale of the receivables is recogni;e! eBual to the finance charge plus the recourse liability C( Retainer--a receivable is recogni;e! eBual the amount retaine! to cover estimate! !iscounts, returns, allowances, an! ba! !ebts #( ,rocee!s--the procee!s from the sale of the receivables is eBual to the recor!e! amount of the receivables less the finance charges an! the retainer --( ,urchaser A( 8inance Revenue--finance revenue from the purchase the receivables is recogni;e! eBual to the finance charge ( Retainer--a liability is recogni;e! eBual to the amount retaine! to cover estimate! !iscounts, returns, allowances, an! ba! !ebts C( ,rocee!s--the procee!s from the purchase of the receivables is eBual to the recor!e! amount of the receivables less the finance charges an! the retainer b( #ate of ,ayment -( Seller--actual !iscounts, returns, allowances, an! ba! !ebts are recor!e! offsetting the retainer --( ,urchaser--the collection of the purchase! receivables is recor!e! the same as the collection of unpurchase! receivables with the actual !iscounts, returns, allowances, an! ba! !ebts offsetting the retainer c( #ate of Settlement -( Seller--the !ifference between the retainer an! the actual !iscounts, returns, allowances, an! ba! !ebts is transferre! between the parties --( ,urchaser--the !ifference between the retainer an! the actual !iscounts, returns, allowances, an! ba! !ebts is transferre! between the parties -llustration--a corporation sol! .10,000 of accounts receivable to a factor1 the factor assesse! a finance charge of 2' of the purchase! accounts receivable an! retaine! 3' of the purchase! accounts receivable to cover sales !iscounts, returns, allowances, an! ba! !ebts1 the estimate! recourse liability from ba! !ebts is .1?/1 !uring the first month the factor collecte! .<,000 of the purchase! accounts receivable less a .100 !iscount an! a .2/0 return1 !uring the secon! month the factor collecte! the rest of the purchase! accounts receivable less a .1/0 ba! !ebt1 at the en! of the secon! month the parties settle! the balance of the retainer

20

Seller% Cash $10,000 5 2' 6 10,000 5 3' 6 10,000( Loss on Sale of Receivables $200 @ 1?/( #ue 8rom 8actor Accounts Receivable Recourse Liability Sales #iscounts Sales Returns an! Allowances #ue 8rom 8actor Recourse Liability #ue 8rom 8actor #ue 8rom 8actor $300 5 2/0 5 1/0( Cash Recourse Liability $1?/ 5 1/0( Loss on Sale of Receivables ,urchaser% Accounts Receivable 8inance Revenue #ue to Seller Cash Cash #ue to Seller Accounts Receivable Cash #ue to Seller Accounts Receivable Cash #ue to Seller A.

4,300 2?/ 300 10,000 1?/ 100 2/0 2/0 1/0 1/0 100 100 2/ 2/ 10,000 200 300 4,300 /,</0 2/0 <,000 2,=/0 1/0 3,000 100 100

#isclosure 1. Fhe !ifferent types of receivables shoul! be segregate!, if material. 2. Aach type of receivable shoul! be offset by the appropriate valuation account. 2. Fhe receivables shoul! be classifie! as either current or long term.

21

3. /. <.

Any loss contingencies that e6ist on the receivables shoul! be !isclose!. Any receivables ple!ge! as collateral shoul! be !isclose!. All significant concentrations of cre!it ris+ arising from receivables shoul! be !isclose!.

22

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Mergers and Acquisitions Chapter QuestionsDocument21 pagesMergers and Acquisitions Chapter QuestionsJang Hee Won78% (23)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Swami Rama's demonstration of voluntary control over autonomic functionsDocument17 pagesSwami Rama's demonstration of voluntary control over autonomic functionsyunjana100% (1)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Donors Tax Theory ExplainedDocument5 pagesDonors Tax Theory ExplainedJoey Acierda BumagatNo ratings yet

- MANAGEMENT ADVISORY SERVICES Q&ADocument21 pagesMANAGEMENT ADVISORY SERVICES Q&ATom Dominguez100% (1)

- Problems - Mariztine B. ADocument12 pagesProblems - Mariztine B. AMariztine MirandillaNo ratings yet

- Smart Grid Standards GuideDocument11 pagesSmart Grid Standards GuideKeyboardMan19600% (1)

- Cpa Review School of The Philippines: Ap-59 FinpbDocument10 pagesCpa Review School of The Philippines: Ap-59 Finpbredearth2929100% (1)

- Ricoh 4055 PDFDocument1,280 pagesRicoh 4055 PDFPham Nguyen Hoang Minh100% (1)

- Cash ProgramDocument13 pagesCash Programapi-3828505No ratings yet

- A Study On Customer Satisfaction Towards Honda Bikes in CoimbatoreDocument43 pagesA Study On Customer Satisfaction Towards Honda Bikes in Coimbatorenkputhoor62% (13)

- Mock Cpa Board Exams Rfjpia R 12 WDocument17 pagesMock Cpa Board Exams Rfjpia R 12 Wlongix100% (2)

- Bangladesh Tourism ThesisDocument144 pagesBangladesh Tourism Thesisacb562100% (2)

- Biltrite Bicycles Inc. Equipment AuditDocument2 pagesBiltrite Bicycles Inc. Equipment Auditredearth2929No ratings yet

- Chapter 17 VVVDocument20 pagesChapter 17 VVVredearth2929No ratings yet

- Problem On Loan ImpairmentDocument25 pagesProblem On Loan Impairmentredearth2929No ratings yet

- Research - The Stand-Up BusinessmanccDocument5 pagesResearch - The Stand-Up Businessmanccredearth2929No ratings yet

- Objective of Financial Statements:: 1. Understandability 2. Relevance 3. MaterialityDocument14 pagesObjective of Financial Statements:: 1. Understandability 2. Relevance 3. Materialityredearth2929No ratings yet

- Practice Exam 1gdfgdfDocument49 pagesPractice Exam 1gdfgdfredearth2929100% (1)

- Cash and Cash EquivalentsgdfgdDocument2 pagesCash and Cash Equivalentsgdfgdredearth2929No ratings yet

- Ppe, Intangiblke InvestmentgfdgfdDocument12 pagesPpe, Intangiblke Investmentgfdgfdredearth2929No ratings yet

- Investments ProgramfdgfgfDocument30 pagesInvestments Programfdgfgfredearth2929No ratings yet

- Letter To The RespondentsfgfhfdfDocument2 pagesLetter To The Respondentsfgfhfdfredearth2929No ratings yet

- Chapter 1 Introduction 1.0 General IntroductionDocument11 pagesChapter 1 Introduction 1.0 General Introductionredearth2929No ratings yet

- Lease Accounting - Notes With IFRS DSFDSFDocument11 pagesLease Accounting - Notes With IFRS DSFDSFredearth2929No ratings yet

- Internal Control Self Assessment Mar-06 1111Document14 pagesInternal Control Self Assessment Mar-06 1111redearth2929100% (1)

- OTC Derivatives General Paper 112010 AaaaDocument5 pagesOTC Derivatives General Paper 112010 Aaaaredearth2929No ratings yet

- 2 - FINAL Sample Annual Report and Financial Statement Formats - New HHHHDocument4 pages2 - FINAL Sample Annual Report and Financial Statement Formats - New HHHHredearth2929No ratings yet

- Chapter 06 BBBBBBBBBBBBBBBDocument8 pagesChapter 06 BBBBBBBBBBBBBBBredearth2929No ratings yet

- OTC Derivatives General Paper 112010 AaaaDocument5 pagesOTC Derivatives General Paper 112010 Aaaaredearth2929No ratings yet

- Louw12 AuditingDocument44 pagesLouw12 Auditingredearth2929No ratings yet

- Kotchetova - Paper For MidyeardunnoDocument44 pagesKotchetova - Paper For Midyeardunnoredearth2929No ratings yet

- Kem Chicks Expands Through Entire Business Format FranchisingDocument2 pagesKem Chicks Expands Through Entire Business Format Franchisingredearth2929No ratings yet

- 9 Intangible Assets AccountingDocument25 pages9 Intangible Assets Accountingredearth2929No ratings yet

- 07 Raction KineticsDocument43 pages07 Raction KineticsestefanoveiraNo ratings yet

- Maintenance Handbook On Compressors (Of Under Slung AC Coaches) PDFDocument39 pagesMaintenance Handbook On Compressors (Of Under Slung AC Coaches) PDFSandeepNo ratings yet

- KAC-8102D/8152D KAC-9102D/9152D: Service ManualDocument18 pagesKAC-8102D/8152D KAC-9102D/9152D: Service ManualGamerAnddsNo ratings yet

- Rectifiers and FiltersDocument68 pagesRectifiers and FiltersMeheli HalderNo ratings yet

- Proposal Anguria Pasta NewDocument24 pagesProposal Anguria Pasta NewNOOR IRDINA HAFIZAH BT TAUPISNo ratings yet

- CAE The Most Comprehensive and Easy-To-Use Ultrasound SimulatorDocument2 pagesCAE The Most Comprehensive and Easy-To-Use Ultrasound Simulatorjfrías_2No ratings yet

- Advanced Ultrasonic Flaw Detectors With Phased Array ImagingDocument16 pagesAdvanced Ultrasonic Flaw Detectors With Phased Array ImagingDebye101No ratings yet

- 2019 Course CatalogDocument31 pages2019 Course CatalogDeepen SharmaNo ratings yet

- What Is DSP BuilderDocument3 pagesWhat Is DSP BuilderĐỗ ToànNo ratings yet

- F-16c.1 Ginkgo Ginkgolic AcidDocument2 pagesF-16c.1 Ginkgo Ginkgolic AcidNarongchai PongpanNo ratings yet

- Effect of Some Algal Filtrates and Chemical Inducers On Root-Rot Incidence of Faba BeanDocument7 pagesEffect of Some Algal Filtrates and Chemical Inducers On Root-Rot Incidence of Faba BeanJuniper PublishersNo ratings yet

- Lincoln Pulse On PulseDocument4 pagesLincoln Pulse On PulseEdison MalacaraNo ratings yet

- Laser Surface Treatment ProcessesDocument63 pagesLaser Surface Treatment ProcessesDIPAK VINAYAK SHIRBHATENo ratings yet

- Madu Rash Tak AmDocument4 pagesMadu Rash Tak AmAdv. Govind S. TehareNo ratings yet

- Telco XPOL MIMO Industrial Class Solid Dish AntennaDocument4 pagesTelco XPOL MIMO Industrial Class Solid Dish AntennaOmar PerezNo ratings yet

- Indian Patents. 232467 - THE SYNERGISTIC MINERAL MIXTURE FOR INCREASING MILK YIELD IN CATTLEDocument9 pagesIndian Patents. 232467 - THE SYNERGISTIC MINERAL MIXTURE FOR INCREASING MILK YIELD IN CATTLEHemlata LodhaNo ratings yet

- Philippines' Legal Basis for Claims in South China SeaDocument38 pagesPhilippines' Legal Basis for Claims in South China SeaGeeNo ratings yet

- Tds G. Beslux Komplex Alfa II (25.10.19)Document3 pagesTds G. Beslux Komplex Alfa II (25.10.19)Iulian BarbuNo ratings yet

- The Art of Now: Six Steps To Living in The MomentDocument5 pagesThe Art of Now: Six Steps To Living in The MomentGiovanni AlloccaNo ratings yet

- Gotham City: A Study into the Darkness Reveals Dangers WithinDocument13 pagesGotham City: A Study into the Darkness Reveals Dangers WithinajNo ratings yet

- 5125 w04 Er PDFDocument14 pages5125 w04 Er PDFHany ElGezawyNo ratings yet

- Placenta Previa Case Study: Adefuin, Jay Rovillos, Noemie MDocument40 pagesPlacenta Previa Case Study: Adefuin, Jay Rovillos, Noemie MMikes CastroNo ratings yet

- Concept Page - Using Vagrant On Your Personal Computer - Holberton Intranet PDFDocument7 pagesConcept Page - Using Vagrant On Your Personal Computer - Holberton Intranet PDFJeffery James DoeNo ratings yet

- BCP-8000 User's ManualDocument36 pagesBCP-8000 User's ManualAsad PatelNo ratings yet

- IS 4991 (1968) - Criteria For Blast Resistant Design of Structures For Explosions Above Ground-TableDocument1 pageIS 4991 (1968) - Criteria For Blast Resistant Design of Structures For Explosions Above Ground-TableRenieNo ratings yet

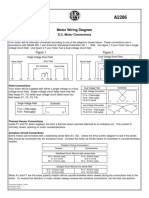

- Motor Wiring Diagram: D.C. Motor ConnectionsDocument1 pageMotor Wiring Diagram: D.C. Motor Connectionsczds6594No ratings yet