Professional Documents

Culture Documents

Commodity Market

Uploaded by

Pabitha MonishaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Commodity Market

Uploaded by

Pabitha MonishaCopyright:

Available Formats

Commodity market refers to markets that trade in primary rather than manufactured products.

Soft commodities are agricultural products such as wheat, coffee,cocoa and sugar. Hard commodities are mined, such as (gold, rubber and oil) A derivative is a financial contract which derives its value from the performance of another entity such as an asset, index, or interest rate, called the "underlying".[1] Derivatives are one of the three main categories of financial instruments, the other two being equities (i.e. stocks) and debt (i.e. bonds and mortgages). Derivatives include a variety of financial contracts, including futures, forwards, swaps, options, and variations of these such as caps, floors, collars, and credit default swaps The derivatives market is the financial market for derivatives, financial instruments like futures contracts or options, which are derived from other forms of assets. The market can be divided into two, that for exchange-traded derivatives and that for over-thecounter derivatives. The legal nature of these products is very different as well as the way they are traded, though many market participants are active in both. Over-the-counter (OTC) derivatives are contracts that are traded (and privately negotiated) directly between two parties, without going through an exchange or other intermediary. Products such as swaps, forward rate agreements, exotic options and other exotic derivatives are almost always traded in this way Exchange-traded derivatives (ETD) are those derivatives instruments that are traded via specialized derivatives exchanges or other exchanges. A derivatives exchange is a market where individuals trade standardized contracts that have been defined by the exchange.[24] A derivatives exchange acts as an intermediary to all related transactions, and takes initial margin from both sides of the trade to act as a guarantee.

A hedge is an investment position intended to offset potential losses/gains that may be incurred by a companion investment. In simple language, a hedge is used to reduce any substantial losses/gains suffered by an individual or an organization. A hedge can be constructed from many types of financial instruments, including stocks, exchange-traded funds, insurance, forward contracts, swaps, options, many types of over-thecounter and derivative products, and futures contracts

investment bank is a financial institution that assists individuals, corporations, and governments in raising capital by underwriting and/or acting as the client's agent in the issuance of securities Capital markets are financial markets for the buying and selling of long-term debt- or equitybacked securities. These markets channel the wealth of savers to those who can put it to long-term productive use, such as companies or governments making long-term investments

current liabilities are often understood as all liabilities of the business that are to be settled in cash within the fiscal yearor the operating cycle of a given firm, whichever period is longer. A more complete definition is that current liabilities are obligations that will be settled by current assets or by the creation of new current liabilities

Long-term liabilities are liabilities with a future benefit over one year, such as notes payable that mature longer than one year. In accounting, a current asset is an asset which can either be converted to cash or used to pay current liabilities within 12 months. Typical current assets include cash, cash equivalents, short-term investments, accounts receivable, stock inventory and the portion of prepaid liabilities which will be paid within a yearFixed assets, also known as "tangible assets" [Dyckman, Intermediate Accounting,Revised Ed. (Homewood IL: Irwin, Inc. 1992),195.] or property, plant, and equipment (PP&E), is a term used in accounting for assets and property that cannot easily be converted into cash. This can be compared with current assets such as cash or bank accounts, which are described as liquid assets Tangible property in law is, literally, anything which can be touched, and includes both real property and personal property (or moveable property), and stands in distinction to intangible property

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- E-Fishery Case StudyDocument15 pagesE-Fishery Case StudyMade Dananjaya100% (3)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Job Interview Questions For Financial AnalystsDocument5 pagesJob Interview Questions For Financial AnalystsPabitha MonishaNo ratings yet

- Journel EntryDocument2 pagesJournel EntryPabitha MonishaNo ratings yet

- Updated Interview QuestionsDocument15 pagesUpdated Interview QuestionsPabitha MonishaNo ratings yet

- Journel EntryDocument2 pagesJournel EntryPabitha MonishaNo ratings yet

- Journel EntryDocument2 pagesJournel EntryPabitha MonishaNo ratings yet

- Customer StatisfactionDocument94 pagesCustomer StatisfactionPabitha MonishaNo ratings yet

- Sample Copy - Mphasis &finsource PDFDocument2 pagesSample Copy - Mphasis &finsource PDFSameer ShaikhNo ratings yet

- Bir 2Q 2020Document4 pagesBir 2Q 2020Leo Archival ImperialNo ratings yet

- 2012 05 - Project Finance Newswire - May 2012Document56 pages2012 05 - Project Finance Newswire - May 2012api-165049160No ratings yet

- PW Department CodesDocument19 pagesPW Department CodesanilNo ratings yet

- Ac3059 ch1-3 PDFDocument60 pagesAc3059 ch1-3 PDFTomson KosasihNo ratings yet

- 4 - Problem SolvingDocument8 pages4 - Problem SolvingKlenida DashoNo ratings yet

- TATA MOTORS Atif PDFDocument9 pagesTATA MOTORS Atif PDFAtif Raza AkbarNo ratings yet

- Exchange Rate in NigeriaDocument12 pagesExchange Rate in NigeriaJoel ChineduNo ratings yet

- Continuous Futures Data Series For Back Testing and Technical AnalysisDocument6 pagesContinuous Futures Data Series For Back Testing and Technical AnalysisIshan SaneNo ratings yet

- Ja TinderDocument6 pagesJa TinderHitlisted VasuNo ratings yet

- Journal of Business Economics and ManagementDocument21 pagesJournal of Business Economics and Managementsajid bhattiNo ratings yet

- SJSC - Volume 27 - Issue 1 - Pages 47-80 PDFDocument34 pagesSJSC - Volume 27 - Issue 1 - Pages 47-80 PDFabdallah ibraheemNo ratings yet

- Overhead Costing - NotesDocument6 pagesOverhead Costing - NotesMohamed MuizNo ratings yet

- Important Points of Our Notes/Books:: TH THDocument42 pagesImportant Points of Our Notes/Books:: TH THpuru sharmaNo ratings yet

- PDF#23 - A New Real Estate Deal Enters The MixDocument3 pagesPDF#23 - A New Real Estate Deal Enters The MixMatthew Tyrmand100% (1)

- Transaction History: NicknameDocument4 pagesTransaction History: NicknameMerle AfricaNo ratings yet

- IT Critique - Goyal 2018Document11 pagesIT Critique - Goyal 2018Aditya GuptaNo ratings yet

- Profits and Gains of Business or Profession: After Studying This Chapter, You Would Be Able ToDocument214 pagesProfits and Gains of Business or Profession: After Studying This Chapter, You Would Be Able ToPragasNo ratings yet

- Riiitzaiit6F5T-L I: R1 Official Form 1) (12/11Document41 pagesRiiitzaiit6F5T-L I: R1 Official Form 1) (12/11Chapter 11 DocketsNo ratings yet

- Financial Performance of Retail Sector Companies in India-An AnalysisDocument7 pagesFinancial Performance of Retail Sector Companies in India-An Analysisaniket jadhavNo ratings yet

- How To Start A Picture Framing BusinessDocument3 pagesHow To Start A Picture Framing BusinessNi NeNo ratings yet

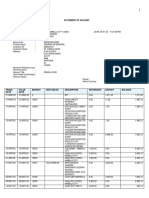

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument9 pagesStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceLoan LoanNo ratings yet

- Signature Not Verified: Speed Post BNPL Code-TN/SP/BNPL/54/CO/18 BPC, Anna Road, Chennai-02Document36 pagesSignature Not Verified: Speed Post BNPL Code-TN/SP/BNPL/54/CO/18 BPC, Anna Road, Chennai-02Ganesh PrasadNo ratings yet

- A Study On Stock and Investment Decision Using Fundamental and Technical AnalysisDocument12 pagesA Study On Stock and Investment Decision Using Fundamental and Technical AnalysispavithragowthamnsNo ratings yet

- CFTC Commitments of Traders Report - CME (Futures Only) 06082013Document10 pagesCFTC Commitments of Traders Report - CME (Futures Only) 06082013Md YusofNo ratings yet

- Aliu Dauda: Customer StatementDocument44 pagesAliu Dauda: Customer Statementaliudauda1982No ratings yet

- Audit of Wasting Assets Learning ObjectivesDocument3 pagesAudit of Wasting Assets Learning ObjectivesTrisha Mae RodillasNo ratings yet

- Startups - Financial PrudenceDocument12 pagesStartups - Financial PrudenceNeelajit ChandraNo ratings yet

- TBCH 13Document43 pagesTBCH 13Tornike JashiNo ratings yet