Professional Documents

Culture Documents

Asst US Atty Handberg-Failure of Justice

Uploaded by

Neil Gillespie0 ratings0% found this document useful (0 votes)

111 views21 pagesI contacted you because as a federal prosecutor, you are responsible for

prosecuting violations of federal law. In this instance the State Attorney has denied my

civil rights. Citizens have federal civil rights that parallel their state civil rights, and

historically when the state fails to uphold a citizen's civil rights, the U.S Department of

Justice acts. That is why I believe you have both the authority and duty to act.

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentI contacted you because as a federal prosecutor, you are responsible for

prosecuting violations of federal law. In this instance the State Attorney has denied my

civil rights. Citizens have federal civil rights that parallel their state civil rights, and

historically when the state fails to uphold a citizen's civil rights, the U.S Department of

Justice acts. That is why I believe you have both the authority and duty to act.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

111 views21 pagesAsst US Atty Handberg-Failure of Justice

Uploaded by

Neil GillespieI contacted you because as a federal prosecutor, you are responsible for

prosecuting violations of federal law. In this instance the State Attorney has denied my

civil rights. Citizens have federal civil rights that parallel their state civil rights, and

historically when the state fails to uphold a citizen's civil rights, the U.S Department of

Justice acts. That is why I believe you have both the authority and duty to act.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 21

Main Office

400Nonh Tampa Street, Suite3200 300Nonh Hogan Street, Suite 700

o

o

Tampa, Florida 33602 Jacksonville, Florida 32202-4270

813/274-6000

904/301-6300

813/274-6200(Fax) 904/301-6310(Fax)

2110FirstStreet, Suite3-137

u.s. Department of Justice

501 WestChurch Street, Suite300

FonMyers, Florida 33901 Orlando, Florida 32805

239/461-2200 United StatesAttorney 407/648-7500

239/461-2219(Fax) 407/648-7643(Fax)

MiddleDistrictof Florida

Replyto: Orlando, Florida

August1,2007

VIAUNITEDSTATESMAIL

Neil J. Gillespie

8092 SW 115

th

Loop

Ocala, Florida34481

Re: YourJuly6, 2007letter

DearMr. Gillespie:

Thisis in responsetoyourJuly6, 2007letter. Asyou know, Iam nolongerwith

the FloridaAttorneyGeneral'sOffice. Ileftthatofficeattheend of2002, and Ihave

had no professionaldealingswithAceCash oranyofthe paydayloancasessincemy

departure. Forthatreason and others, IdonotbelievethatIamtheappropriateperson

towhomyourlettershould be directed. Asafederal prosecutor, Iam primarily

responsibleforprosecutingviolationsoffederal lawthatareinvestigated bylaw

enforcement. Yourrequestforan investigationneedsto bedirectedtoan investigating

agency.

Ihaveenclosedthematerialsthatyou sentme.

Sincerely,

JAMES R. KLINDT

By:

AssistantUnited StatesAttorney

o

o

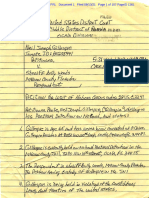

Neil J. Gillespie

8092SW115

th

Loop

Ocala,FL 34481

Telephone:(352)854-7807

email:neilgillespie@mfi.net RECEIVED

U.S. ATTORNFY'S OFFlCE

llUL 09Z007

July6, 2007

MIDDLE DISTRICT at=: FLORIDA

ORLANDO

RogerB. Handberg,Assista

US AttorneyOffice

501 W. ChurchStreet, Suite

Orlando,FL32805-2281

ntUS Attorney

300

DearMr. Handberg,

Sometimeago,inyourpositionwiththeFloridaAttorneyGeneral,youroffice

intervenedinalawsuitwhereIwasaplaintiffina"paydayloan"lawsuit,Neil Gillespie

v. ACE Cash Express, Inc., caseno. 8:00-CV-723-T-23B,inUnitedStatesDistrictCourt,

MiddleDistrictofFlorida,TampaDivision. ImetyouduringamediationJune 12,2002,

attheofficeof GasperJ. Ficarrotta. JustpriortothemediationIcalledACE'scounsel,

PaulWatson,tocomplainaboutmyownlawyers' behaviorandtotrytosettlemy

involvementinthelawsuit. Iamwritingyouaboutthecrimesof myformerlawyers.

MylawyerwasWilliamJ. Cookof Barker,Rodems& Cook,P.A. Mr. Cook

beganrepresentingmewhilehewaswiththefirmAlpert,Barker,Rodems,Ferrentino&

Cook,P.A. Mr. CookalsorepresentedmeinanotherpaydayloancaseagainstAmscot

Corporation. ThatcasesettledOctober30,2001,andIsuspectedthatmylawyers

defraudedmeduringthesettlement,butIcouldnotproveitatthetime. Forexample,

Amscot'slawyer,JohnAnthony,initiallyofferedMr. Cooka$5,000.00"improperpayoff

attempt"tosettlethecase. ShortlythereafterMr. Cooktoldmethathehadreceiveda

$50,000.00court-awardforcostsandattorneys'fees, andthatthisawardtookprecedent

overourcontingentfeeagreement,therebylimitingmyrecovery.

In2003 IlearnedthatMr. Cookdidnotreceive$50,000.00incourt-awardedcosts

andattorneys' fees, andthatMr. Cookdefraudedme. IcontactedTheFloridaBar,but

myformerlawyersaccusedmeofextortionforutilizingBar'sAttorney Consumer

Assistance Program (ACAP)inagood-faithefforttoresolvemydisputewithout

litigation. In2005 Isuedmyformerlawyersforfraudandbreachofcontract,andthey

countersuedmeforlibeloveraletteraboutthebarcomplaint.

InitiallyIproceededprosebecauseIcouldnotfindalawyerwillingtolitigate

againstmyformerlawyers,inpartbecauseof theirreputation,whichIlaterlearned

Roger B. Handberg, s ~ n t US Attorney

o

Page - 2

July 6,2007

includes Mr. Alpert throwing coffee in the face of opposing counsel during a mediation.

Nonetheless I prevailed on Mr. Cook's motion to dismiss and Judge Nielsen found I

stated a cause of action for fraud and breach of contract. Ryan Rodems is representing

Mr. Cook and the firm, and shortly thereafter he filed a false affidavit about a threat of

violence. A voice recording of the conversation later proved Mr. Rodems lied,

committed perjury, and Judge Nielsen recused himself. The antics continued with Judge

Isom, and she recused herself. Now Judge Barton has the case. In April, 2007 I found a

lawyer in Gainesville willing to take the case, Robert W. Bauer, but the case has been

damaged due to Mr. Rodems perjury and obstruction ofjustice.

My former lawyers are incompetent, not just because they failed to prevail in any

of the payday loan claims, but because of the coffee-throwing and other antics. In my

view these lawyers are little more than criminals with law degrees. Their behavior is

outrageous, and certainly more grievous than that of the payday lenders they sued.

I am writing you today about the criminal fraud by my former lawyers. Also, I am

complaining about Mr. Rodems' perjury, obstruction ofjustice, and his threats of

criminal prosecution issued to me during the course of litigation. The local state attorney,

Mark Ober, has not responded to my correspondence.

Enclosed you will find Plaintiffs Motion for Punitive Damages Pursuant to

Section 768.72 Florida Statues, with supporting exhibits 1 through 50. I believe this

document sets forth the facts needed to assist with your evaluation of my request. Also

enclosed is an amicus curiae brief in the Illinois case of Cripe v. Leiter. Amicus HALT

argued that over-billing a client is not part of the practice oflaw, and that lawyers are

subject to statutory consumer protection law in dealing with their clients.

Thank you for your consideration.

enclosures

c o

Neil J. Gillespie

8092 SW 115

1h

Loop

Ocala,FL34481

VIAUNITEDSTATESCERTIFIEDMAIL

Articleno.: 70060100000733661075

October2, 2007

RogerB. Handberg,AssistantUS Attorney

US AttorneyOffice

501 W. ChurchStreet,Suite300

Orlando,FL32805-2281

DearMr. Handberg,

ThankyouforyourletterofAugust 1, 2007. Afterreadingyourresponse,Iam

confusedwhenyoudirectedmetoaninvestigatingagencyforaninvestigationofmy

former lawyers'criminalconduct. Inmy lettertoyouofJuly6, 2007,IwrotethatI

contactedthelocal StateAttorney,MarkOber,butthathedidnotrespondtomy

correspondence. IalsoprovidedyoucopiesofmyletterstoMr. Oberasexhibitsto

PlaintiffsMotionforPunitiveDamagesPursuanttoSection768.72FloridaStatues,

specificallythreelettersgroupedasexhibitnumber47,lettersdatedMarch7

th

, 16

1h

and

24

Ih

,2006. Inaddition,IwroteMr. OberonJuly 15,2006requestingareplytomy

correspondence,buthedidnotrespond. Isn'tMr. Ober,theStateAttorneyforthe

ThirteenthJudicialCircuit,theproperinvestigatingagency? Ifnot,whois?

ItakeMr. Ober'sfailureto replyoracknowledgemycorrespondenceasevidence

ofhistacitapprovalofmyformerlawyers' wrongdoing. TheStateAttorney'sfailure

deniedmycivilrightstoequalprotectionunderlaw,therightto dueprocess,protection

fromwitnessintimidationand/ortampering,andobstructionofjustice.

Icontactedyoubecauseasafederal prosecutor,youareresponsiblefor

prosecutingviolationsoffederal law. InthisinstancetheStateAttorneyhasdeniedmy

civilrights. Citizenshavefederal civilrightsthatparalleltheirstatecivilrights,and

historicallywhenthestatefailsto upholdacitizen'scivilrights,theU.SDepartmentof

Justiceacts. ThatiswhyIbelieveyouhaveboththeauthorityanddutytoact.

~ y ,

a ~ ~ -

. ~ ~

c

o

U.S. Postal Service c'

U')

r'-

CERTIFIED MAILr.1 RECEIPT

CJ (DomesticMailOnly;NoInsuranceCoverageProvided)

M

.JJ

.JJ

IT!

r'- CertJfled Fee S2.65 O?_.... , ...

CJ

CJ Return Receipt Fee 1-------1/,7 '1.

CJ (Endorsement Required) S2.15.

'(: (

CJ Restricted Delivery Fee I------ - - ... ,-.

SOOO

(Endorsement Required) $ .5.21' I t no?

CJ Total Postage &Fees"

.JJ L..:. --1 U;.; rS

CJ ntop_ntt:> .

/$

,

,..)

../v

__

II)

'"

N

U1

r'-

CJ

M

.JJ

.JJ

IT!

IT!

r'-

CJ

CJ

a.

'a;

CJ

a:

CJ

E

CJ :>

M

m

a:

CJ

0

II

CD

..ll

E

0

8

0

r'-

g

0

I

C\l

2

as

.lJ

Ql

u-

ll:

T'""

.8 EO

T'""

,g

GO

C')

.2

E

0

U-

en

N a..

"PADDOCK BRANCH POST OFFICE"

OCALA, Florida

344749998

1143840606 -0093

10/02/2007 (352)861-8188 03:28:24 PM

Product

Receipt

Sale Unit Final

Description Oty Price Price

ORLANDO FL 32805 Zone-2

First-Class Letter

0.50 oz.

Return Rcpt (Green Card)

Certified

$0.41

$2.15

$2.65

Label #:

70060100000733661075

Issue PVI:

$5.21

Total:

$5.21

Paid by:

Cash

$5.25

Change Due:

-$0.04

Order stamps at USPS.com/shop or call

1-800-Stamp24. Go to USPS.com/clicknship

to print shipping labels with postage.

For other information call 1-800-ASK-USPS.

Bill#: 1000701736984

Clerk: 02

All sales final on stamps and postage.

Refunds for guaranteed services only.

Thank you for your business.

****************************************

****************************************

HELP US SERVE YOU BETTER

Go to: http://gx.gallup.com/pos

TELL US ABOUT YOUR RECENT

POSTAL EXPERIENCE

YOUR OPINION COUNTS

****************************************

****************************************

Customer Copy

STATEOFFLORIDA

DEPARTMENTOFBANKINGAND FINANCE

AND

OFFICEOFTHEAnORNEYGENERAL

INRE:

ACECASHEXPRESS,INC.d/b/a

ACEAMERICA'SCASHEXPRESS, DBF CASE NO.: 9177-F-9/02

----------------

I

SETILEMENTAGREEMENT

TheFloridaDepartmentofBankingand Finance, Division ofSecuritiesandFinance

("DBF"),theOfficeoftheAttorneyGeneral (UAttorneyGeneral")and ACECash Express, Inc.

d/b/aACEAmerica'sCashExpress("Respondent"or"ACE")agreeas follows:

1. JURISDICTION. OBFis charged\vith the administrationofChapter516, 560,

and 687,Florida andtheAttorneyGeneral ischarged\viththeadministrationof

Chapters501, 559,687, 895" and 896, FloridaStatutes. Thisagreementapplies toFlorida

transactionsonly.

2. BACKGROUND.

AttorneyGeneral

a. TheAttorneyGeneral movedtointerveneas plaintiffintwo civil cases

thatwerependingagainst contendingthatACEhad violated Chapters501,

516, 559, 687, 895, and 896, FloridaStatutes, in connection withdeferred

.

depositcheckcashingservices.providedby ACE in Floridapriorto ApriL.2000.

Thosecasesare: Eugene aJld Neil Gille.. \pie alld .. ofFlorida,

Office qfthe Atlorlley Gellert,l, Depllrtnlent ofLegal Affairs liS. ACE Cash

Express. IIIC., Allerilative FinclJlcia/, IIIC ofthe Treas11re Il1e., Raymond

c. Henln1ig, DOllold H. Neusll1dl. Kll)' I). Zilliox, J. Schmitt, and unknowl1

FINAL

entities Gnd individuals, No. 9909730, in the Circuit Court for

the Thirteenth Judicial District of Florida (the "Clement" case); and Betls v. Ace

Cash 927 So.2d 294 (Fla. 5

th

DCA 2002), (the "Betts" case). DBF was

not a named party in either case.

b. ACE and the other defendants disagreed with the claims made by the

Plaintiffs and the Attorney General in each of those cases.

c. The Attorney General's Inotion to intervene in the Betts case was denied.

d. In the Clement case, the individual Plaintiffs' clailns were dismissed with

prejudice, leaving the Attorney General as the sole Plaintiff. The Attorney

General's RICO claims were dislnissed with prejudice and are subject ofa

pending appeal before the Second District Coul1 of AppeaJ ofFlorida styled ..')tate

ofFlorida, Qffice ofthe AI/oriley General v. Zilliox, Case No. 2002-2340

(consolidated with Case No. 2002-3] 13). All of the claims asserted bythe

Attorney General in' the Clement case are to be settled pursuant to this

Agreement, with the Attorney General voluntarily dismissing their claims.

e. ACE 'and the individual defendants have denied and continue to deny that

they engaged in any wrongdoing., and this Agreement shall not constitute any

adlnission of any wrongdoing or liability on the part of ACE or any of the

individual defendants.

f. The, Attorney General and ACE wish to avoid the time and expense

involved, in further litigation.

FINAL 2

Department of Banking and Finance

g. Goleta National Bank, a national bank located in Goleta, California

("Goleta"), has offered loans to residents of Florida since April 2000. ACE has

provided agency services to Goleta related to those loans in Florida. On October

25 and 28, 2002. ACE and Goleta entered into separate consent orders with the

Office of the Comptroller of the Currency of the United States ("OCC"), pursuant

to which Goleta agreed, among other things, to generally cease the origination,

renewal and rollover of its loans in Florida and ACE agreed, among other things,

to generally cease providing services to Goleta related to the origination, renewal

and rollover of such Goleta loans, both by no later than December 31, 2002.

Goleta, ACE and the OC..c agreed that the loans provided by Goleta and serviced

by ACE were made pursuant to 12 U.S.C. 85 and that the interest rate charged

by Goleta was permissible under the laws of the United States for national banks

located in the State of California. DBF was not a party to the agreement between

Goleta, ACE, and the OCC..

h. ACE also offers a bill paying service through which it offers to accept or

receive voluntary utility payments from its Florida customers and, for a fee,

electronically transmit the payment to the utility. The DBF has informed ACE

that to offer this service, ACE should be licensed as a Funds Transmitter under

Part II, Chapter 560, Florida Statutes. ACE disagrees with the position taken by

the DBF, but, to avoid the expense and uncertainty of litigation. ACE agreed to

file, and has pending with OBF. an application to act as a Funds Transmitter

FINAL J

..,

underPartII.. Chapter560,FloridaStatutes. TheDBFwill issuethatlicense, as

well asthelicenseauthorizingACE toactasaDeferredPresentmentProvider

underPartIV, Chapter560,FloridaStatutes,onorbeforethe effectivedateofthis

Agreement. Aceagreesthatfuturetransactions involvingthetransmissionof

funds will begovernedbytheprovisionsofPart II, Chapter560, FloridaStatutes,

and ACE will complywiththoseprovisions in all futuretransactions.

i. ACE is licensedwith DBFas aCheck Casherunder PartIII, Chapter560,

FloridaStatutes.

PurooseandIntent

J. Thepartieswishtoresolveand to releaseanyclailnsthatwere asserted,or

could havebeenasserted,orcouldbeasserted, becauseoforarising from the

investigation,litigation,pr regulatoryreviewconductedbythe DBV orthe

AttorneyGeneral.

k. TheDBFagreesthatACEhas fullycooperatedwith itin this matter.

I. Itis theintentofthepartiesthatthisagreementbeimplementedpromptly,

and withoutinjuryorinconvenienceto ACE customers.

m. Itis.theintentofthepartiesthatOBF issueorrenewany authorizationor

licensenecessaryforACEto toofferservicesin Florida, including

deferredpresentmenttransactions.. checkcashing, bill paying

9

debitcard

transactions, money wiretransfersand otherproductsthatareauthorized

underFloridalaw.

n. It'istheintentofthepartiesthatthisagreementbeimplementedwithout

causingcompetitivedisadvantageto ACE..

FINAL 4

3. CONSIDERATION. ACE, the DSF, and the Attorney General agree as follows:

8. ACE will cease providing agent services to Goleta in connection with the

origination,:'-enewal, or rollover of any Goleta loans in the State of Florida by

December 31, 2002. ACE may, howevef, continue to provide services to Goleta

related to the servicing and collection of Goleta loans originated, renewed, or

rolled overin the State of Florida before January 1, subject to paragraph

3(g) below.

b. ACE has applied fOf.. and DBF agrees to issue upon the issuance of the

final order contelnplated by this agreelnent, a license with an effective date of

December 30, 2002, authorizing ACE to act as a Deferred Presentment Provider

under Part IV, Chapter Florida Statutes. ACE agr,ees not to enter into any

deferred presentment trapsactions in Florida unless such deferred presentment

transactions are completed in accordance with Part IV-, Chapter 560, Florida

Statutes. DBF agrees that ACE may act as a Deferred Presentment Provider under

Part IV, Chapter 560.. Florida Statutes, and as a Funds Transmitter under Part II,

Chapter 560, Florida Statutes, between December 30, 2002 and the issuance of

the final' order, provided that all such funds transmission .and .deferred presentment

transactions engaged in during this tilne period are otherwise completed in

accordance with Part II, Chapter 560, Florida Statutes, and Part IV, Chapter 560,

Florida Statutes. OBF agrees that this is consistent with the public interest and

will not constitute a violation of this Agreement or any applicable law, including

but not limited t0

9

501 .. 516,559,560,687,895 and 896, Florida

Statutes, or an Rules related to those statutes.

FINAL 5

c. ACE represents and warrants that it has obtained the consent of Goleta so

that no Goleta loans entered into before 'the effective date of this Agreement will

be extendect (except for the custolners' five-day extension options that are part of

the terms ofoutstanding loans) or converted, without full payment by the Goleta

loan customers, to any other type of transaction. Where applicable., ACE agrees

that it will not otler deferred presentlnent services to a Goleta loan customer

unless that customer's Goleta loan is or cancelled in accordance with

paragraph 3(g)-below. DBF agrees that the continued services provided under

the Goleta loan prograln authorized by this and by paragraph 3(a)

above are consistent with the public interest and will not constitute a violation of

this Agreement or any applicable including but not lilnited to, Chapters 501,

516.. 559, 560, 687, 8951lnd 896, Florida Statutes., or any Rules related to those

statutes.

d. DBF agrees to issue to ACE licenses pursuant to Part II, Chapter 560,

Florida Statutes, and Part IV, Chapter 560, Florida Statutes, with an effective date

of December 30, 2002 upon the issuance of the final order contemplated in this

Agreement. ACE and the DSF agree that, until the issuance of the final

contemplated in this. agreement.. ACE will continue to offer its bill paying service

in order to avoid injury to those customers who rely on that service. DBF and the

Attorney General agree that continuing to offer that service is consistent with the

public interest and will not constitute a violation of this Agreement or any

applicable law, including but not limited to, Chapters 501 .. 516, 559, 560, 687,

895, and 896.. Florida Statutes, or any Rules related to those statutes.

FINAL 6

e. DBF acknowledges that no additional in.formation is needed from ACE for

it to issue the Ijcenses contemplated by this Agreement..

f: ACe agrees to paya total of $500,000 in settlement and for issuance by

DBF of authorizations, licenses, or other approvals necessary for ACE to continue

in business in Florida, and for the releases in paragraphs 7 and 8 below. Of the

$500.000 total settlelnent, ACE has agreed to pay $250,000 to the DBF

Regulatory Trust Fund in full satisfaction of all attorney's fees, costs, and other

expenses incurred by the DBF in connection with this matter and, ACE has agreed

to deliver to the Attorney General, a contribution of$250,000 to the Florida State

University College of Law in full satisfaction of all attorney's fees, costs and

other expenses incurred by the Attorney General in connection with this matter.

These amounts will be p ~ by check, and will be delivered to the DBF or the

Attorney General upon entry of the Final Order as provided for herein.

g. ACE represents and warrants that it has obtained the consent of Goleta so

that loans that are delinquent as of October I,2002. and remain unpaid as of the

effective date of this agreement, from customers who engaged in Goleta loan

transactions commenced or originated before October I, 2002 in Florida

(collectively" the "Goleta Loan Custonlers") need not be repaid,. and the debt

owed to Goleta from Goleta Loan Customers will be cancelled.

h. If Goleta, either directly or through ACE, its agent,. .has notified a credit-

reporting agency ofa Goleta Loan Customer's delinquent debt to Goleta, then

ACE represents and warrants that it has obtained the consent of Goleta for ACE to

notify the credit agency that the delinquent amount has been cancelled. .

FINAL 7

I. In addition to the amount specified in paragraph 3(f) above, ACE will pay

up to $15,000 for an independent audit of the loan cancellations provided in

paragraph above, the credit reporting notifications provided in paragraph 3

(h) above, and verification of compliance with the transition from the Goleta loan

product to the state licensed product contemplated in paragraph 3(b) and 3(c)

above. DBF will select the independent auditor, after consultation with ACE.

The independent auditor selected will be required to report to the DBF within 90

days of the selection.

j. The entry ofa Final Order by OBF in the form of the Attachment to this

agreement.

k. Within 10 days after the entry of the final order contemplated herein, the

Attorney General will with prejudice its lawsuit, Eugene R. Clement alld

Neil Gillespie and State ofFlorida. qffice ofthe Attorney General, Department of

Legal Affairs vs. ACE Cash Express, IIlC., Altemative Financial, Inc., JS ofthe .

Treasure Coast, blc.,.Raymond C. Hemmig, DOllald H. Neustadt, Kay D. Zil/iox,

RonaldJ. Schmitt, alld unknown emilies and Consolidated Case No.

9909730, in the Circuit Court for the Thirteenth Judicial District of Florida, as to

all defendants.

1. Within 10 days after the entry of the final order contemplated in 30)

above, the Attorney General will dismiss with prejudice its appeal ofany orders in

the Clement case..litigation. including State ofFlorida, Office ofthe Attorney

General v. Zi//iox, Case No. 2002-2240 and Slale ofFlorida, Office ofthe

Attomey Gener,,1 1'. AItematil;e FiflCI/lc:i"t, /flC., Case No. 2002-3113.

FINAL 8

4. CONSENT. Without adlnitting or denying any wrongdoing, Respondent

consents to the issuance by the DBF ofa Final Order, in substantially the form of the attached

Final Order, which the terms of this Agreelnent.

5. FINAL ORDER. The Final Order incorporating this Agreelnent is issued

pursuant to Subsection 120.57(4),. Florida Statutes, and upon its issuance shall be a final

administrative order.

6. WAIVERS. Respondent knowingly and voluntarily waives:

a. its right to an adlninistrative hearing provided for by Chapter 120, Florida

Statutes,. to contest the specific agreements included in this Agreement;

b. any requirelnent that the Final Order incorporating this Agreenlent contain

separately stated Findings of Fact and Conclusions of Law or Notice of Rights;

c. its right to the isslJance ofa Recommended Order by an administrative law

judge froln the Division of Adlninistrative Hearings or froln the DBF;

d. any and all rights to object to or challenge in any judicial proceeding,

including but not limited to, an appeal pursuant to Section 120.68.. Florida

Statutes, any aspect, provision or requirement concerning the content, issuance,

procedure or timeliness of the Final Order incorporating this Agreement; and

e. any causes of action in law or in equity, which Respondent may have

arising out of the specific matters addressed in this agreement. DBF for itself and

the DBF.Released Parties, this release and waiver by Respondent without

in any way acknowledging or admitting that any such calise of action does or may

exist, and DBF, for and the DBF Released Parties, expressly denies that any

such right or cause of action does in .fact exist.

FINAL 9

7. ATIORNEY GENERAL The Attorney Genera]9 for himselfand

his predecessors. successors and assigns, hereby waives, releases and forever discharges ACE, its

predecessors, successors, aniliates, subsidiaries and parent corporations, shareholders, directors,

officers, attorneys, employees, agents.. franchisees and assigns, and Goleta, and its predecessors,

successors, affiliates, subsidiaries and parent corporations, shareholders, directors, officers,

attorneys, employees, agents, franchisees and assigns (collecti,vely, the "ACE Released Parties"),

from any and all claims, demands.. causes of action.. suits, debts, dues.. duties, sums of money,

accounts, fees, penalties, damages, judglnents'l 'Iiabi-tities and obligations, both contingent and

fixed, known and unknown.. foreseen and unforeseen. anticipated and unanticipated, expected

and unexpected, related to or arising out of Goleta's or ACE's operations in Florida prior to the

effective date of this agreement. This release includes.. but is not limited to, any claims related to

any loans renewed, or rolled over.bY Goleta in Florida and any services provided by ACE

or its franchisees related thereto.. any clainls related to any violation of Chapters 501,516,559,

560,687, 772, 895 and 896, Florida any clailns related to check cashing services

provided prior to the effective date of Part IV, Chapter 560, Florida and any claims

related to any licensing requirements for the services provided by ACE to its customers in

Florida prior to the effective date of this agreement. Without limiting the generality of the

foregoing, this release also includes all claims asserted or that could have been or could be

asserted against the parties named as defendants or that could have been named as defendants in

ElIgel1e R Clen1ell1 alld Neil Gi//eSlJie clIld (!f Flori,la, ofthe Att()rlley Gel/era!, .

Departn1!11t ofLegal A.ffairs liS. Ex/Jress. IIIC., A/JerI/alive Financial, [IIC., ,)5' a/the

rreaS!,re (;oast. IIIC., Raynl011d !-!enlnlig, [Jollald H. Neustadt. Kay [J. Zilliox, ROl1ald J.

GIld l1111a,OlVII entities and iJ,divi,hlllls, No. 99 09730. ACE, for itself

FINAL 10

and on behalf of the ACE Released Parties, accepts this release and waiver by the Attorney

General without in any way acknowledging or adlnitting that any such cause of action does or

may exist, and ACE, for and on behalf of the ACE Released Parties, expressly denies that

any such right or cause of action does in fact exist. Respondent hereby releases and

forever discharges the Attorney General and his respective employees.. agents, and

representatives (collectively, the lL Attorney'General Released Parties") from any causes of action'

in law or in equity, which Respondent may have arising out of the specific matters in

this agreement. The Attorney General, for themselves and the Attorney General Released

Parties, accept this release and waiver by Respondent without in any way acknowledging' or

admitting that any such cause of action does or may exist, the Attorney General, for himself and

the Attorney General Released Parties, expressly deny that any such right or cause of action does

in fact exist.

8. DEPARTMENT OF BANKING AND FINANCE RELEASE. The DBF, for

itself and its predecessors, successors and assigns, hereby waives, releases and forever

discharges ACE and its predecessors, successors, subsidiaries and parent corporations,

shareholders, directors, officers, attorneys, elnployees, agents, franchisees andass-igns, and

Goleta, and its predecessors.. successors, affiliates, subsidiaries and parent corporations,

shareholders, directors, officers, attorneys.. employees, agents, franchisees and assigns

(collectively, the "ACE Released Parties"), froln any and all claims, demands, causes ofaction,

suits, debts, dues, duties, sums of money, accounts, fees, penalties, damages.. judgments,

liabilities and obligations, both contingent and fixed, known and unknown, foreseen and

unforeseen, anticipated and un.anticipated, expected and related to or arising out of

the conduct of ACE and/or Goleta in connection with the offering of deferred presentment

FINAL 11

services or loans in \vhere such conduct occurred prior to the effective date of this

Agreement.. This release includes.. but is not liJnited to, any claims related to any.loans made,

renewed, or rolled over by poleta in 'Florida and any services provided by ACE or its franchisees

related thereto, any claims related to any violation of Chapters 501, 516, 559, 560,687, 772, 895

and 896, Florida LS'tatllles.. any claims related to check cashing selVices provided prior to the

effective date of Part IV, Chapter 560, F/orid(J .."Illlllles, and any claims related to any licensing

requirements for the services provided by ACE to its custolners in Florida prior to the effective

date of this Agreelnent. ACE, for itself and on behalf of the ACE Released Parties, accept this

release and waiver by the Attorney General and the DBF without in any way acknowledging or

adtnitting that any such cause of action does or may and ACE

9

for itself and on behalf of

the ACE Released Parties, expressly denies that any such right or cause of action does in fact

exist.

9. EXCLUSION. This release does not include any claiIns under Chapter 560,

Florida Statutes, against franchisees of ACE related to deferred presentment transactions

engaged in after the effective date of Part IV.. Chapter 560" Florida Statutes, unless such

transactions were under the Goleta loan program.

10. ATTORNEYS' FEES. Each party to this Agreement shalJ be solely

for its separate costs and attorneys' fees incurred in the prosecution, defense or negotiation in

this matter up to entry of the Final Order incorporating this Agreelnent and the dismissals by the

Attorney General provided for in 3 (k) and 3 (I) above.

11. EFFECTIVE DATE. The effective date of this agreement is December 2002.

12. FAILURE TO COMPLY. Nothing in this Agreelnent limits Respondent's right

to contest any finding or determination made by DBF or the Attorney General concerning

FINAL 12

Respondent's alleged failure to comply with any of the terms and provisions ofthis Agreement

or of the Final Order incorporating this Agreement.

WHEREFORE. in of the foregoing. DBF. the Attorney General. and ACE

execute this Agreement on the dates indicated below.

DEPARTMENT OF BANKING AND FINANCE

By: Date:

D N SAXON

Division Director

OFFICE 0t)TR

By:

Date:

RICHARD DORAN. Attorney General

ACE CASH EXPRESS, INC., d/b/a

ACE AMERICA'S CASH EXPRESS

By: Date:

ERIC C. NORRINGTON

Vice President

STATE OF FLORIDA

COUNTY OF _

BEFORE ME, the undersigned authority. personally appeared

as of ACE CASH EXPRESS. TNC.. d/b/a ACE AMERICA'S CASH

EXPRESS, who is personally known to me or who has produced

______--'- as identification. and who. after being duly sworn. states that he

has read and understands the contents of this Agreement and voluntarily executed the same on

behalfof ACE CASH EXPRESS. INC.. d/b/a ACE AMERICA'S CASH EXPRESS.

FINAL 13

Respondent'sallegedfailuretocomp1y any of thetennsarid provisionsofthisAgreement

oroftheFinalOrderincorporatingthisAgreement.

WHEREFORE.inconsidirationoftheforegoing, DBF,theAttome}"General,andACE

1.

executethisAgreementonthedatesindicatedbelow.

DEPARTMENT OF BANKINGAND FINANCE

By: Date:

DON SAXON

DivisionDirector

Date:

OFFICEOF

By:

RICHARDDORAN,AttorneyGeneral

ACECASHEXPRESS,INC.,d/b/a

ACEA RICA'SCASHEXPRESS

By: Date:

STATEOFFLORlDA

COUNTYOF

----

BEFOREME\the-undersignedauthority,personallyappeared _

as of ACE CASHEXPRESS,INC.,dIo/a ACE AMERICA"S CASH

EXPRESS,who is personallyknowntomeor\vhohasproduced

___________as identification,andwho, afterbeingdulysworn,statesthathe

hasreadandunderstandsth-econtentsofthisAgreementandvoluntarilyexecutedthesameon

behalfofACECASHEXPRE-SS.INC.,d/b/aACE AMERICA'8CASHEXPRESS.

FINAL 13

SWORNANDSUBSCRI.BEDbeforeme this__dayof ,2002.

NOTARY PUBLIC

StateofFlorida

Print Nalne:

My COlnlnission No.:

My C0111111ission Expires:

(SEAL)

FINAL 14

A

ACE Cash Express, Inc.

1231 Greenway Drive #600

Irving, Texas 75038

A"CE

(972) 550-5000

AIoIf",.."iC<\JIr'",'Ue

INVOICE

COMMENT GROSS DEDUCTION AMOUNTPAID

NUMBER DATE

12123/02 12123/02 Settlement

250,000.00 250.000.00

PAYMENTADVICE

WELLSFARGOBANK

A

CHECK

ACE Cash Express, Inc. NUMBER 005132

1231 Greenway Drive #600

Irving, Texas 75038

ACE

(972) 550-5000

AMf'CA'SGuNUJlfUJe

DATE AMOUNT

12/19/02 $**.... ~ 5 0 . 0 0 0 . 0 0

PAY TwoHundredFiftyThousand 00/1 00dollars**....*****************..*************************'*******....*****..*******'**'*

TOTHEORDEROF

FlordiaState UniversityCollegeofLaw

425WestJeffersonStreet

Tallahassee, FL32306 ..

.

liP

liP

II005 Ii :I 211 I:~ ~ ~ 0 ~ ?a?0I:..? 5 b30011811

8

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Usufruct cases 2013-2014Document1 pageUsufruct cases 2013-2014Shammah Rey MahinayNo ratings yet

- Perjury CaseDocument5 pagesPerjury CaseJesa TornoNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Motion For Preliminary InjunctionDocument5 pagesMotion For Preliminary InjunctionIndiana Public Media NewsNo ratings yet

- Hapag-Lloyd Bill of Lading Terms and ConditionsDocument2 pagesHapag-Lloyd Bill of Lading Terms and ConditionsThuAnNo ratings yet

- Jai Narain Vyas University: Submitted To: Submitted By: Raghav DagaDocument13 pagesJai Narain Vyas University: Submitted To: Submitted By: Raghav DagaKaushlya DagaNo ratings yet

- Atong Paglaum Inc. v. ComelecDocument3 pagesAtong Paglaum Inc. v. ComelecReuel RealinNo ratings yet

- Liability For Torts and Corporate NegligenceDocument2 pagesLiability For Torts and Corporate NegligenceJericho RequerqueNo ratings yet

- Supreme Court rules quo warranto as remedy to oust Chief Justice SerenoDocument17 pagesSupreme Court rules quo warranto as remedy to oust Chief Justice SerenoJanice F. Cabalag-De VillaNo ratings yet

- PONDOC Vs NLRCDocument1 pagePONDOC Vs NLRCAgnes LintaoNo ratings yet

- Heirs of Maximo Sanjorjo v. Heirs of Manuel Y. Quijano, 449 SCRA 15 (2005)Document3 pagesHeirs of Maximo Sanjorjo v. Heirs of Manuel Y. Quijano, 449 SCRA 15 (2005)Carie LawyerrNo ratings yet

- 23 Kilosbayan Vs ErmitaDocument3 pages23 Kilosbayan Vs ErmitaMalcolm Cruz100% (1)

- Petition to Remove Judge Peter Brigham 5D23-0814Document44 pagesPetition to Remove Judge Peter Brigham 5D23-0814Neil GillespieNo ratings yet

- Gillespie V Google, Complaint For ReplevinDocument61 pagesGillespie V Google, Complaint For ReplevinNeil GillespieNo ratings yet

- Appeal Order Denying Motion to Withdraw Plea 5D23-2005Document180 pagesAppeal Order Denying Motion to Withdraw Plea 5D23-2005Neil GillespieNo ratings yet

- Habeas Petition 5D23-0913 Judge Peter BrighamDocument146 pagesHabeas Petition 5D23-0913 Judge Peter BrighamNeil GillespieNo ratings yet

- Gillespie V Google, Complaint For Replevin, 2024-CA-0209Document238 pagesGillespie V Google, Complaint For Replevin, 2024-CA-0209Neil GillespieNo ratings yet

- Gillespie V Google, Verified Motion For ReplevinDocument33 pagesGillespie V Google, Verified Motion For ReplevinNeil GillespieNo ratings yet

- Letter of Martin Levine Realtor for Neil GillespieDocument7 pagesLetter of Martin Levine Realtor for Neil GillespieNeil GillespieNo ratings yet

- Neil Gillespie United Nations Fight Against CorruptionDocument13 pagesNeil Gillespie United Nations Fight Against CorruptionNeil GillespieNo ratings yet

- Neil Gillespie Kar Kingdom Bucks County Courier TimesDocument8 pagesNeil Gillespie Kar Kingdom Bucks County Courier TimesNeil GillespieNo ratings yet

- Appendix C, Google Complaint For Replevin (Trump V Anderson, No. 23-719)Document83 pagesAppendix C, Google Complaint For Replevin (Trump V Anderson, No. 23-719)Neil GillespieNo ratings yet

- Gillespie V Google Amended Motion For Writ of ReplevinDocument23 pagesGillespie V Google Amended Motion For Writ of ReplevinNeil GillespieNo ratings yet

- TRUMP V ANDERSON No. 23-719 USSC Response To Amicus EOTDocument97 pagesTRUMP V ANDERSON No. 23-719 USSC Response To Amicus EOTNeil GillespieNo ratings yet

- Gillespie V Google Remanded, Pending Motion For Writ of ReplevinDocument37 pagesGillespie V Google Remanded, Pending Motion For Writ of ReplevinNeil GillespieNo ratings yet

- Offer To Settle Google Lawsuit Neil Gillespie AffidavitDocument2 pagesOffer To Settle Google Lawsuit Neil Gillespie AffidavitNeil GillespieNo ratings yet

- Appendix B Google Complaint For Replevin (Verizon)Document7 pagesAppendix B Google Complaint For Replevin (Verizon)Neil GillespieNo ratings yet

- Appendix A Google Complaint For RepelvinDocument87 pagesAppendix A Google Complaint For RepelvinNeil GillespieNo ratings yet

- Appendix Prosecutorial Misconduct 2022-Cf-1143Document187 pagesAppendix Prosecutorial Misconduct 2022-Cf-1143Neil GillespieNo ratings yet

- Gillespie V Google, Verified Motion For ReplevinDocument33 pagesGillespie V Google, Verified Motion For ReplevinNeil GillespieNo ratings yet

- Notice of Filing Love Letters From Sarah ThompsonDocument11 pagesNotice of Filing Love Letters From Sarah ThompsonNeil GillespieNo ratings yet

- Notice of Prosecutorial Misconduct Case 2022-Cf-1143Document43 pagesNotice of Prosecutorial Misconduct Case 2022-Cf-1143Neil GillespieNo ratings yet

- Order Granting Motion To Waive Confidentiality For Psychological EvaluationDocument7 pagesOrder Granting Motion To Waive Confidentiality For Psychological EvaluationNeil GillespieNo ratings yet

- Psychological Evaluation of Neil GillespieDocument5 pagesPsychological Evaluation of Neil GillespieNeil GillespieNo ratings yet

- Defendants Motion To Waive Confidentiality For Psychological EvaluationDocument18 pagesDefendants Motion To Waive Confidentiality For Psychological EvaluationNeil GillespieNo ratings yet

- Verified Notice of Nolle Prosequi in Case 2020-CF-2417Document31 pagesVerified Notice of Nolle Prosequi in Case 2020-CF-2417Neil GillespieNo ratings yet

- Jailhouse Federal Habeas Corpus Petition From The Marion County Jail, Ocala FloridaDocument116 pagesJailhouse Federal Habeas Corpus Petition From The Marion County Jail, Ocala FloridaNeil GillespieNo ratings yet

- Notice of Prosecutorial Misconduct Case 2021-Cf-0286Document79 pagesNotice of Prosecutorial Misconduct Case 2021-Cf-0286Neil GillespieNo ratings yet

- Jailhouse Amended Verified Motion To Dismiss Charges Against DefendantDocument19 pagesJailhouse Amended Verified Motion To Dismiss Charges Against DefendantNeil GillespieNo ratings yet

- Notice of Claim of Immunity Under Section 776.032 Florida StatutesDocument1 pageNotice of Claim of Immunity Under Section 776.032 Florida StatutesNeil GillespieNo ratings yet

- Jailhouse Constitutional Challenge To Florida One-Party Consent Telephone RecordingDocument198 pagesJailhouse Constitutional Challenge To Florida One-Party Consent Telephone RecordingNeil GillespieNo ratings yet

- Motion To Dismiss One-Party Consent Telephone Recording Case 2021-CF-0286Document6 pagesMotion To Dismiss One-Party Consent Telephone Recording Case 2021-CF-0286Neil GillespieNo ratings yet

- Liam Law Vs Olympic Sawmill: Conditions For Escalation ClauseDocument2 pagesLiam Law Vs Olympic Sawmill: Conditions For Escalation ClauseblessaraynesNo ratings yet

- SC Decision on Recovery of Possession Case Involving Land in Baliuag, BulacanDocument20 pagesSC Decision on Recovery of Possession Case Involving Land in Baliuag, BulacanTaga BukidNo ratings yet

- Meet The Chief of The Lancaster City Police Bureau by Stan J. Caterbone October 9, 2015 Copyright 2015Document33 pagesMeet The Chief of The Lancaster City Police Bureau by Stan J. Caterbone October 9, 2015 Copyright 2015Stan J. Caterbone100% (1)

- Ma Belen FlordelizaDocument3 pagesMa Belen FlordelizaDianne MendozaNo ratings yet

- Erwin V Sistero The Room Copyright Infringement Complaint PDFDocument15 pagesErwin V Sistero The Room Copyright Infringement Complaint PDFMax PowelNo ratings yet

- Rosalyn Asbury v. Leo Brougham, An Individual and D/B/A Brougham Estates and Brougham Management Company, and Wanda Chauvin, An Individual, 866 F.2d 1276, 10th Cir. (1989)Document10 pagesRosalyn Asbury v. Leo Brougham, An Individual and D/B/A Brougham Estates and Brougham Management Company, and Wanda Chauvin, An Individual, 866 F.2d 1276, 10th Cir. (1989)Scribd Government DocsNo ratings yet

- Samonte Vs CADocument7 pagesSamonte Vs CAMaricel Caranto FriasNo ratings yet

- CRPC DocxxxDocument11 pagesCRPC DocxxxPujitNo ratings yet

- Amazon Settlement Agreement ExecutedDocument24 pagesAmazon Settlement Agreement Executedwsaleh33No ratings yet

- Issues and Challenges of GST Sarika NewDocument24 pagesIssues and Challenges of GST Sarika NewSarika ChaturvediNo ratings yet

- 19 170475-2014-Nedlloyd Lijnen B.V. Rotterdam v. Glow LaksDocument9 pages19 170475-2014-Nedlloyd Lijnen B.V. Rotterdam v. Glow LaksMarefel AnoraNo ratings yet

- Charles Hook Gordon Logie WillDocument11 pagesCharles Hook Gordon Logie WillLee DrewNo ratings yet

- Legal Ethics Exam QuestionsDocument55 pagesLegal Ethics Exam QuestionsJasmin GombaNo ratings yet

- SUPREME COURT OF BRITISH COLUMBIA Citation: Davidson v. Wawanesa Insurance CompanyDocument48 pagesSUPREME COURT OF BRITISH COLUMBIA Citation: Davidson v. Wawanesa Insurance CompanyChristopherFouldsNo ratings yet

- SGWINDocument633 pagesSGWINalexkalokNo ratings yet

- Abdula v. Guiani, 326 SCRA 1 (2000)Document8 pagesAbdula v. Guiani, 326 SCRA 1 (2000)donnabelle_cadagNo ratings yet

- Thu CsDocument18 pagesThu CsthulasikNo ratings yet

- Res Judicata: What is Res JudicataDocument8 pagesRes Judicata: What is Res JudicataAngela WigleyNo ratings yet

- Bernardo vs. Court of AppealsDocument9 pagesBernardo vs. Court of AppealsDianne May CruzNo ratings yet