Professional Documents

Culture Documents

ST2 Report

Uploaded by

Shabbeer ZafarOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

ST2 Report

Uploaded by

Shabbeer ZafarCopyright:

Available Formats

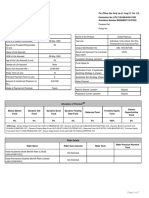

INSTITUTE AND FACULTY OF ACTUARIES

EXAMINERS REPORT

September 2013 examinations

Subject ST2 Life Insurance Specialist Technical

Introduction The Examiners Report is written by the Principal Examiner with the aim of helping candidates, both those who are sitting the examination for the first time and using past papers as a revision aid and also those who have previously failed the subject. The Examiners are charged by Council with examining the published syllabus. The Examiners have access to the Core Reading, which is designed to interpret the syllabus, and will generally base questions around it but are not required to examine the content of Core Reading specifically or exclusively. For numerical questions the Examiners preferred approach to the solution is reproduced in this report; other valid approaches are given appropriate credit. For essay-style questions, particularly the open-ended questions in the later subjects, the report may contain more points than the Examiners will expect from a solution that scores full marks. The report is written based on the legislative and regulatory context pertaining to the date that the examination was set. Candidates should take into account the possibility that circumstances may have changed if using these reports for revision. D C Bowie Chairman of the Board of Examiners January 2014

Institute and Faculty of Actuaries

Subject ST2 (Life Insurance Specialist Technical) Examiners Report, September 2013

General comments on Subject ST2 The Examiners Report covers more points than would be expected to get full marks. This is so that alternative approaches to questions by different candidates can be accommodated within the marking scheme. Candidates are expected to show knowledge of the relevant content of the Core Reading, but those who tailor their answer to the specifics mentioned in the question will score more highly than those who answer in a more generic way. Comments on the September 2013 paper As with previous papers, questions that focussed on knowledge of the Core Reading were well answered. In some questions, candidates tended to only list factors to consider rather than applying them specifically to the particular situation, for example in Q6 (i). Similarly, where questions required candidates to think more widely, candidates should use the number of marks available as a guide the depth of answer required. Some candidates lost marks by not answering the question asked or by not utilising the information in the question or by not building on answers in earlier parts of the question. Candidates should use Examiners Reports to practice applying their knowledge to the situations set.

Page 2

Subject ST2 (Life Insurance Specialist Technical) Examiners Report, September 2013

(i)

The most common methods are: A tax on the annual profits of the business, where broadly profits mean the excess of the change in the value of the assets over the change in the value of the liabilities. Tax payable on investment income less some or all of the operating expenses of the company. In addition, there may be a tax on premium income.

(ii)

Taxation will often reduce the level of profits received by shareholders, increase the cost of life insurance products for policyholders or reduce the value of life insurance benefits received by policyholders. Within a particular country, different types of life insurance business may be taxed on different methods. This can mean that it is lower cost for the consumer if certain forms of benefit can be offered as one type of business rather than another. The taxation treatment of life insurance business may make life insurance more or less attractive as a savings medium especially when compared to contracts offered by other savings institutions, subject to a different fiscal regime. However, tax concessions available to individuals may make the sale of certain types of contract easier or more difficult. This could be in terms of tax relief on premiums or favourable tax treatment of policy proceeds. The ability to avail of favourable taxation treatment may force constraints on policy design, or on assets held. In addition, the fact that taxation can change over time may reduce life insurance companies desire to offer guaranteed products. Changes in the tax regime over time can also represent a risk to the insurance company and the tax regime may influence a decision to sell products to overseas markets.

Part (i) was typically very well answered by most candidates. Part (ii) was reasonably well answered. The best scores were achieved by candidates considering a wide range of points.

Page 3

Subject ST2 (Life Insurance Specialist Technical) Examiners Report, September 2013

(i)

The prospective formula is:

(m) ( m) x x SAx t ea t fAx t Ga t C

Where: S = sum assured x = age of policyholder at date of issue t = duration in-force e = level annual expenses f = death claim expenses G = annual office premium C = costs of surrender = annuity function payable in advance using expected future investment and a mortality assumptions A = assurance function payable continuously using expected future investment and mortality assumptions m = frequency of the premium payments or renewal expenses (ii) (a) Higher mortality than previously assumed will increase the assurance functions and reduce the annuity functions. The value of the sum assured would increase due to the acceleration of the expected death benefit payment, as would the value of death claim expenses. The present value of annual expenses and office premiums would reduce due to the shorter time over which these are expected to be paid. Assuming the surrender value was positive before the basis change, overall, the surrender value would be expected to increase. The level of change would depend upon how long the policy has been in-force. Higher expenses than previously assumed will result in higher future annual expenses and death claim expenses, which will increase the surrender value. It could also mean higher costs of surrender, which would decrease the surrender value. The impact on the surrender value will therefore depend upon the relative size of the present value of the future annual expenses plus the value of claim expenses to the cost of surrender. This in turn will also depend upon how long the policy has been inforce. It is likely that for policies of short to medium duration, the overall impact will be to increase the surrender value.

(b)

This question was not very well answered. In part (i) most marks were lost by candidates not defining all notation used. Some candidates were able to provide the correct the formula in part (i) but then did not consider the impact on the formula when answering part (ii).

Page 4

Subject ST2 (Life Insurance Specialist Technical) Examiners Report, September 2013

With all else being equal the unit reserve will have increased. The non-unit reserve is the amount required to meet shortfall of future charges relative to expenses and the cost of benefits in excess of the unit fund. The movement in the non-unit reserve will therefore depend on the relationship between these charges and costs. The following impacts will reduce the non-unit reserve: The future value of any charges (e.g. fund management charges, guarantee charges) expressed as a percentage of the fund value will have increased. The cost of any life cover in excess of the unit value will have decreased. However if the cost of life cover is a percentage of the fund then the cost would increase. The cost of any guaranteed minimum maturity value will have reduced. The value of any surrender penalties, if expressed as a percentage of unit fund, will have increased. The following impacts will increase the non-unit reserve: The value of any investment management costs which are expressed a percentage of the fund value will have increased. Similarly any fund based commission is likely to have increased in value. The value of any mortality deductions will have reduced if expressed as a percentage of the sum at risk. The value of any charges or costs that are related to the premium will not change. Nor will the value of any charges which are of fixed amounts, such as policy fees. The ongoing renewal expenses will likely be expressed as a fixed amount per policy and so also will not be affected. On the whole, it is likely that the balance of the above effects will have been beneficial for the non-unit reserves. And the non-unit reserve will be lower than before. For any given policy, the extent of the movement in non-unit reserve will depend on the elapsed duration. For relatively new policies, where the unit fund is small, the movement will be very small. For policies which have built up a reasonable unit fund, the movement will be more significant. It is possible that the non-unit reserve may become negative. Local regulation will specify whether this is permissible or whether it needs to be zeroised. In total, the unit reserve will have increased and the non-unit reserve will have decreased and on balance, it is likely that the total reserve will have increased.

This question proved difficult for many candidates. The question asked the impact on the reserves, many candidates discussed the impact on other items. When candidates did

Page 5

Subject ST2 (Life Insurance Specialist Technical) Examiners Report, September 2013

consider the reserves, answers were generally too high level and did not consider the individual cash flows that are used to determine the non-unit reserve.

(i)

There are potential benefits to this proposal. Including an option may make the product more attractive to potential customers and it may also be favoured by distributors. Hence it may reverse the decline in sales volumes and should in turn generate more profit for the company. However the effect on sales volumes will depend upon how the overall product including the option compares to those being offered by the companys competitors. Limiting the level of the sum assured increase will cap the increase in the risk borne by the company as will offering it on new business only. No further underwriting is favoured by policyholders so should help with increasing the sales of the updated product and reduces the underwriting expenses of the company. Locking in to the historic premium rates may actually reduce future take up rates if the locked in premium is higher than the premium rate available at the time, for example if there have been mortality improvements since the original rates were set. Using the age of the policyholder(s) at the time of the option take up will help to align the premium charged to the benefit increase. However the proposal increases the risks to the company of selling this product. In particular it increases the risk of anti-selection from the policyholder as those policyholders with lower than average health levels will be more likely to take up the option. There is currently no proposed limit on the age at which the increase can occur, which will substantially increase the risk at older ages and as no further underwriting is undertaken then this further increases the risk as those close to death are more likely to take up the option. Using the premium rates charged at the time of sale locks in those assumptions though if the rates are only based on the premium rates it may be possible to scale them up. As the product is whole life then it may have been many years in the past when these rates were set. Therefore the company will be at risk from worsening mortality experience, worsening expense experience, worsening economic outlook and changing cross-subsidies in the period between setting the original premium rates and option exercise. Financial underwriting would need to be performed at outset to avoid overinsurance, on the assumption that the option is exercised based on maximum sum assured possible post-increase. Initial premium rates will be higher to charge for this option. Introducing the option will increase reserving requirements for the company and margins may need to be high due to lack of existing experience e.g. of option take up rates.

Page 6

Subject ST2 (Life Insurance Specialist Technical) Examiners Report, September 2013

If reinsurance is currently used for this product, the company will need to consider whether the reinsurer is prepared to cover the option as well. Offering the option only on new business might be deemed by existing policyholders as unfair and there may be lapse and re-entry issues. The company will incur additional costs through developing the new version of the product including system changes, to allow for the option and in particular the complexity of the multiple exercise dates. It may not sell enough additional business to recoup these implementation costs. Alternatively it may sell too much business and so cause an admin strain. It will need to ensure there is sufficient capital to support the new business. The company will also experience additional costs arising from having to monitor the take up and ongoing profitability of the option. The company should also consider whether there are alternative ways in which sales could be improved. (ii) To reduce the risk the company is exposed to from increasing the level of sum assured at any time it could: Restrict the times at which the sum assured can be increased e.g. only allow the sum assured to be increased after 5 years and then every 5 years thereafter Impose a maximum age at which it can be exercised e.g. up to a maximum age of 65. Or restrict the ability to increase the sum assured to certain non-selective events, such as the birth of a child, moving house, getting married or changing jobs. To reduce the risk the company is exposed to from the level of increase in the sum assured it could: Reduce the limit that applies, e.g. 50% increase. The level of increase could be made age dependent such that the level of increase reduces as the age of the policyholder increases. In the case of a joint life policy then this restriction may need to be applied to the older age. To reduce the risk from no underwriting the company could make underwriting a requirement when the option is exercised. Using the original premium rates locks in the assumptions used at sale, so the alternative is to use the premium rates that are in-force at the time the option is exercised though this relies on the company still selling this type of contract throughout the remaining term of these policies. Overall this question was reasonably well answered. In part (i), well prepared candidates scored highly by considering the advantages and dis-advantages of each of the features of the Page 7

Subject ST2 (Life Insurance Specialist Technical) Examiners Report, September 2013

option provided in the question. Some candidates were too superficial with their answers. Part (ii) was well answered by those who did well in part (i).

(i)

An error could have occurred in the unit pricing as the company may be managing a box and may have mis-allocated assets between the unit funds and the box. The systems may have not been updated when switching to/from the appropriation price (offer basis) from/to the expropriation price (bid basis) and this would mean that the wrong number of units may have been allocated or de-allocated making the calculation of the price incorrect. Alternatively the bid may have been used instead of the offer price or appropriation instead of expropriation price. The market value of the assets may have been calculated incorrectly, calculated as at the wrong date or time or input into the systems incorrectly. An incorrect currency rate may have been used when valuing overseas assets. For the appropriation price, the expenses incurred in buying assets may have been estimated incorrectly or for the expropriation price, the expenses incurred on the sale of assets may have been estimated incorrectly. Current assets or current liabilities used in the price may have been incorrect or out-of-date. Similarly accrued income used in the price may have been incorrect or actual income receipts may have been allocated to the wrong funds. Any allowance for accrued tax used in the calculation of the price may have been incorrect e.g. through not allowing correctly for recent changes in tax legislation. If the company applies a bid offer spread or initial charge, it may have been incorrectly applied or the regular management charge may have been applied incorrectly. Any rounding may have been applied incorrectly or inconsistently. There may be an error in the number of units used to calculate the price e.g. taken at the wrong date or input incorrectly. Or finally the price of another fund may have been applied by mistake.

(ii)

Although there are no statutory or other regulations on the pricing of unit funds and policy documents are usually general the company should ensure that the pricing follows the basic equity principle of unit pricing. This means that the interests of unit holders should not be affected by the creation or cancellation of other units. If errors have occurred in unit prices, then units could have been cancelled or created at the wrong price. If the error is over a prolonged period there are material implications for the charges from the fund. In addition, to the extent that there were transactions on the day(s) for which the unit prices were incorrect, a new unit holder could be allocated fewer units than should have been the case or the amount of benefits received by an exiting unit holder is lower which would not be fair to the unit holders.

Page 8

Subject ST2 (Life Insurance Specialist Technical) Examiners Report, September 2013

Alternatively, if the transaction is beneficial to the unit holder then it can be difficult to claw back the benefit in these circumstances thus leading to a loss to the insurance company. Correcting transactions retrospectively can be an administrative burden and costly with the possibility that additional compensation may have to be paid to the unit holder. There may also be reputational issues relating to errors, particularly if they occur frequently. This could potentially impact unit holder persistency and new business volumes. Ultimately, the insurance company could be fined by the regulator for poor controls and there could be an impact on financial reporting and reserving. Overall this question was reasonably well answered. As with other questions, candidates scored well by providing a wide range of sources of errors. Candidates that answered part (i) well appeared to generate ideas by considering how unit prices are determined and ways in which these steps may have generated an error.

(i)

The company will need to perform a cost benefit analysis for the project to ensure that the benefit from the increased level of retention outweighs the cost of implementing and maintaining the project. The cost of implementing the retention plan includes: training the staff for the retention team system changes for monitoring impact setting up dedicated phone line actuarial team time for determining the terms system changes for amending terms on existing policy or for linking two policies together, if required

Ongoing costs of the retention team include staff costs and the cost of monitoring of experience of the project. There could be an impact from removing people from other areas of the company to move onto the retention project. The company needs to set rules on when the options will be offered, what different types of alternative policy could be offered, on what terms and how much additional benefit could be offered. They also need to consider how advice will be provided for this. The option should be offered only in cases where there is expected to be a net increase in value/profit. That is, the reduction in value/profit to the company from that policy staying, and getting improved terms, is less than the reduction in value/profit from that policy leaving where value could be measured as embedded value. The former impact, policy staying, is the cost of providing better terms on the new or existing policy and the initial expense incurred in transferring to these new terms/policy. The latter impact, policy leaving, is the

Page 9

Subject ST2 (Life Insurance Specialist Technical) Examiners Report, September 2013

loss of future profits plus any impact on net assets of the excess of the surrender value over the total of unit and non-unit reserves. The company also needs to consider that there may be lower than average future lapse rates on the amended/new policies as the customers are now more satisfied. There could be the opportunity to cross-sell to the policyholder if they are retained and if they are moving to an alternative policy, then they have saved the additional commission paid to advisers which would have been incurred under a lapse and re-entry. However, they need to be careful not to alienate advisers if the company stops paying renewal commission on existing policies and the impact on existing adviser relationships should be considered. There is a risk that policyholders may surrender their policy just to get enhanced terms. Some policyholders may not feel they are being treated fairly as they are not being offered enhanced terms this would have an impact on the companys reputation and future sales. The company would need to consider any regulation around this including TCF and ability to provide advice. It may actually be beneficial to the company for some policies to leave as they are loss making. The company may choose to target low duration policies under which initial expenses have not yet been recouped. They need to consider how to monitor benefits, targets etc. and whether the offer will vary by sales channel. Thought should be given to whether competitors have implemented similar retention plans and how successful they have been. (ii) Future withdrawal rates should be lower but they need to consider when the benefits are expected to be seen and for how long the retention project is expected to last. Paid-up rates may also be reduced if such policies are also targeted and lower withdrawal rates may mean that per policy expenses can be reduced. Mortality assumptions could also be lower for example, due to large policies being targeted to retain. The expenses for the retention project could increase the expense assumptions. (iii) The company could discuss the issue with the adviser on the basis that simply highlighting that the company is aware may deter the activity. They may investigate whether the adviser is giving bad advice to policyholders and highlight to ombudsman or regulator if they suspect they are. Extending the surrender penalty periods could discourage early churning or introduce loyalty bonus payments at longer terms, to give an incentive for the policyholder to stay. They should ensure that charges are lower than those of competitors, particularly at longer terms. Paying renewal commission rather than initial commission would be an option, this could be premium or fund based.

Page 10

Subject ST2 (Life Insurance Specialist Technical) Examiners Report, September 2013

The company could extend commission clawback to beyond the surrender penalty period, if this is not already the case. They should ensure the policyholders that are with this adviser are coming through the retention project but could stop sales from this adviser. Overall this question was not well answered. In part (i) many candidates provided a standard list of reasons why surrenders would be high rather than answering the question. Many candidates failed to discuss the value of the policy or to consider the trade-off between retaining the profit on the policy and the cost of retention. Part (ii) was reasonably well answered and most candidates were able to provide a spread of actions the company could take to deter the adviser, in part (iii).

(i)

This is also known as coinsurance. All aspects of the contract are shared between the cedant and reinsurer. There are two methods to calculate the premiums: 1. The cedant supplies premium rates to reinsurer, these are referred to as retail rates. The reinsurer then calculates the reinsurance commission it is prepared to pay the cedant for the business The reinsurer provides premium rates to the cedant. The cedant then loads for costs and profits to get the retail rates.

2.

The amount to be reinsured can be specified as: Individual Surplus where the reinsured amount is the excess of benefit over the retention limit on each individual policy. Quota Share where a specified percentage of each policy is reinsured. It is possible to combine individual surplus and quota share.

(ii)

The purpose of taking out the reinsurance will affect the desired retention limit. For example, if it is intended to gain technical assistance a low retention percentage would be used or if it is for the reduction of parameter risk the retention limit may be higher. If it is to protect against individual large claims the retention limit may be even higher. The concentration of risk by factors will play a part, e.g. by geographical area. The size of the book of business being considered will also be a factor as this will influence the likely variations in claims. All else being equal, a larger book of business will allow a higher retention (and vice versa). The experience level of the company will be relevant, e.g. a new company or product will have limited experience so may use a lower retention limit.

Page 11

Subject ST2 (Life Insurance Specialist Technical) Examiners Report, September 2013

The average benefit level and the expected distribution of the benefit will also be taken into account and whether there are any options to increase sums assured. The companys risk appetite will affect the desired limit, this will be dictated by the companys risk policy and will reflect shareholders requirements, e.g. a lower risk appetite will result in a lower retention limit The levels of free assets the company has matter, as lower free assets would imply a lower retention limit. The level of financing required for new business would affect the retention limit if required for this purpose. Also the importance attached to the stability of the free asset ratio. Retention limits available in the market and the effect of the retention limit on the reinsurance terms or price will be considered as will the effect on regulatory capital of the level of retention limit. Consider the potential reduction in profits and the marginal cost of increasing the retention limit compared with capital and other benefits or compared with the cost of financing an appropriate mortality fluctuation reserve. This will be particularly important with the product being term assurance business, which is very price sensitive in the market. The underwriting policy of the company will be a factor, particularly its level of familiarity with underwriting this type of product. The level of retention on any existing arrangements the company has needs to be considered. The existence of any profit sharing arrangements also play a part as sharing profit will allow a lower retention limit for the same premium as would be the case if there was no profit sharing. (iii) The reinsurer may hold a more diversified book of business, and hence through diversification benefits can hold lower capital requirements than the company could. This could be within the product or across products or across territories. The reinsurer may use a different reserving basis to the company, e.g. the mortality basis may be lighter though still within a range acceptable to the regulator. This could be due to the reinsurer having more experience and so allowing for less prudence when setting assumptions. The reinsurer may be able to utilise having a different tax basis as a benefit in the capital requirements. The reinsurer may be subject to a different regulatory or tax regime, with lower regulatory capital requirements. This may be because they are based overseas. Part (i) was standard bookwork and answered well. Part (ii) was reasonably well answered, candidates lost marks by not providing a wide enough range of points for the level of marks

Page 12

Subject ST2 (Life Insurance Specialist Technical) Examiners Report, September 2013

that were on offer. In part (iii), most candidates that provided an answer mentioned the diversification benefit and having different regulatory/tax regimes.

(i)

(a)

Term Assurance

He may want to provide protection for his family in the event of his death and wants the cheapest option, rather than a whole life or endowment assurance. 25 years: he wants to provide cover for long enough for the children to go through higher education and establish themselves financially or it could be linked to a 25 year mortgage or repayment of a loan. Conventional without profits provides a guaranteed benefit and hence certainty, which will be reassuring. (b) Whole Life

She may want to save for later life and has reached a point where she has a lump sum to invest. She wants to protect the investment in the event of her death. Given it is a substantial sum it may be required to cover potential liabilities on death e.g. inheritance tax. It is relatively attractive compared to other investment vehicles, for example due to tax. Invested in unit-linked in order to gain exposure to different asset types and maximise the potential for returns. She is likely to be aiming to stay invested for long enough that volatilities in unit fund values are not a concern. The customer is affluent and so is prepared to take the unit-linked risks. (c) Annuity

He probably wants to provide a regular income to cover living costs which is guaranteed for life, therefore reducing the worry of running out of capital in later old age. He wants index-linked to ensure that the income keeps paces with living costs and protects against high levels of inflation. He may have to buy an annuity from a maturing pension policy as a result of local regulations and may want to secure at least a five year income in order to protect capital and hence added a guaranteed period. (ii) (a) Term Assurance

This is a relatively simple product so can be purchased from most distribution channels. He may already have relationship with an insurance intermediary so could use them. An insurance intermediary would also provide the best deal across the whole market and may be the most appropriate if there are any potential underwriting issues, e.g. potential ratings.

Page 13

Subject ST2 (Life Insurance Specialist Technical) Examiners Report, September 2013

If it is linked to a mortgage/loan, then he may purchase it through the lender who could be tied to a life insurance company. If they already have contact with an insurance company then he could use the direct sales force. They could use direct sales methods e.g. through internet or respond to other advertisements or mailshots assuming simple underwriting is appropriate. (b) Whole Life

This is a more complex product and with a substantial sum invested so is likely to want advice on the best product, charges and investment options and may need tax advice. She is likely to use an insurance intermediary, especially if they have a relationship already. Tied agents may be used, but this would limit the choice of products and/or unit-linked funds. Own salesforce may be used if the lump sum is from a maturing policy, e.g. an endowment. She is unlikely to use direct forms of selling, e.g. internet/mailshots. (c) Annuity

There is likely to be an investment of a large lump sum. If it is from a maturing pension policy, he could just reinvest with the same insurance company, in which case there is likely to be a simple application form. He could use insurance intermediaries to research the market for the best annuity rates. Intermediaries are likely to be involved if it is for an impaired life annuity. He could research via the internet but companies may not offer certain options via internet, e.g. guaranteed period, index linking. He is unlikely to use other forms of direct sales, e.g. mailshots, advertising. He could use tied agents or own salesforce if they already have that relationship. This question was well answered. In part (i) most candidates were able to provide reasons why the specified products would be purchased. Similarly most candidates were able to specify the appropriate distribution channel(s) and provide justification. Some candidates lost marks by failing to utilise their answer in part (i) to help in answering part (ii).

END OF EXAMINERS REPORT

Page 14

You might also like

- Insurance Rev SyllabusxDocument50 pagesInsurance Rev SyllabusxPanzer OverlordNo ratings yet

- Cost Control - It ' S Not Just About NumbersDocument12 pagesCost Control - It ' S Not Just About NumbersShabbeer ZafarNo ratings yet

- Mi N Landscape 2022 VF en Web Dps 4129c365b2Document46 pagesMi N Landscape 2022 VF en Web Dps 4129c365b2Kingsley Kwesi KwabahsonNo ratings yet

- A Commercial General LiabilityDocument2 pagesA Commercial General LiabilityTarannum khatri100% (1)

- Management Accounts For The Year 2022Document6 pagesManagement Accounts For The Year 2022Clyton MusipaNo ratings yet

- Ca1 Pu 12Document100 pagesCa1 Pu 12Shabbeer ZafarNo ratings yet

- 6 Ways To Perform Engineering EconomicsDocument26 pages6 Ways To Perform Engineering EconomicsClarence AG YueNo ratings yet

- IandF ST2 201604 ExaminersReportDocument14 pagesIandF ST2 201604 ExaminersReportz_k_j_vNo ratings yet

- IandF CA11 201204 Examiners' ReportDocument19 pagesIandF CA11 201204 Examiners' ReportSaad MalikNo ratings yet

- Institute and Faculty of Actuaries: Subject CA1 - Actuarial Risk Management Paper OneDocument19 pagesInstitute and Faculty of Actuaries: Subject CA1 - Actuarial Risk Management Paper OneSaad MalikNo ratings yet

- IandF CA11 201504 ExaminersReportDocument19 pagesIandF CA11 201504 ExaminersReportSaad MalikNo ratings yet

- CA11 Sol 0513Document13 pagesCA11 Sol 0513YogeshAgrawalNo ratings yet

- FandI CA11 201009 Examiners' Report FINALDocument17 pagesFandI CA11 201009 Examiners' Report FINALSaad MalikNo ratings yet

- Examination: Subject SA2 - Life Insurance Specialist ApplicationsDocument17 pagesExamination: Subject SA2 - Life Insurance Specialist Applicationsdickson phiriNo ratings yet

- Expenses WP 1988Document48 pagesExpenses WP 1988aditikhanal.135No ratings yet

- IandF CA11 201404 Examiners Report PDFDocument16 pagesIandF CA11 201404 Examiners Report PDFSaad MalikNo ratings yet

- FandI CA11 200904 Examiners' Report FINALDocument14 pagesFandI CA11 200904 Examiners' Report FINALSaad MalikNo ratings yet

- Institute of Actuaries of India: Indicative SolutionDocument9 pagesInstitute of Actuaries of India: Indicative SolutionYogeshAgrawalNo ratings yet

- SFDM Individual Assignment (LMH)Document8 pagesSFDM Individual Assignment (LMH)Fuhgandu RashydNo ratings yet

- Institute of Actuaries of India Subject CA1 - Paper I Core Applications ConceptsDocument23 pagesInstitute of Actuaries of India Subject CA1 - Paper I Core Applications ConceptsYogeshAgrawalNo ratings yet

- 2011185Document7 pages2011185Arqum BajwaNo ratings yet

- IandF CA11 201209 Examiners' Report FINALDocument19 pagesIandF CA11 201209 Examiners' Report FINALSaad MalikNo ratings yet

- Life Insurance Thesis TopicsDocument4 pagesLife Insurance Thesis TopicsWriteMyPaperForMoneyUK100% (2)

- Subject Ca1 - Paper I: Institute of Actuaries ofDocument13 pagesSubject Ca1 - Paper I: Institute of Actuaries ofYogeshAgrawalNo ratings yet

- Subject CA1 - Core Applications Concepts Paper Two Examiners' ReportDocument14 pagesSubject CA1 - Core Applications Concepts Paper Two Examiners' ReportArjun Ajay KavallurNo ratings yet

- Examination: Subject CT2 - Finance and Financial Reporting Core TechnicalDocument9 pagesExamination: Subject CT2 - Finance and Financial Reporting Core TechnicalMohit TharejaNo ratings yet

- Transactions of Society of Actuaries 1985 VOL. 37: A. AdvantagesDocument42 pagesTransactions of Society of Actuaries 1985 VOL. 37: A. AdvantagesVladimir MonteroNo ratings yet

- B03-003 Six Ways To Perform Economic Evaluations of Projects PDFDocument26 pagesB03-003 Six Ways To Perform Economic Evaluations of Projects PDFsamehNo ratings yet

- Examination: Subject SA3 General Insurance Specialist ApplicationsDocument13 pagesExamination: Subject SA3 General Insurance Specialist Applicationsdickson phiriNo ratings yet

- Examination: Subject SA3 General Insurance Specialist ApplicationsDocument265 pagesExamination: Subject SA3 General Insurance Specialist Applicationsscamardela79No ratings yet

- IandF CA11 201104 Examiners' ReportDocument18 pagesIandF CA11 201104 Examiners' ReportSaad MalikNo ratings yet

- Actuarial and Technical Aspects of TakafulDocument22 pagesActuarial and Technical Aspects of TakafulCck CckweiNo ratings yet

- MA922 2017 Assessment1 - Feedback and Specimen Solution IR and PMDocument8 pagesMA922 2017 Assessment1 - Feedback and Specimen Solution IR and PMrenaldo1976No ratings yet

- Wealth MaximizationDocument9 pagesWealth MaximizationApplopediaNo ratings yet

- IandF CA11 201109 Examiners' ReportDocument19 pagesIandF CA11 201109 Examiners' ReportSaad MalikNo ratings yet

- Research Paper On Insurance IndustryDocument8 pagesResearch Paper On Insurance Industryafmcbmoag100% (1)

- IandF ST8 201104 Examiners' ReportDocument16 pagesIandF ST8 201104 Examiners' Reports4brm0a1No ratings yet

- fn3092 Exc 13Document26 pagesfn3092 Exc 13guestuser1993No ratings yet

- FandI Subj302 199909 ExamreportDocument15 pagesFandI Subj302 199909 ExamreportKeithNo ratings yet

- Business-Economics 8Document7 pagesBusiness-Economics 8anshagrawal0000No ratings yet

- A192 CH7 Finite Risk ReinsuranceDocument22 pagesA192 CH7 Finite Risk ReinsuranceWingFatt KhooNo ratings yet

- Examiners' Report: F9 Financial Management December 2008Document4 pagesExaminers' Report: F9 Financial Management December 2008AAUCKLOONo ratings yet

- General Insurance Business UnderwritingDocument8 pagesGeneral Insurance Business UnderwritingMukesh LalNo ratings yet

- Research Paper On Pension FundsDocument6 pagesResearch Paper On Pension Fundsvmehykrif100% (1)

- CA1 Exams 2010-2014Document221 pagesCA1 Exams 2010-2014Xavier Snowy100% (1)

- Insurance and Risk Management (Ranveer)Document9 pagesInsurance and Risk Management (Ranveer)Ranveer Singh RajputNo ratings yet

- Chapter-Six 6.preparation of Operating Budgets: Financial AccountingDocument6 pagesChapter-Six 6.preparation of Operating Budgets: Financial AccountingWendosen H FitabasaNo ratings yet

- Depreciation and Methods of Calculating Depreciation Difference Between Depreciation, Amortization and Depletion"Document7 pagesDepreciation and Methods of Calculating Depreciation Difference Between Depreciation, Amortization and Depletion"Maria QamarNo ratings yet

- Ca1 2005-2009 - No.2Document178 pagesCa1 2005-2009 - No.2BobNo ratings yet

- FM MJ20 Detailed CommentaryDocument4 pagesFM MJ20 Detailed CommentaryleylaNo ratings yet

- FandI ST3 200909 Examiners' ReportDocument18 pagesFandI ST3 200909 Examiners' Reportdickson phiriNo ratings yet

- Chapter 6 11 12Document15 pagesChapter 6 11 12wubeNo ratings yet

- Modern Security Analysis - 2Document7 pagesModern Security Analysis - 2anashj250% (2)

- Lazzari Wong - Dimension ReductionDocument73 pagesLazzari Wong - Dimension ReductionCourtney WilliamsNo ratings yet

- Examiner's Report: F9 Financial Management June 2011Document6 pagesExaminer's Report: F9 Financial Management June 2011Koi Pei TsenNo ratings yet

- Literature Review On Property InsuranceDocument5 pagesLiterature Review On Property Insurancec5hc4kgx100% (1)

- Lecture NotesDocument26 pagesLecture NotesSAMSONINo ratings yet

- Actuarial Society of India: ExaminationsDocument14 pagesActuarial Society of India: ExaminationsYogeshAgrawalNo ratings yet

- Functions of InsurersDocument19 pagesFunctions of InsurersMd Daud Hossian100% (1)

- Examination: Subject CA1 Core Applications Concepts Paper 1 (Assets)Document12 pagesExamination: Subject CA1 Core Applications Concepts Paper 1 (Assets)Saad MalikNo ratings yet

- Institute and Faculty of Actuaries: Subject CT2 - Finance and Financial Reporting Core TechnicalDocument9 pagesInstitute and Faculty of Actuaries: Subject CT2 - Finance and Financial Reporting Core TechnicalPatrick MugoNo ratings yet

- CH 12Document33 pagesCH 12Albert CruzNo ratings yet

- Asc302 AssignmentDocument5 pagesAsc302 AssignmentfatinNo ratings yet

- Ch02 - Further Exercises - and - PointersDocument6 pagesCh02 - Further Exercises - and - Pointershadi electronic serat companyNo ratings yet

- Ca1 Pu 10Document60 pagesCa1 Pu 10Shabbeer ZafarNo ratings yet

- Ca1 Pu 14Document46 pagesCa1 Pu 14Shabbeer ZafarNo ratings yet

- Ca1 Pu 11Document42 pagesCa1 Pu 11Shabbeer ZafarNo ratings yet

- ST2 Pu 13Document44 pagesST2 Pu 13Shabbeer ZafarNo ratings yet

- Ca1 Pu 13Document46 pagesCa1 Pu 13Shabbeer ZafarNo ratings yet

- ST2 Pu 14Document26 pagesST2 Pu 14Shabbeer ZafarNo ratings yet

- ST5 ReportDocument14 pagesST5 ReportShabbeer ZafarNo ratings yet

- Institute and Faculty of Actuaries: Subject ST2 - Life Insurance Specialist TechnicalDocument8 pagesInstitute and Faculty of Actuaries: Subject ST2 - Life Insurance Specialist TechnicalShabbeer ZafarNo ratings yet

- ST5 PaperDocument8 pagesST5 PaperShabbeer ZafarNo ratings yet

- P04 REllis ELearning-Nov921Document33 pagesP04 REllis ELearning-Nov921Shabbeer ZafarNo ratings yet

- Content eLearningProjManagementDocument10 pagesContent eLearningProjManagementShabbeer ZafarNo ratings yet

- Rita PMP Exam Prep 2005 Fifth EditionDocument452 pagesRita PMP Exam Prep 2005 Fifth EditionelmerbarrerasNo ratings yet

- Ere A Der 1Document12 pagesEre A Der 1Shabbeer ZafarNo ratings yet

- Project Management - Best Practices in WorkflowDocument10 pagesProject Management - Best Practices in WorkflowSami KakarNo ratings yet

- IFSEDocument42 pagesIFSEvenkatNo ratings yet

- Ram Mohan MishraDocument10 pagesRam Mohan Mishraram10008No ratings yet

- Project:: Form 1 Owner Controlled Insurance Program Insurance Cost Information WorksheetDocument13 pagesProject:: Form 1 Owner Controlled Insurance Program Insurance Cost Information WorksheetSyed NNo ratings yet

- Overview Manajemen Risiko - DikonversiDocument27 pagesOverview Manajemen Risiko - DikonversiKusnadi CilukNo ratings yet

- Benefit Illustration For HDFC Life Guaranteed Pension PlanDocument2 pagesBenefit Illustration For HDFC Life Guaranteed Pension PlannrameshecmNo ratings yet

- Press Release TanzaniaDocument3 pagesPress Release TanzaniaAnonymous FnM14a0No ratings yet

- LPRDocument1 pageLPRmathieusteeleNo ratings yet

- 1 - Basic DerivativesDocument154 pages1 - Basic DerivativesVipul KharwarNo ratings yet

- Mgt201 Mega Midterm Solved Papers 321 PagesDocument328 pagesMgt201 Mega Midterm Solved Papers 321 Pageszahidwahla1100% (1)

- 1.1. Different Types of General InsuranceDocument3 pages1.1. Different Types of General Insurancebeena antuNo ratings yet

- 9-Principles of Insurance and Loss AssessmentDocument29 pages9-Principles of Insurance and Loss Assessmentmayur shettyNo ratings yet

- Jeevan Nivesh CanarahsbcDocument14 pagesJeevan Nivesh CanarahsbcVinesh ChandraNo ratings yet

- 613a - Principles of Insurance IIDocument23 pages613a - Principles of Insurance IIRavi ShankarNo ratings yet

- In This Policy, The Investment Risk in Investment Portfolio Is Borne by The PolicyholderDocument10 pagesIn This Policy, The Investment Risk in Investment Portfolio Is Borne by The PolicyholderManish NirwanNo ratings yet

- BB 260822115107935Document7 pagesBB 260822115107935Mahesh PatelNo ratings yet

- To The of .: Exceptions Principle IndemnityDocument1 pageTo The of .: Exceptions Principle IndemnityNKOYOYO HANNINGTONNo ratings yet

- Chap 009Document22 pagesChap 009Yarlagadda GayathriNo ratings yet

- Banking and InsuranceDocument7 pagesBanking and InsuranceVanshika GuptaNo ratings yet

- Ch-4 Risk and ReturnDocument40 pagesCh-4 Risk and ReturnEyuel SintayehuNo ratings yet

- QUESTION BANK For Banking and Insurance MBA Sem IV-FinanceDocument2 pagesQUESTION BANK For Banking and Insurance MBA Sem IV-FinanceAgnya PatelNo ratings yet

- Topic 1 Overview of Financial Management and Financial EnvironmentDocument68 pagesTopic 1 Overview of Financial Management and Financial EnvironmentMicaella Fevey BandejasNo ratings yet

- HDFC Child Plan ProposalhhhhDocument7 pagesHDFC Child Plan ProposalhhhhanduNo ratings yet

- JCPenny Life Insurance ClaimDocument2 pagesJCPenny Life Insurance ClaimAllison SylteNo ratings yet

- Tax Equity Financing and Asset RotationDocument18 pagesTax Equity Financing and Asset RotationShofiul HasanNo ratings yet

- Set For Life 10pay Sales Illustration: Celebrate LivingDocument11 pagesSet For Life 10pay Sales Illustration: Celebrate LivingJane NavarezNo ratings yet

- Instant Download Ebook PDF Fundamentals of Corporate Finance 9th Canadian Edition PDF ScribdDocument25 pagesInstant Download Ebook PDF Fundamentals of Corporate Finance 9th Canadian Edition PDF Scribdwalter.herbert733100% (36)