Professional Documents

Culture Documents

Ccra Brochure

Uploaded by

Arushi SrivastavaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ccra Brochure

Uploaded by

Arushi SrivastavaCopyright:

Available Formats

Certified Credit Research Analyst (CCRACM)

Program Overview:

This integrated certicate program will provide students with the necessary foundation of skills and experiences needed to enter the eld of credit research analysis.

Program Objective:

Participants will use a structured and systematic approach to evaluate the credit standing of a company and assess the relative attractiveness of the risk-return prole of the investing / lending proposition. This is a highly interactive workshop where case studies and exercises are used to illustrate key learning points. A case study presentation will form part of the workshop allowing participants to apply the concepts acquired during the workshop to a real-life scenario. Participants are encouraged to be focused and concise in developing and articulating credit judgement. Specically, participants will learn to:

Program Benets:

You will be prepared for entry-level employment in credit research. You will learn from top-ight professionals from the industry and academia. CCRA C M will help you deploy the most comprehensive suite of research, data and tools to analyze and monitor individual securities, companies and industries on the market One-on-one access to industry-leading analysts, briengs, and teleconferences In-depth reports that dissect the credit strengths and weaknesses of individual companies and transactions Accurate, timely and comprehensive sets of data on company nancials, industries, and deal performance metrics Analytical models and software to analyze, screen and monitor individual credits and portfolios Multiple perspectives from qualitative to quantitative and from market-based views to fundamental analysis on the credit quality of your portfolio

Even if you are looking to build your own credit risk measurement system, CCRACM will help you with necessary knowledge that embeds the deep expertise in credit analysis into enterprise-wide software..

Apply a structured approach to assess the creditworthiness of a borrower Evaluate the performance of a company based on qualitative and quantitative frameworks and tools Use appropriate market indicators, where available to understand renancing risk and the market view on a credit Identify the key factors that drive a company's future performance and evaluate the likely impact on its credit standing Use a cash ow approach to ascertain a company's ability to service/renance its debt as it comes due Review debt structures to assess to what extent they meet the commercial needs of the borrower and protect the lender's interests.

Content

Who should study for CCRACM This highly practical course has been specically designed for candidates aspiring for a career in:

Credit Analysis Credit Ratings Commercial and Retail Finance Investment Banking Private Equity Private Banking

Banks Economic Research Portfolio Management Fund Management Academics Treasury

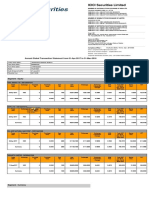

Credit Analyst Salary Scale

Credit Analyst Total Pay (?)

Rs 207,550 - Rs 1,006,647

0 (Median) 210K 310K 440K 740K 1M MEDAN: Rs 442,635

10%

25%

50%

75%

90%

Source: www.payscale.com

Course Structure

Level I Understanding of Financial Statement Analysis Balance Sheet, Prot & Loss Statement, Cas-ow, Ratio & its analysis, Accounting Policies, Projections, Red Flags Credit Specic Analysis Liquidity Analysis, Stress Case Testing, Scenerio, Base, Bear Bull, Covenant Testing with Projections, Comparison- Sector vs. Global, Liquidation Scenerio, Event, M&A, LBO Understanding of Bonds/ Bond Maths Bonds, Covenants, Pricing, Spread, Curves, CDS, Senioriity Ranking, Rich Cheap Analysis, SWAP , OAS, YTW, Term Structure & its theories, Duration, PVBP Level II Credit Ratings Basics 4C Model, Types of ratings, Default rates, Recovery rates, Business, Industry, Financial and other risks, Scenerio Analysis, Soverign Ratings, Methodology, CIBIL/FICO Credit Strategy Pair trade, Basis trade, Rating Analysis Trends, Sectors, etc., Debt maturity prole, Retrace analysis, Sector charts, Efcient frontier, Commodity based traders, FX-based correlation, Senior vs. sub, CDS trader Analysis, Company charts Credit Enhancement Structuring, Types of enhancement Regulations & Others Related party transactions, Management analysis, Overview of xed income markets around the world, Local regulations, Alternative to ratings and

understanding of Corporate Banking Facilities, Riskbased pricing framework (Basel), Credit Risk mitigants

Exams:

Exams are conducted on a daily basis at National Stock Exchange (NSE) Level I II Exam Type MCQ MCQ Duration 2 hours 3 hours

About AIWMI:

T h e A s s o c i a t i o n o f I n t e r n a t i o n a l We a l t h Management of India (AIWMI) is a not-for-prot organization and a globally recognized membership association for nance professionals. AIWMI primarily focuses on broader and strategic role of developing a more robust and forward-looking training infrastructure for nancial services sector and to promote more active industry involvement and collaboration in training and continuing education matters. AIWMI is offering advanced international certication programs along with a wide variety of high-quality executive education programs. AIWMI programs combine state- of-the-ar t knowledge and skills with practical experience and insights into the functioning of the nancial sector. All AIWMI courses and education events have an intense and pragmatic curriculum. Participants are exposed to the latest developments within the nancial services sector. AIWMI plays a key role in guiding the development of the nancial services sector. AIWMI works with

key industry participants viz. the Government, the Regulators, the Industries/Associations, the Corporate, the Media and the General Public to achieve its objectives.Besides enhancing technical competencies and professionalism in the industry, AIWMI organizes events and facilitates discussions to promote best practices in leadership and talent development in the nancial sector with an aim to become Asias premier centre of excellence for nancial education.ents within the wealth management sector

grading businesses like that for banks, subsovereigns ratings and IPO grading. CARE Ratings provides the entire spectrum of rating services that helps the corporate to raise capital and assists investors to take an informed investment decision. CARE Ratings is the Knowledge Partner of AIWMI for the Certied Credit Research Analyst CCRA CM certication and all the content and exams of CCRACM are developed by CARE Research a division of CARE Ratings.

Learning Routes:

Candidates can pursue CCRACM either though selfstudy or under the guidance of any of AIWM India's training providers.

CCRACM will enable you to:

Pedagogy:

The modules for CCRACM have been designed to ensure that participants not only excel academically but also groom themselves to take on better professional responsibilities. The class work focuses on providing the necessary academic fundamentals. The pedagogy includes a mix of lectures, case studies, and group discussions. Participants are required to work on individual and group assignments, and projects. A regular evaluation process will monitor the participant's performance throughout the Program.

Research companies, industries & products Generate better ideas & targets Build & maintain models Monitor your markets & companies Analyze portfolio performance Streamline quantitative research Enhance Internal Ratings system Make Investment Recommendations Analyse credit-worthiness of your individual clients

The study material of CCRACM certication also contains content reproduced with permission from:

Knowledge Partner:

Asian Development Bank Asia Securities Industry and Financial Markets Association (ASIFMA) Fitch Ratings Fixed Income, Money Markets & Derivatives Association of India (FIMMDA) India Ratings (subsidiary of Fitch Ratings) Moodys Investor Services National Institute of Securities Markets (NISM) Standard & Poors Financial Services Swiss Financial Analysts Association World Bank

Credit Analysis and Research Ltd (CARE Ratings) has established itself as a leading credit rating agency in India, having leadership position in various rating and

Exam Partner:

National Stock Exchange (NSE)

India Ofce Association of International Wealth Management of India (AIWMI) Regus, Level 9, Platina, Block G, Plot C-59, Bandra-Kurla Complex, Bandra (East) Mumbai 400051 Ph : +91 8097661200/8097661201 Email: ccra@aiwmindia.com Website: www.aiwmindia.com

You might also like

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Keeping Inventory-AndProfits-Off The Discount RackDocument12 pagesKeeping Inventory-AndProfits-Off The Discount RackArushi SrivastavaNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Placement Brochure 2013Document36 pagesPlacement Brochure 2013rkdexportsNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Guideline RP BFT MFT 2015Document28 pagesGuideline RP BFT MFT 2015Arushi SrivastavaNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- B (1) - F Tech Course Curriculam 26 July 2011Document346 pagesB (1) - F Tech Course Curriculam 26 July 2011Watan Chugh100% (3)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Work Aids and Sewing Machine AttachmentsDocument31 pagesWork Aids and Sewing Machine AttachmentsArushi Srivastava75% (12)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Arushi Srivastava FP TechDocument19 pagesArushi Srivastava FP TechArushi SrivastavaNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- 2 Day Executive Workshop On Algorithmic Trading: NSE Management Development Programme Series 2015-16Document8 pages2 Day Executive Workshop On Algorithmic Trading: NSE Management Development Programme Series 2015-16Arup GhoshNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Bank IFSC Code MICR Code Branch N Address Contact City District StateDocument36 pagesBank IFSC Code MICR Code Branch N Address Contact City District StateAnkur JariwalaNo ratings yet

- ICICI Securities Limited: Signature Not VerifiedDocument2 pagesICICI Securities Limited: Signature Not VerifiedKKNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Financial Markets and InstitutionssDocument30 pagesFinancial Markets and InstitutionssEntityHOPENo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Capital Market Corporate ProfileDocument40 pagesCapital Market Corporate ProfilePinank TurakhiaNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Wealth Insights - Newsletter August 2021Document49 pagesWealth Insights - Newsletter August 2021sabusumeetNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Athena Chhattisgarh Power - Vedanta To Buy Athena Chhattisgarh Power For Rs 564 Crore - The Economic TimesDocument2 pagesAthena Chhattisgarh Power - Vedanta To Buy Athena Chhattisgarh Power For Rs 564 Crore - The Economic TimesstarNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Hasim Trend Analysis of Commodity CopperDocument72 pagesHasim Trend Analysis of Commodity Copperasifkingkhan100% (1)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- ET 500 Companies List 2022 - The Economic Times Fortune 500Document4 pagesET 500 Companies List 2022 - The Economic Times Fortune 500surbhiNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Icici Prudential Silver Etf Final InvestorDocument16 pagesIcici Prudential Silver Etf Final InvestorkshitijgoyalNo ratings yet

- A Project Report On KarvyDocument78 pagesA Project Report On Karvyluvujaya88% (8)

- MBA Project On Fundamental and Technical Analysis of Kotak BankDocument109 pagesMBA Project On Fundamental and Technical Analysis of Kotak BankSneha MaskaraNo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Amaravati Circle & BranchesDocument312 pagesAmaravati Circle & BranchesUday kumarNo ratings yet

- MUFTI - Credo Brands Marketing Limited ProspectusDocument410 pagesMUFTI - Credo Brands Marketing Limited ProspectusCornburn KNo ratings yet

- FINAnceDocument4 pagesFINAnceronin150101No ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- KV Duty List AmbernathDocument2 pagesKV Duty List AmbernathRinishaNo ratings yet

- Sona Koyo Steering Systems LimitedDocument21 pagesSona Koyo Steering Systems LimitedTyagi Munda AnkushNo ratings yet

- Deal Money SIP PDFDocument71 pagesDeal Money SIP PDFSaurav KumarNo ratings yet

- ICICI Securities Limited: Annual Global Transaction Statement From 01-Apr-2017 To 31-Mar-2018Document2 pagesICICI Securities Limited: Annual Global Transaction Statement From 01-Apr-2017 To 31-Mar-2018Lakshmi MuraliNo ratings yet

- Capital MarketDocument8 pagesCapital Marketshounak3No ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Currency Derivatives Beginners ModuleDocument64 pagesCurrency Derivatives Beginners ModuleRam Kumar50% (2)

- Iifl Content FullDocument53 pagesIifl Content FullAkshay Joshi0% (1)

- Karvy Demat ScamDocument4 pagesKarvy Demat ScamcdhjvkfyutdtjyNo ratings yet

- Sharekhan ProjectDocument125 pagesSharekhan ProjectPrashanth SinghNo ratings yet

- Avenue Supermarts LTD.: Margin Reset UnderwayDocument9 pagesAvenue Supermarts LTD.: Margin Reset UnderwayAshokNo ratings yet

- A Literature Review On Investors Perception TowarDocument227 pagesA Literature Review On Investors Perception Towartilak kumar vadapalliNo ratings yet

- MCQ in Indian Stock MarkeDocument9 pagesMCQ in Indian Stock MarkeKadar mohideen ANo ratings yet

- Bond or Debt Market IndiaDocument12 pagesBond or Debt Market IndiaNidhi ChoudhariNo ratings yet

- Falcon7 Manual 734Document116 pagesFalcon7 Manual 734arunNo ratings yet

- Kotak SecuritiesDocument38 pagesKotak SecuritiesPoonam NandaNo ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)