Professional Documents

Culture Documents

Company Registration

Uploaded by

Tsitsi AbigailCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Company Registration

Uploaded by

Tsitsi AbigailCopyright:

Available Formats

Company Registration

Registrar of Companies

WHY SHOULD I REGISTER 1. 2. 3. 4. To qualify for a company bank account To be able to access financial loans and other SME facilities To be able to qualify to apply for any formal tenders in the market To set up sensible legal platform and formal business operations that aid in attracting investors 5. It is one step the ladder of growth of an SME There are two ways of registering a company: 1. Private Business Corporation 2. Private Limited Companies Private Business Corporation What is a Private Business Corporation? It is a body corporate formed by one or more natural persons, but not exceeding 20, formed for the lawful purpose of carrying on business with the object of acquisition of gain. It must be incorporated in terms of the Private Business Corporations Act(Chapter 24:11) Requirements for PBC Registration A name search must be done by way of PBC 1 form An incorporation statement (Form PBC2) must be submitted in duplicate Details of the Accounting Officer (can be provided by TIPS) Pay the registration fee PBC is more suitable for SMEs (Advantages) 1. 2. 3. 4. PBCs are cheaper forms of registration & faster to process Forms are straight forward and easy to complete No extensive drafting of legal documents is necessary as is the case with companies Less paperwork as the Incorporation statement serves also as the certificate of registration.

5. No further requirements ,except when there are major changes.PBC3 filled in Post Incorporation requirements 1. No other burden of requirements is put upon the PBC once it has been incorporated 2. Except where major changes take place, such as changes in shareholding structure in which case a Form PBC 3 is filed.

Private Limited Company A Company means a body corporate with one or more persons formed for the lawful purpose of carrying on business that has for its object the acquisition of gain by that association. It must be incorporated in terms of the Companies Act (Chapter 24:03) It is a body corporate formed by two or more natural persons, but not exceeding 50, formed for the lawful purpose of carrying on business with the object of acquisition of gain. Requirements for Registration A name search must be done by way of C.R.21 form. Where in seven proposed names are listed according to preference. Objectives are communicated to the Registrar of Companies. Physical and postal addresses of directors are also stated. Pay the registration fee. The registered office should also be given. Prepation of the Memorandum and Articles of Asssociation.CR 14 and CR 6 are submitted to the Registrar of Companies. Advantages 1. 2. 3. 4. Shareholders have Limited liability There is sepation between owners and workers. Greater potential to raise Capital Easier transfer of ownership

Disadvantages 1. More paper work compared to the PBC 2. Expensive to start up and operate 3. Rigorous legal requirements

You might also like

- Value Added Tax (VAT) Number Registration / ApplicationDocument4 pagesValue Added Tax (VAT) Number Registration / ApplicationLedger Domains LLCNo ratings yet

- A Revenue Guide To Professional Services Withholding Tax (PSWT) For Accountable Persons and Specified PersonsDocument26 pagesA Revenue Guide To Professional Services Withholding Tax (PSWT) For Accountable Persons and Specified Personstere1330No ratings yet

- Hidayah Factoring FormDocument3 pagesHidayah Factoring FormFahmie SuhaimiNo ratings yet

- Print VAT Registration - GOV - UkDocument11 pagesPrint VAT Registration - GOV - Uksiva kumarNo ratings yet

- Tax Code of BangladeshDocument5 pagesTax Code of Bangladeshsouravsam100% (2)

- Claim Form For Secure Mind PolicyDocument4 pagesClaim Form For Secure Mind PolicyRamya RaviNo ratings yet

- 62983rmo 5-2012Document14 pages62983rmo 5-2012Mark Dennis JovenNo ratings yet

- FLR FP Version 04-15Document59 pagesFLR FP Version 04-15test freNo ratings yet

- Chapter 1 Introduction To Uk Tax SystemDocument3 pagesChapter 1 Introduction To Uk Tax Systemtans1100% (1)

- Whmcs Freenom Module Installation Howto Version110Document9 pagesWhmcs Freenom Module Installation Howto Version110Felix AdiNo ratings yet

- Return For Provisional Tax PaymentDocument2 pagesReturn For Provisional Tax PaymentByron KanengoniNo ratings yet

- Saudi Arabia TINDocument2 pagesSaudi Arabia TINseekusNo ratings yet

- ICAB Professional Level Syllabus For Taxation-2 PDFDocument3 pagesICAB Professional Level Syllabus For Taxation-2 PDFnurulaminNo ratings yet

- Transaction Details: Product Type Loan Amount/Premium (RS.) Downpayment (RS.) EMI Amount (RS.)Document3 pagesTransaction Details: Product Type Loan Amount/Premium (RS.) Downpayment (RS.) EMI Amount (RS.)RnnrohitNo ratings yet

- ISO 9001:2008 CERTIFIED Public Notice Verification of Taxpayers' RecordsDocument2 pagesISO 9001:2008 CERTIFIED Public Notice Verification of Taxpayers' RecordsAnonymous FnM14a0No ratings yet

- UAE Corporate Tax PDFDocument59 pagesUAE Corporate Tax PDFzahidfrqNo ratings yet

- PD7A - Statement of Account For Current Source Deductions: Canada Revenue AgencyDocument3 pagesPD7A - Statement of Account For Current Source Deductions: Canada Revenue AgencycorrinNo ratings yet

- Question Bank AuditingiDocument51 pagesQuestion Bank AuditingiNever GonondoNo ratings yet

- DRC VAT Training CAs Day 1-2Document40 pagesDRC VAT Training CAs Day 1-2iftekharul alam100% (1)

- Tax Group Report FinalDocument45 pagesTax Group Report Finalapi-287792579No ratings yet

- RTGS Application Form - 2022Document3 pagesRTGS Application Form - 2022Arina Zulkifli50% (2)

- Advanced Taxation and Fiscal PolicyDocument5 pagesAdvanced Taxation and Fiscal PolicyTimore FrancisNo ratings yet

- Register A Transport Company in KenyaDocument16 pagesRegister A Transport Company in KenyaSamsonNo ratings yet

- Limited Liability C Ompany (Perseroan Terbatas/PT)Document8 pagesLimited Liability C Ompany (Perseroan Terbatas/PT)Sergyo SihombingNo ratings yet

- BBA-101 (Fundamentals of Accounting)Document10 pagesBBA-101 (Fundamentals of Accounting)Muniba BatoolNo ratings yet

- Company LiquidationDocument9 pagesCompany LiquidationcarltawiaNo ratings yet

- Domestic Tax Electronic Payment Instruction Penality TaxDocument1 pageDomestic Tax Electronic Payment Instruction Penality TaxRad Biomedical Engineering PLCNo ratings yet

- Prachi GasDocument2 pagesPrachi Gassamsa28No ratings yet

- Sharon Kilby - R4 - LATE - EXDocument2 pagesSharon Kilby - R4 - LATE - EXMark ShelloNo ratings yet

- Making An Appeal: 1. HM Courts & Tribunals ServiceDocument9 pagesMaking An Appeal: 1. HM Courts & Tribunals ServiceOWNEditorNo ratings yet

- Settled Status.: Tel Web Our Ref DateDocument6 pagesSettled Status.: Tel Web Our Ref Dateliberto21100% (1)

- Sure Shot Guide To Become A CA PDFDocument22 pagesSure Shot Guide To Become A CA PDFnavya sruthiNo ratings yet

- Federal Register / Vol. 77, No. 44 / Tuesday, March 6, 2012 / Proposed RulesDocument29 pagesFederal Register / Vol. 77, No. 44 / Tuesday, March 6, 2012 / Proposed RulesMarketsWikiNo ratings yet

- Overview of TDS: by C.A. Manish JathliyaDocument21 pagesOverview of TDS: by C.A. Manish JathliyaHasan Babu KothaNo ratings yet

- DM Rights Authorship CertificateDocument3 pagesDM Rights Authorship CertificateelshakalNo ratings yet

- No GST DeclarationDocument1 pageNo GST DeclarationrvisuNo ratings yet

- BIR EFPS JobAid For EnrollmentDocument12 pagesBIR EFPS JobAid For EnrollmentMark Lord Morales BumagatNo ratings yet

- WPPF and WWF (As Per Labour Law and Rules Amended Upto Sept 2015) Accountants PerspectiveDocument29 pagesWPPF and WWF (As Per Labour Law and Rules Amended Upto Sept 2015) Accountants PerspectiveFahim Khan0% (1)

- PartnershipDocument41 pagesPartnershipBinex67% (3)

- Basic Concepts of TaxationDocument5 pagesBasic Concepts of TaxationRhea Javed100% (1)

- KPMG Tax Shelter Caymen Islands KPMG Tax Shelter Caymen IslandsDocument4 pagesKPMG Tax Shelter Caymen Islands KPMG Tax Shelter Caymen Islandskpmgtaxshelter_kpmg tax shelter-kpmg tax shelterNo ratings yet

- Taxation in BangladeshDocument6 pagesTaxation in BangladeshSakibNo ratings yet

- Vendor Creation FormDocument1 pageVendor Creation FormRahul RSNo ratings yet

- Accounting Exam GuideDocument3 pagesAccounting Exam GuideJUNE CARLO CATULONGNo ratings yet

- Sample Intl Bank StatementDocument1 pageSample Intl Bank Statementapi-3834921100% (1)

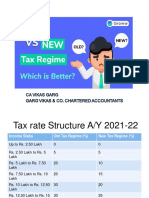

- Old Vs New Tax RegimeDocument9 pagesOld Vs New Tax Regimescintillating26No ratings yet

- Auditing HCDocument28 pagesAuditing HCMiguel SimpsonNo ratings yet

- ITF 12C Income Tax Self Assessment ReturnDocument4 pagesITF 12C Income Tax Self Assessment ReturnTavongasheMaddTMagwati100% (1)

- Ipa-Business Name Renewal & RegisDocument2 pagesIpa-Business Name Renewal & RegisSkyview Travel LTD ManagementNo ratings yet

- Answer For Question 1Document4 pagesAnswer For Question 1靳雪娇No ratings yet

- 267731702final PDFDocument5 pages267731702final PDFelmarcomonal100% (1)

- Articleship RulesDocument80 pagesArticleship RulesVeevaeck Swami100% (1)

- Federal Corporation Information - 726420-8: Registered Office AddressDocument3 pagesFederal Corporation Information - 726420-8: Registered Office AddressSeekingSatoshiNo ratings yet

- DTC ProvisionsDocument3 pagesDTC ProvisionsrajdeeppawarNo ratings yet

- PEPDocument19 pagesPEPMusah Hidir100% (1)

- Pseudo Trader's Unique Reference Number (TURN) ApplicationDocument4 pagesPseudo Trader's Unique Reference Number (TURN) Applicationprincessz_leoNo ratings yet

- MRL For Tax AuditDocument3 pagesMRL For Tax AuditDharmesh TrivediNo ratings yet

- Practice Test - Financial ManagementDocument6 pagesPractice Test - Financial Managementelongoria278100% (1)

- A Business Guide To Thailand 2011 1317913244 Phpapp02 111006100313 Phpapp02Document129 pagesA Business Guide To Thailand 2011 1317913244 Phpapp02 111006100313 Phpapp02Freeman HuNo ratings yet

- Mother Touch Group of Schools (MTGS) Transport PolicyDocument2 pagesMother Touch Group of Schools (MTGS) Transport PolicyTsitsi Abigail100% (1)

- The Ten Commandments/Mirairo Ine Gumi: English ShonaDocument1 pageThe Ten Commandments/Mirairo Ine Gumi: English ShonaTsitsi AbigailNo ratings yet

- New Account Requirements CABSDocument1 pageNew Account Requirements CABSTsitsi AbigailNo ratings yet

- Boarding Enrolment Form: Pupil's DetailsDocument2 pagesBoarding Enrolment Form: Pupil's DetailsTsitsi AbigailNo ratings yet

- MTGS Boarding PolicyDocument2 pagesMTGS Boarding PolicyTsitsi AbigailNo ratings yet

- Boarding Admission Form Copy 1Document1 pageBoarding Admission Form Copy 1Tsitsi AbigailNo ratings yet

- Mother Touch Group of Schools: WWW - Mothertouch.ac - ZW Highschoolbursar@mothertouch - Ac.zwDocument5 pagesMother Touch Group of Schools: WWW - Mothertouch.ac - ZW Highschoolbursar@mothertouch - Ac.zwTsitsi AbigailNo ratings yet

- New General Mathematics For Secondary Schools 1 TG Full PDFDocument60 pagesNew General Mathematics For Secondary Schools 1 TG Full PDFMark Juniel Monzon69% (32)

- Amendments To Chapter I of Finance Act (Chapter 23:04) : SectionDocument17 pagesAmendments To Chapter I of Finance Act (Chapter 23:04) : SectionTsitsi AbigailNo ratings yet

- Motivation Letter - Tips Tricks PDFDocument2 pagesMotivation Letter - Tips Tricks PDFBOOCOMETRUENo ratings yet

- Business Licensing Fees Schedule March 2020.Document3 pagesBusiness Licensing Fees Schedule March 2020.Tsitsi AbigailNo ratings yet

- Shop Municipal Application Form.Document2 pagesShop Municipal Application Form.Tsitsi AbigailNo ratings yet

- Tuck Shop Business Plan Contents TableDocument5 pagesTuck Shop Business Plan Contents TableTsitsi Abigail20% (5)

- Health Registration Application Form.Document2 pagesHealth Registration Application Form.Tsitsi AbigailNo ratings yet

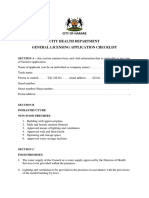

- Business Licensing Checklist.Document4 pagesBusiness Licensing Checklist.Tsitsi AbigailNo ratings yet

- New General Mathematics For Secondary Schools 2 TG Full PDFDocument51 pagesNew General Mathematics For Secondary Schools 2 TG Full PDFAnonymous qaI31H74% (35)

- New General Mathematics For Secondary Schools 3 TG Full PDFDocument73 pagesNew General Mathematics For Secondary Schools 3 TG Full PDFmoola66% (41)

- New General Mathematics For Secondary Schools 2 TG Full PDFDocument51 pagesNew General Mathematics For Secondary Schools 2 TG Full PDFAnonymous qaI31H74% (35)

- 2022 National Budget Statement DrafDocument170 pages2022 National Budget Statement DrafTsitsi AbigailNo ratings yet

- New General Mathematics For Secondary Schools 1 TG Full PDFDocument60 pagesNew General Mathematics For Secondary Schools 1 TG Full PDFMark Juniel Monzon69% (32)

- New General Mathematics For Secondary Schools 3 TG Full PDFDocument73 pagesNew General Mathematics For Secondary Schools 3 TG Full PDFmoola66% (41)

- Budget Speech Final 2022Document44 pagesBudget Speech Final 2022Tsitsi AbigailNo ratings yet

- Government Gazette Vol. 132 19-11-2021 FINALDocument34 pagesGovernment Gazette Vol. 132 19-11-2021 FINALTsitsi AbigailNo ratings yet

- AC414 - Audit and Investigations II - Audit Finalisation and ReviewDocument26 pagesAC414 - Audit and Investigations II - Audit Finalisation and ReviewTsitsi AbigailNo ratings yet

- AC414 - Audit and Investigations II - Introduction To Audit EvidenceDocument32 pagesAC414 - Audit and Investigations II - Introduction To Audit EvidenceTsitsi AbigailNo ratings yet

- AC414 - Audit and Investigations II - Audit of RecievablesDocument14 pagesAC414 - Audit and Investigations II - Audit of RecievablesTsitsi AbigailNo ratings yet

- AC414 - Audit and Investigations II - Audit of Payables, Capital and Reserves IIDocument18 pagesAC414 - Audit and Investigations II - Audit of Payables, Capital and Reserves IITsitsi AbigailNo ratings yet

- AC414 - Audit and Investigations II - Audit of No-For-Profit Organisations - NFPDocument15 pagesAC414 - Audit and Investigations II - Audit of No-For-Profit Organisations - NFPTsitsi AbigailNo ratings yet

- AC414 - Audit and Investigations II - Audit of Payables, Capital and Reserves IDocument16 pagesAC414 - Audit and Investigations II - Audit of Payables, Capital and Reserves ITsitsi AbigailNo ratings yet

- AC414 - Audit and Investigations II - Audit of InventoryDocument29 pagesAC414 - Audit and Investigations II - Audit of InventoryTsitsi AbigailNo ratings yet

- (Keupp 2011) The Strategic Management of Innovation - A Systematic Review and Paths For Future Research PDFDocument24 pages(Keupp 2011) The Strategic Management of Innovation - A Systematic Review and Paths For Future Research PDFYounes El ManzNo ratings yet

- Corporate Restructuring - Types and ImportanceDocument15 pagesCorporate Restructuring - Types and ImportanceAbhijeetNo ratings yet

- Tata Corus PPT - Presentation Transcript: o o o o o o o oDocument9 pagesTata Corus PPT - Presentation Transcript: o o o o o o o oPankaj GoyalNo ratings yet

- 2012-04, Activities Permissible For A National Bank, Cumulative - OCCDocument126 pages2012-04, Activities Permissible For A National Bank, Cumulative - OCCDarrell1573No ratings yet

- Ben Me LechDocument43 pagesBen Me LecheeribeaNo ratings yet

- 23 MergersDocument44 pages23 MergerssiaapaNo ratings yet

- HDFC Bank 110110Document16 pagesHDFC Bank 110110Raj Kumar MadhavarajNo ratings yet

- PureTech AR 2015Document68 pagesPureTech AR 2015Dimsum ChoiNo ratings yet

- Company Law Research PaperDocument10 pagesCompany Law Research PaperVelivelli Naga Venkata Chandra sekhar 20BBA7031No ratings yet

- SME Bank Inc. v. de Guzman (CURA)Document1 pageSME Bank Inc. v. de Guzman (CURA)Joe CuraNo ratings yet

- Dish TV PresentationDocument22 pagesDish TV PresentationAnkit Gupta100% (1)

- AAOIFI Standards: Definition of 'Accounting and Auditing Organization For Islamic Financial Institutions - AAOIFI'Document15 pagesAAOIFI Standards: Definition of 'Accounting and Auditing Organization For Islamic Financial Institutions - AAOIFI'riskyplayerNo ratings yet

- Strategy & Transformation Diagrams (Volumes I & II)Document75 pagesStrategy & Transformation Diagrams (Volumes I & II)AnshulNo ratings yet

- Diamond Case Study AnalysisDocument9 pagesDiamond Case Study AnalysisNaman Tuli0% (1)

- Vice President Regulatory in Arlington VA Resume Mark O'ConnorDocument2 pagesVice President Regulatory in Arlington VA Resume Mark O'ConnorMarkOConnor2No ratings yet

- THE NEXT WAVE Unicorns of Today Giants of Tomorrow - 2019 PDFDocument56 pagesTHE NEXT WAVE Unicorns of Today Giants of Tomorrow - 2019 PDFMarshmallow CreativeNo ratings yet

- Bir Ruling No. 508-12: Deguzman Celis & Dionisio Law OfficesDocument3 pagesBir Ruling No. 508-12: Deguzman Celis & Dionisio Law OfficesThe GiverNo ratings yet

- AGM SpeechDocument9 pagesAGM SpeechPankaj MalikNo ratings yet

- Intro To Mergers and AcquisitionDocument54 pagesIntro To Mergers and AcquisitionAmeesha MunjalNo ratings yet

- CH 14 Foreign Direct InvestmentDocument53 pagesCH 14 Foreign Direct InvestmentharshaNo ratings yet

- Reo Rit - Dealings in PropertiesDocument7 pagesReo Rit - Dealings in PropertiesJohn MaynardNo ratings yet

- Achievements of Sebi @sanchitDocument4 pagesAchievements of Sebi @sanchitAmanNandaNo ratings yet

- Nestle FinalDocument17 pagesNestle FinalAli Imran100% (1)

- ACCO 30023 - Accounting For Business Combination (IM)Document74 pagesACCO 30023 - Accounting For Business Combination (IM)rachel banana hammockNo ratings yet

- Project Report-Corporate RestructuringDocument26 pagesProject Report-Corporate Restructuringchahvi bansal100% (1)

- Accounting For Business Combination NotesDocument4 pagesAccounting For Business Combination NotesJñelle Faith Herrera SaludaresNo ratings yet

- Cs Org Profile 2013 2Document34 pagesCs Org Profile 2013 2api-45397605No ratings yet

- Chemical Industry Outlook 2022Document180 pagesChemical Industry Outlook 2022Err DatabaseNo ratings yet

- Effective Business Leadership Styles: A Case Study of Harriet GreenDocument11 pagesEffective Business Leadership Styles: A Case Study of Harriet GreenThảo PhươngNo ratings yet

- Chapter 5Document31 pagesChapter 5cherryyllNo ratings yet