Professional Documents

Culture Documents

Bank Interview Questions

Uploaded by

Shathish GunasekaranOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Bank Interview Questions

Uploaded by

Shathish GunasekaranCopyright:

Available Formats

(1) Why do you want join banking sector? (2) What is bank and its features and types?

(3) What is Private Banking? (4) What is the difference between Nationalized bank and Private Bank ? (5) What is RBI and Functions of RBI? (6) What is the difference between NBFCs and Bank? (7) What is the Use of Computers in a Bank? (8) What is recession? What is the cause for the present recession? (9) What is Sub-prime crisis? (10) What is FII and FDI? What is the difference between FII and FDI? (11) What is a Repo Rate? (12) What is Reverse Repo Rate? (13) What is CRR Rate? (14) What is SLR Rate? (15) What is Bank Rate? (16) What is Inflation? (17) What is Deflation? (18) What is PLR? (19) What is Deposit Rate? (20) What is IPO? (21) What is Disinvestment? (22) What is Fiscal Deficit? (23) What is Revenue deficit? (24) What is GDP & GNP? (25) What is National Income? (26) What is Per Capita Income? (27) What is SEZ? (28) What is Fiscal Policy? (29) What is Right to information Act? (30) What is Cheque? (31) What is demand Draft? (32) What is a NBFC? (33) What is NABARD? (34) What is SIDBI? (35) What is SENSEX and NIFTY? (36) What is SEBI? (37) What are Mutual funds? (38) What are non-perfoming assets? (39) What is Recession? (40) What is foreign exchange reserver? (41) What is Customer Relationship Management CRM? (42) What is dematerialisation? (43) What is Bancassurance (44) What is Liquidity Adjustment Facility LAF? (45) What is Money Laundering? 1. 2. 3. 4. 5. 6. 7. 8. NABARD - National Bank for Agricultural& Rural Development RTGS - Real Time Gross Settlement NEFT - National Electronic Fund Transfer NAV - Net Asset Value NPA - Non Performing Asset ASBA - Account Supported by Blocked Amount BIFR - Board for Industrial and Financial Reconstruction CAMELS - Capital Adequacy, Asset Quality, Management Earnings,Liquidity, Systems & Controls

9. 10. 11. 12. 13. 14. 15. 16. 17. 18. 19. 20. 21. 22. 23. 24. 25. 26. 27. 28. 29. 30. 31. 32. 33. 34. 35. 36. 37. 38. 39. 40.

BCSBI - Banking Codes & Standard Board of India BIS Bank for International Settlement BCBS Basel Committee on Banking Supervision BOP - Balance of Payment BOT - Balance of Trade BPLR Benchmark Prime Lending Rate CCIL Clearing Corporation of India Ltd. CIBIL - Credit Information Bureau of India Ltd. CRISIL - Credit Rating Information Services of India Ltd. CBLO - Collateralised Borrowing & Lending Obligation CPI - Consumer Price Index ADR American Depository Receipts GDR Global Depository Receipts ALM - Asset Liability Management ARC Asset Reconstruction Companies FINO - Financial Inclusion Network Operation CTT - Commodities Transaction Tax CRM - Customer Relationship Management KYC - Know Your Customer SLR - Statutory Liquidity Ratio CRR - Cash Reserve Ratio MSF - Marginal Standing Facility REPO - Repurchase Option NBFC - Non Banking Finance Companies OSMOS - Off-Site Monitoring & Surveillance IFSC - Indian Financial System Code BSE - Bombay Stock Exchange NSE - National Stock Exchange SWIFT - Society for Worldwide Interbank Financial Tele communication FSLRC Financial Sector Legislative Reforms Commission LAF Liquidity Adjustment Facility DRT Debt Recovery Tribunals.

You might also like

- Bank InterviewDocument6 pagesBank InterviewKUMARI PUJA-MBANo ratings yet

- 250+ Important Terms Related To RBIDocument6 pages250+ Important Terms Related To RBIMohan KumarNo ratings yet

- Finance Banking Abbreviations in PDF 2Document3 pagesFinance Banking Abbreviations in PDF 2vaibhav patwariNo ratings yet

- List of AbbreviationsDocument12 pagesList of Abbreviationsneha sharmaNo ratings yet

- Important Banking Abbreviations (IBPS)Document1 pageImportant Banking Abbreviations (IBPS)murali420No ratings yet

- 100-List of AbbreviationsDocument5 pages100-List of AbbreviationsShunmuga S PandiyanNo ratings yet

- Bank Abbreviations PDFDocument6 pagesBank Abbreviations PDFVineeth VivekanandanNo ratings yet

- Banking GKDocument19 pagesBanking GKapi-248451009No ratings yet

- Banking Awareness QuizDocument4 pagesBanking Awareness QuizGurjinder SinghNo ratings yet

- Ifs Suggestions 2022Document9 pagesIfs Suggestions 2022Sakil MollaNo ratings yet

- 130-ToPICS For Banking InterviewDocument122 pages130-ToPICS For Banking InterviewAmarnath AkellaNo ratings yet

- Money and Banking-Question BankDocument6 pagesMoney and Banking-Question BankHari prakarsh NimiNo ratings yet

- Important Abbreviations in Banking PDFDocument13 pagesImportant Abbreviations in Banking PDFAbhijeet PatilNo ratings yet

- General AwarenessDocument43 pagesGeneral Awarenessmuralisuji0% (1)

- Aug CaDocument17 pagesAug Casahil_647No ratings yet

- Important Banking GK PDFDocument26 pagesImportant Banking GK PDFPriya BanothNo ratings yet

- Finance-Frequently Asked QuestionsDocument2 pagesFinance-Frequently Asked QuestionsPooja PawarNo ratings yet

- Banking Questions For IBPS Gr8AmbitionZDocument25 pagesBanking Questions For IBPS Gr8AmbitionZshahenaaz3No ratings yet

- ACFDocument9 pagesACFduaa fatimaNo ratings yet

- List of Select AbbreviationsDocument5 pagesList of Select AbbreviationsAlokdev MishraNo ratings yet

- Banking G.KDocument10 pagesBanking G.Kvishal tyagiNo ratings yet

- 51 RBI Interview Technical QuestionsDocument4 pages51 RBI Interview Technical Questionsvyasvedansh10No ratings yet

- The Tip of Indian Banking Part I To Part 26my ScribdDocument144 pagesThe Tip of Indian Banking Part I To Part 26my ScribdambujchinuNo ratings yet

- Many Questions Were Asked From, International Organizations,,, RBI Notifications, Annual Budget EtcDocument7 pagesMany Questions Were Asked From, International Organizations,,, RBI Notifications, Annual Budget EtcNikhil YadavNo ratings yet

- Finance Interview Questions: Infosys Brigade Genpact Icici Karvy Capital-IQDocument9 pagesFinance Interview Questions: Infosys Brigade Genpact Icici Karvy Capital-IQdasrashmiNo ratings yet

- 01 Pob Mock Test 1 Cce EditedDocument19 pages01 Pob Mock Test 1 Cce EditedShaik MunnaNo ratings yet

- Banking and Finacial Full FormsDocument6 pagesBanking and Finacial Full FormsAnand DubeyNo ratings yet

- Banking & Financial Institution: SR - NoDocument11 pagesBanking & Financial Institution: SR - NoDubey ShraddhaNo ratings yet

- Management Point: List of Important Full FormDocument3 pagesManagement Point: List of Important Full FormPawan KumarNo ratings yet

- Tybms Sem 5 Q PaperDocument15 pagesTybms Sem 5 Q PaperVimal Singh67% (3)

- Why To Study Banking? Reserve Bank of IndiaDocument2 pagesWhy To Study Banking? Reserve Bank of IndiasathishNo ratings yet

- Banking Abbreviations PDF Model Questions For SBI Clerk, RBI AssistantDocument11 pagesBanking Abbreviations PDF Model Questions For SBI Clerk, RBI AssistantMD ASIF ALI 19DEE8027No ratings yet

- Full Forms - AbbreviationsDocument19 pagesFull Forms - AbbreviationsA SinghNo ratings yet

- Banking and Finance QuestionsDocument22 pagesBanking and Finance Questionsatul mishraNo ratings yet

- As Per Nepal Rastra BankDocument2 pagesAs Per Nepal Rastra BankMandil BhandariNo ratings yet

- Acronyms Important Abbreviations in Banking: AffairsDocument10 pagesAcronyms Important Abbreviations in Banking: AffairsAbhijeet PatilNo ratings yet

- Banking AbbriviationDocument4 pagesBanking AbbriviationPrabhat PatelNo ratings yet

- Finance & Banking Abbreviations: Short Form Full FormDocument10 pagesFinance & Banking Abbreviations: Short Form Full FormDesh Deepak JhaNo ratings yet

- Economics: GDP: Gross Domestic Product GNP: Gross National ProductDocument1 pageEconomics: GDP: Gross Domestic Product GNP: Gross National Productmanur32No ratings yet

- Economy QuestionsDocument17 pagesEconomy QuestionsIsha Malguri 726No ratings yet

- All Banking McqsDocument28 pagesAll Banking McqsManoranjan SethiNo ratings yet

- Fmbo Short AnswersDocument6 pagesFmbo Short Answersvenkatesh telangNo ratings yet

- Finance FAQsDocument3 pagesFinance FAQsKeval MehtaNo ratings yet

- Banking TerminologyDocument4 pagesBanking Terminologyyerale2515No ratings yet

- AML-KYC and Compliance - Indian Bank - AdvancedDocument3 pagesAML-KYC and Compliance - Indian Bank - AdvancedPritamNo ratings yet

- Banking QuestionsDocument7 pagesBanking QuestionsAnuj RajNo ratings yet

- Banking ACronymsDocument8 pagesBanking ACronymsPawan KumarNo ratings yet

- List of Accounting AbbreviationsDocument3 pagesList of Accounting AbbreviationsHeba Hosni100% (1)

- Banking Abbreviations Terms by BCS DailyDocument4 pagesBanking Abbreviations Terms by BCS DailyMOTIVATIONAL VIDEOSNo ratings yet

- Ba 50 11 - Merchant Banking and Finanacial Services Question BankDocument4 pagesBa 50 11 - Merchant Banking and Finanacial Services Question BankHarihara PuthiranNo ratings yet

- 1.years Known As & Rank of India in 2013:: SNAP - IIFT - CMAT Specific G.K. ContentDocument15 pages1.years Known As & Rank of India in 2013:: SNAP - IIFT - CMAT Specific G.K. ContentTejashwi KumarNo ratings yet

- Report On Resolution Regime For Financial InstitutionsDocument254 pagesReport On Resolution Regime For Financial Institutionsraheja_ashishNo ratings yet

- Finance Banking Abbreviations in PDFDocument4 pagesFinance Banking Abbreviations in PDFMahesh PandeyNo ratings yet

- AML-KYC and Compliance - Indian Bank - IntermediateDocument3 pagesAML-KYC and Compliance - Indian Bank - IntermediatePritamNo ratings yet

- AbbreviationDocument5 pagesAbbreviationShanky RanaNo ratings yet

- Abbreviations - Finance: Sreedhar'sDocument6 pagesAbbreviations - Finance: Sreedhar'skommi kiranNo ratings yet

- Treasury & Risk Management: Post Graduate Diploma in Management (ePGDM)Document9 pagesTreasury & Risk Management: Post Graduate Diploma in Management (ePGDM)Jitendra YadavNo ratings yet

- Common Understanding on International Standards and Gateways for Central Securities Depository and Real-Time Gross Settlement (CSD–RTGS) Linkages: Cross-Border Settlement Infrastructure ForumFrom EverandCommon Understanding on International Standards and Gateways for Central Securities Depository and Real-Time Gross Settlement (CSD–RTGS) Linkages: Cross-Border Settlement Infrastructure ForumNo ratings yet

- Next Steps for ASEAN+3 Central Securities Depository and Real-Time Gross Settlement Linkages: A Progress Report of the Cross-Border Settlement Infrastructure ForumFrom EverandNext Steps for ASEAN+3 Central Securities Depository and Real-Time Gross Settlement Linkages: A Progress Report of the Cross-Border Settlement Infrastructure ForumNo ratings yet

- Islamic Capital Markets and Products: Managing Capital and Liquidity Requirements Under Basel IIIFrom EverandIslamic Capital Markets and Products: Managing Capital and Liquidity Requirements Under Basel IIINo ratings yet

- Basic Block Diagram of A Communication SystemDocument9 pagesBasic Block Diagram of A Communication SystemShathish GunasekaranNo ratings yet

- Engineering Metrology Linear Measurements: Dr. Belal Gharaibeh 10/7/2011Document44 pagesEngineering Metrology Linear Measurements: Dr. Belal Gharaibeh 10/7/2011Shathish GunasekaranNo ratings yet

- Basic Block Diagram of A Communication SystemDocument9 pagesBasic Block Diagram of A Communication SystemShathish GunasekaranNo ratings yet

- Production Engineering V SEM SET-1Document3 pagesProduction Engineering V SEM SET-1Shathish GunasekaranNo ratings yet

- Financialhubindia NotesDocument25 pagesFinancialhubindia NotesAnonymous ZcaMXDNo ratings yet

- Banking - IntroductionDocument15 pagesBanking - Introductionsridevi gopalakrishnanNo ratings yet

- M/s Auto India Case StudyDocument3 pagesM/s Auto India Case Studyashrin67% (3)

- Digital Banking in The Middle East 2022 1671784719Document31 pagesDigital Banking in The Middle East 2022 1671784719M.ALiNo ratings yet

- Bilal Ahmad 902344797Document87 pagesBilal Ahmad 902344797natasha_sethi_3No ratings yet

- SRS Internet Banking SystemDocument44 pagesSRS Internet Banking SystemRahul Khanchandani83% (6)

- HDFC Bank ReportDocument43 pagesHDFC Bank ReportAnkit SinhaNo ratings yet

- 7'P S of Banking in MarketingDocument15 pages7'P S of Banking in MarketingAvdhesh ChauhanNo ratings yet

- BTS Accounting Firm Trial Balance December 31, 2014Document4 pagesBTS Accounting Firm Trial Balance December 31, 2014Trisha AlaNo ratings yet

- Cfa CalculatorDocument33 pagesCfa CalculatorTanvir Ahmed Syed100% (2)

- FRP FinalDocument88 pagesFRP Finalgeeta44No ratings yet

- Inverstor'S Protection in Stock Markert: A Role of Sebi.Document7 pagesInverstor'S Protection in Stock Markert: A Role of Sebi.nikhilaNo ratings yet

- Credit Control Methods of RBI or Quantitative and Qualitative Measures of RBIDocument2 pagesCredit Control Methods of RBI or Quantitative and Qualitative Measures of RBItulasinad123100% (7)

- Differences Between Islamic BanksDocument4 pagesDifferences Between Islamic BanksFatima AliNo ratings yet

- Banking Law - Law Relating To Dishonour of Cheques in India: An Analysis of Section 138 of The Negotiable Instruments ActDocument37 pagesBanking Law - Law Relating To Dishonour of Cheques in India: An Analysis of Section 138 of The Negotiable Instruments ActKashyap Kumar NaikNo ratings yet

- Valuation 1Document29 pagesValuation 1Rohan SaxenaNo ratings yet

- A Basic Primer Relative To Managed Buy/Sell Trade Programs: MT 799, MT 999 AND MT 199 Bank Swift MessagesDocument4 pagesA Basic Primer Relative To Managed Buy/Sell Trade Programs: MT 799, MT 999 AND MT 199 Bank Swift MessagesMuhammad AffendiNo ratings yet

- Session Readings (Euro Issues)Document8 pagesSession Readings (Euro Issues)Arathi SundarramNo ratings yet

- Equitable Pci V FernandezDocument10 pagesEquitable Pci V Fernandezrgtan3No ratings yet

- SBI Equity Savings Fund - Presentation PDFDocument23 pagesSBI Equity Savings Fund - Presentation PDFPankaj RastogiNo ratings yet

- Cipla-I 4/4/2018 13:45 565.55 NEUTRAL 567.34 Cnxit-I 4/4/2018 12:30 12620 SELL MODE 12634.93Document8 pagesCipla-I 4/4/2018 13:45 565.55 NEUTRAL 567.34 Cnxit-I 4/4/2018 12:30 12620 SELL MODE 12634.93dewanibipinNo ratings yet

- St. Mary's ICSE School First Assessment Mathematics Class: X (One Hour and A Half) Marks: 50Document3 pagesSt. Mary's ICSE School First Assessment Mathematics Class: X (One Hour and A Half) Marks: 50lilyNo ratings yet

- Agreement: Golden Hills Subdivision, Herein Represented By: Liza R. Molinar, ofDocument3 pagesAgreement: Golden Hills Subdivision, Herein Represented By: Liza R. Molinar, ofJoyceCollantesNo ratings yet

- Ub 0630 09 30 2022Document2 pagesUb 0630 09 30 2022Kc CapacioNo ratings yet

- BarQuestions2BGrp2 PDFDocument44 pagesBarQuestions2BGrp2 PDFfullpizzaNo ratings yet

- Financial ServicesDocument9 pagesFinancial ServicesPratik Rambhia100% (1)

- Document UploadDocument6 pagesDocument UploadJulius Martinez0% (1)

- Temenos Enterprise ArchitectureDocument46 pagesTemenos Enterprise ArchitectureSanjay Rana100% (1)

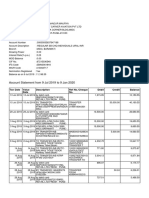

- Account Statement From 9 Jul 2019 To 9 Jan 2020: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument4 pagesAccount Statement From 9 Jul 2019 To 9 Jan 2020: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalancemauryapiaeNo ratings yet

- Tufs BookletDocument274 pagesTufs Booklettiwariparvesh100% (1)