Professional Documents

Culture Documents

Customer Pan Card Form

Uploaded by

Vishu JoshiOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Customer Pan Card Form

Uploaded by

Vishu JoshiCopyright:

Available Formats

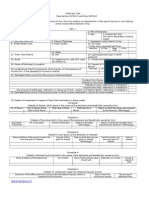

Customer Number- 504979-PUN Pan Card NumberFORM NO.

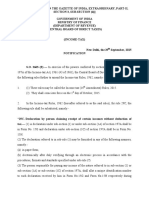

15H [See rule 29C(1A)] Declaration under sub-section (1C) of section 197A of the Income-tax Act, 1961, to be made by an individual who is of the age of sixty-five years or more claiming certain receipts without deduction of tax

I,

Mrs. Maitra Bhalchandra Joshi Mr. Bhalchandra Janardhan Joshi

resident of

*son/ daughter/ wife of 46, Aundh Road, 11 Triveni Kunj, Khadki, Pune - 411 020.

@ do hereby declare-

1. *that the shares/securities/sums, particulars of which are given in the Schedule below, stand in my name and are beneficially owned by me, and the dividend/interest in respect of such *securities/sums and/or income in respect of units is/are not includible in the total income of any other person under sections 60 to 64 of the Income-tax Act, 1961; OR *that the particulars of my account under the National Savings Scheme and the amount of withdrawal are as per the Schedule below:

SCHEDULE

Description and details of investment Amount invested Date of *investment/opening of account Estimated income to be received

2. that that my present occupation is House Wife ; 3. that I am of the age of 64 years and am entitled to a deduction from the amount of income-tax on my total income referred to in section 88B; 4. that the tax on my estimated total income, including *income/incomes referred to in the Schedule below computed in accordance with the provisions of the Income-tax Act, 1961, for the previous year ending on relevant to the assessment year 2010-2011 will be nil; 5. that I have not been assessed to income-tax at any time in the past but I fall within the jurisdiction of the Chief Commissioner of Income-tax Pune or Commissioner of Income-tax OR that I was last assessed to income-tax for the assessment year by the Assessing Officer Circle/Ward and the Permanent Account Number allotted to me is ; 6. that I *am/am not resident in India within the meaning of section 6 of the Income-tax Act, 1961;

Signature of the declarant

Verification

I Mrs. Maitra Bhalchandra Joshi do hereby declare that to the best of my knowledge and belief what is stated above is correct, complete and is truly stated. Verified today, the day of

Place

Pune Source: www.taxguru.in

Signature of the declarant

Source: www.taxguru.in

Notes : 1. @ Give complete postal address. 2. The declaration should be furnished in duplicate. 3. *Delete whichever is not applicable. 4. Before signing the verification, the declarant should satisfy himself that the information furnished in the declaration is true, correct and complete in all respects. Any person making a false statement in the declaration shall be liable to prosecution under section 277 of the Income-tax Act, 1961, and on conviction be punishable(i) in a case where tax sought to be evaded exceeds one lakh rupees, with rigorous imprisonment which shall not be less than six months but which may extend to seven years and with fine; (ii) in any other case, with rigorous imprisonment which shall not be less than three months but which may extend to three years and with fine.

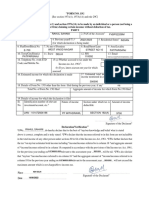

PART II [FOR USE BY THE PERSON TO WHOM THE DECLARATION IS FURNISHED]

1. Name and address of the person responsible for paying the income, mentioned in paragraph 1 of the declaration 2. Date on which the declaration was furnished by the declarant 3. Date of *declaration, distribution or payment of dividend/withdrawal from account number under the National Savings Scheme. 4. Period in respect of which *dividend has been declared/interest is being credited or paid/income in respect of units is being credited or paid 5. Amount of *dividend/interest or income in respect of units/withdrawal from National Saving Scheme Account 6. *Rate at which interest or income in respect of units, as the case may be, is credited/paid Forwarded to the Chief Commissioner or Commissioner of Income-tax,

Place Date

Signature of the person responsible for paying the income referred to in Paragraph 1

Source: www.taxguru.in

You might also like

- The Real Book of Real Estate - Robert KiyosakiDocument513 pagesThe Real Book of Real Estate - Robert Kiyosakiroti0071558100% (3)

- Trading Wti and Brent 101Document7 pagesTrading Wti and Brent 101venkateswarant0% (1)

- Innocent Spouse Relief: How You May Not Have To Pay Your Taxes!From EverandInnocent Spouse Relief: How You May Not Have To Pay Your Taxes!No ratings yet

- Energy Utility BillDocument3 pagesEnergy Utility Billbob100% (1)

- 1040 Exam Prep Module III: Items Excluded from Gross IncomeFrom Everand1040 Exam Prep Module III: Items Excluded from Gross IncomeRating: 1 out of 5 stars1/5 (1)

- 100 Best Businesses FreeDocument34 pages100 Best Businesses Freemally4dNo ratings yet

- Data Book ElectronicsDocument86 pagesData Book ElectronicsplaywithmanojNo ratings yet

- Basic Electronics TutorialsDocument39 pagesBasic Electronics TutorialsDedi PurwantoNo ratings yet

- 1040 Exam Prep: Module I: The Form 1040 FormulaFrom Everand1040 Exam Prep: Module I: The Form 1040 FormulaRating: 1 out of 5 stars1/5 (3)

- IT Business Plan Chapter SummaryDocument35 pagesIT Business Plan Chapter SummaryKap DemonNo ratings yet

- 1040 Exam Prep: Module II - Basic Tax ConceptsFrom Everand1040 Exam Prep: Module II - Basic Tax ConceptsRating: 1.5 out of 5 stars1.5/5 (2)

- Trust and CommitmentDocument11 pagesTrust and CommitmentdjumekenziNo ratings yet

- Bar Review Companion: Taxation: Anvil Law Books Series, #4From EverandBar Review Companion: Taxation: Anvil Law Books Series, #4No ratings yet

- International Human Resource ManagementDocument42 pagesInternational Human Resource Managementnazmulsiad200767% (3)

- EMI in Power SuppliesDocument16 pagesEMI in Power SuppliesHansraj AkilNo ratings yet

- Maharashtra Blacklisted Engineering CollegesDocument3 pagesMaharashtra Blacklisted Engineering CollegesAICTENo ratings yet

- Product Portfolio ManagementDocument4 pagesProduct Portfolio ManagementAna Maria Spasovska100% (1)

- Insurance CompaniesDocument59 pagesInsurance CompaniesParag PenkerNo ratings yet

- Sap BookDocument445 pagesSap BookSai ChivukulaNo ratings yet

- Mind Clutter WorksheetDocument7 pagesMind Clutter WorksheetlisaNo ratings yet

- Eir January2018Document1,071 pagesEir January2018AbhishekNo ratings yet

- An Example ITIL Based Model For Effective Service Integration and ManagementDocument30 pagesAn Example ITIL Based Model For Effective Service Integration and ManagementSudhanshu Sinha100% (3)

- Form 15G/15H detailsDocument7 pagesForm 15G/15H detailsKartikey RanaNo ratings yet

- Senior Citizen Tax FormDocument3 pagesSenior Citizen Tax FormRajanNo ratings yet

- 15G FormDocument2 pages15G Formsurendar147No ratings yet

- "Form No. 15H (See Section 197A (1C) and Rule 29C (1A) ) Declaration Under Section 197A (1C) of The Income of Sixty Years or More Claiming Certain Receipts Without Deduction of TaxDocument3 pages"Form No. 15H (See Section 197A (1C) and Rule 29C (1A) ) Declaration Under Section 197A (1C) of The Income of Sixty Years or More Claiming Certain Receipts Without Deduction of TaxRajanNo ratings yet

- New Form 15H For Fixed Deposits Editable in PDFDocument2 pagesNew Form 15H For Fixed Deposits Editable in PDFMutual Funds Advisor ANANDARAMAN 944-529-6519No ratings yet

- VTL Employee Income Tax DeclarationDocument2 pagesVTL Employee Income Tax DeclarationtanilshuklaNo ratings yet

- Brahm DattDocument16 pagesBrahm DattAditya KhampariaNo ratings yet

- Form 15G TDS waiverDocument2 pagesForm 15G TDS waiverPalaniappan Meyyappan83% (6)

- GTCPhase4 - Terms N ConditionDocument28 pagesGTCPhase4 - Terms N ConditionMitraNo ratings yet

- OBC Bank Form - 15H PDFDocument2 pagesOBC Bank Form - 15H PDFKrishnan Vaidyanathan100% (1)

- Form No 15HDocument3 pagesForm No 15HsaymtrNo ratings yet

- PDF 4Document3 pagesPDF 47ola007No ratings yet

- New Form 15G Form 15H PDFDocument6 pagesNew Form 15G Form 15H PDFdevender143No ratings yet

- 15 G Form (Pre-Filled)Document8 pages15 G Form (Pre-Filled)pankaj_electricalNo ratings yet

- New FORM 15H Applicable PY 2016-17Document2 pagesNew FORM 15H Applicable PY 2016-17addsingh100% (1)

- FORM 15G DECLARATIONDocument3 pagesFORM 15G DECLARATIONulhas_nakasheNo ratings yet

- Form No 15G 3Document1 pageForm No 15G 3MKNo ratings yet

- 15h Form (1) - CompressedDocument4 pages15h Form (1) - Compressedrekha safarirNo ratings yet

- FORM 15G DECLARATIONDocument2 pagesFORM 15G DECLARATIONgrover.jatinNo ratings yet

- Sno Questions / FAQ / Answers/Clarifications ReferenceDocument5 pagesSno Questions / FAQ / Answers/Clarifications ReferenceElvisPresliiNo ratings yet

- Form No. 15H: Part - IDocument2 pagesForm No. 15H: Part - Itoton33No ratings yet

- Auditor's Report for Charitable TrustDocument10 pagesAuditor's Report for Charitable TrustcachandhiranNo ratings yet

- Form 15 HDocument2 pagesForm 15 Hsingh ramanpreetNo ratings yet

- L13LLB183031Document29 pagesL13LLB183031Debasis MisraNo ratings yet

- Unit 5Document43 pagesUnit 5sujal mundhraNo ratings yet

- PAN No.Document5 pagesPAN No.haldharkNo ratings yet

- TourDocument4 pagesTourAnup SahNo ratings yet

- Form 15GDocument2 pagesForm 15GSrinivasa RaghavanNo ratings yet

- Form15h GH01389401 PDFDocument3 pagesForm15h GH01389401 PDFNamme KyarakhahaiNo ratings yet

- Form No.15hDocument2 pagesForm No.15hAmit BhatiNo ratings yet

- Form No.10bDocument4 pagesForm No.10bKeith RobbinsNo ratings yet

- Instruction ITR1 Sahaj 2018Document8 pagesInstruction ITR1 Sahaj 2018MadNo ratings yet

- "Form No. 15GDocument2 pages"Form No. 15GJayvin ShiluNo ratings yet

- PressreleaseDocument1 pagePressreleaseVIKASNo ratings yet

- Administrative Provisions For Individual Income TaxDocument20 pagesAdministrative Provisions For Individual Income Taxramosolaarni0No ratings yet

- 15 G Form (Blank)Document2 pages15 G Form (Blank)nst27No ratings yet

- TAX SAVING Form 15g Revised1 SBTDocument2 pagesTAX SAVING Form 15g Revised1 SBTrkssNo ratings yet

- Annual Information Return of Creditable Income Taxes WithheldDocument2 pagesAnnual Information Return of Creditable Income Taxes WithheldAngela ArleneNo ratings yet

- Icici Form 15GDocument2 pagesIcici Form 15Grajanikant_singhNo ratings yet

- SaharaRefundFormEnglish PDFDocument2 pagesSaharaRefundFormEnglish PDFPrashantUpadhyayNo ratings yet

- CENTURION UNIVERSITY GSTDocument32 pagesCENTURION UNIVERSITY GSTBANANI DASNo ratings yet

- 1902 For Employee'sDocument8 pages1902 For Employee'sbirtaxinfoNo ratings yet

- Epf Joint Declaration - RajeshDocument3 pagesEpf Joint Declaration - Rajeshravikoriveda123No ratings yet

- GST Invoice Guide - When & How to Raise in All ScenariosDocument6 pagesGST Invoice Guide - When & How to Raise in All ScenariosRabin DebnathNo ratings yet

- Form 15H Declaration for Senior CitizensDocument4 pagesForm 15H Declaration for Senior CitizensraviNo ratings yet

- Form No. 15G: Signature of The DeclarantDocument2 pagesForm No. 15G: Signature of The DeclarantNineFinancialNo ratings yet

- FORM 15G DECLARATIONDocument2 pagesFORM 15G DECLARATIONRahul SahaniNo ratings yet

- Income TaxDocument11 pagesIncome Taxvikas_thNo ratings yet

- Project InfoDocument3 pagesProject Infodevki10No ratings yet

- KEY CHANGES FOR ITR FILING FOR AY 2015-16Document2 pagesKEY CHANGES FOR ITR FILING FOR AY 2015-16JimitNo ratings yet

- Declaration For InvestmentsDocument6 pagesDeclaration For InvestmentsAnonymous EkFiHy0QoNo ratings yet

- "Form No. 15H: Printed From WWW - Incometaxindia.gov - in Page 1 of 2Document2 pages"Form No. 15H: Printed From WWW - Incometaxindia.gov - in Page 1 of 2teniyaNo ratings yet

- Component Details PDFDocument37 pagesComponent Details PDFVishu Joshi88% (8)

- Antibiotics PDFDocument8 pagesAntibiotics PDFVishu JoshiNo ratings yet

- LG 32LN5300 PDFDocument43 pagesLG 32LN5300 PDFAldo TonatoNo ratings yet

- Conducted EMI Issues in A Boost PFC Design: L. Rossetto S. Buso, G.SpiazziDocument8 pagesConducted EMI Issues in A Boost PFC Design: L. Rossetto S. Buso, G.SpiazziVishu JoshiNo ratings yet

- Power Supply For LCD TVDocument23 pagesPower Supply For LCD TVNGHONGOCNo ratings yet

- Stmicro LCD Backlight ADocument24 pagesStmicro LCD Backlight AAndres Alegria100% (2)

- Sharp Service ManualDocument74 pagesSharp Service ManualTurlough MakubikaNo ratings yet

- mc74vhc1gt66 On PDFDocument10 pagesmc74vhc1gt66 On PDFVishu JoshiNo ratings yet

- Form 29Document1 pageForm 29jacobpulikodenNo ratings yet

- Jiuzhou dtt1609 Service Manual PDFDocument44 pagesJiuzhou dtt1609 Service Manual PDFVishu JoshiNo ratings yet

- Conducted EMI Issues in A Boost PFC Design: L. Rossetto S. Buso, G.SpiazziDocument8 pagesConducted EMI Issues in A Boost PFC Design: L. Rossetto S. Buso, G.SpiazziVishu JoshiNo ratings yet

- How To Renew&Flush Ip & DNS ConfigDocument1 pageHow To Renew&Flush Ip & DNS ConfigVishu JoshiNo ratings yet

- Learn Complete Accounting and Taxation in TallyDocument37 pagesLearn Complete Accounting and Taxation in TallyPeter joseph SinhaNo ratings yet

- Currency Configuration StepsDocument1 pageCurrency Configuration StepsVishu JoshiNo ratings yet

- Recurring Document TemplateDocument3 pagesRecurring Document TemplateVishu JoshiNo ratings yet

- DunningDocument4 pagesDunningVishu JoshiNo ratings yet

- Sap CoDocument14 pagesSap CoVishu JoshiNo ratings yet

- TcodesDocument13 pagesTcodesVishu JoshiNo ratings yet

- Developing Lean CultureDocument80 pagesDeveloping Lean CultureJasper 郭森源No ratings yet

- RSHDP WB Fin Mannual 13 MayDocument31 pagesRSHDP WB Fin Mannual 13 MaysombansNo ratings yet

- Valuation of Colgate-PalmoliveDocument9 pagesValuation of Colgate-PalmoliveMichael JohnsonNo ratings yet

- 2012 CCG Indonesia Latest Eg Id 050874Document111 pages2012 CCG Indonesia Latest Eg Id 050874kenwongwmNo ratings yet

- Ahold Decathlon Air Liquide Role of The SubsidiariesDocument2 pagesAhold Decathlon Air Liquide Role of The SubsidiariesKai BonsaksenNo ratings yet

- Chapter 1 - An Overview of Accounting Information SystemDocument62 pagesChapter 1 - An Overview of Accounting Information SystemMei Chun TanNo ratings yet

- Clause 35 30062010Document8 pagesClause 35 30062010Dharmesh KothariNo ratings yet

- What Is Microsoft Word Used For?Document3 pagesWhat Is Microsoft Word Used For?Mahmood AliNo ratings yet

- 21 Cost Volume Profit AnalysisDocument31 pages21 Cost Volume Profit AnalysisBillal Hossain ShamimNo ratings yet

- Powell 3543Document355 pagesPowell 3543Ricardo CaffeNo ratings yet

- The Silver Crisis of 1980Document310 pagesThe Silver Crisis of 1980roanrNo ratings yet

- Business Practices of CommunitiesDocument11 pagesBusiness Practices of CommunitiesKanishk VermaNo ratings yet

- PGTRB Commerce Unit 3 Study Material English MediumDocument20 pagesPGTRB Commerce Unit 3 Study Material English MediumAnithaNo ratings yet

- Handout On TakeoversDocument3 pagesHandout On TakeoversSarvesh KamichettyNo ratings yet

- Unit 3 E-CommerceDocument49 pagesUnit 3 E-Commerceanon_733630181No ratings yet

- Mcpe ProgramDocument6 pagesMcpe ProgramdoparindeNo ratings yet

- Word On The Street-Starting Business-Support-PackDocument3 pagesWord On The Street-Starting Business-Support-PackЕлена ХасьяноваNo ratings yet