Professional Documents

Culture Documents

IFRS in India

Uploaded by

Anil ChauhanCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

IFRS in India

Uploaded by

Anil ChauhanCopyright:

Available Formats

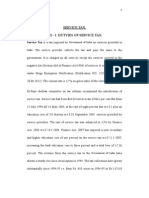

Conversion Roadmap

Preliminary Study

Evaluate IFRS and

Indian GAAP

Diferences

Information

Requirement

Planning

Process Analysis

Develop Change

Strategy

Solution Design,

Build & test

Securitay & Controls

Manage the change

Team Training

User Procedures & Training

Program Management

Change Management

Information Technology frm

u

p

d

a

t

e

d

a

s

o

n

A

p

r

i

l

2

0

1

3

ASA

Systems

Integration Testing

Cutover Planning

Broad Based Assessment

of IFRS Impact

Custom Code Interfaces, Extensions

Evaluating and

Selecting IFRS

Accounting Policies

Creating IFRS

Financial Statements

during the DUAL

Reporting period.

Platform For

Regular Updates

From IASB

Infrastructure

Management

Development

Management

Proper

Reconciliation To

ensure Correctness

Update SOPs

C

o

m

m

u

n

i

c

a

t

i

o

n

New Delhi

Tel : +91 11 4100 9999

Fax : +91 11 4100 9990

Ahmedabad

Tel : +91 79 2657 4985

Fax : +91 79 2657 4986

Bengaluru

Tel : +91 80 4151 0751

Fax : +91 80 4113 5109

Chennai

Tel : +91 44 4904 8200

Fax : +91 44 4904 8222

Gurgaon

Tel : +91 124 4949 350

Fax : +91 124 4949 351

Hyderabad

Tel : +91 40 2776 0423

Kochi

Tel : +91 484 410 9999

Fax : +91 484 410 9990

Mumbai

Tel : +91 22 4921 4000

Fax : +91 22 4921 4099

Contact : info@asa.in

National Afliates

Chandigarh, Kolkata, Pune

International Afliates

Australia, Austria, Belgium, Canada, China, Denmark, Egypt, France, Finland,

Germany, Hongkong, Hungary, Indonesia, Ireland, Israel, Italy, Japan, Luxembourg,

Malaysia, Mauritius, Myanmar, Netherlands, Norway, Philippines, Poland, Portugal,

Russia, South Korea, Singapore, Slovenia, Spain, Switzerland, Sweden, Thailand,

Turkey, UAE, UK, USA, Vietnam

* This document has been prepared as a service to the clients. We recommend that you seek professional

advice prior to initiating action on specifc issues.

K

n

o

w

l

e

d

g

e

M

a

n

a

g

e

m

e

n

t

Initial Conversion Integrate Implement

Prepared by ASA & Associates LLP, chartered accountants, under guidance of

Corporate Catalyst India Pvt. Ltd. (A joint venture with SCS Global)

IFRS >>

India

www.asa.in

ASA & Associates (a partnership frm) converted into ASA & Associates LLP

(a Limited Liability Partnership with LLP Identifcation No. AAB-7688) with efect from September 16, 2013

1. Why IFRS

International Financial Reporting Standards (IFRS) convergence, in recent

years, has gained momentum all over the world. As the capital markets

become increasingly global in nature, more and more investors see the

need for a common set of accounting standards.

India being one of the key global players, migration to IFRS will enable

Indian entities to have access to international capital markets without

having to go through the cumbersome conversion and fling process. It will

lower the cost of raising funds, reduce accountants fees and enable faster

access to all major capital markets. Furthermore, it will facilitate companies

to set targets and milestones based on a global business environment

rather than an inward perspective.

Furthermore, convergence to IFRS, by various group entities, will enable

management to bring all components of the group into a single fnancial

reporting platform. This will eliminate the need for multiple reports and

signifcant adjustment for preparing consolidated fnancial statements or

fling fnancial statements in diferent stock exchanges.

2. How the world is converging into IFRS

IFRS is used in many parts of the world, including the European Union,

Hong Kong, Australia, Malaysia, Pakistan, GCC countries, Russia, South

Africa, Singapore and Turkey. As in December 2011 more than 110 countries

around the world, including all of Europe, currently require or permit IFRS

reporting. Approximately 85 of those countries require IFRS reporting for all

domestic listed companies.

3. India and IFRS

In India, there will be two set of Accounting Standards

1.The existing Indian Accounting Standards (IAS) will be applicable to all

companies which are not required to adopt IFRS converged standards.

2. Indian Accounting Standards, as converged with IFRS (Ind-AS) will be

applicable to companies operating in India in phased manner. The date of

implementation of the Ind-AS is yet to be notifed.

There are conceptual diferences between IAS and IFRS. Keeping in view the

extent of gap between IAS, Ind-AS and the corresponding IFRSs conversion

process would need careful handling. By introducing a new company law,

the Indian Government has initiated the process to amend the legal and

regulatory framework.

The conversion would involve, Impact Assessment, Revisiting Accounting

Policies and thereafter changing the Accounting & Operational Systems

(including ERP) in order to be fully compliant with Ind - AS or IFRS.

5. Corporate Impacted by IFRS in India

In the initial phase, the large entities are expected to adopt Ind-AS

The large entities might be:

- Public Listed Companies forming part of Stock Exchange Index

- All companies above a particular level of net worth.

- Indian subsidiary of foreign companies, if so required by the parent

company for consolidation purpose.

6. Some Key Challenges to Implementation

a) Amendments in the Law

IFRS will have a bearing on the legal provisions as are presently set

out in the Indian Income Tax Act, Companies Act, etc.

b) Impact on fnancial results

Financial reports will experience a lot of changes. For example

treatmentofdepreciation difers. Hence, the value of assets as well

the proftability of the organization may swing, which, in turn, may

impact the net worth.

c) User awareness and training

Many people are yet not aware of IFRS, their complexities and impact.

A change in the reporting format will require awareness of these

new norms and systems, training and education, both for the

professional as well the user.

7. ASA - Your Partner in Change

ASA has established a center of excellence for IFRS. The team includes

chartered accountants certifed in IFRS. We are fully geared to provide the

following services

a) Training (3-5 days): We have both general and industry specifc

training modules on IFRS. Our certifed trainers would help your

users to understand the IFRS and its key diferences with IAS.

b) Impact Analysis (3-6 weeks): Our detailed checklist helps to

determine the impact of conversion on diferent stakeholders of the

company viz. promoters, investors, shareholders, regulators, etc.

c) Conversion (3-4 months): We would take the company through

the process of conversion including changes to accounting/opera

tional systems). We follow template based approach in order to fast

track the process of conversion, besides coordinating the conversion

activities with the concerned IT vendor.

d) Accounting Support: The conversion process would lead to

additional work in relation to accounting or reconciliation. We could

provide appropriate staf to close the gap.

ASA has contributed in many seminars and conferences, and has

arranged client specifc workshops as regards the various aspects of

IFRS conversion. Being a member of NIS Global, an international

association of independent accounting frms, we are able to bring to

bear experience of other member frms in Europe, Japan etc which

assisted their clients to undergo the process of IFRS conversion.

Timeline for Convergence (major countries)

Europe,UK

(2005)

Canada

(2011)

USA

(2016)

Japan

(2016)

India

(yet to be notifed)

Basis IFRS IAS

Principle vs

Rule based

standards

Principle based. Economic sub-

stance of the transaction is the

prime evaluation factor.

Generally rule based. Compa-

nies act and rules dominate

and guide as to

how a transaction is recorded.

Standards vs

Local laws

Accounting standards take

precedence over local laws.

Local regulations usually take

precedence while preparing fi-

nancial statements. Whenever

there is between law

standard, the law prevails.

Presentation

of financial

statements

Primarily, no prescribed format.

Assets and liabilities need to be

divided into

current and non-current.

Companies Act and other

industry regulations have

defined prescribed

formats.

Depreciation

on

fixed assets

Depreciation is an annual charge

on basis of estimated life of

assets.

Minimum depreciation

rates have been prescribed

in Schedule XIV of the Indian

Companys Act.

Cash flow

statements

Mandatory. Any of the direct or

indirect method can be used.

Mandatory for some. Direct

method for insurance compa-

nies and indirect method for

other listed companies.

Change in

accounting

policy and

estimates

Comparatives are restated

unless specifically exempted

where the effect of period(s) not

presented is adjusted against

opening retained earnings.

The effect of change is in-

cluded in current year income

statement. The impact of the

change is disclosed.

Valuations Provides specific guidance and

standards to deal with mergers,

acquisitions, take over, amalga-

mations etc specifically as regards

to valuation

Positions taken under IAS are

debatable.

Adoption

methodology`

IFRS 1 spells out the methodology

and systems to be adopted for

first time adoption of IFRS. IFRS

specifies the financial reporting

in hyper inflationary economies.

Also has a specific standard

for retirement benefit plans,

agriculture, insurance contracts

and disclosure of financial

instruments.

More traditional and insu-

lated from changing economic

scenario. A more historical

perspective.

1. Why IFRS

International Financial Reporting Standards (IFRS) convergence, in recent

years, has gained momentum all over the world. As the capital markets

become increasingly global in nature, more and more investors see the

need for a common set of accounting standards.

India being one of the key global players, migration to IFRS will enable

Indian entities to have access to international capital markets without

having to go through the cumbersome conversion and fling process. It will

lower the cost of raising funds, reduce accountants fees and enable faster

access to all major capital markets. Furthermore, it will facilitate companies

to set targets and milestones based on a global business environment

rather than an inward perspective.

Furthermore, convergence to IFRS, by various group entities, will enable

management to bring all components of the group into a single fnancial

reporting platform. This will eliminate the need for multiple reports and

signifcant adjustment for preparing consolidated fnancial statements or

fling fnancial statements in diferent stock exchanges.

2. How the world is converging into IFRS

IFRS is used in many parts of the world, including the European Union,

Hong Kong, Australia, Malaysia, Pakistan, GCC countries, Russia, South

Africa, Singapore and Turkey. As in December 2011 more than 110 countries

around the world, including all of Europe, currently require or permit IFRS

reporting. Approximately 85 of those countries require IFRS reporting for all

domestic listed companies.

3. India and IFRS

In India, there will be two set of Accounting Standards

1.The existing Indian Accounting Standards (IAS) will be applicable to all

companies which are not required to adopt IFRS converged standards.

2. Indian Accounting Standards, as converged with IFRS (Ind-AS) will be

applicable to companies operating in India in phased manner. The date of

implementation of the Ind-AS is yet to be notifed.

There are conceptual diferences between IAS and IFRS. Keeping in view the

extent of gap between IAS, Ind-AS and the corresponding IFRSs conversion

process would need careful handling. By introducing a new company law,

the Indian Government has initiated the process to amend the legal and

regulatory framework.

The conversion would involve, Impact Assessment, Revisiting Accounting

Policies and thereafter changing the Accounting & Operational Systems

(including ERP) in order to be fully compliant with Ind - AS or IFRS.

5. Corporate Impacted by IFRS in India

In the initial phase, the large entities are expected to adopt Ind-AS

The large entities might be:

- Public Listed Companies forming part of Stock Exchange Index

- All companies above a particular level of net worth.

- Indian subsidiary of foreign companies, if so required by the parent

company for consolidation purpose.

6. Some Key Challenges to Implementation

a) Amendments in the Law

IFRS will have a bearing on the legal provisions as are presently set

out in the Indian Income Tax Act, Companies Act, etc.

b) Impact on fnancial results

Financial reports will experience a lot of changes. For example

treatmentofdepreciation difers. Hence, the value of assets as well

the proftability of the organization may swing, which, in turn, may

impact the net worth.

c) User awareness and training

Many people are yet not aware of IFRS, their complexities and impact.

A change in the reporting format will require awareness of these

new norms and systems, training and education, both for the

professional as well the user.

7. ASA - Your Partner in Change

ASA has established a center of excellence for IFRS. The team includes

chartered accountants certifed in IFRS. We are fully geared to provide the

following services

a) Training (3-5 days): We have both general and industry specifc

training modules on IFRS. Our certifed trainers would help your

users to understand the IFRS and its key diferences with IAS.

b) Impact Analysis (3-6 weeks): Our detailed checklist helps to

determine the impact of conversion on diferent stakeholders of the

company viz. promoters, investors, shareholders, regulators, etc.

c) Conversion (3-4 months): We would take the company through

the process of conversion including changes to accounting/opera

tional systems). We follow template based approach in order to fast

track the process of conversion, besides coordinating the conversion

activities with the concerned IT vendor.

d) Accounting Support: The conversion process would lead to

additional work in relation to accounting or reconciliation. We could

provide appropriate staf to close the gap.

ASA has contributed in many seminars and conferences, and has

arranged client specifc workshops as regards the various aspects of

IFRS conversion. Being a member of NIS Global, an international

association of independent accounting frms, we are able to bring to

bear experience of other member frms in Europe, Japan etc which

assisted their clients to undergo the process of IFRS conversion.

Timeline for Convergence (major countries)

Europe,UK

(2005)

Canada

(2011)

USA

(2016)

Japan

(2016)

India

(yet to be notifed)

Basis IFRS IAS

Principle vs

Rule based

standards

Principle based. Economic sub-

stance of the transaction is the

prime evaluation factor.

Generally rule based. Compa-

nies act and rules dominate

and guide as to

how a transaction is recorded.

Standards vs

Local laws

Accounting standards take

precedence over local laws.

Local regulations usually take

precedence while preparing fi-

nancial statements. Whenever

there is between law

standard, the law prevails.

Presentation

of financial

statements

Primarily, no prescribed format.

Assets and liabilities need to be

divided into

current and non-current.

Companies Act and other

industry regulations have

defined prescribed

formats.

Depreciation

on

fixed assets

Depreciation is an annual charge

on basis of estimated life of

assets.

Minimum depreciation

rates have been prescribed

in Schedule XIV of the Indian

Companys Act.

Cash flow

statements

Mandatory. Any of the direct or

indirect method can be used.

Mandatory for some. Direct

method for insurance compa-

nies and indirect method for

other listed companies.

Change in

accounting

policy and

estimates

Comparatives are restated

unless specifically exempted

where the effect of period(s) not

presented is adjusted against

opening retained earnings.

The effect of change is in-

cluded in current year income

statement. The impact of the

change is disclosed.

Valuations Provides specific guidance and

standards to deal with mergers,

acquisitions, take over, amalga-

mations etc specifically as regards

to valuation

Positions taken under IAS are

debatable.

Adoption

methodology`

IFRS 1 spells out the methodology

and systems to be adopted for

first time adoption of IFRS. IFRS

specifies the financial reporting

in hyper inflationary economies.

Also has a specific standard

for retirement benefit plans,

agriculture, insurance contracts

and disclosure of financial

instruments.

More traditional and insu-

lated from changing economic

scenario. A more historical

perspective.

1. Why IFRS

International Financial Reporting Standards (IFRS) convergence, in recent

years, has gained momentum all over the world. As the capital markets

become increasingly global in nature, more and more investors see the

need for a common set of accounting standards.

India being one of the key global players, migration to IFRS will enable

Indian entities to have access to international capital markets without

having to go through the cumbersome conversion and fling process. It will

lower the cost of raising funds, reduce accountants fees and enable faster

access to all major capital markets. Furthermore, it will facilitate companies

to set targets and milestones based on a global business environment

rather than an inward perspective.

Furthermore, convergence to IFRS, by various group entities, will enable

management to bring all components of the group into a single fnancial

reporting platform. This will eliminate the need for multiple reports and

signifcant adjustment for preparing consolidated fnancial statements or

fling fnancial statements in diferent stock exchanges.

2. How the world is converging into IFRS

IFRS is used in many parts of the world, including the European Union,

Hong Kong, Australia, Malaysia, Pakistan, GCC countries, Russia, South

Africa, Singapore and Turkey. As in December 2011 more than 110 countries

around the world, including all of Europe, currently require or permit IFRS

reporting. Approximately 85 of those countries require IFRS reporting for all

domestic listed companies.

3. India and IFRS

In India, there will be two set of Accounting Standards

1.The existing Indian Accounting Standards (IAS) will be applicable to all

companies which are not required to adopt IFRS converged standards.

2. Indian Accounting Standards, as converged with IFRS (Ind-AS) will be

applicable to companies operating in India in phased manner. The date of

implementation of the Ind-AS is yet to be notifed.

There are conceptual diferences between IAS and IFRS. Keeping in view the

extent of gap between IAS, Ind-AS and the corresponding IFRSs conversion

process would need careful handling. By introducing a new company law,

the Indian Government has initiated the process to amend the legal and

regulatory framework.

The conversion would involve, Impact Assessment, Revisiting Accounting

Policies and thereafter changing the Accounting & Operational Systems

(including ERP) in order to be fully compliant with Ind - AS or IFRS.

5. Corporate Impacted by IFRS in India

In the initial phase, the large entities are expected to adopt Ind-AS

The large entities might be:

- Public Listed Companies forming part of Stock Exchange Index

- All companies above a particular level of net worth.

- Indian subsidiary of foreign companies, if so required by the parent

company for consolidation purpose.

6. Some Key Challenges to Implementation

a) Amendments in the Law

IFRS will have a bearing on the legal provisions as are presently set

out in the Indian Income Tax Act, Companies Act, etc.

b) Impact on fnancial results

Financial reports will experience a lot of changes. For example

treatmentofdepreciation difers. Hence, the value of assets as well

the proftability of the organization may swing, which, in turn, may

impact the net worth.

c) User awareness and training

Many people are yet not aware of IFRS, their complexities and impact.

A change in the reporting format will require awareness of these

new norms and systems, training and education, both for the

professional as well the user.

7. ASA - Your Partner in Change

ASA has established a center of excellence for IFRS. The team includes

chartered accountants certifed in IFRS. We are fully geared to provide the

following services

a) Training (3-5 days): We have both general and industry specifc

training modules on IFRS. Our certifed trainers would help your

users to understand the IFRS and its key diferences with IAS.

b) Impact Analysis (3-6 weeks): Our detailed checklist helps to

determine the impact of conversion on diferent stakeholders of the

company viz. promoters, investors, shareholders, regulators, etc.

c) Conversion (3-4 months): We would take the company through

the process of conversion including changes to accounting/opera

tional systems). We follow template based approach in order to fast

track the process of conversion, besides coordinating the conversion

activities with the concerned IT vendor.

d) Accounting Support: The conversion process would lead to

additional work in relation to accounting or reconciliation. We could

provide appropriate staf to close the gap.

ASA has contributed in many seminars and conferences, and has

arranged client specifc workshops as regards the various aspects of

IFRS conversion. Being a member of NIS Global, an international

association of independent accounting frms, we are able to bring to

bear experience of other member frms in Europe, Japan etc which

assisted their clients to undergo the process of IFRS conversion.

Timeline for Convergence (major countries)

Europe,UK

(2005)

Canada

(2011)

USA

(2016)

Japan

(2016)

India

(yet to be notifed)

Basis IFRS IAS

Principle vs

Rule based

standards

Principle based. Economic sub-

stance of the transaction is the

prime evaluation factor.

Generally rule based. Compa-

nies act and rules dominate

and guide as to

how a transaction is recorded.

Standards vs

Local laws

Accounting standards take

precedence over local laws.

Local regulations usually take

precedence while preparing fi-

nancial statements. Whenever

there is between law

standard, the law prevails.

Presentation

of financial

statements

Primarily, no prescribed format.

Assets and liabilities need to be

divided into

current and non-current.

Companies Act and other

industry regulations have

defined prescribed

formats.

Depreciation

on

fixed assets

Depreciation is an annual charge

on basis of estimated life of

assets.

Minimum depreciation

rates have been prescribed

in Schedule XIV of the Indian

Companys Act.

Cash flow

statements

Mandatory. Any of the direct or

indirect method can be used.

Mandatory for some. Direct

method for insurance compa-

nies and indirect method for

other listed companies.

Change in

accounting

policy and

estimates

Comparatives are restated

unless specifically exempted

where the effect of period(s) not

presented is adjusted against

opening retained earnings.

The effect of change is in-

cluded in current year income

statement. The impact of the

change is disclosed.

Valuations Provides specific guidance and

standards to deal with mergers,

acquisitions, take over, amalga-

mations etc specifically as regards

to valuation

Positions taken under IAS are

debatable.

Adoption

methodology`

IFRS 1 spells out the methodology

and systems to be adopted for

first time adoption of IFRS. IFRS

specifies the financial reporting

in hyper inflationary economies.

Also has a specific standard

for retirement benefit plans,

agriculture, insurance contracts

and disclosure of financial

instruments.

More traditional and insu-

lated from changing economic

scenario. A more historical

perspective.

Conversion Roadmap

Preliminary Study

Evaluate IFRS and

Indian GAAP

Diferences

Information

Requirement

Planning

Process Analysis

Develop Change

Strategy

Solution Design,

Build & test

Securitay & Controls

Manage the change

Team Training

User Procedures & Training

Program Management

Change Management

Information Technology frm

u

p

d

a

t

e

d

a

s

o

n

A

p

r

i

l

2

0

1

3

ASA

Systems

Integration Testing

Cutover Planning

Broad Based Assessment

of IFRS Impact

Custom Code Interfaces, Extensions

Evaluating and

Selecting IFRS

Accounting Policies

Creating IFRS

Financial Statements

during the DUAL

Reporting period.

Platform For

Regular Updates

From IASB

Infrastructure

Management

Development

Management

Proper

Reconciliation To

ensure Correctness

Update SOPs

C

o

m

m

u

n

i

c

a

t

i

o

n

New Delhi

Tel : +91 11 4100 9999

Fax : +91 11 4100 9990

Ahmedabad

Tel : +91 79 2657 4985

Fax : +91 79 2657 4986

Bengaluru

Tel : +91 80 4151 0751

Fax : +91 80 4113 5109

Chennai

Tel : +91 44 4904 8200

Fax : +91 44 4904 8222

Gurgaon

Tel : +91 124 4949 350

Fax : +91 124 4949 351

Hyderabad

Tel : +91 40 2776 0423

Kochi

Tel : +91 484 410 9999

Fax : +91 484 410 9990

Mumbai

Tel : +91 22 4921 4000

Fax : +91 22 4921 4099

Contact : info@asa.in

National Afliates

Chandigarh, Kolkata, Pune

International Afliates

Australia, Austria, Belgium, Canada, China, Denmark, Egypt, France, Finland,

Germany, Hongkong, Hungary, Indonesia, Ireland, Israel, Italy, Japan, Luxembourg,

Malaysia, Mauritius, Myanmar, Netherlands, Norway, Philippines, Poland, Portugal,

Russia, South Korea, Singapore, Slovenia, Spain, Switzerland, Sweden, Thailand,

Turkey, UAE, UK, USA, Vietnam

* This document has been prepared as a service to the clients. We recommend that you seek professional

advice prior to initiating action on specifc issues.

K

n

o

w

l

e

d

g

e

M

a

n

a

g

e

m

e

n

t

Initial Conversion Integrate Implement

Prepared by ASA & Associates LLP, chartered accountants, under guidance of

Corporate Catalyst India Pvt. Ltd. (A joint venture with SCS Global)

IFRS >>

India

www.asa.in

ASA & Associates (a partnership frm) converted into ASA & Associates LLP

(a Limited Liability Partnership with LLP Identifcation No. AAB-7688) with efect from September 16, 2013

Conversion Roadmap

Preliminary Study

Evaluate IFRS and

Indian GAAP

Diferences

Information

Requirement

Planning

Process Analysis

Develop Change

Strategy

Solution Design,

Build & test

Securitay & Controls

Manage the change

Team Training

User Procedures & Training

Program Management

Change Management

Information Technology frm

u

p

d

a

t

e

d

a

s

o

n

A

p

r

i

l

2

0

1

3

ASA

Systems

Integration Testing

Cutover Planning

Broad Based Assessment

of IFRS Impact

Custom Code Interfaces, Extensions

Evaluating and

Selecting IFRS

Accounting Policies

Creating IFRS

Financial Statements

during the DUAL

Reporting period.

Platform For

Regular Updates

From IASB

Infrastructure

Management

Development

Management

Proper

Reconciliation To

ensure Correctness

Update SOPs

C

o

m

m

u

n

i

c

a

t

i

o

n

New Delhi

Tel : +91 11 4100 9999

Fax : +91 11 4100 9990

Ahmedabad

Tel : +91 79 2657 4985

Fax : +91 79 2657 4986

Bengaluru

Tel : +91 80 4151 0751

Fax : +91 80 4113 5109

Chennai

Tel : +91 44 4904 8200

Fax : +91 44 4904 8222

Gurgaon

Tel : +91 124 4949 350

Fax : +91 124 4949 351

Hyderabad

Tel : +91 40 2776 0423

Kochi

Tel : +91 484 410 9999

Fax : +91 484 410 9990

Mumbai

Tel : +91 22 4921 4000

Fax : +91 22 4921 4099

Contact : info@asa.in

National Afliates

Chandigarh, Kolkata, Pune

International Afliates

Australia, Austria, Belgium, Canada, China, Denmark, Egypt, France, Finland,

Germany, Hongkong, Hungary, Indonesia, Ireland, Israel, Italy, Japan, Luxembourg,

Malaysia, Mauritius, Myanmar, Netherlands, Norway, Philippines, Poland, Portugal,

Russia, South Korea, Singapore, Slovenia, Spain, Switzerland, Sweden, Thailand,

Turkey, UAE, UK, USA, Vietnam

* This document has been prepared as a service to the clients. We recommend that you seek professional

advice prior to initiating action on specifc issues.

K

n

o

w

l

e

d

g

e

M

a

n

a

g

e

m

e

n

t

Initial Conversion Integrate Implement

Prepared by ASA & Associates LLP, chartered accountants, under guidance of

Corporate Catalyst India Pvt. Ltd. (A joint venture with SCS Global)

IFRS >>

India

www.asa.in

ASA & Associates (a partnership frm) converted into ASA & Associates LLP

(a Limited Liability Partnership with LLP Identifcation No. AAB-7688) with efect from September 16, 2013

You might also like

- IFRS Simplified: A fast and easy-to-understand overview of the new International Financial Reporting StandardsFrom EverandIFRS Simplified: A fast and easy-to-understand overview of the new International Financial Reporting StandardsRating: 4 out of 5 stars4/5 (11)

- IFRS in India: A GuideDocument6 pagesIFRS in India: A GuidePuneesh SachdevaNo ratings yet

- Comparison of Ind As and IFRSDocument10 pagesComparison of Ind As and IFRSAman SinghNo ratings yet

- 1478-8225-Aftermaths of IFRS CCCDocument25 pages1478-8225-Aftermaths of IFRS CCCsincereboy5No ratings yet

- Benchmarking Best Practices for Maintenance, Reliability and Asset ManagementFrom EverandBenchmarking Best Practices for Maintenance, Reliability and Asset ManagementNo ratings yet

- Benefits Associated With Implementation of IFRSDocument8 pagesBenefits Associated With Implementation of IFRSchinkijsrNo ratings yet

- Understanding Accounting Standards and IFRSDocument22 pagesUnderstanding Accounting Standards and IFRSdodiyavijay25691No ratings yet

- International Financial Reporting Standards (Ifrs) : Presented By, Siva Priyanka Vamshidhar Reddy Manasa ReddyDocument16 pagesInternational Financial Reporting Standards (Ifrs) : Presented By, Siva Priyanka Vamshidhar Reddy Manasa ReddyVamshidhar ReddyNo ratings yet

- Achieving IFRS Compliance (US)Document20 pagesAchieving IFRS Compliance (US)Vikas AroraNo ratings yet

- What is IFRS? International accounting standards explainedDocument8 pagesWhat is IFRS? International accounting standards explainedRagvi BaluNo ratings yet

- November 2014 1476528409 42Document3 pagesNovember 2014 1476528409 42worldrespectshorts01No ratings yet

- Final Assignment 505Document36 pagesFinal Assignment 505PRINCESS PlayZNo ratings yet

- Ifrs Literature ReviewDocument4 pagesIfrs Literature ReviewAsfawosen DingamaNo ratings yet

- Project Report Implementation of IFRS in India Hopes & ChallengesDocument18 pagesProject Report Implementation of IFRS in India Hopes & ChallengesKhyatiNo ratings yet

- IFRS Global Reporting StandardsDocument12 pagesIFRS Global Reporting StandardsArpit JainNo ratings yet

- IFRSDocument14 pagesIFRSNishchay Dhingra100% (1)

- Assignment - Ankit Singh BBA (P) 2Document19 pagesAssignment - Ankit Singh BBA (P) 2Rahul SinghNo ratings yet

- Covergence of Ifrs With Indian GaapDocument15 pagesCovergence of Ifrs With Indian GaappripandeyNo ratings yet

- Ifrs in India 2009 - 2011 Time For TransitionDocument27 pagesIfrs in India 2009 - 2011 Time For TransitionDharmesh ChanchlaniNo ratings yet

- International Financial Reporting Standards (IFRS) : Compiled By: Yogesh Bhanushali Internal Guidance: Dr. Shama ShahDocument22 pagesInternational Financial Reporting Standards (IFRS) : Compiled By: Yogesh Bhanushali Internal Guidance: Dr. Shama ShahYogesh BhanushaliNo ratings yet

- Ifrs PDFDocument6 pagesIfrs PDFkeenu23No ratings yet

- Indian Accounting Standard: (1) To Provide Information: The Main Objectives of Accounting Standards Is To ProvideDocument8 pagesIndian Accounting Standard: (1) To Provide Information: The Main Objectives of Accounting Standards Is To ProvideAkrutNo ratings yet

- IFRS.BhamineeDocument4 pagesIFRS.BhamineeBhaminee patelNo ratings yet

- IFRS-Basic Principles, Assumptions, Importance, Advantages and DisadvantagesDocument32 pagesIFRS-Basic Principles, Assumptions, Importance, Advantages and DisadvantagesPRINCESS PlayZNo ratings yet

- Research Papers On Indian Accounting StandardsDocument4 pagesResearch Papers On Indian Accounting Standardsefdwvgt4100% (1)

- ch6 IFRSDocument56 pagesch6 IFRSAnonymous 6aW7sZWdILNo ratings yet

- Oracle IfrsDocument36 pagesOracle IfrsAdnan RiazNo ratings yet

- IFRS Convergence Are You On TrackDocument12 pagesIFRS Convergence Are You On TrackHEMALA A/P VEERASINGAM MoeNo ratings yet

- IFRS For Power UtilitiesDocument14 pagesIFRS For Power Utilitiesmittaldivya167889No ratings yet

- IFRSDocument26 pagesIFRSSuchetana Anthony50% (2)

- Gaap Vs IfrsDocument7 pagesGaap Vs IfrsAshutosh SharmaNo ratings yet

- Reading Advance AccountingDocument10 pagesReading Advance AccountingMohammadali MominNo ratings yet

- Adopting IFRS in India for Global CompetitivenessDocument2 pagesAdopting IFRS in India for Global CompetitivenessSahana ShivakumarNo ratings yet

- Literature Review On Ifrs in IndiaDocument7 pagesLiterature Review On Ifrs in Indiaafmzxppzpvoluf100% (1)

- Ifrs ANISH MODIDocument7 pagesIfrs ANISH MODIanishmodi667No ratings yet

- IFRS Adoption in Nigeria - Tax ImplicationsDocument33 pagesIFRS Adoption in Nigeria - Tax ImplicationsEjiemen OkunegaNo ratings yet

- IFRS Conversion ServicesDocument2 pagesIFRS Conversion ServicesParas MittalNo ratings yet

- The Path To IFRS Conversion:: Considerations For The Banking and Capital Markets IndustryDocument20 pagesThe Path To IFRS Conversion:: Considerations For The Banking and Capital Markets IndustryHemali PathakNo ratings yet

- Adv. Accountancy Paper-1Document5 pagesAdv. Accountancy Paper-1Avadhut PaymalleNo ratings yet

- IFRS and The Adoption of IFRS in VietnamDocument2 pagesIFRS and The Adoption of IFRS in VietnamBui AnNo ratings yet

- An Analysis of Impact of Transition From Igaap To Ind-As: R. Yogesh Dr. R. AmudhaDocument11 pagesAn Analysis of Impact of Transition From Igaap To Ind-As: R. Yogesh Dr. R. AmudhaPreethi NaiduNo ratings yet

- Ifrs 1 First Time Adoption of Ifrss: BackgroundDocument3 pagesIfrs 1 First Time Adoption of Ifrss: Backgroundmusic niNo ratings yet

- A Project Report ON: Ifrs (International Financial Reporting Standards) & Its Convergence in IndiaDocument80 pagesA Project Report ON: Ifrs (International Financial Reporting Standards) & Its Convergence in IndialalsinghNo ratings yet

- IFRS Convergence in India ProjectDocument32 pagesIFRS Convergence in India ProjectVimal GogriNo ratings yet

- Final Report SHANKARDocument105 pagesFinal Report SHANKARchinkijsrNo ratings yet

- Background of IfrsDocument2 pagesBackground of IfrsShelze Consulting100% (1)

- KPMG IFRS Notes IndAS PDFDocument13 pagesKPMG IFRS Notes IndAS PDFJagadish ChaudharyNo ratings yet

- Relevance of International Financial Rep PDFDocument11 pagesRelevance of International Financial Rep PDFRavi NNo ratings yet

- IFRS in TourismDocument17 pagesIFRS in TourismSODDEYNo ratings yet

- International Financial Reporting Standard1Document6 pagesInternational Financial Reporting Standard1Ashish PatelNo ratings yet

- Thesis On Ifrs For SmesDocument7 pagesThesis On Ifrs For Smesjennyalexanderboston100% (2)

- A Critical Review of The Fairness and Transparency of The Due Process of Accounting Standard SettingDocument5 pagesA Critical Review of The Fairness and Transparency of The Due Process of Accounting Standard SettingRidawati LimpuNo ratings yet

- Financial StatementsDocument6 pagesFinancial StatementsCrissa BernarteNo ratings yet

- Introduction To IFRS 15 and SAP Revenue Accounting and ReportingDocument31 pagesIntroduction To IFRS 15 and SAP Revenue Accounting and ReportingkrishnakishoregaddamNo ratings yet

- AAU February 2015Document28 pagesAAU February 2015RakeshkargwalNo ratings yet

- Accounting Standard-1 and Its Legal Implications in The Corporate WorldDocument32 pagesAccounting Standard-1 and Its Legal Implications in The Corporate Worldlove_djNo ratings yet

- What Is IFRSDocument5 pagesWhat Is IFRSRR Triani ANo ratings yet

- 56 Ifrs e yDocument40 pages56 Ifrs e ybhupathiNo ratings yet

- Urban Farm Business PlanDocument77 pagesUrban Farm Business PlanZartosht Matthijs100% (11)

- Business Plan On Food Vending in Finland PDFDocument65 pagesBusiness Plan On Food Vending in Finland PDFAnil ChauhanNo ratings yet

- M/S. Sunil Tour and Travels Mr. Sunil Nebulal Chauhan: Statement of Total IncomeDocument8 pagesM/S. Sunil Tour and Travels Mr. Sunil Nebulal Chauhan: Statement of Total IncomeAnil ChauhanNo ratings yet

- A A1471e PDFDocument108 pagesA A1471e PDFAnil ChauhanNo ratings yet

- Bank statement request letter templateDocument1 pageBank statement request letter templateAnil ChauhanNo ratings yet

- Advantages of Joint Family System Include Equitable Economy, Care for All MembersDocument2 pagesAdvantages of Joint Family System Include Equitable Economy, Care for All MembersAnil ChauhanNo ratings yet

- New Microsoft Office Word DocumentDocument1 pageNew Microsoft Office Word DocumentAnil ChauhanNo ratings yet

- Book 1Document10 pagesBook 1Anil ChauhanNo ratings yet

- Experiment No 3 DWTTDocument10 pagesExperiment No 3 DWTTAnil ChauhanNo ratings yet

- ReambbmbdmeDocument1 pageReambbmbdmeNibedanPalNo ratings yet

- Advantages of Joint Family System Include Equitable Economy, Care for All MembersDocument2 pagesAdvantages of Joint Family System Include Equitable Economy, Care for All MembersAnil ChauhanNo ratings yet

- Flow ChatDocument1 pageFlow ChatAnil ChauhanNo ratings yet

- Goa TourismDocument11 pagesGoa TourismAnil ChauhanNo ratings yet

- The Recycling of Paper Has Become Increasingly Important Over The Past DecadeDocument2 pagesThe Recycling of Paper Has Become Increasingly Important Over The Past DecadeAnil ChauhanNo ratings yet

- AbhishekDocument1 pageAbhishekAnil ChauhanNo ratings yet

- What Is The Role of The SecretaryDocument3 pagesWhat Is The Role of The SecretaryAnil ChauhanNo ratings yet

- Index & First 4 Pages of AfmDocument4 pagesIndex & First 4 Pages of AfmAnil ChauhanNo ratings yet

- Goa TourismDocument11 pagesGoa TourismAnil ChauhanNo ratings yet

- Paper RecyclingDocument1 pagePaper RecyclingAnil ChauhanNo ratings yet

- The Importance of Recycling PaperDocument1 pageThe Importance of Recycling PaperAnil ChauhanNo ratings yet

- The Recycling of Paper Has Become Increasingly Important Over The Past DecadeDocument2 pagesThe Recycling of Paper Has Become Increasingly Important Over The Past DecadeAnil ChauhanNo ratings yet

- Books of Account To Be Kept by A CompanyDocument8 pagesBooks of Account To Be Kept by A CompanyAnil ChauhanNo ratings yet

- Final of Service TaxDocument36 pagesFinal of Service TaxAnil ChauhanNo ratings yet

- Municipal Solutions for Eco-Efficient Recyclables ManagementDocument1 pageMunicipal Solutions for Eco-Efficient Recyclables ManagementAnil ChauhanNo ratings yet

- Born: January 23, 1897 Died: August 18, 1945 Achievements: Passed Indian Civil Services Exam Elected CongressDocument1 pageBorn: January 23, 1897 Died: August 18, 1945 Achievements: Passed Indian Civil Services Exam Elected CongressAnil ChauhanNo ratings yet

- Preparation of Balance Sheet and Profit and Loss Account: TotalDocument7 pagesPreparation of Balance Sheet and Profit and Loss Account: TotalAnil ChauhanNo ratings yet

- A Good Argument To Halt Human Advancement in Technology Is That If We Continue Creating Technologies and Researching Sciences To ReDocument1 pageA Good Argument To Halt Human Advancement in Technology Is That If We Continue Creating Technologies and Researching Sciences To ReAnil ChauhanNo ratings yet

- Index & First 4 Pages of AfmDocument4 pagesIndex & First 4 Pages of AfmAnil ChauhanNo ratings yet

- Form 12 Print PDFDocument4 pagesForm 12 Print PDFKrishna YeldiNo ratings yet

- Final of AFMDocument34 pagesFinal of AFMAnil ChauhanNo ratings yet

- Benefits Of Bank Mergers And AcquisitionsDocument15 pagesBenefits Of Bank Mergers And AcquisitionsSantosh kumar sahooNo ratings yet

- Client Backgrounder Apa Format 1 1 2Document6 pagesClient Backgrounder Apa Format 1 1 2api-479314637No ratings yet

- Commercial Law Golden NotesDocument390 pagesCommercial Law Golden NotesAnnie Mendes100% (6)

- 03 - Task - Performance - 1 (15) Business TaxationDocument4 pages03 - Task - Performance - 1 (15) Business TaxationAries Christian S PadillaNo ratings yet

- Test Excel v2.1Document923 pagesTest Excel v2.1Andrada ArdeleanNo ratings yet

- Case Study On Sahara Scam Background ofDocument5 pagesCase Study On Sahara Scam Background ofHira Ejaz Ahmed ShaikhNo ratings yet

- Chapter 1 Intermediate 1Document58 pagesChapter 1 Intermediate 1Rez Judiel Aramigo AnchetaNo ratings yet

- Voltas: Sub: Annual Report 2018-19Document2 pagesVoltas: Sub: Annual Report 2018-19ravi shankarNo ratings yet

- Corporate Law AssignmentDocument15 pagesCorporate Law Assignmentsandeep Gurjar100% (1)

- Paper 3 - Advanced Financial Management ObjectiveDocument2 pagesPaper 3 - Advanced Financial Management ObjectiveindhumathigNo ratings yet

- HP CEO Leo Apotheker - Biography and HP Fast FactsDocument1 pageHP CEO Leo Apotheker - Biography and HP Fast FactsHewlett-Packard100% (2)

- Starting a Limited Company GuideDocument32 pagesStarting a Limited Company GuideSam VeeversNo ratings yet

- Remote Codes ApacDocument12 pagesRemote Codes ApacSriram RajappaNo ratings yet

- Ust Inc Case SolutionDocument16 pagesUst Inc Case SolutionJamshaid Mannan100% (2)

- Merger Acquisition Joint VentureDocument10 pagesMerger Acquisition Joint VentureMuazzam BilalNo ratings yet

- Review Test Submission - Lecture 6 - Online Assignment - ..Document6 pagesReview Test Submission - Lecture 6 - Online Assignment - ..RishabhNo ratings yet

- CORPORATION REVIEWER VillanuevaDocument142 pagesCORPORATION REVIEWER Villanuevabobbys88No ratings yet

- S2P Competitive LandscapeDocument27 pagesS2P Competitive LandscapepruthveyNo ratings yet

- Hindalco Novelis CaseDocument13 pagesHindalco Novelis Casekushal90100% (1)

- BCSV5.2 - Organization and FormationDocument9 pagesBCSV5.2 - Organization and Formationjam linganNo ratings yet

- Difference Between A Private LTD and Public LTDDocument4 pagesDifference Between A Private LTD and Public LTDShoaib Shaik0% (1)

- Placement 2021Document16 pagesPlacement 2021Physics loverNo ratings yet

- CDBLDocument5 pagesCDBLsmg_dreamNo ratings yet

- Vodafone IdeaDocument49 pagesVodafone IdeaAarshita Trivedi100% (2)

- CSRExpenditure DetailsDocument158 pagesCSRExpenditure DetailsVinay GoyalNo ratings yet

- Founders Forum 2020Document17 pagesFounders Forum 2020CodyNo ratings yet

- Engel, Louis & Boyd, Brendan - How To Buy StocksDocument364 pagesEngel, Louis & Boyd, Brendan - How To Buy StocksJoao Vicente Oliveira100% (2)

- Autoliv AB Standalone Financial StatementsDocument243 pagesAutoliv AB Standalone Financial StatementsVicky SinhaNo ratings yet

- Article On Capital MaintenanceDocument9 pagesArticle On Capital MaintenanceSamish Dhakal100% (1)

- GROUP REPORTING 1: Concepts and Context: Related Assignment Materials Illustrations Problems Other AssignmentsDocument12 pagesGROUP REPORTING 1: Concepts and Context: Related Assignment Materials Illustrations Problems Other AssignmentsThuỷ TiênnNo ratings yet