Professional Documents

Culture Documents

Interim Report Q4 2012 Eng

Uploaded by

yamisen_kenOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Interim Report Q4 2012 Eng

Uploaded by

yamisen_kenCopyright:

Available Formats

Fortum Corporation January-December 2012 The Interim Statement is based on the audited 2012 Financial Statements approved by the

Board of Directors on 30 January 2013.

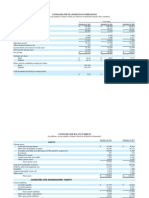

Condensed consolidated income statement

Q4 2012 Q4 2011

EUR million

Note

2012

2011

Sales Other income Materials and services Employee benefits Depreciation, amortisation and impairment charges Other expenses Comparable operating profit Items affecting comparability Operating profit Share of profit/loss of associates and joint ventures Interest expense Interest income Fair value gains and losses on financial instruments Other financial expenses - net Finance costs - net Profit before income tax Income tax expense Profit for the period

4,9,10

4, 11

1,834 46 -732 -147 -175 -239 587 32 619 -5 -72 13 -7 -10 -76 538 123 661

1,667 40 -659 -142 -155 -243 508 71 579 19 -78 13 7 -8 -66 532 -88 444

6,159 109 -2,548 -556 -664 -761 1,739 122 1,861 21 -300 54 -23 -38 -307 1,575 -72 1,503

6,161 91 -2,566 -529 -606 -749 1,802 600 2,402 91 -284 56 5 -42 -265 2,228 -366 1,862

Attributable to: Owners of the parent Non-controlling interests

603 58 661

421 23 444

1,409 94 1,503

1,769 93 1,862

Earnings per share (in per share) Basic Diluted

0.68 0.68

0.47 0.47

1.59 1.59

1.99 1.99

EUR million

Q4 2012

Q4 2011

2012

2011

Comparable operating profit Non-recurring items (capital gains and losses) Changes in fair values of derivatives hedging future cash flow Nuclear fund adjustment Items affecting comparability Operating profit

587 33 6 -7 32 619

508 9 72 -10 71 579

1,739 155 -2 -31 122 1,861

1,802 284 344 -28 600 2,402

30

Fortum Corporation January-December 2012

Condensed consolidated statement of comprehensive income

Q4 2012 Q4 2011

EUR million

2012

2011

Profit for the period Other comprehensive income Cash flow hedges Fair value gains/losses in the period Transfers to income statement Transfers to inventory/fixed assets Tax effect Net investment hedges Fair value gains/losses in the period Tax effect Available for sale financial assets Fair value changes in the period Exchange differences on translating foreign operations Share of other comprehensive income of associates Other changes Other comprehensive income for the period, net of tax Total comprehensive income for the year Total comprehensive income attributable to Owners of the parent Non-controlling interests

661

444

1,503

1,862

-24 -24 -1 10 0 0 0 -26 -12 0 -77 584

106 81 -7 -46 0 0 0 166 2 -3 299 743

15 -152 -5 33 0 0 0 207 -23 0 75 1,578

299 480 -23 -195 2 0 -1 -75 2 3 492 2,354

533 51 584

697 46 743

1,466 112 1,578

2,255 99 2,354

31

Fortum Corporation January-December 2012

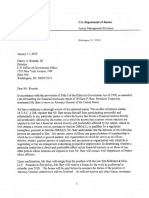

Condensed consolidated balance sheet

EUR million

Note

Dec 31 2012

Dec 31 2011

ASSETS Non-current assets Intangible assets Property, plant and equipment Participations in associates and joint ventures Share in State Nuclear Waste Management Fund Pension assets Other non-current assets Deferred tax assets Derivative financial instruments Long-term interest-bearing receivables Total non-current assets Current assets Inventories Derivative financial instruments Trade and other receivables Cash and cash equivalents Assets held for sale 1) Total current assets Total assets EQUITY Equity attributable to owners of the parent Share capital Share premium Retained earnings Other equity components Total Non-controlling interests Total equity LIABILITIES Non-current liabilities Interest-bearing liabilities Derivative financial instruments Deferred tax liabilities Nuclear provisions Other provisions Pension obligations Other non-current liabilities Total non-current liabilities Current liabilities Interest-bearing liabilities Derivative financial instruments Trade and other payables Liabilities related to assets held for sale Total current liabilities Total liabilities Total equity and liabilities

1)

9 10 4, 11 13

442 16,497 2,019 678 54 71 148 451 1,384 21,744

433 15,234 2,019 653 60 69 150 396 1,196 20,210

5 12 6

428 223 1,270 963 2,884 24,628

528 326 1,020 731 183 2,788 22,998

3,046 73 7,013 73 10,205 616 10,821

3,046 73 6,318 195 9,632 529 10,161

12 5 13 14

7,699 182 1,893 678 207 27 472 11,158

6,845 192 2,013 653 205 26 465 10,399

12 5 6

1,078 264 1,307 2,649 13,807 24,628

925 219 1,265 29 2,438 12,837 22,998

Assets held for sale as of 31 December 2011 includes cash balances of EUR 16 million.

32

Fortum Corporation January-December 2012

Condensed consolidated statement of changes in total equity

Share Share capital premium Retained earnings Other equity components Owners Nonof the controlling parent interests Total equity

Retained Translation earnings of foreign and other operations funds

Cash flow hedges

Other OCI OCI items items associated companies

EUR million

Total equity 31 December 2011 Net profit for the period Translation differences Other comprehensive income Total comprehensive income for the period Cash dividend Dividends to non-controlling interests Changes due to business combinations Other Total equity 31 December 2012 Total equity 31 December 2010 Net profit for the period Translation differences Other comprehensive income Total comprehensive income for the period Cash dividend Dividends to non-controlling interests Changes due to business combinations Other Total equity 31 December 2011

3,046

73

6,670 1,409

-352 179

136 4 -106 -102

-2

61 3 -23 -20

1,409 -888

179

9,632 1,409 186 -129 1,466 -888 0 0 -5 10,205 8,210 1,769 -74 560 2,255 -888 0 52 3 9,632

529 94 21 -3 112

10,161 1,503 207 -132 1,578 -888 -26 2 -6 10,821 8,742 1,862 -74 566 2,354 -888 -21 -29 3 10,161

3,046 3,046

73 73

-5 7,186 5,726 1,769 6 1,775 -888

-173 -278 -74 -74

34 -419

-2 0

41 62

-26 2 -1 616 532 93 6 99

555 555

-1 -1

3,046

73

54 3 6,670

-2 -352 136 -2 61

-21 -81 529

Translation differences Translation differences impacted equity attributable to owners of the parent company with EUR 186 million during 2012 (2011: -74) mainly relating to RUB, SEK and NOK amounting to EUR 173 million in 2012 (2011: -63). Translation of financial information from subsidiaries in foreign currency is done using average rate for the income statement and end rate for the balance sheet. The exchange rate differences occurring from translation to EUR are booked to equity. For information regarding exchange rates used, see Note 7 Exchange rates. Cash flow hedges The impact on equity attributable to owners of the parent from fair valuation of cash flow hedges, EUR -102 million during 2012 (2011: 555), mainly relates to cash flow hedges hedging electricity price for future transactions, where hedge accounting is applied. When electricity price is lower/higher than the hedging price, the impact on equity is positive/negative. Cash dividend The dividend for 2011 was decided at the Annual General Meeting on 11 April 2012. The dividend was paid on 23 April 2012. The dividend for 2010 was decided at the Annual General Meeting on 31 March 2011.

33

Fortum Corporation January-December 2012

Condensed consolidated cash flow statement

Q4 2012 Q4 2011

EUR million

2012

2011

Cash flow from operating activities Net profit for the period Adjustments: Income tax expenses Finance costs-net Share of profit of associates and joint ventures Depreciation, amortisation and impairment charges Operating profit before depreciations (EBITDA) Non-cash flow items and divesting activities Interest received Interest paid Dividends received Realised foreign exchange gains and losses and other financial items Taxes Funds from operations Change in working capital Total net cash from operating activities Cash flow from investing activities Capital expenditures Acquisitions of shares Proceeds from sales of fixed assets Divestments of shares Proceeds from the interest-bearing receivables relating to divestments Shareholder loans to associated companies Change in other interest-bearing receivables Total net cash used in investing activities Cash flow before financing activities Cash flow from financing activities Proceeds from long-term liabilities Payments of long-term liabilities Change in short-term liabilities Dividends paid to the owners of the parent Other financing items Total net cash used in financing activities Total net increase(+) / decrease(-) in cash and cash equivalents Cash and cash equivalents at the beginning of the period Foreign exchange differences in cash and cash equivalents Cash and cash equivalents at the end of the period 1)

1)

661 -123 76 5 175 794 -31 28 -78 0 -37 -17 659 -260 399

444 88 66 -19 155 734 -126 11 -71 0 -26 -32 490 -18 472

1,503 72 307 -21 664 2,525 -181 59 -352 45 -274 -269 1,553 -171 1,382

1,862 366 265 -91 606 3,008 -726 59 -298 108 -245 -394 1,512 101 1,613

-503 -11 4 102 12 -100 6 -490 -91

-421 -18 4 18 0 -63 3 -477 -5

-1,422 -14 13 239 181 -138 13 -1,128 254

-1,285 -62 15 492 89 -109 35 -825 788

10 -123 52 0 -1 -62 -153 1,117 -1 963

0 -60 115 0 4 59 54 685 8 747

1,375 -669 168 -888 -33 -47 207 747 9 963

951 -365 -278 -888 -10 -590 198 556 -7 747

Including cash balances of EUR 16 million relating to assets held for sale as of 31 December 2011.

Non-cash flow items and divesting activities Non-cash flow items and divesting activities mainly consist of adjustments for unrealised fair value changes of derivatives EUR 3 million for 2012 (2011: -358) and capital gains EUR -155 million for 2012 (2011: -285). The actual proceeds for divestments are shown under cash flow from investing activities. Realised foreign exchange gains and losses and other financial items Realised foreign exchange gains and losses EUR -268 million for 2012 (2011: -239) mainly related to financing of Fortum's Swedish subsidiaries and the fact that the Group's main external financing currency is EUR. The foreign exchange gains and losses arise for rollover of foreign exchange contracts hedging the internal loans as major part of these forwards is entered into with short maturities i.e. less than twelve months.

34

Fortum Corporation January-December 2012

Additional cash flow information

Change in working capital

Q4 2012 Q4 2011

EUR million

2012

2011

Change in interest-free receivables, decrease (+)/increase (-) Change in inventories, decrease (+)/increase (-) Change in interest-free liabilities, decrease (-)/increase (+) Total

-505 56 189 -260

-246 -56 284 -18

-226 109 -54 -171

266 -143 -22 101

Negative effect from change in working capital during 2012, EUR -171 million (2011: 101) is mainly due to increase in receivables.

Capital expenditure in cash flow

Q4 2012 Q4 2011

EUR million

2012

2011

Capital expenditure Change in not yet paid investments Capitalised borrowing costs Total

621 -94 -24 503

509 -72 -16 421

1,558 -56 -80 1,422

1,408 -70 -53 1,285

Capital expenditures for intangible assets and property, plant and equipment were EUR 1 558 million (2011: 1 408). Capital expenditure in cash flow EUR 1 422 million (2011: 1 285) is without not yet paid investments i.e. change in trade payables related to investments EUR -56 million (2011: -70) and capitalised borrowing costs EUR -80 million (2011: -53), which are presented in interest paid.

Acquisition of shares in cash flow

Q4 2012 Q4 2011

EUR million

2012

2011

Acquisition of subsidiaries, net of cash acquired Acquisition of associates 1) Acquisition of available for sale financial assets Total

1)

0 10 1 11

1 16 1 18

3 10 1 14

44 16 2 62

Acquisition of associates includes share issues and other capital contributions.

Acquisition of shares in subsidiaries, net of cash acquired

EUR million

Q4 2012

Q4 2011

2012

2011

Gross investments of shares Changes in not yet paid acquisitions Interest bearing debt in acquired subsidiaries Total Acquisition of shares in associates

EUR million

1 0 0 1

5 -2 3

47 -2 -1 44

Q4 2012

Q4 2011

2012

2011

Gross investments of shares Changes in not yet paid acquisitions Total

10 10

9 7 16

10 10

25 -9 16

Divestment of shares in cash flow

Q4 2012 Q4 2011

EUR million

2012

2011

Proceeds from sales of subsidiaries, net of cash disposed Proceeds from sales of associates Proceeds from available for sale financial assets Total

97 4 1 102

5 13 0 18

223 13 3 239

117 375 0 492

Gross divestment of shares totalled EUR 410 million in 2012 (2011: 568) including interest-bearing debt in sold subsidiaries of EUR 181 million (2011: 89), see Note 6. Proceeds from divestments of shares totalled EUR 239 million in 2012 (2011: 492) including EUR 79 million related to divestment of certain heat businesses in Finland and Estonia (Fortum Energiaratkaisut Oy and Fortum Termest AS), EUR 72 million divestment of Fortum Heat Naantali Oy in Finland, EUR 34 million related to divestment of small hydropower plants in Finland and EUR 25 million related to divestment of small hydropower plants in Sweden.

35

Fortum Corporation January-December 2012

Change in net debt

Q4 2012 Q4 2011

EUR million

2012

2011

Net debt beginning of the period Foreign exchange rate differences EBITDA Paid net financial costs, taxes and adjustments for non-cash and divestment items Change in working capital Capital expenditures Acquisitions Divestments Proceeds from the interest-bearing receivables relating to divestments Shareholder loans to associated companies Change in other interest-bearing receivables Dividends Other financing activities Net cash flow (- increase in net debt) Fair value change of bonds, amortised cost valuation and other Net debt end of the period

7,764 -49 794 -135 -260 -503 -11 106 12 -100 6 0 -13 -104 -5 7,814

6,929 97 734 -244 -18 -421 -18 22 0 -63 3 4 -1 -4 7,023

7,023 89 2,525 -972 -171 -1,422 -14 252 181 -138 13 -888 -45 -679 23 7,814

6,826 7 3,008 -1,496 101 -1,285 -62 507 89 -109 35 -888 -10 -110 80 7,023

Key ratios

Dec 31 2012 Sept 30 2012 June 30 March 31 2012 2012 Dec 31 2011 Sept 30 2011 June 30 March 31 2011 2011

EBITDA, EUR million Comparable EBITDA, EUR million Earnings per share (basic), EUR Capital employed, EUR million Interest-bearing net debt, EUR million Capital expenditure and gross investments in shares, EUR million Capital expenditure, EUR million Return on capital employed, % 1) Return on shareholders' equity, % Net debt / EBITDA Comparable net debt / EBITDA 1) Interest coverage Interest coverage including capitalised borrowing costs Funds from operations/interest-bearing net debt, % Gearing, % Equity per share, EUR Equity-to-assets ratio, % Number of employees Average number of employees Average number of shares, 1 000 shares Diluted adjusted average number of shares, 1 000 shares Number of registered shares, 1 000 shares

1)

2,525 2,403 1.59 19,598 7,814

1,731 1,641 0.91 19,120 7,764

1,340 1,253 0.77 17,848 7,420

894 809 0.56 19,016 6,523

3,008 2,374 1.99 17,931 7,023

2,274 1,723 1.52 17,034 6,929

1,813 1,279 1.29 16,998 6,783

1,049 798 0.76 16,560 6,367

1,574 1,558 10.0

942 937 9.0 10.7 3.4 3.5 6.6 5.1 16.4 76 10.89 42 10,584 10,661

566 561 11.2 13.5 2.9 3.0 8.3 6.4 22.7 74 10.66 44 10,848 10,644

218 218 14.5 17.9 2.0 2.0 11.9 9.2 39.1 60 11.65 45 10,542 10,587

1,482 1,408 14.8 19.7 2.3 3.0 10.5 8.5 21.5 69 10.84 44 10,780 11,010

962 899 14.3 19.1 2.4 3.0 11.2 9.1 20.7 74 10.05 44 11,041 11,062

572 533 16.1 22.0 2.2 2.7 14.8 12.0 24.2 72 9.93 44 11,342 11,030

205 167 19.1 26.9 1.8 2.0 19.0 15.1 34.8 72 9.30 39 10,976 10,913

1)

14.3 3.1 3.3 7.5 5.7 19.9 72 11.49 44 10,371 10,600

1)

1)

888,367 888,367 888,367 888,367 888,367 888,367 888,367 888,367 888,367 888,367 888,367 888,367 888,367 888,367 888,367 888,367 888,367 888,367 888,367 888,367 888,367 888,367 888,367 888,367

Quarterly figures are annualised except items affecting comparability. For definitions, see Note 22.

36

Fortum Corporation January-December 2012

Notes to the condensed consolidated interim financial statements

Notes to the condensed consolidated interim financial statements

1. Basis of preparation

The condensed interim financial statements have been prepared in accordance with International Accounting Standard (IAS) 34, Interim Financial Reporting, as adopted by the EU. The condensed interim financial report should be read in conjunction with the annual financial statements for the year ended 31 December 2011.

2. Accounting policies

The same accounting policies and presentation have been followed in these condensed interim financial statements as were applied in the preparation of the consolidated financial statements as at and for the year ended 31 December 2011.

3. Critical accounting estimates and judgements

The preparation of interim financial statements requires management to make judgements, estimates and assumptions that affect the reported amounts of assets and liabilities, income and expense. Actual results may differ from these estimates. In preparing these interim financial statements, the significant judgements made by management in applying the Group's accounting policies and the key sources of estimation uncertainty were the same as those that applied to the consolidated financial statements as at and for the year ended 31 December 2011.

4. Segment information

Sales

EUR million

Q4 2012

Q4 2011

2012

2011

Power sales excluding indirect taxes Heating sales Network transmissions Other sales

Total

991 481 283 79 1,834

907 474 216 70 1,667

3,413 1,501 1,002 243 6,159

3,458 1,602 905 196 6,161

Sales by segment

EUR million

Q4 2012

Q4 2011

2012

2011

Power 1) - of which internal Heat 1) - of which internal Russia - of which internal Distribution - of which internal Electricity Sales 1) - of which internal Other 1) - of which internal Netting of Nord Pool transactions Eliminations Total

1)

2)

719 57 477 6 319 314 12 221 22 41 -1 -161 -96 1,834

654 68 478 6 274 244 4 205 13 32 -5 -134 -86 1,667

2,415 296 1,628 18 1,030 1,070 37 722 55 137 -66 -503 -340 6,159

2,481 -24 1,737 8 920 973 15 900 95 108 115 -749 -209 6,161

Sales, both internal and external, includes effects from realised hedging contracts. Effect on sales can be negative or positive depending on the average contract price and realised spot price. 2) Sales and purchases with Nord Pool Spot is netted on Group level on an hourly basis and posted either as revenue or cost depending on if Fortum is a net seller or net buyer during any particular hour.

Comparable operating profit by segment

EUR million

Q4 2012

Q4 2011

2012

2011

Power Heat Russia Distribution Electricity Sales Other Total

380 93 28 101 9 -24 587

351 96 35 49 2 -25 508

1,144 266 68 317 38 -94 1,739

1,201 278 74 295 27 -73 1,802

37

Fortum Corporation January-December 2012

Notes to the condensed consolidated interim financial statements

Operating profit by segment

EUR million

Q4 2012

Q4 2011

2012

2011

Power Heat Russia Distribution Electricity Sales Other Total

387 118 28 103 5 -22 619

443 100 35 41 -6 -34 579

1,173 339 79 328 38 -96 1,861

1,476 380 74 478 3 -9 2,402

Non-recurring items by segment

EUR million

Q4 2012

Q4 2011

2012

2011

Power Heat Russia Distribution Electricity Sales Other Total

10 23 0 0 0 0 33

0 7 0 0 2 0 9

57 80 11 5 1 1 155

2 86 0 193 3 0 284

During Q1 2012 Power segment sold small hydropower plants in Finland resulting in a gain of EUR 47 million and Heat segment sold certain heat businesses (Fortum Energiaratkaisut Oy and Fortum Termest AS) resulting in a gain of EUR 58 million. In Q2 2012 Russia segment sold heating network assets in Surgut resulting in a gain of EUR 11 million. During Q4 2012 Power segment divested small hydropower plants in Sweden resulting in a gain of EUR 10 million and Heat segment sold its shares in Fortum Heat Naantali Oy to Turun Seudun Maakaasu ja Energiantuotanto Oy (TSME) resulting in a gain of EUR 21 million. In Q1 2011 Heat segment sold its district heat operations and heat production facilities outside the Stockholm area with a gain of EUR 82 million. In Q2 2011 Distribution segment divested its 25% share in Fingrid Oyj with a gain of EUR 192 million.

Other items affecting comparability by segment

Q4 2012 Q4 2011

EUR million

2012

2011

Power Heat Russia Distribution Electricity Sales Other Total

1)

1)

-3 2 0 2 -4 2 -1

-7

92 -3 -8 -10 -9 62

-10

-28 -7 0 6 -1 -3 -33

-31

273 16 -10 -27 64 316

-28

Including effects from the accounting of Fortum's part of the Finnish State Nuclear Waste Management Fund with (EUR million):

Other items affecting comparability mainly include effects from financial derivatives hedging future cash-flows where hedge accounting is not applied according to IAS 39. Other segment includes mainly the effect arising from changes in hedge accounting status on group level. In Power segment there are also effects from the accounting of Fortum's part of the Finnish State Nuclear Waste Management Fund where the asset in the balance sheet cannot exceed the related liabilities according to IFRIC interpretation 5.

Comparable EBITDA by segment

EUR million

Q4 2012

Q4 2011

2012

2011

Power Heat Russia Distribution Electricity Sales Other Total

409 152 57 157 9 -22 762

379 145 50 97 3 -24 650

1,258 476 189 526 39 -85 2,403

1,310 471 148 482 29 -66 2,374

38

Fortum Corporation January-December 2012

Notes to the condensed consolidated interim financial statements

Depreciation, amortisation and impairment charges by segment

EUR million

Q4 2012

Q4 2011

2012

2011

Power Heat Russia Distribution Electricity Sales Other Total

29 59 29 56 0 2 175

28 49 28 48 1 1 155

114 210 121 209 1 9 664

109 193 108 187 2 7 606

Share of profit/loss in associates and joint ventures by segment

EUR million

Q4 2012

Q4 2011

2012

2011

Power 1), 2) Heat Russia Distribution Electricity Sales Other Total

1)

8 8 2 5 0 -28 -5

30 7 -8 3 1 -14 19

-12 20 27 8 0 -22 21

3 19 30 14 2 23 91

Including effects from the accounting of Fortum's associates part of Finnish and Swedish Nuclear Waste Management Funds with (EUR million):

2)

-3

-1

-9

-6

The main part of the associated companies in Power are power production companies from which Fortum purchases produced electricity at production costs including interest costs, production taxes and income taxes.

Participation in associates and joint ventures by segment

EUR million

Dec 31 2012

Dec 31 2011

Power Heat Russia Distribution Electricity Sales Other Total

906 157 476 109 0 371 2,019

921 160 443 101 0 395 2,020

Capital expenditure by segment

EUR million

Q4 2012

Q4 2011

2012

2011

Power Heat Russia Distribution Electricity Sales Other Total Of which capitalised borrowing costs

64 180 257 117 1 2 621 24

48 126 208 120 1 6 509 16

190 464 568 324 1 11 1,558 80

131 297 670 289 5 16 1,408 53

39

Fortum Corporation January-December 2012

Notes to the condensed consolidated interim financial statements

Gross investments in shares by segment

EUR million

Q4 2012

Q4 2011

2012

2011

Power Heat Russia Distribution Electricity Sales Other Total

10 1 11

10 1 11

10 6 16

17 32 24 1 74

Gross divestments in shares by segment

EUR million

Q4 2012

Q4 2011

2012

2011

Power Heat Russia Distribution Electricity Sales Other Total

39 74 0 113

5 -1 -3 10 11

102 269 37 2 0 410

3 203 23 323 16 0 568

See Note 6 and additional cash flow information for more information about the gross divestment in shares in 2012.

Net assets by segment

EUR million

Dec 31 2012

Dec 31 2011

Power Heat Russia Distribution Electricity Sales Other Total

6,454 4,335 3,846 3,911 59 237 18,842

6,247 4,191 3,273 3,589 11 208 17,519

Comparable return on net assets by segment

%

Dec 31 2012

Dec 31 2011

Power Heat Russia Distribution Electricity Sales Other Return on net assets by segment

%

18.2 6.8 2.7 8.7 148.4 -30.9

19.9 7.4 3.5 8.6 33.5 -12.7

Dec 31 2012

Dec 31 2011

Power Heat Russia Distribution Electricity Sales Other

18.4 8.5 3.0 9.0 118.0 -57.6

24.6 9.9 3.5 13.7 4.2 5.3

Return on net assets is calculated by dividing the sum of operating profit and share of profit of associated companies and joint ventures with average net assets. Average net assets are calculated using the opening balance and end of each quarter values.

40

Fortum Corporation January-December 2012

Notes to the condensed consolidated interim financial statements

Assets by segments

EUR million

Dec 31 2012

Dec 31 2011

Power Heat Russia Distribution Electricity Sales Other Eliminations Assets included in Net assets Interest-bearing receivables Deferred taxes Other assets Cash and cash equivalents Total assets Liabilities by segments

EUR million

7,412 4,797 4,309 4,433 293 707 -403 21,548 1,393 148 576 963 24,628

7,134 4,597 3,692 4,187 249 628 -306 20,181 1,219 150 717 731 22,998

Dec 31 2012

Dec 31 2011

Power Heat Russia Distribution Electricity Sales Other Eliminations Liabilities included in Net assets Deferred tax liabilities Other liabilities Total liabilities included in Capital employed Interest-bearing liabilities Total equity Total equity and liabilities

958 462 463 522 234 470 -403 2,706 1,893 431 5,030 8,777 10,821 24,628

887 406 419 598 238 420 -306 2,662 2,013 392 5,067 7,770 10,161 22,998

Other assets and Other liabilities not included in segment's Net assets consists mainly of income tax receivables and liabilities, accrued interest expenses, derivative receivables and liabilities qualifying as hedges and receivables and liabilities for interest rate derivatives. Number of employees

Dec 31 2012 Dec 31 2011

Power Heat Russia Distribution Electricity Sales Other Total Average number of employees

1,846 2,212 4,253 870 509 681 10,371

1,847 2,504 4,379 898 519 633 10,780

2012

2011

Power Heat Russia Distribution Electricity Sales Other Total Average number of employees is based on a monthly average for the whole period in question.

1,896 2,354 4,301 873 515 661 10,600

1,873 2,682 4,436 902 510 607 11,010

41

Fortum Corporation January-December 2012

Notes to the condensed consolidated interim financial statements

5. Financial risk management

The Group has not made any significant changes in policies regarding risk management during the period. Aspects of the Group's financial risk management objectives and policies are consistent with those disclosed in the consolidated financial statements as at and for the year ended 31 December 2011. The tables below disclose the notional values or volumes and net fair values for the Group's derivatives used in different areas mainly for hedging purposes. Derivatives

Dec 31 2012 Interest and currency derivatives Notional value MEUR Net fair value MEUR Notional value MEUR Dec 31 2011 Net fair value MEUR

Interest rate swaps Forward foreign exchange contracts Forward rate agreements Interest rate and currency swaps

6,268 8,671 116 544

201 -159 0 -8

Net fair value MEUR

4,737 8,257 196 247

141 -143 0 1

Net fair value MEUR

Electricity derivatives

Volume TWh

Volume TWh

Sales swaps Purchase swaps Purchased options Written options

90 45 0 2

314 -138 0 1

Net fair value MEUR

95 48 1 1

559 -289 1 1

Net fair value MEUR

Oil derivatives

Volume 1000 bbl

Volume 1000 bbl

Sales swaps and futures Purchase swaps and futures

9,419 9,452

-8 3

Net fair value MEUR

10,000 9,910

-6 4

Net fair value MEUR

Coal derivatives

Volume kt

Volume kt

Sold Bought

8,305 8,390

127 -123

Net fair value MEUR

12,325 11,642

94 -80

Net fair value MEUR

CO2 emission allowance derivatives

Volume ktCO2

Volume ktCO2

Sold Bought

-12,810 14,005

Notional value MEUR

50 -32

Net fair value MEUR

15,283 13,981

Notional value MEUR

89 -59

Net fair value MEUR

Share derivatives

Share forwards 1)

1)

Cash-settled share forwards are used as a hedging instrument for Fortum Group's performance share arrangement.

6. Acquisitions, disposals and assets held for sale

Acquisitions There were no material acquisitions during 2012. The acquisitions of 85% of the shares in the Polish power and heat companies Elektrociepownia Zabrze S.A. and Zesp Elektrociepowni Bytom S.A. was completed in January 2011. Acquisition price for the transaction was EUR 22 million (PLN 82 million). Disposals Disposals for 2012 During Q4 2012 Fortum divested small hydropower plants in Sweden, a minor gain was recognised in the Power Division.

42

Fortum Corporation January-December 2012

Notes to the condensed consolidated interim financial statements

Fortum sold its shares in Fortum Heat Naantali Oy to Turun Seudun Maakaasu ja Energiantuotanto Oy (TSME) in which Fortum has 49.5% interest at 31 December 2012. The total sales price (less liquid funds in the sold company) was approximately EUR 74 million, of which EUR 2 million is unpaid as of 31 December 2012. Fortum's capital gain EUR 21 million was recognised in Heat Division. In connection with the sale Fortum participated in a share issue in TSME with EUR 10 million and gave a shareholder loan to the company amounting to EUR 13 million. Fortum closed its divestment of Fortum Energiaratkaisut Oy and Fortum Termest AS to EQT Infrastructure Fund as of January 31, 2012. The total sales price, including net debt, was approximately EUR 200 million. Fortum's capital gain was EUR 58 million. The assets and liabilities related to the divested operations were presented as assets and liabilities held for sale in December 2011. According to a deal signed with Imatran Seudun Shk on 20 December 2011, Fortum sold Distribution's Estonian subsidiary Fortum Elekter AS to Imatran Seudun Shk. In connection with the agreement, Fortum also sold its ownership in Imatran Seudun Shk Oy. The transaction was completed in the beginning of January, 2012. The assets and liabilities related to the divested operations were presented as assets and liabilities held for sale in December 2011. During Q1 2012 Fortum divested small hydropower plants in Finland with the sale of a 60% share in Killin Voima Oy to KoillisSatakunnan Shk Oy and sale of 14 small hydropower plants in Finland to Koskienergia Oy. Capital gain from these transactions was EUR 47 million booked in the Power Division's first-quarter results. Disposals for 2011 In December 2010 Fortum signed an agreement to divest district heat operations and production facilities outside Stockholm in Sweden. The divestment was completed on 31 March 2011. The total sales price was approximately EUR 220 million and the recognised gain EUR 82 million. The operations were part of the Heat segment and the gain is recognised in Heat segment. Major part of the divested operations were owned by Fortum's subsidiary Fortum Vrme in which the city of Stockholm has a 50% economic interest. Fortum's divestment of 25% shareholding in the Finnish transmission system operator Fingrid was completed on 19 April 2011. See Note 11.

Gross divestments of shares

EUR million

Q4 2012

Q4 2011

2012

2011

Proceeds settled in cash Interest bearing debt in sold subsidiaries Proceeds not yet settled in cash Gross divestments of shares in subsidiaries 1) Gross divestment of associates Gross divestment of available for sale financial assets Total

1)

97 12 2 111 1 1 113

5 -1 4 7 11

223 181 2 406 1 3 410

117 89 206 362 568

Cash and cash equivalents in sold subsidiaries EUR 14 million (2011: 14) are netted from gross divestments.

7. Exchange rates

The balance sheet date rate is based on exchange rate published by the European Central Bank for the closing date. The average exchange rate is calculated as an average of each months ending rate from the European Central Bank during the year and ending rate previous year. Key exchange rates for Fortum Group applied in the accounts: Average rate

Jan-Dec 2012 Jan-Sept 2012 Jan-June 2012 Jan-March 2012 Jan-Dec 2011 Jan-Sept 2011 Jan-June 2011 Jan-March 2011

Sweden (SEK) Norway (NOK) Poland (PLN) Russia (RUB)

8.7015 7.4840 4.1900 40.2354

8.7275 7.5182 4.2152 40.1847

8.8756 7.5855 4.2524 40.1999

8.8658 7.6136 4.2389 39.9714

9.0038 7.7824 4.1254 41.0219

8.9982 7.7962 4.0320 40.7778

8.9273 7.7996 3.9655 40.4461

8.8775 7.8173 3.9692 40.4504

Balance sheet date rate

Dec 31 2012 Sept 30 2012 June 30 2012 March 31 2012 Dec 31 2011 Sept 30 2011 June 30 2011 March 31 2011

Sweden (SEK) Norway (NOK) Poland (PLN) Russia (RUB)

8.5820 7.3483 4.0740 40.3295

8.4498 7.3695 4.1038 40.1400

8.7728 7.5330 4.2488 41.3700

8.8455 7.6040 4.1522 39.2950

8.9120 7.7540 4.4580 41.7650

9.2580 7.8880 4.4050 43.3500

9.1739 7.7875 3.9903 40.4000

8.9329 7.8330 4.0106 40.2850

43

Fortum Corporation January-December 2012

Notes to the condensed consolidated interim financial statements

8. Income tax expense

The tax rate for the year 2012, excluding the tax rate change in Sweden, the impact of share of profits of associated companies and joint ventures as well as non-taxable capital gains was 21.2% (2011: 21.4%). In Sweden, the corporate tax rate was decreased to 22.0% from 26.3% starting 1 January 2013. In 2012, the one-time positive effect from the tax rate change is approximately EUR 230 million of which EUR 34 million is attributable to non-controlling interests. The tax rate used in the income statement is always impacted by the fact that share of profits of associates and joint ventures is recorded based on Fortum's share of profits after tax.

9. Changes in intangible assets

EUR million

Dec 31 2012

Dec 31 2011

Opening balance Increase through acquisition of subsidiary companies Capital expenditures Changes of emission rights Depreciation, amortisation and impairment Moved to Assets held for sale Reclassifications Translation differences and other adjustments Closing balance Goodwill included in closing balance Change in goodwill during the period due to translation differences

433 2 35 -25 -22 6 13 442 309 15

421 0 27 13 -19 -2 -7 433 294 -7

10. Changes in property, plant and equipment

EUR million

Dec 31 2012

Dec 31 2011

Opening balance Increase through acquisition of subsidiary companies Capital expenditures Changes of nuclear asset retirement cost Disposals Depreciation, amortisation and impairment Sale of subsidiary companies Moved to assets held for sale Reclassifications Translation differences and other adjustments Closing balance

15,234 0 1,523 -1 -15 -642 -84 -6 488 16,497

14,621 26 1,381 5 -13 -587 -128 -71 15,234

44

Fortum Corporation January-December 2012

Notes to the condensed consolidated interim financial statements

11. Changes in participations in associates and joint ventures

Dec 31 2012 Dec 31 2011

EUR million

Opening balance Share of profits of associates and joint ventures Investments Share issues and shareholders' contributions Divestments Dividend income received OCI items associated companies Moved to assets held for sale Translation differences and other adjustments Closing balance

2,019 21 10 -45 -20 34 2,019

2,161 91 9 16 -146 -108 -1 -1 -2 2,019

Share of profits from associates and joint ventures Share of profits from associates in Q4 2012 was EUR -5 million (Q4 2011: 19) of which Hafslund ASA represented EUR -27 million (Q4 2011: -14) and TGC-1 EUR 2 million (Q4 2011: -8). In Q4 2012 share of profit from Hafslund included EUR -25 million related to Hafslund's extraordinary write-downs and provisions on BioWood Norway AS, Bio-El Fredrikstad and an ongoing tax dispute.

Fortum's share of profit for the full year 2012 amounted to EUR 21 million (2011: 91), of which Hafslund represented EUR -22 million (2011: 23), TGC-1 EUR 27 million (2011: 30) and Gasum EUR 15 million (2011: 16). In 2012 the share of profit from Hafslund included EUR -25 million related to extraordinary write-downs and provisions and EUR 7 million loss in relation to Hafslund's divestment of REC shares. In 2011 write-downs on REC shares amounted to EUR 36 million. In December 2010 Hafslund sold its fully-owned subsidiary Hafslund Fibernett AS. Fortum recognised EUR 38 million in relation to Hafslund's divestment of Hafslund Fibernett AS shares as a part of the share of profit of associates and joint ventures in 2011.

According to Fortum Group accounting policies the share of profits from Hafslund and TGC-1 will be included in Fortum Group figures based on the previous quarter information since updated interim information is not normally available. Investments and share issues In December 2012 Turun Seudun Maakaasu ja Energiantuotanto Oy increased the companys share capital by EUR 20 million of which Fortums share is EUR 10 million. The additional participation was recognised and paid in December 2012. Teollisuuden Voima Oyj's (TVO) Annual General meeting in March 2011 decided to raise the company's share capital by EUR 65 million of which Fortum's share is EUR 16 million. The increase in Fortum's participation in TVO was booked in Q1 2011 and was paid during Q4 2011. Divestments There were no material divestments of shares in associated companies during 2012. In the first quarter of 2011 Electricity Sales segment divested its 30.78% share in Energiapolar Oy. In the second quarter of 2011 Distribution segment divested its 25% share in Fingrid Oyj. Dividends received During 2012 Fortum has received EUR 45 million (2011: 108) in dividends from associates of which EUR 22 million (2011: 64) was received from Hafslund, EUR 10 million (2011: 23) from Gasum and EUR 4 million (2011: 3) from Infratek ASA.

12. Interest-bearing liabilities and cash and cash equivalents

On 7 March 2012, Fortum issued two 5 year bonds under its existing Euro Medium Term Note programme. The amount of SEK 2,750 million consisting of SEK 1,000 million floating rate and SEK 1,750 million at 3.25% fixed rate. During the second quarter Fortum increased the amount of re-borrowing from the Finnish nuclear waste fund by EUR 53 million to EUR 940 million. During the same quarter Fortum repaid a maturing SEK 3,500 million bond and maturing debt SEK 1,000 million to Svensk Exportkredit. On 30 August 2012, Fortum issued a EUR 1,000 million ten-year bond under its existing Euro Medium Term Note programme. The bond carries a fixed rate coupon of 2.25%. During the last quarter OAO Fortum repaid a bilateral loan of RUB 4,000 million.

45

Fortum Corporation January-December 2012

Notes to the condensed consolidated interim financial statements

Short term financing on 31 December 2012 was EUR 432 million ( 2011: 254). The reported interest-bearing debt on December 31, 2012 was EUR 8,777 million ( 2011: 7,770). The interest-bearing debt decreased during the fourth quarter by EUR 104 million from EUR 8,881 million to EUR 8,777 million. Total liquid funds decreased by EUR 154 million from EUR 1,117 million to EUR 963 million during the fourth quarter.

13. Nuclear related assets and liabilities

Dec 31 2012 Dec 31 2011

EUR million

Carrying values in the balance sheet Nuclear provisions Share in the State Nuclear Waste Management Fund Legal liability and actual share of the State Nuclear Waste Management Fund Liability for nuclear waste management according to the Nuclear Energy Act Funding obligation target Fortum's share of the State Nuclear Waste Management Fund

678 678

653 653

996 996 956

968 941 903

Nuclear related provisions The liability regarding the Loviisa nuclear power plant is calculated according to the Nuclear Energy Act and was decided by the Ministry of Employment and Economy in December 2012. The liability is based on a technical plan, which is made every third year. The technical plan and the cost estimates were last updated in Q2 2010. The legal liability on 31 December 2012 was EUR 996 million. The provision in the balance sheet related to nuclear waste management is based on cash flows for future costs which uses the same basis as the legal liability. The carrying value of the nuclear provision, calculated according to IAS 37, increased by EUR 25 million compared to 31 December 2011, totalling EUR 678 million on 31 December 2012. The main reason for the difference between the carrying value of the provision and the legal liability is the fact that the legal liability is not discounted to net present value. Fortum's share in the State Nuclear Waste Management Fund Fortum contributes funds to the State Nuclear Waste Management Fund based on the yearly funding obligation target decided by the governmental authorities in December in connection with the decision of size of the legal liability. The current funding obligation target decided in December 2012 is EUR 996 million. The Fund is from an IFRS perspective overfunded with EUR 278 million, since Fortum's share of the Fund on 31 December 2012 was EUR 956 million and the carrying value in the balance sheet was EUR 678 million. Effects to comparable operating profit and operating profit Operating profit in Power segment is affected by the accounting principle for Fortum's share of the Finnish Nuclear Waste Management Fund, since the carrying value of the Fund in Fortum's balance sheet can in maximum be equal to the amount of the provisions according to IFRS. As long as the Fund is overfunded from an IFRS perspective, the effects to operating profit from this adjustment will be positive if the provisions increase more than the Fund and negative if actual value of the fund increases more than the provisions. This accounting effect is not included in Comparable operating profit in Fortum financial reporting, see Other items affecting comparability in Note 4. Fortum had an effect from this adjustment in Q4 of EUR -7 million, compared to EUR -10 million in Q4 2011. The cumulative effect 2012 was EUR -31 million compared to EUR -28 million in 2011. Associated companies Fortum has minority shareholdings in associated Finnish and Swedish nuclear production companies. Fortum has for these companies accounted for its share of the effects from nuclear related assets and provisions according to Fortum accounting principles.

14. Other provisions

CSA provision Other provisions

EUR million

Dec 31 2012

Dec 31 2011

Dec 31 2012

Dec 31 2011

Opening balance Unused provisions reversed Change in the provision Provisions used Unwinding of discount Exchange rate differences Closing balance Current provisions Non-current provisions

180 -23 15 6 178 178

208 -42 8 -5 16 -5 180 180

29 -2 15 -7 1 36 7 29

40 -11 8 -9 0 1 29 4 25

46

Fortum Corporation January-December 2012

Notes to the condensed consolidated interim financial statements

Fortum's extensive investment programme in Russia (8 units) is subject to possible penalties that can be claimed if the new capacity is substantially delayed or agreed major terms of the capacity supply agreement (CSA) are not otherwise fulfilled. The new rules for the long-term capacity market were approved in the beginning of 2011. This brought also more clarity to the possible penalties imposed on late delivery. Penalties are now defined on power plant level. This means that Fortum's risk for penalties under CSA agreement is proportionally decreasing when a new unit starts operation. The effect of changes in the timing of commissioning of new power plants is assessed at each balance sheet date and provision is changed accordingly. The increase in the provision due to the discounting during 2012 amounted to EUR 15 million. This amount was booked in other financial expenses.

15. Pledged assets

Dec 31 2012 Dec 31 2011

EUR million

On own behalf For debt Pledges Real estate mortgages For other commitments Real estate mortgages On behalf of associated companies and joint ventures Pledges and real estate mortgages

293 137 124 3

290 137 148 3

Pledged assets for debt Finnish participants in the State Nuclear Waste Management Fund are allowed to borrow from the Fund. As of 31 December 2012 the value of the pledged shares amounts to EUR 269 million (31 December 2011: 269). Pledged assets for other commitments Fortum has given real estate mortgages in power plants in Finland, total value of EUR 124 million in December 2012 (2011: 148), as a security to the State Nuclear Waste Management Fund for the uncovered part of the legal liability and unexpected events relating to future costs for decomissioning and disposal of spent fuel in Loviisa nuclear power plant. The size of the securities given is updated yearly in Q2 based on the decisions regarding the legal liabilities and the funding target which takes place around year end every year.

16. Operating lease commitments

Dec 31 2012 Dec 31 2011

EUR million

Due within a year Due after one year and within five years Due after five years Total

32 73 176 281

32 68 142 242

17. Capital commitments

Dec 31 2012 Dec 31 2011

EUR million

Property, plant and equipment Intangible assets Total

1,168 4 1,172

940 10 950

Capital commitments have increased compared to year end 2011. Commitments have mainly increased relating OAO Fortum's investment programme and dam safety investments in Sweden, as well as CHP investments in Joensuu, Finland, Stockholm in Sweden and Jelgava, Latvia.

47

Fortum Corporation January-December 2012

Notes to the condensed consolidated interim financial statements

18. Contingent liabilities

Dec 31 2012 Dec 31 2011

EUR million

On own behalf Other contingent liabilities On behalf of associated companies and joint ventures Guarantees Other contingent liabilities On behalf of others Guarantees

67 487 125 0

68 347 125 0

Guarantees on behalf of associated companies Guarantees and other contingent liabilities on behalf of associated companies and joint ventures mainly consist of guarantees relating to Fortum's associated nuclear companies (Teollisuuden Voima Oyj, Forsmarks Kraftgrupp AB and OKG AB). The guarantees for Forsmarks Kraftgrupp AB and OKG AB for 2012-2014 have been increased from SEK 2,574 million (EUR 289 million) to SEK 3,696 million (EUR 431 million) during 2012. The guarantee given on behalf of Teollisuuden Voima Oyj (TVO) to the Finnish fund amount to EUR 39 million at 31 December 2012 (31 December 2011: 44).

19. Legal actions and official proceedings

The Swedish Energy Authority (EI), which regulates and supervises the distribution network tariffs in Sweden, has issued a decision concerning the allowed income frame for the years 2012-2015. EI has based its decision on a model with a transition rule stating that it takes 18 years to reach the allowed level of income according to the new model. The EI decision has been appealed to the County Administrative Court by more than 80 distribution companies, including Fortum Distribution AB. The basis for Fortum Distribution ABs appeal is that the model is not compatible with the existing legislation and that EI has applied an incorrect method for the calculation of Weighted Average Cost of Capital (WACC). In Finland, the Energy market authority has issued methodology decisions for the years 2012-2015. The decisions were appealed by more than 70 distribution companies. Main points of the appeal related to the changes in WACC-calculation and increased quality sanctions. Market Court gave its decision on 21 December 2012. It ordered the Energy market authority to reconsider and amend said methodology decisions as regards the calculation of the efficiency incentive in order to limit the financial impact of large outages. Apart from said component, the Market Court dismissed the appeals. Fortum Espoo Distribution Oy and Fortum Shknsiirto Oy have not appealed the Market Court decision. Fortum received income tax assessments in Sweden for the year 2009 in December 2011. The appeal process is ongoing and based on legal analysis, no provision has been accounted for in the financial statements. Fortum Sweden AB, Fortum Nordic AB and Fortum 1 AB have received income tax assessments for the year 2010 in December 2012 from the Swedish tax authorities. According to the tax authorities, Fortum would have to pay additional income taxes for the reallocation of the loans between the Swedish subsidiaries in 2004-2005 and for financing of the acquisition of TGC 10 (current OAO Fortum) in 2008. The claims are based on the change in tax regulation as of 2009. Fortum considers the claims unjustifiable and has appealed the decisions. No provision has been accounted for in the financial statements. If the decision by the tax authority remains final despite the appeals process, the impact on the net profit for the period would be approximately SEK 444 million (EUR 52 million). Years 2009 and 2010 assessments are totally SEK 869 million (EUR 101 million). Fortum has 2012 received an income tax assessment in Belgium for the year 2008. Tax authorities disagree the tax treatment of Fortum EIF NV. Fortum finds the tax authorities interpretation not to be based on the local regulation. No provision has been accounted for in the financial statements. If the decision by the tax authorities remains final despite the appeal process, the impact on the net profit for the period would be approximately EUR 36 million. The tax is already paid. If the appeal is approved, Fortum will receive a 7% interest on the amount. Fortum has on-going tax audits in Finland, Belgium and some other countries.

48

Fortum Corporation January-December 2012

Notes to the condensed consolidated interim financial statements

In Finland Fortum is participating in the country's fifth nuclear power plant unit, Olkiluoto 3, through the shareholding in Teollisuuden Voima Oyj (TVO) with an approximately 25% share representing some 400 MW in capacity. The civil construction works of the Olkiluoto 3 plant unit have been mainly completed, and the major components of the reactor plant have been installed. The installation works and plant automation system engineering of Olkiluoto 3 plant unit have not progressed according to the schedules of AREVASiemens Consortium, who is constructing the plant unit as a fixed-price turnkey project. Based on the information submitted by the Supplier, TVO estimates that the plant unit will not be ready for regular electricity production in 2014. During the reporting period TVO submitted a claim and defense in the International Chamber of Commerce (ICC) arbitration proceedings concerning the delay and the ensuing costs incurred at the Olkiluoto 3 project. The quantification estimate of TVO's costs and losses is approximately EUR 1.8 billion, which includes TVO's current actual claim and estimated part. The arbitration proceedings may continue for several years and TVO's claimed amounts will be updated. The proceedings were initiated in December 2008 by the OL3 supplier, AREVA-Siemens. The supplier's latest monetary claim including indirect items and interest is approximately EUR 1.9 billion. TVO has considered and found the claim by the supplier to be without merit. During the second quarter 2012 TVO received an International Chamber of Commerce arbitration tribunal decision concerning a few partial payments previously made, to a blocked account, to be released to the Olkiluoto 3 plant supplier. The decision takes no position on the delay of the plant unit and the cost resulting from the delay. In addition to the litigations described above, some Group companies are involved in tax and other disputes incidental to their business. In management's opinion the outcome of such disputes will not have material effect on the Group's financial position. No other material changes in legal actions and official proceedings have occurred during 2012 compared to the year-end 2011.

20. Related party transactions

Related parties are described in the annual financial statements as of the year ended 31 December 2011. No material changes have occurred during year 2012. The Finnish State owned 50.76% of the shares in Fortum 31 December 2012. Transactions with associated companies and joint ventures

EUR million

2012

2011

Sales Interest on loan receivables Purchases Sales during 2012 include sales of inventory and services to Turun Seudun Maakaasu ja Energiantuotanto Oy (TSME). For information regarding the sale of Fortum Heat Naantali Oy shares to TSME see Note 6. Associated company and joint ventures balances

123 42 679

21 34 662

EUR million

Dec 31 2012

Dec 31 2011

Long-term interest-bearing loan receivables Trade receivables Other receivables Long-term loan payables Trade payables Other payables

1,370 15 16 234 23 7

1,186 12 11 223 14 22

21. Events after the balance sheet date

Fortum announced 31 January 2013 that the company has decided to assess the strategic position of its electricity distribution business. In accordance with its strategy, Fortum seeks growth in low-carbon power generation, energy-efficient combined heat and power (CHP) production and customer offerings. The assessment has no impact on Fortum's electricity distribution customers and excludes the company's electricity retail business. Fortum expects to conclude the assessment during 2013.

49

Fortum Corporation January-December 2012

Notes to the condensed consolidated interim financial statements

22. Definition of key figures

EBITDA (Earnings before interest, taxes, depreciation and amortisation) Comparable EBITDA = Operating profit + Depreciation, amortisation and impairment charges

EBITDA - items affecting comparability - Net release of CSA provision

Items affecting comparability Comparable operating profit Non-recurring items Other items affecting comparability

= = = =

Non-recurring items + other items affecting comparability Operating profit - non-recurring items - other items affecting comparability Mainly capital gains and losses Includes effects from financial derivatives hedging future cash-flows where hedge accounting is not applied according to IAS 39 and effects from the accounting of Fortums part of the Finnish Nuclear Waste Fund where the asset in the balance sheet cannot exceed the related liabilities according to IFRIC interpretation 5.

Funds from operations (FFO) Capital expenditure

= =

Net cash from operating activities before change in working capital Capitalised investments in property, plant and equipment and intangible assets including maintenance, productivity, growth and investments required by legislation including borrowing costs capitalised during the construction period. Maintenance investments expand the lifetime of an existing asset, maintain useage/availability and/or maintains reliability. Productivity investments improve productivity in an existing asset. Growth investments' purpose is to build new assets and/or to increase customer base within existing businesses. Legislation investments are done at certain point of time due to legal requirements.

Gross investments in shares

Investments in subsidiary shares, shares in associated companies and other shares in available for sale financial assets. Investments in subsidiary shares are net of cash and grossed with interest-bearing liabilities in the acquired company. Profit for the year Total equity average Profit before taxes + interest and other financial expenses Capital employed average Operating profit + Share of profit (loss) in associated companies and joint ventures Net assets average x 100

Return on shareholders' equity, %

Return on capital employed, %

x 100

Return on net assets, %

x 100

Comparable return on net assets, %

Comparable operating profit + Share of profit (loss) in associated companies and joint ventures (adjusted for IAS 39 effects, nuclear fund adjustments and major sales gains or losses) Comparable net assets average

x 100

Capital employed Net assets

= =

Total assets - non-interest bearing liabilities - deferred tax liabilities - provisions Non-interest bearing assets + interest-bearing assets related to the Nuclear Waste Fund - non-interest bearing liabilities - provisions (non-interest bearing assets and liabilities do not include finance related items, tax and deferred tax and assets and liabilities from fair valuations of derivatives where hedge accounting is applied)

50

Fortum Corporation January-December 2012

Notes to the condensed consolidated interim financial statements

22. Definition of key figures

Comparable net assets = Net assets adjusted for non-interest bearing assets and liabilities arising from financial derivatives hedging future cash flows where hedge accounting is not applied according to IAS 39 Interest-bearing liabilities - cash and cash equivalents Interest-bearing net debt Total equity Total equity including non-controlling interest Total assets Interest-bearing net debt Operating profit + Depreciation, amortisation and impairment charges Interest-bearing net debt Comparable EBITDA Operating profit Net interest expenses Operating profit Net interest expenses - capitalised borrowing costs Earnings per share (EPS) = Profit for the period - non-controlling interest Average number of shares during the period x 100

Interest-bearing net debt Gearing, %

= =

Equity-to-assets ratio, %

x 100

Net debt / EBITDA

Comparable net debt / EBITDA

Interest coverage

Interest coverage including capitalised borrowing costs

Equity per share

Shareholder's equity Number of shares at the end of the period Twelve months preceding the reporting date

Last twelve months (LTM)

51

Fortum Corporation January-December 2012

Market conditions and achieved power prices

Power consumption

TWh

Q4 2012

Q4 2011

2012

2011

Nordic countries Russia Tyumen Chelyabinsk Russia Urals area

109 284 22 10 68

102 279 22 10 67

391 1,037 83 36 252

384 1,020 83 36 250

Average prices

Q4 2012 Q4 2011 2012 2011

Spot price for power in Nord Pool power exchange, EUR/MWh Spot price for power in Finland, EUR/MWh Spot price for power in Sweden, SE3, Stockholm EUR/MWh 1) Spot price for power in Sweden, SE2, Sundsvall EUR/MWh 1) Spot price for power in European and Urals part of Russia, RUB/MWh Average capacity price, tRUB/MW/month Spot price for power in Germany, EUR/MWh Average regulated gas price in Urals region, RUB/1000 m 3 Average capacity price for old capacity, tRUB/MW/month 3) Average capacity price for new capacity, tRUB/MW/month 3) Spot price for power (market price), Urals hub, RUB/MWh 2) CO2, (ETS EUA), EUR/tonne CO2 Coal (ICE Rotterdam), USD/tonne Oil (Brent Crude), USD/bbl

1) 2) 3)

2)

37.3 40.8 37.5 37.4 1,037 254 41.4 2,924 168 627 973 7 88 110

34.2 37.4 35.7 35.0 918 246 49.9 2,548 174 534 858 9 115 109

31.2 36.6 32.3 31.8 1,001 227 42.6 2,736 152 539 956 7 93 112

47.1 49.3 47.9 N/A 990 209 51.1 2,548 160 560 925 13 122 111

From 1st Nov 2011 onwards price area SE3 (Stockholm), before Sweden as one area. Excluding capacity tariff. Capacity prices paid only for the capacity available at the time.

Water reservoirs

TWh

Dec 31 2012

Dec 31 2011

Nordic water reservoirs level Nordic water reservoirs level, long-term average

85 83

95 83

Export/import

TWh (+ = import to, - = export from Nordic area)

Q4 2012

Q4 2011

2012

2011

Export / import between Nordic area and Continental Europe+Baltics Export / import between Nordic area and Russia Export / import Nordic area, Total

-4 2 -2

-5 2 -2

-19 5 -14

-6 11 5

Power market liberalisation in Russia % Share of power sold at the liberalised price by OAO Fortum

Q4 2012 Q4 2011 2012 2011

82

86

82

85

Achieved power prices

EUR/MWh

Q4 2012

Q4 2011

2012

2011

Power's Nordic power price Achieved power price for OAO Fortum

46.8 30.9

45.2 28.9

44.6 30.6

46.1 29.2

52

Fortum Corporation January-December 2012

Production and sales volumes

Power generation

TWh

Q4 2012

Q4 2011

2012

2011

Power generation in the EU and Norway Power generation in Russia Total

15.2 5.1 20.3

15.0 4.9 19.9

53.9 19.2 73.1

55.3 17.4 72.7

Heat production

TWh

Q4 2012

Q4 2011

2012

2011

Heat production in the EU and Norway* Heat production in Russia Total

* Q3/2012 restated

6.0 8.7 14.7

5.9 8.6 14.5

18.5 24.8 43.3

22.0 25.4 47.4

Power generation capacity by division

MW

Dec 31 2012

Dec 31 2011

Power Heat Russia Total

9,702 1,569 3,404 14,675

9,752 1,670 3,404 14,826

Heat production capacity by division

MW

Dec 31 2012

Dec 31 2011

Power Heat Russia Total

250 8,785 13,396 22,431

250 10,375 14,107 24,732

Power generation by source in the Nordic area

TWh

Q4 2012

Q4 2011

2012

2011

Hydropower Nuclear power Thermal power Total

7.1 6.5 1.0 14.6

6.4 6.7 1.2 14.3

25.2 23.4 3.0 51.6

21.0 24.9 7.2 53.1

Power generation by source in the Nordic area

%

Q4 2012

Q4 2011

2012

2011

Hydropower Nuclear power Thermal power Total

49 44 7 100

45 47 8 100

49 45 6 100

40 47 13 100

Power sales

EUR million

Q4 2012

Q4 2011

2012

2011

Power sales in the EU and Norway Power sales in Russia Total

784 207 991

746 161 907

2,700 713 3,413

2,868 590 3,458

53

Fortum Corporation January-December 2012

Production and sales volumes

Heat sales

EUR million

Q4 2012

Q4 2011

2012

2011

Heat sales in the EU and Norway Heat sales in Russia Total

379 102 481

364 110 474

1,201 300 1,501

1,278 324 1,602

Power sales by area

TWh

Q4 2012

Q4 2011

2012

2011

Finland Sweden Russia Other countries Total

6.0 8.6 6.7 1.1 22.4

6.1 8.2 5.6 1.1 21.0

21.6 30.1 23.3 3.8 78.8

24.6 29.4 20.2 3.6 77.8

NordPool transactions are calculated as a net amount of hourly sales and purchases at the Group level.

Heat sales by area

TWh

Q4 2012

Q4 2011

2012

2011

Russia Finland Sweden Poland Other countries1) Total

1)

8.6 1.7 2.9 1.5 0.9 15.6

9.2 2.2 2.5 1.5 0.8 16.2

26.4 5.8 8.5 4.3 2.9 47.9

26.7 8.5 8.5 4.3 3.4 51.4

Including the UK, which is reported in the Power division, other sales.

54

You might also like

- Business Credit Institutions Miscellaneous Revenues World Summary: Market Values & Financials by CountryFrom EverandBusiness Credit Institutions Miscellaneous Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Consolidated Accounts June-2011Document17 pagesConsolidated Accounts June-2011Syed Aoun MuhammadNo ratings yet

- 155.ASX IAW Aug 16 2012 16.33 Preliminary Final ReportDocument14 pages155.ASX IAW Aug 16 2012 16.33 Preliminary Final ReportASX:ILH (ILH Group)No ratings yet

- Different: ... and Better Than EverDocument4 pagesDifferent: ... and Better Than EverViral PatelNo ratings yet

- Financial Statements Review Q4 2010Document17 pagesFinancial Statements Review Q4 2010sahaiakkiNo ratings yet

- MCB Consolidated For Year Ended Dec 2011Document87 pagesMCB Consolidated For Year Ended Dec 2011shoaibjeeNo ratings yet

- In Thousands of Euros: Balance SheetDocument5 pagesIn Thousands of Euros: Balance SheetNguyễn Hải YếnNo ratings yet

- Financial+Data+Excel of UBMDocument100 pagesFinancial+Data+Excel of UBMmohammedakbar88No ratings yet

- Metro Holdings Limited: N.M. - Not MeaningfulDocument17 pagesMetro Holdings Limited: N.M. - Not MeaningfulEric OngNo ratings yet

- Interim Condensed Consolidated Financial Statements: OJSC "Magnit"Document41 pagesInterim Condensed Consolidated Financial Statements: OJSC "Magnit"takatukkaNo ratings yet

- 2011 Financial Statements NESTLE GROUPDocument118 pages2011 Financial Statements NESTLE GROUPEnrique Timana MNo ratings yet

- Financial - CocaColaDocument45 pagesFinancial - CocaColadung nguyenNo ratings yet

- Myer AR10 Financial ReportDocument50 pagesMyer AR10 Financial ReportMitchell HughesNo ratings yet

- Rupees 000: Unconsolidated Statement of Financial Position As at December 31, 2011Document17 pagesRupees 000: Unconsolidated Statement of Financial Position As at December 31, 2011Jamal GillNo ratings yet

- CNXX JV 2012 Verkort 5CDocument77 pagesCNXX JV 2012 Verkort 5CgalihNo ratings yet

- 494.Hk 2011 AnnReportDocument29 pages494.Hk 2011 AnnReportHenry KwongNo ratings yet

- Strabag 2010Document174 pagesStrabag 2010MarkoNo ratings yet

- Consolidated First Page To 11.2 Property and EquipmentDocument18 pagesConsolidated First Page To 11.2 Property and EquipmentAsif_Ali_1564No ratings yet

- 2012 Annual Financial ReportDocument76 pages2012 Annual Financial ReportNguyễn Tiến HưngNo ratings yet

- Airbus Annual ReportDocument201 pagesAirbus Annual ReportfsdfsdfsNo ratings yet

- Universal Tech - Final Result Announcement For The Year Ended 31 December 2012 PDFDocument27 pagesUniversal Tech - Final Result Announcement For The Year Ended 31 December 2012 PDFalan888No ratings yet

- ASX Appendix 4E Results For Announcement To The Market: Ilh Group LimitedDocument14 pagesASX Appendix 4E Results For Announcement To The Market: Ilh Group LimitedASX:ILH (ILH Group)No ratings yet

- Balance Sheet: As at June 30,2011Document108 pagesBalance Sheet: As at June 30,2011Asfandyar NazirNo ratings yet

- HMC Annual StatementDocument65 pagesHMC Annual Statementৰিতুপর্ণ HazarikaNo ratings yet

- PR - 27 March 2013 - Proforma Financial Information - Icade-Silic - 31 December 2012Document10 pagesPR - 27 March 2013 - Proforma Financial Information - Icade-Silic - 31 December 2012IcadeNo ratings yet

- Macys 2011 10kDocument39 pagesMacys 2011 10kapb5223No ratings yet

- Notes SAR'000 (Unaudited) 14,482,456 6,998,836 34,094,654 115,286,635 399,756 411,761 1,749,778 3,671,357Document10 pagesNotes SAR'000 (Unaudited) 14,482,456 6,998,836 34,094,654 115,286,635 399,756 411,761 1,749,778 3,671,357Arafath CholasseryNo ratings yet

- Ashok LeylandDocument1,832 pagesAshok Leylandjadhavshankar100% (1)

- TCS Ifrs Q3 13 Usd PDFDocument23 pagesTCS Ifrs Q3 13 Usd PDFSubhasish GoswamiNo ratings yet

- 2014 IFRS Financial Statements Def CarrefourDocument80 pages2014 IFRS Financial Statements Def CarrefourawangNo ratings yet

- Robert Bosch GMBH - Statement of Financial PositionDocument2 pagesRobert Bosch GMBH - Statement of Financial PositionRamesh GowdaNo ratings yet

- Cash Flow Statement: For The Year Ended March 31, 2013Document2 pagesCash Flow Statement: For The Year Ended March 31, 2013malynellaNo ratings yet

- Aplicación Del MNT Multifilamentos 2010Document17 pagesAplicación Del MNT Multifilamentos 2010Juan KsanovaNo ratings yet

- CVM Minerals - Announcement of Final Results For The Financial Year Ended 31 December 2012 PDFDocument59 pagesCVM Minerals - Announcement of Final Results For The Financial Year Ended 31 December 2012 PDFalan888No ratings yet

- MCB Annual Report 2008Document93 pagesMCB Annual Report 2008Umair NasirNo ratings yet

- Kuoni Gb12 Financialreport en 2012Document149 pagesKuoni Gb12 Financialreport en 2012Ioana ElenaNo ratings yet

- ITC Cash Flow StatementDocument1 pageITC Cash Flow StatementIna PawarNo ratings yet

- Financial Analysis of Islami Bank BangladeshDocument5 pagesFinancial Analysis of Islami Bank BangladeshMahmudul Hasan RabbyNo ratings yet

- TSAU - Financiero - ENGDocument167 pagesTSAU - Financiero - ENGMonica EscribaNo ratings yet

- Adidas Group AR2011 Consolidated Statement of Financial PositionDocument2 pagesAdidas Group AR2011 Consolidated Statement of Financial PositionJan Johnny JonathanNo ratings yet

- Half-Year Report Julius Baer Group LTDDocument24 pagesHalf-Year Report Julius Baer Group LTDEvgeny SkorobogatkoNo ratings yet

- LGE 2010 4Q ConsolidationDocument89 pagesLGE 2010 4Q ConsolidationSaba MasoodNo ratings yet

- HOLCIM 2011 Annual ResultsDocument5 pagesHOLCIM 2011 Annual ResultsgueigunNo ratings yet

- Consolidated Statements of Changes in Equity: Samsung Electronics Co., Ltd. and Its SubsidiariesDocument4 pagesConsolidated Statements of Changes in Equity: Samsung Electronics Co., Ltd. and Its SubsidiarieschirahotoNo ratings yet

- Faysal Bank Spread Accounts 2012Document133 pagesFaysal Bank Spread Accounts 2012waqas_haider_1No ratings yet

- Consolidated Statements of Operations: Years Ended September 29, 2012 September 24, 2011 September 25, 2010Document5 pagesConsolidated Statements of Operations: Years Ended September 29, 2012 September 24, 2011 September 25, 2010Basit Ali ChaudhryNo ratings yet

- Ar 11 pt03Document112 pagesAr 11 pt03Muneeb ShahidNo ratings yet

- 1Q2013 AnnouncementDocument17 pages1Q2013 AnnouncementphuawlNo ratings yet

- Financial Statements: December 31, 2011Document55 pagesFinancial Statements: December 31, 2011b21t3chNo ratings yet

- CHEM Audited Results For FY Ended 31 Oct 13Document5 pagesCHEM Audited Results For FY Ended 31 Oct 13Business Daily ZimbabweNo ratings yet

- ICI Pakistan Limited Condensed Interim Unconsolidated Balance Sheet (Unaudited) As at March 31, 2011Document9 pagesICI Pakistan Limited Condensed Interim Unconsolidated Balance Sheet (Unaudited) As at March 31, 2011Sehrish HumayunNo ratings yet

- Pak Elektron Limited: Condensed Interim FinancialDocument16 pagesPak Elektron Limited: Condensed Interim FinancialImran ArshadNo ratings yet

- BMW's Financial Statements For The Year 2013Document8 pagesBMW's Financial Statements For The Year 2013audit202No ratings yet

- ITC Consolidated FinancialsDocument49 pagesITC Consolidated FinancialsVishal JaiswalNo ratings yet

- Dell IncDocument6 pagesDell IncMohit ChaturvediNo ratings yet

- Rupees in '000 Rupees in '000: Balance Sheet 2008 2009Document22 pagesRupees in '000 Rupees in '000: Balance Sheet 2008 2009Ch Altaf HussainNo ratings yet

- Sales Financing Revenues World Summary: Market Values & Financials by CountryFrom EverandSales Financing Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Pawn Shop Revenues World Summary: Market Values & Financials by CountryFrom EverandPawn Shop Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Miscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryFrom EverandMiscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- BDO Peso Balanced Fund (1st Quarter 2010)Document1 pageBDO Peso Balanced Fund (1st Quarter 2010)Iñigo Martin MendozaNo ratings yet

- TSX Listed Mining Companies in Africa 2011Document29 pagesTSX Listed Mining Companies in Africa 2011Vicente PonsNo ratings yet

- Stock Market PredictionDocument27 pagesStock Market PredictionJatin Kapoor100% (1)

- OFD Question PapersDocument7 pagesOFD Question PapersLeo DeepakNo ratings yet

- Multiple Time Frames TradingDocument13 pagesMultiple Time Frames Tradingeternityksa100% (2)

- Nagindas Khandwala College: Class - Sybbi Subject - Financial Markets Topic - Derivatives Submitted To - Prof. RohanDocument20 pagesNagindas Khandwala College: Class - Sybbi Subject - Financial Markets Topic - Derivatives Submitted To - Prof. RohanNikita GajendragadkarNo ratings yet

- Vale 20-F FY2016 - IDocument289 pagesVale 20-F FY2016 - Ibernd81No ratings yet

- Hedgefund Market WizardsDocument7 pagesHedgefund Market Wizardspraneet singhNo ratings yet

- JPMorgan ComplaintDocument118 pagesJPMorgan ComplaintInvestor ProtectionNo ratings yet

- Ra 7653Document17 pagesRa 7653Sherna Adil100% (2)

- BBA 6 Sem Fin PDFDocument8 pagesBBA 6 Sem Fin PDFvidyashree patilNo ratings yet

- Building An Equity Millipede Page 28 PDFDocument166 pagesBuilding An Equity Millipede Page 28 PDFShaun ChangNo ratings yet

- Interchange FeeDocument3 pagesInterchange FeeAnkita SrivastavaNo ratings yet

- The Missing Risk Premium: Why Low Volatility Investing WorksDocument118 pagesThe Missing Risk Premium: Why Low Volatility Investing WorksMinh NguyenNo ratings yet

- Pubali Bank Limited by Overall Banking PerformanceDocument117 pagesPubali Bank Limited by Overall Banking PerformanceHamim Al Mukit100% (6)

- Bimbo Company ProfileDocument14 pagesBimbo Company ProfileramapvkNo ratings yet

- 2.1 Charting Basics PDFDocument13 pages2.1 Charting Basics PDFmerope2No ratings yet

- Analysis Size PremiumDocument4 pagesAnalysis Size PremiumAntonio Moreno SantelizNo ratings yet

- Margin TradingDocument50 pagesMargin TradingfendyNo ratings yet

- Larry Pesavento & Peggy Mackay - Opening Price Principle - The Best Kept Secret On Wall StreetDocument105 pagesLarry Pesavento & Peggy Mackay - Opening Price Principle - The Best Kept Secret On Wall StreetSwapneel Dey100% (5)

- AGS InfotechDocument349 pagesAGS InfotechBikashNo ratings yet

- Ias 21Document23 pagesIas 21Ricard MatahariNo ratings yet

- UBS 20-F Annual Reporting 2008Document583 pagesUBS 20-F Annual Reporting 2008kalvinwhiteoakNo ratings yet

- FinDocument210 pagesFinHARI SINGH CHOUHANNo ratings yet

- Anand Rathi GroupDocument100 pagesAnand Rathi GroupRenu MahayachNo ratings yet

- The Dynamics of Leveraged and Inverse Exchange-Traded FundsDocument24 pagesThe Dynamics of Leveraged and Inverse Exchange-Traded FundsshorttermblogNo ratings yet

- Barr, William P. FinalEADocument15 pagesBarr, William P. FinalEAErin LaviolaNo ratings yet

- Applying IRP and IFEDocument2 pagesApplying IRP and IFEAriel LogachoNo ratings yet

- Gold DerivativesDocument19 pagesGold DerivativesvinusachdevNo ratings yet

- 12th Commerce Lesson 6Document16 pages12th Commerce Lesson 6sonaiya software solutionsNo ratings yet