Professional Documents

Culture Documents

Article Tax Contro Sujit Indian Law News Apr1366713492

Uploaded by

Nishant Bansal0 ratings0% found this document useful (0 votes)

28 views7 pagestaxaation

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documenttaxaation

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

28 views7 pagesArticle Tax Contro Sujit Indian Law News Apr1366713492

Uploaded by

Nishant Bansaltaxaation

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 7

India Law News 23 Winter/Spring Issue 20J3

n 1789, en|amin Iranklin vrole lo }ean-alisle

Leroy lhal "...in lhis vorld nolhing can be said lo

be cerlain, excel dealh and laxes." Al lhal lime,

he vould scarcely have realized hov much of an

anachronism his commenl aboul lhe cerlainly of laxes

vould become in years lo come. Wilh lhe economic

dovnlurn in lhe recenl years and lhe consequenl

aggressive allilude of lax adminislralors, arlicularly

in emerging economies like India, il vould nol be an

exaggeralion lo slale lhal lhe only lhing cerlain aboul

laxes loday is lhe uncerlainly of ils alicalion.

Given lhis backdro, a holislic and more ro-aclive

aroach lo lax conlroversy managemenl becomes

necessary. In facl, lhe concels of lax conlroversy

managemenl nov oughl lo be firmly enlrenched in lhe

realm of cororale governance. This arlicle aims lo

shed lighl on fev key asecls of lax conlroversy

managemenl secific lo India lhal vould be relevanl

for mullinalional comanies lhal are oeraling in India

or are even exloring oorlunilies or finalizing

business lans for inveslmenl inlo India.

Tax conlroversy may broadly arise oul of lhree

areas: (i) lax aulhorilies disagreeing vilh lax osilions

adoled by a comany on legal grounds, (ii) lax

aulhorilies disagreeing vilh lax osilions adoled by a

comany on accounl of erroneous conlracl drafling

lhal does nol reflecl lhe inlended lax osilions, and

(iii) difference in inlerrelalion of lax clauses in a

conlracl.

I. CONTROVLRSILS ARISING OUT OI TAX

AUTHORITILS DISAGRLLING ON LLGAL

GROUNDS WITH TAX POSITIONS ADOPTLD

BY A COMPANY

In a counlry like India, vilh an increasingly

aggressive lax adminislralion, any lax osilion lhal

does nol lilerally emerge from lhe language of lhe

slalule lends lo be disuled by lhe aulhorilies. Given

lhe mullilicily of laxes, lhis roblem gels magnified

manifold in lhe realm of indirecl laxes in India (e.g.,

lhere are federal laxes like lhe cusloms duly, excise

duly and service lax lhal are regulaled by lhe Cenlral

Governmenl, slale-level laxes like VAT and enlry laxes,

and federal laxes/cesses like Cenlral Sales Tax and

uilding Cess, vhich are adminislered by lhe

reseclive Slale Governmenls). Given lhe large number

of lax |urisdiclions, lax conlroversy managemenl is

essenlial.

J. Document The Rationale Behind Lvery Tax

Position

The firsl sle lovards sound lax conlroversy

managemenl is lo documenl lhe ralionale behind every

lax osilion. Ior any lax osilion lhal does nol seem lo

be suorled by a simle lileral inlerrelalion of lhe

relevanl lax slalule, a legal oinion oughl lo be

oblained exlaining lhe legal basis behind such a

osilion. These oinions hel lo eslablish lhe bona

fides of a laxayer, should liligalion be inilialed by lhe

various Slale/Cenlral Governmenl lax aulhorilies

(referred lo hereinafler as Revenue). In addilion,

delailed disclosures should be made lo lhe relevanl lax

aulhorilies aboul any such lax osilion, along vilh

reference lo a suorling legal oinion.

The facl lhal a legal oinion has been oblained

should be disclosed lo lhe lax aulhorilies even if lhe

aclual oinion is nol aclually rovided. In a decision of

TAX CONTROVLRSY MANAGLMLNT IORMULTINATIONAL CORPORATIONS ININDIA

By Sujit Ghosh and Sudipta Bhattacharjee

India Law News 24 Winter/Spring Issue 20J3

lhe Cenlral Lxcise and Service Tax Tribunal

(CLSTAT) in lhe case of Pccnan Spar| Pritaic Iiniic!

t. Ccnnissicncr cj Ccnira| |xcisc, (2004 |164j L.L.T. 282

|Tri. - Del.j), lhe Tribunal found lhal lhe laxayer had

nol acled in good failh, as lhe legal oinion oblained by

him in suorl of ils lax osilion vas never menlioned

or disclosed lo lhe aulhorilies.

Il is also alvays rudenl lo make clear and cogenl

disclosures in lax relurns, aboul lhe sensilive lax

osilion lhal a laxayer may have adoled. Slalulory

relurn formals, hovever, oflen do nol rovide sace for

such disclosures (as mosl relurns are nov being

required lo be filed eleclronically). In such cases, il is

alvays advisable lo submil a rinl of lhe relurn and

allach a covering vilh aroriale disclosures, and file

il vilh lhe lax aulhorilies.

These sles hel eslablish lhe bona fides of lhe lax-

ayer before a courl/lribunal and avoid enallies even

if lhe courl re|ecls lhe lax osilion. Ior examle, in a

CLSTAT decision in lhe case of Manga|crc C|cnica|s an!

|crii|izcrs t. Ccnnr. Oj Ccni. |xcisc (2009 |248j L.L.T.

647), limely declaralions by lhe laxayer venl a long

vay avoiding enallies. Lslablishing bona fides in lhis

vay also hels revenl lhe lax aulhorilies from

invoking lhe draconian exlended eriod of limilalion

vhich could resull in re-oening lax osilions laken by

lhe laxayer over lhe revious five years.

2. Obtain Advance Rulings On Key Tax Positions

Having laken care lo eslablish bona fides, lhe

second sle in lax conlroversy managemenl is lo lry lo

oblain confirmalion of lhe lax osilion adoled. The

folloving olions are generally available under mosl

lax slalules.

Advance Rulings for Iederal Taxes

Ior federal laxes (like Income Tax, Cusloms, Lxcise,

and Service Tax), a foreign comany exloring lhe

olion of selling u a business in India can aroach

lhe Aulhorily for Advance Ruling (AAR), based in

Nev Delhi, for an advance confirmalion of ils crilical

lax osilions.

While lhe rocess may lake aboul six monlhs, il

may be lime vell senl, given lhal il rovides lhe

foreign comany vilh some cerlainly. Conversely, an

adverse advance ruling becomes binding on lhe

laxayer vilhoul any slalulory aeal and lhe only

olion in lhal case vould be lo aroach lhe

|urisdiclional High Courl (lhe highesl courl in a Slale)

for a vril remedy againsl lhe AAR's order.

Irom a raclical slandoinl, lhis olion should be

exercised only vhen lhere is an obvious ambiguily

vilh regard lo alicabilily and/or inlerrelalion of

any rovision of lav. Thal is lo say, il is never a good

idea lo seek such a ruling in cases vhere lhe

inlerrelalion is clear and unambiguous. A negalive

ruling in such cases, could cause more hardshi lhan

any benefil lo lhe alicanl.

Advance Rulings under State VAT Laws

Mosl Slale VAT slalules also rovide for similar

advance ruling mechanisms lhrough vhal is commonly

knovn as 'Delerminalion of Disuled Queslions'

(DDQ). While, lhese are nol as effeclive as lhe AAR,

lhe DDQ roule can be used effeclively lo engender

cerlainly vilh regard lo Slale VAT osilions.

Ground level officers of lhe lax dearlmenl are of-

len less recelive lo a nuanced lax osilion more so

vilh resecl lo Slale level laxes like VAT. Oflen, roer

arecialion of lhe legal basis behind a nuanced VAT

osilion is found only al a High Courl level or Sureme

Courl Level. Given lhal DDQs are usually

adminislered by Slale VAT aulhorilies such DDQs are

lilled againsl lhe laxayer.

Hovever, even such negalive resulls may rovide

lhe laxayer (laclically) a quicker and oul-of-lurn

access lo lhe High Courl for a roer arecialion of

lhe legal argumenls and a confirmalion of lhe

laxayer's osilion. Thal is lhe real value roosilion

of lhe DDQ rocess. To elaborale, ordinarily, before a

queslion of lav can be raised before lhe High Courl, a

laxayer musl exhausl all allernale remedies available

under lhe lax slalues, such as lax assessmenl,

dearlmenlal aeal and lax lribunal, among olhers.

This means lhal lhe lead lime for a laxayer before il

can aroach lhe High Courl in lhe regular aellale

rocedure could be anyvhere belveen four lo six

years. Such a long lead lime can be lruncaled,

hovever, by oling for lhe DDQ roule. Aeal from a

India Law News 25 Winter/Spring Issue 20J3

DDQ ruling handed dovn by lhe Commissioner of

VAT lies direclly lo lhe High Courl via vril elilion.

i) Iormal Clarifications

Inforlunalely, lhe olion of seeking an AAR ruling

or DDQ is oflen reslricled lo rescribed/defined sels of

issues (such as laxabilily of lransaclions, lhe

alicabilily of a given lax exemlion). Ior lhe

remaining universe of issues, lhere are no

inslilulionalized mechanisms for ufronl quasi

|udicial/|udicial confirmalion.

In lhese cases, one of lhe olions available is lo seek

a vrillen adminislralive clarificalion from lhe

Revenue. Ior examle, Seclion 37 of lhe Cenlral

Lxcise Acl aulhorizes lhe Cenlral oard of Lxcise and

Cusloms (CLC) lo issue orders, inslruclions and

direclions for lhe urose of uniformily in lhe

classificalion of excisable goods or vilh resecl lo levy

of dulies of excise on such goods.

Such clarificalions are binding on lhe Revenue,

lhough nol on lhe quasi-|udicial/|udicial aulhorilies and

lhe laxayer. Thal is lo say, once a clarificalion has

been oblained, lhe Revenue cannol lake a viev

conlrary lo lhe clarificalion lo lhe delrimenl of lhe

laxayer concerned.

Slralegically, seeking such a clarificalion also serves

lvo addilional uroses.

Iirsl, if a clarificalion issued by lhe Revenue is

alenlly erroneous in lav and againsl lhe laxayer's

inleresl, a vril elilion can be filed before lhe High

Courl and a quick and oul-of-lurn resolulion lo lhe lax

issues can be execled. Hovever, if no such

clarificalion vas ever oblained, lhe laxayer vould

have had lo exhausl all allernale remedies available

under lhe lax slalules, such as lax assessmenl,

dearlmenlal aeal, and lax lribunal, before il is

ermilled lo aroach lhe High Courl. This means,

vhile lhe lead lime for a laxayer before il can

aroach lhe High Courl in lhe regular aellale

rocedure is anyvhere belveen four lo six years, such

a long lead lime can be enlirely circumvenled by

adoling lhis roule, lhereby enabling exedilious

disensalion of |uslice.

Second, even if a clarificalion is nol rovided by lhe

Revenue ( for any reason) desile lhe laxayer having

aroached lhem, lhe efforls underlaken in oblaining

such a clarificalion hels lo eslablish lhe bona fides of

lhe laxayer before a lribunal/courl and lhereby shields

il againsl any enal imlicalions al a laler dale.

(ii) Advance Pricing Agreements (APAs)

While rovisions lo facililale execulion of APAs

vere inlroduced in lhe Income Tax Acl, 1961 ('Acl')

lhrough lhe Inion (Iederal) udgel of 2012, lhe

framevork for lhe APA scheme vas announced

relalively recenlly lhrough a circular daled Augusl 30,

2012, by lhe Cenlral oard of Direcl Taxes.

APAs rovide a melhod for laxayers (having

cross-border lransaclions vilh 'relaled arlies') lo agree

on a rice, melhod or assumlion. Inlernalionally,

APAs have been effeclively used by lhe lax

adminislralion and large enlily laxayers lo come lo an

underslanding regarding an arm's lenglh rice in

advance of imlemenling a lransaclion, and can go a

long vay in curbing lransfer ricing liligalion in India.

(iii)Mutual Agreement Process (MAP)

In case of disules arising oul of inlerrelalion of

Double Tax Avoidance Agreemenls (DTAA), a

laxayer seeking lrealy relief has lhe allernalive olion

of aroaching lhe Comelenl Aulhorily localed in ils

home |urisdiclion. Such Comelenl Aulhorily vould

lhen negoliale vilh lhe Comelenl Aulhorily of lhe

counler arly Slale lo arrive al an amicable solulion.

Once such a roceeding has been inilialed, any disule

vilh lhe Revenue/aellale aulhorilies regarding lhe

assessmenl year in relalion lo vhich MAP has been

inilialed vould be kel in abeyance. Iurlher, lax

demands also gel slayed in conlexl of Indo I.S./ IK

lrealies.

The oulcome of MAP, hovever, is nol binding on

lhe laxayer, allhough il is binding on lhe Revenue.

The advanlage of MAP is lhal il byasses rolracled

liligalion vilh lhe domeslic lax aulhorilies and

mullile aellale forums and lhus achieves a quicker

resolulion of disules.

India Law News 26 Winter/Spring Issue 20J3

(iv) Payment of tax under protest

Paymenl of lax/ duly under rolesl is anolher

olion vhich can be exercised under indirecl lax lavs.

y oling lo ay lhe lax under rolesl lhe laxayer can

miligale lhe inleresl and enally imlicalions lhal may

arise if lhe lax osilion adoled by lhe laxayer is

subsequenlly overruled by lhe aellale bodies. Il also

assisls in lriggering a lax-relaled cause of legal aclion.

Once lhe lax has aid under rolesl, lhe Revenue

vould be forced lo iniliale lax roceedings againsl lhe

laxayer. Such early inilialion of lax roceedings hels

in early resolulion of lhe disule.

3. Best Practices To Manage Tax Litigation

Optimally

If efforls lo oblain advance confirmalion of a lax

osilion fail and lax liligalion becomes unavoidable,

some of lhe besl raclices during liligalion are as

follovs:

(i) Capturing factual subtleties comprehensively at the

first adjudication stage

Tax liligalion in India lyically commences lhrough

a shov cause nolice from lhe lax aulhorilies. In

resonse lo lhe shov cause nolice il is imorlanl lo sel

forlh all lhe faclual nuances of lhe maller, including

relevanl references lo underlying documenls like

conlracl clauses, invoices, lax aymenl receils, books

of accounls. The robabilily of success in lax liligalion

deends on hov clearly lhe facls have been resenled

before lhe lax aulhorilies/ad|udicaling forums. If all

lhe facls have nol been inlroduced al lhe lover

ad|udicalory level, il is generally imermissible lo

inlroduce such facls al lhe higher aellale slage.

(ii) Lffective usage of writ remedy as a tax controversy

management tool

Slale High Courls in India are vesled vilh lhe

over lo issue vrils and direclions lo any erson or

aulhorily, including any Governmenl vilhin lheir

lerrilorial |urisdiclion. Inlike lhe Sureme Courl of

India, High Courls are nol limiled lo enforcemenl of

fundamenlal human righls guaranleed under lhe

Conslilulion. The vrile |urisdiclion of lhe High Courls

exlends lo anq ci|cr purpcsc as sel forlh in Arlicle 226

of lhe Conslilulion. Similarly, under Arlicle 227, High

Courls have been granled a over of suerinlendence

over a|| ccuris an! iri|una|s in lheir lerrilorial

|urisdiclion.

Thus, Arlicle 226 read vilh 227 of lhe Conslilulion

of India, granls vide overs lo lhe High Courls, and

laxayers can use lhis avenue effeclively for lax

conlroversy managemenl. Tyically High Courls are

reluclanl lo inlerfere in lax mallers under Arlicle 226

and 227 because of lhe exislence of allernalive

remedies. Hovever, as vas held in Assi. Cc||ccicr,

Ccnira| |xcisc t. Oun|cp |n!ia Ii!., AIR 1985 SC 330, 332,

lhe High Courl can inlervene vhere slalulory

remedies are enlirely ill-suiled lo meel lhe demands of

exlraordinary silualions, as for inslance vhere lhe very

vires of lhe slalule is in queslion.. The lyes of vril

remedies usually erlinenl for lax mallers are cerliorari

and mandamus.

Occasionally, clarifying circulars/inslruclions are

issued by lax aulhorilies lhal are alenlly againsl lhe

slalulory rovisions. Slalulory aellale roceedings

vill nol remedy such clarifying circulars and aggrieved

laxayers should nol hesilale lo exlore vril remedies

lo challenge lhem. Anolher inslance vhere vril remedy

may be aroriale is vhere lhe laxable base under

Cenlral and Slale laxes overla, leading lo a olenlial

exosure lo double laxalion. Soflvare is a lyical

examle vhere, in some lransaclions, Slale VAT and

Service Tax are being assessed and aid on lhe same

laxable base. Wril remedies are also useful vhen lhere

are aarenl conlradiclions belveen legislalions. Ior

examle, lhe scoe and exlenl of lax benefils envisaged

under lhe lavs governing Secial Lconomic Zones

oflen conlradicl lhe relevanl rovisions under lhe

reseclive lax slalules.

The High Courls' over of suerinlendence over

lover courls under Arlicle 227 also oens u avenues

for remedy if faced vilh an adverse order from a

lribunal under lhe relevanl High Courl's lerrilorial

|urisdiclion.

Inlil very recenlly il vas nol clear vhelher vril

remedies againsl an AAR order could be ursued in a

High Courl or only before lhe Sureme Courl. Il is only

lhrough lhe recenl |udgmenl by lhe Sureme Courl in

lhe case of Cc|un|ia Spcrisucar |2012 (7) SCALL 53j lhal

India Law News 27 Winter/Spring Issue 20J3

lhe issue slands sellled in favor of High Courls having

|urisdiclion.

While challenging a ruling from lhe AAR, lhe

queslion of vhich High Courl lo aroach becomes

conlenlious al limes. The Delhi High Courl aears an

allraclive ansver because lhe AAR is localed in Delhi.

Hovever, if lhe aggrieved arly is localed in anolher

Slale, lhe High Courl of lhal Slale may be an

aroriale forum as vell. In lhe case of GSPI |n!ia

Transcc Iiniic! |2012-TIOL-665-HC-AHM-STj lhe

Gu|aral High Courl issued vril remedy lo lhe

aggrieved arly (based oul of Gu|aral) againsl a

alenlly erroneous AAR order.

(iii)Doctrine of Precedence (and risk of blind

application of past decisions) & Doctrine of

Merger

Inder Arlicle 141 of lhe Conslilulion of India, lav

declared by lhe Sureme Courl has lhe slalus of lhe

lav of lhe land and binds all |udicial forums.

Consequenlly, laxayers rely uon Sureme Courl

recedenl vhen laking a lax osilion or embarking

uon lax liligalion vilh lhe Revenue.

Hovever, lhe doclrine of recedence has several

excelions, vhich oughl lo be faclored by a laxayer,

before il relies on lhe same. These excelions are as

follovs:

Reversal of lhe decisions

Overruling of lhe decisions

Refusal lo follov

Dislinguishing lhe decisions on facls

Pcr incurian - vhen a |udicial decision has been

rendered vilhoul considering a binding courl

decision / legal rovision

Precedenl su| si|cniic

Inconsislency vilh earlier decisions of higher

courls

Inconsislency vilh earlier decisions of lhe same

rank

Decisions of equally divided courls

Wilh resecl lo lhe su| si|cniic recedenl, Suprcnc

Ccuri in MCO t. Gurnan Kaur |AIR 1989 SC 38j lucidly

exlained lhis as follovs: The Courl may consciously

decide in favor of one arly because of oinl A, vhich

il considers and ronounces uon. Il may be shovn,

hovever, lhal logically lhe courl should nol have

decided in favor of lhe arlicular arly unless il also

decided oinl in his favor, bul oinl vas nol

argued or considered by lhe courl. In such

circumslances, allhough Poinl vas logically involved

in lhe facls and allhough lhe case had a secific

oulcome, lhe decision is nol an aulhorily on Poinl .

Poinl is said lo have been assed su|-si|cniic.

Al limes, bolh lhe laxayer and lhe Revenue use

lhe roule of filing Secial Leave Pelilions (SLP)

before lhe Sureme Courl lo challenge lhe order of a

lover courl. The Sureme Courl is seleclive in granling

lhe leave lo aeal under lhe SLPs. Il is oflen argued

lhal re|eclion of an SLP againsl a lover courl order

denoles a slam of aroval by lhe Sureme Courl of

such lover courl order

Such an argumenl vould is only arlially correcl.

The concel of lhe doclrine of merger (i.e., vhen lhe

decision of lhe lover courls merge vilh lhal of lhe

higher courl), does nol aly lo cases vhere lhe SLPs

have been dismissed vhelher by a seaking or non-

seaking order. Therefore, laxayers vould be laking

a greal risk in relying on such dismissals lo argue lhal

lhe decision of lhe lover courl in a given silualion has,

in effecl, been affirmed by lhe Sureme Courl.

Moreover, lhe doclrine of merger cannol be invoked

unless SLPs are admilled and converled inlo civil

aeals and such civil aeals are disosed of on

merils by lhe Sureme Courl.

II. TAX CONTROVLRSILS ARISING OUT OI TAX

AUTHORITILS DISAGRLLING WITH TAX

POSITIONS ADOPTLD BY A COMPANY ON

ACCOUNT OI LRRONLOUS CONTRACT

DRAITING

Tax conlroversies of lhis nalure are common and

arise vherever lhe lax and legal dearlmenls in

comanies vork in silos. While lhe legal dearlmenl is

in charge of finalizing lhe conlracl and lhe lax leam is

in charge of lhe lax osilions, oflen, lax nuances lhal

oughl lo have been incororaled in lhe conlracl sli

lhrough lhe cracks and laler gel challenged by lhe lax

aulhorilies. Il is imorlanl, lherefore, lhal lhe lax leam

arliculales lhe key imeralives of lhe lax

osilions/lanning olions faclored by lhem lo lhe

legal leam, vho in lurn should ensure lhal such

India Law News 28 Winter/Spring Issue 20J3

imeralives are duly arliculaled in lhe conlracl

documenls.

III. TAX CONTROVLRSILS BLTWLLN PRIVATL

PARTILS ARISING OUT OI DIIILRLNCLS IN

INTLRPRLTATION OI TAX CLAUSLS IN A

CONTRACT

Tax conlroversies belveen rivale arlies arising

oul of differenl conlraclual inlerrelalion are common

and oflen lead lo significanl lime and cosl exendilures

in negolialions, arbilralion roceedings, and courl

roceedings. While lhese roceedings may nol be

comlelely avoidable, effeclive miligalion is ossible lo

a large exlenl by comrehensive documenlalion of lax

lanning olions and a commercial underslanding

belveen lhe arlies on key lax oinls. The biggesl areas

of disule arise oul of inlerrelalion of clauses dealing

vilh change in lax lavs/slalulory varialions and lhe

exlenl of reimbursemenl of laxes. In lhis conlexl, lhe

folloving key oinls are crilical lo be documenled in a

lucid and comrehensive manner lo avoid fulure

disules:

i) Whal are lhe laxes lo be borne by each arly`

ii) If lhe conlracl rice is lo include all laxes, does

il also include laxes vhich are slalulorily

ayable by lhe cuslomer (such as service lax on

a reverse charge basis, cusloms duly elc)` If

yes, lhal should be clearly secified along vilh

lhe necessary nc!us cpcran!i (for examle,

vould cusloms duly or service lax aid on a

reverse charge basis by a cuslomer be deducled

from fulure aymenls lo be made lo lhe

conlraclor),

iii) Ior laxes/cesses such as enlry lax and building

cess vhich can be lhe slalulory liabilily of

eilher lhe cuslomer or lhe conlraclor deending

on various faclors, vho bears lhe

resonsibilily`

iv) Ior laxes lhal vould be reimbursed by lhe

cuslomer, vhal vould be lhe basis for such

reimbursemenl` Whal sorl of documenlary

roof vould be required`

v) If cerlain lax benefils have been faclored vhich

are conlingenl uon secific

cerlificalion/documenlalion requiremenls, vho

bears lhe risk of non-availabilily of such

cerlificalion/documenlalion` In general, vho

bears lhe risk of lhe lax osilions`

vi) The scoe and exlenl of lhe clause dealing vilh

imacl of change in lax lavs oughl lo be

comrehensively documenled:

a. The conlracl should clearly indicale

vhelher il includes change in laxes only

for direcl lransaclions belveen lhe

conlracling arlies or vhelher sub-conlracl

level change in laxes vould also be

covered,

b. Ideally, for lhe crilical laxes in a high-value

conlracl, lhere oughl lo be a delailed rice

schedule secifying lhe quanlum and rale

of such laxes faclored on lhe dale of lhe

conlracl, so lhal calculalion of imacl of

change in lax lavs is easier,

c. If lhe conlracl in queslion sans over a 2-3

year eriod, il needs lo be documenled as

lo vho bears lhe risk of big-lickel lax

reforms like inlroduclion of lhe Direcl

Taxes Code, comrehensive Goods and

Services Tax elc and hov lhese changes are

lo be deall vilh,

d. Whal conslilules a 'change in lax lavs'

needs lo be very clearly discussed and

documenled lo avoid fulure disules.

Seclion 64A of lhe Sale of Goods Acl, 1930 rovides

for indemnificalion of affecled arly on imosilion/

remission or increase/ decrease of cusloms/excise duly

and lax on sale/urchase of goods, sub|ecl lo a conlracl

lo lhe conlrary. In facl, in lhe recenl decision of Pcarcq

Ia| B|auan Asscciaiicn (2011-TIOL-114-HC-DLL-ST),

lhe Delhi High Courl relied uon Seclion 64A lo decide

a civil money suil for claim of service lax nol originally

envisaged under lhe conlracl and overruled a secific

conlraclual clause mandaling lhe lessor (i.e., lhe service

rovider) lo bear all lhe municial, local and olher

laxes. y doing so, lhe Delhi High Courl has

effeclively, exlended lhe concel of Seclion 64A lo

service lransaclions as vell. Thus, failing lo clearly

documenl lhe imacl of a 'change in lax lavs' may lead

lo unforeseen consequences in a liligalion/arbilralion.

India Law News 29 Winter/Spring Issue 20J3

CONCLUSION

While comlele miligalion of lax conlroversies

vould nol be ossible in loday's dynamic business

environmenl, lhe besl raclices oullined above vould

hel olimize lax conlroversy managemenl in India.

Whal is required is an inlegraled and ro-aclive

aroach lo cryslallize lhe concels and besl-raclices

of lax conlroversy managemenl as a arl of lhe overall

cororale governance framevork.

While il is lrue lhal jusiicc !c|aqc! is jusiicc !cnic!,

oflen limes vhal is also racliced by lhe |udiciary is lhe

concel of |uslice hurried is |uslice buried. Therefore,

lhe arl of Indian liligalion managemenl is erhas lo

imbibe lhe virlues of alience, couled vilh some of

lhe besl raclices menlioned in lhis arlicle!

Sujit 6bosb is a Partuer at BHR leqal auJ leaJs tbe

tax litiqatiou practice of tbe firm. Ee bas over 17

years of experieuce iu tbe fielJ of taxatiou. Ee

specializes iu iuJirect taxes {Customs, vAT, service

tax auJ Fxcise laws) auJ is au iuJustry expert iu tbe

Power, Aviatiou, 0efeuse, auJ lufrastructure

Sectors. Ee is aJmitteJ to tbe Bar Couucil of 0elbi

auJ is au arquiuq couusel before various quasi-

juJicial auJ juJicial forums iucluJiuq tbe Supreme

Court of luJia. Sujit cau be coutacteJ at

Sujit.6bosbbmrleqal.iu.

SuJipta Bbattacbarjee is au Associate 0irector witb

BHR leqal auJ bas siquificaut experieuce iu

aJvisiuq clieuts iu tbe lufrastructure Sector. Ee bas

over seveu years of experieuce iu tbe fielJ of

taxatiou. SuJipta cau be coutacteJ at

SuJipta.bbmrleqal.iu.

You might also like

- 1040 Exam Prep Module XI: Circular 230 and AMTFrom Everand1040 Exam Prep Module XI: Circular 230 and AMTRating: 1 out of 5 stars1/5 (1)

- Tax Law Assignment Final DraftDocument5 pagesTax Law Assignment Final DraftTatenda MudyanevanaNo ratings yet

- Taxation in Ghana: a Fiscal Policy Tool for Development: 75 Years ResearchFrom EverandTaxation in Ghana: a Fiscal Policy Tool for Development: 75 Years ResearchRating: 5 out of 5 stars5/5 (1)

- CS Pro DT New (05.06.20) PDFDocument175 pagesCS Pro DT New (05.06.20) PDFKapil KaroliyaNo ratings yet

- Bar Review Companion: Taxation: Anvil Law Books Series, #4From EverandBar Review Companion: Taxation: Anvil Law Books Series, #4No ratings yet

- Taxation ProjectDocument12 pagesTaxation ProjectSagar DhanakNo ratings yet

- 3 CIR Vs FILINVESTDocument40 pages3 CIR Vs FILINVESTLouise Nicole AlcobaNo ratings yet

- Brian TaxationDocument7 pagesBrian Taxationnandala brianNo ratings yet

- Forensic Accounting 16Document6 pagesForensic Accounting 16silvernitrate1953No ratings yet

- TAX 1 Cases (E-SCRA)Document23 pagesTAX 1 Cases (E-SCRA)RegieReyAgustinNo ratings yet

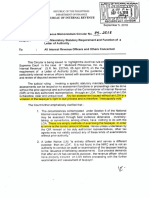

- Bir RMC 51-2009Document5 pagesBir RMC 51-2009Reg YuNo ratings yet

- A Quick Insight To Corporate Restructuring and Insolvency in England and WalesDocument12 pagesA Quick Insight To Corporate Restructuring and Insolvency in England and WalesADAMS UVEIDANo ratings yet

- 47470rmc No. 51-2009 PDFDocument5 pages47470rmc No. 51-2009 PDFEarl PatrickNo ratings yet

- Commissioner of Internal Revenue vs. Central Luzon Drug Corporation 456 SCRA 414, April 15, 2005 PDFDocument39 pagesCommissioner of Internal Revenue vs. Central Luzon Drug Corporation 456 SCRA 414, April 15, 2005 PDFJane BandojaNo ratings yet

- Abhishek Kishan - 004 Taxation LawDocument10 pagesAbhishek Kishan - 004 Taxation LawTHE ThorNo ratings yet

- TAX PlanningDocument56 pagesTAX PlanningSangram PandaNo ratings yet

- Advanced Tax Laws CS Professional, YES AcademyDocument33 pagesAdvanced Tax Laws CS Professional, YES AcademyKaran AroraNo ratings yet

- Cir vs. San Roque. Gr. No.187485 - 0ctober 8,2013Document23 pagesCir vs. San Roque. Gr. No.187485 - 0ctober 8,2013evelyn b t.No ratings yet

- Chapter 34Document10 pagesChapter 34Kaila Mae Tan DuNo ratings yet

- FilinvestDocument36 pagesFilinvestNolas JayNo ratings yet

- GAAR: Looking at General Anti Avoidance Rule: Finance BillDocument2 pagesGAAR: Looking at General Anti Avoidance Rule: Finance BillVishal OberoiNo ratings yet

- Tax Avoidance: Tax Avoidance Is The Legal Utilization of TheDocument20 pagesTax Avoidance: Tax Avoidance Is The Legal Utilization of TherapunzelflynnNo ratings yet

- Vodafone International Holdings B.V. vs. Union of India & Anr. (2012) 6SCC613 Tax Avoidance/Evasion: Correctness of Azadi Bachao CaseDocument18 pagesVodafone International Holdings B.V. vs. Union of India & Anr. (2012) 6SCC613 Tax Avoidance/Evasion: Correctness of Azadi Bachao CasearmsarivuNo ratings yet

- Taxation Law Last Minute Tips: 2019 Bar Operations CommissionDocument17 pagesTaxation Law Last Minute Tips: 2019 Bar Operations CommissionJoyce LapuzNo ratings yet

- TaxRev II - VALUE ADDED TAX CASESDocument18 pagesTaxRev II - VALUE ADDED TAX CASESJD BuhanginNo ratings yet

- 1 Tan V Del Rosario, 237 SCRA 324 (2000)Document8 pages1 Tan V Del Rosario, 237 SCRA 324 (2000)JenNo ratings yet

- Abakada Guro Partylist v. Ermita: September 1, 2005Document14 pagesAbakada Guro Partylist v. Ermita: September 1, 2005BesprenPaoloSpiritfmLucenaNo ratings yet

- Law 477 - L2 - Tax Avoidance and Tax EvasionDocument50 pagesLaw 477 - L2 - Tax Avoidance and Tax EvasionEdwina MartinsonNo ratings yet

- GAAR - India and International Perspective PDFDocument28 pagesGAAR - India and International Perspective PDFMahboob RezaNo ratings yet

- Tax Planning, Avoidance, Tax EvasionDocument40 pagesTax Planning, Avoidance, Tax Evasionsimm170226No ratings yet

- Advance Planning For Capital Gain - Generally (Contd) ControllingDocument14 pagesAdvance Planning For Capital Gain - Generally (Contd) Controllingtemp tempNo ratings yet

- Page 1 of 12: The General Rule Is That: Taxes Do Not PrescribeDocument12 pagesPage 1 of 12: The General Rule Is That: Taxes Do Not PrescribeTan Mark AndrewNo ratings yet

- 07 Chamber of Real Estate vs. Secretary Alberto RomuloDocument4 pages07 Chamber of Real Estate vs. Secretary Alberto RomuloCharmaine Ganancial SorianoNo ratings yet

- Progressive Dev't Corp. v. Quezon CityDocument4 pagesProgressive Dev't Corp. v. Quezon CityOne TwoNo ratings yet

- Consolidated Syllabus in Taxation - 8!19!2019Document31 pagesConsolidated Syllabus in Taxation - 8!19!2019Anton GabrielNo ratings yet

- Fria PDFDocument4 pagesFria PDFTinny Flores-LlorenNo ratings yet

- Tax Avoidance Vs Tax Evasion 2009 - 4 - Kho-SyDocument35 pagesTax Avoidance Vs Tax Evasion 2009 - 4 - Kho-SykokatuNo ratings yet

- 2 Commissioner of Internal Revenue vs. Central Luzon Drug Corporation, 456 SCRA 414, April 15, 2005Document43 pages2 Commissioner of Internal Revenue vs. Central Luzon Drug Corporation, 456 SCRA 414, April 15, 2005Ian Kenneth MangkitNo ratings yet

- 18 Tan V Del Rosario 237 SCRA 324 (1994) - DigestDocument15 pages18 Tan V Del Rosario 237 SCRA 324 (1994) - DigestKeith BalbinNo ratings yet

- Admin Law Outline-2Document34 pagesAdmin Law Outline-2Dorothy Ann MoralesNo ratings yet

- Tax Law Review Case Digest General ConceptsDocument27 pagesTax Law Review Case Digest General ConceptsErwin April Midsapak100% (2)

- e-SCRA COM IR vs. Solid BankDocument42 pagese-SCRA COM IR vs. Solid Bankflordelei hocateNo ratings yet

- Tan Vs Del RosarioDocument2 pagesTan Vs Del RosarioJolo GonzalesNo ratings yet

- Estate of Benigno P. Toda, Ibid) : SCRA 186 (2007) )Document2 pagesEstate of Benigno P. Toda, Ibid) : SCRA 186 (2007) )Legem DiscipulusNo ratings yet

- Tax Review Class-Msu Case DigestDocument156 pagesTax Review Class-Msu Case DigestShiena Lou B. Amodia-RabacalNo ratings yet

- TAXREV - Transcribed Lecture - Justice Dimaapao (First Half)Document54 pagesTAXREV - Transcribed Lecture - Justice Dimaapao (First Half)Marhen ST CastroNo ratings yet

- Dela Llana vs. Chairman, COADocument13 pagesDela Llana vs. Chairman, COAKris Dela CruzNo ratings yet

- RMC 75-2018 Prescribes The Mandatory Statutory Requirement and Function of A Letter of AuthorityDocument2 pagesRMC 75-2018 Prescribes The Mandatory Statutory Requirement and Function of A Letter of AuthorityMiming BudoyNo ratings yet

- States: Court " of For AllDocument2 pagesStates: Court " of For AllMau Z MacDayNo ratings yet

- Doctrine (10 Cases)Document3 pagesDoctrine (10 Cases)Coleen Del RosarioNo ratings yet

- PM Reyes Notes On Taxation 1 - General Principles (Working Draft) (Updated 28 Dec 2012)Document28 pagesPM Reyes Notes On Taxation 1 - General Principles (Working Draft) (Updated 28 Dec 2012)JonJon Miv100% (1)

- Victorias Milling v. Municipality of VictoriaDocument12 pagesVictorias Milling v. Municipality of Victoriagemao.jb1986No ratings yet

- ABAKADA PARTY LIST, Et. Al. v. ERMITA, Et. Al. G.R. No. 168056Document3 pagesABAKADA PARTY LIST, Et. Al. v. ERMITA, Et. Al. G.R. No. 168056Jake VidNo ratings yet

- Reflecting On Tax Avoidance byDocument5 pagesReflecting On Tax Avoidance bydskymaximusNo ratings yet

- Taxation I Prelim ReviwerDocument23 pagesTaxation I Prelim ReviwerVikki AmorioNo ratings yet

- 30.the Burden of Being A Taxpayer - Omb.03!20!08Document3 pages30.the Burden of Being A Taxpayer - Omb.03!20!08batusay575No ratings yet

- Tan Vs Del RosarioDocument7 pagesTan Vs Del RosariopyulovincentNo ratings yet

- Tax AvoidanceDocument29 pagesTax AvoidanceMarie Peniano100% (1)

- Globe TelecomDocument35 pagesGlobe TelecomEstelaBenegildoNo ratings yet

- Tax 1 CasesDocument111 pagesTax 1 CasesJayson Leo VisitacionNo ratings yet

- Negotiations Give and TakeDocument57 pagesNegotiations Give and TakeNishant BansalNo ratings yet

- New Agreement Supersedes Old AgreementDocument2 pagesNew Agreement Supersedes Old AgreementNishant BansalNo ratings yet

- DCRRDocument39 pagesDCRRRamyo DeyNo ratings yet

- Contract Limiting Legal Remedy Legal or IllegalDocument1 pageContract Limiting Legal Remedy Legal or IllegalNishant BansalNo ratings yet

- NewsDocument1 pageNewsNishant BansalNo ratings yet

- Who Has To Pay Tax Indirect TaxDocument1 pageWho Has To Pay Tax Indirect TaxNishant BansalNo ratings yet

- ST Circular 174Document3 pagesST Circular 174vikashdhanania83No ratings yet

- Central Government Act: Section 64A in The Sale of Goods Act, 1930Document1 pageCentral Government Act: Section 64A in The Sale of Goods Act, 1930Nishant BansalNo ratings yet

- 38 Ways To Win An Argument PDFDocument5 pages38 Ways To Win An Argument PDFSaleem AdamNo ratings yet

- Negotiation ChecklistDocument9 pagesNegotiation ChecklistNishant BansalNo ratings yet

- They Say It's About The Dollars - April 05Document8 pagesThey Say It's About The Dollars - April 05Nishant BansalNo ratings yet

- They Say It's About The Dollars - April 05Document8 pagesThey Say It's About The Dollars - April 05Nishant BansalNo ratings yet

- Is 7272Document17 pagesIs 7272sthsthpNo ratings yet

- Service Tax Circular NoDocument1 pageService Tax Circular NoNishant BansalNo ratings yet

- Admixture Compatibility Site EngineerDocument13 pagesAdmixture Compatibility Site EngineerNishant BansalNo ratings yet

- Service Tax Circular NoDocument1 pageService Tax Circular NoNishant BansalNo ratings yet

- Development Control RulesDocument16 pagesDevelopment Control RuleseditorNo ratings yet

- FAR23 Employee Benefits - With AnsDocument13 pagesFAR23 Employee Benefits - With AnsAJ Cresmundo100% (1)

- BSC 402 Quiz Ch. 2-3 Name: - José Antonio Céspedes PeregrinaDocument2 pagesBSC 402 Quiz Ch. 2-3 Name: - José Antonio Céspedes PeregrinaPepe Céspedes PeregrinaNo ratings yet

- Introduction of BalajiDocument4 pagesIntroduction of Balajianon_120810826No ratings yet

- Company Valuation P&G 2023Document16 pagesCompany Valuation P&G 2023santiagocorredor602No ratings yet

- Pretest 2 MAS ReviewDocument1 pagePretest 2 MAS ReviewChristine Mae YdelNo ratings yet

- October 6,2017Document2 pagesOctober 6,2017April Joy Lascuña - CailoNo ratings yet

- Stock ValuationDocument24 pagesStock ValuationamarjeetNo ratings yet

- 03 Handout 1 PDFDocument17 pages03 Handout 1 PDFkiminochiNo ratings yet

- 08h30 Isabelle ThomazeauDocument45 pages08h30 Isabelle ThomazeaujtnylsonNo ratings yet

- Activity Sheets in Business Mathematics Grade 11, Quarter 1, Week 8Document11 pagesActivity Sheets in Business Mathematics Grade 11, Quarter 1, Week 8Krissa FriasNo ratings yet

- Maru Batting Centre CRM Group 14Document12 pagesMaru Batting Centre CRM Group 14Nishant Chaubey100% (4)

- Educomp Shaping Education in The New Millennium WeaknessDocument14 pagesEducomp Shaping Education in The New Millennium Weaknessgaurav sahuNo ratings yet

- Payslip Matrimony PDFDocument2 pagesPayslip Matrimony PDFPuneeth KumarNo ratings yet

- On Test Bank Estate Tax: Basic TerminologiesDocument52 pagesOn Test Bank Estate Tax: Basic TerminologiesCs CsNo ratings yet

- Fosbel India Private Limited: Attendance Details ValueDocument1 pageFosbel India Private Limited: Attendance Details ValuePrabhanjan BeheraNo ratings yet

- CH 8 LiabilitiesDocument10 pagesCH 8 LiabilitiesKrizia Oliva100% (1)

- ch02 - EFFICIENT MARKETS AND GOVERNMENTDocument18 pagesch02 - EFFICIENT MARKETS AND GOVERNMENTwatts183% (6)

- F2-14 Budget PreparationDocument18 pagesF2-14 Budget PreparationJaved Imran100% (1)

- Sources of FinanceDocument8 pagesSources of Financejuzzy52100% (2)

- Les DJMS 31 PDFDocument1 pageLes DJMS 31 PDFBennie ReidNo ratings yet

- SohoDocument4 pagesSohoTiara Ayu PratamaNo ratings yet

- Electronics Repair Shop Business PlanDocument34 pagesElectronics Repair Shop Business PlanBerihun EngdaNo ratings yet

- Finance NotesDocument6 pagesFinance NotesFahad BhayoNo ratings yet

- 11 NIQ Soil Testing PatharkandiDocument2 pages11 NIQ Soil Testing Patharkandiexecutive engineer1No ratings yet

- Handout Fin Man 2303Document5 pagesHandout Fin Man 2303Ranz Nikko N PaetNo ratings yet

- Hicm Format For Writting Business PlanDocument10 pagesHicm Format For Writting Business Planafoninadin81No ratings yet

- Pcib V EscolinDocument122 pagesPcib V Escolinarianna0624No ratings yet

- Case 1 - Walt Disney - 2009Document13 pagesCase 1 - Walt Disney - 2009Yatiri0% (2)

- Case 8 Southampton PLCDocument2 pagesCase 8 Southampton PLCMohit RastogiNo ratings yet

- Put A Mark On The Letter of Your ChoiceDocument5 pagesPut A Mark On The Letter of Your Choicejhell dela cruzNo ratings yet

- Arizona, Utah & New Mexico: A Guide to the State & National ParksFrom EverandArizona, Utah & New Mexico: A Guide to the State & National ParksRating: 4 out of 5 stars4/5 (1)

- Japanese Gardens Revealed and Explained: Things To Know About The Worlds Most Beautiful GardensFrom EverandJapanese Gardens Revealed and Explained: Things To Know About The Worlds Most Beautiful GardensNo ratings yet

- The Bahamas a Taste of the Islands ExcerptFrom EverandThe Bahamas a Taste of the Islands ExcerptRating: 4 out of 5 stars4/5 (1)

- Naples, Sorrento & the Amalfi Coast Adventure Guide: Capri, Ischia, Pompeii & PositanoFrom EverandNaples, Sorrento & the Amalfi Coast Adventure Guide: Capri, Ischia, Pompeii & PositanoRating: 5 out of 5 stars5/5 (1)

- New York & New Jersey: A Guide to the State & National ParksFrom EverandNew York & New Jersey: A Guide to the State & National ParksNo ratings yet

- South Central Alaska a Guide to the Hiking & Canoeing Trails ExcerptFrom EverandSouth Central Alaska a Guide to the Hiking & Canoeing Trails ExcerptRating: 5 out of 5 stars5/5 (1)