Professional Documents

Culture Documents

Oklahoma Public Trust Laws Explained

Uploaded by

Min Hotep Tzaddik BeyOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Oklahoma Public Trust Laws Explained

Uploaded by

Min Hotep Tzaddik BeyCopyright:

Available Formats

Public Trusts Laws

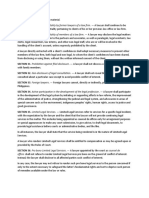

(Title 60 of the Oklahoma Statutes, Sections 176-180.4) PURPOSE Public trusts may be created to issue obligations and provide funds for the furtherance of any public purpose of the municipality, which is the beneficiary of the trust. ADVANTAGE, Unlike a municipality, a public trust is not subject to the constitutional debt limitation and may issue revenue bonds. LEGAL STATUS The trust must be operated as a legal entity separate from the municipality rather than as a department of the municipality even when its board of trustees is identical to the governing body of the municipality. This requires separate meetings for conducting trust business, separate books and accounts and separate fiscal affairs. Funds of the trust must not be commingled with those of the municipality. POWERS The trust indenture is the main source for determining the purpose, powers and operating procedures of the trust. Some indentures provide that surplus funds of the trust may be transferred to the municipality but others direct that revenues will be retained by the trust. Also some trust indentures or bond indentures require specific rate structures or maintenance and capital improvements standards. TORT LIABILITY The public trust is liable for its own torts. The Governmental Tort Claims Act controls the limits and conditions of the liability. (Title 51, Section 152) PURCHASING AND COMPETITIVE BIDDING Public trusts are governed by two competitive bidding requirements. They are subject to the Public Competitive Bidding Act. (Title 61, Section 101). In addition, bids must be sought for all contracts for construction, labor, equipment, material or repairs in excess of $7,500.00 in accordance with the procedure set out in Title 60, Section 1 76(h).

(h)

Contracts for construction, labor, equipment, material or repairs in excess of seven thousand five hundred dollars ($7,500.00) shall be awarded by public trusts to the lowest and best competitive bidder, pursuant to public invitation to bid, which shall be published in the manner provided in the preceding section hereof [see Section 1 76(f)]; such advertisements shall appear in the county where the work, or the major part of it, is to be done, or the equipment or materials are to be delivered, or the services are to be rendered. Provided, however, should the trustee or the trustees find that an immediate emergency exists, which findings shall be entered in the journal of the trust proceedings, by reason of whicl1 an immediate outlay of trust funds in an amount exceeding seven thousand five hundred dollars ($7,500.00) is necessary in order to avoid loss of life. Substantial damage to property, or damage to the public peace or safety, then such contracts may be made and entered into without public notice or competitive bids; provided that the provisions of this subsection shall not apply to contracts of industrial trusts. Other purchasing requirements may be provided in the trust instrument or by policies adopted by the trust's board of trustees.

MEETINGS AND RECORDS In addition to the Open Meeting Law and the Open Records Act, public trusts must comply with the meeting, record keeping and reporting requirements of Title 60, Section 1 7XD. D. Meetings of trustees of al I public trusts shall be open to the public to the same extent as is required by law for other public boards and commissions. Such meetings shall also be open to the press and any such equipment deemed necessary by the press to record or reports the activities of the meetings. In such trusts wherein the State of Oklahoma is the beneficiary, a written notice of trustees' meetings shall be filed with the office of the Secretary of State at least three (3) days prior to the meeting date. Records of the trust and minutes of the trust meetings of any public trust shall be written and kept in a place, the location of whicl1 shall be recorded in the office of the county clerk of each county, wherein the trust instrument shall be recorded. Such records and minutes shall be available for inspection by any person during regular business hours. Every trust created under Sections 176 et seq. of this title shall file a monthly report of all expenditures of bond proceeds with the governing body of the beneficiary and with the Governor, the Speaker of the House of Representatives and the President Pro Tempore of the Senate in the case of a public trust having the State of Oklahoma as beneficiary. CONFLICTS OF INTEREST The specific conflict of interest provisions for public trustees appear at in Title 60, Section 178.8. A. Except with regard to residents of a facility for aged persons operated by a public trust, who are trustees of the public trust operating the facility and who comprise less than a majority of the trustees, a conflict of interest shall be deemed to exist in any contractual relationship in which a trustee of a public trust, or any for-profit firm or corporation in which such trustee or any member of his or her immediate family is an officer, partner, principal stockholder, shall directly or indirectly buy or sell goods or services to, or otherwise contract with such trust. Upon a showing thereof, such trustee shall be subject to removal and such contact shall be deemed unenforceable; as against such trust unless the records of such trust shall reflect that such trustee fully and publicly disclosed all such interest or interests, and unless such contractual relationship shall have been secured by competitive bidding following a public invitation to bid. The following types of transactions are exempt from the aforementioned provisions of this section: 1. The making of any loan or advance of any funds to, or the purchase of any obligations issued by such public trust, in connection with the performance of any of its authorized purposes; 2. Any legal advertising required by law or indenture or determined necessary by the trustees of such public trust; 3. The performance by any bank, trust company or similar entity or any services as a depository; or 4. The sale of any public utility services to such public trust, in which the price of said services, is regulated by law. It shall be the duty of each public trust to compile a list of all conflicts of it which its trustees have made disclosure, It shall also be the duty of each trust to compile a list of all dealings between its trustees and the trust which involve the exempted transactions listed above. Such lists shall be compiled semiannually for periods ending June 30 and December 31 of each year. Such lists shall be compiled on forms prescribed by the Oklahoma Tax Commission and shall be a matter of public record. Copies of such shall be filed with the Secretary of State by September 1and March 1 of each year.

B. The provisions of this section shall be inapplicable to any public trust created and existing prior to July I, 1988, if all bonds issued by such public trust are required to be issued under and pursuant to a single bond indenture by amendment or supplement thereto and if the incitement or will creating such public trust and the bond indenture under which such trust must issue all bonds shall have been held to be valid and binding agreements in an opinion of the Supreme Court of the State of Oklahoma, and nothing in this section shall impair or be deemed to impair the trust indenture, the bond indenture, or existing or future obligations of such public trust. AUDITS Title 60, Section 180. 1: The trustees of every trust created for the benefit and furtherance of any public function with the State of Oklahoma or any 'county or municipality as the beneficiary or beneficiaries thereof must cause an audit to Be mace: of, including, but not limited to, the funds, accounts, and fiscal affairs of such trust, such audit to be ordered within thirty (30) days of the close of each fiscal year of the trust. Title 60, Section 180.2: a. The audits herein required shall be certified with the opinion of a certified public accountant or a licensed public accountant notwithstanding any lesser requirement by any instrument under which the trust may have covenanted for an audit to be made or furnished. The required audit shall adhere to standards set by the State Auditor and Inspector. Once copy of the annual audit shall be filed with the State Auditor and Inspector one copy with each beneficiary of the trust, not later then six (6) months following the close of each fiscal year of the trust. b. Within thirty (30) days after the effective date hereof' each trust mentioned in Section 180.1 of this title shall certify to the State Auditor and Inspector the date of the close of its fiscal year. c. In the event that copy of such audit as herein requited shell not be filed with the State Auditor and Inspector within the time herein provided, the State Auditor and Inspector hereby is authorized to employ at the cost and expense of the trust, a certified public accountant or licensed public accountant to make the audit herein required. d. Prior to the delivery of and payment for any bonds, notes or other evidences of indebtedness by a public trust there shall be filed with the Secretary of State an executed original or certified copy of the written instrument or will creating such public trust and a notice of said filing with the Secretary of State shall be delivered to the State Auditor and Inspector. Budget Title 60, Section 176 (g): Public trusts created pursuant to this section shall file annually, with their respective beneficiaries, copies of financial documents and reports sufficient to demonstrate the fiscal activity of such trust, including, but not limited to, budgets, financial repots, bond indentures and audits. Amendments to the adopted budget shall be approved by the trustees of the public trust and recorded as such in the officials minutes of such trust. Public trusts created pursuant to this section shall comply with annual budget provisions applicable to the beneficiary of such trust. A copy of such budget shall be submitted to the beneficary.

You might also like

- Person Court Tricks: This Is How The Perceive YouDocument1 pagePerson Court Tricks: This Is How The Perceive YouMin Hotep Tzaddik Bey100% (1)

- Uniform Code and Trust 3Document1 pageUniform Code and Trust 3Min Hotep Tzaddik BeyNo ratings yet

- The Barbary Treaties 1786-1816 - Treaty of Peace and Friendship, Signed at Tripoli November 4, 1796Document3 pagesThe Barbary Treaties 1786-1816 - Treaty of Peace and Friendship, Signed at Tripoli November 4, 1796Min Hotep Tzaddik Bey100% (1)

- Page 1 of 3: Ucc Affidavit/Lien (Ablien - Doc.C:/Rostrust/Fs1)Document6 pagesPage 1 of 3: Ucc Affidavit/Lien (Ablien - Doc.C:/Rostrust/Fs1)Bruce NonassumpsitNo ratings yet

- Unveiling the Purpose of the NotaryDocument3 pagesUnveiling the Purpose of the NotaryMin Hotep Tzaddik Bey100% (2)

- Alseisin in DeedDocument8 pagesAlseisin in Deedmoorishnation100% (1)

- The Moorish Divine and National Movement of The World Legal I (Otice! Name Declaration, Correction Proclamatioi/ Ai/d PublicationDocument1 pageThe Moorish Divine and National Movement of The World Legal I (Otice! Name Declaration, Correction Proclamatioi/ Ai/d PublicationMalikBey100% (1)

- 12 USC 411 FRN ObligationsDocument1 page12 USC 411 FRN ObligationszicjrurtNo ratings yet

- Vital and Applicable United States Codes of LawDocument18 pagesVital and Applicable United States Codes of LawWen' George BeyNo ratings yet

- Registration of owner after deathDocument2 pagesRegistration of owner after deathKishore ReddyNo ratings yet

- Noble Drew AliDocument2 pagesNoble Drew AliSpiritually GiftedNo ratings yet

- Irs Notice Intent Lie NV 2..... MoorsDocument8 pagesIrs Notice Intent Lie NV 2..... Moorsamenelbey100% (2)

- Message To AmericaDocument4 pagesMessage To AmericaWen' George Bey100% (1)

- Web Civics Class 4Document7 pagesWeb Civics Class 4bill_w85081100% (1)

- PartIX Qualified ImmunityDocument7 pagesPartIX Qualified ImmunityYaw Mensah Amun RaNo ratings yet

- FAR Mandatory DisclosureNEWDocument5 pagesFAR Mandatory DisclosureNEWMin Hotep Tzaddik BeyNo ratings yet

- Secured Transactions Reading Notes and Cases - Week 2Document3 pagesSecured Transactions Reading Notes and Cases - Week 2BG215No ratings yet

- Ndictment Permanent Injuction For The Muurs EmpireDocument69 pagesNdictment Permanent Injuction For The Muurs Empireahmal coaxumNo ratings yet

- Gansul Arrival NoticeDocument19 pagesGansul Arrival Noticejaguar99100% (5)

- Sionya 20160607 0001Document6 pagesSionya 20160607 0001PriyaSiranELNo ratings yet

- Hurds Revised StatutesDocument11 pagesHurds Revised StatutesTata Chaz Uriel BeyNo ratings yet

- 12 U.S. Code 411 - Issuance To Reserve BanksDocument2 pages12 U.S. Code 411 - Issuance To Reserve BanksMin Hotep Tzaddik BeyNo ratings yet

- Clirk, U.S. Distrtct Court: RespondentDocument25 pagesClirk, U.S. Distrtct Court: RespondentSalaam Bey®100% (1)

- RV BEY PUBLICATIONS Is in Commercial Dishonor UCC 3-305, 3-502, 3-505Document4 pagesRV BEY PUBLICATIONS Is in Commercial Dishonor UCC 3-305, 3-502, 3-505:Aaron :Eil®©™No ratings yet

- Standardized Compromise and Write-Off ProceduresDocument3 pagesStandardized Compromise and Write-Off ProceduresscarsunaNo ratings yet

- Nationality Card 3.5 by 2.25Document2 pagesNationality Card 3.5 by 2.25Ilataza Ban Yasharahla -El80% (5)

- GLASGOW, DEXTER, N. ®©™ SF181 POSTED December 16th, 2016 A.D.EDocument16 pagesGLASGOW, DEXTER, N. ®©™ SF181 POSTED December 16th, 2016 A.D.EShabazz-El Foundation ©®™No ratings yet

- Purchase Agreement Between Rasheedah and Aiesha JonesDocument1 pagePurchase Agreement Between Rasheedah and Aiesha JonesS S Ali100% (2)

- MACN-A004 - Allodial Moorish Sovereign Trust-Tara Nova ElDocument12 pagesMACN-A004 - Allodial Moorish Sovereign Trust-Tara Nova ElTara Nova ElNo ratings yet

- Document No. 10105905 - Noble Drew Ali Vast Estate Trust and Original 1099 FormDocument4 pagesDocument No. 10105905 - Noble Drew Ali Vast Estate Trust and Original 1099 FormArchive BeyNo ratings yet

- SF 181 and SSA-Tiyemerenaset Ma'at ElDocument7 pagesSF 181 and SSA-Tiyemerenaset Ma'at ElTiyemerenaset Ma'at ElNo ratings yet

- How Much Satisfaction Should You Expect From An Accord - The U.C.C PDFDocument29 pagesHow Much Satisfaction Should You Expect From An Accord - The U.C.C PDFAngel DeleonNo ratings yet

- DuesDocument1 pageDuesneter58No ratings yet

- I Self Law Am Master - Neophyte Discusses Moorish Philosophy and JurisprudenceDocument4 pagesI Self Law Am Master - Neophyte Discusses Moorish Philosophy and Jurisprudencebill_w85081No ratings yet

- Bentley PDFDocument1 pageBentley PDFnanna bioNo ratings yet

- The 5 Principles of ISLAMDocument55 pagesThe 5 Principles of ISLAMJennifer David100% (2)

- MOORISH ZODIAC CONSTITUTION - Natural and Legal Rights - Human RightsDocument22 pagesMOORISH ZODIAC CONSTITUTION - Natural and Legal Rights - Human RightsAQUA KENYATTENo ratings yet

- Understanding The Doctrine of Equitable Estoppel in FloridaDocument44 pagesUnderstanding The Doctrine of Equitable Estoppel in Floridablcksource100% (1)

- Home Cover LetterDocument2 pagesHome Cover LetterYakub Dewaine bey100% (1)

- Auto Recovery Save of Kush Caliphate of North AmexemDocument27 pagesAuto Recovery Save of Kush Caliphate of North AmexempaxateicNo ratings yet

- Xi Anu Nation Tribal Police Law and Order CodeDocument4 pagesXi Anu Nation Tribal Police Law and Order CodeRoyal Maku Chief100% (1)

- Noble Drew Ali: A Divine Warning To The NationsDocument3 pagesNoble Drew Ali: A Divine Warning To The Nationsbstvsn100% (3)

- Title 4 112. Compacts Between States For Cooperation in Prevention of Crime Consent of CongressDocument1 pageTitle 4 112. Compacts Between States For Cooperation in Prevention of Crime Consent of Congresswinona mae marzocco100% (2)

- Certified Copy 1790 SC House Resolution On The Sundry Free Moors PetitionDocument6 pagesCertified Copy 1790 SC House Resolution On The Sundry Free Moors PetitionLonnie L Grady-El100% (2)

- Cover Letter Intro of SelfDocument3 pagesCover Letter Intro of SelfAndrew Mayes El0% (1)

- The Moorish Science Temple of America-De Jure Business Authority-SIS MELKIYAH Notary - ANNOUNCEMENTDocument1 pageThe Moorish Science Temple of America-De Jure Business Authority-SIS MELKIYAH Notary - ANNOUNCEMENTalmaurikanosNo ratings yet

- Adversary Proceeding. BKDocument8 pagesAdversary Proceeding. BKGOD SAVES AMERICANo ratings yet

- Skip To Main ContentDocument10 pagesSkip To Main ContentWen' George BeyNo ratings yet

- Moorish Nation Rebuts News Report on Squatter ArrestDocument8 pagesMoorish Nation Rebuts News Report on Squatter Arrestplayboi501No ratings yet

- SALES - Special LawsDocument4 pagesSALES - Special LawsElaine Belle OgayonNo ratings yet

- Foreign Assistance Act of 1961Document507 pagesForeign Assistance Act of 1961Jose TonquinNo ratings yet

- Lawful RebellionDocument2 pagesLawful RebellionHelen Walker Private PersonNo ratings yet

- The FezDocument7 pagesThe FezJ AUSARU50% (2)

- Petition for Certiorari – Patent Case 99-396 - Federal Rule of Civil Procedure 12(h)(3) Patent Assignment Statute 35 USC 261From EverandPetition for Certiorari – Patent Case 99-396 - Federal Rule of Civil Procedure 12(h)(3) Patent Assignment Statute 35 USC 261No ratings yet

- Intellectual Property Securitization: Intellectual Property SecuritiesFrom EverandIntellectual Property Securitization: Intellectual Property SecuritiesNo ratings yet

- 26 U.S. Code 7701 - Definitions - LII: Legal Information InstituteDocument18 pages26 U.S. Code 7701 - Definitions - LII: Legal Information InstituteMin Hotep Tzaddik Bey100% (1)

- "Vapor Money" Theory To Avoid Repayment of Real Property Loan Rejected by Utah Court of Appeals - UtahpropertylawDocument1 page"Vapor Money" Theory To Avoid Repayment of Real Property Loan Rejected by Utah Court of Appeals - UtahpropertylawMin Hotep Tzaddik BeyNo ratings yet

- $$$$ Collect Your Own Attorney Fees$$$ - What A Private Attorney General Is AND Why It Matters.Document48 pages$$$$ Collect Your Own Attorney Fees$$$ - What A Private Attorney General Is AND Why It Matters.83jjmackNo ratings yet

- 12 U.S. Code 411 - Issuance To Reserve BanksDocument2 pages12 U.S. Code 411 - Issuance To Reserve BanksMin Hotep Tzaddik BeyNo ratings yet

- "Vapor Money" Theory To Avoid Repayment of Real Property Loan Rejected by Utah Court of Appeals - UtahpropertylawDocument1 page"Vapor Money" Theory To Avoid Repayment of Real Property Loan Rejected by Utah Court of Appeals - UtahpropertylawMin Hotep Tzaddik BeyNo ratings yet

- "Vapor Money" Theory To Avoid Repayment of Real Property Loan Rejected by Utah Court of Appeals - UtahpropertylawDocument1 page"Vapor Money" Theory To Avoid Repayment of Real Property Loan Rejected by Utah Court of Appeals - UtahpropertylawMin Hotep Tzaddik BeyNo ratings yet

- 5 Words To Control YouDocument17 pages5 Words To Control YouMin Hotep Tzaddik Bey100% (3)

- 3 Pillars of Life Program A Start For The Youth To Be Wise AdultsDocument4 pages3 Pillars of Life Program A Start For The Youth To Be Wise AdultsMin Hotep Tzaddik Bey100% (1)

- IRS Church 501 (C) (3) Tax Exempt InfoDocument32 pagesIRS Church 501 (C) (3) Tax Exempt Infomoury227No ratings yet

- Discharging Debt As Secured Party Creditor You Need To KnowDocument3 pagesDischarging Debt As Secured Party Creditor You Need To KnowMin Hotep Tzaddik Bey78% (54)

- FAR Mandatory DisclosureNEWDocument5 pagesFAR Mandatory DisclosureNEWMin Hotep Tzaddik BeyNo ratings yet

- The Indians Are The Moorish-Israelites EgyptiansDocument43 pagesThe Indians Are The Moorish-Israelites EgyptiansJoe Marsh97% (37)

- How Section 1-207 of the UCC Affects Accord and SatisfactionDocument10 pagesHow Section 1-207 of the UCC Affects Accord and SatisfactionMin Hotep Tzaddik Bey100% (3)

- Court of RecordDocument5 pagesCourt of RecordMin Hotep Tzaddik Bey100% (1)

- Guidelines For Adverse Possession-1Document3 pagesGuidelines For Adverse Possession-1Min Hotep Tzaddik Bey100% (1)

- White Europeans 'Only Evolved 5,500 Years Ago After Food Habits Changed' - Mail OnlineDocument8 pagesWhite Europeans 'Only Evolved 5,500 Years Ago After Food Habits Changed' - Mail OnlineMin Hotep Tzaddik BeyNo ratings yet

- 5 Words To Control YouDocument17 pages5 Words To Control YouMin Hotep Tzaddik Bey100% (3)

- 2013 Rules of The CourtDocument84 pages2013 Rules of The CourtMin Hotep Tzaddik BeyNo ratings yet

- 12 USC 83 - Loans by Bank On Its Own Stock - Title 12 - Banks and Banking - U.S. Code - LII: Legal Information InstituteDocument5 pages12 USC 83 - Loans by Bank On Its Own Stock - Title 12 - Banks and Banking - U.S. Code - LII: Legal Information InstituteMin Hotep Tzaddik BeyNo ratings yet

- Guidelines For Adverse Possession-1Document3 pagesGuidelines For Adverse Possession-1Min Hotep Tzaddik Bey100% (1)

- The Wafer-God and the Bloody History of the VaticanDocument58 pagesThe Wafer-God and the Bloody History of the VaticanMin Hotep Tzaddik BeyNo ratings yet

- Entered Apprentice Introduction For The Young MasonDocument29 pagesEntered Apprentice Introduction For The Young MasonMin Hotep Tzaddik BeyNo ratings yet

- Melanin Paper BomDocument26 pagesMelanin Paper BomMin Hotep Tzaddik Bey67% (3)

- 5 Words To Control YouDocument17 pages5 Words To Control YouMin Hotep Tzaddik Bey100% (3)

- Pyramid Text of UnasDocument111 pagesPyramid Text of UnasMin Hotep Tzaddik BeyNo ratings yet

- LOSAP Investigative ReportDocument32 pagesLOSAP Investigative ReportAsbury Park PressNo ratings yet

- Code of EthicsDocument8 pagesCode of EthicsBandukwala MustafaNo ratings yet

- Dpb30083: Business Ethics: Case Study: Conflict of InterestDocument11 pagesDpb30083: Business Ethics: Case Study: Conflict of InterestTengku AlifNo ratings yet

- AdsasdDocument3 pagesAdsasdDAblue ReyNo ratings yet

- New Supplier Registration FormDocument2 pagesNew Supplier Registration FormZahra Gita ShafiraNo ratings yet

- 220/400 KV Substation Tender Documents - Vol 1Document204 pages220/400 KV Substation Tender Documents - Vol 1tanujaayerNo ratings yet

- Malaysia ECM Due Diligence GuideDocument56 pagesMalaysia ECM Due Diligence GuideRachel GohNo ratings yet

- To All Khudu Group (Pty) Ltd. StaffDocument22 pagesTo All Khudu Group (Pty) Ltd. StaffTaoKuchNo ratings yet

- Trial Advocacy 2015 PDFDocument97 pagesTrial Advocacy 2015 PDFPaul Hontoz86% (7)

- Pale Canon 15Document11 pagesPale Canon 15Yannie BarcelonaNo ratings yet

- Tendernotice 1Document27 pagesTendernotice 1Shashikant VermaNo ratings yet

- Engineering Ethics QuestionsDocument2 pagesEngineering Ethics QuestionsHabib Musa Mohamad0% (1)

- Danchenko - Defense Team - Waiver of Conflicts of InterestDocument4 pagesDanchenko - Defense Team - Waiver of Conflicts of InterestCami MondeauxNo ratings yet

- AES PTO BylawsDocument15 pagesAES PTO BylawsaesptoNo ratings yet

- Ambit Capital - Strategy - Can 'Value' Investors Make Money in India (Thematic) PDFDocument15 pagesAmbit Capital - Strategy - Can 'Value' Investors Make Money in India (Thematic) PDFRobert StanleyNo ratings yet

- 02 Code of Ethics For Professional Accountants in The PhilippinesDocument22 pages02 Code of Ethics For Professional Accountants in The PhilippinesJoevitt Louis DelfinadoNo ratings yet

- Conflicts ToolkitDocument76 pagesConflicts ToolkitAyesha NaazNo ratings yet

- 51960revised Code of Conduct For BIR Officials and Employees 4-22-10 PDFDocument58 pages51960revised Code of Conduct For BIR Officials and Employees 4-22-10 PDFGab Naparato100% (1)

- 3 Conflict of InterestDocument3 pages3 Conflict of InterestTressa Salarza PendangNo ratings yet

- Furcht Discipline Report at The University of MinnesotaDocument9 pagesFurcht Discipline Report at The University of MinnesotaBill GleasonNo ratings yet

- Implied PoliciesDocument8 pagesImplied PoliciesTanushree HingoraniNo ratings yet

- SoD - DemandMedia - Disadvantage of Not Having SoD Within Accounting - 2021Document1 pageSoD - DemandMedia - Disadvantage of Not Having SoD Within Accounting - 2021Rohan BNo ratings yet

- Ethics 5Document12 pagesEthics 5Atif WaheedNo ratings yet

- Conflicts of Interest Policy PDFDocument16 pagesConflicts of Interest Policy PDFHuma AyubNo ratings yet

- Publication Ethics: Avoiding Fabrication, Falsification, Plagiarism and Other Unethical PracticesDocument11 pagesPublication Ethics: Avoiding Fabrication, Falsification, Plagiarism and Other Unethical PracticesThe ProfessorNo ratings yet

- ICMJE Guidelines For ResearchDocument16 pagesICMJE Guidelines For ResearchShrutiNo ratings yet

- PP - Cases - Material - Ethics of The Legal Profession and Duties of Counsel 20-4-2020Document178 pagesPP - Cases - Material - Ethics of The Legal Profession and Duties of Counsel 20-4-2020Manveer SinghNo ratings yet

- Research Ethics HandbookDocument21 pagesResearch Ethics HandbookMohammedSaqrNo ratings yet

- Sample Code of Conduct & Corporate EthicssDocument10 pagesSample Code of Conduct & Corporate Ethicssjsconrad12No ratings yet

- Ambit Strategy Thematic Tomorrows Ten Baggers 19jan2012Document15 pagesAmbit Strategy Thematic Tomorrows Ten Baggers 19jan2012jainvivekNo ratings yet