Professional Documents

Culture Documents

2LOLES Gregory Govt Supp Sentencing Memo

Uploaded by

Helen Bennett0 ratings0% found this document useful (0 votes)

326 views403 pagesSentencing memo in federal case of Gregory Loles in church embezzlement case

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentSentencing memo in federal case of Gregory Loles in church embezzlement case

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

326 views403 pages2LOLES Gregory Govt Supp Sentencing Memo

Uploaded by

Helen BennettSentencing memo in federal case of Gregory Loles in church embezzlement case

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 403

1

UNITED STATES DISTRICT COURT

DISTRICT OF CONNECTICUT

UNITED STATES OF AMERICA

v.

GREGORY P. LOLES

CRIMINAL NO. 3:10 CR 237 (AWT)

December 31, 2013

FILED UNDER SEAL

GOVERNMENT=S SUPPLEMENTAL SENTENCING MEMORANDUM

SEEKING OBSTRUCTION OF JUSTICE AND DENIAL OF ACCEPTANCE

This memorandum is submitted in further aid of the sentencing of Defendant Gregory P.

Loles, who as is now apparent stole more that $27 million from friends, clients, the endowment

fund and building fund of a church in Orange, Connecticut, St. Barbara=s Greek Orthodox Church

(Athe Church@ or ASt. Barbara=s@), and as recently corroborated, from a Greek family overseas.

In particular, this memorandum is submitted in support of the Government=s adjusted

Guidelines= calculation which now seeks an additional two levels for amount of loss, provides

additional evidence and argument for the number of victims being greater than 250, and seeks an

enhancement for obstruction of justice based on the Defendants lying under oath to the Court and

the corresponding denial of the adjustment for acceptance of responsibility.

For the reasons set forth in the Government=s Original Sentencing Memorandum (Dkt. No.

80), those set forth in the Governments Reply Memorandum (Dkt. No. 89), those set forth in open

Court at the multi-day hearing, and those set forth below, the Government asserts that the

Case 3:10-cr-00237-AWT Document 163 Filed 02/20/14 Page 1 of 30

2

Defendant=s Guidelines= range should also include a two-point enhancement for obstruction of

justice and he should be denied acceptance of responsibility.

I. Guideline Calculation

A. Burden of Proof

The parties agree that the Defendants base offense level pursuant to the United States

Sentencing Guidelines is a base of 7 as the offense charged has a statutory maximum of 20 years or

more. See U.S.S.G. ' 2B1.1(a)(1). The remaining factors, about which the parties do not agree,

need only be established by a preponderance of the evidence.

As the court explained in United States v. Salim, 287 F.Supp.2d 250, 305-06 (S.D.N.Y.

2003) [a]lthough the Sentencing Guidelines do not specify a burden of proof to govern the

resolution of disputed sentencing factors, the Second Circuit has held that the preponderance of the

evidence standard satisfies the requirements of due process in determining conduct relevant to

sentencing issues under the Guidelineseven for the determination of unconvicted conduct.

(citing United States v. Gigante, 94 F.3d 53, 55 (2d Cir. 1996) ( [U]nconvicted conduct may be

relied upon to adjust a defendant's sentence level as contemplated by the Guidelines based on

proof by a preponderance of the evidence.); United States v. Guerra, 888 F.2d 247, 251 (2d Cir.

1989) ( [T]he preponderance of the evidence standard satisfies the requisite due process in

determining relevant conduct pursuant to the Sentencing Guidelines in the calculation of offense

level based on defendant's possession of uncharged narcotics).

Additionally, the Second Circuit has found that in making factual findings in determining

the Guidelines, a sentencing court remains entitled to rely on any type of information known to

it. United States v. Concepcion, 983 F.2d 369, 388 (2d Cir.1992) (upholding sentence where court

referred at sentencing to conduct for which the defendant was acquitted) (citing United States v.

Case 3:10-cr-00237-AWT Document 163 Filed 02/20/14 Page 2 of 30

3

Carmona, 873 F.2d 569, 574 (2d Cir. 1989)); see also United States v. Franklyn, 157 F.3d 90, 97

(2d Cir. 1998) (Disputed facts relevant to sentencing must be established by a preponderance of

the evidence, and the sentencing court may rely upon any information known to it).

A. The Amount of Loss is Over $20 million

The amount of loss suffered as a result of the fraud now is calculated above $20,000,000.

Therefore, the offense level is increased by 22 pursuant to U.S.S.G ' 2B1.1(b)(1)(L).

As established in the Government=s Sentencing Memorandum and as established by

witness testimony at the Defendant=s sentencing hearing, the Defendant stole over $12 million

from St. BarbarasChurch, his friends and investor-clients in the United States, and individuals he

met through his Farnbacher-Loles car businesses and subsequently defrauded.

However, as established in more detail below, after the Defendant testified under oath that

$14 million from Milbury Holdings was his money purportedly from a combination of profitable

trades in the Greek stock exchange and twelve years of compounding from an initial investment

of amillion Euro or a little bit more than a million Euro, originally made in the late 1980s, the

Government investigated and has established that the money was not the Defendants money.

Moreover, thisfurther investigation revealed that the over $14 million at issue were investment

funds of the familyinvested with Loles fraudulent entity Apeiron. (See Attachments

I and J ).

Accordingly, while in an earlier sentencing memorandum (Dkt. No. 80)) the Government

argued that, were the Court to take an aggressive posture the Court could include in the reasonable

estimate of loss the additional $14 million taken in by the Defendant, from Milbury Holdings

(Gov. Mem. (Dkt. No. 80) at Attachment 2), the Government now asserts that the Court should

include the money that the Family invested via Milbury Holdings in its loss

Case 3:10-cr-00237-AWT Document 163 Filed 02/20/14 Page 3 of 30

4

calculation. See Attachment A (Government Exhibit 1C). Loles theft and fraudulent taking

of the additional $14 million was part of the same fraudscheme and, as explained in detail by

counsel for the victim family, Loles used the same motis operandi and same manner and means in

defrauding the Family as he did with all the other victims. He pretended to befriend

them, gained their confidence even attending a family funeral in Greece, told them he had

millions of dollars under management, told them he had investments for them that would pay a

certain steady percentage, provided them corresponding account statements, impressed them with

his luxury car businesses, and eventually stole their money. (See Attachments F, G, H, I, J , and

K).

Accordingly, the loss amount for the Guidelines calculation should be found to be well

above $20,000, 000. Thus, resulting in an increase of 22-levels for the amount of loss.

B. Determination of the Number of Victims

As set forth in the Government=s Sentencing Memorandum (Gov. Mem. (Dkt. No. 80) at

29-33) and the Reply Sentencing Memorandum (Dkt. No. 89) as well as the additional arguments

made before the Court, in determining the specific offense characteristic for the number of victims,

the Court should count as victims the hundreds of parishioners who donated to the endowment

fund and the building fund and who were relying on the safety and security of the investments

made with the Defendant in the so-called bonds. The Guidelines define a victim as Aany person

who sustained any part of the actual loss . . .@ U.S.S.G. ' 2B1.1, App. Note 1.

Attached to this Memorandum at Attachment B are the names of parishioners,

individuals, families and parish organizations who made donations to the Building Fund prior to

December 2009 and attached at Attachment C are the names of Sunday School children and

Greek School children who collected coins and donated portions of their allowance and donated to

the Family as he did with all the other victims. the Family as he did with all the other victims.

Case 3:10-cr-00237-AWT Document 163 Filed 02/20/14 Page 4 of 30

5

the Churchs Building Fund prior to December 2009. These are 327 specific identified

individuals and families and 86 specific school children who gave their money to the St. Barbara

Building funds before the discovery of the fraud in December 2009 (a few were anonymous).

These specific identified donors, many of whom were families and couples, resulting in over 700

in total, should be included in the Courts calculation of the number of victims. This is not an

unidentified amorphous group of donors but, to the contrary, comprise a specific identified list of

donors who were victimized.

The inclusion of these individuals as victims for Guidelines purposes is clearly supported

by controlling case law. In United States v. Gonzalez, 641 F.3d 41 (2d Cir 2011) the Second

Circuit reached this conclusion regarding donors to a charity, a holding that is clearly on point here

and should be followed as controlling precedent. In Gonzalez, the Second Circuit found that the

individuals who made charitable contributions were properly considered victims pursuant to

U.S.S.G. 2B1.1(b)(2) and held as follows: [a] donor whose charitable contribution was included

in the district courts finding of actual loss under 2B1.1(b)(1) is thus, by definition, a victim

within the meaning of 2B1.1(b)(2). There is no suggestion in this definition or any other part of

the Guidelines that the victim must be linked with a specific part of the loss. Gonzalez, 641 F.3d

at 63. In rejecting the contention raised by defendant Gonzalez, the Second Circuit reasoned:

[a]s Guidelines commentary observes elsewhere, defendants who exploit victims charitable

impulses or trust in government create particular social harm. Guidelines 2B1.1 Application

Note 19(D). We see no intent in the multiple-victim-enhancement provision of the Guidelines to

exacerbate societal harm by rewarding a defendant who simply commingles fraudulently obtained

charitable contributions before spending them. Id. at 63-64.

Case 3:10-cr-00237-AWT Document 163 Filed 02/20/14 Page 5 of 30

6

The Eleventh Circuit reached the same conclusion in United States v. Longo, 184 Fed.

Appx. 910, 2006 WL 1674267 (11th Cir. 2006) (unpublished per curiam). In Longo, the Eleventh

Circuit held that the district court did not err in counting as victims all 110 individual members of

an employee benefit plan from which the defendant embezzled. See Longo, 184 Fed. Appx. 910,

970 n.1 (noting that the record showed that Longos fraud and theft diminished the total plan

assets). As the Government has argued previously in this case, the Eleventh Circuit's analysis in

Longo applies here. In Longo, each participant in the employee benefit plan put money into the

plan and sought to draw on it in the future. When the plans funds were diminished by the fraud

each employee who had contributed was determined to be a victim. Here, as the money was

going to the St. Barbara Endowment fund and Building fund, each parishioner, including the 86

school children, relied on the fact that they believed the money would be there in the future to

support the Church and its programs. Similarly in United States v. Ellisor, 522 F.3d 1255, 1275

(11th Cir. 2008) the Court found that where money belonging to multiple individuals has been

aggregated by a school for the production of a Christmas pageant (not too different from pooling

funds for the construction of a building) and each individual maintained his or her interest in

seeing the show (or enjoying the building), each individual may be counted as a victim. In

Ellisor, 522 F.3d at 1275, the Court held that where thousands of parents and students each paid

money for tickets to a sham Christmas pageant, it did not matter that the schools had aggregated

the money; each child or parent who had paid was considered a victim. The same logic holds

here.

As the Court need only find by a preponderance of the evidence that the approximately

$1.9 million that the Defendant took from St. Barbara=s can be attributed to more than 250 victims,

the government asserts that the Court should make this finding.

Case 3:10-cr-00237-AWT Document 163 Filed 02/20/14 Page 6 of 30

7

Finally, as previously argued, if the Court determines that a mere four-level increase is

appropriate based on the discrete victims, the Government will argue for an upward departure so

that the losses suffered by the parishioners B as members of the church who donated to the building

fund and the school children who collected coins and donated portions of their allowances B are

considered by the Court.

C. Obstruction of Justice

a. Legal Standards

The U.S. Sentencing Guidelines direct that:

If (A) the defendant willfully obstructed or impeded, or attempted to

obstruct or impede, the administration of justice during the course of

the investigation, prosecution, or sentencing of the instant offense of

conviction, and (B) the obstructive conduct related to (i) the

defendant's offense of conviction and any relevant conduct; or (ii) a

closely related offense, increase the offense level by 2 levels.

U.S.S.G. 3C1.1 (emphasis added). The Guidelines provide that the conduct to which this

adjustment applies is not subject to precise definition, U.S.S.G. 3C1.1, Application Note 3, and

provide a non-exhaustive list of conduct to which the adjustment is intended to apply, U.S.S.G.

3C1.1, Application Note 4, including, inter alia, providing materially false information to a judge

or magistrate, U.S.S.G. 3C1.1, Application Note 4(F); providing materially false information

to a law enforcement officer that significantly obstructed or impeded the official investigation or

prosecution of the instant offense; U.S.S.G. 3C1.1, Application Note 4(G); and providing

materially false information to a probation officer in respect to a pre-sentence or other

investigation for the court. U.S.S.G. 3C1.1, Application Note 4(H).

In connection with an enhancement for obstruction of justice pursuant to U.S.S.G. 3C1.1

the misrepresentations must be material. U.S.S.G. 3C1.1, Application Notes 4(F), 4(G) and

Case 3:10-cr-00237-AWT Document 163 Filed 02/20/14 Page 7 of 30

8

4(H). For the false statements to be material, they must be information that, if believed, would

tend to influence or affect the issue under determination. U.S.S.G. 3C1.1, Application Note 6;

see also United States v. McKay, 183 F.3d 89, 93 (2d Cir.1999) (defendant's statement in

pre-sentence interview that he was a peripheral participantwhen in fact he was the leader of a

narcotics ring, which resulted in an erroneous Probation reportwas material because it could

have impeded imposition of an appropriate sentence); United States v. Johns, 27 F.3d 31, 34 (2d

Cir.1994) (Under the law of this Circuit ... we look to the defendant's representations in deciding

the issue of materiality. If those representations could affect the sentence (if believed), then it is

irrelevant that the government has possession of other information that rebuts the defendant's

representations.); United States v. Rodriguez, 943 F.2d 215, 218 (2d Cir.1991) (The definition of

a material statement embraces all false statements that would tend to affect a defendant's

sentence, whether or not discovery of the falsity of the statement is inevitable.).

As the Salim court discussed, in Second Circuit cases upholding application of U.S.S.G.

3C1.1 wherein a defendant made false statements, it is apparent that the defendant's false

statements would have improved the defendant's position with respect to the proceedingeither

by minimizing or mitigating the defendant's potential sentence. United States v. Salim, 287

F.Supp.2d at 312 (collecting cases at note 83 including inter alia: United States v. McLeod, 251

F.3d 78, 82 (2d Cir. 2001) (defendant repeatedly lied at sentencing after fraud conviction in his

attempts to disclaim responsibility for fraudulent documents); United States v. Lincecum, 220

F.3d 77, 8081 (2d Cir. 2000) (Defendant's false representations in affidavit in support of motion

to suppress post-arrest statements would have resulted in granting of defendant's motion to

suppress); United States v. Kelly, 147 F.3d 172, 179 (2d Cir.1998) (district court found defendant's

false testimony at trial for tax fraud was given to confuse the jury and to prevent the jury from

Case 3:10-cr-00237-AWT Document 163 Filed 02/20/14 Page 8 of 30

9

finding him guilty concerning the charges in the indictment); United States v. Ventura, 146 F.3d

91, 98 (2d Cir.1998) (Defendant's false statements about his age, accompanied by fraudulent or

forged documents, were made in order to secure a more favorable sentence, caused

considerable delay in sentencing, and required investigation by a number of officials of the

United States and Honduran governments.); United States v. Rodriguez, 943 F.2d 215, 218 (2d

Cir. 1991) (Defendant stated falsely to probation officer that he had no prior record, when in fact

he had been arrested and convicted six times previously)).

b. Defendant Provided False Testimony Regarding $14 million in Losses

It is clear based on the entirety of the evidence, including his own statements, documents

previously collected by the Government, and the information discovered through the

Governments additional investigation, that Loles provided material false testimony to the Court

during his re-direct and re-cross examination on November 25, 2013, (see Attachment E) and also

provided materially false information to the Federal Bureau of Investigation during the course of

numerous interviews. (See Attachments L-P). These false statements if believed would have

influenced the Courts determination of the estimated loss amount, and ultimately the seriousness

of the crime.

Defendant Loles gave the following materially false testimony during his re-direct

examination on November 25, 2013. (Attachment E at pages 6-10.)

Q. The money that came over from Milbury Holdings, I mean, it belonged to

Milbury Holdings, but who owned Milbury Holdings?

A. Milbury Holdings, upon his passing, was was the owner of

Milbury Holdings.

Q. Did that money really belong to ?

A. No.

Case 3:10-cr-00237-AWT Document 163 Filed 02/20/14 Page 9 of 30

10

Q. Who did it belong to?

A. The money that came is money that I earned with J ohn over the years

primarily in trading over the Greekstock.

Q. Essentially, it was you're money?

A. Well, yeah. That's why it came in the fashion it came. It was just sort

of on demand.

THE COURT: Can you explain that a littlemore?

BY MR. DONOVAN:

Q. Why don't you explain that a little bit more. Tell us how that money was

earned?

THE COURT: How it's his money if it's Milbury Holdings money?

BY MR. DONOVAN:

Q. Why was Milbury Holdings money really yours?

A. Milbury Holdings was the investor for most of the investing that he and I

did in the Greek -- Greece was an emerging market in the early '90s and so

forth. Sothere was huge interest and appreciation in the market.

Q. Remind us who "he" was?

A. He was Mr. who passed away, who was a friend and lawyer that

represented -- because we lived in Greece, as you know, for a number of years

and that's where I met him. So when the Greek markets started doing well and

therewas a lot of investing, I was sort of already in the investment business and

here we had a emerging market at our feet. A lot of new capitalization and so

forth. So a lot of money was made. And the investment vehicle in the Greek

markets, he chose for it to be Milbury Holdings. So we both put some seed

money and then just started trading, mostly in new capitalizations. And it just

-- and it grew substantially as the whole market grew.

Q. What was Milbury Holdings? Was it a company or anLLC?

A. It was -- I believe it was Panamanian. It was acompany that he basically

was running his finances through. So the way these capitalizations were

working inthe Greek market system is an entity would actually askfor a certain

amount of stock, let's say, in an offeringand then it would be granted. And if it

was over-subscribed, everything would be prorated. It wasunlike here where

the stock is given to individuals. There you actually -- there was a proration

done.

And then there's a lot of secondary trading that we did. I mean, I lived in

Greece.

Case 3:10-cr-00237-AWT Document 163 Filed 02/20/14 Page 10 of 30

11

Q. You don't have to go through all the details.

THE COURT: I guess I'm getting the impressionfrom what your client is saying

is that he's saying he put money into Milbury Holdings, Mr. put

money in, and that money was invested and he subsequently got a return of his

investment withearnings. I guess what I'm interested in is when did he put

money in and how much? Does that come out? Is that somewhere in the

record?

BY MR. DONOVAN:

Q. Could you tell us that?

A. Let's see. My contributions would have been now we're talking in the

late '80s. I can go to the bank records and probably try to -- well, not bank

recordshere.

Q. J ust roughly?

A. I would say a total of a million euro, a littlemore than a million euro.

Q. And that was an investment made in the late '80s?

A. Yeah. That's way, way early. My dad had some property. We had sold

some things. And everybody in Greece was investing in the market. And we

had done -- and that was sort my contribution. And then he kept his ledger

about sort of what was mine, what was his. I was, if you will, the more market

knowledgeable person. But again, it was a roaring bull market. So it was

morejust being in the right place at the right time.

Q. And what period of time did the trading take place, the initial public offerings

and the investment in companies?

A. Well, when Greece was granted the Olympics for 2004, it was the 10 years, if

you will, before that was the big sort of financial boom. And Greece had just

entered into the European community. So suddenly, borrowing in Greece went

from 8, 9 percent to 4 percent, overnight literally, which is what's created

obviously the huge financial problems that Greece has now. But yeah, it was in

that period sort of from thelate '80s it started as Greece was sort of an emerging

market and then it became a developed market. And then obviously came the

huge crash like all the emerging markets in I think the early 2000s.

Q. Where were you living when you were doing this trading?

A. Well, we were living mostly in Greece. And that'swhere he and I sort of met

and solidified our relationship. And then we continued, even when I cameback

to the U.S. in -- came back -- I'm sorry came back to the U.S. in '91 we

obviously continued. There was no need for me to be there. Through various

sort of computer systems, I was able to see the Greek market live. So I was able

to continue doing whatever trading we needed to do.

put money into Milbury Holdings, Mr. put put money into Milbury Holdings, Mr. put

Case 3:10-cr-00237-AWT Document 163 Filed 02/20/14 Page 11 of 30

12

(Attachment E Re-direct Testimony of Loles at 6-10.)

Then, on cross examination, and in response to questions from the Court, itself, Defendant

Loles gave the further following materially false testimony also on November 25, 2013.

(Attachment E at 26-33).

Q. Do you remember telling the FBI that the intent wasthat Loles was growing

the Farnbacher Loles business andhe would reconcile with George later? Do

you remember telling the FBI that, that youwould pay George his money back

later?

A. Well, I think reconcile with George -- it wasn't George's money. It was

sitting in Milbury Holdings.

Q. It was the family's money, correct?

A. No, it was not. Not what came here. If there was more money in

Milbury Holdings, that could be theirs, but that's not accurate what

you're saying.

Q. I'm just quoting you back to you. So if it's not accurate, which time were

you not accurate? When youtalked to the FBI for four hours in 2010, or when

youtalked to this judge for two hours today? Which timewas it not accurate?

A. Mr. McGarry, George was afraid that the $14 million would be seized.

Medtronic --

Q. Let me put it this way: George would have noreason to worry about the $14

million if it was your money, would he? But he was worried about it being

seized because it was not your money, correct?

A. Because it was in their family entity. I didn't have direct link. He

knew his father and I had dealings, but I didn't have -- I couldn't go and

physically takethe money out. So obviously I assumed that in this context

we're talking about -- because George was very worried and that's how I even

heard about all this Karayanis stuff because he brought me in and he said

Medtronic is being investigated, Smith & Nephew is being investigated.

Eventually are they going to try to implicate my father? We sort of pieced

together what exactly was going on. I mean, I'm sorry that I'm confused.

Q. Let me direct your attention to page 2. Do youremember telling the FBI

Milbury Holdings is a Panamanian company and is personal

company comprised of his personal money?

A. The most -- most of the money in Milbury Holdings was his, but what

we did in trading together and was therefore then allowed to come to me

was obviously my part of profits with George's father.

Panamanian company and is personal Panamanian company and is personal

Case 3:10-cr-00237-AWT Document 163 Filed 02/20/14 Page 12 of 30

13

* * *

THE COURT: I guess I'd like to understand something.

THE WITNESS: Yes.

THE COURT: We're talking about $14 million. You say you put in, I think, a

million euros originally back in 19

THE WITNESS: In the '80s.

THE COURT: So just explain to me --

THE WITNESS: The growth --

THE COURT: -- what happened to that money and how much was in at

the time we're talking about when we're talking about the $14 million?

How much was in Milbury Holdings and who did it come from?

THE WITNESS: I only knew what I had an interest in. So I don't know

the total balance of Milbury Holdings.

THE COURT: Okay.

THE WITNESS: Because again --

THE COURT: So just give me a rough approximation over the years, so far as

you can, from the 1980s to the point in time we're talking about, about how

much money you had in Milbury Holdings?

THE WITNESS: Well, eventually it grew to that full amount.

THE COURT: What full amount?

THE WITNESS: The 14.

THE COURT: Okay.

THE WITNESS: There was over, I would say, 12 years of active trading.

And then there was a period where the Greek market was not doing anything.

And then obviously, unfortunately J ohn just passed away all of a sudden and it

created the confusion. George sees all these investigations and his father's

name being mentioned and so forth. As you can see, if there was a fear that

something was happening.

THE COURT: I'm not -- I'm just interested in the amounts of money and when.

That's all I want to know.

THE WITNESS: Yes. So that would be the total. And I would draw in

THE COURT: And you don't have any recollection as to the growth from a

million euros to $14 million?

THE WITNESS: Oh, no. There was 12 years. I could sit and sort of put

something to show you, but there was years and years of investing. And

Case 3:10-cr-00237-AWT Document 163 Filed 02/20/14 Page 13 of 30

14

obviously, with the big capitalizations, just like when the market was growing

here, these things were coming public at 120 percent. Big increases as new

companies were being capitalized. And we, like everyone

THE COURT: I guess what I'm trying to get a sense for is at what rate did the

value of your investment in Milbury Holdings grow?

THE WITNESS: I guess it was compounding we can sit and calculate. I

think it was about 12 years of active trading. So it was compounding at 25

percent.

THE COURT: 25 percent a year on average?

THE WITNESS: Maybe a bit more. Obviously, by leaving the money in and

taking bigger and bigger allocations, I mean, some of these --

THE COURT: I'm only interested in numbers.

THE WITNESS: Yes.

THE COURT: I think you're supposed to be financially astute. 25 percent a

year or more compounding?

THE WITNESS: Right.

THE COURT: That answers my question. And then at the end of this

time period your total -- the total value of your investment was $14

million?

THE WITNESS: Thereabouts.

THE COURT: That was everything?

THE WITNESS: That was everything. And obviously, when it was all

brought

THE COURT: That answers my question.

* * *

Q. And in fact, I believe you told the FBI that it was comprised of his personal

money.

A. That's just not accurate. What can I tell you?

Q. So when you told that to the FBI you were not being accurate?

A. No. Milbury Holdings, obviously I described Milbury Holdings, which

was the company that J ohn would do a lot of his personal finances through,

including our mutual trading.

Case 3:10-cr-00237-AWT Document 163 Filed 02/20/14 Page 14 of 30

15

c. Defendants Testimony Regarding $14 Million is Demonstrably False

The testimony Loles provided the Court is demonstrably false for a number of reasons,

most importantly it is directly contradicted by information and documentary evidence provided by

an attorney for the victim-family.

After Loles provided the new and wholly incredible testimony to the Court, the

government reinitiated the investigation into the source of the $14 million, about which the

Government had been aware but had not previously focusedon. As background, on May 21,

2010, Loles had been specifically asked about Milbury Holdings and the approximately $14

million wire transfers into his accounts. (Attachment M). Loles gave a detailed answer to

questions about Milbury Holdings and never mentioned or alluded tothe funds being his money

or his share of the trading profits. He never mentioned his being entitled to trading profits, or a

million Euros invested in the late 1980s, or any portion of the Milbury money being his money.

Loles told the government that Milbury Holdings was personal company comprised

of his personal money. (Attachment M at 2). Loles provided a lengthy and complex

explanation that included statements regarding: how was only getting 1%

-1.5% interest on the money in London (Id. at 4), and how Loles would reconcile with George

later. (Id.). Loles stated that the purpose of transferring the money to Loles was to get the money

out of London. (Id.). Loles further stated that he did not have any agreement as to how the

money would be returned to George. Loles clearly stated that George and his mother still think

their $14 million is still there, but it was already spent by Loles. (Id. at 5).

In J une of 2010, Loles was again asked about Milbury holdings and the $14 million

Milbury had placed with him. Loles told the FBI that he is waiting to see what Milbury Holdings

is going tosay. Because as he stated, there is no money. (Attachment N at 7). Loles told the

Holdings was personal company comprised Holdings was personal company comprised

Case 3:10-cr-00237-AWT Document 163 Filed 02/20/14 Page 15 of 30

16

FBI that the approximate $14 million received from MilburyHoldings went into Farnbacher Loles

and for other general purposes. Milbury Holdings was not going to give Lolesmoney to build his

business or to make investments like the church or other individuals. Milbury Holdings was

giving the money to Loles to park it. (Attachment N at 7). As discussed more below, the

family didin fact believe that they had invested with Apeiron and produced account

statements, and an account questionnaire, as well as photographs taken at Loles home, in New

York City and at his garage, to support their belief that he was their investment advisor and they

had invested with Apeiron and Somerset Partners. (Attachments I, J , at K).

Also during the May 21, 2010 interview, Loles told the FBI that George [and the

family] was not a who invested his money with Loles.

(Attachment M at 4). This was not true. (See Attachments F, G, I, J and K). Loles stated that

there was no formal agreement from George to invest in Farnbacher Loles but to simply take the

money off his hands, but it was the family's money. Loles also stated that George

was afraid the $14 million would be seized by the authorities in the United Kingdom.

(Attachment M at 4). When confronted on re-cross examination with the direct contradiction

between his re-direct testimony that it was his money and this statement previously given to the

FBI, Lolesprovided no explanation and attempted to side-step thequestion. (Attachment E at 27,

re-cross examination 11/25/13).

Also during the May 21, 2010 interview, Loles told the FBI that he received a visitor at

Wyatt from an unknown man regarding Milbury Holdings. (Attachment M at 1). In an

August 2010 interview (Attachment P) Loles disclosed the name of the visitor as Ian Cook.

(Attachment P at 3). Also during the August 2010 interview, the Government was provided a

letter that had been sent to Loles defense counsel from HCLS LLP, Solicitors, a law firm in

who invested

Case 3:10-cr-00237-AWT Document 163 Filed 02/20/14 Page 16 of 30

17

London, referencing Mr. Cook and their client (the family) and the significant sums

that had been sent to Loles for investment purposes. (Attachment R).

After Loles provided the Court sworn testimony that directly and materially contradicted

his earlier statements regarding the ownership of the $14 million and the documents provided by

his own counsel, the prosecution team, in coordination with the Department of J usticesOffice of

International Affairs and the Federal Bureau of Investigations London LEGAT, reached out to the

London Solicitors and spoke to Mr. Cook. After a brief conversation with Mr. Cook and a

subsequent phone call, the Government was contacted by Attorney Frederick Kessler on behalf of

the family.

Attorney Kessler provided a detailed history of the family relationship with

Loles and also provided documents that establishedthat the family, like the scores of

other individuals and families that dealt with Defendant Loles, were victims of his fraud.

Attorney Kessler provided an Apeiron account statement that is precisely the same type of

fraudulent account statement provided to the other victims. (Attachment I). Attorney Kessler

also provided, from the family, what appearedto be at least to the family

an account opening questionnaire for an account purportedly in Bermuda and purportedly

opened in the name of Somerset Associates Limited. (Attachment J ). This document clearly

lists Gregory P. Loles and his home address as the Client Contact and describes the intended

type of business as Hold Family Assets and Estate Planning. (Attachment J ). This account

questionnaire contained the same company name as in the earlier document provided by counsel

from the London solicitors (Attachment R) yet it proved to be merely a further element or prop of

the fraud perpetrated on this Greek family.

the family. the family.

ttorney Kessler provided a detailed history of the family relationship with ttorney Kessler provided a detailed history of the family relationship with

that the family that the family

at least to the family at least to the family

Case 3:10-cr-00237-AWT Document 163 Filed 02/20/14 Page 17 of 30

18

Attorney Kessler told the FBI that Loles abused the trust placed in him by the

family. Kessler stated the family was the biggest victim of his Loles scheme.

(Attachment F at 1). Attorney Kessler explained to the FBI that Milbury Holdings was an entity

of the family. The money sent from Milbury holdings was not Loles money. The

money belonged to the family. Milbury Holdings is the familys

investment vehicle and it included three victims. Kessler primarily dealt with George .

(Id. at 1).

Attorney Kessler explained how Loles had nurtured the trust of the family just as he had

done with so many parishioners at St. Barbaras. Attorney Kessler explained that George had

been hosted by Loles at his home when his kids went tothe Hopkins School, back in 2002. (Id. at

1) and Attachment S). This apparently was the nurturing of the relationship of trust that Loles

later usedto steal the millions of dollars. After the death of Georges father, the family sent

millions of dollars toLoles. Approximately three months or so after Georgesfather passed

away, Loles contacted George and told him that he had a $300 million fundwhich was how he was

able to get 7 to 7.5% returns on investments. (Attachment F at 1).

Attorney Kessler met with the FBI on December 20, 2013 and provided additional detail of

this part of the fraud. Attorney Kessler explained to the FBI how the relationship between the

family and Loleswas initially furthered in the summer of 2002, when George went to

Connecticut to participate in asummer school programat the Hopkins School in New Haven with

the Loles children. George spent six weeks living with the Loles family while heattended the

program. (Attachment G). While visiting Connecticut, George observed firsthand how Loles

livedthe high life in his home, that George described as a mansion, and wherehe saw nice cars

including a Range Rover and BMW during his six week visit. Over the years contact between

stated the family was the biggest victim of stated the family was the biggest victim of

of the family. of the family.

family. Milbury Holdings is the family family. Milbury Holdings is the family

Case 3:10-cr-00237-AWT Document 163 Filed 02/20/14 Page 18 of 30

19

George and the Loles family was sporadic. In J une of 2007, Georges father passed away. The

next day Loles flewto Greece to attend the funeral. This gesture was much appreciated by the

family at that time. Loles stayed for several days and said he would return to Greece

at some point. (Attachment G at 2).

Later in the summer of 2007, Loles did return to Greece and told George, Georges mother,

and Georges sister that he, Loles, had a $300 million fund that got modest returns of about 7 to

7.5%. Loles explained his fee for managing this money was 1.5% of the assets under

management, but since the family was like family to him, Loles would not charge a fee.

Later in 2007, more wire transfers came from the family account in London to Loles.

In the later part of 2007, when the wires continued George explained that Loles played the role of

second father to George. Loles and George spokeon the phone and discussed Georges education

and his girlfriends and Loles bragged about his Porsche dealership and investments. (Id.). This

discussion of the courting of the family is remarkably (and predictably) similar to the

experiences provided to the Court by the and other parishioners who were told by

Loles that they were like family or like a father to him. This is even more despicable when

one considers that George was only about 19 years of age or so at the time of his fathers passing.

Attorney Kessler also explained to the FBI that around Christmas time of 2007 into 2008

the family decidedto visit the Loles family in Connecticut for a 10 day trip.

(Attachment G at 2). During this trip, Loles paid for everything. Loles wined and dined the

family and took them on a trip to New York City where they stayed at the Carlisle

Hotel and visited the famed Rainbow Room. (Id.) Kessler provided to the FBI the photographs

(attached as Attachment K) of this trip. While staying at the Loles mansion, Georgeobserved art

he believed to be of significant value as well as a newgarage structure that had beenbuilt by Loles

transfers came from the family account in London to Loles. transfers came from the family account in London to Loles.

e family is remarkably (and predictably) similar to the e family is remarkably (and predictably) similar to the

experiences provided to the Court by the and other parishioners who were told by experiences provided to the Court by the and other parishioners who were told by

he family decided he family decided

Case 3:10-cr-00237-AWT Document 163 Filed 02/20/14 Page 19 of 30

20

since Georges original 2002 visit. (Id. at 2; Attachment K). George observed fancy cars

including a Porsche, Mercedes, BMW and a Range Rover. Many of the rooms inside the Loles

house had plasma televisions which was rare at this time. (Id. at 3). On New Years Eve George

observed Loles book their dinner reservations using an American Express Black card which was

an exclusive credit card. They enjoyed fancy dinners at this time. During this visit the

family also visited Loles race car business. (A photograph is attached at Attachment

K depicting the visit to the car racing facility). Clearly Loles was using the racing car business to

establish his bona fides as a wealthy successful money manager. As has been stated by other

victim-witnesses, George observed a Bloomberg terminal in Loles office in the car racing facility

which gave Georges family the impression that he was an Investment Advisor. (Attachment G at

3). At this time the family did not live a wealthy lifestyle like the Loles family. It

was during this Christmas visit that Loles gave the family the investment statements

from Apeiron Capital Management. (Attachment G at 3; Attachment I).

In the springof 2009, Loles asked George to sendmoney to Knightsbridge which served as

Loles investment vehicle. (Attachment G at 4). At that time wire transfers were sent to

Knightsbridge. Again, this is the precise conduct and precise experience suffered by many of

Loles other victims. Some of the family wires weresent from Space Trading, which

was another investment vehicle owned by the family. In addition George had a

telephone call with Loles in approximately J une of 2009 where Loles asked if George could send

money to his car racing business partner Farnbacher to whom Loles owed money. Loles told

George he would credit the family account. Again this is consistent with things Loles

told other victim-investors, such as the . The wiretransfers sent by the

family from Milbury Holdings in 2009effectively emptied their account in London. (Attachment

At this time the family did not live a wealthy lifestyle like the Loles family. At this time the family did not live a wealthy lifestyle like the Loles family.

was during this Christmas visit that Loles gave the family the investment statements was during this Christmas visit that Loles gave the family the investment statements

George he would credit the family account. George he would credit the family account.

Case 3:10-cr-00237-AWT Document 163 Filed 02/20/14 Page 20 of 30

21

G at 4). Accordingly, statements to the Court that Loles took his share of the Milbury money

and there is other money there, while wholly incredible on its face, is further belied by his greed in

which he took all of the money in the Milbury Holdings London account.

In J anuary of 2010 after Loles was arrested, George reached out to theBermudan law firm

to inquire about his investment. It was then that he learned the Bermuda entity (Attachment J )

had never heard of Loles and the forms Loles had filled out on their behalf could have been

obtained by simply going to their website. (Attachment G at 4). Loles was supposed to have

establishedSomerset as an investment funds or account for the family which George

now knows never existed. (Attachment G at 4).

In a follow-up discussion, Attorney Kessler explained to the FBI that the family

had no knowledge of any partnership agreement between Ioannis (the father) and Loles for

investment purposes. (Attachment H). The family had no knowledge of any

involvement with investments in Smith and Nephew or Medtronic. Loles never told the

family that he, Loles, andtheir father Ioannis had a partnership of any kind. (Id.).

Their father also never mentioned that he had a partnership with Loles when he was alive. (Id.).

d. Loles Testimony is itself Incredible

Were the information, account statements, and photographs provided by counsel for the

family not sufficient to convince the Court that Loles lied to the Court and obstructed

justice, the Court could also look at the statements themselves to establish their falsehood.

The statements themselves simply do not make sense and are not consistent. As detailed

above they are contradicted by numerous earlier statements by Loles. However, they are also

illogical and not credible. First, Loles told the Court directly that he invested a million Euro or a

little more than a million Euro in the late 1980s. This was under scored by the Court itself and

The family The family

Case 3:10-cr-00237-AWT Document 163 Filed 02/20/14 Page 21 of 30

22

Government counsel during re-cross examination. However, as the Court is presumably aware,

the Euro as a currency was not in existence in the late 1980s nor was the European Union. The

Euro itself was introduced J anuary 1, 2002. (See Attachment T). Thus, typical of a con-mans

effort to deflect and distract, Loles was clearly just using the Euro to sound international and

making up figures and numbers out of thin air.

Second, Loles also told the Court that he turned one million Euro into $14 million by

investing in the bull market, and being in the right place at the right time. However, upon inquiry,

Loles could not give a single concrete example of a company he invested in or an investment he

made, an IPO he participated in, or a trade that he engaged in on behalf of Milbury Holdings. As

the Court observed, he is supposed to be financially astute, having held a brokers license and

having passed the Series 7, Series 63, and Series 65 exams. (Attachment U at 6). In fact, Loles

scored a 96 on the series 7 exam and an 88 on the series 63 exam. (Id.) Yet, while under oath he

could not explain to the Court what he invested in, what IPOs he had purchased, or how the money

grew.

Typical of a con-man, Loles was long on generalities, spoke about the market, even

mentioned the fact that Greece hosted the 2004 Olympics, but did not mention one company by

name that he had invested the Milbury Holding money into. In fact, he even at one point, when

questioned by the Court, attempted to explain the significant growth as the result of

compounding, a term generally used for interest being accrued and re-invested and earning more

steady interest. Loles estimated this compounding at a steady rate of 25% per year, every year,

for more than 12 years. But again could give no specifics as how he achieved this return. He

also described seeing the Greek markets live on his computer here in the United States, but did

not explain what or how he was trading half a world away, who his executing broker was, who

Case 3:10-cr-00237-AWT Document 163 Filed 02/20/14 Page 22 of 30

23

confirmed the trades, which firm he used as a settlement agent, why the money was in a London

account, or why a 19 year-old in Greece and his mother had control of the funds as compared to

Loles himself. As he said in his own words, Because it was in their family entity. I didnt

have direct link. He knew his father and I had dealings, but I didn't have -- I couldn't go

and physically take the money out. (Attachment E at 27). It simply makes no sense, that a

sophisticated licensed investment professional would have $14 million and have no direct link and

couldnt go and take the money out. That is not a credible story because it is false. What rings

true is that he had no direct link and could not go and directly take the money out because it was

not his money and thus he had to fool the family into giving him the money as he did with

everyone else.

Third, Loles did not and simply could not explain on re-cross examination why he had

entirely failed to mention in the hours and hours of interviews that the $14 million was his own

money, including when he was asked by the FBI specifically about Milbury Holdings.

Additionally, on direct examination that had occurred a few weeks prior (Attachment D), Loles did

not mention that he had made $14 million in trading, yet he painstakingly took the Court and the

victims through much smaller transactions in an attempt to shave a few thousand dollars off the

Guidelines loss calculation. On its face, the testimony was not credible, was filled with

double-speak, and as is typical of Loles constant attempts to cloud the issue, was replete with

claims of grandeur.

e. Loles Testimony is Belied by the Entirety of the Record

Loles testimony, that the $14 million was his money, is demonstrably false based on

all the other documents, evidence, and circumstances surrounding this matter. In this regard,

Loles provided the FBI, in an initial interview, a somewhat detailed work history (Attachment L)

Case 3:10-cr-00237-AWT Document 163 Filed 02/20/14 Page 23 of 30

24

and never mentioned that he had done significant trading in the Greek market. As pointed out in

Court and addressed above, Loles spoke to the FBI for hours including specific questions about

Milbury Holdings and never mentioned that it was his money. (Attachments M, N, O, P).

The interview Loles gave to Probation, as set forth in the PSR, does not mention anywhere

his purported prolific trading and the millions of dollars of profit he made with Milbury Holdings

in the Greek markets. Paragraphs 113, 114, 115, 116, 117, and 118 describe his work history and

he plainly did not tell the U.S. Probation Officer about Milbury Holdings or his business dealings

overseas. In fact, paragraph 115 describes him taking a job as a stockbroker trainee at Investors

Associates, Inc. in New York City, in 1992. The Court may wonder why Loles would need to be

a mere trainee in New York City if he were in the midst of a 12 year run, begun in the late

1980s, of generating returns through compounding of 25% per year every year. As reflected in

paragraph 117 of the PSR, Loles told Probation he earned approximately $350,000 per year as an

investment advisor from 1995-2002. This clearly does not include any of the $14 million made

from Milbury Holdings, presumably because he made no such money. His work history reflects

that of a failed broker who turned to a Ponzi scheme to support his lifestyle, not that of a

multi-millionaire.

Similarly, other portions of the PSR also tend to undermine his testimony that he was a

multi-millionaire. In paragraph 99 and 100 of the PSR he states that his wifes family contributed

significantly to the purchase of their home and that his wife worked as a sales information analyst

at Virgin Atlantic Airlines. These facts are not consistent with someone who is a millionaire 14

times over and who can achieve remarkable rates of return of 25 % consistently for more than a

decade.

Case 3:10-cr-00237-AWT Document 163 Filed 02/20/14 Page 24 of 30

25

Similarly, with regards to New Haven Savings Bank, Loles described for the Court at great

detail how he was able to secure money from a man named Gus Boosalis but at incredibly high

rates for the parishioners to participate in the mutual bank conversion. Had Loles actually been

entitled to the $14 million in the spring of 2004, before the death of Mr. would not this

money have been used to help the church and parishioners rather than pay the extortionist rates

Boosalis was charging the St Barbaras parishioners? Obviously Loles had no rights to the

Milbury Holdings money until he took it from the family by fraudafter the fathers

passing.

Additionally, in connection with the New Haven Savings Bank transactions, Loles

provided sworn testimony to the United States Securities and Exchange Commission (SEC) on

March 23, 2006. This sworn SEC testimony has been previously provided to the Court. In that

testimony, sworn and under oath, Loles was asked what he had been doing in terms of employment

for the last 10 years, which would cover back to at least March 1996. Loles gave various answers,

memorialized on pages 7 through 10, and at no point did Loles mention trading in the Greek

markets and making millions of dollars through Milbury Holdings. Such information, if true

would have been responsive to the questions posed by the SEC and the Connecticut Department of

Banking.

In addition to statements made in Court and to the United States Probation Officer, Loles

also provided his work history when he applied for a license to be an investment professional.

This information is retained by FINRA and included at Attachment U. As memorialized in the

FINRA documents, Loles gave his work history from 1982 up through 1997. In connection with

applying to be an investment professional Loles indicated that his positions up to and before 1993

were NOT investment related. (Attachment U at 5). This work history is consistent with what

entitled to the $14 million in the spring of 2004, before the death of Mr. would not this entitled to the $14 million in the spring of 2004, before the death of Mr. would not this

Milbury Holdings money until he took it from the family by fraud Milbury Holdings money until he took it from the family by fraud

Case 3:10-cr-00237-AWT Document 163 Filed 02/20/14 Page 25 of 30

26

he told Probation and what he originally told the FBI, but is not consistent with his sworn

testimony to the Court that he was trading in the Greek markets from the late 1980s again

trading a million Euros which did not yet exist and earning approximately 25 %.

In summary, prior to taking the stand and seeking to mislead the Court, Loles had spoken

with the FBI on numerous occasions and never mentioned trading in the Greek markets and

making $14 million in the Greek stock market. He gave a Pre-Sentence Interview to U.S.

Probation and never mentioned making $14 million in the Greek stock market. He gave sworn

testimony to the SEC, who asked about his investment and investment advisor history and work

history, and he never mentionedtrading in and making $14 million in the Greek stock market. He

applied for and received a Series 7, a Series 63, and a Series 65 license and never mentioned to

FINRA that he had engaged in trading in the Greek stock market, and in fact, to the contrary

indicated that his work was not investment related. In fact, he even testified on direct

examination on November 7, 2013 and even addressed Milbury Holdings specifically (Attachment

D at 68-70) and mentioned that he wanted whistle blower protection related to Milbury Holdings

and Smith and Nephew, but never mentioned that it was a trading vehicle that he had an ownership

interest or a personal financial interest in.

It was only later, when hefor some reason thought he could influence the Court and limit

his Guidelines exposure that he decidedhe would make the material misstatement and claim that

the $14 million that he had previously described to the FBI as family money was

somehow his. Loles has now placed himself in the precarious position of either: (i) having lied to

the FBI and U.S. Probation by making false statements about Milbury Holdings, and failing to

disclose his Greek trading to the FBI and U.S. Probation (as well as FINRA and the SEC) or (ii)

having lied to the Court. Clearly both versions cannot be true.

described to the FBI as family described to the FBI as family

Case 3:10-cr-00237-AWT Document 163 Filed 02/20/14 Page 26 of 30

27

D. Loles Alternative Version of the Facts

It is commonly said that one is entitled to ones own opinion but not entitled to ones own

version of the facts. Loles seems to want multiple versions of the facts depending on his

predicament. In that regard, the Government contends that the facts are as presented by the

Government both in Court and set forth above and in the cited attachments. That is, that Loles

made materially false statements to the Court.

However, it bears mention that if Loles version of the facts were to be true which they

are not and if he did in fact have $14 million in Milbury Holdings upon which he could draw but

which he did not call upon until approximately 2007, then he stands before the Court as an

individual who was amillionaire 14 times over but still chose to run a Ponzi scheme and defraud

his friends andfellow Parishioners. He stands before the Court a multi-millionaire14 times over

who still chose to steal the money from the St. Barbara Church Endowment fund and Building

fund, including stealing scholarship money and money donated by hundreds of families

(Attachment B) and collected by school children. (Attchment C). He would stand before the

Court a millionaire 14 times over who stole the retirement money, college tuition money, life

insurance proceeds, and devastated an entire community simply so that he could run astreet

performance race car business and race Porschesaround in a circle, live like a kingin a huge home

with tennis courts, a pool and a multi-car garage, and travel internationally, all while leaving his

$14 million untouched in an account in London until 2007.

Were this the version of the facts, the Government would then contend that the nature and

characteristics of Loles as a person and the utter soullessness of the crime would be that much

more egregious. That he could steal from , , , , ,

Case 3:10-cr-00237-AWT Document 163 Filed 02/20/14 Page 27 of 30

28

himself, the Endowment Fund, the Building Fund, all while having a $14 million nest

egg in London at Milbury Holdings. Frankly, this newest version is simply not believable.

What is believable and what is the true version of the facts is that even after four years of

incarcerationLoles has still not yet learned any lessons, that he still seeks to deceive, mislead and

outright lie if he perceives it will benefit him in some way. Now Loles has succeeded in adding

the Court itself to the list of those to whom he has lied and should be found to have obstructed

justice.

Thus, no matter which version of the facts the Defendant choses to advance, and as a

con-man he has advanced many versions, he must still be sentenced to a remarkably long term of

imprisonment.

Accordingly, the Government now calculates the Guidelines range as follows:

Base Offense Level 7

Loss Greater than $20,000,000 +22

More than 250 Victims + 6

Charitable Misrepresentation + 2

Sophisticated Means + 2

Violation of Securities Law while acting as Investment Advisor + 4

Money Laundering in Violation of 1956 + 2

Obstruction of J ustice + 2

Adjustment for Acceptance of Responsibility Zero

Total 49

If the Court were to decline to find obstruction of justice and decide, even given the

Defendants false testimony, to award a three level adjustment for acceptance of responsibility, the

DefendantsAdjusted Offense level would still be a level 44, placing him literally above the

Guidelines. Given the incredibly serious nature of the crime and the utter contempt that he has

shown the Court and the process, a sentence of 360 months would not be inappropriate.

Case 3:10-cr-00237-AWT Document 163 Filed 02/20/14 Page 28 of 30

29

II. CONCLUSION

For the foregoing reasons, those set forth in the prior Government=s Sentencing

Memoranda, and those advanced in open Court, the Government respectfully submits that, under

the circumstances of this case the Defendants Offense level is a level 49. Moreover, under either

calculation, the Court should not hesitate to give Defendant Loles a remarkably long period of

incarceration and an order of restitution of over $26 million to the victims of his crimes.

Respectfully submitted,

DEIRDRE M. DALY

UNITED STATES ATTORNEY

/S/

MICHAEL S. MCGARRY

ASSISTANT U.S. ATTORNEY

Federal Bar No. CT25713

157 Church Street, 23rd Floor

New Haven, CT 06510

Tel.: (203) 821-3751

Fax: (203) 773-5378

Michael.McGarry@usdoj.gov

Case 3:10-cr-00237-AWT Document 163 Filed 02/20/14 Page 29 of 30

30

CERTIFICATION

I hereby certify that on December 31, 2013 a copy of foregoing Government=s Sentencing

Memorandum was filed electronically and served by hand on anyone unable to accept electronic

filing. Notice of this filing will be sent by e-mail to all parties by operation of the Court=s

electronic filing system or by mail to anyone unable to accept electronic filing as indicated on the

Notice of Electronic Filing. Parties may access this filing through the Court=s CM/ECF System.

/S/

MICHAEL S. McGARRY

ASSISTANT U.S. ATTORNEY

Case 3:10-cr-00237-AWT Document 163 Filed 02/20/14 Page 30 of 30

ATTACHMENT A

Case 3:10-cr-00237-AWT Document 163-1 Filed 02/20/14 Page 1 of 3

Case 3:10-cr-00237-AWT Document 163-1 Filed 02/20/14 Page 2 of 3

Case 3:10-cr-00237-AWT Document 163-1 Filed 02/20/14 Page 3 of 3

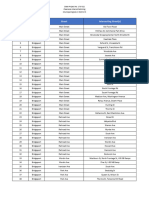

ATTACHMENT B

Case 3:10-cr-00237-AWT Document 163-2 Filed 02/20/14 Page 1 of 9

Individuals, Families and Parish Organizations who made donations

to the Building Fund Prior to December 2009

1.

2.

3.

4.

5.

6.

7.

8.

9.

10.

11.

12.

13.

14.

15.

16.

17.

18.

19.

20.

21.

22.

23.

24.

25.

26.

27.

28.

29.

30.

31.

32.

33.

34.

35.

36.

37.

38.

39.

40.

41.

42.

Case 3:10-cr-00237-AWT Document 163-2 Filed 02/20/14 Page 2 of 9

43.

44.

45.

46.

47.

48.

49.

50.

51.

52.

53.

54.

55.

56.

57.

58.

59.

60.

61.

62.

63.

64.

65.

66.

67.

68.

69.

70.

71.

72.

73.

74.

75.

76.

77.

78.

79.

80.

81.

82.

83.

84.

85.

86.

87.

Case 3:10-cr-00237-AWT Document 163-2 Filed 02/20/14 Page 3 of 9

88.

89.

90.

91.

92.

93.

94.

95.

96.

97.

98.

99.

100.

101.

102.

103.

104.

105.

106.

107.

108.

109.

110.

111.

112.

113.

114.

115.

116.

117.

118.

119.

120.

121.

122.

123.

124.

125.

126.

127.

128.

129.

130.

131.

132.

Case 3:10-cr-00237-AWT Document 163-2 Filed 02/20/14 Page 4 of 9

133.

134.

135.

136.

137.

138.

139.

140.

141.

142.

143.

144.

145.

146.

147.

148.

149.

150.

151.

152.

153.

154.

155.

156.

157.

158.

159.

160.

161.

162.

163.

164.

165.

166.

167.

168.

169.

170.

171.

172.

173.

174.

175.

176.

177.

Case 3:10-cr-00237-AWT Document 163-2 Filed 02/20/14 Page 5 of 9

178.

179.

180.

181.

182.

183.

184.

185.

186.

187.

188.

189.

190.

191.

192.

193.

194.

195.

196.

197.

198.

199.

200.

201.

202.

203.

204.

205.

206.

207.

208.

209.

210.

211.

212.

213.

214.

215.

216.

217.

218.

219.

220.

221.

222.

Case 3:10-cr-00237-AWT Document 163-2 Filed 02/20/14 Page 6 of 9

223.

224.

225.

226.

227.

228.

229.

230.

231.

232.

233.

234.

235.

236.

237.

238.

239.

240.

241.

242.

243.

244.

245.

246.

247.

248.

249.

250.

251.

252.

253.

254.

255.

256.

257.

258.

259.

260.

261.

262.

263.

264.

265.

266.

267.

Case 3:10-cr-00237-AWT Document 163-2 Filed 02/20/14 Page 7 of 9

268.

269.

270.

271.

272.

273.

274.

275.

276.

277.

278.

279.

280.

281.

282.

283.

284.

285.

286.

287.

288.

289.

290.

291.

292.

293.

294.

295.

296.

297.

298.

299.

300.

301.

302.

303.

304.

305.

306.

307.

308.

309.

310.

311.

312.

Case 3:10-cr-00237-AWT Document 163-2 Filed 02/20/14 Page 8 of 9

313.

314.

315.

316.

317.

318.

319.

320.

321.

322.

323.

324.

325.

326.

327.

328.

329.

330.

Number of Pledges: 330

Case 3:10-cr-00237-AWT Document 163-2 Filed 02/20/14 Page 9 of 9

ATTACHMENT C

Case 3:10-cr-00237-AWT Document 163-3 Filed 02/20/14 Page 1 of 4

Sunday School and Greek School Children Who Collected Coins and

Donated Portions of Their Allowance and Donated to the Church's

Building Fund Prior to December 2009

1.

2.

3.

4.

5.

6.

7.

8.

9.

10.

11.

12.

13.

14.

15.

16.

17.

18.

19.

20.

21.

22.

23.

24.

25.

26.

27.

28.

29.

30.

31.

32.

33.

34.

35.

Case 3:10-cr-00237-AWT Document 163-3 Filed 02/20/14 Page 2 of 4

36.

37.

38.

39.

40.

41.

42.

43.

44.

45.

46.

47.

48.

49.

50.

51.

52.

53.

54.

55.

56.

57.

58.

59.

60.

61.

62.

63.

64.

65.

66.

67.

68.

69.

70.

71.

72.

73.

74.

Case 3:10-cr-00237-AWT Document 163-3 Filed 02/20/14 Page 3 of 4

75.

76.

77.

78.

79.

80.

81.

82.

83.

84.

85.

86.

Number of Pledges: 86

Case 3:10-cr-00237-AWT Document 163-3 Filed 02/20/14 Page 4 of 4

ATTACHMENT D

Case 3:10-cr-00237-AWT Document 163-4 Filed 02/20/14 Page 1 of 74

UNITED STATES DISTRICT COURT

FOR THE DISTRICT OF CONNECTICUT

- - - - - - - - - - - - - - - - x

UNITED STATES OF AMERICA 3:10CR00237(AWT)

vs.

GREGORY P. LOLES

HARTFORD, CONNECTICUT

Defendant NOVEMBER 7 , 2013

- - - - - - - - - - - - - - - - x

EXCERPT OF SENTENCING HEARING - VOLUME II

DIRECT EXAMINATION OF GREGORY LOLES

BEFORE:

HON. ALVIN W. THOMPSON, U.S.D.J.

APPEARANCES:

FOR THE GOVERNMENT:

OFFICE OF THE UNITED STATES ATTORNEY

157 Church Street, 23rd Floor

New Haven, Connecticut 06510

BY: MICHAEL S. MCGARRY, AUSA

FOR THE DEFENDANT:

LAW OFFICE OF JEREMIAH F. DONOVAN

P. O. bOX 554

Old Saybrook, Connecticut 06854

BY: JEREMIAH DONOVAN, ESQ.

Corinna F. Thompson, RPR

Official Court Reporter

Case 3:10-cr-00237-AWT Document 163-4 Filed 02/20/14 Page 2 of 74

2

TABLE OF CONTENTS

WITNESS DIRECT CROSS REDIRECT RECROSS

GREGORY LOLES

BY MR. DONOVAN: 3

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

Case 3:10-cr-00237-AWT Document 163-4 Filed 02/20/14 Page 3 of 74

3

(Transcript excerpt follows.)

MR. DONOVAN: May I call Mr. Loles, please.

THE COURT: Yes.

GREGORY LOLES,

called as a witness, having been first duly

sworn or affirmed, was examined and testified

as follows:

THE CLERK: Please state your name and spell

your last name for the record.

THE WITNESS: My name is Gregory Peter Loles.

Last name is L-O-L-E-S.

THE CLERK: Thank you, sir.

DIRECT EXAMINATION

BY MR. DONOVAN:

Q. Mr. Loles, are you the defendant in this case?

A. Yes, I am.

Q. And you understand we're here for the first part of

a sentencing hearing?

A. Yes, I understand.

Q. And you understand on the last part of the

sentencing hearing you'll be able to talk directly to

the Judge and to people who may or -- who may be here

about a variety of different things. You understand

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

Case 3:10-cr-00237-AWT Document 163-4 Filed 02/20/14 Page 4 of 74

4

that, don't you?

A. Yes, I do.

Q. And today we're only concerned about kind of

technical and specific aspects of the amount of loss?

A. I understand.

Q. Although I know there are a lot of things you want

to explain and talk about, I'm going to be asking you

some specific questions about the events and how they

led to loss. You understand?

A. Yes.

Q. Do you know St. Barbara's Church?

A. Yes, I do.

Q. Where is it located?

A. In Orange, Connecticut.

Q. What was your relationship to St. Barbara's?

A. I believe in about 1994, '95, my wife and I were

trying to --

Q. Just quickly.

A. I became a parishioner.

Q. Did you ever sit on any of the boards of St.

Barbara's?

A. I was invited to sit on the board of the Endowment

Fund.

Q. And did you sit?

A. Yes, I did.

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

Case 3:10-cr-00237-AWT Document 163-4 Filed 02/20/14 Page 5 of 74

5

Q. Do you remember when you began on the Endowment

Fund?

A. I believe it was around or about 1995.

Q. How many members sit on the Endowment Fund?

A. The charter, it had to be between I think nine and

13.

Q. Did it vary during the course of your time there?

A. Sometimes.

Q. Did you sit on the Endowment Fund until the time of

your arrest?

A. Yes.

Q. When you began at the Endowment Fund, where were

the endowment fund's assets kept?

A. They were kept at a local branch of a brokerage

firm named Tucker Anthony.

Q. Did there come a time when those Endowment Fund

assets were moved?

A. Yes.

Q. Where were they moved to?

A. They were moved to the company that was providing

custody for me.

Q. What was the name of that company?

A. DLJ Pershing.

Q. Very briefly, was that a decision of the Endowment

Fund board?

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

Case 3:10-cr-00237-AWT Document 163-4 Filed 02/20/14 Page 6 of 74

6

A. Yes, it was.

Q. Was it taken after some discussion?

A. Yes.

Q. Can you tell the Court why it was decided to move

the assets of the Endowment Fund to I'll call it

Pershing?

A. After seeing some of the transaction statements

from Tucker Anthony, I noticed that the Endowment Fund

was paying full retail commission for every transaction.

Q. Would they have to do that if they moved to

Pershing?

A. At Pershing, because I was an institutional client,

the transaction cost was almost nothing. Very small.

Q. All right. Now, are you familiar with -- have you

ever heard the term "day trade"?

A. Yes.

Q. And have you yourself acted as a day trader?

A. Yes, I have.

Q. And what does a day trader trade?

A. He can trade all sorts of different instruments.

Q. Financial instruments?

A. Financial instruments.

Q. Why do they call it day trading?

A. Because by the end of the trading day at 4:00, his

positions are typically all closed.

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

Case 3:10-cr-00237-AWT Document 163-4 Filed 02/20/14 Page 7 of 74

7

Q. Now, you said that you have worked as a day trader;

is that right?

A. I day traded for myself. I never was employed as a

day trader.

Q. Did there come a time when you began assigning

certain day trades to the church?

A. Yes.

Q. And about when was that?

A. I believe, from the church statements, the first

appearance of day trade entries were in 1995. '96 for

sure.

Q. I want to explain mechanically to the Court how

this would work.

First of all, just give me an example of a day

trade, a fictitious day trade.

A. Well, on a given day through the day, let's, as an

example, say I am trading IBM stock. So I may do 20

transactions during the day, buying 5,000 shares,

selling 5,000, then buying 15, selling five. All sorts

of transactions around one instrument.

Now, at the end of the day, the custodian, DLJ in

this case, would then add up all the buys and come up

with a price. Then they would add up all the sells and

come up with a price. So I would then be informed at

the end of the day that I bought, through the day,

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

Case 3:10-cr-00237-AWT Document 163-4 Filed 02/20/14 Page 8 of 74

8

100,000 shares of IBM, average price $100. And then

they would say to me, your 100,000 shares you have also