Professional Documents

Culture Documents

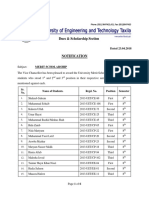

StockAnalytics - Lion Asiapac Limited

Uploaded by

Winston LimOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

StockAnalytics - Lion Asiapac Limited

Uploaded by

Winston LimCopyright:

Available Formats

Stock Analytics

Page 1 of 2

Search :

Lion Asiapac Limited

Market: SGX | Industry: Semiconductors

Company Links

Corporate History/Profile Executives Financial Information Home Page Investor Relations News Releases Products/Services

Consensus Target Price

Last Traded Price (21 Feb 14)

Potential Upside

SGD

SGD

N/A

Business Summary

0.160

Basic Stock Information

Stock Data Market Capitalization (SGD 'mil) Common Shares Outstanding ('mil) 52 Week High (SGD) (21/05/2013) 52 Week Low (SGD) (01/08/2013) 52 Week Return (%) Average Volume ('mil) Beta Financial strength Current Ratio Quick Ratio Long Term Debt to Equity (%) Total Debt to Equity (%) Interest Coverage Ratio (TTM) Free Cash Flow to Firm (TTM) (SGD 'mln) 5.40 5.16 1,285.50 -10.83 Valuation Historical P/E Ratio P/E Ratio (TTM) P/BV (latest interim) BVPS (latest interim) (SGD) EPS TTM (SGD) 36.87 34.71 0.54 0.2969 0.0046 64.88 405.5227 0.190 0.152 -15.790 0.0463 1.40 Dividend

Margin Gross Margin (TTM) (%) Operating Profit Margin (TTM) (%) Net Profit Margin (TTM) (%) 24.40 8.16 6.80

Lion Asiapac Limited is an investment holding company. The principal activities of its subsidiaries consist of investment holding, as well as limestone processing, scrap metal trading, and component distribution. The Company operates in four business segments: Limestone processing, Scrap metal trading, Electronic component distribution and Investment holding/others. As of June 30, 2012, the Company operated in three main geographical areas: Malaysia, which is engaged in limestone processing and scrap metal trading; Singapore, which is engaged in investment holding, and Other countries, which is engaged in limestone processing. Its subsidiaries include Clarington Investment Pte Ltd, Halton Investment Pte Ltd, LAP Investment Pte Ltd, Lion Asiapac Management Consultancy (Shanghai) Co., Ltd, LAP Exploration Pte Ltd and LAP Development Pte Ltd. On November 6, 2012, the Company struck off Bright Steel Pte Ltd.

Research Report

No report was issued in the last one year.

Annual Dividend per share (SGD) Dividend Yield (TTM) (%) Dividend Yield (Annual) (%) Payout Ratio (TTM) (%) 3-Year Growth Rate (%)

0.0010 0.63 0.63 21.68 -78.46

Technical Analysis

Financial Summary

BRIEF: For the three months ended 30 September 2013, Lion Asiapac Limited revenues decreased 37% to SP$5.4M. Net income increased 14% to SP$894K. Revenues reflect a decrease in demand for the Company's products and services due to unfavorable market conditions. Net Income benefited from Depreciation decrease of 4% to SP$588K (expense), Finance decrease from SP$1K (expense) to SP$0K.

Summarized Financial Statement

Annual Quarter FY2009 Income Statement Total Revenue Cost of Revenue Gross Profit Operating Expenses Operating Income Others, Net Income before Taxes Tax Extraordinary Items and Adjustments Net Income 61.99 (57.12) 4.87 (2.68) 2.19 2.19 (1.09) 2.42 3.52 43.33 (35.92) 7.41 80.99 88.41 88.41 (13.62) 0.28 75.06 23.71 (17.86) 5.85 (1.91) 3.94 3.94 (1.10) (0.00) 2.84 36.74 (26.45) 10.29 (18.06) (7.76) (7.76) 13.52 0.01 5.77 30.82 (24.04) 6.78 (4.47) 2.31 2.31 (0.53) (0.02) 1.76 Industry Peer Lion Asiapac Limited WBL Corporation Ltd Elec & Eltek International Co. Ltd. Gul Technologies Singapore Ltd Serial System Ltd. ROA(%) ROE(%) 2.45 -0.14 2.74 15.82 3.37 2.97 3.71 4.64 36.28 10.79 P/E 36.87 16.48 8.79 7.76 13.17 P/BV 0.54 EPS 0.0046 DPS 0.0010 0.1000 0.2000 0.0053 Div FY2010 FY2011

Standarized in SGD mln

FY2012

FY2013

Highlights Technical Events 8 bullish 4 bearish Suppport found at: 0.16 Resistance found at: 0.18 (based on 500 bars)

Stops For long position: 0.159 For short position: 0.163

Peer Comparison

1.33 -0.0410 0.88 0.1142 1.77 0.0283 0.91 0.0139

Balance Sheet Cash and Short Term Investments Total Receivables, Net Other Current Assets Total Current Assets Property/Plant/Equipment, Net Other Long Term Assets Total Assets Payables and Accrued Expenses Other Current Liabilities Total Current Liabilities Total Long Term Debt 164.32 23.51 4.37 192.19 19.51 211.71 4.69 3.78 8.47 0.05 125.34 13.62 2.31 141.27 19.75 7.35 168.38 6.08 43.49 49.57 0.02 73.44 13.08 4.71 91.23 26.50 6.78 124.51 5.23 3.98 9.21 82.47 11.60 4.56 98.63 26.54 4.25 129.42 4.30 0.90 5.20 66.45 11.06 41.34 118.85 24.07 5.35 148.26 21.32 Buy Outperform Hold Underperform Sell No Recommendation

Recommendation

Current 1 week ago 1 month ago 2 months ago 3 months ago

1 0 0 0 0 0 0

1 0 0 0 0 0 0

1 0 0 0 0 0 0

1 0 0 0 0 0 0

Total Recommendation Consensus Target Price

0.69 22.01 -

N/A

Buy

Buy Buy Buy

Consensus Recommendation

http://203.116.47.65/UI/Liveprice/StockAnalytics.aspx

24/2/2014

Stock Analytics

Page 2 of 2

Other Liabilities Total Liabilities Common Equity Retained Earnings (Accumlated Deficit) Other Equities Total Equity

12.81 21.33 47.49 100.78 42.11 190.38

4.10 53.69 47.49 70.34 (3.15) 114.69

4.09 13.29 47.49 73.18 (9.46) 111.22

4.01 9.21 47.49 76.92 (4.21) 120.20

4.26 26.27 47.49 76.62 (2.12) 121.99

Management Team

Name Kgai Mun Loh Hongbo Fan Min Seong Wong Silvester BernardGrant Yen Hui Tan Kim Kee Tan Min Seong Wong Hai Yan Yap Kgai Mun Loh Position Executive Director Finance Manager Assistant General Manager - Limestone Processing D Company Secretary Company Secretary Senior Manager - Automotive Investments Assistant General Manager - Limestone Processing D Executive Director - Electronics Division Group General Manager

Cash Flow Statement Cash Flow From Operations Activities Cash Flow From Investing Activities Cash Flow From Financing Activities Currency Translation Adjustments Net Change in Cash 4.19 14.09 (5.46) 1.72 14.54 (0.41) 125.61 (64.99) (0.74) 59.47 1.31 (10.57) (40.36) (2.28) (51.90) 15.24 (5.20) (2.30) 1.29 9.03 3.60 (17.84)

Company Related News

(2.03) 0.25 (16.02) Source: DJ Market Talk, Dow Jones

Ratios & Other data ROA (%) ROE (%) DPS (SGD) EPS (SGD) 0.54 2.01 0.0100 0.0087 39.35 49.39 0.1000 0.1857 1.94 2.63 0.0050 0.0073 4.54 4.98 0.0050 0.0142 1.28 1.45 0.0010 0.0043

Last Updated 17 hours ago 18 hours ago DJ Southeast Asian Stocks Higher; February Performance Beats Asia Pacific -- Market Talk 19 hours ago DJ K1 Ventures +10% On Sale Of Transportation Business 3 days ago DJ Shell's Refinery Sale Opens up Trading Opportunities - Market Talk 3 days ago DJ China Shares Fall at Midday; Downward Bias -- Market Talk 3 days ago DJ Keppel Unit K1 Ventures to Sell Transportation Leasing Business to Wells Fargo 3 days ago DJ Singapore Budget To Focus On Productivity, Inclusive Growth -- Market Talk 3 days ago *DJ K1 Ventures: Wells Fargo to Pay US$152 Million to Buy 80.1% of Unit 3 days ago *DJ Keppel Unit K1 Ventures to Sell Transportation Leasing Business to Wells Fargo Bank 3 days ago DJ SE Asian Shares Mixed; Gains Led by Singapore, Indonesia -- Market Talk 3 days ago DJ Singapore's Wilmar Intl. Gains On Shree Renuka Offer 3 days ago

DJ Singapore's Budget To Benefit Telcos -DBS -- Market Talk DJ Singapore's GLP Extends Its China Reach -- Market Talk

Selected data supplied by

All information contained on Phillip Stock Analytics is provided on an as is and as available basis. Please see disclaimer for full details.

http://203.116.47.65/UI/Liveprice/StockAnalytics.aspx

24/2/2014

You might also like

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- A Study On Waves of FeminismDocument3 pagesA Study On Waves of FeminismLusekero MwangondeNo ratings yet

- Monetbil Payment Widget v2.1 enDocument7 pagesMonetbil Payment Widget v2.1 enDekassNo ratings yet

- Bhikkhuni Patimokkha Fourth Edition - Pali and English - UTBSI Ordination Bodhgaya Nov 2022 (E-Book Version)Document154 pagesBhikkhuni Patimokkha Fourth Edition - Pali and English - UTBSI Ordination Bodhgaya Nov 2022 (E-Book Version)Ven. Tathālokā TherīNo ratings yet

- MCI FMGE Previous Year Solved Question Paper 2003Document0 pagesMCI FMGE Previous Year Solved Question Paper 2003Sharat Chandra100% (1)

- Social Responsibility and Ethics in Marketing: Anupreet Kaur MokhaDocument7 pagesSocial Responsibility and Ethics in Marketing: Anupreet Kaur MokhaVlog With BongNo ratings yet

- SCIENCE 5 PPT Q3 W6 - Parts of An Electric CircuitDocument24 pagesSCIENCE 5 PPT Q3 W6 - Parts of An Electric CircuitDexter Sagarino100% (1)

- Extra Vocabulary: Extension Units 1 & 2Document1 pageExtra Vocabulary: Extension Units 1 & 2CeciBravoNo ratings yet

- A COIN FOR A BETTER WILDLIFEDocument8 pagesA COIN FOR A BETTER WILDLIFEDragomir DanielNo ratings yet

- Senarai Syarikat Berdaftar MidesDocument6 pagesSenarai Syarikat Berdaftar Midesmohd zulhazreen bin mohd nasirNo ratings yet

- Inflammatory Bowel DiseaseDocument29 pagesInflammatory Bowel Diseasepriya madhooliNo ratings yet

- DSA Interview QuestionsDocument1 pageDSA Interview QuestionsPennNo ratings yet

- Decision Support System for Online ScholarshipDocument3 pagesDecision Support System for Online ScholarshipRONALD RIVERANo ratings yet

- Iso 30302 2022Document13 pagesIso 30302 2022Amr Mohamed ElbhrawyNo ratings yet

- Inver Powderpaint SpecirficationsDocument2 pagesInver Powderpaint SpecirficationsArun PadmanabhanNo ratings yet

- REMEDIOS NUGUID vs. FELIX NUGUIDDocument1 pageREMEDIOS NUGUID vs. FELIX NUGUIDDanyNo ratings yet

- Theories of LeadershipDocument24 pagesTheories of Leadershipsija-ekNo ratings yet

- Intentional Replantation TechniquesDocument8 pagesIntentional Replantation Techniquessoho1303No ratings yet

- Balochistan Conservation Strategy VDocument388 pagesBalochistan Conservation Strategy VHãšãñ Trq100% (1)

- The Forum Gazette Vol. 2 No. 23 December 5-19, 1987Document16 pagesThe Forum Gazette Vol. 2 No. 23 December 5-19, 1987SikhDigitalLibraryNo ratings yet

- Unit 9 What Does APES Say?Document17 pagesUnit 9 What Does APES Say?johnosborneNo ratings yet

- Julian's GodsDocument162 pagesJulian's Godsअरविन्द पथिक100% (6)

- Dues & Scholarship Section: NotificationDocument6 pagesDues & Scholarship Section: NotificationMUNEEB WAHEEDNo ratings yet

- Merah Putih Restaurant MenuDocument5 pagesMerah Putih Restaurant MenuGirie d'PrayogaNo ratings yet

- Lifting Plan FormatDocument2 pagesLifting Plan FormatmdmuzafferazamNo ratings yet

- Introduction To Alternative Building Construction SystemDocument52 pagesIntroduction To Alternative Building Construction SystemNicole FrancisNo ratings yet

- Sustainable Marketing and Consumers Preferences in Tourism 2167Document5 pagesSustainable Marketing and Consumers Preferences in Tourism 2167DanielNo ratings yet

- Surrender Deed FormDocument2 pagesSurrender Deed FormADVOCATE SHIVAM GARGNo ratings yet

- Computer Conferencing and Content AnalysisDocument22 pagesComputer Conferencing and Content AnalysisCarina Mariel GrisolíaNo ratings yet

- Vol 013Document470 pagesVol 013Ajay YadavNo ratings yet

- Dealer DirectoryDocument83 pagesDealer DirectorySportivoNo ratings yet