Professional Documents

Culture Documents

Compulsory Health Insurance - Switzerland

Uploaded by

ForeverSleepingCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Compulsory Health Insurance - Switzerland

Uploaded by

ForeverSleepingCopyright:

Available Formats

Federal Department of Home Affairs FDHA Federal Office of Public Health FOPH Health and Accident Insurance Directorate

Requirement to take out insurance Frequently Asked Questions (FAQ)

1. Is health insurance compulsory in Switzerland? Yes. Health insurance is compulsory in Switzerland. You need health insurance in particular: If you are resident in Switzerland, irrespective of your nationality. All the members of your family, both adults and children, require insurance. If you have a Swiss residence permit valid for three months or longer. If you are working in Switzerland for less than three months and do not have equivalent insurance cover from another country which is valid in Switzerland. If you are a Swiss national or a national of an EU/EFTA country, are working in Switzerland and are resident in a member state of the EU, in Iceland or in Norway. This also applies to any members of your family who are not employed. If you are a Swiss national or a national of an EU/EFTA country whose only source of income is a Swiss pension and are resident in a member state of the EU, in Iceland or in Norway. This also applies to any members of your family who are not employed. If you are receiving unemployment benefit from Switzerland and go to an EU/EFTA country for 3 months to look for work. If your Swiss employer posts you abroad to work for a limited period of time, you continue to be insured under the health insurance scheme during the posting. You can find more information in the information sheets on social insurance for posted workers (http://www.bsv.admin.ch/themen/internationales/02765/index.html?lang=en).

2. What happens if I do not take out insurance? The authority designated by the canton will automatically register anyone required to take out insurance who fails to comply with this obligation in good time. The health insurance fund will then be chosen by the cantonal authority on your behalf.

3. When is insurance no longer required? Insurance coverage ceases when a policyholder is no longer subject to compulsory insurance: if he or she dies if he or she leaves Switzerland to take up residence in another country and is not required to remain insured in Switzerland on the basis of the bilateral agreements with the EU or the agreement with EFTA countries (e.g. cross-border commuters, pensioners and their family members.

4. Who can be exempted from the obligation to obtain insurance in Switzerland, and what procedure should be followed? You do not have to take out insurance: 01102013

if you are a Swiss citizen or national of an EU/EFTA state and live in Switzerland but work in an EU/EFTA member state or receive your pension only from an EU/EFTA state; if you are an EU/EFTA member state national or Swiss national and have been sent from an EU/EFTA member state to Switzerland for a period of up to 24 months; if you are member of a diplomatic or consular mission or are employed by an international

Requirement to take out insurance

organization which enjoys privileges under international law. The following are exempted on request: people who are required to have health insurance under the law of a country with which no agreement has been concluded concerning limitation of the obligation to obtain insurance, insofar as liability to Swiss insurance would impose a double burden; people staying in Switzerland for purposes of basic or advanced training, such as students, pupils and trainees, and family members accompanying them; employees seconded to Switzerland who are exempted from liability to pay Swiss old-age and surviving dependents/disability insurance (AHV/IV) contributions under an international social security agreement, together with family members accompanying them; people residing in a member state of the EU, insofar as they may be exempted from the obligation to obtain insurance under the bilateral Agreement on Free Movement of Persons and Annex II thereto; holders of a residence permit for persons not pursuing an economic activity in accordance with the Agreement on Free Movement of Persons and the European Free Trade Agreement; people for whom membership of a Swiss insurance scheme would entail a marked deterioration in insurance coverage or in reimbursement of expenses and who, on account of their age and/or state of health, could not obtain comparable supplementary insurance or could only do so on terms that would be difficult to accept; provided that, throughout the period for which the exemption is valid, they have equivalent insurance coverage for healthcare in Switzerland.

Requests will be assessed by the competent cantonal authorities. For further information or to obtain the necessary forms, please contact the competent authority directly where you are residing/staying http://www.bag.admin.ch/themen/krankenversicherung/06377/06508/index.html?lang=de.

5. My child was born at the end of the month. I registered in Switzerland in the middle of the month. Is the insurer entitled/obliged to charge a premium for the whole month? Yes. Although this question is not explicitly mentioned in the law, it is important to note that premiums for compulsory health insurance are not calculated on a daily but exclusively on a monthly basis and that, in addition, these premiums are payable in advance. Premiums thus have to be paid for the whole month. However, health insurance funds may adopt different practices with regard to charging for the first month. For example, while some insurers charge a premium for the month of birth regardless of the precise date of birth, others only charge a premium for the month of birth if the child is born in the first half of the month in question.

6. Within which period do I have to take out insurance, and what are the consequences of delayed registration? You have to take out health insurance within three months of the date you take up residence or give birth to a child in Switzerland. The insurance is then back-dated to that date. As long as you meet this deadline, the health insurance company will reimburse you for the costs of any medical treatment incurred from the date you take up residence or gave birth to a child in Switzerland. If you do not meet this three-month deadline, your insurance cover will only take effect from the date you register, and you will have to pay a premium supplement unless you can give good reasons for the delay.

7. Am I free to choose a health insurance fund? Yes, the health insurance fund can be freely chosen; however, the fund in question must be approved in accordance with the Health Insurance Law. A list of current premiums, by health insurance fund and canton/region, can be found at: http://www.priminfo.ch.

01102013

2/3

Requirement to take out insurance

8. Can a health insurance fund refuse to insure me or attach conditions? No. As far as compulsory health insurance (basic insurance) is concerned, all health insurance funds are obliged to accept your application irrespective of your age and state of health, and without stipulating any conditions or waiting period.

9. Can a health insurance fund require me to complete a health questionnaire when I apply for basic insurance? No. In line with the obligation to provide insurance and the prohibition on stipulating conditions or a waiting period, the health insurance fund has to accept your application irrespective of your age and state of health. For this reason, you cannot be required to complete a health questionnaire. In contrast, when you apply for supplementary insurance, the health insurance fund is entitled under the Federal Act on Insurance Policies to enquire about your state of health, to attach conditions, or simply to reject your application.

10. What can I do if a health insurance fund does not reply to my application? If you wish to register with a health insurance fund, but it does not reply to your application or seeks to impose a deductible or coverage which does not suit you, our advice would be as follows: using registered mail, send this health insurance fund your application for basic health insurance, indicating your choice of deductible (either the standard rate or one of the options offered by the insurer in question) and the date on which coverage should start.

11. Can I suspend my accident cover if I am already covered under the Accident Insurance Act? Yes. Your insurer will suspend this cover on request if you provide evidence that you are fully covered in accordance with the Accident Insurance Law. Your health insurer will then reduce your premium accordingly.

12. Can I suspend my health insurance during military or community service? Yes, you can suspend your insurance during periods of service lasting longer than 60 consecutive days (e.g. basic military training, community service, protection and support (P&S) service). During these periods, the risk illness and the risk accident are covered by military insurance. Your health insurance fund will refund your premiums. The competent military or community authorities inform you about the procedure.

13. Do I have to remain insured in Switzerland when I am temporarily abroad (travelling, studying)? Yes. If you leave the country for a certain period to travel or study but do not take up residence abroad, you are still required to have insurance in Switzerland (even if you have informed the local authority of your absence).

14. If I take up residence abroad, can I retain my basic health insurance in Switzerland? Essentially, insurance coverage ceases when you leave Switzerland. Exceptions are made for certain groups (pensioners, unemployed, cross-border commuters, etc.) on the basis of bilateral agreements with the EU and the agreement with EFTA countries. In addition, for people who were subject to compulsory health insurance, insurers may (but are not obliged to!) offer to continue to provide coverage on a contractual basis. The contract may be concluded with the same or a different insurer. The insurance relationship is then governed by insurance contract law.

01102013

3/3

You might also like

- Ivantchenko - GEANT4 LOW ENERGY Geant4 EM PackagesDocument34 pagesIvantchenko - GEANT4 LOW ENERGY Geant4 EM PackagesForeverSleepingNo ratings yet

- Relativity and Cosmology Notes for PHY312Document307 pagesRelativity and Cosmology Notes for PHY312xahdoomNo ratings yet

- Pfeiffer SmartTest Technical DataDocument2 pagesPfeiffer SmartTest Technical DataForeverSleepingNo ratings yet

- COMSOL 4.3b - Introduction To Structural Mechanics ModuleDocument52 pagesCOMSOL 4.3b - Introduction To Structural Mechanics ModuleForeverSleepingNo ratings yet

- Atom Editor Cheat SheetDocument1 pageAtom Editor Cheat SheetMiloš SamardžijaNo ratings yet

- Intro AC/DC Module MEMS InductorDocument46 pagesIntro AC/DC Module MEMS InductorRafael CoelhoNo ratings yet

- Physics Reference Manual GEANT4Document572 pagesPhysics Reference Manual GEANT4ForeverSleepingNo ratings yet

- Intro AC/DC Module MEMS InductorDocument46 pagesIntro AC/DC Module MEMS InductorRafael CoelhoNo ratings yet

- Pfeiffer Vacuum - SmartTest HLT 550, HLT 560 and HLT 570 Operating InstructionsDocument124 pagesPfeiffer Vacuum - SmartTest HLT 550, HLT 560 and HLT 570 Operating InstructionsForeverSleepingNo ratings yet

- Agilent E364xA Dual Output DC Power Supplies ManualDocument257 pagesAgilent E364xA Dual Output DC Power Supplies ManualForeverSleepingNo ratings yet

- Zuzka 30 Day CalendarDocument31 pagesZuzka 30 Day CalendarForeverSleeping0% (1)

- CAEN Sy3527 ManualDocument34 pagesCAEN Sy3527 ManualForeverSleepingNo ratings yet

- TurboFire - CLX Hybrid ScheduleDocument3 pagesTurboFire - CLX Hybrid ScheduleForeverSleepingNo ratings yet

- CLX CalendarsDocument4 pagesCLX CalendarsCrystal MooreNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Products and Services in MFBDocument24 pagesProducts and Services in MFBMichael TochukwuNo ratings yet

- 2023 2024 Academic Fees Schedule Nursing Med Lab Human NutitionDocument7 pages2023 2024 Academic Fees Schedule Nursing Med Lab Human Nutitionchukwuemekac359No ratings yet

- 0003007793-Student Letter of Offer - Riki IrawanDocument21 pages0003007793-Student Letter of Offer - Riki IrawanARGO SEJATI GROUPNo ratings yet

- Proof of Cash ReconciliationDocument7 pagesProof of Cash ReconciliationReginald ValenciaNo ratings yet

- OVHC Policy GuideDocument26 pagesOVHC Policy GuideAleena ShakirNo ratings yet

- AP - Cash in VaultDocument14 pagesAP - Cash in VaultNorie Jane CaninoNo ratings yet

- NH7003167061226.INDIA CustomerVoucherDocument3 pagesNH7003167061226.INDIA CustomerVoucherAshok BansalNo ratings yet

- Audit Testing (Audttheo)Document5 pagesAudit Testing (Audttheo)marieieiem100% (1)

- Republic o F The Philippines Department o F Social Welfare and DevelopmentDocument6 pagesRepublic o F The Philippines Department o F Social Welfare and DevelopmentJasmin Mingo CalaNo ratings yet

- Liabilitas LancarDocument22 pagesLiabilitas Lancarayu utamiNo ratings yet

- 连接方式调研 中文Document39 pages连接方式调研 中文王烁然No ratings yet

- LA Metro - 940Document2 pagesLA Metro - 940cartographica100% (1)

- Dog Concierges, LLC: Transaction Analysis and Statement of Cash Flows PreparationDocument9 pagesDog Concierges, LLC: Transaction Analysis and Statement of Cash Flows PreparationCristina Elizabeth Portilla BravoNo ratings yet

- 1 Aug 22 - 27 Jan 22Document42 pages1 Aug 22 - 27 Jan 22Anurag SinghNo ratings yet

- Invitation - Alumni USMDocument3 pagesInvitation - Alumni USMNoor Aida AbdullahNo ratings yet

- Retail Math Cheat Sheet XIDocument1 pageRetail Math Cheat Sheet XIEmerson SuarezNo ratings yet

- Member Rewards Cashback and VouchersDocument2 pagesMember Rewards Cashback and VouchersASHRAF SANYEONGNo ratings yet

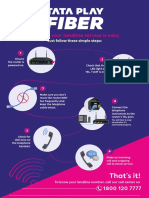

- Installation Guide Tata FiberDocument2 pagesInstallation Guide Tata Fiberabhi tNo ratings yet

- Designing Cisco Enterprise Networks v1.0 (300-420) : Exam DescriptionDocument3 pagesDesigning Cisco Enterprise Networks v1.0 (300-420) : Exam DescriptionInkyNo ratings yet

- Case Study On Sachet InsuranceDocument2 pagesCase Study On Sachet Insurancesmd.naeem2No ratings yet

- MBM Criteria For Accreditation v2Document5 pagesMBM Criteria For Accreditation v2Leo PorrasNo ratings yet

- IG210-1 Wire Transfer Instructions USDDocument1 pageIG210-1 Wire Transfer Instructions USDMope SASNo ratings yet

- Nabil 2Document33 pagesNabil 2Aayush PunNo ratings yet

- Aws Saa McqsDocument24 pagesAws Saa McqsHarleen KaurNo ratings yet

- Adjusting Entry Part 2Document4 pagesAdjusting Entry Part 2Ken DiNo ratings yet

- Updated HBL-Gauri-AqsaDocument6 pagesUpdated HBL-Gauri-AqsaAbdul Moiz YousfaniNo ratings yet

- Purchase OrderDocument1 pagePurchase Orderksb sales teamNo ratings yet

- Chapter7 Cash and EquivalentsDocument6 pagesChapter7 Cash and EquivalentsTamayo PaulaNo ratings yet

- IT For Management: On-Demand Strategies For Performance, Growth, and SustainabilityDocument43 pagesIT For Management: On-Demand Strategies For Performance, Growth, and SustainabilityanastasiaaNo ratings yet

- Next-Generation Firewall (NGFW)Document6 pagesNext-Generation Firewall (NGFW)MelroyNo ratings yet